Gujarat Board GSEB Textbook Solutions Class 11 Commerce Accounts Part 2 Chapter 9 Accounts of Non-trading Concerns Textbook Exercise Questions and Answers.

Gujarat Board Textbook Solutions Class 11 Accounts Part 2 Chapter 9 Accounts of Non-trading Concerns

GSEB Class 11 Accounts Accounts of Non-trading Concerns Text Book Questions and Answers

Question 1.

Write the correct option from those given below each question:

1. What kind of concern has not the aim of profit generation but to undertake activity of welfare and to provide service to members?

(a) Company

(b) Government

(c) Trading

(d) Non-trading

Answer:

(d) Non-trading

2. Receipt-Payment Account is similar to ……………………. Account. While Income-Expenditure Account is similar to …………………….. Account.

(a) Profit and Loss, Cash

(b) Balance Sheet, Profit and Loss

(c) Profit and Loss, Balance Sheet

(d) Cash, Profit and Loss.

Answer:

(d) Cash, Profit and Loss

3. Where are the capital type expenses disclosed?

(a) Asset side of Balance Sheet

(b) Liability side of Balance Sheet

(c) Debit side of Income-Expenditure A/c

(d) Debit side of Receipt-Payment A/c

Answer:

(a) Asset side of Balance Sheet

4. A significant expense of painting work is a ……………………. kind of expense.

(a) Revenue Expense

(b) Capital Expense

(c) Deferred Revenue Expense

(d) Administration Expense

Answer:

(c) Deferred Revenue Expense

![]()

5. Where to record capitalized income?

(a) Debit side of Income-Expenditure Account

(b) Credit side of Income-Expenditure Account

(c) Added to Capital fund in Balance Sheet

(d) Deducted from Capital fund in Balance Sheet

Answer:

(c) Added to Capital fund in Balance Sheet

6. What is credit balance of the Income-Expenditure Account?

(a) Excess of Income over Expenditure

(b) Excess of Expenditure over Income

(c) Opening cash / Bank balance

(d) Closing cash/Bank balance.

Answer:

(a) Excess of Income over Expenditure

7. In which account interest on investments of permanent fund will be recorded?

(a) Will be added to permanent fund in Balance Sheet.

(b) Will be added to capital fund in Balance Sheet.

(c) Will be added to investments of permanent fund in Balance Sheet.

(d) Will be recorded at the credit side of the Income-Expenditure Account.

Answer:

(d) Will be recorded at the credit side of the Income-Expenditure Account.

8. Where will the prizes distribution recorded?

(a) Debited to Income-Expenditure Account

(b) Debited to Receipt-Payment Account

(c) Deducted from Prize fund in Balance Sheet

(d) Deducted from Prize fund investments in Balance Sheet.

Answer:

(c) Deducted from Prize fund in Balance Sheet

9. The credit balance of receipt and payment account of non-trading concern is ………………………. .

(a) Bank balance

(b) Cash balance

(c) Bank overdraft

(d) Excess of income over expenditure

Answer:

(c) Bank overdraft

10. The accounting treatment of depreciation is not recorded in …………………………. .

(a) Receipt-Payment Account

(b) Income-Expenditure Account

(c) Balance Sheet

(d) All of these three

Answer:

(a) Receipt-Payment Account

![]()

Question 2.

Answer the following questions in one sentence:

1. In which account only cash transactions are recorded?

Answer:

Only cash transactions are recorded in Receipts-Payments Account.

2. What kind of income a charity is?

Answer:

Charity is considered as a capital income.

3. What is the debit balance of Income- Expenditure Account called?

Answer:

The debit balance of Income-Expenditure Account is called as ‘Excess of expenses over incomes (Loss)’.

4. What kind of expense is that which is incurred to pay fixed asset for business?

Answer:

An expense which is incurred to pay fixed asset for business is known as capital expense or expenditure.

5. What kind of income is that which is regularly received and arise from routine activities?

Answer:

The income which is received regularly and which arises from routine activities of an institution is known as revenue income.

6. What is non-trading concern? Give its illustrations.

Answer:

Concern which is not having an aim to generate profit but having the aim of social service, welfare of the members of the concern, to protect the interest of the members, to extend academic and sports activities, to develop cultural activities is known as non-trading concern.

Illustration: In these concerns Clubs, Gymkhana, Chamber of Commerce, Association of Traders, Political Unions, Labours Associations, Medical Associations, Charitable Hospitals, Educational Institutions, Cultural Committees, Red Cross Society, etc. are included.

![]()

7. Which are different main methods to maintain accounts of non-trading concern?

Answer:

Generally, there are two main methods to maintain accounts of non-trading concerns:

1. Mercantile System and

2. Cash System.

8. What is mainly prepared in the accounts of non-trading concern?

Answer:

Generally, non-trading concerns prepare their accounts as per Mercantile System, mainly it prepares accounts as under:

- Receipt and Payment Account,

- Income and Expenditure Account and

- Balance Sheet.

9. What is legacy? Where is it recorded?

Answer:

If the concern receives any assets or property by the will of the deceased person, then it is called legacy. This amount is a capital income and so it is added to capital fund.

Question 3.

(A) Write short notes :

1. Specific purpose fund

Answer:

The amount received for specific purpose is credited to the fund account for which it is received and not to the capital fund account. For e.g., Fund for building, President’s felicitation fund, Fund for prizes, etc. If funds are received for specific purpose then all the expenses relating to the fund are subtracted from the fund. For e.g., if fund is received for prizes, then all expenses relating to prizes are subtracted from the prize fund.

The expenses of prize fund are not shown in the Income and Expenditure Account. If thie amount of the fund is invested in specific securities then interest received on such investments are not credited to Income and Expenditure Account but the amount of interest received is added to the respective fund.

If expense incurred is more than the specifice fund amount, the amount of difference is treated as revenue expense and debited to the Income and Expenditure Account.

2. Deferred Revenue Expense

Answer:

Many times, huge amounts of revenue expenses are incurred and the benefit of which is received by the concern for a long period of time. This expense is treated as a revenue expense and is written off by allocating the same proportionately over a number of years in which, the benefit is likely to be received.

Such types of expenses are known as Deferred Revenue Expenses. The portion which is not written off is shown in the Balance Sheet on the Assets side, which is known as fictitious asset.

Illustrations: Preliminary expenses, Expenses on issue of shares or debentures, Repairing expenses on large scale, underwriting commission, etc. are included in the Deferred Revenue expense.

3. Receipts-Payments Account

Answer:

Meaning: A summary prepared by non-trading concern, of cash receipts and cash payments effected during the year, is known as Receipts- Payments Account.

Explanation:

- Receipts-Payments Account is a type of Cash-book/Cash Account.

- Opening and closing cash balance and bank balance (or bank overdraft) are shown in this account.

- On its debit side cash receipts and on credit side cash payments are recorded.

- In addition to cash transactions, bank transactions are also recorded in the account.

- This account is a short summary of cash transactions during the year.

Points to be kept in mind while preparing the Receipts-Payments Account:

1. Show the opening cash or bank balance on debit side of Receipts-Payments Account. If there is an opening bank overdraft, then / show it on the credit side of this account.

2. On the debit side of the Receipts and Payments Account, all the cash and cheque received during the year are recorded.

3. On the credit side of the Receipts and Payments Account, all the payments made during the year in cash or cheque are recorded.

4. In the Receipts and Payment Account, amount received or paid for any year are recorded.

5. In the Receipts and Payments Account, the capital income and the revenue incomes, the capital expense and revenue expense both are recorded.

6. In the Receipts and Payments Account, the outstanding incomes and expenses are not recorded.

7. The non-cash transactions are not recorded in the Receipts and Payments Account. For e.g., Depreciation, Bad-debts reserve, Credit purchase of assets, Taxation provision, etc.

8. While closing the Receipts and Payments Account:

- If the total of the debit side is more, then the difference is recorded on the credit side and is the closing balance.

- If the total of credit side is more, the difference is recorded on the debit side and it is the closing bank overdraft.

![]()

4. Income-Expenditure Account

Answer:

Meaning: The account which is prepared by non-trading concerns at the end of the year to know the result (Surplus or Deficit) of the institution, is known as Income-Expenditure Account.

Explanation:

On the debit side of this account, current year’s revenue expenses and on the credit side current year’s revenue incomes are recorded.

The non-cash transactions like bad debts, provision for doubtful debts, depreciation, etc. are also recorded in this account.

The main purpose to prepare this account is to know whether the expenses incurred during the relevant year or time period, are within the rules and regulations.

Points to be kept in mind while preparing the Income-Expenditure Account:

- Keep in mind the year for which the Income- Expenditure Account has to be prepared.

- On the debit side of the Income-Expenditure Account, the current year’s revenue expenses are recorded.

