Gujarat Board GSEB Textbook Solutions Class 11 Commerce Accounts Part 1 Chapter 6 Subsidiary Books Textbook Exercise Questions and Answers.

Gujarat Board Textbook Solutions Class 11 Accounts Part 1 Chapter 6 Subsidiary Books

GSEB Class 11 Accounts Subsidiary Books Text Book Questions and Answers

Question 1.

Write the correct option from those given below each question :

(1) Credit purchase will be recorded in ………………… .

(a) Purchase return book

(b) Purchase book

(c) Cash book

(d) Journal proper

Answer:

(b) Purchase book

(2) Credit purchase of assets will be recorded in ………………. .

(a) Purchase book

(b) Journal proper

(c) Cash book

(d) Bills payable book

Answer:

(b) Journal proper

![]()

(3) Cash purchase of goods will be recorded in …………….. .

(a) Cash book

(b) Journal proper

(c) Purchase book

(d) Bills receivable book

Answer:

(a) Cash book

(4) Credit sales of goods will be recorded in ………………. .

(a) Sales book

(b) Purchase book

(c) Journal proper

(d) Bills receivable book

Answer:

(a) Sales book

(5) What is sent to the traders along with goods returned which is purchased on credit ?

(a) Debit note

(b) Credit note

(c) Bills receivable

(d) Bills payable

Answer:

(a) Debit note

(6)What is sent by the customers along with goods returned by them ?

(a) Debit note

(b) Credit note

(c) Bills receivable

(d) Bills payable

Answer:

(a) Debit note

(7) Which transactions are recorded in Journal Proper ?

(a) Credit purchase of goods

(b) Credit sales of goods

(c) Assets purchase – sales in credit

(d) Goods return

Answer:

(c) Assets purchase – sales in credit

(8) Manoj has purchased goods of ₹ 10,000 at 10% trade discount. GST 5 %. Half of the amount was paid immediately. Which amount will be recorded in Purchase Book ?

(a) ₹ 10,000

(b) ₹ 9,000

(c) ₹ 9,450

(d) ₹ 4,500

Answer:

(b) ₹ 9,000

![]()

(9) Nilesh deals with mobile purchase-sales business. Nilesh has purchased furniture of ₹ 25,000 from Pankaj Mart, where it will be recorded ?

(a) Purchase book

(b) Journal proper

(c) Bills payable book

(d) Cash book

Answer:

(b) Journal proper

Question 2.

Answer the following questions in one sentence :

(1) What is meant by Subsidiary Books ?

Answer:

For all the business transactions, transactions having same nature and takes place frequently are categorised and recorded in the separate books which are known as Subsidiary Books.

(2) How many types of subsidiary books are there? Which are they?

Answer:

There are four types of subsidiary books :

- Cash book (Cash journal),

- Goods subsidiary books,

- Subsidiary books for bills and

- Journal proper.

(3) Which types of transactions are recorded in journal proper?

Answer:

Generally all adjustments, closing entries and transfer entries are recorded in journal proper.

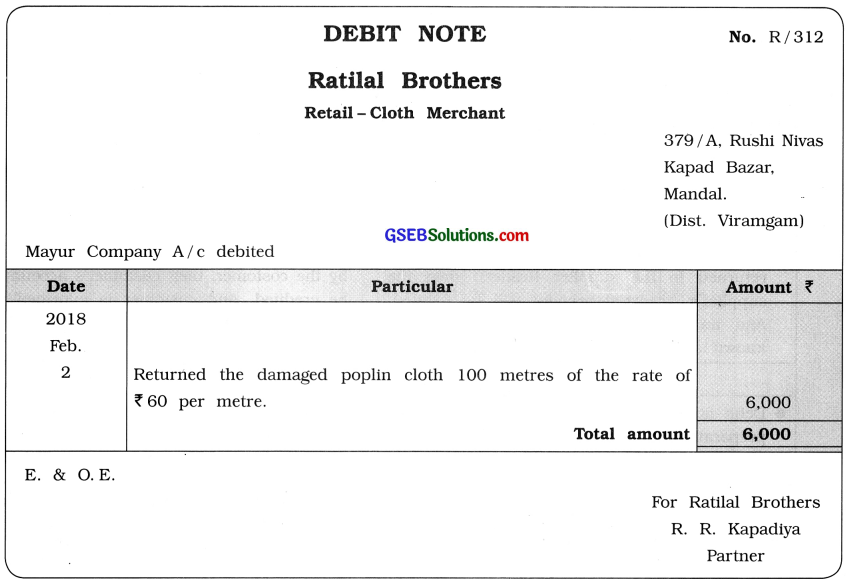

(4) What is meant by Debit Note ?

Answer:

When the goods purchased on credit are returned to the supplier, the note sent to the supplier to claim rebate for the returned goods is known as ‘Debit Note’.

(5) What is meant by Credit Note ?

Answer:

When the goods sold on credit are returned by the customer, then customer’s account will be credited. And customer is informed by a document, which is written in some specific manner is known as ‘Credit Note’.

![]()

Question 3.

Answer the following questions in two or three sentences :

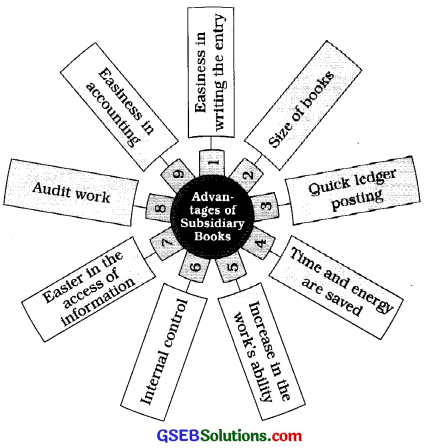

(1) State the advantages of preparing subsidiary books.

Answer:

Advantages of preparing subsidiary books are as under :

1. Easiness in writing the entry: As the journal is divided into the subsidiary books, writing of the books of accounts becomes easy.

2. Size of books: Because of preparing the subsidiary books, size of books decreases and therefore it is more convenient to write the books of accounts and transfer of books of accounts becomes easy.

