Gujarat Board GSEB Class 11 Commerce Economics Important Questions Chapter 5 Cost of Production and Concept of Revenue Important Questions and Answers.

GSEB Class 11 Economics Important Questions Chapter 5 Cost of Production and Concept of Revenue

Short Answer Type Questions

Question 1.

State two importance of determining / cost and revenue for a firm.

Answer:

- Helps the firms to decide price of its commodity.

- Provides guidelines to maximize the profit of the firm.

Question 2.

How many types of different concepts of cost are there? Name them?

Answer:

Three:

- Real cost

- Opportunity cost and

- Monetary cost.

Question 3.

Which factors are included in real cost over and above money

Answer:

Mental factors such as fatigue, boredom tension, stress, faced by the labourers, the anxiety faced by entrepreneur or investors who risk their saving and capital, insecurity of wrong decisions, etc. are also the factors included in the real cost.

Question 4.

Why it is very difficult or rather impossible to measure real cost?

Answer:

Over and above money used for production, real cost also includes psychological factors such as fatigue, boredom, pain, sacrifice, effect on worker’s health due to smoke emitted, polluted water released, etc. It is very difficult to measure these factors and hence

Question 5.

‘If a factor of production has only one use than its, opportunity cost cannot be decided’. Give one example that justifies this statement.

Answer:

Example to justify this statement is: Suppose if a piece of land is used only to produce grass so far than we cannot calculate the opportunity cost of that land.

Question 6.

Give an example of monetary cost.

Answer:

If a factory producing pens incur the cost of ₹ 50,000 to produce 1000 units of pen, the monetary cost to produce 1,000 units 4 of pen is ₹ 50,000.

![]()

Question 7.

With respect to production what all can a producer do in short run?

Answer:

The producer can increase/decrease production by increasing or decreasing variable factors such as raw material, labour, electricity, etc. The producer cannot change the size of firm but can increase production by increasing the capacity of factors of production.

Question 8.

What is long term or long run?

Answer:

A long term (run) is a time period in which a producer can change all the factors of production. Hence, in this period all the factors of production such as plant, heavy machinery, building of a factory, etc. are variable.

Question 9.

With respect to production what all can a producer do in long run?

Answer:

The producer can increase or decrease these factors of production and hence increase/decrease the production in long term (run). The producer can change the size of the firm. By doing so he can change the total production to a large extent in a long term. The firms can also its size by using new and modern technology.

Question 10.

Which costs are included in fixed cost of production?

Answer:

Fixed cost includes salary of permanent staff, rent of factory building, house or property tax, license fee, interest on capital, premium of insurance, etc.

Question 11.

What is variable cost? What type of relation does it has with production?

Answer:

In short term if the cost of production changes with the change in quantity of production it is called variable cost. The variable cost increases if cost of production increases and decreases if the cost of production decreases and also becomes zero if production is zero. This cost has direct (positive) relation with quantity of production.

Question 12.

State few costs that are included in variable cost.

Answer:

Price of raw material, energy consumption, transportation expenditure, labour wages, tax on product, sale tax, etc.

Question 13.

What is true about fixed cost and variable cost in short and long run?

Answer:

The difference between fixed cost and variable cost is possible in short period of time only. In a long run (period) all costs are variable costs.

Question 14.

What is the reason for variable cost to increase at diminishing rate with increase in production upto certain extent?

Answer:

The reason for variable cost to increase at diminishing rate with increase in production upto certain extent is that it is affected by the law of increasing returns to scale.

Question 15.

What is total cost?

Answer:

The summation of Total Fixed Cost (TFC) and Total Variable Cost (TVC) is called Total Cost (TC).

TC = TFC + TVC.

Question 16.

State the relation between total cost and production.

Answer:

There is a cause-effect relationship between total production and total cost. If total production is more, total cost is more and if total production is less, total cost is also less.

Question 17.

Explain the behavior of TC curve and TVC curve.

Answer:

When the production increases, the fixed cost remains fixed but variable cost increases and so total cost also increases. Due to this reason, Total Cost (TC) curve lies above Total Variable Cost (TVC) curve. However, the difference between TC and TVC remains constant because of which TC and TVC remain parallel to each other.

Question 18.

What is Average Fixed cost? State its formula.

Answer:

The cost of per unit of output is called the Average Fixed Cost (AFC). AFC is obtained by dividing total fixed cost of a firm with production unit.

Question 19.

Give an idea about the slope of Average Fixed Cost?

Answer:

Due to the decreasing cost, the Average Fixed Cost curve (AFC) is a downward sloping curve, but it never becomes zero.

Question 20.

What is average variable cost?

Answer:

Average Variable Cost is the variable cost per unit of output. It is obtained by dividing Total Variable Cost (TVC) by total units produced or says Total Production (TP).

AVC = \(\frac{\mathrm{TVC}}{\mathrm{TP}}\)

Question 21.

What is average cost?

Answer:

The total cost per unit of production is called the average cost or total average cost. Average cost is obtained by dividing total cost by units of production.

Question 22.

State the formula for average cost.

Answer:

Average cost (AC) = \(\frac{\mathrm{TC}}{\mathrm{TP}}\)

OR

Average cost (AC) = \(\frac{\mathrm{FC}+\mathrm{VC}}{\mathrm{TP}}\)

Question 23.