- On the credit side of the Income-Expenditure Account, the current year’s revenue incomes are recorded.

- If the total of the credit side of the Income- Expenditure Account is more, then the difference is recorded on the debit side as ‘Excess of income over expenses (profit).’

- If the total of the debit side of the Income- Expenditure Account is more then the difference is recorded on the credit side as ‘Excess of expenses over incomes (loss).’

Following particulars are not to be considered:

- The opening and closing balances of Receipts-Payments Account.

- All capital incomes and capital expenses.

- Last year’s revenue income received in current year.

- Revenue expenses of last year paid in current year.

- Revenue income received for the next year in the current year.

- Revenue expenses paid for the next year in the current year.

Following details to be considered (which are not shown in the receipts and payments accounts):

- Depreciation, bad-debts reserve, provision for taxation, etc.

- Current year’s outstanding income to be received and current year’s expenses to be paid.

- Current year’s revenue income which was received in the last year and current year’s revenue expenses which was paid in the last year.

5. Subscription

Answer:

Specified amount is paid regularly every year by the members of the institution to continue their membership, it is known as subscription. Subscription is also known as annual membership fees. For institutions, subscription is a main revenue income. It means subscription is the main source of income of the institution. Subscription is recorded on the income side of the Income and Expenditure Account as revenue income.

(B ) Explain differences :

1. Accounts of Trading Concern and Accounts of Non-Trading Concern

Answer:

|

Difference |

Accounts of Trading Concern |

Accounts of Non-Trading Concern |

| 1. Meaning | The concern which has an objective to generate profit through purchase-sales activities or through other trading activities is a trading concern. | The concern which has an objective to provide service or social service is a non-trading concern. |

| 2. Trading Account | Trading concerns prepare Trading Account to find out gross profit. | The non-trading concerns’ objective are not to earn profit, so they are not required to prepare a Trading Account. |

| 3. Accounting basis | Trading concerns maintain their accounts on mercantile basis. | Generally, all non-trading concerns prepare their accounts on cash basis. |

| 4. Profit and Loss Account | Trading concerns prepare a Profit and Loss Account to know the result of business. | Non-trading concerns prepare an Income and Expenditure Account to know excess of income over expenditure or excess of expenditure over income. |

| 5. Result | The result found out by Profit and Loss Account is termed as ‘Net Profit’ or ‘Net Loss’. | The result found out by Income and Expenditure Account is termed as ‘Excess of income over expenditure’ or ‘Excess of expenditure over incomes.’ |

| 6. Main source of income | The main source of income of a trading concern is sale of goods. | The main source of income of a non-trading concern is Annual Subscriptions of members, Entrance fees, Donations, etc. |

| 7. Summary of cash or bank transactions | To produce the summary at the end of the year regarding cash and bank transactions no any account is prepared. | The Income and Expenditure Account is prepared at the end of the year to produce the summary regarding cash and bank transactions. |

| 8. Capital | A trading concern shows the excess of assets over liabilities as ‘Capital’. | A non-trading concern shows the excess of assets over liabilities as ‘Capital fund’ or ‘Permanent fund’. |

| 9. For cash transactions | For Cash transactions, Cashbook is prepared by the trading concern. | For Cash transactions, a Receipt-Payment Account is prepared by the non-trading concern. |

| 10. Annual Accounts | (1) Trading Account, (2) Profit and Loss Account and (3) Balance Sheet are prepared by the trading concerns. | (1) Income-Expenditure Account, (2) Balance Sheet and to know cash balance and cash transaction Receipt and Payment Account are prepared by the non-trading concerns. |

2. Capital Income and Revenue Income

Answer:

| Difference | Capital Income | Revenue Income |

| 1. Meaning | The income which is not received regularly is known as ‘Capital income’. | The income which is received regularly is known as ‘Revenue income’. |

| 2. Illustrations | Admission fees. Donation, Subscription for life membership, Donation for specific purpose, Legacy, Donation received for prize distribution, Income for loan taken, etc. are included in Capital income. | The daily income of the institution like Annual Subscription of members, Interest on investments. Rent of hall, Locker rent, Sale of old newspapers, income from entertainment programme, Government subsidy or grant, Small amount of donations or charity, Bank interest, etc. are included in Revenue income. |

| 3.Presentation in Accounts | Capital income is shown on the Liability side of Balance Sheet. | Revenue income is shown on the credit side of the Income-Expenditure Account. |

| 4. Balance | The balance of capital income is carried forward to the next year. | The revenue income accounts are closed at the end of year, so there is no question of carrying it forward. |

| 5. Received information |

Capital income shows the financial position of the institute. | Revenue income shows the profit of loss of the institute. |

| 6. Objective | The objective of capital income is to procure long term fund. | The objective of revenue income is to procure regular income. |

3. Capital Expense and Revenue Expense

Answer:

| Difference | Capital Expense | Revenue Expense |

| 1. Meaning | The expense which is not made regularly and whose benefit is received for a long period of time, is known as ‘Capital expense’. | The expense which is made regularly and the benefit of which is received for a short time period is known as ‘Revenue expense’. |

| 2. Illustrations | The expenditure which results in acquisition of an asset is included in capital expenditure. For e.g., expenses like legal expenses, establishment expense incurred for purchase of building, land, furniture. | The day-to-day expenses of the business like salary, rent, postage and telegram, stationery expenses, interest, etc. are included in revenue expenditure. |

| 3. Presentation in accounts | Capital expense is shown on the asset side of Balance Sheet. | Revenue expense is shown on the debit side of the Income-Expenditure Account. |

| 4. Depreciation | At the end of the year, depreciation is calculated on the capital expense. | At the end of the year, depreciation is not calculated on the revenue expense. |

| 5. Regularly | Generally, capital expense is made only once. | Generally, revenue expense is made regularly and repeatedly. |

| 6. To close the account | At the end of the year capital accounts are not closed but their balances are carried forward to the next year. | At the end of the year revenue accounts are closed and so there is no question of carrying their balances forward to the next year. |

| 7. Received information | Capital expense shows the financial position of the institute. | Revenue expense shows the profit or loss of the institute. |

| 8. Objective | The objective of the capital expense is either to acquire fixed assets and with their help to create facilities to generate income. | The objective of tire revenue expense is to run activities of the concern. |

4. Receipts-Payments Account and Income-Expenditure Account

Answer:

| Difference | Receipts-Payments Account | Income-Expenditure Account |

| 1. Meaning | A summary of cash received and cash paid prepared by a non-trading concern is known as ‘Receipts-payments Account.’ | To know the result of a concern at the end of the year, the account which is prepared by a non-trading concern is known as ‘Income-Expenditure Account’. |

| 2. Nature | Receipts-Payments Account is similar to Cash Account. | Income-Expenditure Account is similar to Profit and Loss Account. |

| 3. Transactions | In Receipts-Payments Account only cash transactions are recorded. | In Income-Expenditure Account non-cash transactions are also recorded. |

| 4. Balance | This account starts with an opening cash balance and at the end of the year, the balance of the account shows the closing cash balance. | There is no opening balance of this account, but at the end of the year, there is a balance showing the ‘excess of incomes over expenses’ or the ‘excess of expenses over incomes.’ |

| 5. Sides show | The debit side of this account shows the incomes and the credit side shows the expenses. | The debit side of this account shows the expenses and the credit side shows the incomes. |

| 6. Receipts- Payments | The receipts and payments of both capital and revenue types are recorded in this account. | Only revenue receipts and revenue payments are recorded in this account. |

| 7. Time period | All cash transactions are included here irrespective of the time period. | Only transactions of income and expenditure only of current year are recorded in this account. |

| 8. Difference | The difference of both the sides of this account shows the closing balance. | The difference of both the sides of this account shows the excess of incomes or excess of expenses. |

| 9. Balance | This account generally shows a debit balance, but if there is bank overdraft, it shows a credit balance. | This account may have any balance, debit or credit. |

| 10. Accounting basis | This account is prepared on cash basis. | This account is prepared on mercantile basis. |

| 11. Treatment of transactions | Debit side receipts and credit side payments are recorded. | On debit side revenue expenses and on credit side revenue incomes are recorded. |

Question 4.

Explain classification of incomes of a non-trading concern with illustrations.

Answer:

There are two types of incomes of a non-trading concern :

1. Revenue incomes and

2. Capital incomes.

1. Revenue income: Incomes received for the regular activities of the concern are known as revenue incomes or receipts. Revenue incomes are those incomes without which the activities of the concern cannot be carried out.

Illustrations: Admission fees of members, Subscriptions, Interest on investments, Incomes from various activities, Locker’s rent, Rent of hall, Government grant or subsidy, Income from entertainment programme, Small amounts of donations or charity, Sale of old newspaper, Sale of sports equipment, Discount, Commission, etc. The revenue incomes or receipts are recorded on the credit side of Income and Expenditure Account. The objective of revenue incomes are to procure regular income.