3. Quick ledger posting: Because of subsidiary books work distribution among more persons is possible and therefore quick ledger posting is also possible.

4. Time and energy are saved: Because of subsidiary books in the individual’s accounts separate ledger posting is to be done. While at the end of specific period the total amount of the subsidiary book is posted to concern account that means it saves time and energy of the posting of one effect.

5. Increase in the work’s ability: Because of subsidiary books work distribution is possible, particular person can be an expert by doing the same work and therefore with minimum errors work can be completed quickly.

6. Internal control: Subsidiary books mini¬mised the chances of mistakes, misappropriations and frauds and arrangement can be made so that one person’s work can checked by the other person.

7. Easier in the access of information: The information regarding the purchase, sales, cash, debtor or creditor are available quickly and easily at any time because of the subsidiary books.

8. Audit work: If the subsidiary books are maintained, than audit work of the books of accounts can be conducted by more persons at a time is possible.

9. Easiness in accounting: It becomes easy to computerise the books of accounts and to keep self balancing ledger.

Advantages of subsidiary books are expressed by diagram as follows :

![]()

(2) Distinguish between Debit note and Credit note.

Answer:

Debit Note Credit Note

| Debit Note | Credit Note |

| 1. Meaning | |

| • When the goods purchased on credit are returned to the supplier (trader), then the supplier’s (trader’s) account will be debited. And an intimation letter is sent which is known as ‘Debit Note’. | • When the goods sold on credit are returned by the costomer, then customer’s account will be credited. And customer is informed by a document, which is known as ‘Credit Note’. |

| 2. Important Document | |

| • Debit note is an important document for the preparation of Purchase Return Book. | • Credit note is an important document for the preparation of Sales Return Book. |

| 3. Effected Account | |

| • The amount of the Debit note will be debited to the concered trader’s (supplier’s) account. | • The amount of the Credit note will be credited to the concered customer’s account. |

| 4. What Shows ? | |

| • The Debit note shows why the account of the person to whom it is sent, has been debited. | • The Credit note shows why the account of the person in whose favour it has been written has been credited. |

| 5. Who Written? | |

| • Debit note is written by the goods purchaser (customer) and it is sent to trader. | • Credit note is written by the trader and it is sent to customer. |

| 6. When is it written? | |

| • A Debit note is written because of the following

main reasons: (i) When goods purchased are returned to trader. (ii) When the invoice received is for more amount. (iii) When some rebate is to be claimed on trader. |

• A Credit note is written because of the

following main reasons: (i) When goods sold are returned by customer. (ii) When the invoice sent is of higher amount. (iii) When some rebate is to be given to the customer. |

| 7. Where entry is made ? | |

| • Generally an accounting entry is made in the Purchase Return Book. | • Generally an accounting entry is made in the Sales Return Book. |

(3) Give the specimen of Debit note.

Answer:

![]()

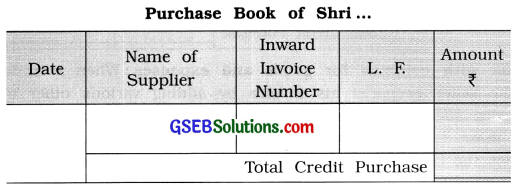

(4) Explain the purchase book and types of purchase book with example.

Answer:

A subsidiary book in which trader records credit purchase transaction is known as ‘Purchase Book’. Purchase book is also known as Jamavahi or Credit Book as in this book the account of supplier of the goods is credited. When a businessman is purchasing only one type of goods, generally a simple purchase book is maintained. In purchase book, only the transactions relating to credit purchase of respective goods are recorded. Transactions of cash purchase and purchases of assets are not recorded in purchase book. The specimen of it is as follow:

Explanation :

(1) In the Date column, the date of transaction will be recorded. (2) In the Particular column, name of the supplier from whom goods are purchased on credit, will be recorded. (3) In the ‘Inward Invoice Number’ column, the invoice number or serial order number given by the trader will be recorded. (4) The page number of the ledger, on which the amount is credited in the account of the concerned supplier, will be recorded in the Ledger Folio (L.E) column. (5) Amount of net purchases arrived at, after deducting the amount of trade discount, will be recorded in the Amount column.

In the purchase book, according to the convenience and needs, the trader records the fixed time interval transactions and at the end of that period, total credit purchase will be decided after adding all the amounts. This time interval may be on weekly, fortnightly, monthly, quarterly, etc. basis. This type of the summary can be found out frequently at the end of fixed time interval.

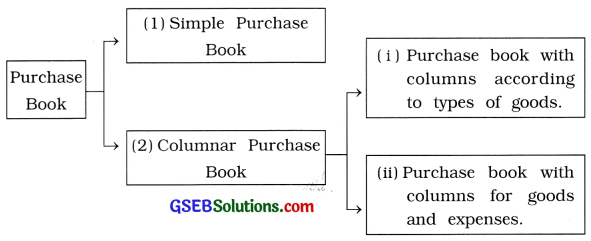

Types of Purchase Book: Purchase book can be maintained in following two ways :

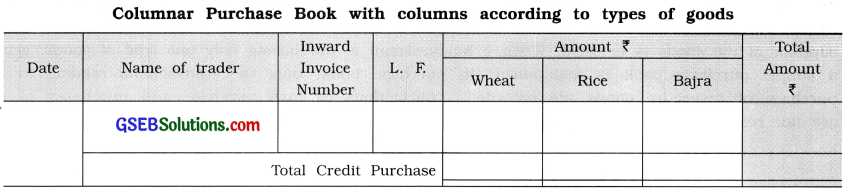

(i) Purchase book with columns according to types of goods : When a trader purchases goods

of more than one type, instead of maintaining different purchase books for different type of goods, he will maintain, a columnar purchase book. Other particulars remaining constant, there will be additional columns for each different types of goods, in which the purchases of the respective goods will be recorded. e.g., Wheat, Rice, Bajra, etc. In addition to this a column showing total purchase is kept as the last column. Based on this type of purchase book, one can ascertain credit purchase of each type of goods as also the total credit purchase from a particular supplier.