Why the curve of average cost is ‘U’ shaped?

Answer:

After production of some units the increase in Average Variable Cost (AVC) is more in comparison to decrease in Average Fixed Cost (AFC). As a result, Total Cost (TC) increases and Average Cost (AC) curve becomes ‘U’ shaped.

Question 24.

What is marginal cost?

Answer:

The change in total cost when an additional unit of output is produced is called Marginal Cost (MC).

Question 25.

How is the curve of marginal cost?

Answer:

Upto certain increase in output, the curve of marginal cost slopes downward and has a negative slope. After this pointy, as production increases marginal cost also increase which results in a positive slope. The entire curve becomes hockey shaped.

Question 26.

State the importance of marginal cost in economics.

Answer:

- It helps to decide optimum sales price,

- To study effect on profit,

- To take decision of selling products at different prices to different customers, etc.

Question 27.

How is the curve of marginal cost and average cost when MC < AC?

Answer:

As average cost decreases marginal cost also decreases but, marginal cost decreases more rapidly than the Average Cost. Hence, when marginal cost is decreasing its curve remains below the curve of average cost i.e. MC < AC.

Question 28.

How is the curve of marginal cost and average cost when MC = AC?

Answer:

When marginal cost = Average cost, it means that marginal cost is at minimum

Question 29.

How is the curve of marginal cost and average cost when MC > AC?

Answer:

When MC > AC, marginal cost curve goes above Average cost curve.

Question 30.

What is Long Run Average Cost curve?

Answer:

The Long Run Average Cost (LRAC) curve of a firm shows the minimum or lowest average total cost at which a firm can produce any given level of output in the long run.

Question 31.

What is total revenue? On what does it largely depends?

Answer:

Money received by a firm on selling the units it produces is known as revenue. The total income received by firm from sale is called total revenue. This income is known as total revenue or sale revenue.

A firm’s total income is based on two things:

- Price per unit and

- Total sale.

Question 32.

What is average revenue?

Answer:

The revenue generated per unit of output sold is called the Average Revenue (AR). It is obtained by dividing total revenue with total sale. Formula : Average Revenue (AR) = Total Revenue (TR)/ Total sale (Q)

Question 33.

What does the average revenue curve show?

Answer:

The Average Revenue curve shows the Average Revenue of a producer by selling of commodity.

![]()

Question 34.

What is an imperfect market? Give few examples of imperfect market.

Answer:

A situation where perfect competition is absent is called imperfect competition or imperfectly competitive market. Monopoly, duopoly, oligopoly, monopolistic competition, etc. are examples imperfectly competitive market.

Long Answer Type Questions

Question 1.

State the importance of determining cost and revenue of a firm.

Answer:

- In economic analysis it is quite important to understand concept of cost and revenue to understand behaviour of firm.

- As the production quantity changes, its cost of production changes. By cost we come to know the debit side and by revenue we come to know the credit side of the firm.

Importance of determining cost and revenue:

- Helps the firms to decide price of its commodity

- Provides guidelines to maximize the profit of the firm

- Marginal cost helps to explain maximum profit .

- Concept of marginal cost helps to understand the behaviour of a firm

- Concepts of cost and revenue play an important role in taking decisions like, what amount of factors of production are invested by firms, how much employment is given, what amount of production and investment is done, etc.

- Concept of opportunity cost is important to know the alternative uses of factors of production in managerial economics.

- Concepts of monetary cost guide the administration of a firm.

Question 2.

Explain the concept of real cost and problems faced in measuring it.

Answer:

Real cost:

- According to Marshall, the labourers, capitalists and entrepreneurs who are involved in the process of production bear psychological and physical burden. Such burden is called real cost.

- Money spent by producers for production work of goods is not the only cost of production. Mental factors such as fatigue, boredom tension, stress faced by the labourers, the anxiety faced by entrepreneur or investors who risk their saving and capital, insecurity of wrong decisions, etc. are also the factors included in the real cost.

- Owing to the monetary as well as various other factors, real cost cannot be actually measured in monetary terms. Hence, real cost is also called non-monetary cost.

- As per Marshall, the factors of production have to bear this real cost. So, to attract these factors return is given in the form of wage, interest and profit.

Problems in measuring real cost:

- As per the concept of real cost psychological factors such as fatigue, boredom, pain, sacrifice and anxiety are a part of production of goods. It is quite difficult to measure the real cost of goods which face these psychological factors during production.

- Moreover, other factors such as the smoke emitted by factories, the polluted water released in rivers, streams, etc. create adverse effect on health of the people of surrounding area. From the perspective of society this adverse effect is also a cost which cannot be measured.

Question 3.

Explain the concept of opportunity cost, problems faced in measuring it and factors affecting it.

Answer:

Opportunity cost:

- The concept of opportunity cost was presented by Austrian economist but it was properly presented by Marshall. We know that the means of production have alternative uses i.e. more than one use. The concept of opportunity cost is based on the particular characteristic of factor of production which says that when a factor is used for a particular use, the other use is left out or the same cannot be used for other purpose. Under such circumstances, the best alternative which remains is the opportunity cost of production.

- If a factor of production is used in the production of one commodity which seems the best, the next best or say the second best alternative is left out.