2. Capital incomes: The incomes which are not received regularly or repeatedly and whose benefit is going to be received by the concern for a longer period, are known as capital incomes or receipts.

Illustrations: Donation, Charity, Subscription received for life membership, Amount of loan taken, etc. Profit arising from the sale of fixed asset is a capital income but it is generally credited to Income-Expenditure Account instead of adding to capital fund. Generally in non-trading concerns except borrowings capital incomes such as donations, legacy, etc. are added in capital fund or are shown separately from capital fund on liabilities side of a Balance Sheet. The objective of capital income is to procure long term fund.

![]()

Question 5.

Explain classification of expenses of a non-trading concern with illustrations.

Answer:

There are three types of expenses of a non-trading concern :

(1) Revenue expenses,

(2) Capital expenses and

(3) Deferred revenue expenses.

- Revenue expenses: The expenses which are incurred regularly and repeatedly to carry on day-to-day activities or to maintain the assets in proper and efficient condition or those expenses the benefit of which is limited for the current year only, are known as revenue expenses or expenditure.

Illustrations: Salary, Rent, Interest, Discount, Commission, Stationery expenses, Telephone bill, Subscription of newspapers and magazines, Expenses on entertainment, Depreciation on assets, etc. are recorded on the debit side of the Income Expenditure Account. The objective of the revenue expense is to run activities of the concern.

2. Capital expenses: The expenses which are not incurred regularly and the benefit of it is received for long period of time or it is made in order to purchase assets for the concerns are known as capital expenses or expenditures. In short, capital expense is expenses incurred to purchase an asset, to put the assets into working conditions, to decrease the production cost, etc. are nothing but capital expense or expenditure.

Illustrations: Expenses on sports equipments, Expenses on purchase of fixed assets like as land, building, furniture, X-ray machine, etc. Capital expenses are shown on the Asset side of Balance Sheet.

The object of capital expense is to acquire fixed assets and with the help of which to create facilities or to generate income.

3. Deferred revenue expense:

Answer:

Many times, huge amounts of revenue expenses are incurred and the benefit of which is received by the concern for a long period of time. This expense is treated as a revenue expense and is written off by allocating the same proportionately over a number of years in which, the benefit is likely to be received. Such types of expenses are known as Deferred Revenue Expenses. The portion which is not written off is shown in the Balance Sheet on the Assets side, which is known as fictitious asset.

Illustrations: Preliminary expenses, Expenses on issue of shares or debentures, Repairing expenses on large scale, underwriting commission, etc. are included in the Deferred Revenue expense.

Question 6.

Explain the meaning of Receipt-Payment Account. Write the points to be considered for the preparation of it.

Answer:

Meaning: A summary prepared by non-trading concern, of cash receipts and cash payments effected during the year, is known as Receipts- Payments Account.

Explanation:

Receipts-Payments Account is a type of Cash-book/Cash Account. Opening and closing cash balance and bank balance (or bank overdraft) are shown in this account. On its debit side cash receipts and on credit side cash payments are recorded.

In addition to cash transactions, bank transactions are also recorded in the account. This account is a short summary of cash transactions during the year.

Points to be kept in mind while preparing the Receipts-Payments Account:

- Show the opening cash or bank balance on debit side of Receipts-Payments Account. If there is an opening bank overdraft, then / show it on the credit side of this account.

- On the debit side of the Receipts and Payments Account, all the cash and cheque received during the year are recorded.

- On the credit side of the Receipts and Payments Account, all the payments made during the year in cash or cheque are recorded.

- In the Receipts and Payment Account, amount received or paid for any year are recorded.

- In the Receipts and Payments Account, the capital income and the revenue incomes, the capital expense and revenue expense both are recorded.

- In the Receipts and Payments Account, the outstanding incomes and expenses are not recorded.

- The non-cash transactions are not recorded in the Receipts and Payments Account. For e.g., Depreciation, Bad-debts reserve, Credit purchase of assets, Taxation provision, etc.

While closing the Receipts and Payments Account:

- If the total of the debit side is more, then the difference is recorded on the credit side and is the closing balance.

- If the total of credit side is more, the difference is recorded on the debit side and it is the closing bank overdraft.

Question 7.

Explain the meaning of Income- Expenditure Account. Write the points to be considered for the preparation of it.

Answer:

Meaning: The account which is prepared by non-trading concerns at the end of the year to know the result (Surplus or Deficit) of the institution, is known as Income-Expenditure Account.

Explanation:

On the debit side of this account, current year’s revenue expenses and on the credit side current year’s revenue incomes are recorded. The non-cash transactions like bad debts, provision for doubtful debts, depreciation, etc. are also recorded in this account. The main purpose to prepare this account is to know whether the expenses incurred during the relevant year or time period, are within the rules and regulations.

Points to be kept in mind while preparing the Income-Expenditure Account:

- Keep in mind the year for which the Income- Expenditure Account has to be prepared.

- On the debit side of the Income-Expenditure Account, the current year’s revenue expenses are recorded.

- On the credit side of the Income-Expenditure Account, the current year’s revenue incomes are recorded.

- If the total of the credit side of the Income- Expenditure Account is more, then the difference is recorded on the debit side as ‘Excess of income over expenses (profit).’

- If the total of the debit side of the Income- Expenditure Account is more then the difference is recorded on the credit side as ‘Excess of expenses over incomes (loss).’

Following particulars are not to be considered:

- The opening and closing balances of Receipts-Payments Account.

- All capital incomes and capital expenses.

- Last year’s revenue income received in current year.

- Revenue expenses of last year paid in current year.

- Revenue income received for the next year in the current year.

- Revenue expenses paid for the next year in the current year.

Following details to be considered (which are not shown in the receipts and payments accounts):

- Depreciation, bad-debts reserve, provision for taxation, etc.

- Current year’s outstanding income to be received and current year’s expenses to be paid.

- Current year’s revenue income which was received in the last year and current year’s revenue expenses which was paid in the last year.

Question 8.

Do as directed :

1. Classify the following details into revenue income, capital income, revenue expense and Classification of Incomes and Expenses Revenue Income Capital Income Revenue Expense Capital Expense

1. Membership fee

2. Prize fund

3. Life membership fee periodicals

4. Legacy

5. Donation

6. X-ray machine

7. Investment of prize fund

8. Subscription of

9. Annual day expense

10. Purchase of sports

11. Ground maintenance equipment

12. Sale of tickets of drama

13. Expense of drama

14. Government aid (subsidy)

15. Rent of locker

16. Purchase of National meal

17. Machine installation wages and expense

18. Annual meal expense

19. Contribution for annual

20. Entertainment Programme income

21. Annual function expense

22. Sale of sports equipments

23. Purchase of billiard table

24. Repairing expense

25. Entrance fee

26. Expense to bring an old asset in operation

27. Loss on sale of assets

28. Interest on Investments

29. Canteen income fund

30. Depreciation of asset

31. Charity expense

32. Purchase of HDFC bond

33. President felicitation Savings Certificate

34. President felicitation expense.

Answer:

Classification of Incomes and Expenses

| Revenue Income | Capital Income | Revenue Expense | Capital Expense |

| 1. Membership fee | 2. Prize fund | 8. Subscription of periodicals | 6. X-ray machine |

| 12. Sale of tickets of drama | 3. Life membership fee | 9. Annual day expense | 7. Investment of prize fund |

| 14. Government aid (subsidy) | 4. Legacy | 11. Ground maintenance expense | 10. Purchase of sports equipment |

| 15. Rent of locker | 5. Donation | 13. Expense of drama | |

| 19. Contribution for annual meal | 31. Charity | 18. Annual meal expense | 16. Purchase of National Savings Certificate |

| 20. Entertainment Programme income | 33. President felicitation fund | 21. Annual function expense | 17. Machine installation wages and expense |

| 22. Sale of sports equipment | 24. Repairing expense | 23. Purchase of billiard table | |

| 25. Entrance fee | 27. Loss on sale of assets | 26. Expense to bring an old asset in operation | |

| 28. Interest on Investments | 30. DepreciatIon of asset | 32. Purchase of HDFC bond | |

| 29. Canteen income | 34. President felicitation expense |

![]()