The specimen of such columnar purchase book is as under :

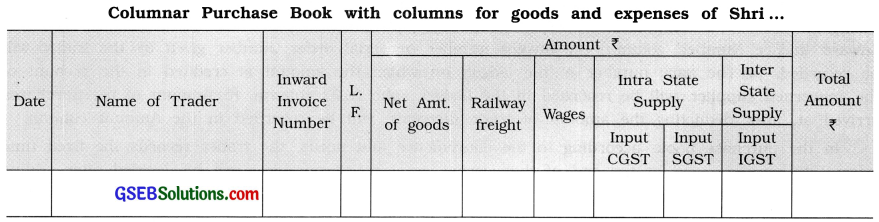

(ii) Purchase book with columns for goods and expenses: When a trader purchases goods on credit, many times, the seller prepares his invoice by adding various other charges apart from the value of goods. Normally, such charges are in respect of GST, Railway freight, Wages, Carriage, etc. For the recording of these types of expenses, a purchase book having the columns of expenses is prepared which includes the columns of cost of goods as well the columns of expenses. The specimen of such columnar purchase book is as under

![]()

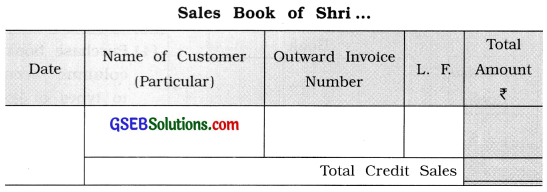

(5) Give the specimen of Sales Book and Sales Returns Book.

Answer:

(i) The specimen of Sales Book is as under :

Explanation :

(1) In the Date column, the date of transaction is recorded. (2) In the Particular column, name of the customer is recorded to whom trader sold goods on credit. (3) In the Outward Invoice Number column, the number of bill issued to customer is recorded. (4) In the Ledger Folio (L. F.) column, the page number of the ledger in which the amount is debited in the account of the concerned customer is recorded. (5) In the Amount column, amount of net sales arrived at after deducting the amount of trade discount is recorded.

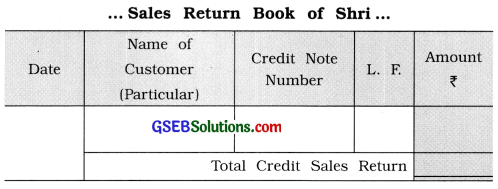

(ii) The specimen of Sales Return Book is as under:

Explanation :

(1) In the Date column, the date on which goods are returned is recorded. (2) In the Particular column, name of the customer who has returned the goods and details of goods returned are entered. (3) In the credit Note Number column, the number of credit note sent for return of goods is recorded. (4) In the Ledger Folio (L. E) column, the page number of the ledger on which the amount is credited in the account of the concerned customer is recorded. (5) In the Amount column, amount of net sales return arrived at after deducting trade discount is recorded.

Question 4.

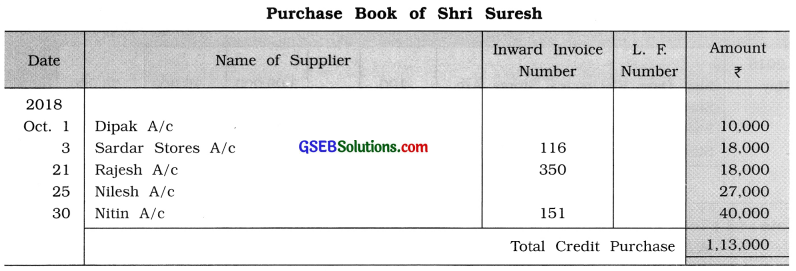

Prepare Purchase Book in the books of Shri Suresh:

2018

Oct. 1 Purchased goods of ₹ 10,000 from Dipak on one month credit.

3 Purchased goods of ₹ 20,000 from Sardar Stores at 10 % trade discount. Invoice no. 116

7 Purchased goods of ₹ 18,000 from Pankaj on cash.

15 Placed order with Rajesh for supply goods of ₹ 20,000 at 10% trade discount.

20 Purchased furniture of ₹ 16,000 from Vyas Furniture Mart on one month credit.

21 Rajesh has sent goods as per our order and sent invoice no. 350 after adding ₹ 1,000 for railway freight.

24 Purchased goods of ₹ 14,000 at 5 % cash discount.

25 Purchased goods of ₹ 30,000 from Nilesh at 10 % trade discount and half of the

amount paid immediately by cheque.

26 Purchased goods of ₹ 15,000 from Chirag at 10 % trade discount and 5% cash

discount. Amount paid immediately.

30 Purchased goods of ₹ 40,000 from Nitin. Invoice no. 151.

Answer:

Note :

(1) Total Credit Purchase is of ₹ 1,13,000. This amount will be debited on debit side of Purchase A/c.

(2) The following transactions will not be recorded in Purchase Book:

(i) Date 7 Transaction of cash purchases

(ii) Date 15 Non-economic transaction

(iii) Date 20 Purchase of furniture [fixed asset) on credit

(iv) Date 24 Transaction of cash purchases

(v) Date 26 Transaction of cash purchases

(3) Transaction of Date 25 is recorded considering the whole transaction, a credit transaction.

(4) Date 21 Railway freight of ₹ 1,000 will be recorded in the Journal proper.

![]()

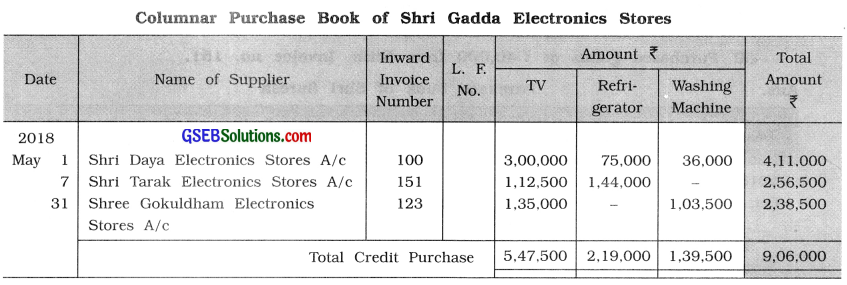

Question 5.

