Gujarat Board GSEB Class 11 Commerce Economics Important Questions Chapter 10 Budget Important Questions and Answers.

GSEB Class 11 Economics Important Questions Chapter 10 Budget

Short Answer Type Questions

Question 1.

What is NITI Aayog?

Answer:

The planning commission of India is now known as NITI Aayog. Its full form is National Institution for Transforming India Aayog.

Question 2.

How can the government undertake activities or incur expenses in a democracy?

Answer:

To undertake activities or incur expenses the government needs to first prepare a budget. Then it has to present it before the elected representatives to get an approval for the budget.

Question 3.

What is federal finance?

Answer:

The division of the power for generating revenues and making expenditures into a three-tier government is called the concept of federal finance. The three tiers are free to make expenditures on their respective heads and get revenue from their respective sources.

![]()

Question 4.

List the three tiers of government.

Answer:

The three tiers of government are,

- The central government

- The state governments and

- The local governments such as municipalities, panchayats, etc.

Question 5.

Which developmental responsibilities are given to the central government? Name few.

Answer:

Responsibilities that are extremely important for the country and have a uniform impact in all the states are given to the central government. For example, defence, foreign affairs, census, railway, etc.

Question 6.

What does the state list contain?

Answer:

Those subjects which are important for a particular region i.e. state are included in the list of responsibilities of the state. This list contains items important for the physical and social environments of respective states. Also the list may vary as per state. Example: Law and order in the state, public health, police, sanitation, forests, etc.

Question 7.

How does budget help the government to understand allocation of resources?

Answer:

Government gathers current development data and target of each sector. Based on this it decides the estimates needed for the targeted development of each and hence the resources to allocate.

Question 8.

What is balanced budget?

Answer:

A budget in which the government plans its expenditures in such a way that all the expenditures can be fully made from the available sources of revenue is called a balanced budget. A balanced budget is an ideal as well as a theoretical situation. In reality, a balanced budget is impractical.

Question 9.

Why developing countries do not have a balanced budget?

Answer:

Developing countries need a lot of funds to develop their nations. Hence, the government of these nations cannot plan expenditures within given revenue constraints. So, such countries cannot have a balanced budget.

Question 10.

Why developed countries do not have a balanced budget?

Answer:

Developed countries keep on increasing expenditures on defence, research, technology, etc. so that they can maintain their growth rate and develop in newer directions.

Question 11.

State two merits of a balanced budget?

Answer:

- A balanced budget ensures financial stability.

- The government avoids wasteful expenditures so that it can maintain the expenditure equal to income.

Question 12.

State two do merits of a balanced budget?

Answer:

- Because the government aims at keeping the expenditure same as income, the economic growth and welfare of the nation may not take place properly.

- If government does not restrict expenditures and raises taxes in order to increase incomes to match the excess expenditures then people have to bear additional tax burdens.

Question 13.

What is unbalanced budget? State its types.

Answer:

A budget in which the total expenditure is not equal to the total income i.e. either the expenditure is more than or less than the income is called unbalanced budget. Types: deficit budget and surplus budget.

Question 14.

Why developing countries have a deficit budget?

Answer:

A developing economy usually spends a lot on development activities like education, social welfare, creation of public utilities, etc. However, since the economy is yet developing, the income of such nations from taxes and other sources are lower. Hence, developing nations have a deficit budget.

Question 15.

Why developed countries have a deficit budget?

Answer:

Developed nations spend quite a lot on defence, research, etc. and hence developed countries have a deficit budget.

Question 16.

State two merits of deficit budget.

Answer:

- Deficit budget promotes development and welfare activities.

- In times of slow economic activity, the government spends more in the economy for investment and creating employment. This boosts the economy during depression and hence can lead to economic growth.

Question 17.

State two demerits of deficit budget.

Answer:

- In order to meet the deficit governments borrows money. This increases debts of the government.

- A deficit in the budget means that the government does not have control on expenditures.

Question 18.

What is a surplus budget?

Answer:

A budget in which the government’s anticipated total expenditure is less than the anticipated total income is called deficit budget. Thus, Surplus Budget = Anticipated Expenditure < Anticipated Income.

Question 19.

What does a surplus budget represents?

Answer:

If a government’s budget is a surplus it means that the government is collecting more revenue from citizens through taxes as compared to the amount it is spending for the citizens.

Question 20.

State two merits of a surplus budget.

Answer:

- Surplus budget is useful in times of severe inflation. When the government spends less, employment, income and demand reduce. This helps ¡n restricting inflation.

- Since the budget is surplus, there is no burden of borrowing.

Question 21.

State two demerits of a surplus budget.

Answer:

People are made to pay more taxes to increase the income of government, On the other hand, the welfare they receive from government spending reduces. If the surplus in the budget persistently rises for several years then excess savings may lead to several problems.

Question 22.

State developmental expenditure of state budget related to special services.

Answer:

Education, health, nutrition, family welfare, water supply, sainitation, welfare of SC, ST and QBC, etc.

Question 23.

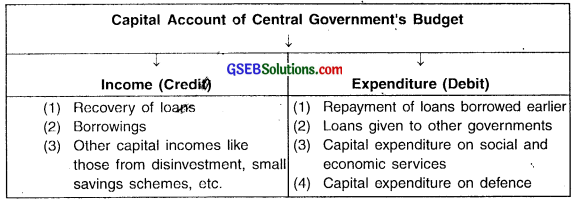

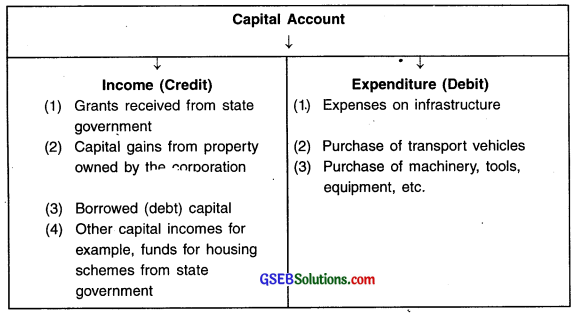

Which entries are recorded in capital income?