- Assuming the best choice is made, opportunity cost is the ‘cost’ incurred by not enjoying the benefit that would have been had by taking the second best available choice

Example:

(a) If someone is producing wheat on one piece of land, then at the same time on the same piece of land other food grain (crop) cannot be produced.

(b) A worker working in textile mill cannot at the same time work in any other industry.

- Suppose if wheat is produced on a piece of land one can earn an income of ₹ 2 lakh can be earned and if rice is produced the income of ₹ 3.5 lakh can be earned.

- The farmer decides produce rice in which he earns more.

- So, to get the income of ₹ 3.5 lakh from the production of rice, farmer loses out income of ₹ 2 lakh from the production of wheat. This left out income of ₹ 2 lakh from the production of wheat is called the opportunity cost of ₹ 3.5 lakh earned from the production of rice.

Problems in measuring opportunity cost:

(I) Factors with one use:

If a factor of production has only one use then its opportunity cost cannot be decided.

Example:

(a) Suppose if a piece of land is used only to produce grass so far than we cannot calculate the opportunity cost of that land.

(b) The same applies for a person who is currently unemployed. Since the person does not have any work how can we calculate alternative cost?

(II) Factors having specific use:

-If factors of production have only a specific use then the concept of opportunity cost is not useful. Returns of these factors are not decided by their alternative uses but on the basis of their demand.

Example:

(a) Persons having expertise over computers, scientist having knowledge of atomic power, etc. These people do not know any other work except their own.

(b) Machine for making ice can only produce ice i.e. it has no alternative use and so no opportunity cost is involved.

![]()

Question 4.

Explain monetary cost.

Answer:

Monetary cost:

Generally, the amount that the producer pays monetarily for the process of production is called its monetary cost. Thus, the cost of production in terms of money is known as monetary cost. Monetary cost includes wages, rent, raw material, fuel and the total of all the expenditure made by the producer.

Example:

- If a factory producing pens incur the cost of ₹ 50,000 to produce 1000 units of pen, the monetary cost to produce 1,000 units of pen is ₹ 50,000.

- Real cost and opportunity cost have many limitations which make their calculation very difficult. Hence, the concept of monetary cost is widely used in economic analysis, for decisions related to production and in price determination. Since cost of production is calculated in terms of money, the concept of monetary cost is important.

Question 5.

What is variable cost of production and fixed cost of production?

Answer:

Variable cost of production:

Raw material, extra labourers, fuel, etc. are factors which can get changed in short period and so they are known as variable factors. Expenditure done on these factors is known as variable cost of production.

Fixed cost of production:

Machinery, building of factory, administrative staff, etc. cannot get changed , i.e. increase or decrease in short period of time therefore they are known as fixed factor of production and cost of such factors is known as fixed cost of production.

Question 6.

Differentiate between short term (run) and long term (run).

Answer:

| Short term (run) | Long term (run) |

| 1. A short term (run) is a time period in which a producer cannot change factors of production. | 1. A long term (run) is a time period in which a producer can change all the factors of production. |

| 2. In this period all the factors of production such as plant, heavy machinery, building of a factory, etc. remain fixed. | 2. In this period all the factors of production such as plant, heavy machinery, building of a factory, etc. are variable. |

| 3. The producer can increase/decrease production by increasing or decreasing variable factors such as raw material, labour, electricity, etc. | 3. The producer can increase or decrease factors of production and hence increase/decrease the production. |

Question 7.

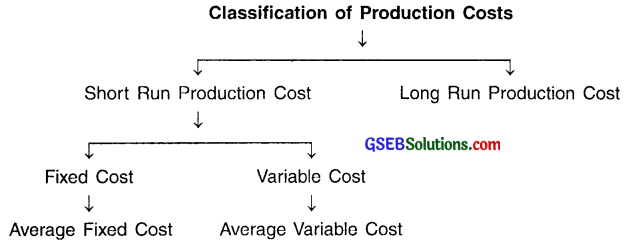

Classify the various production costs with the help of a chart.

Answer:

Question 8.

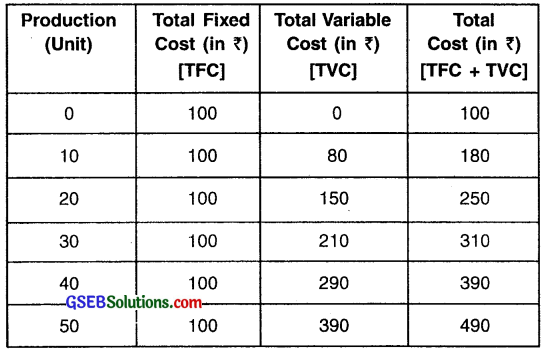

Explain total cost in detail.

Answer:

Total cost (TC):

- The summation of Total Fixed Cost (TFC) and Total Variable Cost (TVC) is called Total Cost (TC).

∴ TC = TFC + TVC - There is a cause-effect relationship between total production and total cost. If total production is more, total cost is more and if total production is less, total cost is also less.

Diagram of total cost

Graph and curve:

- When the production increases, the fixed cost remains fixed but variable cost increases and so total cost also increases. Due to this reason, Total Cost (TC) curve lies above Total Variable Cost (TVC) curve.

- However, the difference between TC and TVC remains constant because of which TC and TVC remain parallel to each other.