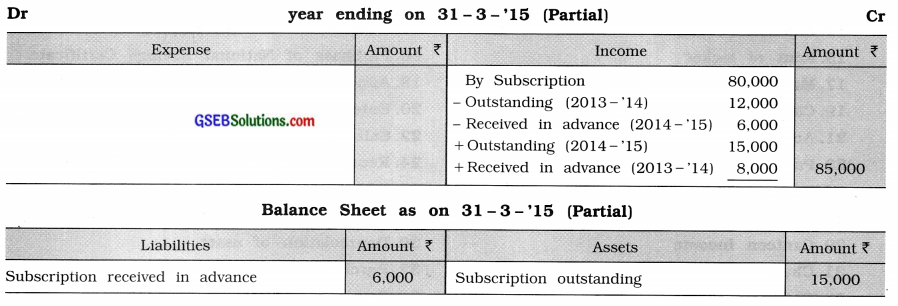

2. Disclose the following information in the Income-Expenditure Account ending on 31-3-’15 and Balance Sheet as of that day. Subscription received in the year 2014-’15 is ₹ 80,000.

| Particulars | 1 – 4 -’14 Amount ₹ |

31 -3 – ’15 Amount ₹ |

| Subscription outstanding | 12,000 | 15,000 |

| Subscription received in advance | 8,000 | 6,000 |

Answer:

Income-Expenditure Account for the

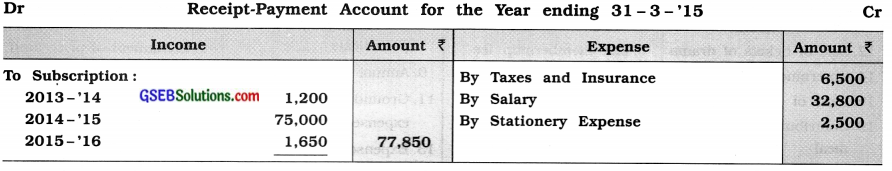

3. Disclose the following information in Income-Expenditure Account for the year ending 31 – 3 – ’15 :

Note:

(i) Salary outstanding 2013 -’14 : ₹ 3,000; 2014 -’15 :₹ 6,300.

(ii) Opening stock of stationery ₹ 670 and closing stock ₹ 250.

Answer:

Income-Expenditure Account for the

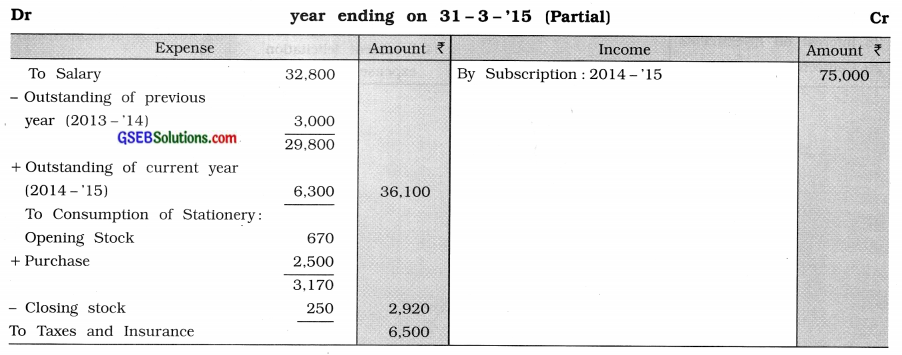

4. Disclose the following balances in the Balance Sheet of Vinayak Cricket Club:

| Balances of Accounts | Amount ₹ | Balances of Accounts | Amount ₹ |

| Match fund | 70,000 | Interest on match fund investment | 4,000 |

| Investments of match fund | 35,000 | Donation received for match fund | 16,000 |

| Prize distribution to match winners | 5,700 | Permanent fund | 1,05,000 |

| Match expense | 8,250 | Investments of permanent fund | 1,05,000 |

Answer:

Balance Sheet of Vinayak Cricket Club as on… (Partial)

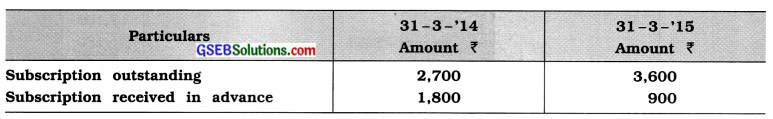

5. Income of subscription ₹ 45,000 is disclosed in the Income-Expenditure Account for the year ending 31-3-’15. Other details of subscription are as follows:

Disclose the amount of subscription in the Receipt-Payment Account for the year ending 31-3 – ’15.

Answer:

Only subscription received by cash is shown/disclosed in Receipt-Payment Account while total subscription of the current year is shown/disclosed in Income-Expenditure Account.

Explanation: Given reverse (opposite) effect of subscription of Income-Expenditure Account, forgetting the amount of subscription as per Receipt-Payment Account.

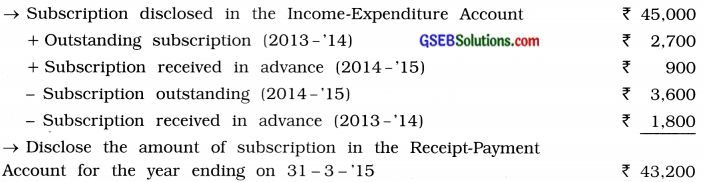

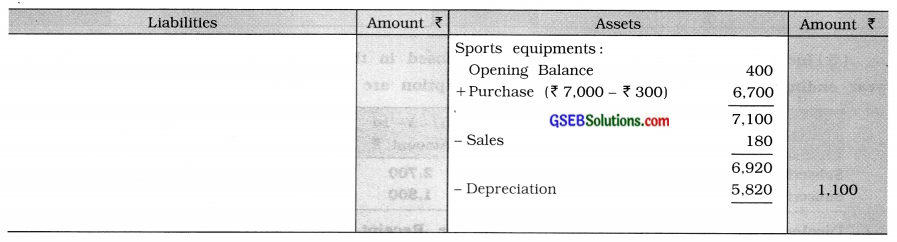

6. How would you disclose the following details on 31-3-’15, during the preparation of Annual Accounts?

Balance Sheet as on 1-4-’14

| Liabilities | Amount ₹ | Assets | Amount ₹ |

| Creditors for sports equipment | 300 | Sports Equipments | 400 |

Additional information: Sports equipments on hand on 31-3-’15 ? 1,100.

Answer:

Balance Sheet as on 31-3-’15 (Partial)

Explanation : Depreciation on Sports equipments = Opening Balance + Purchase – (sales + Closing Balance) = 400 + 6,700 – (180 + 1,100) = 7,100 – 1,280 = 5,820.

Question 9.

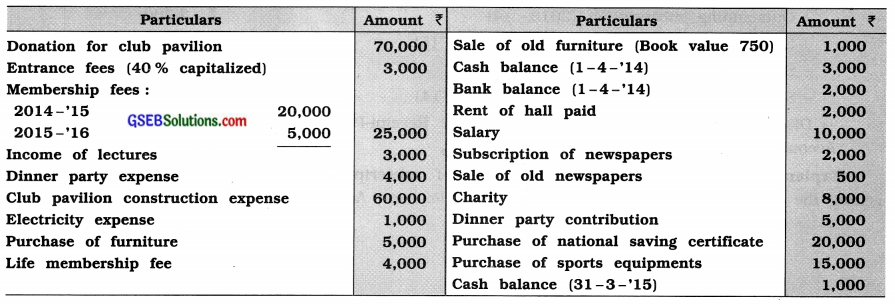

From the following given information, prepare a receipt-payment account for the year ending 31-3-’15 of Omkar Club:

Additional information :

(1) Salary outstanding ₹ 10,000.

(2) Provide 10 % depreciation on sports equipments.

(3) Subscription outstanding ₹ 2,500.

(4) Prepaid hall rent ₹ 500.

Answer:

Receipt-Payment Account of Omkar Club

Note: The total of debit side of Receipt-Payment Account is more. Thus, the difference of ₹ 4,500 would appear at credit side, which discloses Bank balance.

Additional information given in the question are non-cash transactions and therefore they have no effect on Receipt-Payment Account.

![]()

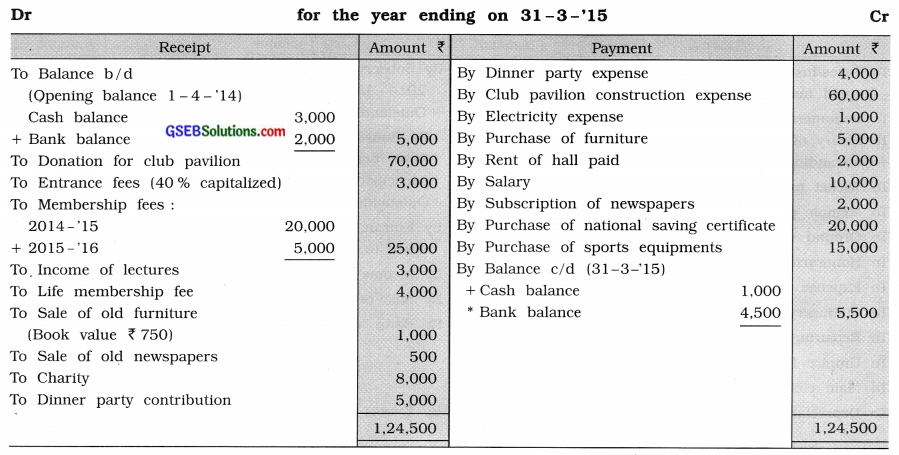

Question 10.