From the following transactions of Shri Gadda Electronics Stores, prepare Columnar Purchase Book. Shri Gadda Electronics deals with TV, Refrigerator and Washing Machine.

2018

May 1 Purchased 10 TV set at ₹ 30,000 each set, 5 Refrigerators at ₹ 15,000 per piece and 2 Washing Machines at ₹ 18,000 per piece from Shri Daya Electronic Stores. Credit period 1 month. Invoice no. 100.

7 Purchased from Shri Tarak Electronics Stores, 5 Pieces TV at ₹ 25,000 per piece and 10 Refrigerators at ₹ 16,000 per piece at 10 % trade discount. Received invoice no. 151. Half of the amount paid immediately.

12 Purchased cycle of ₹ 5,000 from Shree Ambey Cycle Stores.

20 Purchased 5 Refrigerators at ₹ 20,000 per piece and 10 Washing Machines at ₹ 15,000 per piece at 10 % trade discount and 5 % cash discount from Shree Atmaram Electronics Stores and amount paid immediately.

25 Placed on order to Smt. Babita for supplying 20 pieces TV at ₹ 28,000 per piece and 6 pieces Washing Machines at ₹ 21,000 per piece.

31 From Shree Gokuldham Electronics Stores, purchased 5 pieces TV sets at ₹ 30,000 per piece and 5 Washing Machines at ₹ 23,000 per piece. Trade discount at 10 %. Invoice no. 123.

Answer:

Note :

(1) Total credit purchase is of ₹ 9,06,000 which shall be recorded on debit side of Purchase A/c.

(2) The following transactions will not be recorded in Columnar Purchase Book :

(i) Date 12 Transaction of asset (cycle) purchased

(ii) Date 20 Cash transaction

(iii) Date 25 Non-economic transaction

(3) Transaction of Date 7 is recorded considering the whole transaction, a credit transaction.

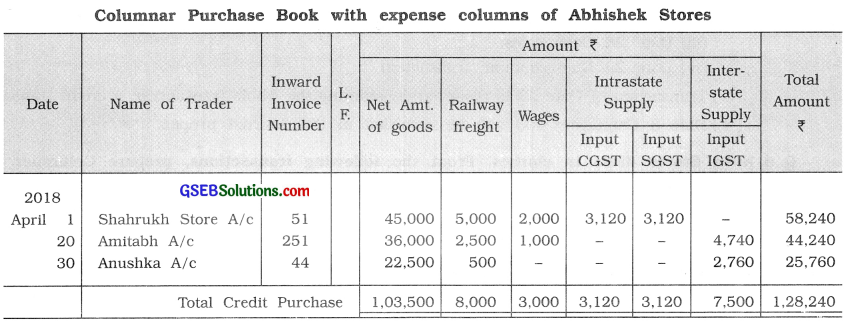

Question 6.

Abhishek Stores of Rajkot is iron merchant. Prepare purchase book in his books of account with columns of expenses. He maintain separate columns for expenses like GST. Railway

freight, labour, prepare purchase book by applying total 12 % GST rate. GST is not included

for following transactions. Add applicable amount of GST and prepare purchase book.

2018

April 1 Goods purchased of ₹ 50,000 10 % trade discount from Shahrukh Store, labour of ₹ 2,000 and railway freight of ₹ 5,000 are disclosed invoice no. 51.

5 Goods purchased of ₹ 30,000 at 5 % trade discount from Dipika. Total amount paid

immediately inclusive of labour ₹ 500 and railway freight ₹ 600.

20 Goods purchased of ₹ 40,000 at 10 % trade discount from Amitabh of Mumbai (Maharashtra). Bill no. 251 received inclusive of labour ? 1,000 and railway freight ? 2,500.

25 A machine off ₹ 35,00 is purchased from Pooja on credit of 1 month. Transportation labour of ₹ 2,000 is paid in cash.

30 Goods purefased of ₹ 25,000 at 10 % trade discount and 5 % cash discount from Anushka of Chennai (Tamil Nadu). Invoice no. 44 is received, inclusive of railway ‘ freight of ₹ 500.

Answer:

Note :

(1) The following transactions will not be recorded in Columnar Purchase Book:

(i) Date 5 Transaction of cash purchases.

(ii) Date 25 Transaction of asset purchases.

(2) Transaction of Date 20 is recorded considering the whole transaction, a credit transaction.

![]()

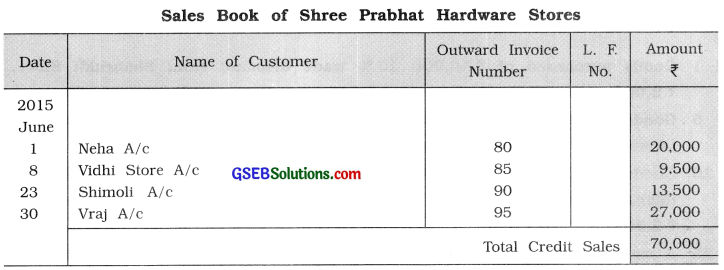

Question 7.

From the following transactions, prepare Sales Book in the books of Shree Prabhat Hardware Stores who is an iron trader:

2015

June 1 Sold goods of ₹ 20,000 to Neha on 3 months credit and bill no. 80 sent.

8 Sold goods of ₹ 10,000 to Vidhi Store at 5 % trade discount and sent bill no. 85 with carriage of ₹ 400.

12 Sold goods of ₹ 15,000

15 Sold machinery of ₹ 10,000 for ₹ 3,000 of Krima.

23 Sold goods of ₹ 15,000 to Shimoli at 10 % trade discount, and half of the amount immediately paid by Shimoli. Bill no. 90.

28 Sold goods of ₹ 20,000 to Riddhi at 10 % cash discount on cash.

29 Meet placed an order for supply of goods of ₹ 15,000.

30 Sold goods of ₹ 30,000 to Vraj at 10 % trade discount. Bill no. 95.

Answer:

Note :

(1) Here, total credit sales is of ₹ 70,000 which will be recorded on credit side of Sales A/c.