Example:

- As shown in the diagram, X-axis represents production and Y-axis represents cost. The upper curve is of TC and the lower is of TVC.

- Total cost curve begins from point P on Y-axis. Point P of TC which lies at ₹ 100 shows that even when output is 0, Total Fixed Cost i.e. TFC = 100, while Total Variable Cost TVC = 0.

- As the production increases TFC remains constant and TVC increases. Due to this TVC curve moves upward from left hand side to right hand side and TC curve is upside and parallel to TVC curve.

Important conclusions:

- When production is 0, TVC = 0.

- When production = 0, VC = 0. TFC = TC = OP.

- When production = OQ1 TFC = Q1b, VC = Q1C and TC = Q1a.

- When production = OQ2, TFC = Q2f, VC = Q2g and TC = Q2e.

![]()

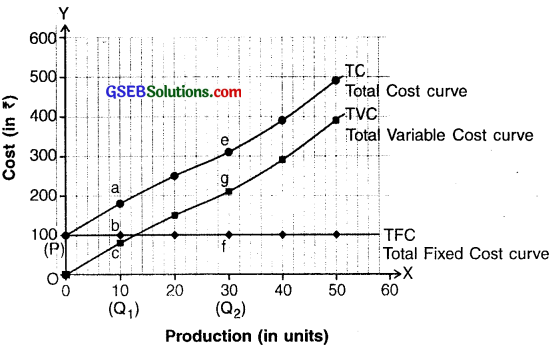

Question 9.

Give the meaning of Average Variable Cost and explain with the help of diagram.

Answer:

Average Variable Cost (AVC):

Average Variable Cost is the variable cost per unit of output. It is obtained by dividing Total Variable Cost (TVC) by total units produced or says Total Production (TP).

Total Variable Cost (TVC):

∴ Average Variable Cost (AVC) = \(\frac{\text { Total Variable Cost (TVC) }}{\text { Total Production (TP) }}\)

Thus, AVC = \(\frac{\text { TVC }}{\text { TP }}\)

Example:

- Suppose a firm’s total variable cost is ₹ 150 and a firm produces 20 units of output.

∴ AVC = \(\frac{150}{20}\) = ₹ 7.5 . - The concept of Average Variable Cost helps a firm to decide whether to continue production or increase/decrease it.

| Output (units) | Total Variable Cost (in ₹) [TVC] | Average Variable Cost (in ₹) [AVC = TVC/output] |

| 10 | 80 | 8 |

| 20 | 150 | 7.5 |

| 30 | 210 | 7 |

| 40 | 290 | 7.25 |

| 50 | 390 | 7.8 |

| 60 | 500 | 8.33 |

| 70 | 620 | 8.85 |

Diagram of average variable cost

Graph and curve:

- The schedule shows output, Total Variable Cost (TVC) and Average Variable Cost (AVC) of a firm. The graph shows output on X-axis and AVC on Y-axis.

- As can be seen, first the Average Variable Cost moves left to right upward , to downward i.e. it has negative slope curve. This indicates that in beginning as output increases Average variable cost decreases because it follows the law of increasing return to scale.

- After the production of 30 units, average variable cost shows an increasing trend because it follows decreasing return to scale law. Thus, Average Variable Cost is related to the volume of production.

Question 10.

Give the meaning of Average Cost (or Average Total Cost) and explain with the help of diagram.

Answer:

Average Cost (or Average Total Cost):

The total cost per unit of production is called the average cost or total average cost. Average cost is obtained by dividing total cost by units of production.

Total cost is a sum of total Fixed Cost (FC) and total Variable Cost (VC).

∴ Average Cost (AC) = \(\frac{\text { Total Cost (TC) }}{\text { Total Production (Units of Production) }}\)

i.e AC = \(\frac{\text { TC }}{\text { TP }}\)

OR

Average Cost (AC) = \(\frac{\text { Fixed Cost (FC) }+\text { Variable Cost (VC) }}{\text { Total Production (Units of Production) TP }}\)

i.e. AC = \(\frac{\mathrm{FC}+\mathrm{VC}}{\mathrm{TP}}\)

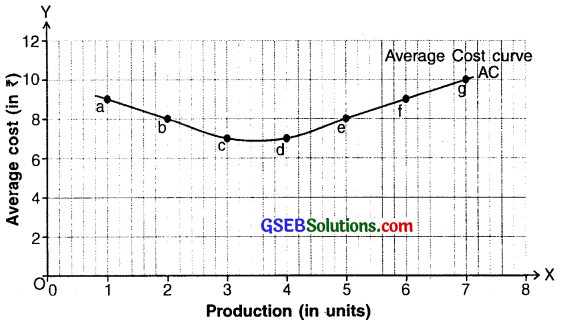

| Production (unit) [Output] | Total Cost (in ₹) [TC] | Average Cost (in ₹) [TC/output] |

| 1 | 9 | 9 |

| 2 | 16 | 08 |

| 3 | 21 | 07 |

| 4 | 28 | 07 |

| 5 | . 40 | 08 |

| 6 | 54 | 09 |

| 7 | 70 | 10 |

Example:

The schedule shows production in units, total cost and average cost of a firm. As output increases, the total cost rises. Initially the average cost falls then remains constant and subsequently rises.

