Gujarat Board GSEB Class 11 Organization of Commerce and Management Important Questions Chapter 6 Forms of Business Organisation-2 Important Questions and Answers.

GSEB Class 11 Organization of Commerce and Management Important Questions Chapter 6 Forms of Business Organisation-2

Short Answer Type Questions

Question 1.

State the principle and philosophy on which a co-operative society works?

Answer:

A co-operative society works on the principle of ‘No progress without co-operation’ and philosophy of each for all and all for each.

Question 2.

How can one say that formation of co-operative society is quite easy?

Answer:

Any 10 persons with common interest can join together form a co-operative society and get it registered with Registrar of Co-operative society under Co-operative Society Act easily. Hence,

Question 3.

How can one say that all the members are treated equally in a co-operative society?

Answer:

Each member of Co-operative Society has gets an equal right and opportunity to vote, contest an election of executive committee, participate in management, etc. Hence,

Question 4.

Who manages the co-operative society?

Answer:

The representatives elected by the members of the society.

Question 5.

How can one say that the management of co-operative society is truly democratic?

Answer:

A co-operative society gives equal right of voting to each member on the basis of one person one vote, Moreover, each member gets equal right and opportunity to vote, contest election of executive committee, participant in management, etc. Due to such equality rights given to each member one can say that

Question 6.

How is surplus profit used in a co-operative society?

Answer:

First the surplus profit is distributed as dividend to the members. The remaining profit is utilized for welfare of the members and society.

Question 7.

Why it is very easy to become the member of a co-operative society?

Answer:

Anyone who wishes to become a member of the society can buy a share which is so low priced that anyone can afford it and become a member. Moreover, the society also gives installment facility on buying the share. Finally, if one wants to quit the society he can simply give that share back to the society and obtain his money back. Hence……

Question 8.

Who can become a member of a co-operative society?

Answer:

Anyone irrespective of his religion, caste and sex with a common interest can become the member of co-operative society.

Question 9.

How is the liability of members of a co-operative society?

Answer:

Liability of members is limited to the value of shares they have purchased.

Question 10.

How does government provide assistance to the society members?

Answer:

Government provides assistance to the society for conducting activities based on service and betterment of members. It provides this assistance in the form of loan, grant and subsidy.

![]()

Question 11.

How can one say that the administrative expenses of a co-operative society are lesser?

Answer:

Many members provide honorary service to the society. Moreover, there are hardly any advertisement or marketing expenses of the society. Hence,

Question 12.

How can a co-operative society stand as a strong competitor against private trading business firms?

Answer:

A Co-operative society ensures economic upliftment, social and economic justice to members, good quality products at fair prices, etc. Also, it does not follow unfair trade practices, adulteration, hoarding, black-marketing, etc. Hence, people develop faith in the products of the society and so it gives a strong

Question 13.

What kind of welfare activities does a society conduct?

Answer:

Societies arrange medical camps at low fees or even free, establish dispensaries, schools and public gardens, etc.

Question 14.

Why is it difficult for societies to raise large capital?

Answer:

Because their share prices are low and also people are not much interested in buying their shares. Moreover, members belong to poor class and so cannot contribute much in capital.

Question 15.

How does co-operative society become victim of inefficient management?

Answer:

The representatives who provide honorary service in management may lack personal interest. Also, they may not have specialized knowledge, business experience, professional skills and time. Mismanagement may also take place due to formation of groups within the society due to differences. Hence,

Question 16.

How can the democratic values of a society get jeopardized?

Answer:

When political parties start interfering and influencing the societies, the freedom of doing business and member’s rights may get compromised. Hence,

Question 17.

How can non-cooperation crop in co-operative societies?

Answer:

When the members lack faithfulness or discord, conflicts, selfishness and group formation occurs in the society, non-co-operation crops in co-operative societies

Question 18.

Why did the need of Joint Stock Company arise?

Answer:

After the industrial revolution there arose huge demand for various new products and machineries. It was quite impossible for proprietorship or partnership firms to raise a very huge capital with unlimited liability to meet such demands. Hence, the need of joint stock company arise.

Question 19.

What is a joint stock company or company?