(2) The following transactions will not be recorded in Sales Book:

(i) Date 12 Cash sales.

(ii) Date 15 Transaction of sales of asset (machinery).

(iii) Date 28 Cash sales.

(iv) Date 29 Non-economic transaction.

(3) Transaction of Date 23 is recorded considering the whole transaction, a credit transaction. (4) Date 8 Carriage ₹ 400 will be recorded in the Journal proper.

Question 8.

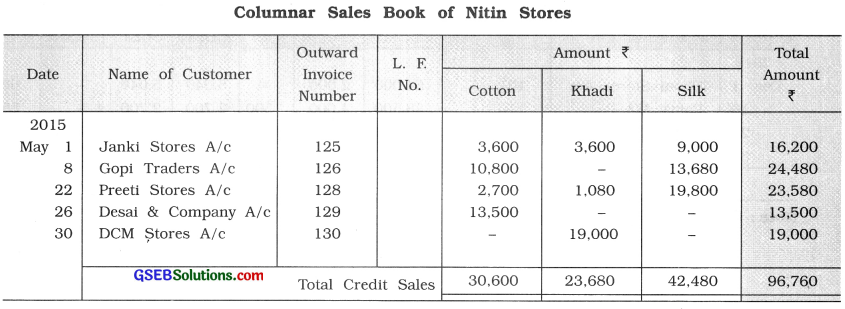

Nitin Stores deals in clothes. From the following transactions, prepare Columnar Sales Book in the books of Nitin Stores. Nitin Stores deals in three types of clothes namely Cotton, Khadi and Silk.

2015

May 1 Sold to Janki Stores 100 metres cotton cloth at ₹ 40 per metre, 200 metres khadi

at ₹ 20 per metre and 50 metres silk at ₹ 200 per metre with 10 % trade discount.

Bill no, 125. Credit period 3 months.

8 Sold to Gopi Traders 200 metres cotton cloth at ₹ 60 per metre and 80 metres silk

at ₹ 190 per metre at 10 % trade discount. Goods sold on 2 months credit. Bill no.

126 sent. Gopi Traders paid half of the amount immediately in cash.

15 Sold to Misarg Trading Co. 100 metres khadi and 50 metres silk at ₹ 40 and ₹ 200 per metre respectively. Nssarg Trading Co. paid amount immediately by cheque at 10 % trade discount and 10 % cash discount. BUI no. 127.

20 Preeti Stores place an order for the supply of 40 metres khadi, 60 metres cotton cloth and 100 metres silk cloth.

22 Supplied goods to Preeti Stores as per her order under bill no. 128 at ₹ 30 per metre, ₹ 50 per metre and ₹ 220 per metre respectively at 10 % trade discount

allowed.

26 Sold to Desai & Company cotton cloth of ₹ 15,000 at 10 % trade discount under bill no. 129.

30 Sold to DCM Stores khadi goods of ₹ 20,000 at 5 % trade discount. Sent bill no. 130 after adding 13% GST.

Answer:

Note :

(1) Date 30 output COST of ₹ 1,710 and output SGST of ₹ 1,710 will be recorded in Journal Proper.

(2) The following transactions will not be recorded in Sales Book :

(i) Date 15 Transaction of cash sales.

(ii) Date 20 Non-economic transaction.

(3) Transaction of Date 8 is recorded considering the whole transaction, a credit transaction.

![]()

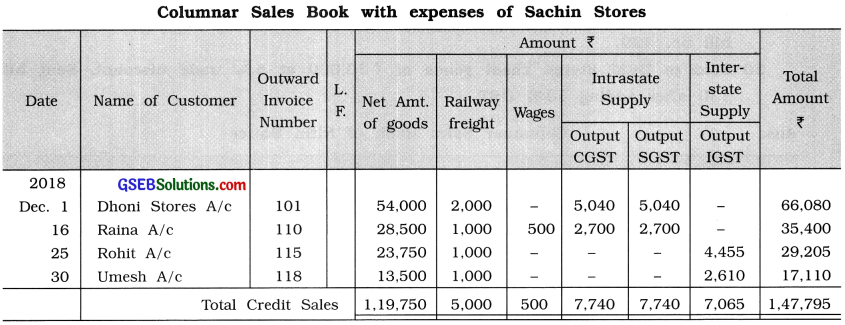

Question 9.

From the following transactions prepare sales book with columns of expanse in the books of Sachin Stores of Navsari. Sachin Stores maintains record of expenses like GST, railway freight and labour. Prepare sales book by applying total GST rate of 18 %. GST is not included for the following transactions. Add applicable amount of GST and prepare sales book.

2018

December 1 Goods sold of ₹ 60,000 at 10 % trade discount to Dhoni Stores. Railway freight is ₹ 2,000 and invoice no. 101.

10 Goods sold of ₹ 40,000 at 10 % trade discount to Virat Stores on cash of Gangtok (Sikkim). Labour charge ₹ 200.

16 Goods sold of ₹ 30,000 at 5 % trade discount on credit of 1 month to Raina. .

Bill no. 110 send after adding ₹ 500 for labour and ₹ 1,000 for railway freight.

20 A machine of ₹ 35,000 sold to Jadeja Stores. Labour charges paid ₹ 700.

Jadeja Stores gave gurantee to pay amount in 15 days.

25 Goods sold of ₹ 25,000 at 5 % trade discount on credit of I month to Rohit of Jodhpur (Rajasthan). Railway freight ₹ 1,000. Rohit paid half amount of total amount immediate. Bill no. 115.

30 Goods sold of ₹ 15,000 at 10% trade discount on credit of 1 month to Umesh of Kolkatta (West Bengal). By adding railway freight of ₹ 1,000. Invoice no. 118 sent.

31 An order of ₹ 70,000 is received from Yuvraj.

Answer:

Note :

(1) The following transactions will not be recorded in Sales Book :

(i) Date 10 Cash sales.

(ii) Date 20 Sales of asset.

(iii) Date 31 Non-economic transaction.

