Gujarat Board GSEB Textbook Solutions Class 12 Commerce Accounts Part 1 Chapter 5 Admission of a Partner Textbook Exercise Questions and Answers.

Gujarat Board Textbook Solutions Class 12 Accounts Part 1 Chapter 5 Admission of a Partner

GSEB Class 12 Accounts Admission of a Partner Text Book Questions and Answers

Question 1.

Select the correct answer for each questions :

(1) Balance of general reserve and credit balance of profit and loss account is transferred to ………………. account at the time of the admission of a new partner.

(A) capital account of newly admitted partner

(B) all partners’ capital accounts including new partner

(C) old partners’ capital accounts

(D) revaluation account

Answer:

(C) old partners’ capital accounts

(2) Goodwill appearing in the books of the firm at the time of admission of the new partner

is recorded as ……………….

(A) debited to old partners’ capital accounts in their old profit-loss sharing ratio and good¬will account is credited

(B) credited to all partners’ capital accounts including new partner in their new profit-loss sharing ratio.

(C) admitted partners’ capital A/c Cr. Goodwill A/c Dr.

(D) credited to old partners’ capital accounts in their old profit-loss sharing ratio and good¬will account debited.

Answer:

(A) debited to old partners’ capital accounts in their old profit-loss sharing ratio and good¬will account is credited

![]()

(3) Premium for goodwill brought by the partner is recorded on ……………….. side.

(A) debit side of old partners’ capital accounts in old profit-loss sharing ratio.

(B) credit side of old partners’ capital accounts in their old profit-loss Sharing ratio

(C) debit side of old partners’ capital accounts in their sacrificing ratio

(D) credit side of old partners’ capital accounts in their sacrificing ratio

Answer:

(D) credit side of old partners’ capital accounts in their sacrificing ratio

(4) Revaluation account is ………………. type of account.

(A) personal

(B) nominal

(C) real

(D) temporary

Answer:

(B) nominal

(5) When new partner brings his share of goodwill in cash, ……………….. account is credited.

(A) cash

(B) premium for goodwill

(C) goodwill

(D) his capital account

Answer:

(B) premium for goodwill

(6) As per accounting standard-26 ………………., goodwill can not be shown in the books.

(A) goodwill for which some amount is paid for consideration

(B) internally generated

(C) (A) and (B) both

(D) neither of (A) and (B)

Answer:

(B) internally generated

(7) Revaluation account is also known as ………………

(A) profit-loss account

(B) profit and loss adjustment account

(C) pro tit and loss appropriation account

(D) profit and loss suspense account

Answer:

(B) profit and loss adjustment account

(8) When only old profit-loss sharing ratio is given; sacrificing ratio of partners = …………………

(A) equal

(B) old ratio

(C) old share – new share

(D) can not be calculated

Answer:

(B) old ratio

![]()

(9) Old partner is also required to give his share in goodwill to other old partner, when ………………..

(A) his capital is less

(B) his new share in new profit-loss ratio is more than his old share

(C) his new share in new profit-loss ratio is less than his old share

(D) his new share in new profit-loss ratio is equal to old share

Answer:

(B) his new share in new profit-loss ratio is more than his old share

(10) Profit or loss of revaluation account is transferred to ………………. account in ……………… ratio.

(A) old partners, equal

(B) all partners, new profit-loss sharing ratio

(C) old partners, sacrificing ratio

(D) old partners, old ratio

Answer:

(D) old partners, old ratio

Question 2.

Answer the following questions in one sentence :

(1) How is a new partner admitted in a firm ?

Answer:

According to Indian Partnership Act 1932, a new partner shall be admitted in the firm with the consent of all the existing partners, otherwise by the partners in the partnership agreement.

(2) For what purpose a new partner is admitted in a firm ?

Answer:

A new partner may be admitted in a continuing firm because of the following reasons :

- When continuing firm needs additional capital, additional managerial ability.

- For the distribution of risk of the partnership firm.

- When any continuing partner retires or dies.

- When services or skilled and efficient employees of the firm is required.

(3) State necessary accounting adjustments at the time of the admission or a new partner.

Answer:

At the time of the admission of a new partner following accounting adjustments are to be considered.

- New profit and loss sharing ratio and old partners sacrificing ratio.

- Accounting effects relating to goodwill, profit/ loss arising from the revaluation of assets and liabilities, and accumulated profit, losses and reserves.

- Adjustments of change in capital.

(4) State rights of a new partner.

Answer:

New partner becomes entitled to share future profits and future assets of the firm.

![]()

(5) Why assets and liabilities are revalued at the time of the admission of a new partner ?

Answer:

Due to revaluation of assets and liabilities net change can be adjusted in the old partners

capital accounts, and accounting effect of profit/loss arising from revalued assets and liabilities can be given.

(6) Why a new partner is required to give his share in goodwill ?

Answer:

On the admission of a new partner, old partners sacrifice some of their profit share in favour of the new partner. To compensate profit share acquired by the new partner he is required to give his share of goodwill to the firm.

(7) What is sacrificing ratio ? How it is calculated ?

Answer:

At the time of admission of a new partner, old partners sacrifice some portion of profit in favour of new partner which is known as sacrifice ratio.

Sacrifice of Old partners = Old share of Profit – New share of Profit.

(8) Explain with reasons the accounting treatment of reserves and accumulated profit and loss appearing in the books of the firm at the time of the admission of a new partner.

Answer:

(i) When partners decide to distribute the balances of reserves and accumulated profits and losses at the time of admission of a new partner : These balances must be distributed among old partners in their old profit-loss ratio even if no instruction is given in ‘ the question regarding reserves and accumulated profit and loss consequently, these balances will not be shown in the balance sheet of the new firm.

(ii) If partners decide not to make any change in the balance of reserves, accumulated profit and loss and fictitious assets and show the balances in the new balance sheet at their old values, in this situation if the net amount of such balances is credit, it is debited to the capital accounts of gaining partner including new partner by the amount of gain and credited to sacrificing partners capital accounts by the amount of sacrifice. If net amount of such balances is debit, it is credited to the gaining partner’s capital accounts by the amount of gain and debited to sacrificing partners capital accounts by the amount of their sacrifice.

(9) When revaluation account is debited and credited ?

Answer:

When there is gain/profit at the time of revaluation, Revaluation A/c is credited and when there is loss at the time of revaluation, Revaluation A/c is debited.

(10) State provision for the goodwill as per accounting standard-26.

Answer:

As per AS-26, goodwill should be shown as an asset in the books only when some consideration is paid for goodwill. Internally generated goodwill should not be shown in the books of accounts.

![]()

Question 3.

Answer the following questions :

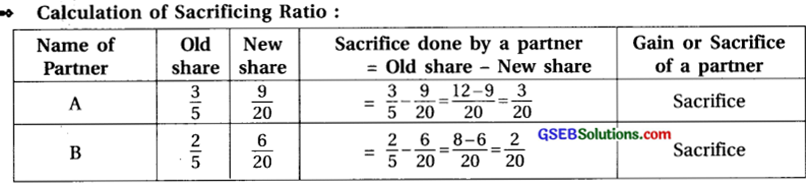

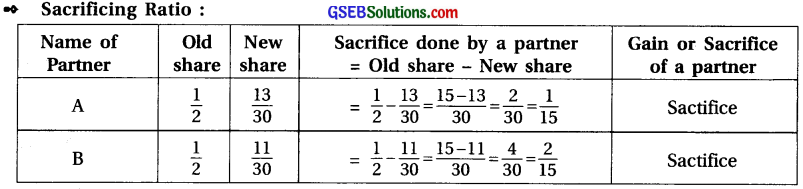

(1) A and B are the partners sharing profit and loss in the ratio of 3 : 2. They admitted C as a new partner for \(\frac {1}{4}\) share in profit.

Answer:

Old sharing ratio of A and B = 3 : 2 ; Let the total share of profit = 1

C’s share = \(\frac {1}{4}\), after giving \(\frac {1}{4}\) to C,

Remaining share of A and B= Total profit – Share of new partner

= 1 – \(\frac {1}{4}\) = \(\frac{4-1}{4}\) = \(\frac {3}{4}\)

New share of old partners = Remaining share of profit x Share in old ratio

As new share = \(\frac {3}{4}\) x \(\frac {3}{5}\) = \(\frac {9}{20}\) ;Bs new share = \(\frac {3}{4}\) x \(\frac {2}{5}\) = \(\frac {6}{20}\) ;Cs new share = \(\frac {1}{4}\)

∴ New profit sharing ratio of A, B and C = 9 : 6 : 5 (making denominator equal)

∴ Sacrificing Ratio of partner A and B = \(\frac{3}{20}: \frac{2}{20}\) = 3 : 2

(2) A and B are the partners sharing profit and loss in the ratio of \(\frac {4}{5}\) and \(\frac {2}{10}\) . They admitted C as a new partner for 20% profit of the firm.

Answer:

Profit-loss sharing ratio of partners A and B is \(\frac {4}{5}\) and \(\frac {2}{10}\). = \(\frac {4}{5}\) : \(\frac {2}{10}\) = \(\frac {4}{5}\) : \(\frac {1}{5}\)

They admitted C with 20% profit part in the firm mean \(\frac {20}{100}\) = \(\frac {5}{5}\) th share.

Calculation of new profit and loss ratio :

Old sharing ratio of A and B = 4 : 1, Let the total share of profit = 1

C’s share = \(\frac {1}{5}\), after giving \(\frac {1}{5}\) th share to C.

Remaining share of A and B= Total profit – Share of new partner

= 1 – \(\frac {1}{5}\) = \(\frac {4}{5}\)

New share of old partners = Remaining share of profit x share in old ratio

A’s new share = \(\frac {4}{5}\) x \(\frac {4}{5}\) = \(\frac {16}{25}\) ; B’s new share = \(\frac {4}{5}\) x \(\frac {1}{5}\) = \(\frac {4}{25}\) ; C’s new share = \(\frac {1}{5}\)

∴ New profit sharing ratio of A, B and C = 16 : 4 : 5 (making denominator equal)

∴ Sacrificing ratio of partner A and B = \(\frac{4}{25}: \frac{1}{25}\) = 4 : 1

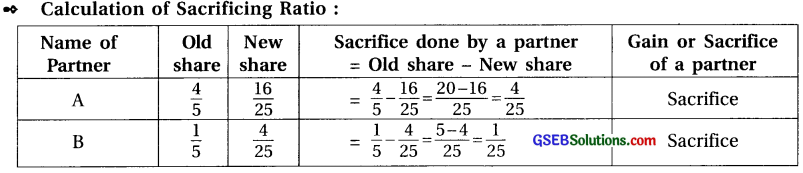

(3) A and B are the partners in a firm. They admitted C for \(\frac{1}{6}\) th share as a new partner. After the admission of C, the new profit and loss sharing ratio of A and B will be 2 : 3.

Answer:

Old profit-loss ratio of partners A and B = 1 : 1

Share in profit of new partner C = \(\frac{1}{6}\)

Remaining share of profit = Total profit – Share of new partner

= 1 – \(\frac{1}{6}\) = \(\frac{5}{6}\)

New share of partner = Rem. Part of profit x share of new partner after admission

A’ s new share = \(\frac{5}{6} \times \frac{2}{5}=\frac{10}{30}\) ; B s new share = \(\frac{5}{6} \times \frac{3}{5}=\frac{15}{30}\) ; C s new share = \(\frac{1}{6} \times \frac{5}{5}=\frac{5}{30}\)

∴ New profit-loss sharing ratio of A, B and C = 10 : 15 : 5 = 2 : 3 : 1

Sacrifice of partner A = \(\frac{1}{6}\)

![]()

(4) A and B are partners in a firm sharing profit and loss in the ratio of 2 : 1. They admitted C as a new partner for \(\frac{1}{5}\) th share in the profit. C will acquire \(\frac{1}{10}\) th share from A and \(\frac{1}{10}\) th share from B.

Answer:

Old profit-loss sharing ratio of A and B = 2 : 1 = \(\frac{2}{3}\) : \(\frac{1}{3}\)

C’s share = \(\frac{1}{5}\) which C receives \(\frac{1}{10}\) part form A and \(\frac{1}{10}\) part from B.

∴ A’s sacrifice = \(\frac{1}{10}\) [from his own share] ; B’s sacrifice = \(\frac{1}{10}\) [from his own share]

Now. Sacrifice = Old share – New share

∴ New share = Old share – Sacrifice

A’s new share = \(\frac{2}{3}\) – \(\frac{1}{10}\) = \(\frac{20-3}{30}\) = \(\frac{17}{30}\) : B’s new share = \(\frac{1}{3}\) – \(\frac{1}{10}\) = \(\frac{10-3}{30}\) = \(\frac{7}{30}\)

C’s share of profit = \(\frac{1}{5}\)

∴ New profit and loss sharing ratio of A, B and C = 17 : 7 : 6 (making denominator equal)

Sacrificing ratio of partners A and B = \(\frac{1}{10}\) : \(\frac{1}{10}\) = 1 : 1.

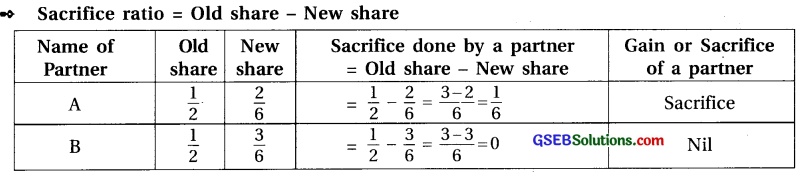

(5) A, B and C are the partners sharing profit and loss in the ratio of 5 : 3 : 2. They admitted D as a new partner. ‘A’ sacrifices \(\frac{1}{20}\) th from his share and ‘B’ sacrifices \(\frac{3}{40}\) th from his share in favour of D.

Answer:

Sacrificing Ratio : A sacrifice = \(\frac{1}{20}\) from his share and B sacrifice = \(\frac{3}{40}\) from his share in favour of D.

∴ Sacrifice of A = \(\frac{1}{20}\) and B = \(\frac{3}{40}\) (making denominator equal)

∴ Sacrifice ratio = \(\frac{2}{40}: \frac{3}{40}\) = 2 : 3

∴ Share of D = Sacrifice of A + Sacrifice of B= \(\frac{2}{40}+\frac{3}{40}=\frac{5}{40}\)

New Profit and Loss sharing ratio :

New share = Old share – Sacrifice

∴ New share of A = \(\frac{5}{10}-\frac{2}{40}=\frac{20-2}{40}=\frac{18}{40}\)

∴ New share of B = \(\frac{3}{10}-\frac{3}{40}=\frac{12-3}{40}=\frac{9}{40}\)

∴ New share of C = \(\frac{2}{10}\) (making denominator equal)

= \(\frac{2}{10} \times \frac{4}{4}=\frac{8}{40}\)

∴ New share of D = \(\frac{5}{40}\)

∴ New Profit and Loss sharing ratio A, B, C and D = 18 : 9 : 8 : 5

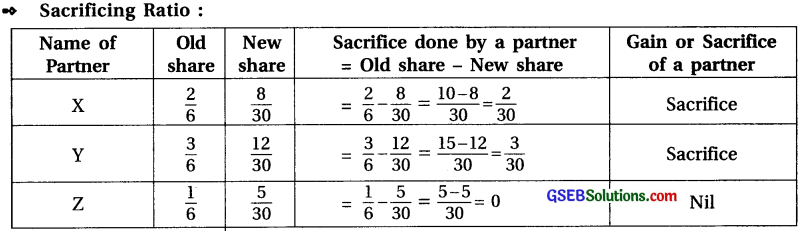

(6) A and B share the partners sharing profits in the ratio of 3 : 2. They admitted C as a new partner for \(\frac{1}{10}\) th share of profit which he will acquire from A and B in equal proportion.

Answer:

Partner C receives his share from partner A and B in equal ratio i.e. 1 : 1.

Now, sacrifice of old partners = New partners share × sacrificing ratio of old partner

A’s sacrifice = \(\frac{1}{10} \times \frac{1}{2}=\frac{1}{20}\) ; B’s sacrifice = \(\frac{1}{10} \times \frac{1}{2}=\frac{1}{20}\)

New share = Old share – Sacrifice

A’s new share = \(\frac{3}{5}-\frac{1}{20}=\frac{12-1}{20}=\frac{11}{20}\) : B’s new share = \(\frac{2}{5}-\frac{1}{20}=\frac{8-1}{20}=\frac{7}{20}\) ;

C’s new share = \(\frac{1}{10}\)

New profit and loss sharing ratio of partners A, B and C = 11 : 7 : 2 (making denominator equal) C receives his share from partners A and B in equal ratio.

∴ Sacrifice ratio for A and B = 1 : 1.

(7) A, B and C are the partners sharing profit in the ratio of 20 %, 40 % and 40 % respectively. They admitted D as a new partner for \(\frac {1}{8}\) th share in profit. D is to receive his share from B and C in the ratio of 3 : 2.

Answer:

A, B and C are partners sharing profit in the ratio of 20%, 40% and 40%, means their profit-loss ratio = 2 : 4 : 4 = 1 : 2 : 2.

Share of new partner D = \(\frac {1}{8}\) ; B’s sacrifice = \(\frac {3}{5}\) ; C’s sacrifice = \(\frac {2}{5}\).

Now, sacrifice of old partners = News partner’s share x Sacrificing ratio of old partners

B’s sacrifice = \(\frac{1}{8} \times \frac{3}{5}=\frac{3}{40}\) C’s sacrifice = \(\frac{1}{8} \times \frac{2}{5}=\frac{2}{40}\)

Now, New share = old share – sacrifice

B’s new Share = \(\frac{2}{5}-\frac{3}{40}=\frac{16-3}{40}=\frac{13}{40}\) ; C’s new Share = \(\frac{2}{5}-\frac{2}{40}=\frac{16-2}{40}=\frac{14}{40}\)

There is no change in the A’s share i.e = \(\frac {1}{5}\) ; D’s share = \(\frac {1}{8}\)

∴ New profit and loss ratio of partners A, B, C and D = \(\frac{1}{5}: \frac{13}{40}: \frac{14}{40}: \frac{1}{8}\) = 8 : 13 : 14 : 5

D receives his share from B and C in the ratio of 3 : 2 and not receiving anything from A.

∴ Sacrificing ratio of partners B and C = 3 : 2.

![]()

(8) A and B are the partners in a firm. They admitted C as a new partner for \(\frac{1}{5}\) th share in profit. Out of which C takes \(\frac{1}{15}\) th share from A and remaining share from B.

Answer:

Old ratio of A and B = 1 : 1 = \(\frac{1}{2}: \frac{1}{2}\)

Profit share of new partner C = \(\frac{1}{5}\) in which he receives \(\frac{1}{15}\) from A and remainging from B.