Answer:

As per Companies Act, 1956, a company is an artificial, invisible and intangible person created by law, having a separate legal entity. As per Companies Act, 2013, ‘Company’ means a company registered under this act or any former act.

Question 20.

Explain company as a legal entity.

Answer:

Being an artificial person, a joint stock company has its own separate legal entity independent of its investors. This means a company can own property, enter into contracts, it can sue and can be sued by others.

Question 21.

What do you mean by perpetual existence of a company?

Answer:

As per the law, a‘company’is separate from its investors. So, it is not affected by the death or insolvency of the members. A company can be brought to an end only through liquidation procedure.

Question 22.

How is capital raised in a company?

Answer:

A public limited company divides its required capital in small fractions called shares and invites public to buy it. The private limited company raises the funds from its own members or borrows it from bank and other sources.]

Question 23.

What is common seal?

Answer:

The seal or stamp of a company that it uses while sighing contracts, agreements, certificates and other important documents is called the common seal. A document carrying the seal shows the consent of that company.

Question 24.

Who manages the company? How?

Answer:

Board of Directors elected by the members, as per the Memorandum of Association and Articles of Association.

Question 25.

What is the status of a member of the company?

Answer:

A member can neither enter into a contract on behalf of the company nor the company is liable for the act of members. However, members can enter into contracts with the company.

Question 26.

Why inspite company being a person cannot enjoy fundamental rights or considered as citizen?

Answer:

The company is an invisible entity created by law. It does not exist physically, Hence,……

Question 27.

What are the special characteristics (attractions) of a company with respect to shares?

Answer:

Easy transfer of share, an opportunity to earn through share trading and voting right per share.

Question 28.

How does a company get advantage of large scale?

Answer:

Company can raise very large capital through shares. Hence, it gets the advantage of low cost production at very large scale, buying raw material at large volume, buying large land at cheaper rates, etc.

Question 29.

Why management of a company is highly efficient?

Answer:

Companies have very large scale capital, Hence they can afford hiring industry experts, highly skilled professionals and their expert services, very highly qualified managers, etc.

Question 30.

What kind of management does a company follow?

Answer:

Democratic management whem in the Board of Directors are elected by members through voting. Majority of decisions are take; in general meetings of members.

Question 31.

How does a company benefit the society and public?

Answer:

Public buys shares and debentures of company to earn profit. This induces saving habits in them. Moreover, society gets advantage of large scale production, variety of products, employment, etc. Also, some companies set-up art centers, gardens, schools and colleges, etc. for the society. Also, company pays cores of rupees as tax to the government which is then used for the country’s welfare.

Question 32.

Why the process of incorporating a company quite lengthy, complicated and expensive?

Answer:

A company needs to furnish a very large number of documents to the Registrar of Companies. If has to also prepare important documents like MOA, Articles of Association, director’s consent, etc. For all these documentation and activities it needs to hire experts too. Finally, the registration fees is also quite high. Hence,

Question 33.

What kind of legal restrictions are laid on company?

Answer:

The company needs to observe strict legal provisions and other provisions laid by SEBI lifetime. It has to submit its statements, reports, accounts, etc. to the registrar on a regular basis.

Question 34.

Why administrative expenses are quite high in company?

Answer:

A company has to invest in research and development, hire very high level industry experts, pay high salaries to them as well as other highly qualified managers, etc. and so…

![]()

Question 35.

How can a company management become autocratic?

Answer:

Share-holders or directors having very large number of shares may dominate company’s decisions. They may force the company to work in such a manner that their personal interests get satisfied and they make more money and enjoy more power.

Question 36.

Why it is difficult for a company to maintain secrets?

Answer:

A company needs to undergo audit of its accounts and furnish its accounts and report to the Registrar of Companies. It also needs to publish information like redemption of debentures, bonus shares, etc. Hence …

Question 37.

Why company decisions get delayed?

Answer:

Company needs to hold meetings of Board of Directors for taking major decisions. For this it needs to inform the company members in advance. Moreover, there might be differences among directors. All these consumes a lot of time. Hence, …..

Question 38.

Why a company is less flexible

Answer:

In order to make major changes the company compared to other forms of business? needs to pass resolution in general meeting.