Diagram of average total cost (ATC/AC)

Graph and curve:

- X-axis shows output and Y-axis average cost.

- As can be seen, initially up to certain rise in production of units the average cost decreases.

- From the concepts of average fixed costs and average variable costs we know that after production of some units the increase in Average Variable Cost (AVC) is more in comparison to decrease in Average Fixed Cost (AFC). As a result, Total Cost (TC) increases and Average Cost (AC) curve becomes ‘U’shaped.

Question 11.

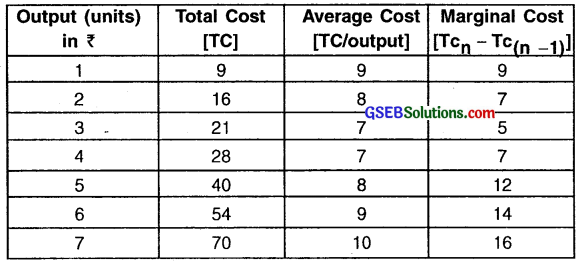

Give the meaning of Marginal Cost and explain with the help of diagram.

Answer:

Marginal cost (MC):

The change in Total Cost (TC) when an additional unit of output is produced is called marginal cost.

Suppose,

Units produced = n Total cost = TC

So, Total cost of ‘n’ units of output = Tcn

Similarly, for ‘n-1′ units i.e. 1 unit lesser than ‘n’ units, Total cost of n-1 units = Tc(n – 1)

Marginal cost of n units = Total cost of (n) units of output – Total cost of (n-1) units of output.

Thus, MCn – Tcn – Tc(n – 1)

Example:

As shown in the schedule, for n = 3 units output, Total Cost (Tc) = 21 and for n = 2 units of output, Tc = 16.

Now,

MCp = Tcn – TC(n – 1)

∴ Mc3 = TC3 – Tc(3 – 1) (For Marginal Cost of 3rd unit i.e. n = 3)

= TC3 – TC2

∴ MC3 =21 -16 (Substituting values from above or from the schedule) = 5

- Thus, the marginal cost of the 3rd unit is the difference of the Total Cost of 3rd and the 2nd unit i.e. ₹ 5.

- Marginal cost is independent of fixed cost. This means marginal cost is not affected by fixed cost.

- Hence, it can be said that marginal cost is the result of change in variable cost.

- When production decrease from n and goes to n – 1 then increase in total variable cost is equal to marginal cost with the change in production of output marginal cost is equal to total cost.

From the table, we can see that till increase in production up to 3rd unit, total average cost decreases and marginal cost decreases from ₹ 9 to ₹ 5. At the 3rd unit, marginal cost is minimum i.e. ₹ 5. After this point there is continuous increase in marginal cost.

Diagram of marginal cost

Graph and curve:

- The graph shows output in units on X-axis and Average cost on Y-axis.

- As per the data till output of 3rd unit both total average cost and marginal cost decreases. After 3rd unit, the total average cost and marginal cost increases because of the increase in total variable cost at diminishing rate and after some point increases at increasing rate.

- Due to such data, in the diagram, marginal cost curve is like “Hockey Stick” (✓). Till the third unit, marginal cost is decreasing therefore marginal cost curve has negative slope after the third unit with the increase in production MC increases therefore marginal cost curve has positive slope.

![]()

Question 12.

Give an example to explain the difference between Average Cost (AC) and Marginal Cost (MC). Also, state its role in economics.

Answer:

Marginal cost and average cost can differ greatly.

Example:

Suppose a firm produces 100 units at Total Cost (TC) ₹ 1000.

Now, Average Cost per unit will be 1000/100 = ₹ 10.

Suppose, the Total Cost of the firm to produce 101 units is ₹ 1020.

In this case, Average Cost per unit will be \(\frac{1020}{101}\) = ₹ 10.

Marginal Cost MCn = Tcn – Tc(n – 1)

Marginal Cost for 101th unit MC101 = Tc101 – Tc(101 – 1)

– 1020 – 1000

= ₹ 20

Conclusion:

Though the average cost is ₹ 10 for the first 100 units, when the firm produces 1 unit more, the cost of 1 additional unit becomes ₹ 20. This ₹ 20 is also called the marginal cost.

Role/Importance of Marginal Cost in economics:

- It helps to decide optimum sales price.

- To study effect on profit.

- To take decision of selling products at different prices to different customers, etc.

Question 13.

State and explain the types of relation between Average Cost and Marginal Cost.

Answer:

Relation between AC and MC:

1. Marginal Cost < Average Cost (MC < AC):

Initially, as average cost decreases marginal cost also decreases but, marginal cost decreases more rapidly than the Average Cost. Hence, when marginal cost is decreasing its curve remains below the curve of average cost i.e. MC < AC.

2. Marginal Cost = Average Cost (MC = AC):

When Average Cost is minimum, the Marginal Cost curve intersects the Average Cost curve from below. At the point of intersection the Marginal Cost and Average Cost become equal i.e. MC = AC.

3. Marginal Cost > Average Cost (MC > AC):

- When Marginal Cost curve intersects the Average Cost curve, both the costs start increasing. After this point increase in Marginal Cost is rapid than the increase in Average Cost.

- Hence, Marginal Cost curve goes above Average Cost curve i.e. MC > AC.

Question 14.