From the following information prepare an Income-Expenditure Account for the year ending 31-3-’15 of Divya Cricket Club:

Additional information:

(1) Prepaid insurance is ₹ 2,400.

(2) Subscription outstanding from members participating in sports ₹ 6,000.

(3) Subscription outstanding from members for current year ₹ 6,000.

(4) 10 % depreciation p.a. is to be provided on sports equipments.

(5) Salary outstanding is ₹ 3,000.

Answer:

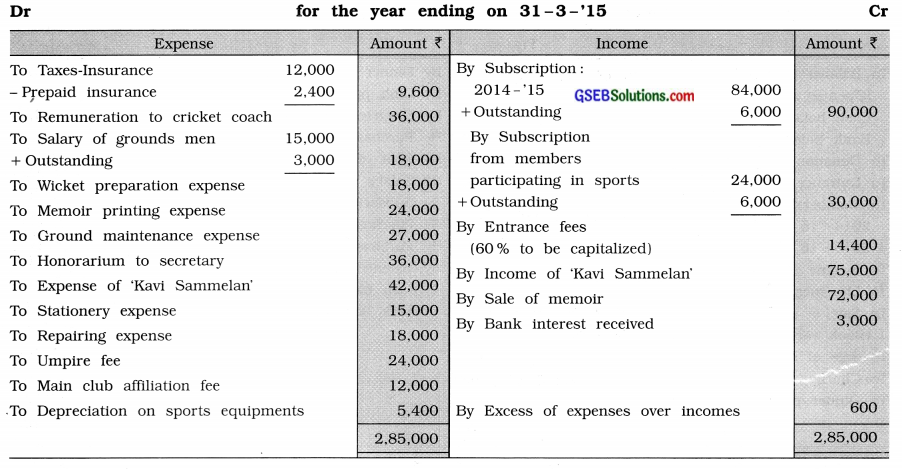

Income-Expenditure Account of Divya Cricket Club

Explanation :

1. Purchase of Sports equipments and Investment of tournament fund, which are capital expenses, therefore, they are shown on Assets side of a Balance Sheet.

2. Donation received for tournament is for specific purpose. Therefore tournament prize distribution expense, tournament fee received and Interest on investment of tournament fund are shown on Liabilities side of a Balance Sheet.

Question 11.

From the following information of Surabhi Club, prepare a Receipt-Payment and an Income-Expenditure Account:

| Particulars | Amount ₹ |

| Subscription (including ₹ 30,000 of 2013-’14) | 3,00,000 |

| Outstanding at the end of year | 20,000 |

| Donation (revenue) | 30,000 |

| Purchase of furniture | 70,000 |

| Purchase of sports equipments | 40,000 |

| Subscription of newspapers | 15,000 |

| Sale of old furniture (Book value of ₹ 5,000) | 2,000 |

| Opening cash and Bank balance | 60,000 |

| Rent paid | 28,000 |

| Bank expense | 1,000 |

| Stationery and Printing (Inclusive a bill of ₹ 5,000 of previous year) | 20,000 |

| Entrance fees (50% to be capitalized) | 20,000 |

| Legacies | 50,000 |

| Honorarium to secretary (Inclusive ₹ 4,000 of previous year) | 48,000 |

| Honorarium outstanding | 4,000 |

| Postage and Telephone | 10,000 |

| Sundry expenses | 10,000 |

| Income of cultural programme | 80,000 |

| Expenses of cultural programme | 60,000 |

| Depreciation written off on furniture | 5,000 |

| Purchase of investment | 1,00,000 |

| Interest on investments | 7,000 |

Answer:

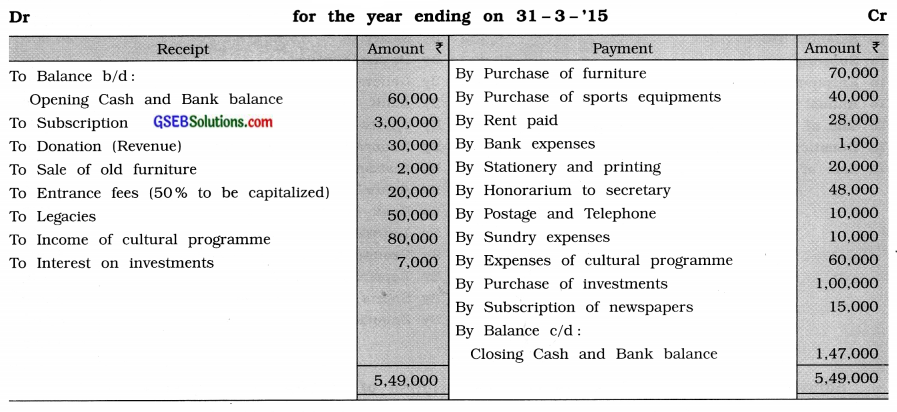

Receipt-Payment Account of Surabhi Club

Income-Expenditure Account of Surabhi Club

Explanation :

1. The book value of furniture sold is deducted from the amount of furniture in the Balance Sheet, but the loss of sale of furniture is shown in the Income-Expenditure Account.

2. 50% amount of entrance fees is to be shown in the Income-Expenditure Account.

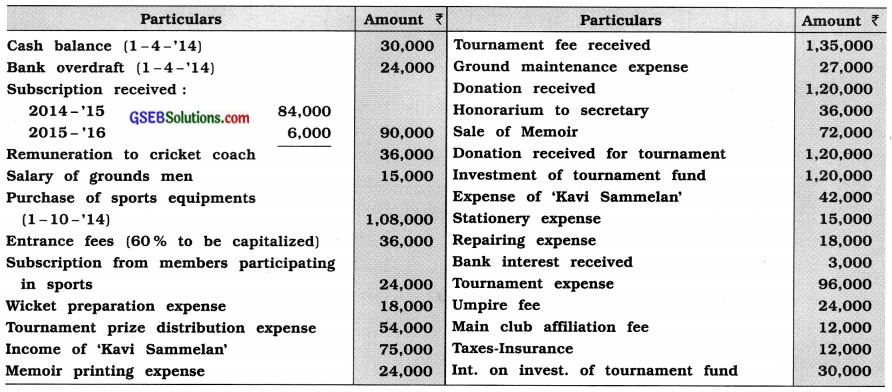

Question 12.

From the following information of Sanket Sports Club for the year ending 31-3-’15, prepare an Income-Expenditure account for the year ending on that date:

Adjustment:

Subscription includes, subscription of ₹ 2,000 for the year 2015-’16.

Subscription outstanding ₹ 3,000 for the year 2014-’15.

General expenses include, prepaid insurance of ₹ 500.

Salary outstanding ₹ 2,000.

Depreciation on sports equipments is to be provided ₹ 3,000.

50% of entrance fees is to be capitalized.

Stationery stock ₹ 200.

Answer:

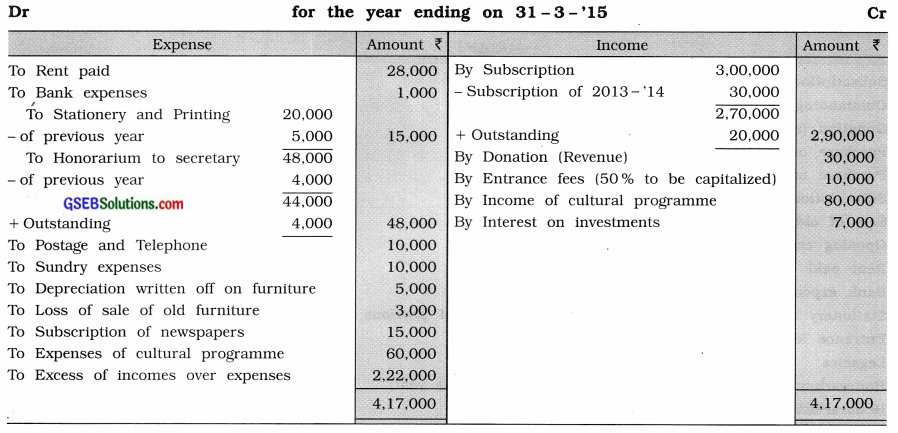

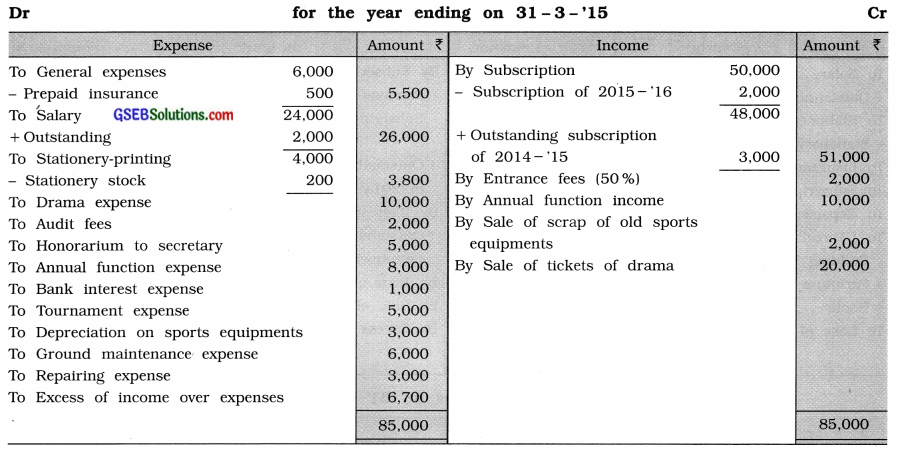

Income-Expenditure Account of Sanket Sports Club

Explanation: Donation for sports prizes and sports prizes distribution are to be shown in Balance Sheet.