In some instances it may also need the approval of central government. Also, the resolution may not pass and for the government may not approve changes. Hence, ….

Question 39.

How can a company speculate?

Answer:

The directors of the company are very well versed with company’s secrets. Hence, they can use these secrets to raise rumors in the market and create artificial changes in the stock market. This can encourage speculation of the shares that badly affects the economic interests of small investors.

Question 40.

How can company badly affect economic interests of small investors.

Answer:

By speculating.

Question 41.

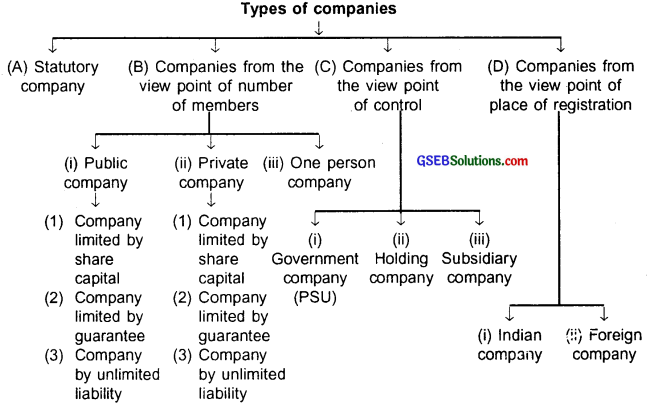

Name the four major types of companies.

Answer:

(A) Statutory company,

(B) Companies from the view point of number of members,

(C) Companies from the view point of domination and

(D) Companies from the view point of registration.

Question 42.

Name the types of companies from the view point of number of members.

Answer:

(A) Public company,

(B) Private company and

(C) One person company.

Question 43.

Give full form of OPC.

Answer:

One Person Company.

Question 44.

What is a statutory company? Give two examples.

Answer:

A statutory company is a public enterprise brought into existence by a special act of the parliament or legislative assembly; Reserve Bank of India (RBI), Life Insurance Corporation (LIC) of India, etc. are statutory companies.

Question 45.

Define public company.

Answer:

As per Companies Act, a company which is not a private company is called a public company.

Question 46.

What do you mean by company limited by share capital?

Answer:

A company in which the liability of members is limited to the face value of number of shares they hold is called company limited by share capital

Question 47.

Which word(s) does a company limited by share capital needs to insert at the end of its name? Give example.

Answer:

‘Limited’; For example, National Insurance. Company Limited.

Question 48.

What do you mean by company limited by guarantee?

Answer:

A company where in the members work as guarantors and guarantees to pay the amount guaranteed by them during liquidation of the company is called company limited by guarantee.

Question 49.

What do you mean by company with unlimited liability?

Answer:

A company in which the liability of members is unlimited i.e. they may even have to sell their personal assets in case company cannot pay its debts is called company with unlimited liability

Question 50.

What is a private company?

Answer:

A company where in there are minimum 2 members and maximum 200 members, who raises its capital on its own or through banks, etc. and whose shares cannot be transferred easily is called a private company.

![]()

Question 51.

Name the types of companies from the point of view of domination.

Answer:

(A) Government company

(B) Holding company and

(C) subsidiary company.

Question 52.

What is a government company?

Answer:

A company whose 51% or more capital is held by either

- Central government or

- State government or

- more than one State governments or

- Central government and one or more than one state governments is called a government company.

Question 53.

What is a holding company?

Answer:

A company which holds more than 50% shares of another company and holds the right to appoint majority of directors of that company is called a holding company.

Question 54.

What is a subsidiary company?

Answer:

A company whose more than 50% shares are with the holding company and the right to appoint majority of its directors also lie with the holding company is called a subsidiary company.

Question 55.

State the types of companies from the point of view of place of registration.

Answer:

(A) Indian company and

(B) Foreign company

Question 56.

What is an Indian company?

Answer:

A company which is registered in India under the Indian Companies Act or under the special act passed by the parliament is called an Indian company. An Indian Company can be private company, public company or Government Company.

Question 57.

What is a foreign company?

Answer:

A company which is registered outside India and whose registered office is also outside India, but whose place of business is in India is called a foreign company. For example, Vodafone.