Give a brief idea about Long Run Average Cost Curve and effect of fixed / cost and variables in the long run.

Answer:

Long Run Average Cost Curve:

- The Long Run Average Cost (LRAC) curve of a firm shows the minimum or lowest average total cost at which a firm can produce any given level of output in the long run.

- According to Benham, in the long run, there is no distinction between fixed cost and variable cost. Hence, classifying costs as fixed and variable does not make sense in the long run as all factors of production become variable in the long run.

- In order to increase production in the long run, factors of production can be altered in any proportion. This expands the scale of the firm.

- For example, the remuneration paid to an employee is considered as a fixed cost in the short run.

- However, in the long run, in response to an increase in demand, if the producer decides to increase production then he may employ new workers or buy new land or rent in new land, etc. Thus, factors which are fixed in the short run become variable in the long run.

Question 15.

Explain the concept of Total Revenue (TR) with the help of an example.

Answer:

Total Revenue (TR):

- Money received by a firm on selling the units it produces is known as revenue. The total income received by firm from sale is called total revenue. This income is known as total revenue or sale revenue.

- A firm’s total income is based on two things:

- Price per unit and

- Total sale.

- Change in one or both the factors brings change in the revenue of the firm.

Formula:

Total Revenue (TR) = Units sold (Q) × Price of commodity (P)

Example:

A firm produces pen.

Sale price per unit of pen = ₹ 50

Total sale = 100 units

Therefore, Total Revenue (TR) = Units sold (Q) × Price of commodity (P)

TR = Q × P

∴ 5000 = 100 × 50

= ₹ 5000

∴ Firm’s Total Revenue (TR) = ₹ 5000

The firm’s total revenue will change if:

- The sale of commodity increases/decreases OR

- Price increases/decreases OR

- Both the above factors change

Question 16.

Explain the concept of Average Revenue with the help of an example.

Answer:

Average Revenue (AR):

The revenue generated per unit of output sold is called the Average Revenue (AR). It is obtained by dividing Total Revenue with Total sale.

Formula:

Average Revenue (AR) = \(\frac{\text { Total Revenue (TR) }}{\text { Total sale }(\mathrm{Q})}\)

Example:

A firm produces pen.

Total sales (Q) = 1000 units of pen

Total revenue = ₹ 50000

∴ Average Revenue (AR) = \(\frac{\text { Total Revenue (TR) }}{\text { Total sale }(\mathrm{Q})}\)

= \(\frac{50000}{1000}\)

= ₹ 50

- Thus, the firm’s average revenue per pen is ₹ 50.

- The curve formed on plotting units sold against revenue is called the Average Revenue curve.

- When the firm sells all units of commodity at a same price, then Average Revenue is equal to price i.e. AR = R

- In such situation, the Average Revenue curve also becomes the demand curve for the producer.

- Demand curve shows, how much commodity is a consumer ready to purchase at different prices. On the other hand the Average Revenue-curve shows the Average Revenue of a producer by selling the commodities.

![]()

Question 17.

Explain the concept of Marginal Revenue with the help of an example.

Answer:

Marginal Revenue:

The change in total revenue which results from the sale of one more unit of a commodity is called the marginal revenue.

Formula:

MRn = Rn – R(n – 1)

where, MR = Marginal Revenue

n = Number of sold units

Rn = Revenue from the sale of n units commodity

R(n – 1) = Revenue from sale of (n – 1) units

Example:

- A firm receives income of ₹ 50,000 by selling 1000 units of pen.

- On selling 1001 units of pen, firm’s revenue increases to ₹ 50,045. Here,

n =1001,

Rn = ₹ 50,045

(n – 1) = 1000,

R(n – 1) = ₹ 50,045

Thus, Marginal Revenue MRn = Rn – R(n – 1)

= ₹ 50,045 – ₹ 50,000

= ₹ 45

Thus, the firm’s Marginal Revenue (MR) is ₹ 45.

Question 18.

State and define the types of revenue.

Answer:

Types of revenue:

1. Total Revenue (TR):

Money received by a firm on selling the units it produces is known as revenue. The total income received by firm from sale is called total revenue. This income is known as total revenue or sale revenue.

Formula:

Total Revenue (TR) = Units sold (Q) × Price of commodity (P)

2. Average Revenue (AR):

The revenue generated per unit of output sold is called the Average Revenue (AR). It is obtained by dividing total revenue with total sale.

Formula:

Average Revenue (AR) = \(\frac{\text { Total Revenue (TR) }}{\text { Total sale }(\mathrm{Q})}\)

3. Marginal Revenue:

The change in total revenue which results from the sale of one more unit of a commodity is called the marginal revenue.

Formula:

MRn = Rn – R(n – 1)

where, MR = Marginal Revenue

n = Number of sold units

Rn = Revenue from the sale of n units commodity

R(n – 1) = Revenue from the sale of (n – 1) units

Question 19.

State the characteristics of perfect competitive market.

Answer:

Perfect competitive market:

1. Perfect market or perfect competitive market is defined by several characteristics.

Some are:

- Perfectly competitive market is such a market where firms accepts market price and sell their commodities

- Commodities are homogeneous (i.e. the qualities and characteristics of goods or services available in market do not vary between different suppliers)

- There are large number of buyers and sellers

- Buyers and sellers have complete knowledge of market situation

- Price is determined by demand and supply of a commodity. Firms sells commodity on this price only and no firm can influence this price. Hence, price is fixed and constant.