![]()

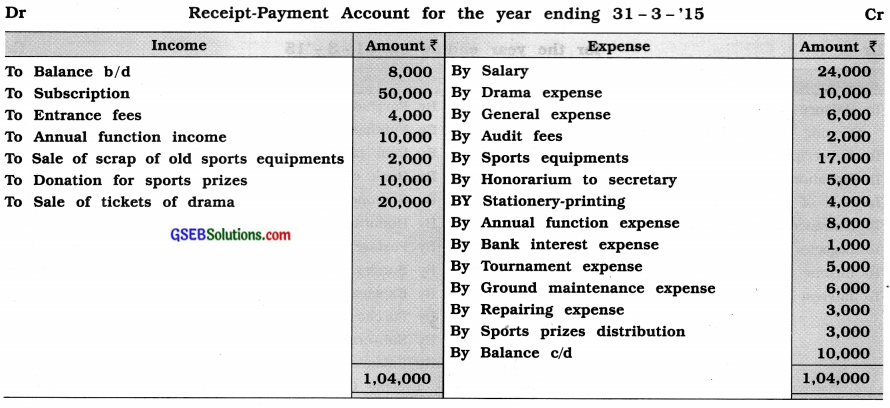

Question 13.

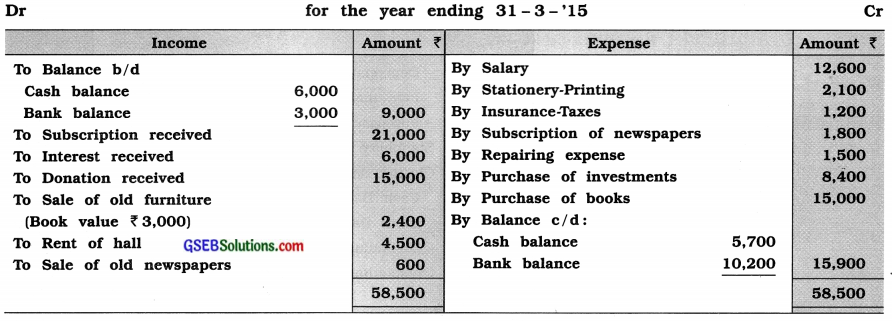

From the Receipt-Payment Account for the year ending 31-3-’15 and other given information of Sheela Mahila Vikas Mandal, prepare an Income-Expenditure Account for the year ending 31-3-’15 and the Balance Sheet as of that day:

Receipt-Payment Account of Sheela Mahila Vikas Mandal Dr for the year ending 31-3-’15 Cr

Other information:

(1) Balance as on 1-4-’14:

Building ₹ 90,000, Furniture ₹ 12,000, Books ₹ 30,000, Investments ₹ 1,20,000, Subscription outstanding ₹ 3,000 and permanent fund ₹ 2,64,000.

(2) Subscription included ₹ 1,500, subscription of the year 2015-’16.

(3) Subscription outstanding for the year 2014-’15 ₹ 2,100.

(4) Salary outstanding ₹ 1,800.

(5) Unused Stationery on 31-3-’15 was of ₹ 300.

(6) Provide 10 % depreciation on closing balance of Building, Furniture and Books.

(7) Interest outstanding on investment ₹ 1,500.

Answer:

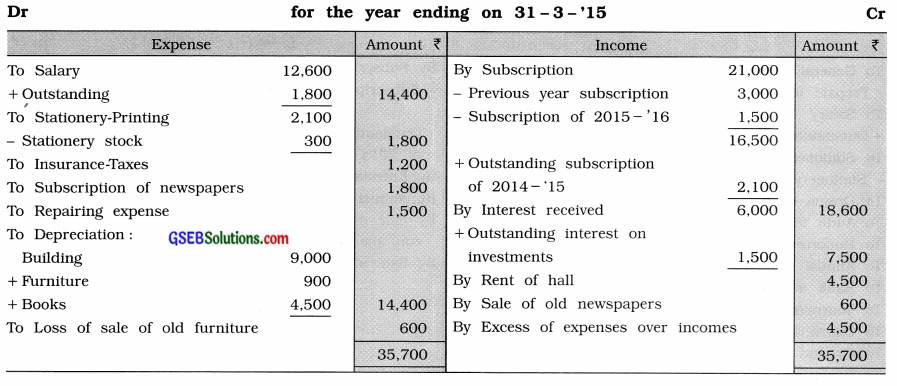

Income-Expenditure Account of Sheela Mahila Vikas Mandal

Balance Sheet as on 31-3-’15

Question 14.

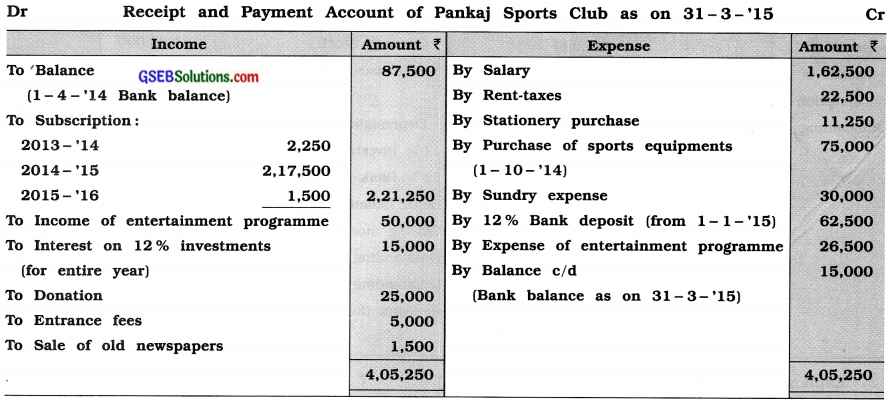

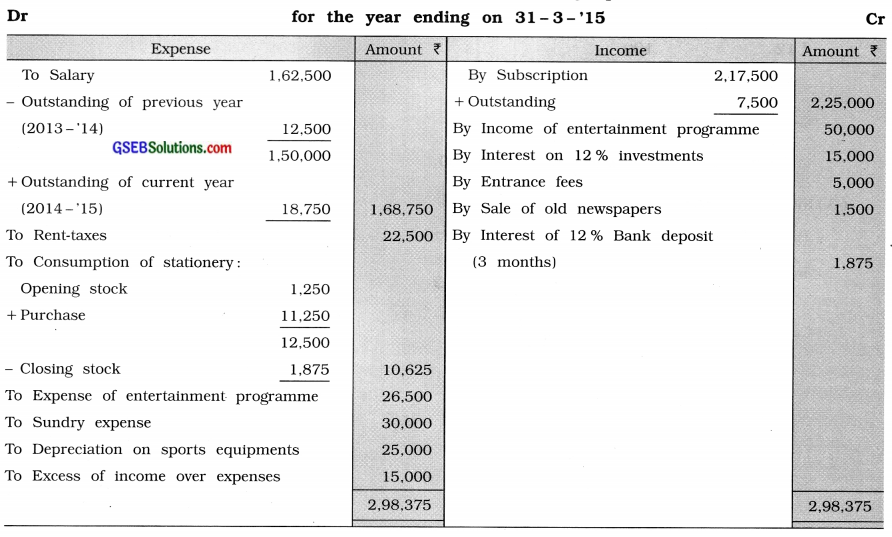

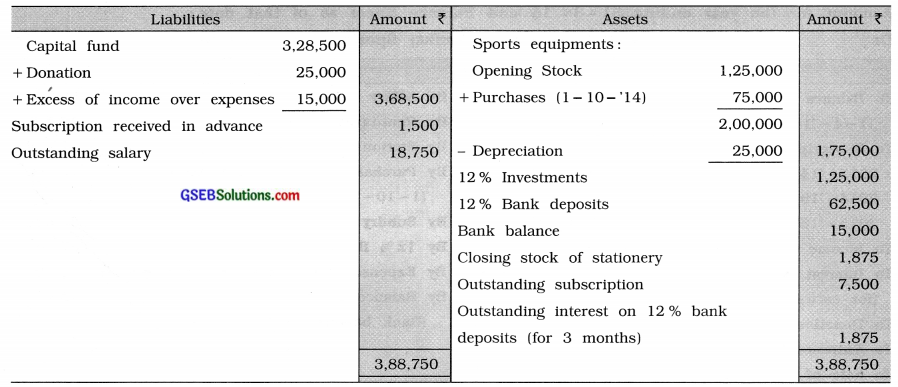

From the following information of Pankaj Sports Club, prepare an Income-Expenditure Account for the year ending 31-3-’15 and Balance Sheet as of that date:

Additional information:

(1) There are 300 members of club, each member pays annual subscription of ₹ 750.