Long Answer Type Questions

Question 1.

What is a co-operative society? How does it differ from other forms of business?

Answer:

Co-operative society:

- A co-operative society is a voluntary form of business where in individuals intending to set-up a business get associated for economic interests but on the basis of equality i.e. to provide equal right and opportunity to all the members.

- Thus, people with common interests voluntarily get associated to fulfill economic interest of members through co-operation among members but, by treating all members equally. In other words to uplift economically weaker sections of society. The co-operative societies are set-up by weaker sections of society to protect its members from the clutches of profit hungry businessman.

- Amul is one of the best examples of a co-operative society.

Difference between co-operative society and other forms of business:

- Sole proprietorship, partnership and company are three major forms of business. But, the prime motive of all these three forms is profit.

- In order to earn profit these forms can even adopt unfair means like over-pricing, exploiting employees, tampering quality, black-marketing, etc.

- On the other hand, though co-operative society is also a form of business but it differs from those three due to its special characteristics.

- These societies work on the principle ‘No progress without co-operation’.

- The philosophy behind these societies is ‘Each for all and all for each’.

Question 2.

Write a short note on democratic management of a co-operative society.

Answer:

Democratic management:

The business of co-operative society is managed by the committee elected by the members.

- The basic element on which the co-operative democracy works is ‘One man one vote’. Here, one man or say one member may have 10,000 shares of the society and another may have only 1 share still both have the right of one vote only i.e. equal voting right. In this regard we can say that in a co-operative society it is the ‘person’ that counts and not the money he has or holds in the society. Whereas in companies a person is allowed the number of votes based on the number of shares he holds.

- Any member can contest the election of executive committee, participate in management, etc.

- Hence, we can say that the management of a co-operative society is truly democratic and also that the society is a training school of democracy where one can learn ideal principles of democracy.

Question 3.

Explain motive of service as an objective of co-operative society.

Answer:

Motive of service:

- The primary objective of the co-operative society is to serve its members. Profit is a secondary objective.

- The society aims to raise the economic conditions and living standards of the members and to make them self-reliant.

- For example, the objective of Amul is providing milk at desired quality and fair price. It does this by collecting milk from villagers, pay them reasonably well and sell it to market. This helps to improve economic condition of villagers who supply milk and hence make them self-reliant.

Question 4.

How can one say there is fair distribution of profit in a co-operative society?

Answer:

- The objective of a co-operative society is ‘service’. However if the society makes surplus income it distributes some part of profit among the society members in the form of dividend as per the provision of law.

- The remaining profit is utilized for the welfare of the members and the society.

- Owing to these reasons one can say that in a co-operative society there is fair distribution of profit.

![]()

Question 5.

State and explain the advantages of a co-operative society.

Answer:

Advantages of a co-operative society:

1. Easy establishment:

It does not require lengthy legal procedure to set-up a co-operative society. Ten persons can simply come together voluntarily and form a co-operative society. If they wish they can even easily register it.

2. Perpetual existence:

- As soon as a co-operative society gets registered it becomes a separate legal entity i.e. members and society are considered two separate entities.

- The existence of the society than does not get affected by the exit, death or insolvency of the member. Hence, a co-operative society enjoys a long and also in many cases a perpetual life.

3. Open membership:

The membership is open to all who have a common interest. Anyone can become a member irrespective of religion, caste, sex or economic condition.

4. Limited liability of the members:

The liability of each member is limited only to the number of shares he purchases.

5. Government aid:

Government provides financial assistance to the society for conducting activities to uplift the members and serve the society. The assistance can be in the form of loan, grant or subsidy.

6. Democratic management:

- The business of co-operative society is managed by the committee elected by the members. Each member has a right to caste only one vote irrespective of the number of shares he holds.

- The decisions of the society are taken on the basis of majority.

- Every member can contest the election, cast vote and participate in meetings and elect the representatives of the society.

7. Lesser administrative expenses:

- The co-operative society works on the principle of thrift i.e. wisely managing money and other resources.

- Members provide honorary services for managing the society. Moreover, management is done on an economical way without spending or spending very less on advertisements and marketing of the products.

- These things together reduces overall administrative expenses of the society.