Answer:

Receipts of those transactions which have long term or continuous impacts on government funds. Income generated by the government in the form of borrowings from the market in own country and abroad, borrowing from central bank, income from disinvestment, etc. are recorded in this account.

![]()

Question 24.

Which accounts are there in the debit side?

Answer:

Current expenditure and capital expenditure.

Question 25.

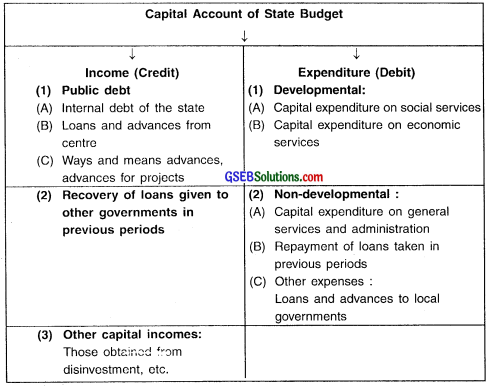

What is current (revenue) account?

Answer:

The account showing current incomes and current expenditures in a budget is called the current account of a budget.

Question 26.

What is capital account of a budget?

Answer:

The account showing capital incomes and capital expenditures in a budget is called the capital account of a budget.

Question 27.

What is current (revenue) expenditure of a budget?

Answer:

Expenditures made in the current year on salaries of government employees, interest payment on loan taken by the government, pension, subsidies, grants, current spending on defence etc. are called current (revenue) expenditure of a budget.

Question 28.

What is capital receipt?

Answer:

Receipts from transactions which have long term or continuous impacts on government funds. Incomes generated by the government in the form of borrowings from the market in own country and abroad, borrowing from central bank, income from disinvestment, etc. are recorded in this account.

Question 29.

What is capital expenditure?

Answer:

Capital expenditure is expenditures on transactions which have long term or continuous impacts on government funds. This account includes loans given by the government to other governments, repayment of previously taken loans, capital expenses on social and economic services, as well as capital expenses on defence, etc.

Question 30.

State two revenues recorded in the credit side of the union government’s budget?

Answer:

(A) Revenues from direct taxes and

(B) Revenues from indirect taxes.

Question 31.

Into which parts the expenditures of the central government were divided after the budget of 2016?

Answer:

As per the budget 2016, the expenditure of central government is divided into plan expenditure and non-plan expenditure.

Question 32.

State two non-plan expenditure of the central government.

Answer:

(A) Interest payments (on loans borrowed in earlier periods)

(B) Social services like education, health, public utilities and administration and general services.

Question 33.

State two ‘plan-expenditures’ of central government.

Answer:

(A) Agriculture, industries, irrigation, information and communication, energy, minerals, transport and such sectors,

(B) Planned grants and assistance given to states and union territories

Question 34.

State two incomes other than tax-incomes recorded in the records of central government.

Answer:

(A) Interest incomes earned from loans given by the centre in earlier periods,

(B) Profits and dividends from public sector enterprises

Question 35.

State two development expenditures.

Answer:

(A) Capital expenditure on social services,

(B) Capital expenditure on economic services

Question 36.

What is non-developmental expenditure?

Answer:

Expenditure which does not have a direct impact on development is called non-developmental expenditure. For example, expenditure on pensions.

Question 37.

What is panchayat and panchayati raj institution?

Answer:

Panchayat means ‘an assembly of fives. Panchayati Raj Institution is the oldest method of local governance in Asia.

Question 38.

What role do states play in panchayats?

Answer:

The state must delegate powers to the panchayats so that they can function accordingly and welfare their regions. The states also provide finance to the panchayats as per the recommendation of the state finance commissions.

Question 39.

State the functions of panchayats that lead to their expenditures.

Answer:

Panchayats are mainly responsible for raising facilities of water supply, water pumps, sewage, roads, cleanliness, public health, electricity, etc. in their concerned region.

Question 40.

What is revenues deficit?

Answer:

When the total expenditure of the government on revenue (current) account is more than total receipts of the government on the revenue account it results in revenue deficit.

Question 41.

How can revenue deficit be overcome?

Answer:

By increasing borrowings on the capital account.

Question 42.

What is budgetary deficit?

Answer:

When the total expenditure (current as well as capital) is greater than the total income (current as well as capital) it results in budgetary deficit.

Question 43.

How can government overcome budgetary deficit? OR What is overdraft?

Answer:

The central government undertakes deficit financing (i.e. borrows from RBI) to meet this deficit. The state governmcnts borrow more from the central government which is then called overdraft.

Question 44.

What is fiscal deficit?

Answer:

When a government’s total expenditures exceed the revenue that it generates, excluding money from borrow:ngs, it gives rise to fiscal deficit. Thus, fiscal deficit = Total expenditure – Total income (excluding market borrowings)

![]()

Question 45.

What is primary deficit?

Answer:

The difference between fiscal deficit of the current year and interest payments on the previous borrowings is called primary deficit. Thus, primary deficit = Fiscal deficit – Interest payments

Long Answer Type Questions

Question 1.

What is NITI Aayog? Explain briefly.

Answer:

- In India’s mixed economic system the activities of the state hold a very crucial and unique importance.

- After independence, India took-up the responsibility of creating essential basic industries and infrastructure facilities that were necessary for India’s economic development.

- This gave birth to the process of planned economic development of the country. For this, India formed the ‘Planning Commission’. Now, the planning commission is reformed and is known as NITI Aayog i.e. National Institution for Transforming India Aayog.

Question 2.

What do you mean by budget? Why does the government need to prepare a budget?

Answer:

Meaning of budget:

Every year, before the hew financial year starts (i.e. before 1st April), the government of India prepares and presents an estimated statement of expenditure and income before the elected body for its approval. This statement is called budget.

Definition:

A government budget is an annual accounting statement of the item-wise estimates of expected revenue and anticipated expenditure of the government for the new fiscal year.