(2) Opening capital fund is of ₹ 3,28,500.

(3) Outstanding salary on 31-3-’14 ₹ 12,500 and on 31-3-’15 ₹ 18,750.

(4) Opening stock of stationery was of ₹ 1,250 while at closing stock was of ₹ 1,875.

(5) The value of sports equipments was of ₹ 1,25,000 on 1-4-’14 while ₹ 1,75,000 on 31-3 – ’15.

Answer:

Income-Expenditure Account of Pankaj Sports Club

Balance Sheet as on 31-3-’15

Explanation :

(3 ) Interest on Bank deposits:

P = 62.500; R = 12%: N = 3 months (from 1 – 1 -‘15 to 31 -3- ‘15) and Interest (I) =?

Interest on bank deposits I = \(\frac{\text { PRN }}{100}\)

=\(62,500 \times \frac{12}{100} \times \frac{3}{12}\)

= ₹ 1,875.

Question 15.

From the given below trail balance of Suresh Youth Club, prepare an Income-Expenditure Account and a Balance Sheet as of that day:

Trial Balance as on 31-3-’15 of Suresh Youth Club

| Name of Account | L.F. | Debit ₹ | Credit ₹ |

| Colourwork expense | 9,000 | – | |

| Stationery-Printing | 2,000 | – | |

| Capital Fund | – | 36,000 | |

| Donation received | – | 2,000 | |

| Cash balance | 3,000 | – | |

| Bank overdraft | – | 1,000 | |

| 12% Loan (from l-4-’14) | – | 15,000 | |

| Furniture | 8,000 | – | |

| Building of club | 35,000 | – | |

| Lifetime subscription | – | 2,000 | |

| Taxes-Insurance | 2,500 | – | |

| Honorarium to secretary | 6,000 | – | |

| Entrance fees | – | 6,000 | |

| Sports equipment | 10,000 | – | |

| Subscription received in advance | 2,000 | – | |

| Salary-wages | 9,000 | – | |

| Outstanding salary | – | 1,000 | |

| Legal expenses | 600 | – | |

| Subscription | – | 25,000 | |

| Interest on loan | 900 | – | |

| Electricity expense | 1,000 | – | |

| Electric fittings | 4,000 | – | |

| Locker rent | – | 1,000 | |

| 91,000 | 91,000 |

Adjustment:

(1) Subscription outstanding ₹ 2,000 for the year 2014-’15.

(2) \(\frac{2}{3}\) Colourwork expense is to be carried forward to next year.

(3) Unused stationery is of ₹ 100.

(4) Provide 10 % depreciation on building, sports equipments and furniture of club.

(5) Consider amount of donation as revenue income.

(6) Prepaid insurance is of ₹ 200.

Answer:

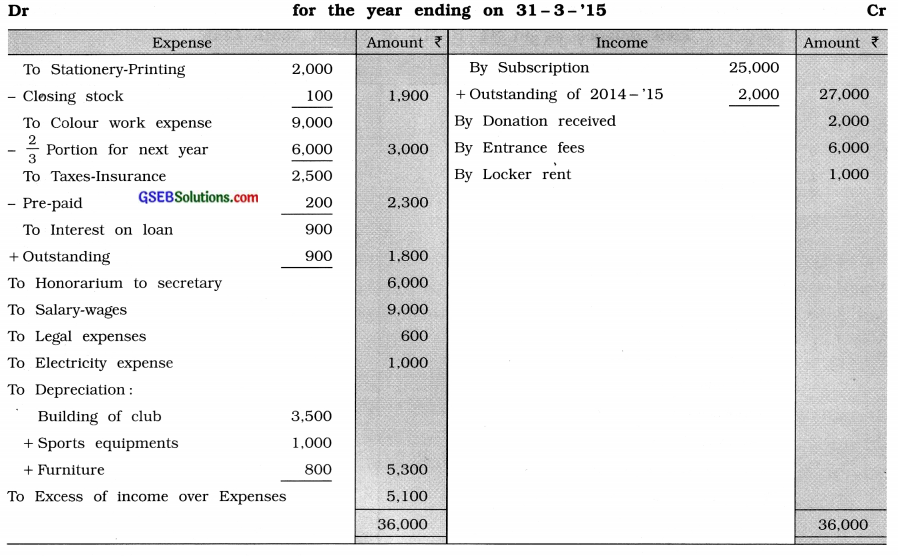

Income-Expenditure Account of Suresh Youth Club

Balance Sheet as on 31-3-’15

![]()

Question 16.

From the trial balance as on 31 -3 -’15 and additional information of Kankuba Jivabhai Parivar Adarsh Vidyalaya given below, prepare an Income-Expenditure Account and a Balance Sheet:

Trail balance as of 31-3-’15 of Kankuba Jivabhai Parivar Adarsh Vidyalaya

| Debit Balance | Amount ₹ | Credit Balance | Amount ₹ |

| Building | 62,500 | Capital fund | 1,15,000 |

| Furniture | 29,000 | Donation | 30,000 |

| Laboratory | 25,000 | Creditors of stationery | 1,000 |

| 12 % Investments (31 – 3 – ’ 15) | 25,000 | Tuition fees | 62,500 |

| Library | 25,000 | Entrance fees | 750 |

| Salary | 40,000 | Rent of hall | 1,250 |

| Stationery | 6,500 | Sundry income | 250 |

| Annual sports day expense | 3,000 | Government grant | 7,500 |

| Cash balance | 500 | Sale of old furniture (1-10-’14) | 1,750 |

| Bank balance | 3,500 | ||

| 2,20,000 | 2,20,000 |

Additional information :

(1) 50% entrance fees is to be capitalized.

(2) Tuition fees outstanding of ₹ 1,500.

(3) Salary outstanding is of ₹ 6,000.

(4) Book value of furniture sold is ₹ 2,500.

(5) Provide 10% depreciation on furniture and library 20% on laboratory and 5% on building.

Answer:

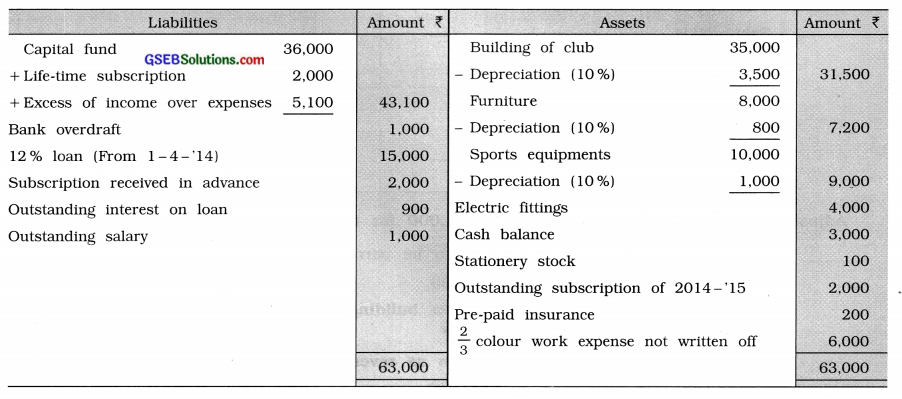

Income-Expenditure Account of Kankuba Jivabhai Parivar

Balance Sheet as on 31-3-’15

Explanation: Book value of furniture sold is ₹ 2,500 and the date of sale is 1-10-’14. Therefore @ 10% for 6 months depreciation is ₹ 125 thereon. Thus, depreciated value of furniture sold is ₹ 2,375 (₹ 2,500 -₹ 125). But this furniture is sold of ₹ 1,750.