(2) Transaction of Date 25 is recorded considering the whole transaction, a credit transaction.

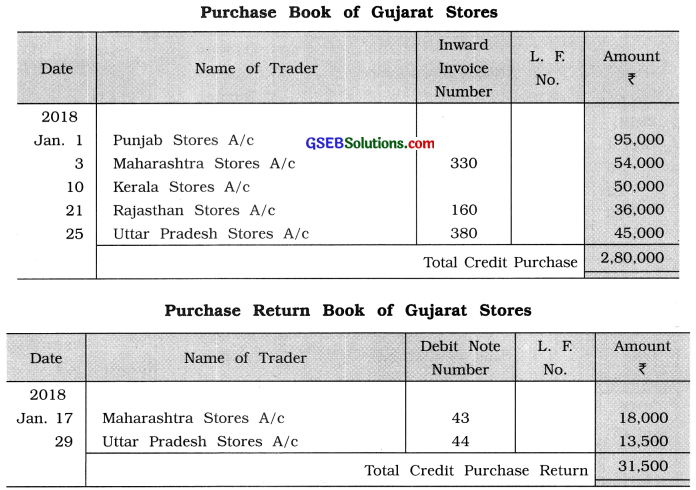

Question 10.

From the following transactions, prepare Purchase Book and Purchase Returns Book in the books of Gujarat Stores:

2018

Jan. 1 Purchased goods of ₹ 1,00,000 from Punjab Stores at 5 % trade discount.

3 Purchased goods of ₹ 60,000 from Maharashtra Stores. Credit period 1 month. Trade discount 10 %, bill no. 330.

10 Purchased goods of ₹ 50,000 from Kerala Stores on credit. 50 % of the amount paid immediately.

17 Returned \(\frac {1}{3}\) rd of goods purchased from Maharashtra Stores. Sent debit note no. 43 for the amount thereof.

21 Purchased goods of ₹ 40,000 from Rajasthan Stores at 10% trade discount. Rajasthan Stores sent a bill no. 160 after charging 5 % value added tax and ₹ 400 for carriage.

25 Purchased goods of ₹ 50,000 from Uttar Pradesh Stores on credit. Credit period 2 months. Trade discount 10 %, Bill no. 380.

29 Returned 30 % of the goods purchased from Uttar Pradesh Stores and sent debit note no. 44 with goods.

30 Placed an order with Madhya Pradesh for supply of goods of ₹ 80,000 at 10% trade- discount.

31 Purchased goods of ₹ 30,000 from Haryana Stores at 10% trade discount and 5% cash discount on cash.

Answer:

Note:

(1) The following transactions will not be recorded in Purchase Book and in Purchase Return Book :

(i) Date 30 Non-economic transaction.

(ii) Date 31 Transaction of cash purchases.

(2) The whole transaction of Date 10 is recorded in purchase book considering, it as a credit purchase.

(3) Date 21 Input CGST ₹ 900, Input SGST ₹ 900 and wages ₹ 400 will be recorded in Journal Proper.

![]()

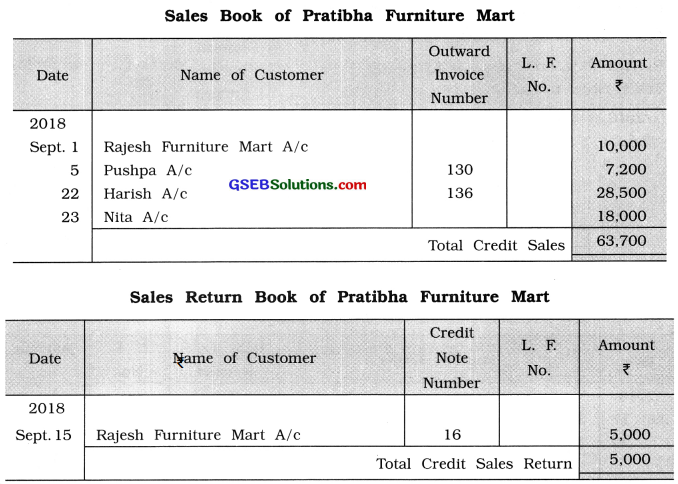

Question 11.

From the following transactions, prepare Sales Book and Sales Returns Book in the books of Pratibha Furniture Mart:

2018

Sept. 1 Sold goods of ₹ 10,000 to Rajesh Furniture Mart at 10 % cash discount. He paid half of the amount immediately.

5 Sold goods of ₹ 8,000 at 10 % trade discount and 5 % cash discount to Pushpa. Credit period 1 month. Sent bill no. 130 after charging ? 100 for carriage.

12 Sold goods of ? 4,000 at 10 % trade discount and 5 % cash discount;

15 Rajesh returned goods of ₹ 5,000. Sent credit note on. 16 after receipt of the returned goods.

20 One old machine sold to Manju for ₹ 3,000. Credit period 1 month.

22 Sold goods of ₹ 30,000 to Harish at 5 % trade discount. Bill no. 136 sent after charging 5 % GST and ₹ 200 for wages.

23 Sold goods of ₹ 20,000 to Nita on one month credit. Trade discount 10 %, cash discount 10 %.

30 Mukesh placed an order for supply of goods for ₹ 15,000.

Answer:

Note :

(1) The following transactions will not be recorded in Sales Book as well as in Sales Return Book :

(i) Date 12 Transaction of cash sales.

(ii) Date 20 Transaction of sales of asset.

(iii) Date 30 Non-economic transaction.

(2) The whole transaction of Date 1 is recorded in sales book considering, it as a credit sales.

(3) Date 22 output COST ? 712.50, output SGST ? 712.50 and wages ? 300 will be recorded in Journal Proper.

Question 12.