Need of budget:

- In order to run the state, the government needs money. The state incurs expenses for the activities it undertakes. In order to pay for these expenses, it must raise and generate income.

- In democracy, the government cannot undertake activities, incur expenses or raise incomes without the approval of elected representatives in the constituted body. This approval can be obtained only when the government prepares and presents the budget to the elected body.

- In India, such permission the government take from the Lok Sabha, State legislative assembly, Municipal bodies and Panchayats.

Question 3.

State the need of budget.

Answer:

Need of budget:

- In order to run the state, the government needs money. The state incurs expenses for the activities it undertakes. In order to pay for these expenses, it must raise and generate income.

- In democracy, the government cannot undertake activities, incur expenses or raise incomes without the approval of elected representatives in the constituted body. This approval can be obtained only when the government prepares and presents the budget to the elected body.

- In India, such permission the government take from the Lok Sabha, State legislative assembly, Municipal bodies and Panchayats.

Question 4.

Explain federal finance.

Answer:

- The Constitution of India has distributed the power of generating revenue and making expenditures into a three-tier government. These tiers are:

- The central government

- The state governments and

- The local governments (For e.g. municipality).

- All these three forms of government are free to make expenditures on their respective heads and to get revenue from their respective sources. This system of financing is called federal finance.

Question 5.

Explain the division of power and responsibilities of the country among the three different lists as mentioned in the Constitution.

Answer:

The Constitution of India has divided the powers of the centre and state governments into three different lists of subjects. They are discussed below.

1. The Union list:

This list contains those subjects of responsibilities of Central government that are extremely important for the country and have a uniform impact on all states.

Example:

Defence, foreign affairs, census, railway, communication, etc.

2. The State list:

- Those subjects which are important for a particular region i.e. state are included in the list of responsibilities of the state.

- This list contains items important for physical and social environments of respective states. Also the list may vary as per state.

Example:

Law and order in the state, public health, police, sanitation, forests, etc.

3. The Concurrent list:

- The list contains subjects that are common to both i.e. center as well as state. Both of them are jointly responsible for the areas mentioned in this list.

- These subjects are important for the country and are uniform in purpose for all states. However, the subjects may vary among states.

Example:

- Economic planning, electricity, education, social security, etc.

- Note that the local bodies look after primary activities like sanitation, street lights, etc.

Question 6.

What is union list? List few subjects that fall under the union list.

Answer:

The Union list:

This list contains those subjects of responsibilities of Central government that are extremely important for the country and have a uniform impact on all states.

Example:

Defence, foreign affairs, census, railway, communication, etc.

![]()

Question 7.

What is state list? List few subjects that fail under the state list.

Answer:

The State list:

- Those subjects which are important for a particular region i.e. state are included in the list of responsibilities of the state.

- This list contains items important for physical and social environments of respective states. Also the list may vary as per state.

Example:

Law and order in the state, public health, police, sanitation, forests, etc.

Question 8.

What is concurrent list? List few subjects that fall under the concurrent / list.

Answer:

The Concurrent list:

- The list that contains subjects that are common to both i.e. center as well as state. Both of them are jointly responsible for the areas mentioned in this list.

- These subjects are important for the country and are uniform in purpose for all states. However, the subjects may vary among states.

Example:

- Economic planning, electricity, education, social security, etc.

- Note that the local bodies look after primary activities like sanitation, street lights, etc.

Question 9.

Budgets help entrepreneurs to decide prices. Give reason.

Answer:

- Through the budget people come to know which sectors is the government favouring and how much resource is it allocating to those sectors.

- People also come to know the change in the tax structure that will be done in the commodities and the sectors.

- All this information helps entrepreneurs to understand which commodities will become costlier and which will become cheaper. Based on this they then set their market prices.

Question 10.

State the main elements of budget.

Answer:

Main elements of the budget:

- It is a statement of estimates of government receipts and expenditures.

- Budget estimates are for a fixed period, generally a year.

- The objective of budget of any government is economic development of the region and public welfare.

- A budget must be approved by Lok Sabha or Assembly or some such public body before its implementation.

- Usually the finance minister of the country, state-or the head of the governing body declares the budget.

Question 11.

Explain the purpose (objective) of the budget.

Answer:

Purpose (Objective) of the budget:

The government must plan its expenditures and raise its income in such a way that the following objectives can be fulfilled:

1. To obtain approval of the body of elected representatives:

The ruling government need to take approval of the elected representatives of the democratic government for the expenditures and incomes estimated to incur in the coming financial year.

2. To get an idea regarding available resources and areas requiring expenses:

To get an idea regarding:

(a) The activities which the government can and should undertake

(b) The expenses to be incurred in various sectors and

(c) The sources from where the necessary income may be raised

3. Provide direction for allocation of resources:

- To allocate the resources i.e. income earned into different sectors with respect to their priority and need.

- If proper estimates are not made for each sector then it is quite possible that ‘ some sectors may receive more than necessary funds and some seciors may get neglected.

4. For knowledge of the public:

- Through the budget people come to know which sectors is the government favouring and how much resource is it allocating to those sectors.

- People also come to know the change in the tax structure that will be done in the commodities and the sectors.

- All this information helps people to understand which commodities will become costlier and which will become cheaper.

Question 12.

Write a short note on balanced budget.

Answer:

(A) Balanced budget:

- A budget in which the government plans its expenditures in such a way that all the expenditures can be fully made from the available sources of revenue is called a balanced budget.

- A balanced budget is an ideal as well as a theoretical situation. In reality a balanced budget is impractical.

Developing countries:

Developing countries need a lot of funds to develop their nations. Hence, the government of these nations cannot plan expenditures within given revenue constraints. So, such countries cannot have a balanced budget.

Developed countries:

The developed countries keep on increasing their expenditures on defence, research, technology, etc. so that they can maintain their growth rate and develop in newer directions. Hence, even developed countries do not have a balanced budget

(B) Merits of a balanced budget:

- A balanced budget ensures financial stability.