Sacrifice of B = Share of C – Share of A = \(\frac{1}{5}-\frac{1}{15}=\frac{3-1}{15}=\frac{2}{15}\)

New share = Old share – Sacrifice

New share of A = \(\frac{1}{2}-\frac{1}{15}=\frac{15-1}{30}=\frac{13}{30}\)

New share of B = \(\frac{1}{2}-\frac{2}{15}=\frac{15-4}{30}=\frac{11}{30}\)

New share of C = \(\frac{1}{5}\) (making denominator equal)

= \(\frac{1}{5} \times \frac{6}{6}=\frac{6}{30}\)

New Profit – Loss ratio of A, B and C = 13 : 11 : 6

∴ Sacrifice ratio of partners A and B = \(\frac{1}{15}: \frac{2}{15}\) = 1 : 2

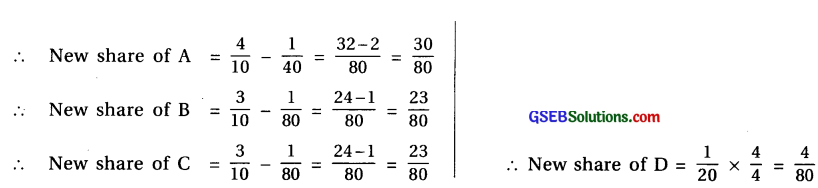

(9) A, B and C are the partners sharing profit and loss in the ratio of 4 : 3 : 3. They admitted D

as a new partner for \(\frac{1}{20}\) th share of profit, out of which he takes \(\frac{1}{40}\) th from A and remaining share from B and C equally.

Answer:

Old profit- loss sharing ratio = 4 : 3 : 3

Total sacrifice by partner B and C = Share of D – Sacrifice of A = \(\frac{1}{20}-\frac{1}{40}\) = \(\frac{2-1}{40}=\frac{1}{40}\)

B’s sacrifice = \(\frac{1}{40} \times \frac{1}{2}=\frac{1}{80}\) C’s sacrifice = \(\frac{1}{40} \times \frac{1}{20}=\frac{1}{80}\)

New Share of Partner = Old Share – Sacrifice

New Profit-Loss ratio of partner A, B, C and D = 30 : 23 : 23 : 4.

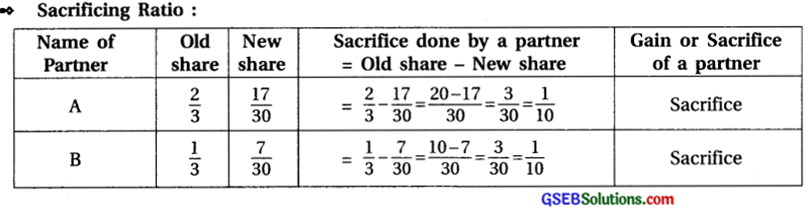

(10) A and B are the partners sharing profit and loss in the ratio of 3 : 1. They admitted C as a new partner. ‘A’ sacrifices \(\frac {1}{3}\)rd of his share and ‘B’ sacrifices \(\frac {1}{4}\)th of his share in favour of C.

Answer:

Old profit-loss ratio of A and B = 3 : 1 = \(\frac{3}{4}: \frac{1}{4}\)

Sacrifice of A = \(\frac{1}{3}\) ; Sacrifice of B = \(\frac{1}{4}\)

Sacrifice by A = \(\frac{3}{4} \times \frac{1}{3}=\frac{1}{4}\) ;

Sacrifice by B = \(\frac{1}{4} \times \frac{1}{4}=\frac{1}{16}\)

New share = Old share – Sacifice

A’s New Share = \(\frac{3}{4}-\frac{1}{4}=\frac{3-1}{4}=\frac{2}{4}\) ; B’s New Share = \(\frac{1}{4}-\frac{1}{16}=\frac{4-1}{16}=\frac{3}{16}\)

C’s New Share = Sacrifice by A + Sacrifice by B = \(\frac{1}{4}+\frac{1}{16}=\frac{4+1}{16}=\frac{5}{16}\)

∴ New profit-loss ratio of partners’A,Band C= \(\frac{8}{16}: \frac{3}{16}: \frac{5}{16}\) = 8 : 3 : 5

![]()

(11) A and B are the partners sharing profit and loss in the ratio of 5 : 3. They admitted C as a new partner. A sacrifices 30 % his share and ‘B’ sacrifices 20% of his share in favour of C.

Answer:

Old profit sharing ratio of A and B = 5 : 3 means \(\frac{5}{8}: \frac{3}{8}\)

∴ A’s sacrifice = A’s old share x share of his sacrifice = \(\frac{5}{8} \times \frac{3}{10}=\frac{15}{80}\)

B’s sacrifice = B’s old share x share of his sacrifice = \(\frac{3}{8} \times \frac{2}{10}=\frac{6}{80}\)

News share = Old share – Sacrifice

A’s New Share = \(\frac{5}{8}-\frac{15}{80}=\frac{50-15}{80}=\frac{35}{80}\); B’s New share = \(\frac{3}{8}-\frac{6}{80}=\frac{30-6}{80}=\frac{24}{80}\)

C’s New Share = Sacrifice of A + Sacrifice of B = \(\frac{15}{80}+\frac{6}{80}=\frac{15+6}{80}=\frac{21}{80}\)

∴ News profit-loss sharing ratio of A, B and C = 35 : 24 : 21

Sacrificing ratio : Now, A’s sacrifice = \(\frac{15}{80}\) ; B’s sacrifice = \(\frac{6}{80}\) = 15 : 6 = 5 : 2

(12) X and Y are the partners sharing profit and loss in the ratio of 2 : 1. They admitted Z as a new

partner. ‘X’ sacrifices \(\frac {1}{15}\)th from his share and ‘Y’ sacrifices \(\frac {1}{5}\) th of his share in favour of Z.

Answer:

Old profit and loss sharing ratio of X and Y = 2 : 1

X’s sacrifice = \(\frac {1}{15}\) = ; Y’s sacrifice = \(\frac{1}{3} \times \frac{1}{5}=\frac{1}{15}\)

New share = Old share – Sacrifice

X’s New Share = \(\frac{2}{3}-\frac{1}{15}=\frac{10-1}{15}=\frac{9}{15}\) ; Y’s New Share = \(\frac{1}{3}-\frac{1}{5}=\frac{5-1}{15}=\frac{4}{15}\)

Z’s New Share = X’s sacrifice + Y’s sacrifice = \(\frac{1}{15}+\frac{1}{15}=\frac{2}{15}\)

∴ New profit-loss ratio of X, Y and Z = 9 : 4 : 2

Sacrificing ratio of X and Y :

X’s sacrifice = \(\frac{1}{15}\) ; Y’s sacrifice = \(\frac{1}{15}\)

Sacrificing ratio X and Y = \(\frac{1}{15}\) : \(\frac{1}{15}\) = 1 : 1

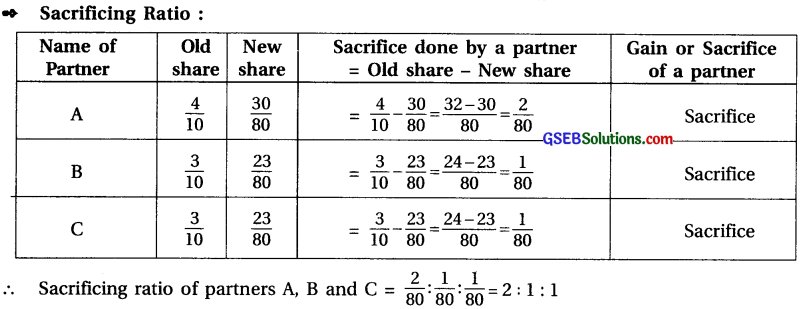

(13) X, Y and Z are the partners sharing profit and loss in the ratio of 2 : 3 : 1. They admitted W as a new partner with \(\frac {1}{6}\) th share. Z will retain his original share in future also.

Answer:

Old ratio of X, Y and Z = 2 : 3 : 1, New partner W’s share = \(\frac{1}{6}\)

After admission of W, share of Z = \(\frac{1}{6}\) will be maintained.

∴ Remaining share of X and Y= Total share – Z’s share – W’s share

= 1 – \(\left[\frac{1}{6}+\frac{1}{6}\right]\) = 1 – \(\frac{2}{6}\) = 1 – \(\frac{1}{3}=\frac{2}{3}\)

X and Y will acquire remaining share \(\) in their relative ratio of 2 : 3.

X’s new share = \(\frac{2}{3} \times \frac{2}{5}=\frac{4}{15}=\frac{8}{30}\); Y’s new share = \(\frac{2}{3} \times \frac{3}{5}=\frac{6}{15}=\frac{12}{30}\)

Z’s new share = \(\frac{1}{6} \times \frac{5}{6}=\frac{5}{30}\) ; W’s new share = \(\frac{1}{6} \times \frac{5}{6}=\frac{5}{30}\)

∴ News profit-loss sharing raio of X : Y: Z : W = 8 : 12 : 5 : 5

∴ Sacrificing ratio of partner X and Y = \(\frac{2}{30}: \frac{3}{30}\)= 2 :3

![]()

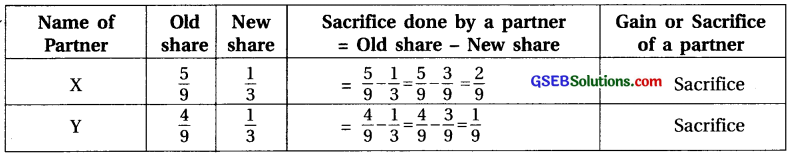

(14) X and Y are the partners sharing profit and loss in the ratio of 5 : 4. They admitted Z as a new partner. All the three partners will distribute future profit in equal proportion. (Calculate only sacrificing ratio)

Answer:

Old ratio of X and Y = 5 : 4 and New ratio of X Y and Z = 1 : 1 : 1 = 1/3 : 1/3 : 1/3

∴ Sacrificing ratio of partner X and Y = \(\frac{2}{9}\) : \(\frac{1}{9}\) = 2 : 1

(15) X, Y and Z are the partners sharing profit and loss in the ratio of 3 : 2 : 1. They admitted W as a new partner. Their new profit-loss sharing ratio is to be 4 : 3 : 2 : 3. (Calculate only sacrificing ratio).

Answer:

Old ratio of X, Y and Z = 3 : 2 : 1 = \(\frac{3}{6}: \frac{2}{6}: \frac{1}{6}\)

New ratio of X, Y and W = 4 : 3 : 2 : 3 = \(\frac{4}{12}: \frac{3}{12}: \frac{2}{12}: \frac{3}{12}\)

∴ Sacrificing ratio of X and Y = \(\frac{2}{12}: \frac{1}{12}\) = 2 : 1

Question 4.

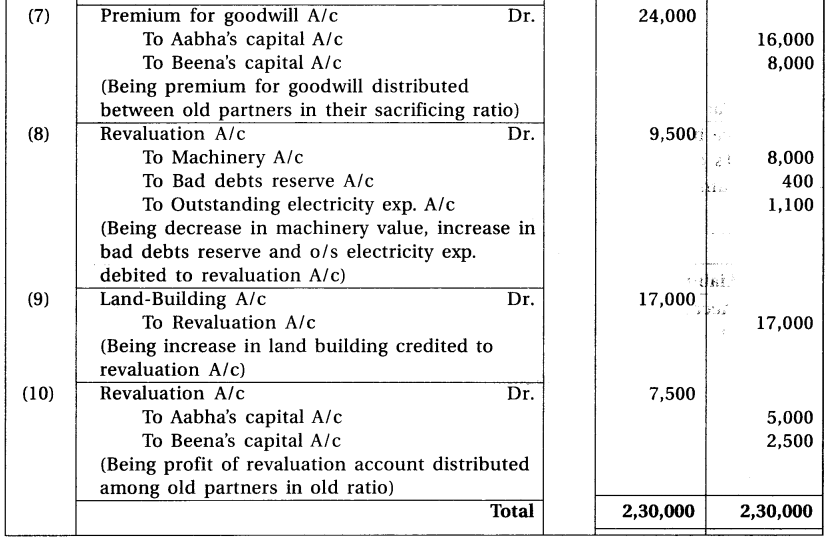

Pass necessary journals for the following transactions :

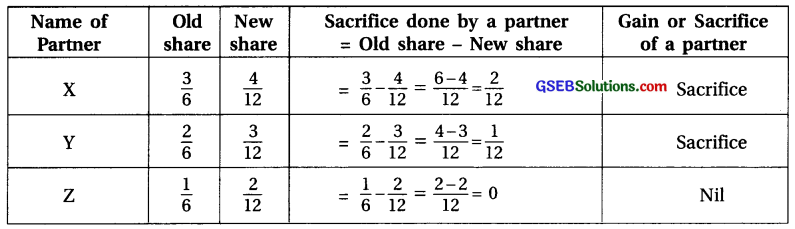

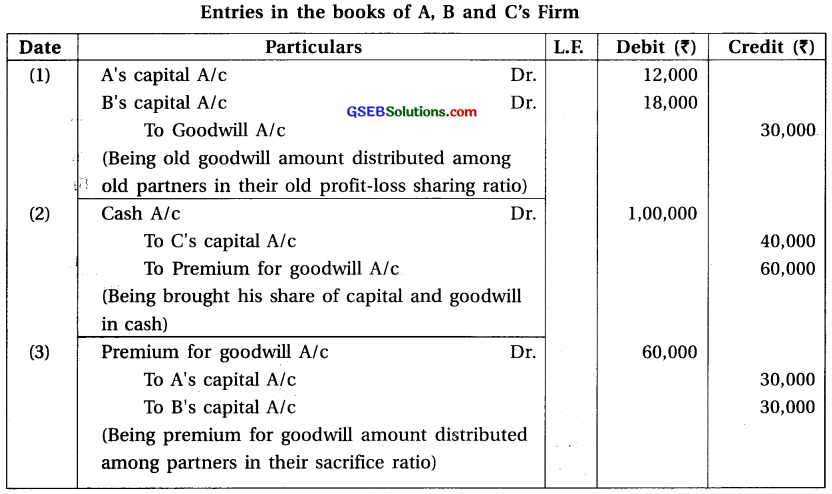

(1) A and B are the partners sharing profit and loss in the ratio of 3 : 2. They admitted C as a new

partner for \(\frac {1}{5}\) th share of profit. C brings ₹ 80,000 as his capital in cash. C gave his share of goodwill

personally to A and B. There was a balance of goodwill ₹ 25,000 in the books of firm before C’s admission.

Answer:

Note : C gives his share in goodwill to A and B privately therefore no entry will be passed in the

books of the firm.

(2) A and B are the partners in a firm. C admitted as a new partner for \(\frac {1}{4}\) th share in profit. C brought

₹ 80,000 as his capital and his proportionate share of goodwill in cash. Goodwill of the firm is valued at ₹ 1,00,000.

Answer:

Note :

(1) Share of goodwill of partner C = ₹ 1,00,000 x \(\frac {1}{4}\) = ₹ 25,000.

(2) If new Profit and Loss sharing ratio is not given then sacrifice ratio = old ratio is considered. So goodwill will be distributed between old partner A and B equally.

![]()

(3) A and B are the partners sharing profit and loss in the ratio of 2 : 3. They admitted C as a new partner. C brought his share in capital and goodwill ₹ 40,000 and ₹ 60,000 in cash respectively. At the time of C’s admission the balance of goodwill in balance sheet of the firm was ₹ 30,000. New profit and loss sharing ratio of all the partners is decided at 3 : 5 : 2.

Note:

Sacrificing Ratio :

Old ratio of A and B = 2 : 3 = \(\frac{2}{5}: \frac{3}{5}\)

New ratio of A, B and C = 3 : 5 : 2 = \(\frac{3}{10}: \frac{5}{10}: \frac{2}{10}\)

Sacrifice of partner = Old share – New share

∴ Sacrifice of A = \(\frac{2}{5}-\frac{3}{10}=\frac{4-3}{10}=\frac{1}{10}\)

∴ Sacrifice of B = \(\frac{5}{5}-\frac{5}{10}=\frac{6-5}{10}=\frac{1}{10}\)

∴ Sacrificing ratio between partner A and B = \(\frac{5}{5}-\frac{5}{10}=\frac{6-5}{10}=\frac{1}{10}\) =1 : 1

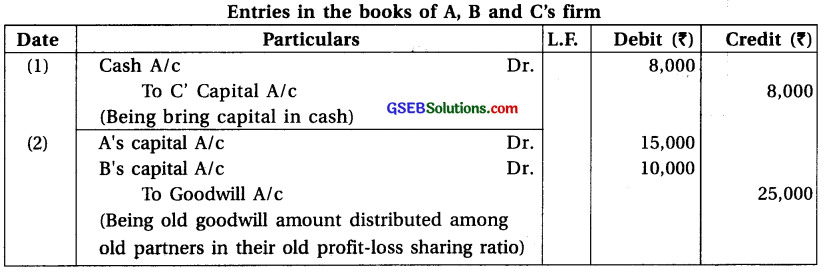

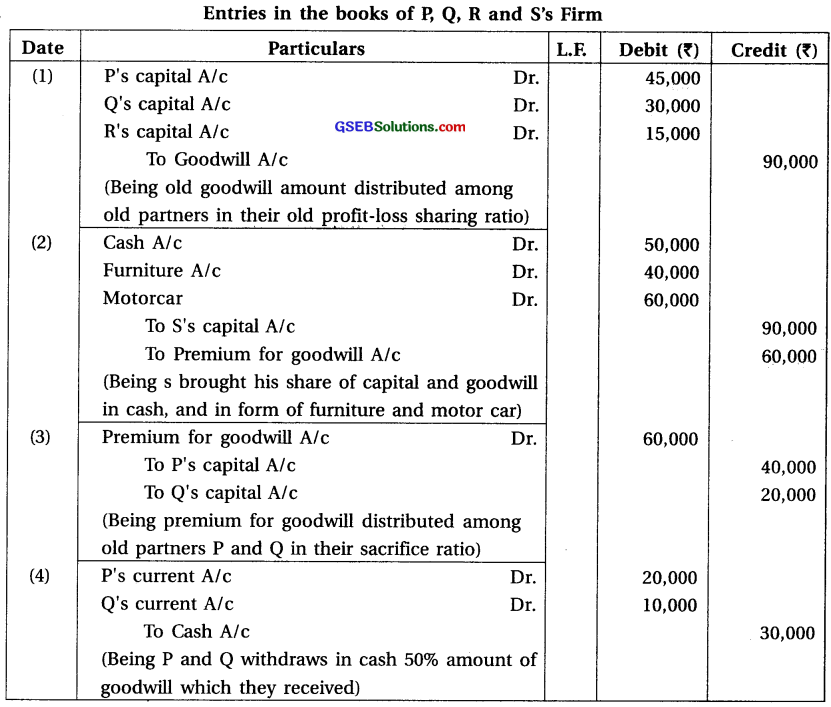

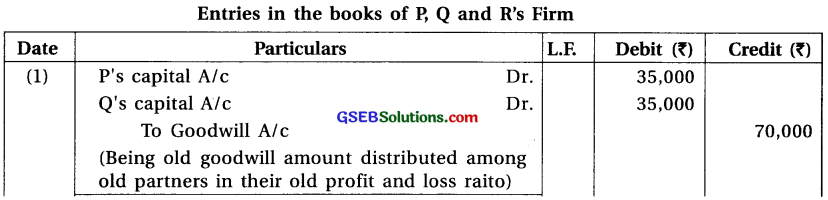

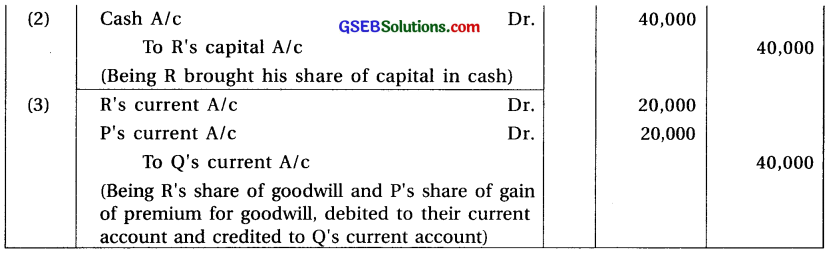

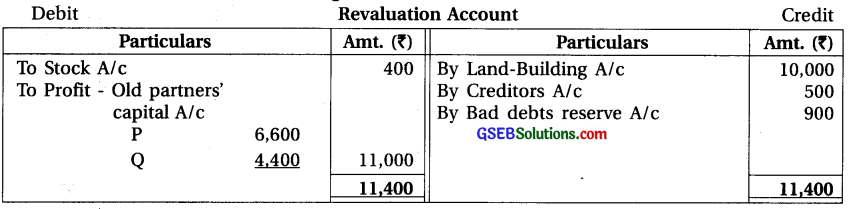

(4) P, Q and R are the partners sharing profit and loss in the ratio of 3 : 2 : 1. They maintain their capital account by fixed capital method. They admitted S as a new partner. S brought cash ₹ 50,000, Furniture ₹ 40,000 and Motor car ₹ 60,000 as his capital and share of goodwill. Goodwill is valued at ₹ 2,40,000. At the time of S’s admission goodwill appeared in the books of the firm at ₹ 90,000. New profit-loss sharing ratio of all the partners is decided at 4 : 3 : 2 : 3. Old partners withdrew 50 % goodwill of their share in cash.