8. A specific class of customers:

Mostly the members are customers too. Members are specific and goods are sold to them.

9. Strong competitor against trading firms:

- Sometimes business firms in order to earn more profit may involve in unfair practices like adulteration, cheating, profit-maximization, black marketing, etc.

- A co-operative society can stand strongly against such firms because it does not involve in unfair trade particles and aims at providing goods at reasonable prices. Also its administrative expenses are lesser and so it can provide a good competition to business firms.

10. Welfare activities for the society (public):

- Co-operative societies from their profits and reserve conduct various types of welfare activities for the society.

- They arrange activities like setting-up medical camps free of charge or at very nominal rates, develop schools, dispensaries, gardens, etc.

- These activities are advantages to general public of the country.

11. Training school for democracy:

- A co-operative society works purely on a democratic way. It gives importance to humans and not money or power.

- In this sense the co-operative society works as a training school democracy where ideals of democracy can be thoroughly learnt.

12. Economic upliftment and growth of members:

- Co-operative societies play a significant role in the growth of its members. For example, consumers’ co-operative societies supply day-to-day consumable products like milk, grains, etc. of good quality at fair prices and prevent economic exploitation of customer by the middleman.

- Similarly, producer’s co-operative societies supply raw materials, equipment, tools, etc. at fair prices to the members.

- Small producers can sell their produce easily to these societies and attain economic growth.

- Co-operative societies have achieved much progress in sugar, milk, leather, and cotton industries.

Question 6.

How can one say that a Co-operative society can have a perpetual existence?

Answer:

Perpetual existence:

- As soon as a co-operative society gets registered it becomes a separate legal entity i.e. members and society are considered two separate entities.

- The existence of the society than does not get affected by the exit, death or insolvency of the member.

- Hence, a co-operative society enjoys a long and also in many cases a perpetual life.

Question 7.

Why are administrative expenses lesser in co-operative societies?

Answer:

Lesser administrative expenses:

- The co-operative society works on the principle of thrift i.e. wisely managing money and other resources.

- Members provide honorary services for managing the society. Moreover, management is done on an economical way without spending or spending very less on advertisements and marketing of the products.

- These things together reduces overall administrative expenses of the society.

Question 8.

How can a co-operative society in spite of hardly any advertisement compete strongly against private firms?

Answer:

Strong competitor against trading firms:

- Sometimes business firms in order to earn more profit may involve in unfair practices like adulteration, cheating, profit-maximization, black marketing, etc.

- A co-operative society can stand strongly against such firms because it does not involve in unfair trade particles and aims at providing goods at reasonable prices. Also its administrative expenses are lesser and so it can provide a good competition to business firms.

Question 9.

Co-operative societies welfare the public. Give reason.

Answer:

- Co-operative societies from their profits and reserve conduct various types of welfare activities for the society.

- They arrange activities like setting-up medical camps free of charge or at very nominal rates, develop schools, dispensaries, gaiucns, etc.

- Moreover, these societies sell quality goods at fair prices.

- Hence, co-operative societies welfares the public.

Question 10.

Economic upliftment and growth of members take place under co-operative societies. Give reason.

Answer:

Economic upliftment and growth of members:

- Co-operative societies play a significant role in the growth of its members. For example, consumers’ co-operative societies supply day-to-day consumable products like milk, grains, etc. of good quality at fair prices and prevent economic exploitation of customer by the middleman.

- Similarly, producer’s co-operative societies supply raw materials, equipment, tools, etc. at fair prices to the members.

- Small producers can sell their produce easily to these societies and attain economic growth.

- Co-operative societies have achieved much progress in sugar, milk, leather, and cotton industries.

Question 11.

How does a co-operative society face capital shortage?

Answer:

Limited capital:

It is difficult to raise capital in a co-operative society. The main reason for this is that the price of shares to be sold to members is quite low and members generally belong to poor class. Moreover, unlike companies any member can have only one vote irrespective of the number of shares he holds. So, members are not much interested in buying shares which further adds to capital shortage.

Question 12.

How can a co-operative society become a victim of inefficient management?

Answer:

Lack of efficient management:

- The directors of co-operative societies work on an honorary basis i.e. without taking any fees or salary. Hence, at times they may not take personal and deep interest in the management and administration.