- The government avoids wasteful expenditures so that it can maintain the expenditure equal to income.

- The government does not need to impose additional taxes on the people to raise extra income to meet undue expenditures.

(C) Demerits of a balanced budget:

- Because the government aims at keeping the expenditure same as income, the economic growth and welfare of the nation may not take place properly.

- If government does not restrict expenditures and raises taxes in order to increase incomes to match the excess expenditures then people have to bear additional tax burdens.

Adam Smith favoured balanced budget. But J. M. Keynes was of a strong belief that in case of balanced budget, governments do not spend enough to maintain full employment. In other words in order to maintain full employment, governments must incur more expenditure in the economy if required and hence let go the concept of balanced budget.

![]()

Question 13.

A balanced budget is an ideal as well as a theoretical situation. Give reason.

Answer:

- In order to run the state, the state needs money. The state incurs expenses for the activities it undertakes. In order to pay for these expenses, it must raise and generate income.

- A budget in which the government plans its expenditures in such a way that all the expenditures can be fully made from the available sources of revenue is called a balanced budget.

- Developing countries need a lot of funds to develop their nations. Hence, the government of these nations cannot plan expenditures within given revenue constraints. So, such countries, cannot have a balanced budget.

- On the other hand, developed countries also do not have a balanced budget because they keep on increasing their expenditures on defence, research, technology, etc. to maintain their growth rate and develop in newer directions.

- Since, neither developing countries can have a balanced budget nor developed countries, it is said that balanced budget is a theoretical situation.

Question 14.

Explain balanced budget.

Answer:

Balanced budget:

- A budget in which the government plans its expenditures in such a way that all the expenditures can be fully made from the available sources of revenue is called a balanced budget.

- A balanced budget is an ideal as well as a theoretical situation. In reality a balanced budget is impractical.

Developing countries:

Developing countries need a lot of funds to develop their nations. Hence, the government of these nations cannot plan expenditures within given revenue constraints. So, such countries cannot have a balanced budget.

Developed countries:

The developed countries keep on increasing their expenditures on defence, research, technology, etc. so that they can maintain their growth rate and develop in newer directions. Hence, even developed countries do not have a balanced budget

Question 15.

State the merits of balanced budget.

Answer:

Merits of a balanced budget:

- A balanced budget ensures financial stability.

- The government avoids wasteful expenditures so that it can maintain the expenditure equal to income.

- The government does not need to impose additional taxes on the people to raise extra income to meet undue expenditures.

Question 16.

State the demerits of balanced budget.

Answer:

Demerits of a balanced budget:

- Because the government aims at keeping the expenditure same as income, the economic growth and welfare of the nation may not take place properly.

- If government does not restrict expenditures and raises taxes in order to increase incomes to match the excess expenditures then people have to bear additional tax burdens.

Adam Smith favoured balanced budget. But J. M. Keynes was of a strong belief that in case of balanced budget, governments do not spend enough to maintain full employment. In other words in order to maintain full employment, governments must incur more expenditure in the economy if required and hence let go the concept of balanced budget.

Question 17.

Write a short note on deficit budget.

Answer:

(A) Deficit budget:

- A budget in which the government’s anticipated total expenditure is more than the anticipated total income is called deficit budget.

- Thus, Deficit budget = Anticipated total expenditure > Anticipated total income.

- In present times, government budgets are mostly deficit budgets.

Developing nations:

A developing economy usually spends a lot on development activities like ‘ education, social welfare, creation of public utilities, etc. However, since the economy is yet developing, the income of such nations from taxes and other sources is lower. Hence, developing nations have a deficit budget.

Developed nations:

Developed nations spend quite a lot on defence, research, etc. and hence even developed countries can have a deficit budget.

(B) Merits of a deficit budget:

- Deficit budget promotes development and welfare activities.

- In times of slow economic activity, the government, spends more in the economy for investment and creating employment. This boosts the economy during depression and hence can lead to economic growth.

- Since the expenditures are high and incomes are low and taxes are a major source of income for the government, the government put lesser tax burden on people in proportion to the economic activity going on in the state.

(C) Demerits of a deficit budget:

- In order to meet the deficit governments borrow money. This increases debts of the government.

- A deficit in the budget means that the government does not have control on expenditures.

- From a high budget deficit, one can also conclude that the tax revenues collected from public is getting wasted in unnecessary expenditures.

Question 18.

Explain deficit budget.

Answer:

Deficit budget:

- A budget in which the government’s anticipated total expenditure is more than the anticipated total income is called deficit budget.

- Thus, Deficit budget = Anticipated total expenditure > Anticipated total income.

- In present times, government budgets are mostly deficit budgets.

Developing nations:

A developing economy usually spends a lot on development activities like ‘ education, social welfare, creation of public utilities, etc. However, since the economy is yet developing, the income of such nations from taxes and other sources is lower. Hence, developing nations have a deficit budget.

Developed nations:

Developed nations spend quite a lot on defence, research, etc. and hence even developed countries can have a deficit budget.

Question 19.

State the merits of deficit budget.

Answer:

Merits of a deficit budget:

- Deficit budget promotes development and welfare activities.

- In times of slow economic activity, the government, spends more in the economy for investment and creating employment. This boosts the economy during the depression and hence can lead to economic growth.

- Since the expenditures are high and incomes are low and taxes are a major source of income for the government, the government put lesser tax burden on people in proportion to the economic activity going on in the state.

Question 20.

State the demerits of deficit budget.

Answer:

Demerits of a deficit budget:

- In order to meet the deficit governments borrow money. This increases debts of the government.

- A deficit in the budget means that the government does not have control on expenditures.

- From a high budget deficit, one can also conclude that the tax revenues collected from public is getting wasted in unnecessary expenditures.

Question 21.

Deficit budget promotes development and welfare activities. Give reason.

Answer:

- A budget in which the government’s anticipated total expenditure is more than the anticipated total income is called deficit budget.