Answer:

Note :

(1) Goodwill of partner S = ₹ 2,40,000 x \(\frac{3}{12}\) = ₹ 60,000.

(2) Capital of S = Cash ₹ 50,000 + Furniture ₹ 40,000 + Motorcar ₹ 60,000 = Total ₹ 1,50,000 – Goodwill of S ₹ 60,000 = ₹ 90,000.

(3) Sacrificing Ratio :

Old ratio of P, Q and R = 3 : 2 : 1 = \(\frac{3}{6}: \frac{2}{6}: \frac{1}{6}\)

New ratio of P, Q, R and S = 4 : 3 : 2 : 3 = \(\frac{4}{12}: \frac{3}{12}: \frac{2}{12}: \frac{3}{12}\)

Sacrifice of partner = Old Share – New Share

Share of P = \(\frac{3}{6}-\frac{4}{12}=\frac{6-4}{12}=\frac{2}{12}\)

Share of Q = \(\frac{2}{6}-\frac{3}{12}=\frac{4-3}{12}=\frac{1}{12}\)

∴ Share of R = \(\frac{1}{6}-\frac{2}{12}=\frac{2-2}{12}\) = 0

∴ Sacrifice ratio of P and Q = \(\frac{2}{12}: \frac{1}{12}\) = 2 : 1

∴ Premium for goodwill will be distributed between partner P and Q in the ratio 2 : 1.

![]()

(5) X and Y are the partners sharing profit and loss in the ratio of 1 : 3. Z admitted as a new partner. Z brought ₹ 65,000 as a capital and ₹ 36,000 as his share of goodwill in cash. After Z’s admission, all partners decided to distribute the profit equally in future.

Answer:

Note :

(1) Sacrificing Ratio :

Old ratio of X and Y = 1 : 3 = \(\frac{1}{4}: \frac{3}{4}\), New ratio of X, Y and Z = 1 : 1 : 1 = \(\frac{1}{3}: \frac{1}{3}: \frac{1}{3}\)

Sarcrifice of partner = Old share – New share

∴ Sacrifice of X = \(\frac{1}{4}-\frac{1}{3}=\frac{3-4}{12}=\frac{-1}{12}\) (gain) Sacrifice of Y =\(\frac{3}{4}-\frac{1}{3}=\frac{9-4}{12}=\frac{5}{4}\)

(2) Goodwill of Z = Firm’s goodwill x Profit share of Z

∴ ₹ 36,000 = Firm’s goodwill x \(\frac{1}{3}\)

∴ Firm’s total goodwill = ₹ 36,000 x \(\frac{1}{3}\) = ₹ 1,08,000

∴ Goodwill bring by X = ₹ 1,08,000 x \(\frac{1}{12}\)(Gain) = ₹ 9,000

(6) M, N and O are the partners sharing profit and loss in the ratio of 4 : 3 : 3, They admitted P as a new partner. P brought ₹ 40,000 as goodwill in cash. New profit sharing ratio of all the partners is decided at 1 : 1 : 2 : 1. Balance of goodwill in old firm was ₹ 50,000.

Answer:

Note:

(1) Sacrificing Ratio :

Old ratio of M, N and O = 4 : 3 : 3 = \(\frac{4}{10}: \frac{3}{10}: \frac{3}{10}\)

New ratio of M, N, O and P = 1 : 1 : 2 : 1 = \(\frac{1}{5}: \frac{1}{5}: \frac{2}{5}: \frac{1}{5}\)

Sacrifice of Partner = Old share – New share

∴ Sacrifice of M = \(\frac{4}{10}-\frac{1}{5}=\frac{4-2}{10}=\frac{2}{10}\)

∴ Sacrifice of N = \(\frac{3}{10}-\frac{1}{5}=\frac{3-2}{10}=\frac{1}{10}\)

∴ Sacrifice of O = \(\frac{3}{10}-\frac{2}{5}=\frac{3-4}{10}=\frac{-1}{10}\) (Gain)

Sacrifice ratio of partner M and N = \(\frac{2}{10}: \frac{1}{10}\) = 2 : 1

(2) Goodwill of P = Goodwill of firm × Share of P

∴ ₹ 40,000 = Goodwill of firm × \(\frac{1}{5}\)

∴ Goodwill of firm = ₹ 40,000 × \(\frac{1}{5}\) = ₹ 2,00,000

∴ Goodwill bring by O = ₹ 2,00,000 × \(\frac{1}{0}\) (Gain) = ₹ 20,000 which is debited to its capital account.

(3) Total amount of Goodwill = ₹ 40,000 + ₹ 20,000 = ₹ 60,000 which is distributed between partner M and N in their sacrificing ratio 2 : 1.

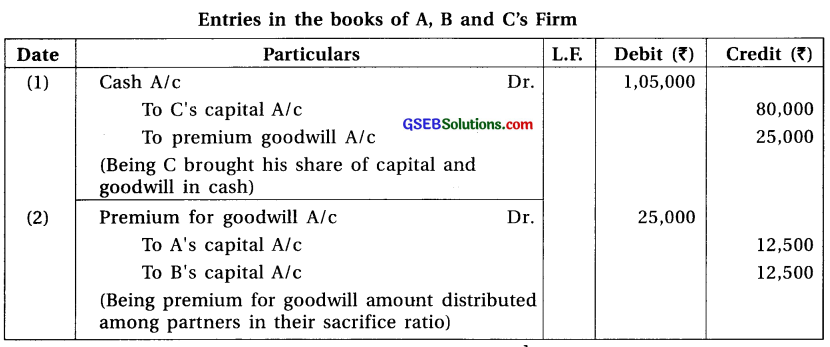

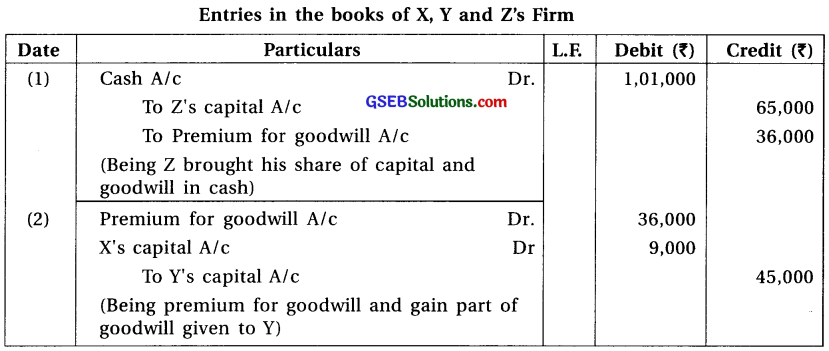

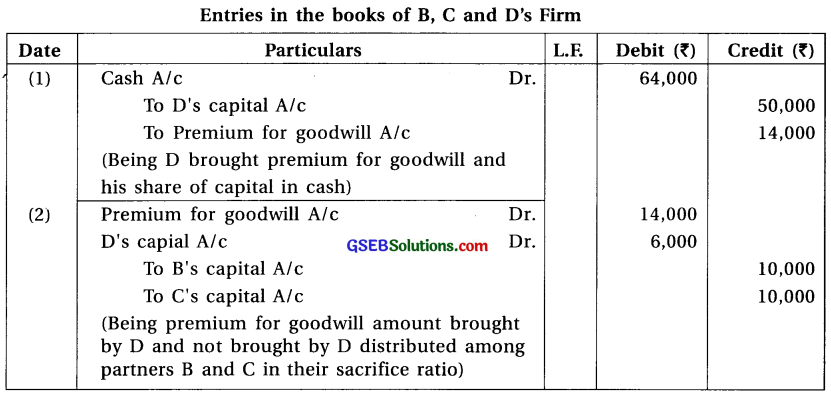

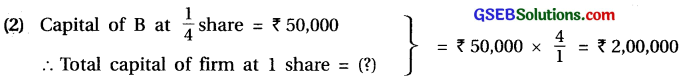

(7) B and C are the partners. D admitted as a new partner in the firm. D brought ₹ 50,000 as a capital and ₹ 14,000 in cash out of his share in goodwill ₹ 20,000.

Answer:

![]()

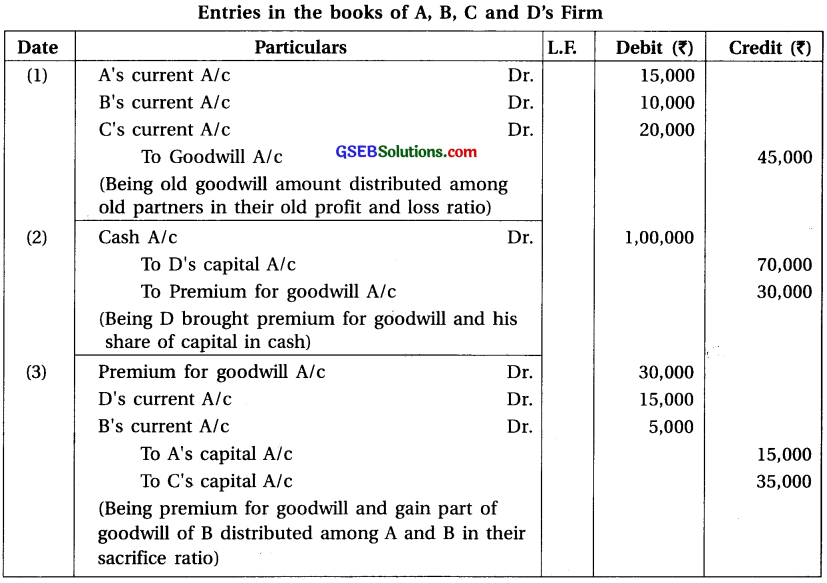

(8) A, B and C are the partners sharing profit and loss in the ratio of 3 : 2 : 4. They maintain their capital accounts by fixed capital method. They admitted D as a new partner. D brought ₹ 70,000 as capital and ₹ 30,000 as share of goodwill in cash. At the time of admission of D, the balance of goodwill was ₹ 45,000 in the balance sheet of the firm. At the time of admission, goodwill is valued of ₹ 1,80,000. New ratio of A, B, C and D decided at 1 : 1 : 1 : 1.

Answer:

Note :

(1) Sacrificing Ratio :

Old ratio of A, B and C = 3 : 2 : 4 = \(\frac{3}{9}: \frac{2}{9}: \frac{4}{9}\).

New ratio of A, B, C and D = 1 : 1 : 1 : 1 = \(\frac{1}{4}: \frac{1}{4}: \frac{1}{4}: \frac{1}{4}\)

Sacrifice of partner = Old share – New share

∴ Sacrifice of A = \(\frac{3}{9}-\frac{1}{4}=\frac{12-9}{36}=\frac{3}{36}\)

∴ Sacrifice of C = \(\frac{4}{9}-\frac{1}{4}=\frac{16-9}{36}=\frac{7}{36}\)

∴ Sacrifice of B =\(\frac{2}{9}-\frac{1}{4}=\frac{8-9}{36}=\frac{-1}{36}\)(Gain)

∴ Sacrifice ratio of partner A and C = \(\frac{3}{36}: \frac{7}{36}\) = 3 : 7 and gain of B = \(\frac{1}{36}\)

(2) Goodwill bring by B = ₹ 1,80,000 × \(\frac{3}{36}\) = ₹ 15,000 which is debited to its current account.

(3) Share of D in goodwill = ₹ 1,80,000 × \(\frac{1}{4}\) = ₹ 45,000

∴ Amount of goodwill bring by D not in cash = ₹ 45,000 – ₹ 30,000 = ₹ 15,000 which is debited to its current account.

(4) Amount of premium for goodwill of D’s share ₹ 45,000 (Cash account ₹ 30,000 + D’s current account ₹ 15,000) and goodwill of B’s gain ₹ 5,000 so total ₹ 50,000 is distributed between partner A and C in the ratio of 3 : 7.

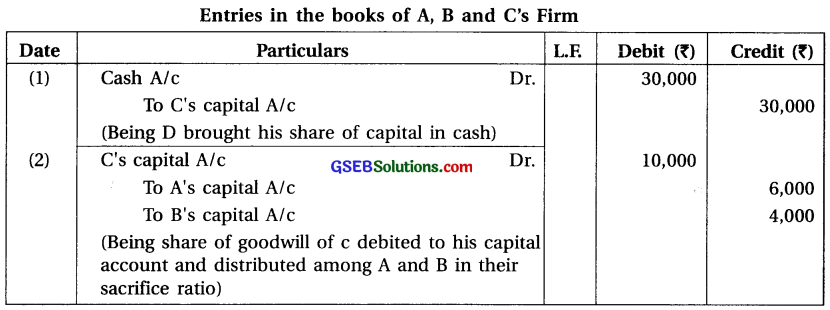

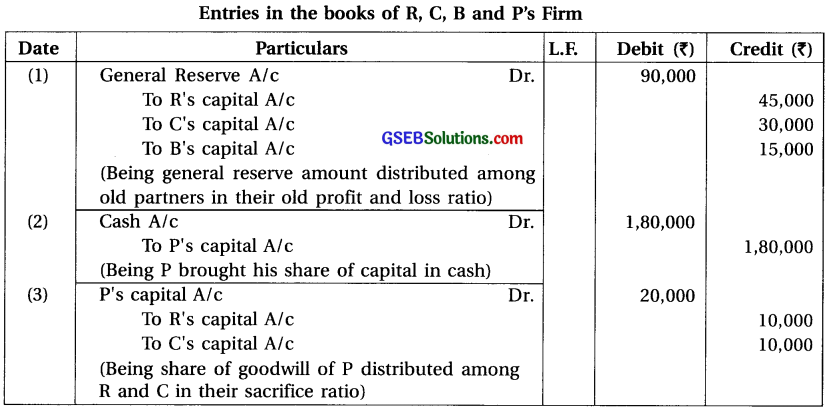

(9) A and B are the partners sharing profit and loss in the ratio of 3 : 2. They admitted C as a new

partner for \(\frac {1}{5}\) th share. C brought ₹ 30,000 as capital in cash, but he could not bring his share of goodwill ₹ 10,000 in cash.

Answer:

(10) P and Q are the partners sharing profit and loss in the equal proportion. They maintain their capital accounts by fixed capital method. They admitted R as a new partner. At the time of R’s admission goodwill ₹ 70,000 was appearing in the balance sheet. R brought ₹ 40,000 as his capital in cash. Goodwill is valued at ₹ 1,60,000. New profit sharing ratio of P, Q and R is decided at 5 : 2 : 1.

Answer:

Note :

(1) Goodwill of partner R = ₹ 1,60,000 x \(\frac{1}{8}\) = ₹ 20,000

(2) Sacrificing Ratio :

Old ratio of P and Q = 1 : 1 = \(\frac{1}{2}: \frac{1}{2}\), New ratio of P, Q and R = 5 : 2 : 1 = \(\frac{5}{8}: \frac{2}{8}: \frac{1}{8}\)

Sacrifice of partner = Old share – New share

∴ Sacrifice of P = \(\frac{1}{2}-\frac{5}{8}=\frac{4-5}{8}=\frac{-1}{8}\) (Gain)

∴ Sacrifice of Q = \(\frac{1}{2}-\frac{2}{8}=\frac{4-2}{8}=\frac{2}{8}\)

(3) Goodwill bring by P = ₹ 1,60,000 × \(\frac{1}{8}\) (Gain) = ₹ 20,000 which is debited to its current account.

(4) Sacrifice done by partner Q, so goodwill amount is credited to its current account only.

![]()

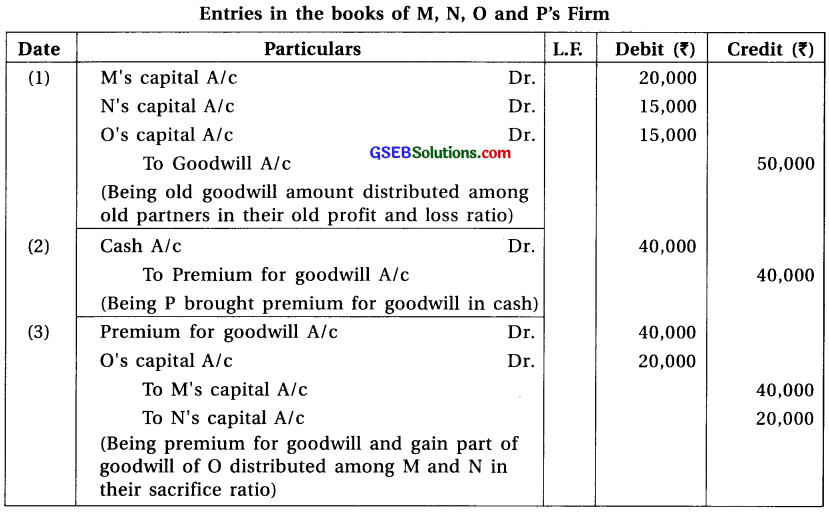

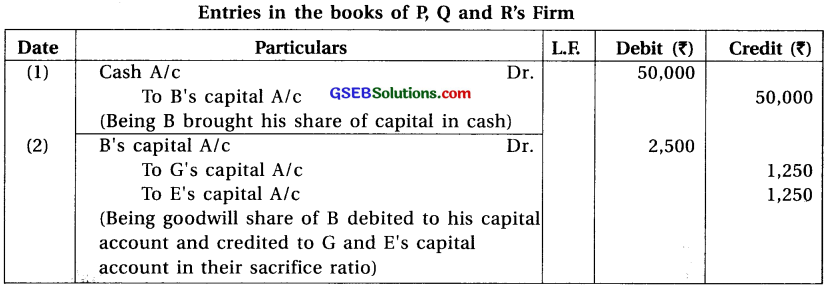

(11) Capital of G and E is ₹ 80,000 and ₹ 60,000 respectively. They admitted B as a new partner for \(\frac {1}{4}\)th share in profit B brought ₹ 50,000 as his capital. Calculate goodwill and pass necessary journal entries for goodwill.