∴ Loss on furniture sold = ₹ 2,375 – ₹ 1,750

= ₹ 625

On the remaining furniture, i.e., ₹ 29,000 – ₹ 2.500 (sold) = ₹ 26,500 @10% depreciation is ₹ 2.650.

Question 17.

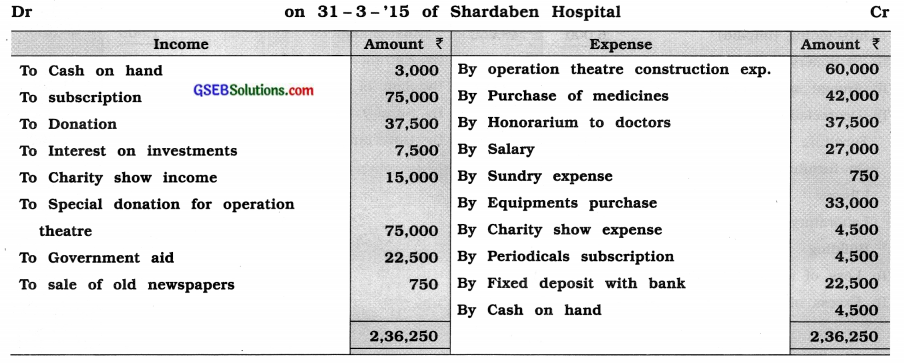

Receipt-Payment Account for the year ending 31 – 3 – ’15 of Shardaben Hospital is as follows :

Receipt-Payment Account for the year ending

Other Information:

| Particulars | 1-4-’14 Amount ₹ | 31 -3-15 Amount ₹ |

| Subscription outstanding | 450 | 750 |

| Subscription received in advance | 150 | 300 |

| Stock of medicines | 9,000 | 10,500 |

| Cost of equipments | 52,500 | 78,000 |

| Building less depreciation | 60,000 | 57,000 |

| Investments | 37,500 | 37,500 |

| Capital fund | 1,62,300 | (?) |

From the above given Receipt-Payment Account and additional information, prepare an Income- Expenditure Account for the year ending 31 -3-’15 and a Balance Sheet as on that day.

Answer:

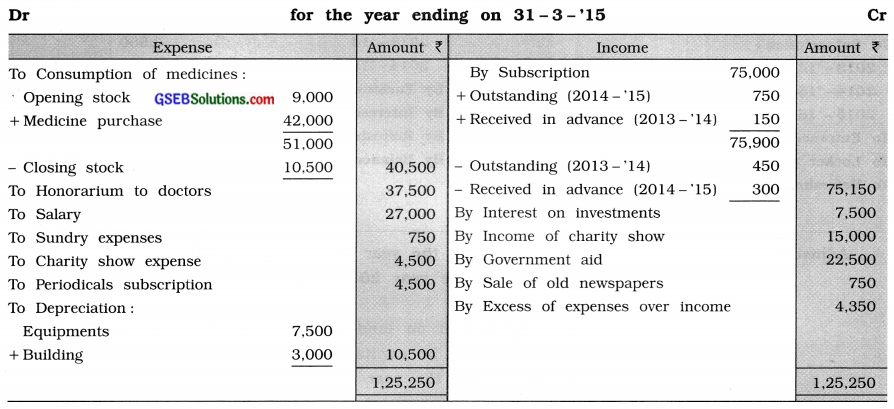

Income-Expenditure Account of Shardaben Hospital

Balance Sheet as on 31-3-’15

Question 18.

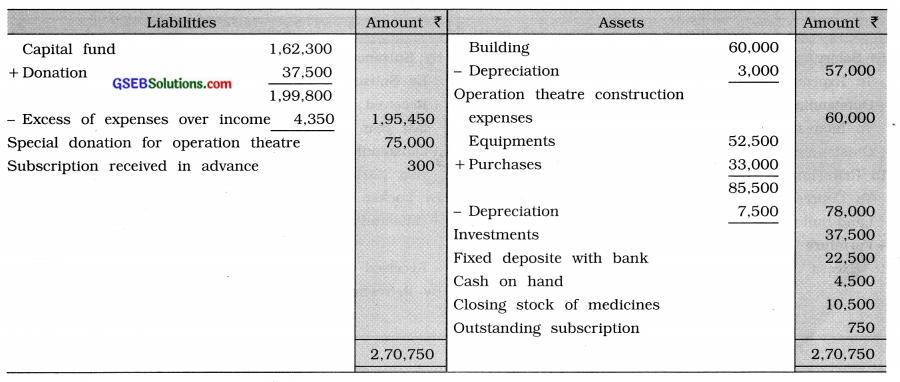

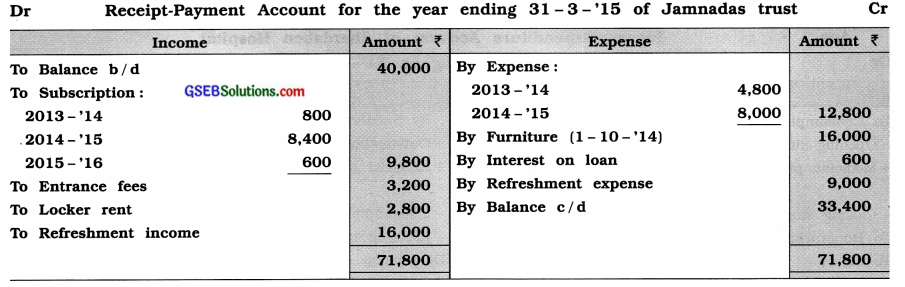

From the information given below of Jamnadas Trust, prepare an Income-Expenditure Account for the year ending 31 – 3 – 15 and a Balance Sheet as on that date:

Balance Sheet as on 31-3-’14 of Jamnadas Trust

Adjustment:

(1) Subscription outstanding for the year 2014-’15 ₹ 3,200.

(2) Expenses outstanding for the year 2014-’15 ₹ 1,000.

(3) Salary outstanding ₹ 2,000.

(4) Provide 5 % p.a. depreciation on land-building and 10 % p.a. on furniture.

(5) 50% of entrance fees is to be capitalized.

(6) Locker rent outstanding for the year 2014-’15 ₹ 360.

Answer:

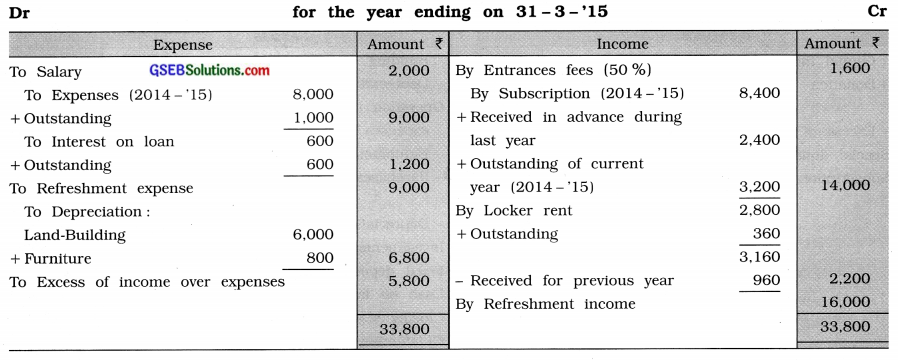

Income-Expenditure Account of Jamnadas Trust

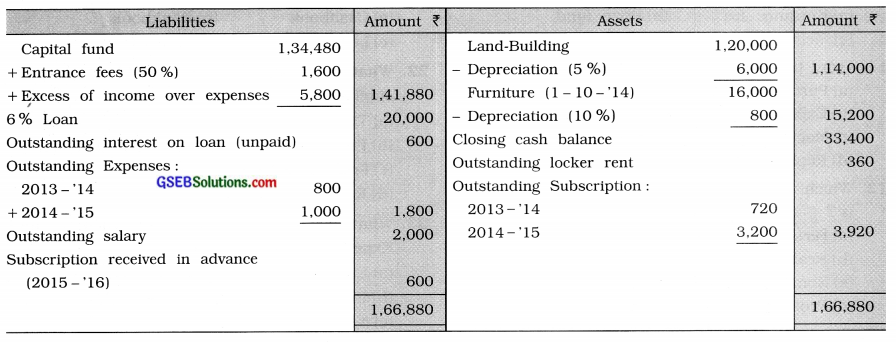

Balance Sheet as on 31-3-’15

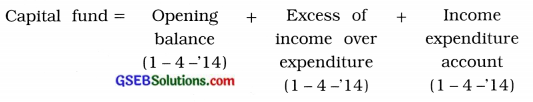

Explanation : Calculation of Capital Fund :

= ₹ 1,08,000 + ₹ 20,000 + ₹ 6,480 = ₹ 1,34,480