- In times of slow economic activity, the government spends more in the economy for investment and creating employment. This boosts the economy during depression and hence can lead to economic growth.

- Since the expenditures are high and incomes are low and taxes are a major source of income for the government, the government put lesser tax burden on people in proportion to the economic activity going on in the state.

- A developing economy usually spends a lot on development activities like education, social welfare, creation of public utilities, etc. However, since the economy is yet developing, the income of such nations from taxes and other sources are lower. Hence, developing nations have a deficit budget.

- On the other hand, developed nations spend quite a lot on defence, research, etc. and hence even developed countries can have a deficit budget.

- Hence, deficit budget promotes development and welfare activities.

![]()

Question 22.

Write a short note on surplus budget.

Answer:

(A) Surplus budget:

- A budget in which the government’s anticipated total expenditure is less than the anticipated total income is called deficit budget.

- Thus, Surplus Budget = Anticipated Expenditure < Anticipated Income.

- If a government’s budget is a surplus budget it means that the government is collecting more revenue from citizens through taxes as compared to the amount it is spending for the citizens.

- A surplus budget will result in lesser overall development and welfare activities. In reality most governments do not do this i.e. do not have a surplus budget.

(B) Merits of surplus budget:

- Surplus budget is useful in times of severe inflation. When the government spends less, employment, income and demand reduce. This helps in restricting inflation.

- Since the budget is surplus, there is no burden of borrowing.

- Savings of the government increase which can be used for development in future periods.

(C) Demerits of a surplus budget:

- People are made to pay more taxes to increase the income of government. On the other hand, the welfare they receive from government spending reduces.

- In case of deflation lower spending will result in lower investment, employment, income and production which may lead to depression in the economy.

- If the surplus in the budget persistently rises for several years then excess savings may lead to several problems.

Question 23.

Surplus budget hinders economic development. Give reason.

Answer:

- A budget in which the government’s anticipated total expenditure is less than the anticipated total income is called deficit budget.

- If a government’s budget is a surplus budget it means that the government is collecting more revenue from citizens through taxes as compared to the amount it is spending for the citizens.

- Moreover, in case of deflation lower spending will result in lower investment, , employment, income and production which may lead to depression in the economy.

- Since surplus budget result in lesser overall development and welfare activities, it hinders economic development.

Question 24.

Explain surplus budget.

Answer:

Surplus budget:

- A budget in which the government’s anticipated total expenditure is less than the anticipated total income is called deficit budget.

- Thus, Surplus Budget = Anticipated Expenditure < Anticipated Income.

- If a government’s budget is a surplus budget it means that the government is collecting more revenue from citizens through taxes as compared to the amount it is spending for the citizens.

- A surplus budget will result in lesser overall development and welfare activities. In reality most governments do not do this i.e. do not have a surplus budget.

Question 25.

State the demerits of surplus budget.

Answer:

Demerits of a surplus budget:

- People are made to pay more taxes to increase the income of government. On the other hand, the welfare they receive from government spending reduces.

- In case of deflation lower spending will result in lower investment, employment, income and production which may lead to depression in the economy.

- If the surplus in the budget persistently rises for several years then excess savings may lead to several problems.

Question 26.

How is the account of a budget maintained? Explain the various types of accounts that are maintained.

Answer:

- The accounts of budget help to thoroughly understand the concept of budget.

- As per the rules of accounts, every budget has two sides. They are:

- The credit side and

- The debit side

(I) The credit side:

The revenues (i.e. incomes) of the government are recorded on this side.

There are two accounts on the credit side. They are:

1. Current ineome (revenue):

- The revenue income includes direct and indirect taxes, profits of public enterprises, fees and fines from public utilities, etc.

- Revenue income is also called current income because this section records receipts and expenditures transactions of the current period.

2. Capital income:

- The section of capital income records receipts of those transactions which have long term or continuous impacts on government funds.

- Income generated by the government in the form of borrowings from the market in own country and abroad, borrowing from central bank, income from disinvestment, etc. are recorded in this account.

(II) The debit side:

The expenditures of the government are recorded on this side.

There are two accounts on the debit side. They are:

1. Current (Revenue) expenditures:

Current expenditures include expenditure made in the current year on salaries of government employees, interest payment on loan taken by the government, pension, subsidies, grants, current expenses on defence, etc.

2. Capital expenditures:

- These are expenditures on those transactions which have long term or continuous impact on government funds.

- This account includes loans given by the government to other governments, repayment of previously taken loans, capital expenses on social and economic services, as well as capital expenses on defence, etc.

Conclusion:

Thus a budget has following two accounts:

(A) Current account which records current incomes and expenditures and

(B) Capital account which records capital incomes and expenditures

Question 27.

Explain the credit side of a budget.

Answer:

The credit side:

The revenues (i.e. incomes) of the government are recorded on this side.

There are two accounts on the credit side. They are:

1. Current ineome (revenue):

- The revenue income includes direct and indirect taxes, profits of public enterprises, fees and fines from public utilities, etc.

- Revenue income is also called current income because this section records receipts and expenditures transactions of the current period.

2. Capital income:

- The section of capital income records receipts of those transactions which have long term or continuous impacts on government funds.

- Income generated by the government in the form of borrowings from the market in own country and abroad, borrowing from central bank, income from disinvestment, etc. are recorded in this account.

Question 28.

Explain the debit side of a budget.

Answer

The debit side:

The expenditures of the government are recorded on this side.

There are two accounts on the debit side. They are:

1. Current (Revenue) expenditures:

Current expenditures include expenditure made in the current year on salaries of government employees, interest payment on loan taken by the government, pension, subsidies, grants, current expenses on defence, etc.

2. Capital expenditures:

- These are expenditures on those transactions which have long term or continuous impact on government funds.

- This account includes loans given by the government to other governments, repayment of previously taken loans, capital expenses on social and economic services, as well as capital expenses on defence, etc.

Question 29.

Give details of the income and expenditure sides of the current account of the union budget.