Answer:

Note :

(1) Sacrifice ratio of G and E = Old ratio = 1 : 1.

∴ Goodwill of the firm = (Net worth of firm on the basis of B’s capital)

– (Net worth of New firm excluding goodwill)

= ₹ 2,00,000 – (₹ 80,000 + ₹ 60,000 + ₹ 50,000)

= ₹ 2,00,000 – ₹ 1,90,000

∴ Goodwill of the firm = ₹ 10,000

∴ Goodwill of B = ₹ 10,000 × \(\frac {1}{4}\) = ₹ 2,500

(12) R, C and B are the partners sharing profit and loss in the ratio of 3 : 2 : 1. Their capital as on 1-4-2016 is ₹ 1,00,000, ₹ 60,000 and ₹ 50,000 respectively. On that date the-balance of general reserve was ₹ 90,000. They admitted P as a new partner. P brought ₹ 1,80,000 as his capital. New profit and loss sharing ratio of all the partners is decided to 2 : 1 : 1 : 2. Calculate goodwill and pass necessary journal entries.

Answer:

Note :

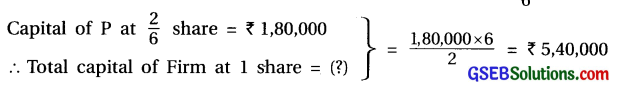

(1) Goodwill of New partner :

New ratio of R, C, B and P = 2 : 1 : 1 : 2; New ratio of P = \(\frac {2}{6}\)

Net worth of New firm excluding goodwill = Capital of old partner + General reserves

+ Capital of New Partner

= ₹ 2,10,000 + ₹ 90,000 + ₹ 1,80,000 = ₹ 4,80,000

∴ Goodwill of the firm = Net worth of the firm on the basis of P’s capital – Net worth of New firm excluding goodwill

= ₹ 5,40,000 – ₹ 4,80,000

∴ Goodwill of the firm = ₹ 60,000

∴ Goodwill of P = ₹ 60,000 x \(\frac {2}{6}\) = ₹ 20,000

(2) Sacrifice Ratio :

Old ratio of R, C and B = 3 : 2 : 1 = \(\frac{3}{6}: \frac{2}{6}: \frac{1}{6}\),

New ratio of R, C, B and P = 2 : 1 : 1 : 2 = \(\frac{2}{6}: \frac{1}{6}: \frac{1}{6}: \frac{2}{6}\)

Sacrifice ratio = Old share – New share

Sacrifice of R = \(\frac{3}{6}-\frac{2}{6}=\frac{3-2}{6}=\frac{1}{6}\)

Sacrifice of C = \(\frac{2}{6}-\frac{1}{6}=\frac{2-1}{6}=\frac{1}{6}\)

Sacrifice of B = \(\frac{1}{6}-\frac{1}{6}=\frac{1-1}{6}\) = 0

Sacrifice ratio of partners R and C = \(\frac{1}{6}: \frac{1}{6}\) = 1 : 1. Amount of goodwill will be credited to capital account of R and C in the ratio of 1 : 1.

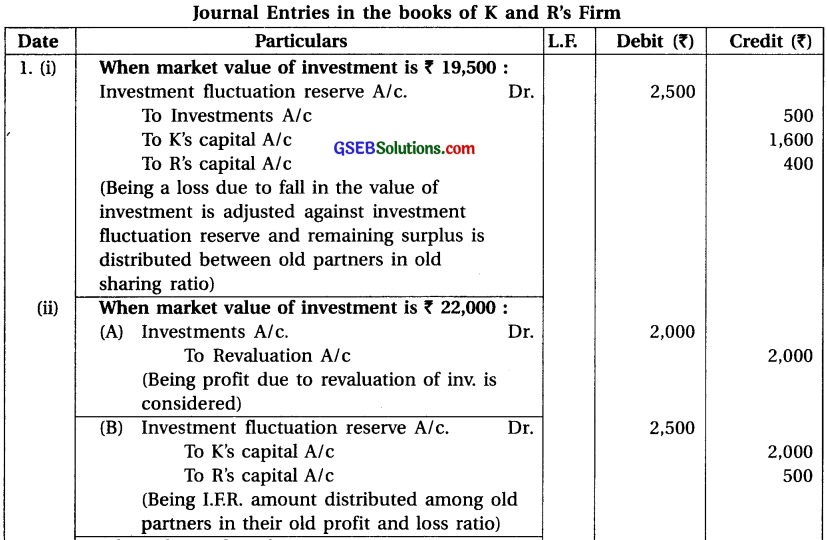

(13) X and Y are the partners sharing profit and loss in the ratio of 2 : 3. They admitted Z as a new

partner for \(\frac {1}{5}\) th share. Goodwill is valued at ₹ 20,000. Balance of goodwill appeared at ₹ 15,000 in the balance sheet. Z brought ₹ 50,000 as his capital and 80 % of his share of goodwill in cash. Old partners withdrew 40 % amount of goodwill in cash which is credited to their capital account After the admission of Z the profit of the first year of the new firm was ₹ 60,000. Pass necessary journal entries.

Answer:

Note :

(1) Old ratio of X and Y = Sacrifice ratio = 2 : 3

(2) New Profit and Loss sharing ratio : Suppose total share of the firm is 1.

Profit remains after share of Z’s profit = 1 – \(\frac{1}{5}=\frac{4}{5}\)

New share = Remaining Profit × Old share

New share of X = \(\frac{4}{5} \times \frac{2}{5}=\frac{8}{25}\)

New share of Y = \(\frac{4}{5} \times \frac{3}{5}=\frac{12}{25}\)

New share of Z = \(\frac{1}{5}\) ; (making denominator equal) = \(\frac{1}{5} \times \frac{5}{5}=\frac{5}{25}\)

:. New Profit – Loss sharing ratio = 8 : 12 : 5

(3) Goodwill of Z = ₹ 20,000 × \(\frac{1}{5}\) = ₹ 4,000 from which 80% amount is ₹ 3,200 bring in cash and remaining ₹ 800 will be debited to its capital account.

![]()

Question 5.

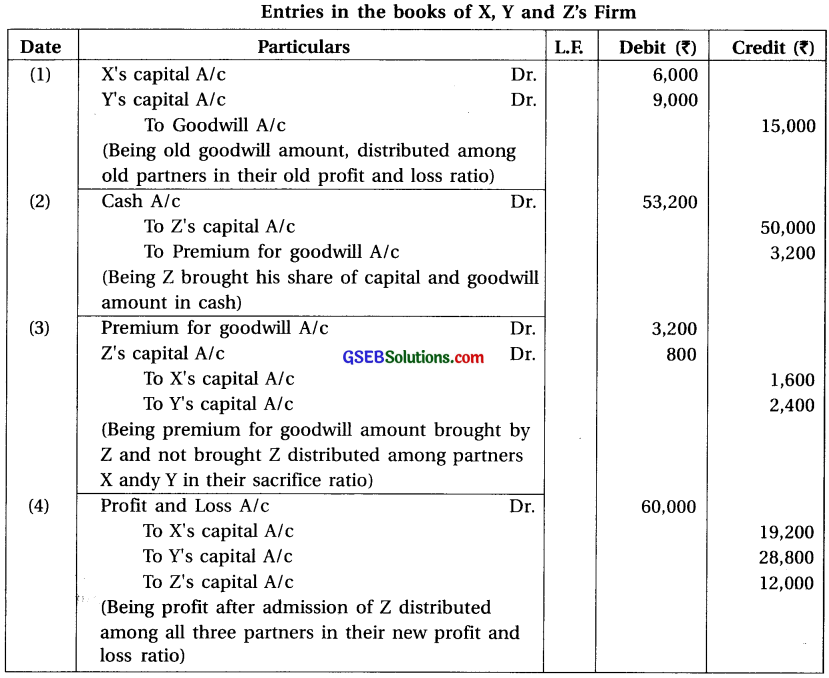

R and J are the partners sharing profit and loss in the ratio of 2 : 3. They admitted B as a new

partner for \(\frac{1}{6}\)th share of profit. Following balances appeared in the books of R and J at the time of the admission of B :

General reserve ₹ 7,000

Workmen compensation reserve ₹ 6,000

Investment fluctuation reserve ₹ 1,900

Profit-loss A/c (Debit balance) ₹ 1,600

Contingency reserve ₹ 5,100

Bad debt reserve ₹ 4,200

Advertisement campaign expenditure ₹ 3,400

Pass necessary journal entries.

Answer:

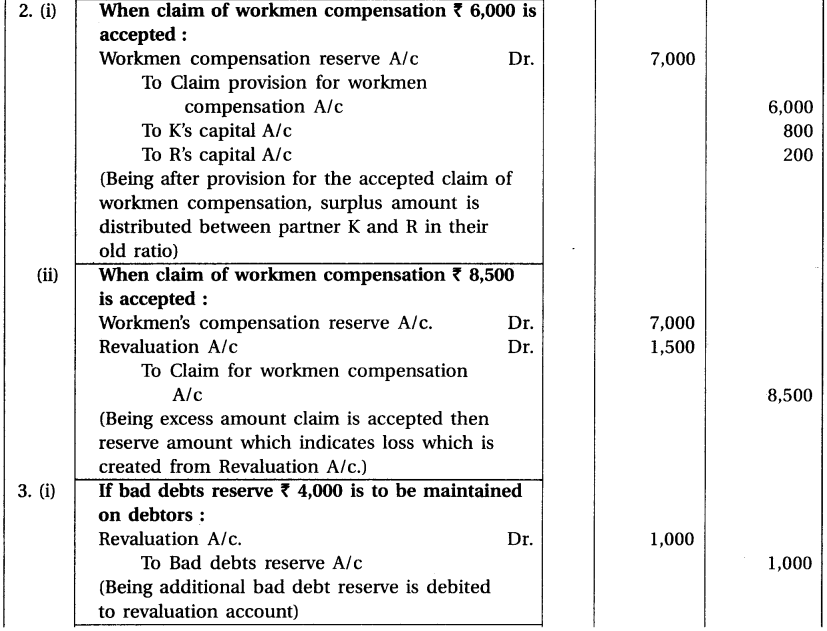

Question 6.

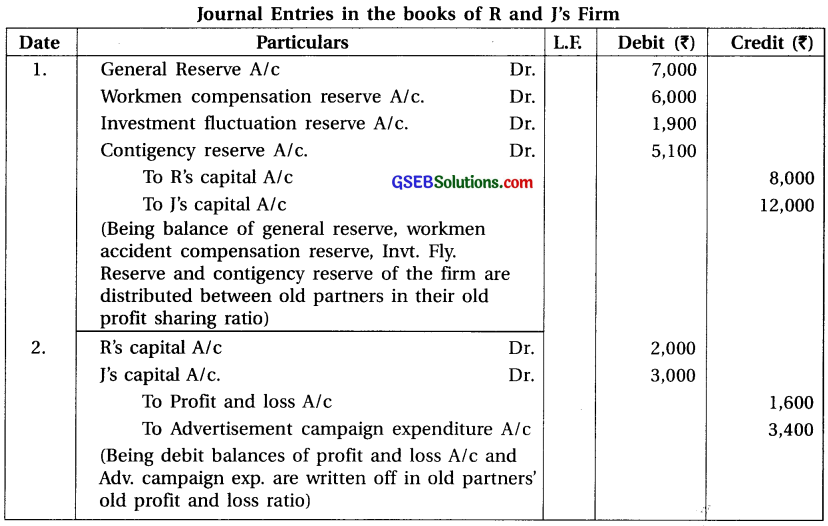

K and R are the partners sharing profit and loss in the ratio of 4 : 1. They admitted P as a new partner for \(\frac{1}{5}\)th share. Following balances were appearing in the books of K arid R at the time of admission of P.

Investment fluctuation reserve ₹ 2,500

Workmen compensation reserve ₹ 7,000

Bad debt reserve ₹ 3,000

Investment ₹ 20,000

Debtors ₹ 70,000

Pass necessary journal entries in the following-cases :

(1) If market value of investment is as under :

(i) ₹ 19,500 (ii) ₹ 22,000

(2) If following claim of workmen compensation is accepted :

(i) ₹ 6,000 (ii) ₹ 8,500

(3) If bad debt reserve is to be maintained on debtors :

(i) ₹ 4,000 (ii) ₹ 2,500

(iii) 10% bad debt reserve is to be maintained after writing off bad debt ₹ 2,000.

Answer:

![]()

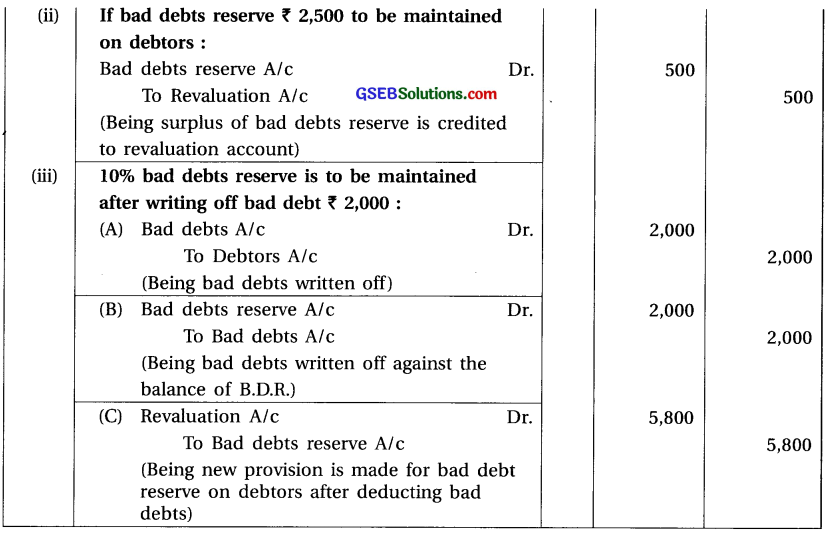

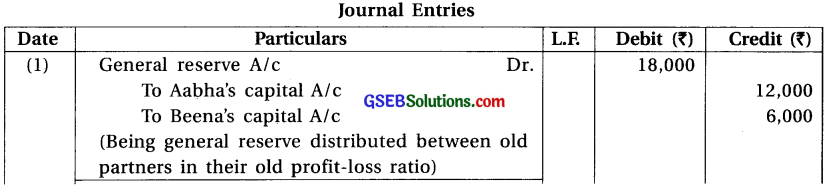

Question 7.

A and B are the partners sharing profit and loss in equal proportion. They admitted C as a new partner for \(\frac {1}{4}\) th share. Following balances were appearing in the balance sheet of A and B at the time of the admission of C.

Patents ₹ 30,000

Land-Building ₹ 1,80,000

Stock ₹ 35,000

Goodwill ₹ 20,000

Machinery ₹ 60,000

Creditors ₹ 40,000

On C’s admission, they decided that, (i) Patents are to be written off fully, (ii) Value of land and building is to be increased by 20%. (iii) Value of machinery is to be decreased upto 60%. (iv) Stock was overvalued by ₹ 4,000 than its cost price, (v) Creditors of ₹ 6,000 are not to be paid.

Pass necessary journal entries and prepare the revaluation account.