2. In perfect competition, market price (P) = Average Revenue (AR) = Marginal Revenue (MR) i.e. (P – AR = MR).

3. Under such market condition, if price of commodity is ₹ 50 then Average

Revenue and Marginal Revenue of firm will also be ₹ 50.

4. As a result, the curves of Average Revenue and Marginal Revenue of the firm are same and also parallel to X-axis. This curve is represented as DD in the diagram.

Question 20.

In perfect competition, average revenue curve and marginal revenue curve are same and parallel to the X-axis. Explain.

Answer:

- In perfectly competitive market, Marginal Revenue (MR) and Average Revenue (AR) are constant and equal. As a result, both of them can be shown through one line or say curve DD.

- Moreover, in perfect competition, market price (P) = Average Revenue (AR) = Marginal Revenue (MR) i.e. (P = AR = MR). Hence, irrespective of any price MR and AR will remain parallel to the X-axis.

- All points on DD curve will show Average Revenue = Marginal Revenue.

- Also, the Average Revenue and Marginal Revenue curve merge into one another and since value of both the revenues are same and constant the slope of curve is zero.

- Hence, in perfect competition, average revenue curve and marginal revenue curve are same and parallel to the X-axis.

Question 21.

Differentiate between fixed cost and variable cost.

Answer:

| Fixed cost (FC) | Variable cost (VC) |

| 1. In a short period (run), the production may increase, decrease or become zero i.e. no production, but the cost would remain same. Such a type of cost is called the fixed cost. | 1. In short term if the cost of production changes with the change in quantity of production it is called variable cost. |

| 2. Fixed cost is also known as complementary cost. | 2. Variable cost is also known as unstable or direct or main cost. |

| 3. Example: Salary of permanent staff, rent of factory building, house property tax, license fee, interest on capital, premium of insurance, etc. | 3. Example: Price of raw material, energy consumption, transportation expenditure, labour wages, tax on product, sale tax, etc. |

| 4. Fixed cost is not related to the units produced. | 4. Variable cost is directly related to the units produced. |

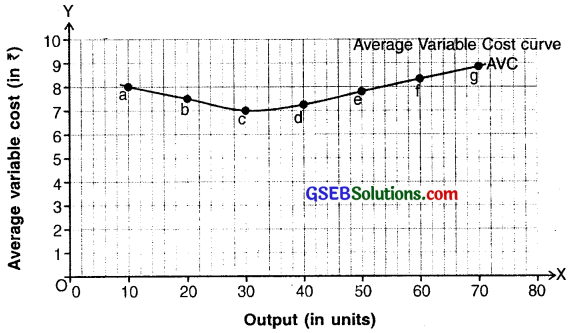

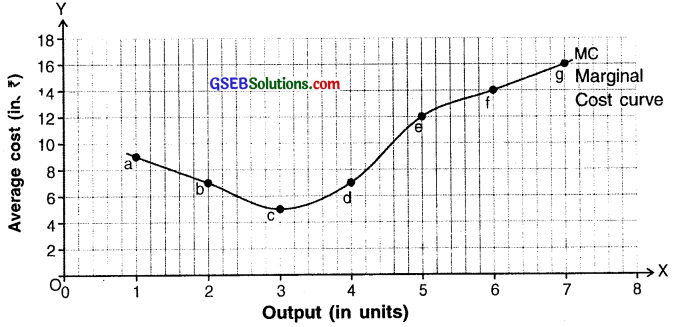

Question 22.

Differentiate between Average Fixed Cost and Average Variable Cost.

Answer:

| Average fixed cost (AC) | Average variable cost (AVC) |

| 1. The cost of per unit of output is called the Average Fixed Cost (AFC). | 1. Average Variable Cost is the variable cost per unit of output. |

| 2. Equation: AFC = TFC/TP | 2. Equation: AVC = TVC/TP |

| 3. Due to the decreasing cost, the average fixed cost curve (AFC) is a downward sloping curve, but it never becomes zero. | 3. First the Average Variable Cost moves left to right upward to downward i.e. it has negative slope curve. Later, average variable cost shows an increasing trend because it follows decreasing return to scale law. |

![]()

Question 23.

Differentiate between Average Cost and Marginal Cost.

Answer:

| Average cost | Marginal cost |

| 1. The total cost per unit of production marginal cost. is called the average cost or total average cost. | 1. The change in total cost when an additional unit of output is produced is called |

| 2. Equation: Average cost (AC) = \(\frac{TC}{TP}\) OR Average cost (AC) = \(\frac{\mathrm{FC}+\mathrm{VC}}{\mathrm{TP}}\) | 2. Equation: MCn = Tcn – Tc(n – 1) |

| 3. Curve of Average cost is ‘U’ shaped. | 3. Curve of Marginal Cost is hockey stick shaped. |

Multiple Choice Questions

Question 1.

Which cost is important to know the alternative uses of factors of production?

(A) Opportunity cost

(B) Marginal cost

(C) Real cost

(D) Both (A) and (B)

Answer:

(A) Opportunity cost

Question 2.