Answer:

Question 30.

Give details of the income and expenditure sides of the capital account of the union budget.

Answer:

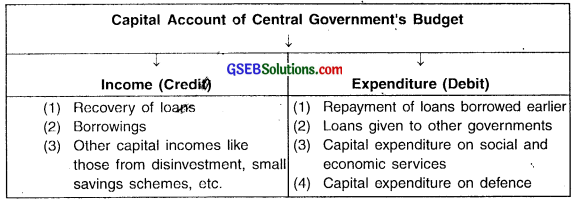

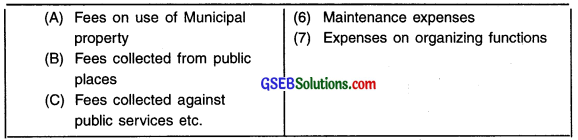

An Idea of the Budget of the State Governments in India

Question 31.

Give details of the income and expenditure sides of the current account of the union budget.

Answer:

Question 32.

What do you mean by developmental and non-developmental expenditures?

Answer:

The expenditure of the budget of state governments is classified into

- Developmental expenditures and

- Non-developmental expenditures.

1. Developmental expenditure:

Expenditure that provides a direct boost to economic development is known as developmental expenditure. For example, expenditure on irrigation.

2. Non-developmental expenditure:

Expenditure which does not have a direct impact on development is called non-developmental expenditure. For example, expenditure on pensions.

Question 33.

Write a note on budget of local governments in India.

Answer:

Budget of local governments:

- In India the local governments are called Municipal Corporations in big cities, Municipalities in smaller cities, District (Jilla) Panchayats in districts, Taluka Panchayats in talukas and Gram Panchayat in villages.

- Constitution has provided guidance for the role of these governments. Moreover, these governments can also collect some income on their own.

- The main functions of local governments include water supply, water pumps, sewage, roads, cleanliness, public health, electrification of their concerned region, etc.

An example of the Budget of Municipal Corporation

![]()

Question 34.

Explain briefly, Panchayats as a third-tier of government administration.

Answer:

Functions of a Panchayat and its sources of revenue:

Meaning of panchayat:

Panchayat means ‘an assembly of five’. Panchayati Raj Institution is the oldest method of local governance in Asia.

- In India, the district panchayats, taluka panchayats and gram panchayats are a part of the three-tier government for rural administration. The form of Panchayati Raj Institutions varies in different states.

Provision in the constitution: - As per the provision given in the Constitution of India, the panchayats in their respective areas can prepare a plan for economic development and. social justice and execute it.

- The constitution has also mentioned several functions and responsibilities for the panchayats.

- The gram sabha/samati are the committees that undertakes the responsibility of conducting development and welfare activities in these rural areas.

Role of the states in giving power and finance to the panchayats:

- The state must delegate powers to the panchayats so that they can function ‘ accordingly and welfare their regions.

- The states also provide finance to the panchayats as per the recommendation of the state finance commissions.

- As per the changes made in the Panchayati Raj Act, the panchayats are now vested more powers. Hence, now, the panchayats do not have to de¬pend too much on recommendations of state finance commissions and upon the state governments and they can obtain some funds in their accounts directly from the centre.

- As a result, now the panchayats are financially better than before and also enjoy greater decision making power.

Question 35.

What is the role of constitution in the Panchayat?

Answer:

- The constitution of India has made a provision under which the panchayats in their respective areas can prepare a plan for economic development and social justice and execute it.

- The constitution has also mentioned several functions and responsibility for the panchayats.

Question 36.

Explain briefly revenue deficit.

Answer:

Revenue deficit:

- When the total expenditure of the government on revenue (current) account is more than total receipts of the government on the revenue account it results in revenue deficit.

- Revenue account contains current transactions of the government. A deficit in this account means that the government is not able to meet its routine ‘ expenditures from its current income.

- Revenue deficit shows’ inefficient working of government.

Solution:

Revenue deficit can be overcome by increasing borrowings on the capital account.

Question 37.

Explain briefly budgetary deficit.

Answer:

Budgetary deficit:

When the total expenditure (current as well as capital) is greater than the . total income (current as well as capital) it results in budgetary deficit.

Solution:

The central government undertakes deficit financing (i.e. borrows from RBI) to meet this deficit. The state governments borrow more from the central government which is then called overdraft.

Question 38.

Explain briefly fiscal deficit.

Answer:

Fiscal deficit:

- When a government’s total expenditures exceed the revenue that it generates, excluding money from borrowings, it gives rise to,fiscal deficit.

- Thus, Fiscal deficit = Total expenditure – Total income (excluding market borrowings).

- The borrowings that a government does from the market are considered as income on the capital account. In fact this borrowing is a debt created by the government and must not be included as a source of income.

Question 39.

Explain briefly primary deficit.

Answer:

Primary deficit:

- Primary deficit is a relatively new concept in Indian budget.

- The difference between fiscal deficit of the current year and interest payments on the previous borrowings is called primary deficit.

- Thus, Primary deficit = Fiscal deficit – Interest payments

- Interest payment is an important part of government expenditures. However, these expenditures actually do not incur on current activities but are an inevitable burden to be paid for amounts borrowed in the past.

- Hence, the concept of primary deficit takes out interest payments from fiscal deficit.

- This concept does not have an impact on the policy.

Question 40.

What is the need of collecting tax? Classify taxes into its two major categories and explain each briefly.

Answer:

- A democratic country has to incur expenditures on a variety of activities that ‘ it does in the country. Also, a developing economy makes investment in raising and maintaining several public utilities. To meet all these expenditures a state (government) must raise incomes.

- Taxes are an important source.of revenue/income for a state (government).

Taxes can be broadly divided into two categories:

- Direct taxes and

- Indirect taxes.

1. Direct taxes:

- When the taxpayer ‘directly pays the taxes’ to the government, the tax is called a direct tax.

- A direct tax is applied on individuals and organizations directly by the government.