Answer:

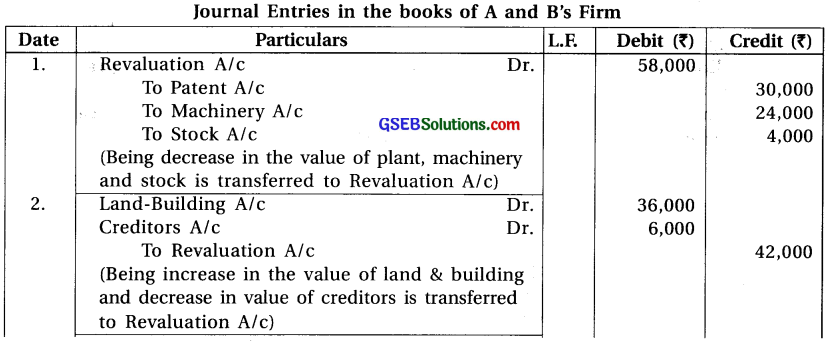

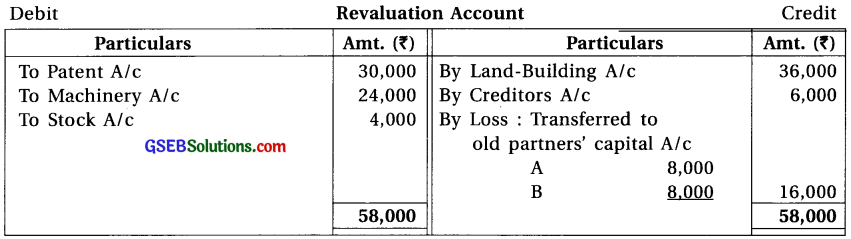

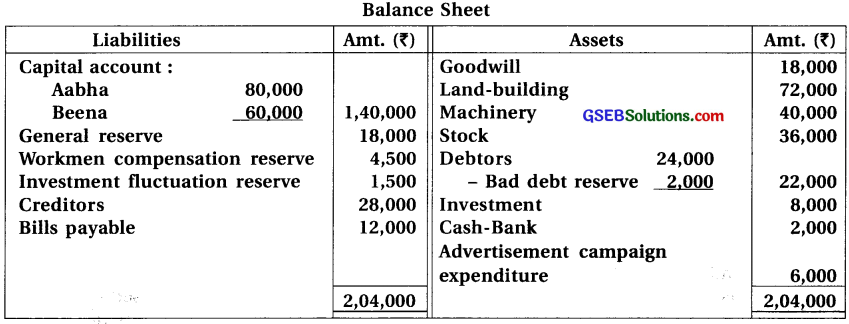

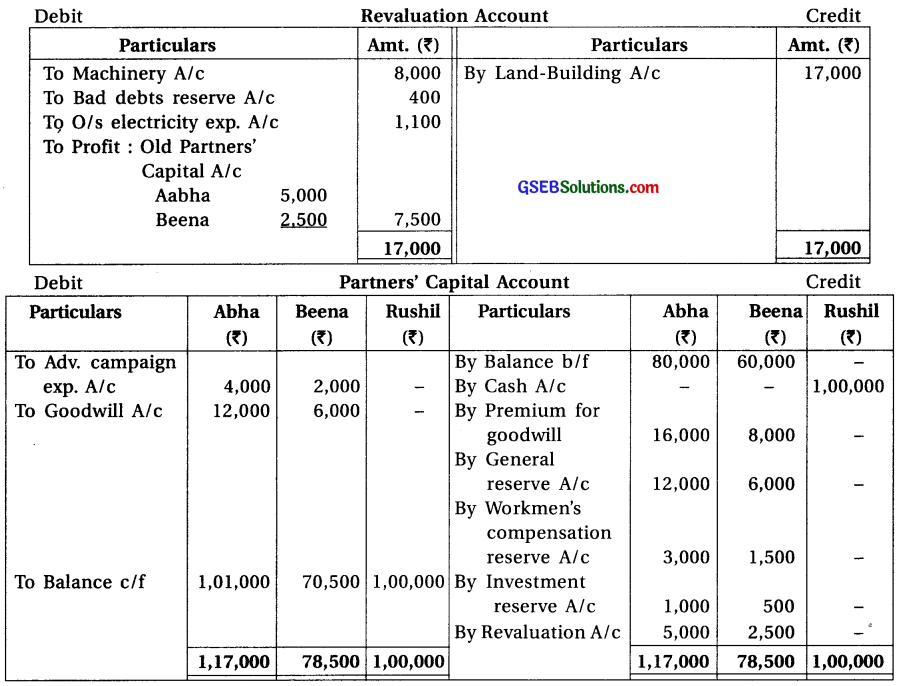

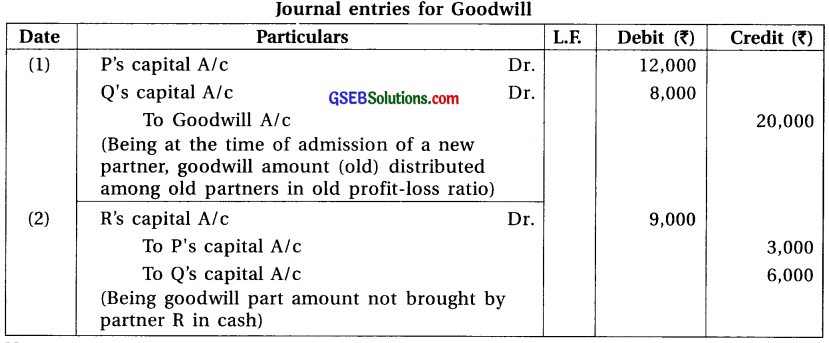

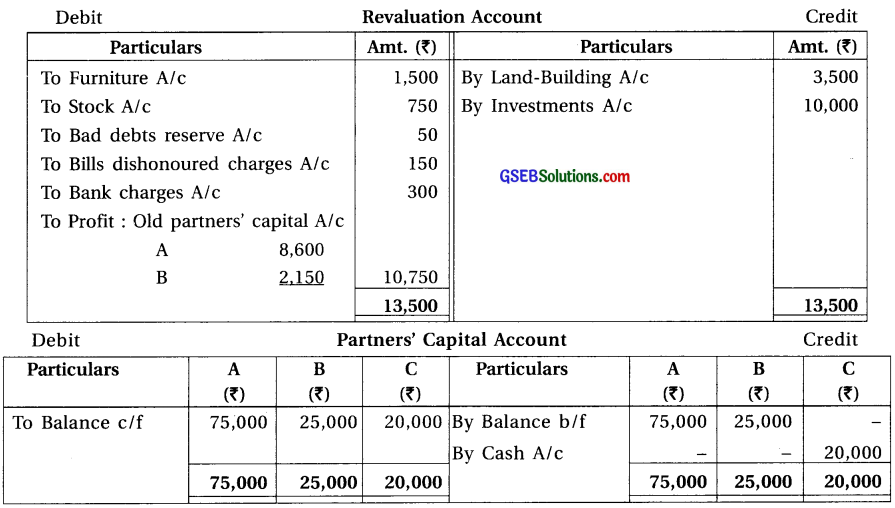

Question 8.

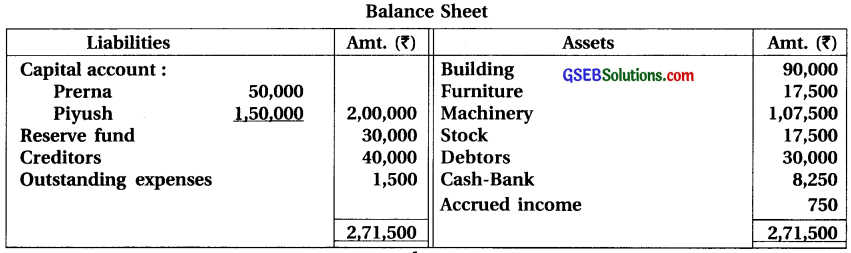

Aabha and Beena are partners in a firm sharing profit and loss in the ratio of 2 : 1. Their

balance sheet as on 31-3-2017 was as under:

They admitted Rushil as a new partner from 1-4-2017 on the following conditions :

(1) Rushil will bring ₹ 1,00,000 as his capital and ₹ 24,000 as goodwill in cash. (2) Value of land and building is to be increased by ₹ 17,000. (3) Value of machinery is to be decreased upto ₹ 32,000. (4) Provision for bad debt is to be kept at 10 % on debtors. (5) Provision for outstanding electricity bill is to be made at ₹ 1,100. (6) New profit sharing ratio of all three partners is to be kept at 2 : 1 : 2.

Pass necessary journal entries and prepare revaluation account, partners’ capital account, cash-bank account and balance sheet after admission.

Answer:

Note:

(1) Sacrificing Ratio :

Old ratio of Aabha and Beena = 2 : 1

New ratio of Aabha, Beena and Rushil = 2 : 1 : 2

Sacrifice of partner = Old share – New Share

∴ Sacrifice of Aabha = \(\frac{2}{3}-\frac{2}{5}=\frac{10-6}{15}=\frac{4}{15}\)

∴ Sacrifice of Beena = \(\frac{1}{3}-\frac{1}{5}=\frac{5-3}{15}=\frac{2}{15}\)

∴ Sacrifice Ratio = \(\frac{4}{15}: \frac{2}{15}\) = 4 : 2 = 2 : 1

(2) Goodwill will be distributed between Aabha and Beena in sacrificing ratio.

distributed between Aabha and Beena in sacrificing ratio.

Goodwill of Aabha = ₹ 24,000 × \(\frac{2}{3}\) = ₹ 16,000

Goodwill of Beena = ₹ 24,000 × \(\frac{1}{3}\) = ₹ 8,000

![]()

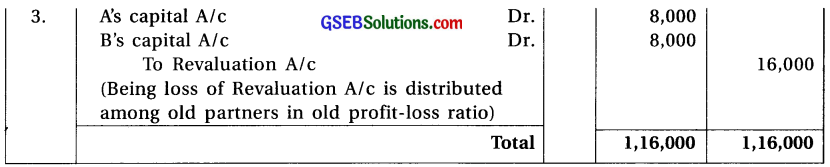

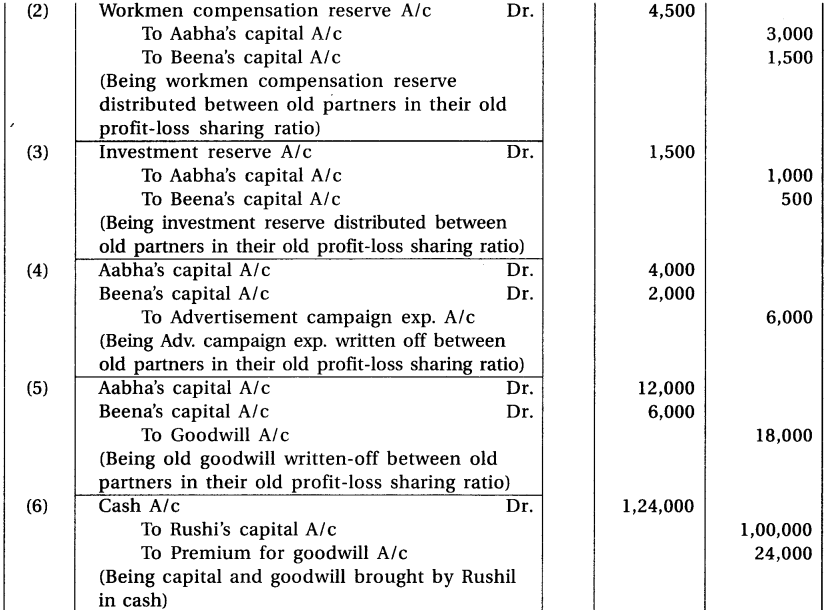

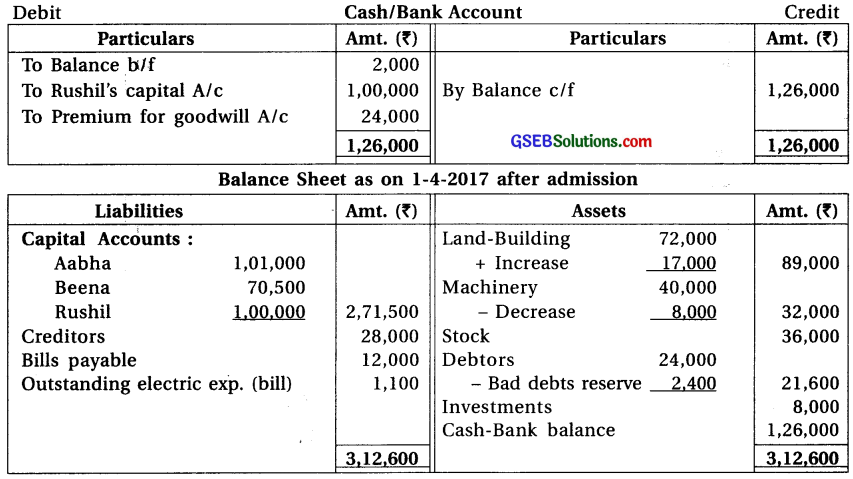

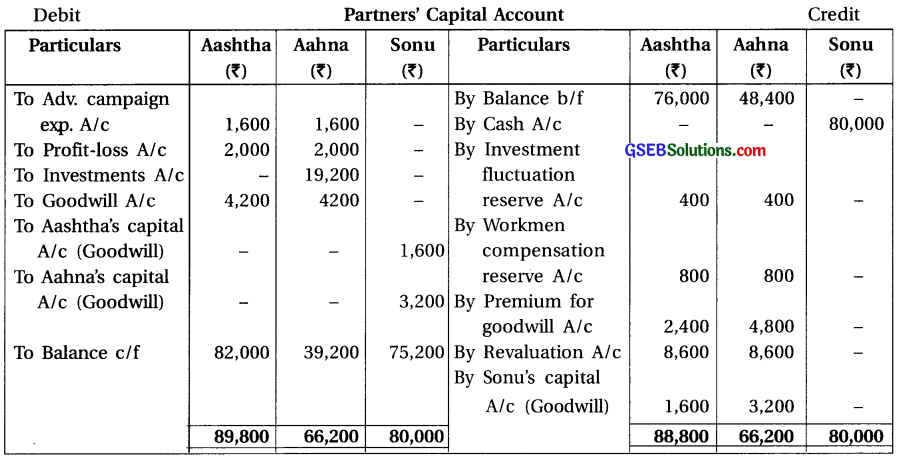

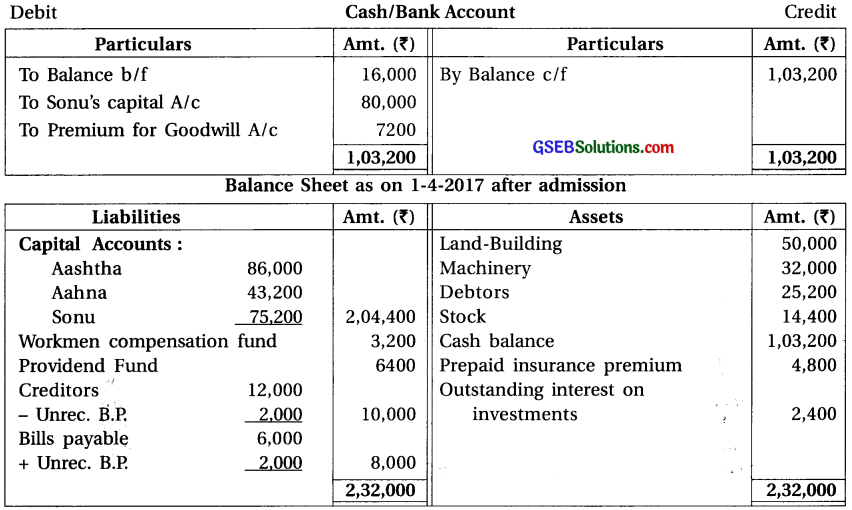

Question 9.

Aashtha and Aahna are partners in a firm. The balance sheet of the firm as on 31-3-2017 was as under:

The admitted Sonu as a new partner as on 1-4-2017 on the following condition :

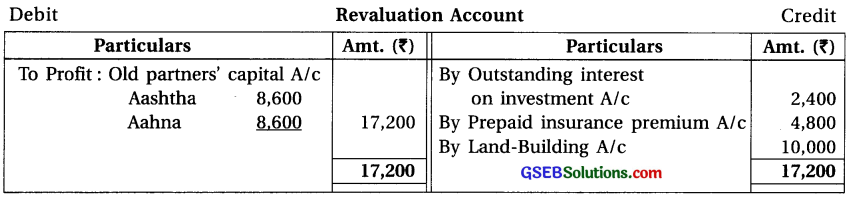

(1) Sonu will bring ₹ 80,000 as her capital and ₹ 7200 as her share of goodwill in cash. (2) New profit and loss sharing ratio will be 4 : 3 : 3. (3) Goodwill is to be valued at ₹ 40,000. (4) The claim of workmen compensaiton is accepted at ₹ 3,200. (5) Aahna will take over investments at ₹ 19,200. (6) Accrued interest on investment ₹ 2,400 is not recorded. (7) Accepted bills payable of ₹ 2,000 which was drawn by creditors is not recorded.. (8) Book value of land-building is 20 % less then its market value. (9) Out of insurance premium paid, ₹ 4,800 is for next year. Prepare necessary accounts and balance sheet after admission.

Answer:

Note :

(1) Sacrificing Ratio :

Old profit-loss ratio of Aashtha and Aahna = 1 : 1

New profit-loss ratio of Aashtha, Aahna and Sona = 4 : 3 : 3

Sacrifice of partner = Old share – New Share

Aashtha’s Sacrifice = \(\frac{1}{2}-\frac{4}{10}=\frac{10-8}{20}=\frac{2}{20}=\frac{1}{10}\) ; Aashtha’s Sacrifice = \(\frac{1}{2}-\frac{3}{10}=\frac{10-6}{20}=\frac{4}{20}=\frac{2}{10}\)

∴ Sacrifice ratio = \(\frac{1}{10}: \frac{2}{10}\) = 1 : 2

∴ Amount of goodwill will be distributed between Aashtha and Aashna in their sacrifice ratio = 1 : 2.

(2) Sonu’s share in goodwill :

Sonu’s share in new goodwill = 40,000 × \(\frac{3}{10}\) = ₹ 12,000.

Out of this ₹ 12,000, Sonu brought only ₹ 7,200 means ₹ 4,800 is still outstanding.

∴ Journal entry for goodwill will be as under :

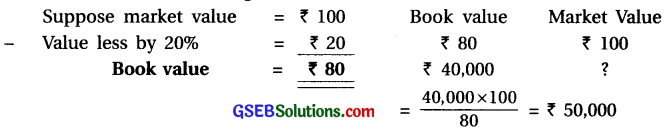

(3) Market value of Land-Building :

Book value of Land-Building is ₹ 40,000 which is 20% less than its market value.

![]()

Question 10.

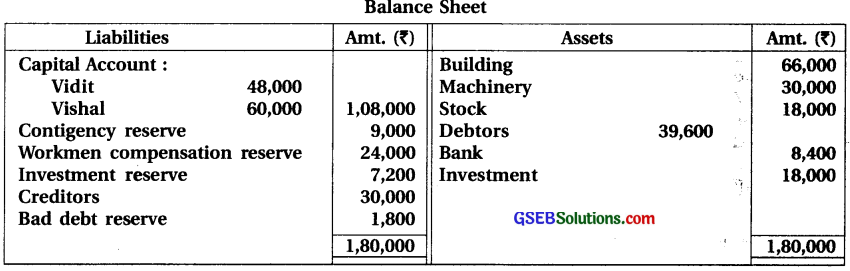

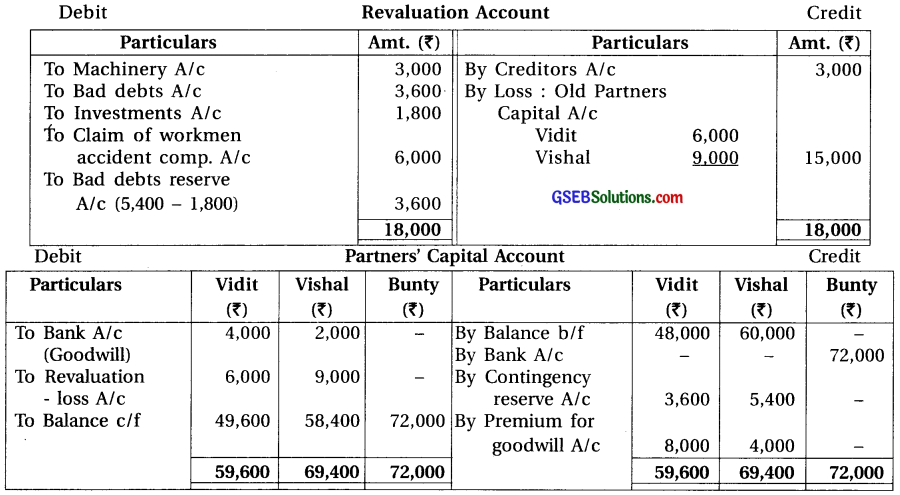

Vidit and Vishal are partners sharing profit and loss in the ratio of 2 : 3, The balance sheet of their firm as on 31-3-2016 was as under :

They admitted Bunty on 1-4-2016 as a new partner on the following terms :

(1) Vidit will sacrifice \(\frac {1}{4}\) th from his share and Vishal will sacrifice ^th from his share in the

favour of Bunty. (2) Bunty will bring ₹ 72,000 as capital and his share of goodwill in cash.

(6) Goodwill of the firm is valued at ₹ 32,000. (4) Vidit and Vishal withdrew 50% of goodwill received by them in cash. (5) Provision for depreciation on machinery is to be made at 10%.