________ works as a guideline for administration of the company.

(A) Real cost

(B) Monetary cost

(C) Opportunity cost

(D) Marginal cost

Answer:

(B) Monetary cost

Question 3.

As per classical economics, real cost was considered in ________

(A) Land and labour

(B) Labour and capital

(C) Capital and entrepreneur

(D) All factors of production

Answer:

(A) Land and labour

Question 4.

According to whom the labourers involved in production undergo psychological and physical burden?

(A) Robinson

(B) Chamberlin

(C) Prof. Leftwich

(D) Marshall

Answer:

(D) Marshall

Question 5.

Who presented the concept of opportunity cost?

(A) A Dutch researcher

(B) A German teacher

(C) An Austrian economist

(D) A Management professor

Answer:

(C) An Austrian economist

Question 6.

Which of the following works on the principle ‘means of production have alternative uses’?

(A) Opportunity cost

(B) Marginal cost

(C) Monetary cost

(D) Variable cost

Answer:

(A) Opportunity cost

Question 7.

We can broadly classify production costs as ________

(A) Fixed cost and variable cost

(B) Short run production cost and long run production cost

(C) Marginal cost and real cost

(D) Opportunity cost and monetary cost

Answer:

(B) Short run production cost and long run production cost

Question 8.

Fixed cost is also known as ________

(A) Expenses

(B) Temporary cost

(C) Overhead cost

(D) All of these

Answer:

(C) Overhead cost

![]()

Question 9.

TFC curve is ________

(A) U-shaped

(B) Hockey stick shaped

(C) Parallel to X-axis

(D) Upward sloping

Answer:

(C) Parallel to X-axis

Question 10.

Change in quantity of production results in change in cost. Which cost is this?

(A) Variable cost

(B) Real cost

(C) Opportunity cost

(D) All of these

Answer:

(A) Variable cost

Question 11.

Variable cost is also known as

(A) Unstable cost

(B) Main cost

(C) Direct cost

(D) All of these

Answer:

(D) All of these

Question 12.

Difference exists between fixed cost and variable cost ________

(A) Always

(B) For short run

(C) Rarely

(D) For long period

Answer:

(B) For short run

Question 13.

Prof. Marshall calls variable cost as a main cost because ________

(A) It has a negative slope

(B) It is directly related with production

(C) It increases significantly compared to fix cost

(D) Both (B) and (C)

Answer:

(B) It is directly related with production

Question 14.

There is a ________ relationship between total production cost and total

(A) Exponential

(B) Cyclic

(C) Cause-effect

(D) Inverse

Answer:

(B) Cyclic

Question 15.

TC = ________

(A) TVC + TFC – MC

(B) WC + TFC + MC

(C) TOC + MC + TVC

(D) WC + TFC

Answer:

(D) WC + TFC

Question 16.

TC curve is ________

(A) Negatively sloped

(B) Parallel with TVC

(C) Above total variable cost curve

(D) Both (B) and (C)

Answer:

(D) Both (B) and (C)

Question 17.

Which of the following statements is true?

(A) TC curve and TVC curve start from origin O.

(B) TVC starts from a specific point on Y-axis and TC from origin O.

(C) TC starts from a specific point on Y-axis and TVC from origin O.

(D) Both TC and TVC start from a specific point on Y-axis.

Answer:

(C) TC starts from a specific point on Y-axis and TVC from origin O.

Question 18.

Average fixed cost = ________

(A) TFC/TP

(B) TVC/TP

(C) TP/TFC

(D) TVC + (MC/TP)

Answer:

(A) TFC/TP

Question 19.

How does the average cost curve behave as production increases?

(A) Goes on decreasing positively

(B) Falls, remains constant and then rises

(C) Rises, remains constant and then falls

(D) Remains parallel to X-axis and then falls

Answer:

(B) Falls, remains constant and then rises

![]()

Question 20.

MCn = TC

(A) – Tc(n-1)

(B) x Tc(n-1)

(C) Tc(n-1)

(D) – 2Tc(n-1)

Answer:

(A) – Tc(n-1)

Question 21.

The curve of marginal cost is ________

(A) U shaped

(B) Straight line

(C) Hockey shaped

(D) Zigzag shaped

Answer:

(C) Hockey shaped

Question 22.

How many types of relations exist between average cost and marginal cost?

(A) 1

(B) 2

(C) 3

(D) Many

Answer:

(C) 3

Question 23.

As per who, fixed cost = variable cost in long run?

(A) Marshall

(B) Stigler

(C) Robinson

(D) Benham

Answer:

(D) Benham

Question 24.

Total revenue changes when

(A) Price per unit changes

(B) Total sale changes

(C) Both per unit price and total sale changes

(D) All of these

Answer:

(D) All of these

Question 25.

Commodities are homogeneous in ________

(A) Perfect competition market

(B) Monopolistic market

(C) Monopoly

(D) Imperfect competition market

Answer:

(A) Perfect competition market

Question 26.

Which relation holds true in perfect competition market?

(A) P = AR – MR

(B) P = AR + MR

(C) P ≠ AR ≠ MR

(D) P = AR = MR

Answer:

(D) P = AR = MR

Question 27.

In perfect competition market, TR curve is

(A) Parallel to X-axis

(B) Parallel to Y-axis

(C) At 45°

(D) Downward slopping

Answer:

(C) At 45°