- Income tax, corporation tax, wealth tax, etc. are examples of direct taxes.

Indirect taxes:

- The taxes applied on the manufacture or sale of goods and services are called indirect taxes.

- The tax payer does not pay this tax directly to the government. These taxes are initially paid to the government by an intermediary. The intermediary then adds the amount of the tax it paid to the value of the goods /services and passes on the total amount to the end user.

- Sales tax, service tax, excise duty, GST, etc. are examples of indirect taxes.

Question 41.

What are direct and indirect taxes?

Answer:

Direct taxes:

- When the taxpayer ‘directly pays the taxes’ to the government, the tax is called a direct tax.

- A direct tax is applied on individuals and organizations directly by the government.

- Income tax, corporation tax, wealth tax, etc. are examples of direct taxes.

Indirect taxes:

- The taxes applied on the manufacture or sale of goods and services are called indirect taxes.

- The tax payer does not pay this tax directly to the government. These taxes are initially paid to the government by an intermediary. The intermediary then adds the amount of the tax it paid to the value of the goods /services and passes on the total amount to the end user.

- Sales tax, service tax, excise duty, GST, etc. are examples of indirect taxes.

![]()

Question 42.

Give an introduction of GST.

Answer:

- GST refers to Goods and Service Tax. It is an indirect tax which has been introduced in India from 1st July, 2017.

- Before the introduction of GST, all forms of government namely central, state and local government used to collect various types of indirect taxes.

- The government of India made constitutional amendments and introduced a common indirect tax called Goods and Services Tax (GST). GST has replaced almost all indirect taxes.

- Thus, a common tax introduced in lieu of several indirect taxes imposed by the central and state governments in India came to be known as the Goods and Services tax (GST).

- GST is levied on the supply of goods and services.

- The administrative authority for GST is the GST Council.

The finance minister of India is the chairperson of the GST council whereas the finance ministers of states are the members.

Indirect taxes replaced by GST:

(A) Indirect taxes of the centre replaced by GST:

- Central State Tax (CST)

- Central Excise Duty (and additional excise duties)

- Additional Custom Duties

- Service Tax

(B) Indirect taxes of the states and union territories replaced by GST

- Value Added Tax (VAT)

- Purchase Tax

- Octroi

- Sales Tax,

- Entertainment Tax,

- Entry Tax, etc.

Note that, the basic custom duty collected separately and not yet replaced by GST.

Question 43.

Which indirect taxes of the centre have been replaced by GST?

Answer:

Indirect taxes replaced by GST:

(A) Indirect taxes of the centre replaced by GST –

- Central State Tax (CST)

- Central Excise Duty (and additional excise duties)

- Additional Custom Duties

- Service Tax

Question 44.

Which indirect taxes of the state and union territories have been replaced by GST?

Answer:

Indirect taxes of the states and union territories replaced by GST

- Value Added Tax (VAT)

- Purchase Tax

- Octroi

- Sales Tax,

- Entertainment Tax

- Entry Tax, etc.

Note that, the basic custom duty collected separately and not yet replaced by GST.

Question 45.

How will you classify GST? Explain. OR Write a note on CGST, SGST, UTGST and IGST.

Answer:

GST applicable in India can be classified into two broad categories. They are explained below:

1. Central Goods and Service Tax (CGST), State Goods and Service Tax (SGST) and Union Territory Goods and Service Tax (UTGST):

- When the location of the supplier and the place of supply i.e., location of the buyer are in the same state, the seller collects CGST as well as SGST.

- Here, the transactions are termed as intra-state transactions. Similarly, UTGST and CGST are collected by union territories for transactions taking place within a union territory.

- The CGST gets deposited with Central Government and SGST gets deposited with State Government.

Example:

- Suppose, a good is produced in Ahmedabad and sold in Bhavnagar (intra-state).

- Let the cost of good be ₹ 100/- and suppose the applicable GST is 18% where in CGST is 9% and SGST is 9%.

- Thus, the total price of the product will be

= ₹ 100 + CGST 9% + SGST 9% = ₹ 100 + ₹ 9 + ₹ 9 = ₹ 118 - Thus, the consumer will have to pay? 118 as the final price.

2. Integrated Goods and Service Tax (IGST):

When a good is produced in one state and is sold in another state, the GST rate applied on the product is called Integrated Goods and Service Tax (IGST).

Example:

- Suppose a good produced in Ahmedabad is sold in Mumbai (inter-state). Let the cost of good be ₹ 100/- and suppose the applicable IGST is 18%.

- Thus, the total price of the product will be

= ₹ 100 + IGST 18% = ₹ 100 + ₹ 18 = ₹ 118 - Thus, the consumer will have to pay? 118 as the final price. The entire amount of GST goes to the central government.

Question 46.

What is tax credit scheme? Explain.

Answer:

- For any effective tax regime, it is very important to ensure that there is no duplication of tax. When tax is levied on the same transaction more than once, it is known as duplication of tax.

- Input Tax Credit (ITC) is a mechanism to avoid duplication of tax on the same transaction. ITC ensures that whatever tax is paid on a given product at an earlier stage, it is set off against the tax payable at the present stage. Earlier, there was no provision under indirect tax system for input tax credit on indirect tax paid, but now GST allows for input tax credit.

Example:

Suppose a trader pays GST of ₹ 35000 at the time of purchase of goods. Suppose at the time of selling this product he is liable to pay GST of ₹ 40,000/-. Then the person needs to pay only the difference in the amount of GST i.e. GST during sale – GST during purchase = ₹ 40,000 – ₹ 35,000 = ₹ 5000/-

Multiple Choice Questions

Question 1.

Planning commission is now replaced by

(A) Niti Shashtra

(B) Niti Aayog

(C) Gadh Niti

(D) Niti Tantra

Answer:

(B) Niti Aayog

Question 2.

In a democracy, the government needs to take an approval from ________ for undertaking activities, incur expenses and raise incomes.