(7) Write off ₹ 3,600 as bad debt from debtors and provision for bad debt is to be maintained at 15%. (7) Market value of investment is ₹ 9,000 which is to be recorded in the books. (8) Claim of workmen compensation is accepted at ₹ 30,000. (9) 10% of creditors are now not to be paid. Prepare necessary account and balance sheet of new firm.

Answer:

Note :

(1) Vidit and Vishal sacrifice \(\frac {1}{4}\) and \(\frac {1}{8}\) respectively (making denominator equal); \(\frac {2}{8}\) and \(\frac {1}{8}\)

∴ Sacrifice Ratio =2 : 1

Share of Bunty = Sacrifice of Vidit + Sacrifice of Vishal = \(\frac{2}{8}+\frac{1}{8}=\frac{3}{8}\)

(2) Goodwill bring by new partner Bunty = ₹ 32,000 × \(\frac {3}{8}\) = ₹ 12,000, which is distributed between Vidit and Vishal in sacrificing ratio 2 : 1.

(3) Claim for workmens’ compensation accepted is ₹ 30,000 against the provision for workmen’s compensation reserve ₹ 24,000 ∴ Additional claim of ₹ 6,000 is debited to the Revaluation A/c.

(4) There is decrease in the value of investments of ₹ 9,000 while investment fluctuation reserve is only ₹ 7,200. ∴ Additional loss ₹ 1,800 is debited to the Revaluation A/c.

![]()

Question 11.

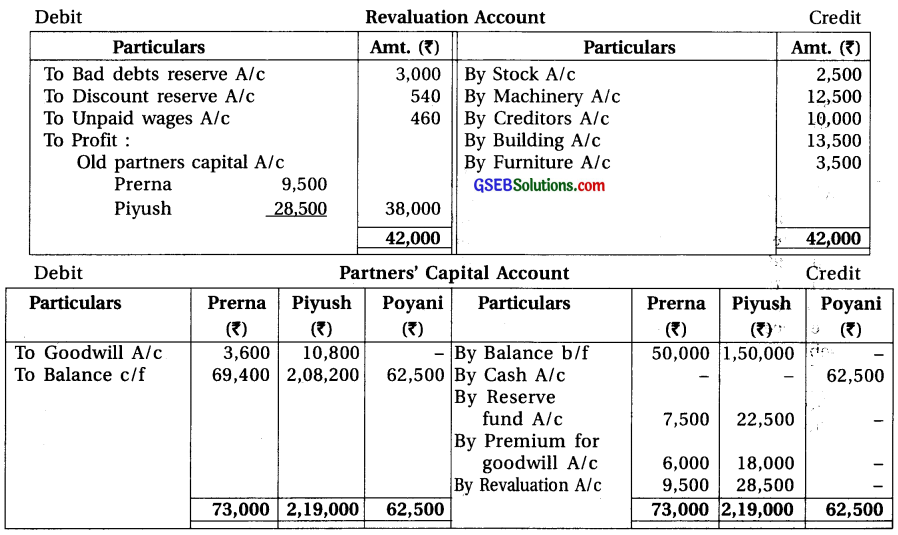

Prerna and Piyush are partners in a firm sharing profit and loss in the ratio of their capital. Balance sheet of their firm was as under :

They admitted Poyani as a new partner for \(\frac {1}{5}\)th share of profit on 31-3-2016 on following terms:

(1) Poyani brought ₹ 62,500 as capital and ₹ 24,000 as her share of goodwill in cash. 60% amount of goodwill is withdrawn by the old partners. (2) Market value of stock and machinery is ₹ 20,000 and ₹ 1,20,000 respectively. (3) Provision for bad debt at 10% and 2% discount reserve on debtors is to be made. (4) Creditors are to be paid ₹ 30,000. (5) Value of building is to be increased by 15% and value of furniture is to be increased by 20%. (6) Outstanding wages of ₹ 460 is not recorded in the books.

From the above information prepare necessary accounts and new balance sheet of the firm.

Answer:

Note :

(1) Prerna and Piyush shared profit and loss in capital ratio. Their capital is ₹ 50,000 and ₹ 1,50,000 respectively.

(2) Premium for goodwill of Poyani will be distributed between Prerna and Piyush in the ratio of 1 : 3.

![]()

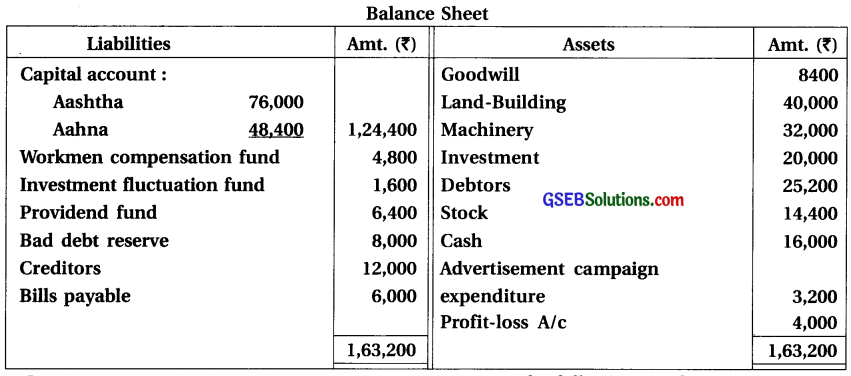

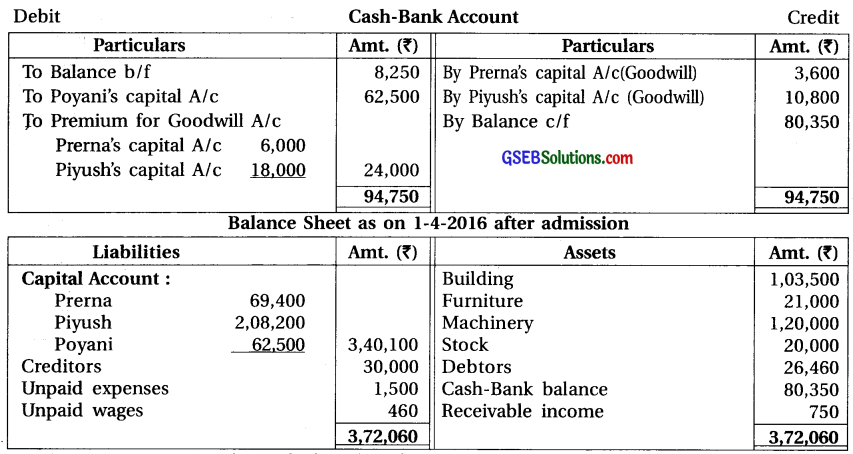

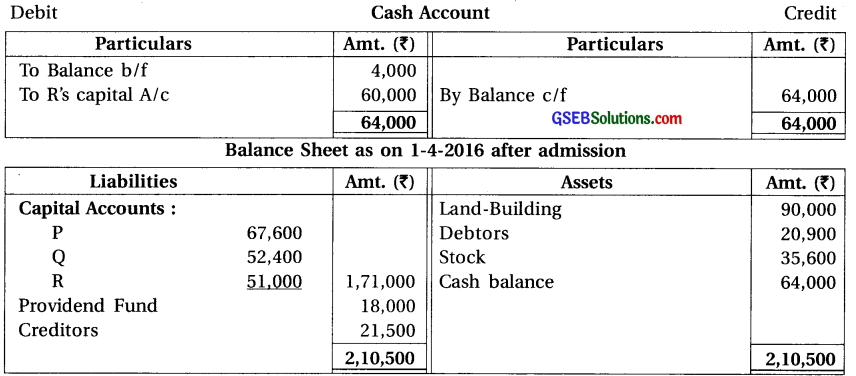

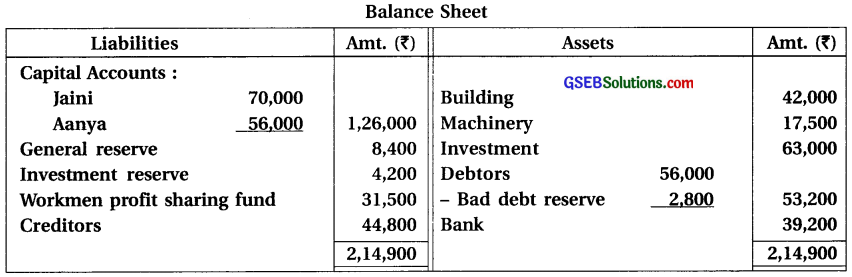

Question 12.

P and Q are partners sharing profit and loss in the ratio of 3 : 2. Balance sheet of their firm as on 31-3-2016 was as under :

On above date they admitted R as a new partner on the following terms :

(1) R will bring ₹ 60,000 as capital in cash. (2) Goodwill is valued at ₹ 30,000. (3) R can not bring his share of goodwill in cash. (4) Value of land and building is ₹ 90,000. (5) Bad debt reserve is to be provided at 5% on debtors. (6) Value of stock is to be reduced by ₹ 400. (7) Creditors of ₹ 500 are not to be paid. (8) New profit and loss sharing ratio of all partners is decided at 5 : 2 : 3.

From the above information prepare necessary accounts and balance sheet after admission. Give necessary journal entries for goodwill.

Answer:

Note :

(1) Sacrificing Ratio : Old ratio of P and Q = 3 : 2, New ratio of P, Q and R = 5 : 2 : 3 Sacrifice of partner = Old share – New share

Sacrifice of P = \(\frac{3}{5}-\frac{5}{10}=\frac{6-5}{10}=\frac{1}{10}\) ; Sacrifice of Q = \(\frac{2}{5}-\frac{2}{10}=\frac{4-2}{10}=\frac{2}{10}\) Sacrifice ratio = \(\frac{1}{10}: \frac{2}{10}\) = 1 : 2

(2) Goodwill of R = ₹ 30,000 x \(\) = ₹ 9,000

![]()

Question 13.

A and B are partners in a firm sharing profit and loss in the ratio of 4 : 1. Balance sheet of their firm on 31-3-2017 was as under :

They admitted C as a new partner on above date on the following conditions. They decided to keep their new profit-loss sharing ratio at 3 : 1 : 1 :

(1) C will bring ₹ 20,000 as capital for his \(\frac {1}{5}\) th share of profit and ₹ 5,000 as his share of

goodwill in cash. Out of goodwill half amount is to be withdrawn by the old partners. (2) Value of land and building is to be increased by 10%. While value of furniture and stock is to be decreased by 5%. (3) Market value of investment is ₹ 35,000. Which is to be shown in the books. (4) Provision for doubtfull debt is to be made at 10% on debtors. (5) Workmen accident compensation claim is accepted ₹ 1,000. (6) Dishonour expense of bills receivable ₹ 150 and bank charges ₹ 300 which are paid but not recorded in the books.

Answer:

Note :

(1) Sacrificing Ratio : Old ratio of A and B = 4 : 1, New ratio of A, B and C = 3 : 1 : 1

Sacrifice of partner = Old share – New share

∴ A’s Sacrifice = \(\frac{4}{5}-\frac{3}{5}=\frac{1}{5}\) ∴ B’s Sacrifice = \(\frac{1}{5}-\frac{1}{5}\) = 0

Only A has sacrifice, so he will received the C’s share of goodwill ₹ 5,000.

(2) From the amount of goodwill ₹ 5,000, half amount ₹ 2,500 will be withdraw by partner A.

![]()

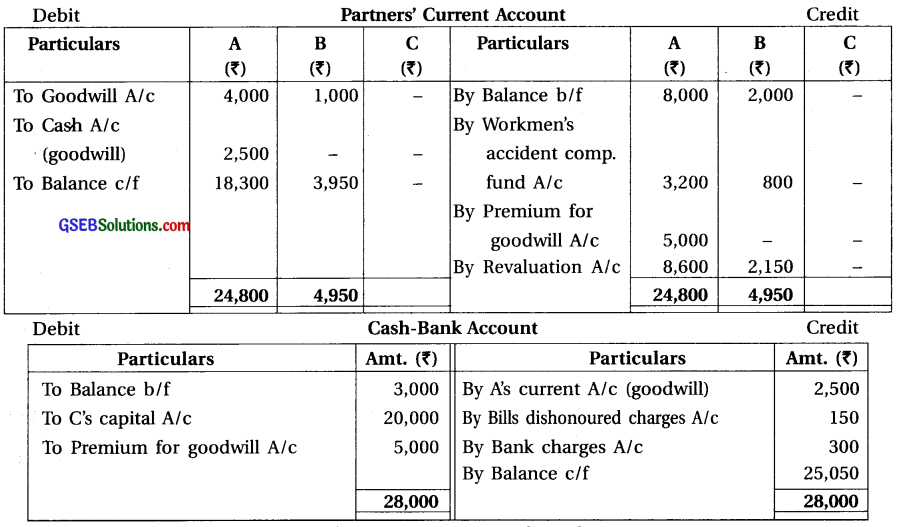

Question 14.

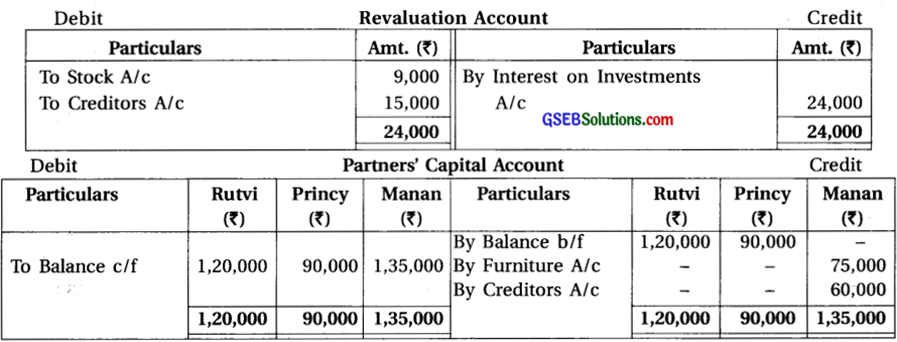

Rutvi and Princy are partners sharing profit and loss in the ratio of 5 : 3. The balance sheet of their firm as on 31-3-2017 was as under :

They admitted Manan as a partner on 3-4-2017 on the following terms :

(1) Manan will bring his personal furniture of ₹ 75,000 as capital. (2) Out of creditors ₹ 60,000 are payable to Manan which is to be transferred to his capital account. (3) Manan will be given \(\frac {1}{5}\) th share in future. (4) Manan will bring ₹ 45,000 as goodwill in cash. (5) Goodwill of firm is valued at ₹ 3,00,000. (6) Credit purchase of ₹ 15,000 which was not recorded in creditors account and purchase account but it is included in closing stock. (7) Market value of stock of ₹ 45,000 is ₹ 36,000. (8) Liability of workmen compensation is ₹ 28,000. (9) Accrued interest on investment ₹ 24,000 is not recorded.

Prepare new balance sheet after admission.

Answer:

Note :

(1) Manan brings furniture of ₹ 75,000 in the firm and paid creditors of ₹ 60,000.

Capital of Manan ₹ 75,000 + ₹ 60,000 = ₹ 1,35,000.

(2) Goodwill of Manan = ₹ 3,00,000 x \(\frac {1}{5}\) = ₹ 60,000. From which he bring ₹ 45,000 in cash so the amount to goodwill which is not in cash ₹ 15,000 is debited to his current account.

(3) Premium for goodwill of Manan ₹ 60,000 is distributed between Rutvi and Princy in their Sacrificing ratio.

(4) Here new profit – loss sharing ratio or sacrifice ratio is not given, so sacrifice ratio = Old ratio (5 : 3).

![]()

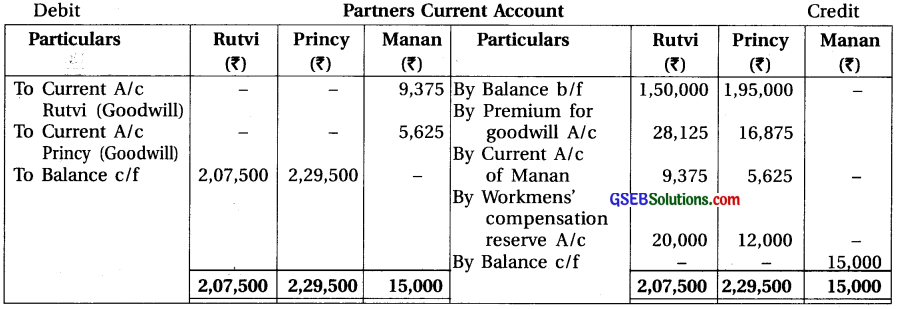

Question 15.

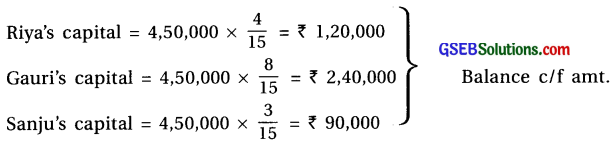

Riya and Gauri are the partners sharing profit and loss in the ratio of 1 : 2. They admitted Sanju as a new partner for \(\frac {1}{5}\)th share on 1-4-2017. Sanju brings ₹ 90,000 as capital in cash. After the adjustment of reserves, profit of revaluation and goodwill the capital of Riya and Gauri was ₹ 1.50.0 and ₹ 2,00,000 respectively. Partners decided to maintain new firms’ total capital at ₹ 4.50.0 in their new profit and loss ratio. Necessary amount is to be brought or withdrawn in cash. Prepare partners’ capital account.

Answer:

Note :

(1) New profit-loss sharing ratio : Old profit-loss ratio of Riya and Gauri = 1 : 2 = \(\frac{1}{3}: \frac{2}{3}\)

Let the total share of profit = 1 and Sanju’s share = \(\frac{1}{5}\)

Remaining share of Riya and Gauri = 1 – \(\frac{1}{5}=\frac{4}{5}\)

New share of old partners = Remaining share of profit x Share in old ratio

Riya’s new share = \(\frac{4}{5} \times \frac{1}{3}=\frac{4}{15}\) ; Gauri’s new share = \(\frac{4}{5} \times \frac{2}{3}=\frac{8}{15}\) ; Sanju’s new share = \(\frac{1}{5}\)

∴ New profit-loss ratio = \(\frac{4}{15}: \frac{8}{15}: \frac{1}{5}\) = 4 : 8 : 3 (making denominator equal)

(2) Capital of each partner in New Firm: Total capital of new firm = 4,50,000

To be distributed among partners in new profit-loss ratio –

∴ Riya should withdraw ₹ 30,000 cash from business firm.

∴ Gauri should bring ₹ 40,000 cash into the business firm.

![]()

Question 16.