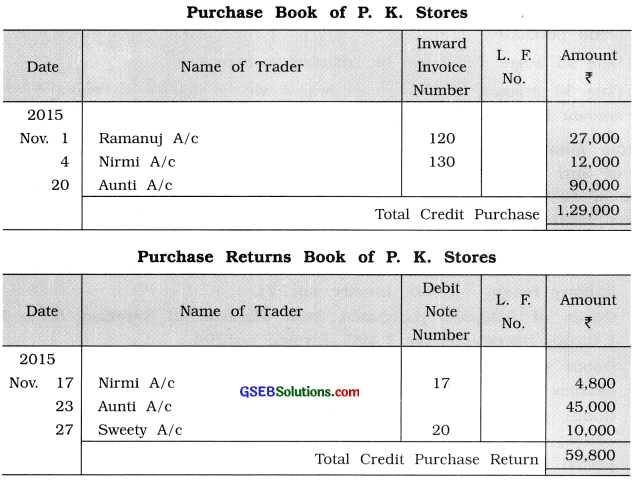

Prepare Purchase Book, Sales Book, Purchase Returns Book and Sales Returns Book in the books of P. K. Stores from the following transactions:

2015

Nov. 1 Purchased goods of ₹ 30,000 from Ramanuj at 10% trade discount. Bill no. 120.

4 Purchased goods of ₹ 12,000 from Nirmi at 10 % cash discount. Credit period 1 month. Bill no. 130.

6 Sold goods of ₹ 15,000 to Suresh at 5 % trade discount and 3 % cash discount under Bill no. 350.

11 Purchased goods of ₹ 10,000. Cash Memo no. 58.

15 Suresh returned goods of ₹ 3,000. Credit note no. 20 sent to Suresh.

17 40 % goods returned to Nirmi and debit note no. 17 sent.

19 Purchased furniture of ₹ 7,000 from Shree Saraswati Furniture Mart.

20 Purchased goods of ₹ 90,000 from Aunti. Half of the amount paid immediately.

21 All the goods purchased from Aunti sold to Bala for ₹ 1,08,000. Credit one month.

Trade discount 10 %. Bill no. 360.

23 Bala returned half of the goods which was sent to Aunti.

24 Karan placed an order for ₹ 30,000 at 10 % trade discount for supply of goods.

25 Goods sent to Karan as per order. ₹ 500 added for carriage under bill no. 365.

26 Cash purchase ₹ 16,000 and cash sales ₹ 20,000.

27 Returned goods to Sweety of ₹ 10,000 which was purchased in October and sent debit note no. 20.

30 Karan returned half of the goods and proportionate amount of carriage was given credit.

Answer:

Note :

(1) The following transactions will not be recorded :

(i) Date 11 Cash purchases. It will be recorded in cash book.

(ii) Date 19 Purchase of furniture (asset) which is on credit, it will be recorded in journal proper.

(iii) Date 24 Non-economic transaction.

(iv) Date 26 Cash transaction, it will be recorded in cash book.

(2) The whole transaction of Date 20 is recorded in Purchase Book considering, it as a credit purchase.

(3) Date 25 wages ₹ 500 will be recorded in cash book.

(4) Date 30 : Amount of proportional wages will be debited as wages A / c and with same

amount Karan A/c will be credited in journal proper.

![]()

Question 13.

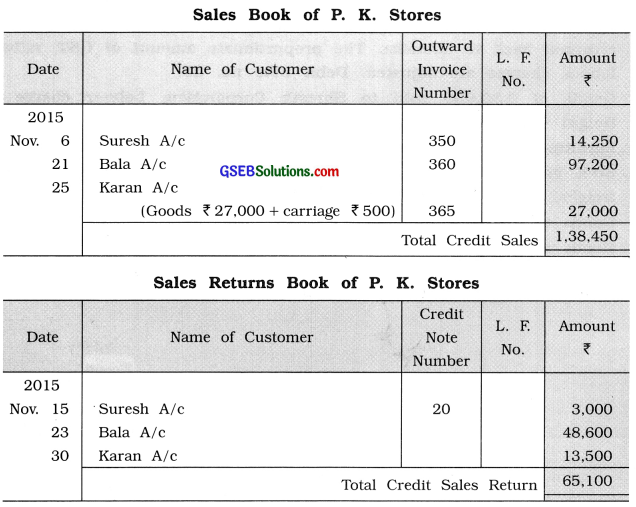

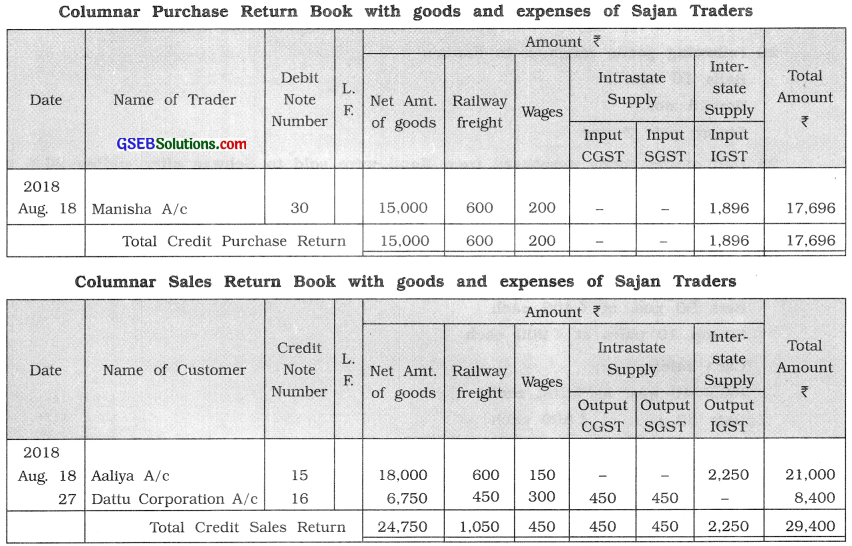

From following transactions prepare subsidiary books along with expenses amount in the books of Shri Sajan Traders of Surendranagar prepare subsidiary book on the basis of total GST rate of 12 %. GST is not included for following transactions. Add applicable amount of GST, prepare subsidiary books:

2018

1 Goods purchased of ₹ 20,000 at 10 % trade discount from Viramgam Stores. Railway freight ₹ 1,000. Invoice no. 171.

5 Goods of ₹ 30,000 purchased from Manisha of Varanasi (UP). Railway freight ₹ 1,200, labour charges ₹ 400. Invoice no. 204.