(A) The President

(B) The elected representatives

(C) The Prime Minister

(D) Both (A) and (C)

Answer:

(B) The elected representatives

Question 3.

Which of the following is not a responsibility of the central government?

(A) Foreign affair

(B) Census

(C) Railways

(D) Public health

Answer:

(A) Foreign affair

![]()

Question 4.

Which of the following is not a responsibility of the state?

(A) Census

(B) Law and order

(C) Forests

(D) Sanitation

Answer:

(D) Sanitation

Question 5.

________ can declare a budget.

(A) Finance minister of country

(B) Head of the governing body

(C) Finance minister of state

(D) All of these

Answer:

(C) Finance minister of state

Question 6.

Which of the following is not the purpose of a budget?

(A) To get an idea regarding available resources and areas that require expenses

(B) Provide direction for allocating resources

(C) For knowledge of the government

(D) For obtaining approval of the body of elected representatives

Answer:

(C) For knowledge of the government

Question 7.

Basically, a budget is of ________ types.

(A) Only 1

(B) 2

(C) 4

(D) 5

Answer:

(B) 2

Question 8.

Which of the following is a form of unbalanced budget?

(A) Deficit budget

(B) Primary budget

(C) Surplus budge

(D) Both (A) and (C)

Answer:

(D) Both (A) and (C)

Question 9.

Which budget practically does not exist?

(A) Deficit budget

(B) Unbalanced budge

(C) Surplus budget

(D) Balanced budget

Answer:

(D) Balanced budget

Question 10.

One of the merits of the balanced budgets is that

(A) It ensures financial stability

(B) Promotes development and welfare activities

(C) It is useful in times of inflation

(D) Both (B) and (C)

Answer:

(A) It ensures financial stability

Question 11.

In present times, government budgets are mostly budgets.

(A) Surplus

(B) Deficit

(C) Balanced

(D) Unbalanced

Answer:

(B) Deficit

Question 12.

In reality, most governments do not have ________ budgets.

(A) Surplus

(B) Unbalanced

(C) Deficit

(D) Balanced

Answer:

(A) Surplus

Question 13.

Which of the following is a demerit of deficit budget?

(A) It shows that the governments do not have control on expenditures.

(B) Governments borrow more and increase debts.

(C) People are made to pay more taxes to enhance government incomes.

(D) Both (A) and (B)

Answer:

(D) Both (A) and (B)

![]()

Question 14.

The credit side of the budget records ________

(A) Current income

(B) Revenue expenditure

(C) Capital income

(D) Both (A) and (C)

Answer:

(D) Both (A) and (C)

Question 15.

Borrowings from the market are recorded in ________

(A) Revenue income

(B) Current expenditure

(C) Capital income

(D) Capital expenditure

Answer:

(C) Capital income

Question 16.

How many accounts are there on the debit side of the budget?

(A) 1

(B) 2

(C) 3

(D) 4

Answer:

(B) 2

Question 17.

The Indian budget is effective between ________

(A) Diwali to next Diwali

(B) 1st April to 31st March

(C) 1st January to 31st December

(D) 1st March to 31st April of next year

Answer:

(B) 1st April to 31st March

Question 18.

The union budget is presented in the Lok Sabha in ________

(A) First week of March

(B) First week of April

(C) Last week of February

(D) Last week of January

Answer:

(C) Last week of February

Question 19.

Which of the following is recorded is the income side of the capital account , of central government?

(A) Revenue from direct taxes

(B) Assistance received from abroad

(C) Interest income

(D) None of these

Answer:

(D) None of these

Question 20.

Which of the following is recorded as expenditure in the current account of union budget?

(A) Non-plan grants

(B) Assistance given to union territories

(C) Subsidies

(D) Both (A) and (C)

Answer:

(D) Both (A) and (C)

Question 21.

Since ________ the expenditure of central government is classified into plan and non-plan expenditures.

(A) 1991

(B) 2001

(C) 2016

(D) 2013

Answer:

(C) 2016

Question 22.

Which of the following is recorded on the credit side of current account?

(A) Land revenue

(B) Internal debt

(C) State excise

(D) Both (A) and (C)

Answer:

(D) Both (A) and (C)

![]()

Question 23.

Which is a non-developmental expenditure?

(A) Repayment of loans

(B) Capital expenditure on social service

(C) Advances to local

(D) Both (A) and (C)

Answer:

(D) Both (A) and (C)

Question 24.

________ is a part of credit side of current account of Municipal Corporation.

(A) Octroi

(B) Education less

(C) Property tax

(D) All of these

Answer:

(D) All of these

Question 25.

Grants received from state government and borrowed capitals are recorded in ________

(A) Debit side of capital account

(B) Credit side of capital account

(C) Debit side of current account

(D) Credit side of current account

Answer:

(B) Credit side of capital account

Question 26.

The states provide finance to the Panchayats as per the recommendation of ________

(A) Central government

(B) Niti Aayog

(C) State Finance Commissions

(D) Central Reserve

Answer:

(C) State Finance Commissions

Question 27.

How many types of budget deficits are there?

(A) 2

(B) 3

(C) 4

(D) 6

Answer:

(C) 4

Question 28.

Total expenditure on revenue account > total receipts = ________

(A) Budgetary deficit

(B) Primary deficit

(C) Fiscal deficit

(D) Revenue deficit

Answer:

(D) Revenue deficit

Question 29.

The central government incurs deficit financing to meet deficit.

(A) Budgetary

(B) Revenue

(C) Fiscal

(D) Primary

Answer:

(A) Budgetary

Question 30.

During budgetary deficit when the state government borrows more from the central government it is called

(A) Loan

(B) Borrowing

(C) Overdraft

(D) All of these

Answer:

(C) Overdraft

![]()

Question 31.

Fiscal deficit = ________

(A) Total income – total expenditure

(B) Total expenditure – total income

(C) Total expenditure – total income (Including market borrowings)

(D) Total expenditure – total income (Excluding market borrowings)

Answer:

(D) Total expenditure – total income (Excluding market borrowings)