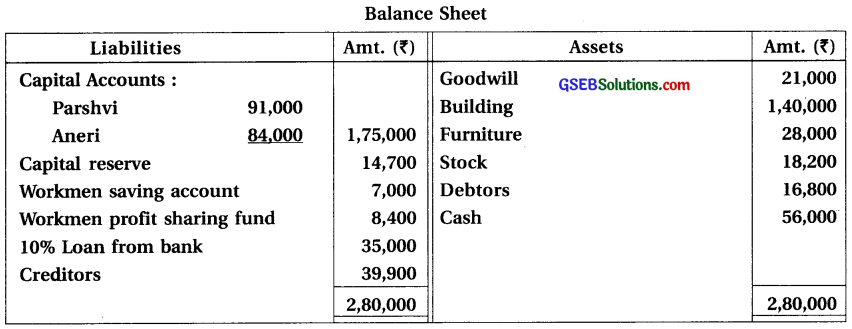

Parshvi and Aneri are the partners sharing profit and loss in the ratio of 2 : 1. Balance sheet of their firm as on 31-3-2016 was as under :

On l-4-2016.they admitted Henshi as a new partner on the following conditions :

(1) New profit and loss sharing ratio is to be kept at 3 : 4 : 2. (2) Henshi brings ₹ 40,000 as capital. (3) Interest on bank loan is outstanding for one year. (4) Personal expense of Parshvi paid by the firm is debited to the profit and loss account ₹ 5,600. (5) Reconstruction expense is paid by Aneri ₹ 8,400. (6) Goodwill is valued at ₹ 90,000. (7) Parshvi and Aneri will maintain their capital in the new firm in their new profit and loss sharing ratio by taking Henshi’s capital as base. For this purpose necessary adjustments should be made in partners’ current account.

Prepare necessary accounts and balance sheet after admission.

Answer:

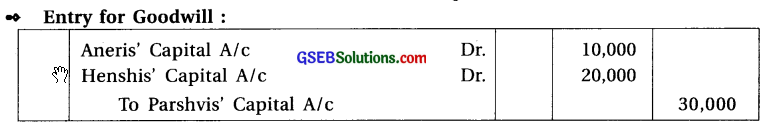

Note :

(1) Sacrificing Ratio :

Old ratio of Parshvi and Aneri = 2 : 1. New ratio of Parshvi, Aneri and Henshi = 3 : 4 : 2 Sacrifice of partner = Old share – New share

Sacrifice of Parshvi = \(\frac{2}{3}-\frac{3}{9}=\frac{6-3}{9}=\frac{3}{9}\) Sacrifice of Aneri = \(\frac{1}{3}-\frac{4}{9}=\frac{3-4}{9}=\frac{-1}{9}\)

(2) New Goodwill :

Here, valuation of goodwill is ₹ 90,000. So,

Goodwill receivable by Parshvi = ₹ 90,000 × \(\frac{3}{9}\) = ₹ 30,000

Goodwill given to Aneri = ₹ 90,000 × \(\frac{1}{9}\) = ₹ 10,000

Goodwill given to Henshis = ₹ 90,000 × \(\frac{2}{9}\) = ₹ 20,000

(3) Capital of New partners :

Now, Capital of Parshvi = ₹ 1,80,000 × \(\frac{3}{9}\) = ₹ 60,000

Capital of Aneri = ₹ 1,80,000 × \(\frac{4}{9}\) = ₹ 80,000

![]()

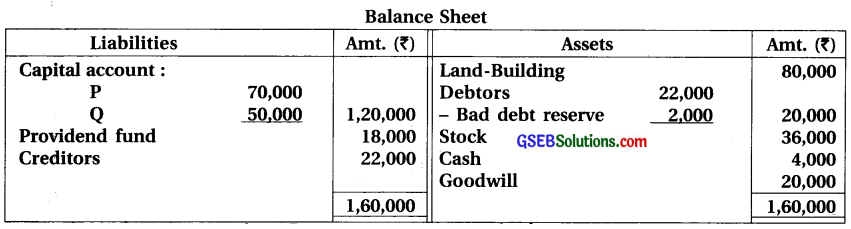

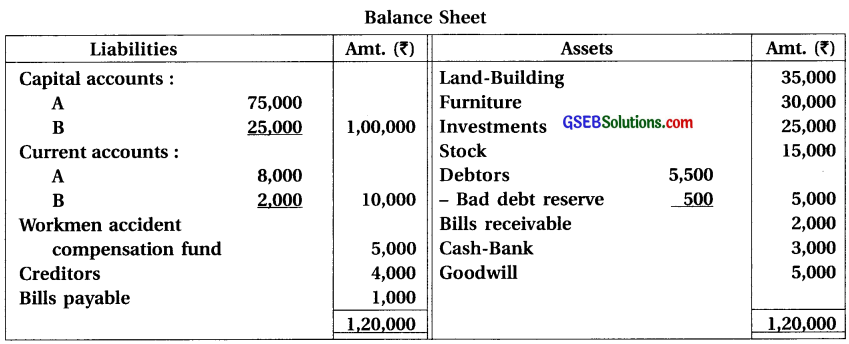

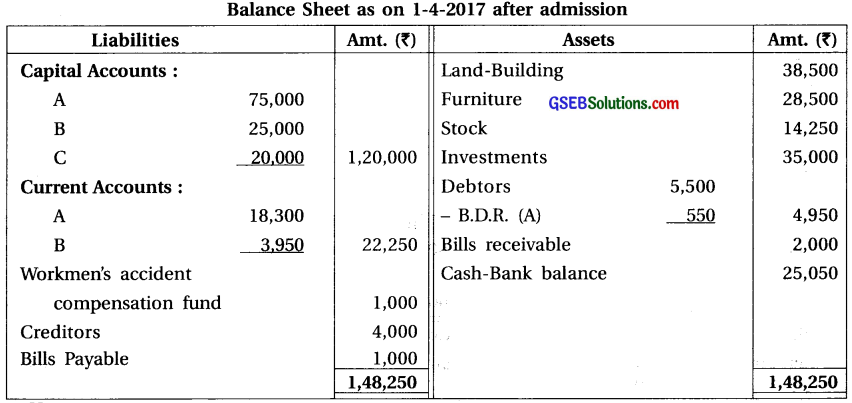

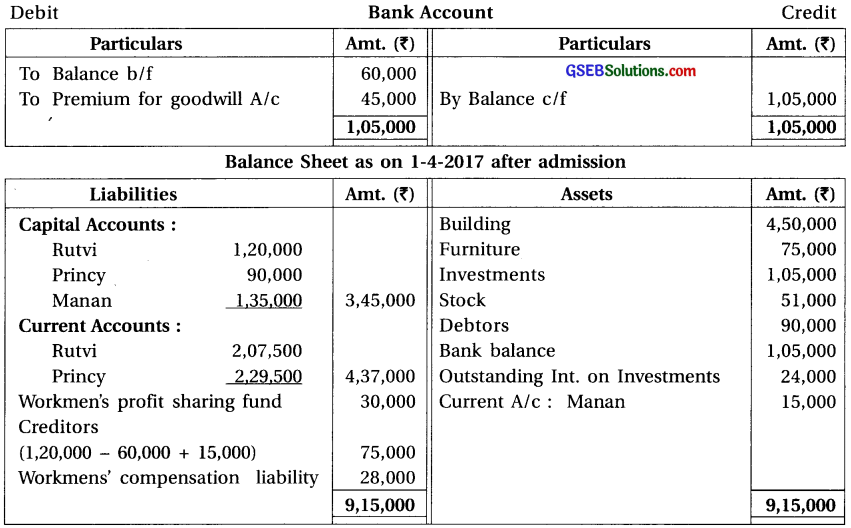

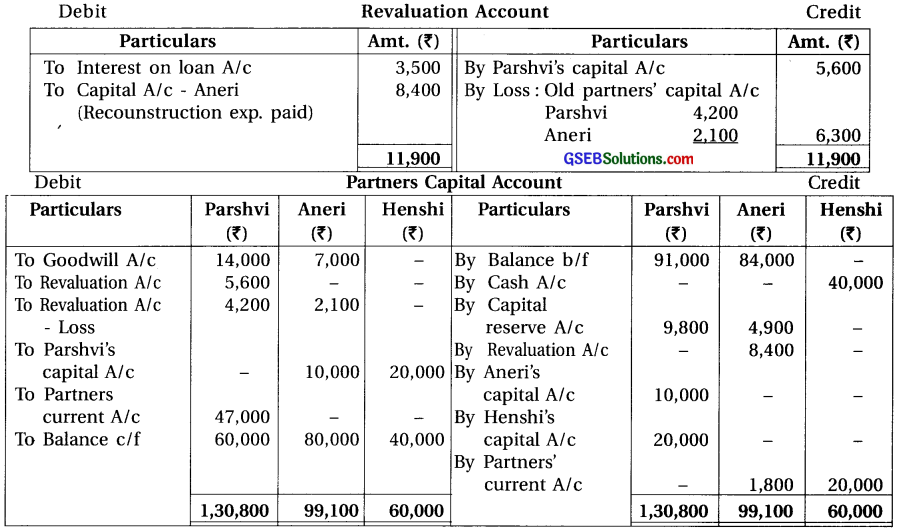

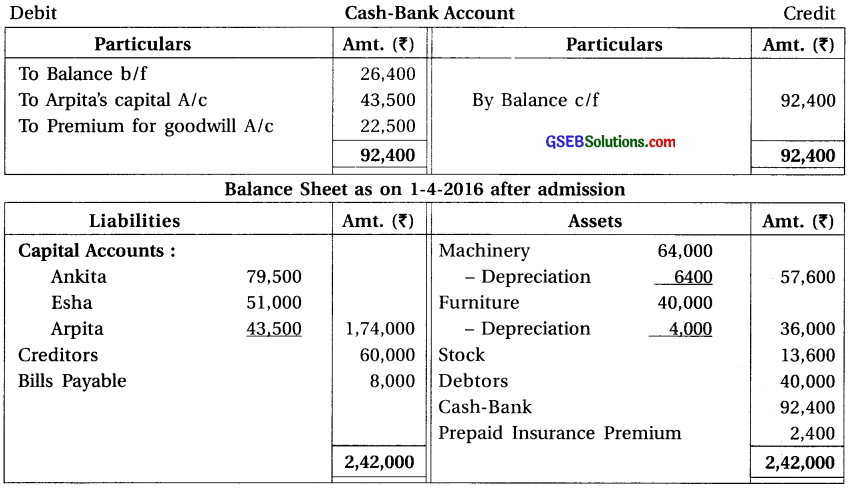

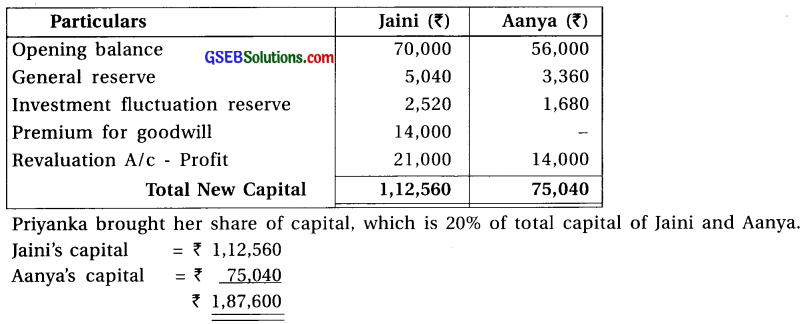

Question 17.

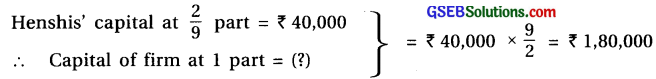

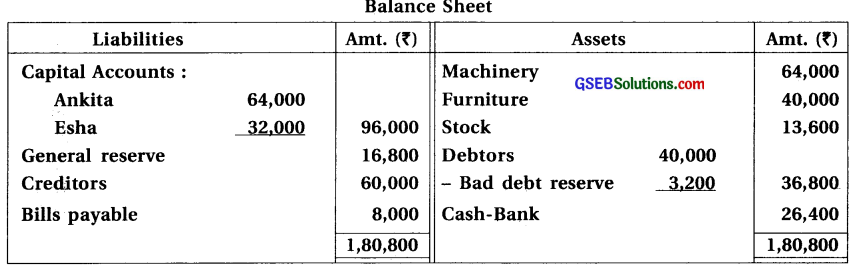

Ankita and Esha are the partners sharing profit and loss in the ratio of 2 : 1. Balance sheet of their firm as on 31-3-2016 was as under :

They admitted Arpita as a new partner on 1-4-2016 on the following conditions :

(1) Ankita sacrificed \(\frac {1}{12}\) th from her share and Esha sacrificed \(\frac {1}{6}\) th from her share in favour of Arpita. (2) Arpita is to bring proportionate capital. (3) Arpita is to bring her share of goodwill in cash. Goodwill of the firm is valued at ₹ 90,000. (4) Fixed assets are to be depreciated by 10%. (5) All debtors are good. (6) Insurance premium of ₹ 2,400 out of ₹ 12,000 is to be carried forward to next year.

Prepare necessary accounts and balance sheet.

Answer:

Note :

(1) Sacrificing Ratio :

Sacrifice by Ankita = \(\frac {1}{12}\) ; Sacrifice by Esha = \(\frac {1}{6}\) = \(\frac {2}{12}\) = ∴ Sacrificing ratio : 1 : 2

Arpita’s share = Ankita’s sacrifice + Esha’s sacrifice = \(\frac{1}{12}+\frac{2}{12}=\frac{3}{12}=\frac{1}{4}\)

(2) Goodwill :

Goodwill amount to be brought by Arpita = 90,000 × \(\frac {1}{4}\) = ₹ 22,500

Arpita’s goodwill amount, distributed among old partners in the sacrificing ratio = 1 : 2

Ankita’s goodwill amt. = 22,500 × \(\frac {1}{3}\) = ₹ 7,500 ; Esha’s goodwill amt. = 22,500 × \(\frac {2}{3}\) = ₹ 15,000

(3) Arpita’s capital :

![]()

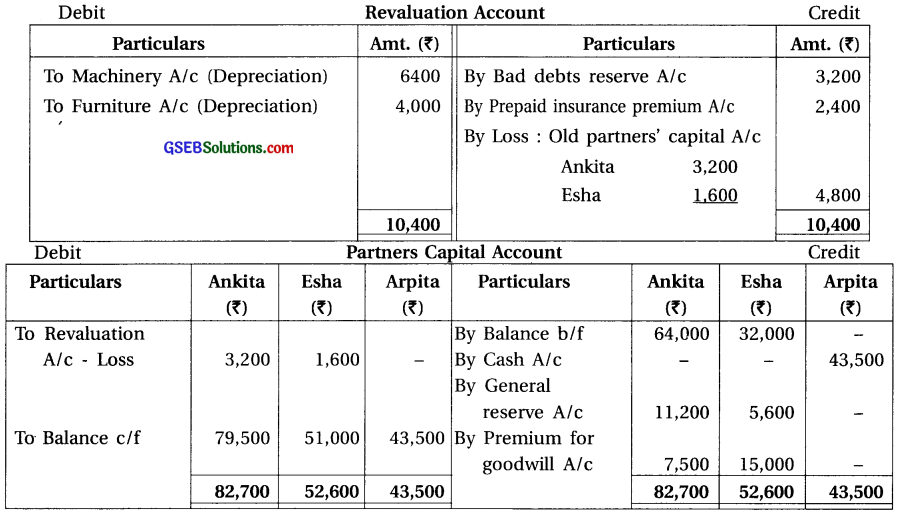

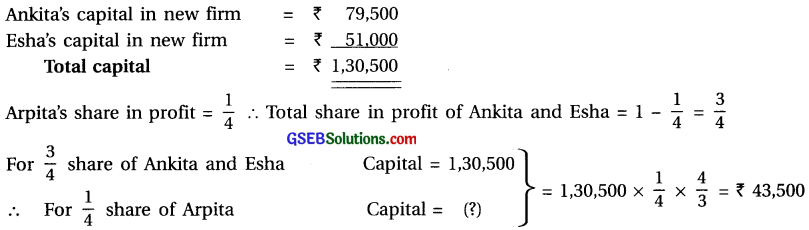

Question 18.

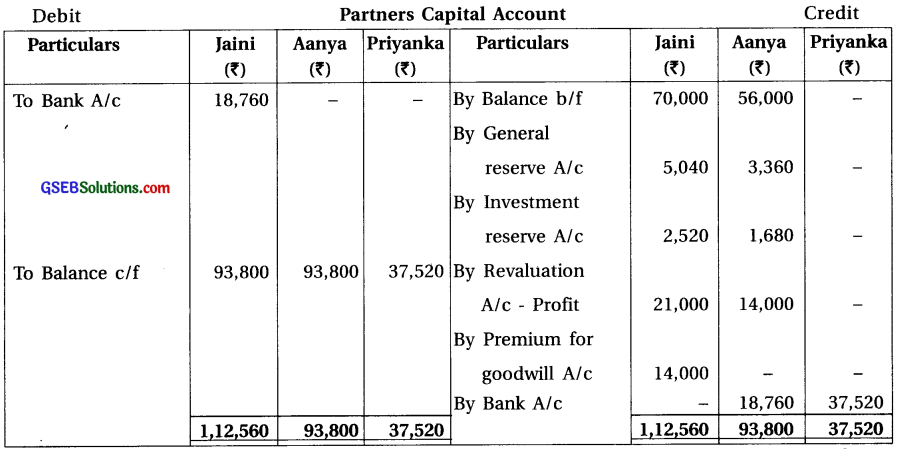

Jaini and Aanya are the partners sharing profit and loss in the ratio of 3 : 2. The balance sheet of their firm as on 31-3-2016 was as under :

They admitted Priyanka as a partner on 1-4-2016 on the following terms :

(1) Priyanka will bring ₹ 14,000 as goodwill in cash. (2) Priyanka will bring her capital equal to 20% of new total capital of Jaini and Aanya. (3) New profit and loss sharing ratio is to be kept at 2 : 2 : 1. (4) Provision for bad debt is not required. (5) Machinery is to be reduced by 10%. (6) Market value of building is ₹ 70,000. (7) Market value of investments is ₹ 68,950. (8) Total capital of the old partners Jaini and Aanya after all adjustments will be maintained in their relative new ratio. For this purpose necessary adjustments will be made through bank.

Prepare necessary accounts and balance sheet.

Answer:

Note : (1) Sacrificing ratio :

Old profit-loss sharing ratio of Jaini and Aanya = 3 : 2

New profit-loss sharing ratio of Jaini, Aanya and Priyanka = 2 : 2 : 1

Sacrifice of partner = Old share – New share

Jaini’s Sacrifice = \(\frac{3}{5}-\frac{2}{5}=\frac{1}{5}\);Aanya ’s Sacrifice = \(\frac{2}{5}-\frac{2}{5}\) = 0

∴ Premium for goodwill amount received by Jaini only.