11 Goods of ₹ 15,000 sold to Dattu Corporation at 10% trade discount. Labour charges ₹ 600, railway freight ₹ 900. Invoice no. 231.

16 Goods purchased from Manisha, sold to Aaliya of Mumbai (Maharashtra) after adding 20 % profit on cost price. Railway freight ₹ 1,200, labour ₹ 300, credit period 1 month and invoice no. 232.

18 Aaliya has returned 50 % goods. The proportionate amount GST, railway freight and labour charges are adjusted. Credit note no. is 15. This goods immediately returned back to Manisha. The proportionate amount of GST, railway freight and labour charges are adjusted. Debit note no. 30.

20 Goods of ₹ 30,000 sold to Shresth Corporation. Labour charge ₹ 250, railway

freight ₹ 600. Invoice no. 240.

25 Furniture of ₹ 18,000 purchased from Gandhi Furniture Mart. Invoice no. 120.

27 50 % goods returned by Dattu Corporation. The Proportionate amount of railway freight, labour and GST are adjusted. Credit note no. 16.

28 Goods of ₹ 10,000 purchased on cash from Raju.

30 Goods sold of ₹ 15,000 on cash to Kanu.

Answer:

Note :

The following transactions will not be recorded :

(i) Date 25 Purchase of asset transaction. It will be recorded in Journal Proper.

(ii) Date 28 Cash purchases. It will be recorded in cash book.

(iii) Date 30 Cash sales. It will be recorded in cash book.

![]()

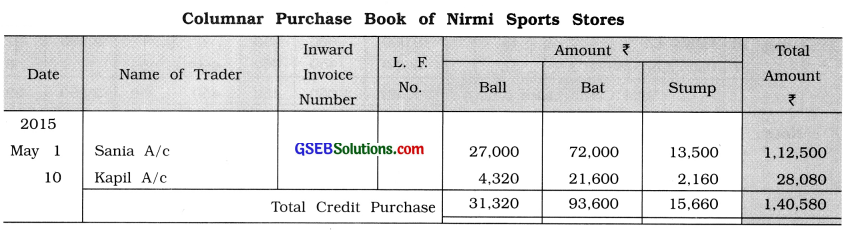

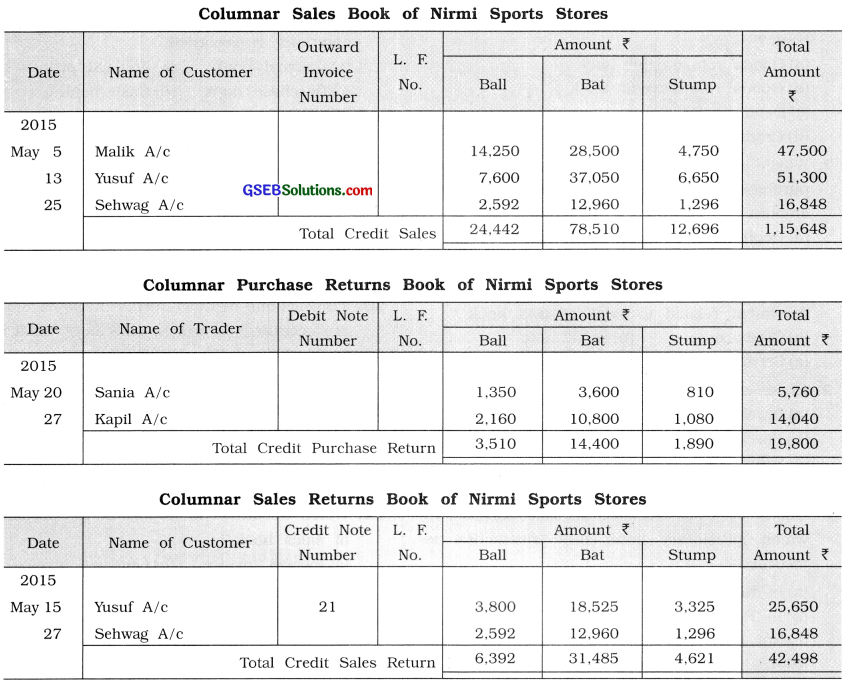

Question 14.

Prepare columnar subsidiary books viz. Purchase Book, Sales Book, Purchase Returns Book and Sales Returns Book in the book of Nirmi Sports Stores:

2015

May 1 Purchased following goods from Santa at 10 % trade discount and 5 % cash discount with 1 month credit:

Balls 200 nos. at ₹ 150 per piece

Bats 100 nos. at ₹ 800 per piece

Stump pair (nos.) 50 at ₹ 300 per pair.

5 Sold following goods to Malik at 5 % trade discount:

Balls 60 nos. at ₹ 250 per piece

Bats 30 nos. at ₹ 1000 per piece

Stump pair (nos.) 10 at ₹ 500 per pair

10 Purchased following goods from Kapil at 10 % trade discount:

Balls 30 nos. at ₹ 160 per piece

Bats 20 nos. at ₹ 1200 per piece

Stump pair (nos.) 6 at ₹ 400 per pair

13 Following goods sold to Yusuf at 5 % trade discount:

Balls 40 nos. at ₹ 200 per piece

Bats 30 nos. at ₹ 1300 per piece

Stump pair (nos.) 10 at ₹ 700 per pair

15 Yusuf returned half of the goods. Credit note no. 21 sent to him.

20 Following goods returned to Sania:

Balls 10 nos.

Bats 5 nos.

Stump pair 3 nos.

25 Half of the goods purchased from Kapil were sold to Sehwag after adding 20 % profit on cost.

27 Sehwag returned all of the goods which were returned to Kapil.

30 Cash purchase :

Balls 60 nos. at ₹ 120 each Bats 50 nos. at ₹ 400 each Stump 10 pairs at ₹ 200 each Cash sales :

Balls 40 nos. at ₹ 200 each Bats 30 nos. at ₹ 800 each

Answer:

Note : The following transaction will not be recorded :

Date 30 Cash purchases and Cash sales, it will be recorded in cash book.