(2) Capital of Jaini, Aanya and priyanka :

∴ Priyanka’s capital = 1,87,600 × \(\) = ₹ 37,520

Jaini and Aanya maintaied their capital in their new profit sharing ratio, which is 2 : 2 or 1 : 1 (equal share)

∴ Jaini’s capital = 1,87,600 × \(\frac{1}{2}\) = ₹ 93,800 ; Aanya’s capital = 187,600 – × \(\frac{1}{2}\) = ₹ 93,800

![]()

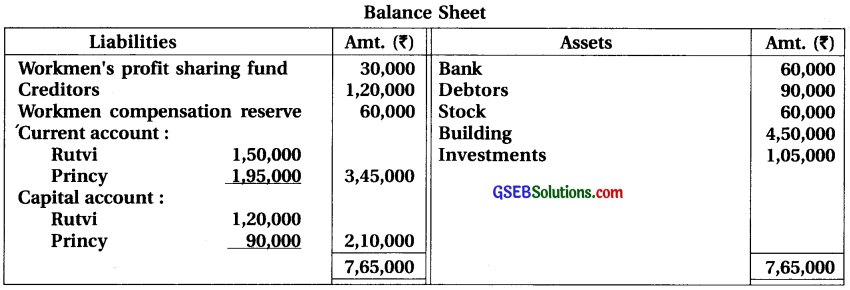

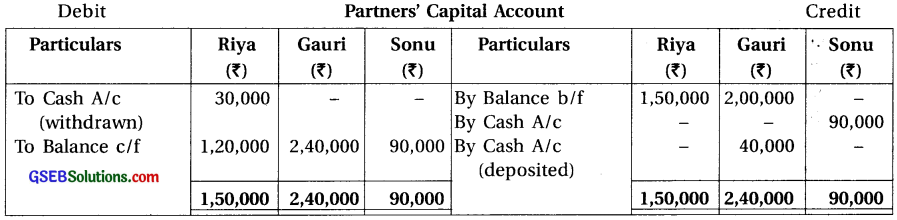

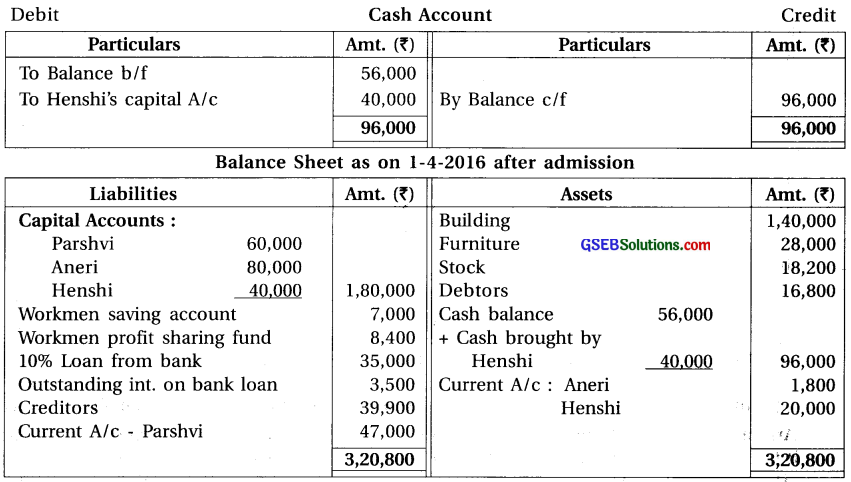

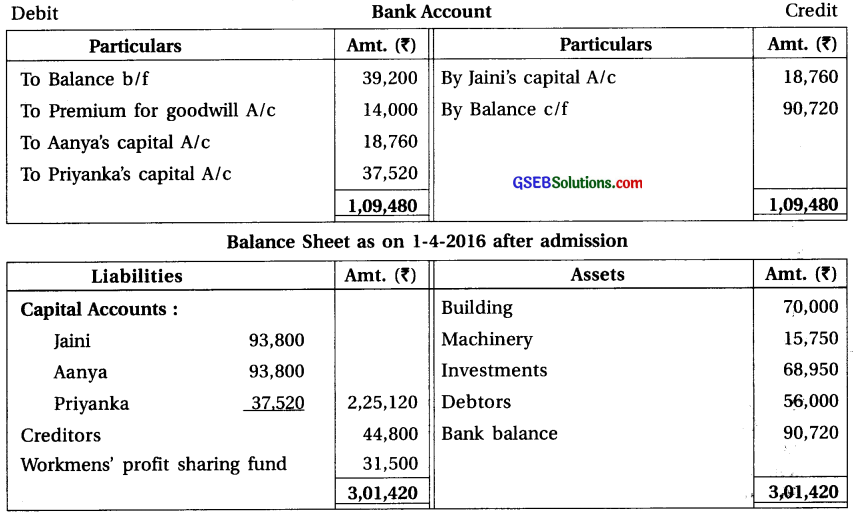

Question 19.

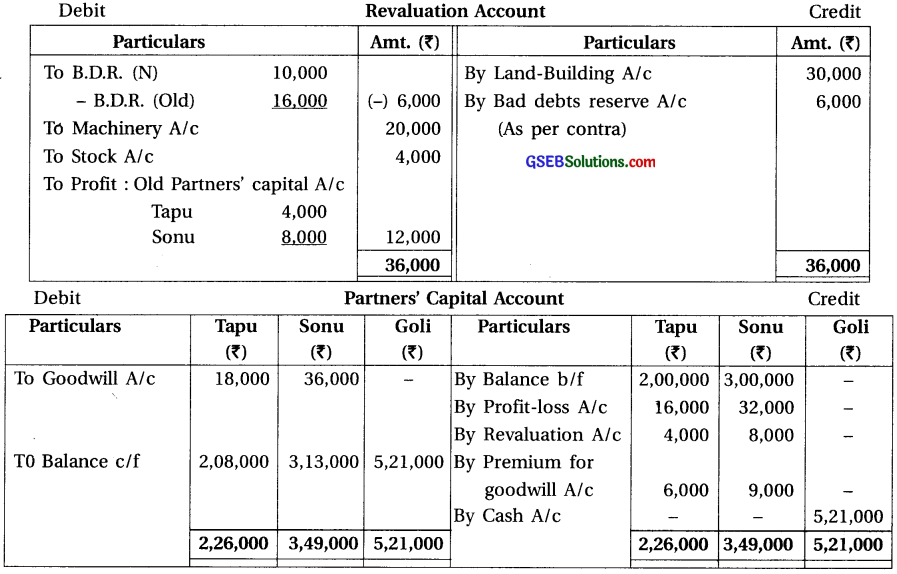

Tapu and Sonu are the partners sharing profit and loss in the ratio of 1 : 2. The balance sheet of their firm as on 31-3-2016 was as under :

They admitted Goli as a new partner on the following terms :

(1) Goodwill is valued at ₹ 54,000. (2) Bad debt reserve on debtors to be maintained at ₹ 10,000. (3) Land-building is to be increased by 10%. (4) Book value of machinery is 25% more than its market value. (5) Value of stock is to be reduced by 10%. (6) Goli will bring his capital equal to 50% of net assets of the new firm. (7) Goli will bring his share of goodwill in cash. (8) Tapu sacrifices \(\frac {1}{3}\) rd of his profit share and Sonu sacrifices \(\frac {1}{6}\) share for Goli.

Prepare the necessary accounts and balance sheet. Also determine new profit-loss sharing ratio of all the three partners.

Answer:

Note :

(1) Sacrificing ratio : Old profit-loss ratio of Tapu and Sonu = 1 : 2

∴ Sacrifice of Tapu = \(\frac{1}{3} \times \frac{1}{3}=\frac{1}{9}\) ∴ Sacrifice of Sonu = \(\frac{1}{6}\) ∴ Sacrifice ratio = \(\frac{1}{9}: \frac{1}{6}\) = 2 : 3

(2) Distribution of Goodwill :

Part of Goli = Sacrifice by Tapu + Sacrifice by Sonu = \(\frac{1}{9}+\frac{1}{6}=\frac{2+3}{18}=\frac{5}{18}\)

∴ Share of Goodwill of Goli = 54,000 × \(\frac{5}{18}\) = ₹ 15,000

∴ Goodwill amount brought in by Goli will be distributed among Tapu and Sonu in their sacrifice ratio = 2 : 3.

Tapu’s share in goodwill = 15,000 × \(\frac{2}{5}\) = ₹ 6,000 ; Sonu’s share in goodwill = 15,000 × \(\frac{3}{5}\) = ₹ 9,000

(3) Capital amount to be brought in by Goli :

Goli will brings 50% amount of net assets in new firm as his capital.

Net assets = Total assets – Debts

Goli’s capital in new firm = 50% means, remaining 50% capital is of Tapu and Sonu.

Now, Tapu and Sonu’s total capital = ₹ 5,21,000 ∴ Goli’s capital = ₹ 5,21,000.

![]()

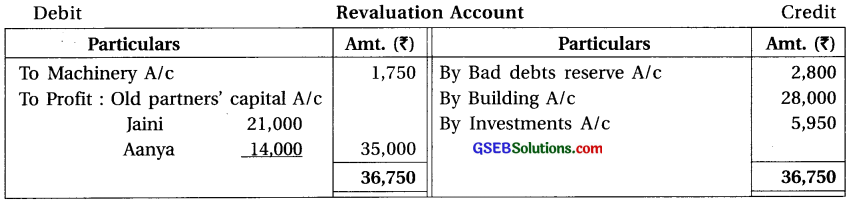

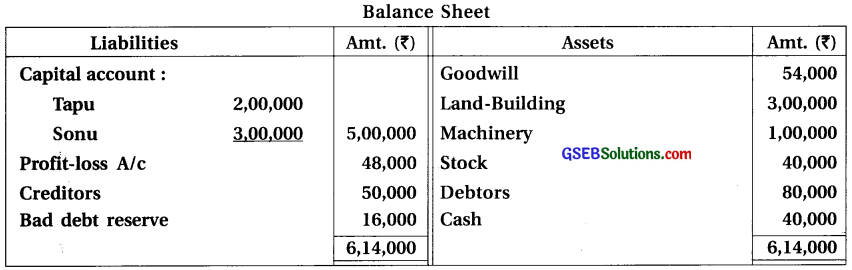

Question 20.

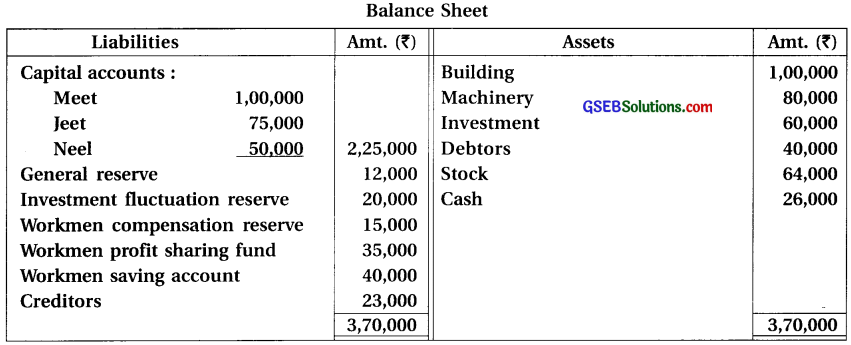

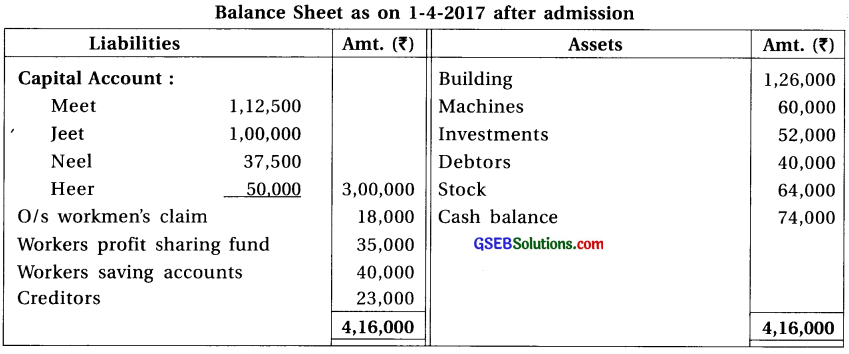

Meet, Jeet and Neel are the partners sharing profit and loss in the ratio of 3 : 2 : 1. The balance sheet of their firm as on 31-3-2017 was as under :

On the above date they admitted Heer as a new partner on the following conditions :

(1) Meet sacrificed \(\frac {1}{8}\) th share and Neel sacrificed \(\frac {1}{24}\) th share from their profit in favour of Heer. (2) Goodwill is valued at ₹ 60,000. Heer will bring her share of goodwill in cash. (3) Market value of investment is ₹ 52,000, which is to be shown in books. (4) Claim for workmen compensation is accepted at ₹ 18,000. (5) Market value of machinery is ₹ 60,000 and market value of building is ₹ 1,26,000 which are to be brought in the books. (6) Heer will bring ₹ 50,000 as her capital in cash. (7) Capital of the partners shall be proportionate to their new profit sharing ratio, taking Heer’s capital as base. Necessary effect is to be given in cash.

Prepare the necessary account and balance sheet after admission of Heer.

Answer:

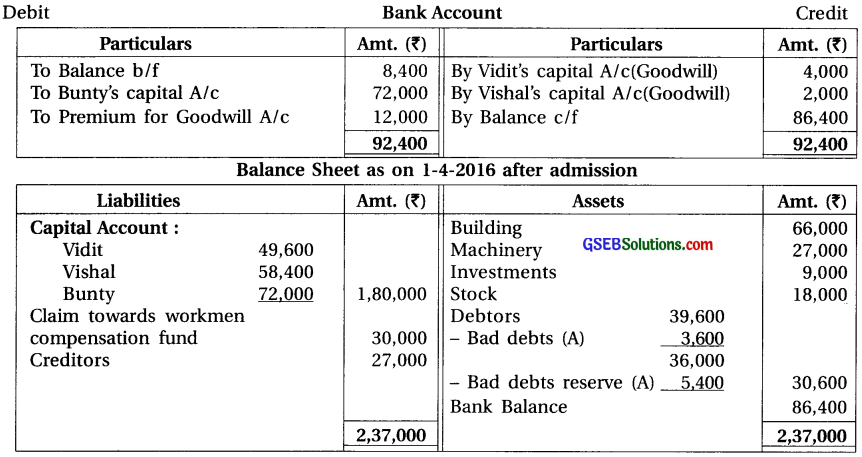

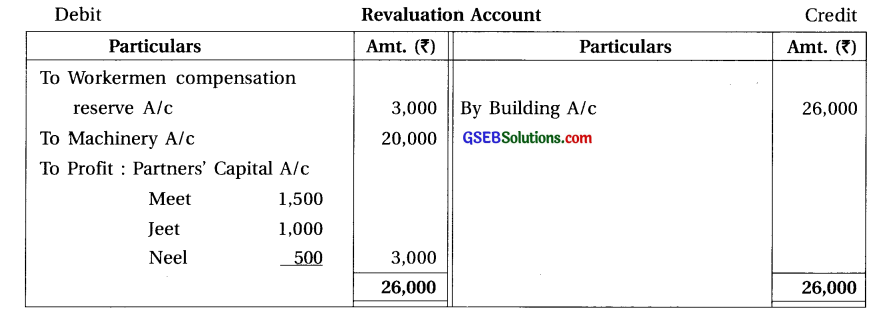

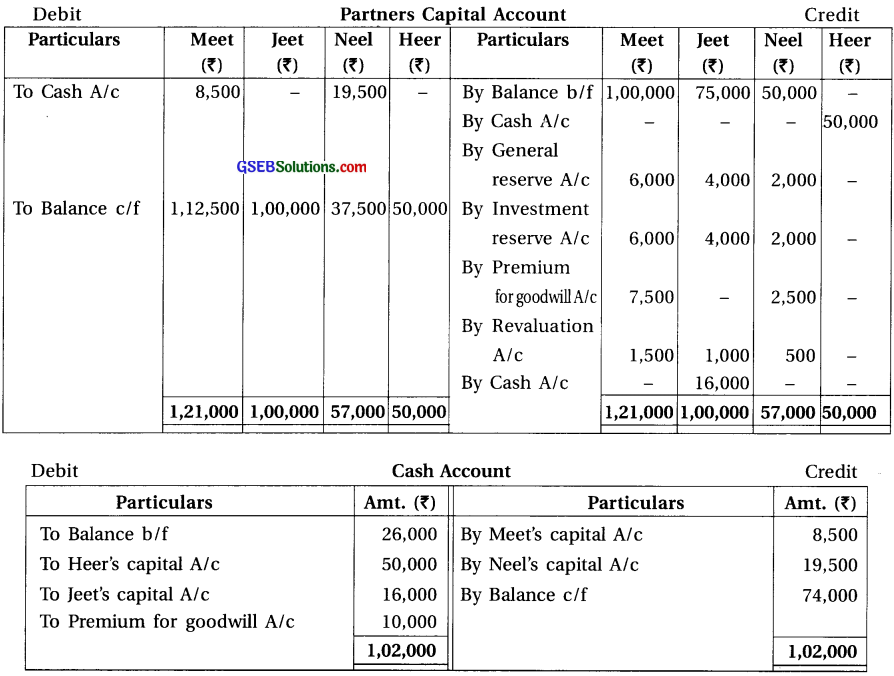

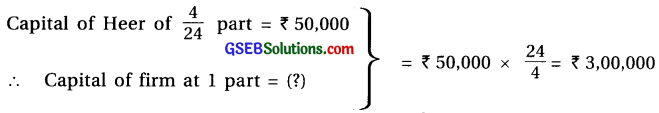

Note :

(1) New Profit – Loss Ratio :

Sacrifice by Meet and Neel is \(\frac {1}{8}\) and \(\frac {1}{24}\) respectively. ∴ Sacrifice ratio = 3 : 1.

New profit-loss ratio of partner = Old share – Sacrifice

Meets new share = \(\frac{3}{6}-\frac{1}{8}=\frac{12-3}{24}=\frac{9}{24}\) ; Jeet’s new share = \(\frac{2}{6}=\frac{8}{24}\)

Neels new share = \(\frac{1}{6}-\frac{1}{24}=\frac{4-1}{24}=\frac{3}{24}\) ; Heer’s new share = \(\frac{1}{8}+\frac{1}{24}=\frac{3+1}{24}=\frac{4}{24}\)

∴ New Profit-loss sharing ratio = 9 : 8 : 3 : 4

(2) Sacrificing ratio of Meet and Neel :

Sacrifice of Meet = \(\frac {1}{8}\) and Sacrifice of Neel = \(\frac {1}{24}\)

Sacrificing ratio = \(\frac{1}{8}: \frac{1}{24}=\frac{3}{24}: \frac{1}{24}\) = 3 : 1

(3) Share of goodwill of Heer = ₹ 60,000 x \(\frac{4}{24}\) = ₹ 10,000; which is distributed between Meet and Neel in sacrifice ratio of 3 : 1.

(4) New capital of Partners :

Now,

New capital of Meet = ₹ 3, 00,000 × \(\frac{9}{24}\) = ₹ 1,12,500

New capital of Neel = ₹ 3, 00,000 × \(\frac{3}{24}\) = ₹ 57,500

New capital of Jeet = ₹ 3, 00,000 × \(\frac{8}{24}\) = ₹ 1,00,000

New capital of Heer = ₹ 3, 00,000 × \(\frac{4}{24}\) = ₹ 50,000