- Since the directors work honorary the society may hot get an efficient person / having specialized knowledge, business experience and time.

Question 13.

The basis of a co-operative society is ‘no progress without co-operation’. Give reason.

Answer:

- As the name suggests a co-operative society is established and functions on the basis of co-operation.

- The members having common interest voluntarily associate with each other to fulfill definite common goals.

- The primary object is to serve and then to earn profit. These objectives require dedicated selfless efforts, honesty and loyalty.

- In such a business set-up if members do not possess these characteristics the co-operative society will not progress.

- Members mainly work for economic upliftment rather than profit maximization. Every member needs to stay focused with the objectives of the co-operative society to progress and attain the goal of coOoperative society. Hence, it is said ‘no progress without co-operation’.

![]()

Question 14.

A co-operative society is a boon for economically backward class. Give reason.

Answer:

- The primary objective of the co-operative society is to serve its members. Profit is a secondary objective.

- The society aims to raise the economic conditions living standards of the members and to make them self-reliant.

- For example, the objective of Amul is providing milk at desired quality and fair price. It does this by collecting milk from villagers, pay them reasonably well and sell it to market. This helps to improve economic condition of villagers who supply milk and hence make them self-reliant.

- Moreover, economically backward people can easily become members of co-operative societies. By doing so they can supply their produce to the society and fetch good prices, buy products from society’s fair price centers, etc.

- Hence, a co-operative society is a boon for economically backward class.

Question 15.

How did the need of a joint stock company arise?

Answer:

The need of joint stock company:

- In a partnership, there can be a maximum of 20 partners. These partners together can raise only a limited capital but their liabilities will be unlimited and also their firm will have a shorter life.

- After the industrial revolution the demand of newly produced goods went up drastically. To meet these demands there arose need of setting up huge factories and very large business establishments. A very large’scale production was the need of the hour.

- Due to limited capital, unlimited liability, short life of the business firm, etc. sole proprietorship and partnership forms of business were unable to set-up such large establishments.

- These reasons led to creation of a new form or Dusiness known as the Joint Stock Company or simply, company.

- In India a company is formed as per Companies Act, 1956. The latest companies act is the Companies Act, 2013 which is in force from 01-04-2014. The companies are now formed and managed as per this to latest act.

- Broadly, there are two types of companies, (A) Private limited company and (B) Public limited company.

Question 16.

How does a company raise its capital?

Answer:

Divison of capital in small fractions:

- If for a public company, the capital to start the company is raised from the public in the form of shares.

- The company asks the public to apply for purchasing shares of the company or in simple words ‘purchasing a share’ in the company.

- People buy company’s shares from stock market and become shareholders. The company than starts its business with the share capital i.e. fund raised by selling the shares.

- In case of a private limited company, fund is raised by members or borrowed from banks and other sources.

Question 17.

Trading and transfer of ownership of shares is the lifeline of a company. Give reason.

Answer:

Easy transfer of shares:

- The shareholders sell and purchase the shares of the company in the stock market. They can easily do so subject to the provisions of the company and the law.

- If one sees trial ine company is performing well he can buy its shares from the stock market. On the other hand the holder of the shares can sell them at the stock market and book his profit.

- This way the share-trading continuous in the market. Thus, trading and transfer of ownership of shares is one of the main and continuous characteristic.

Question 18.

What is common seal? Explain.

Answer:

Common seal:

- A company has a ‘seal’ or say stamp is used while dealing with third parties, entering into contracts, issuing share certificates, documents and day-to-day transactions of the company.

- This seal is called ‘common seal’ because it can be used by any authorized officer of the company.

- Stamping a document with this seal means that the company expresses its consent to whatever is mentioned in the document.

Question 19.

Explain liability of members in a company.

Answer:

Liability of members:

The liability of members is limited to the face value of number of shares he possesses of that company. This means that if a share-holder possesses 50 shares of ₹ 100 each then his total share in that company is of ₹ 5000. If the company goes bankrupt the share-holder will lose only ₹ 5000 he invested in the company and he will not be liable for the entire loss of the company.

- Note that, the concept of unlimited liability is rarely seen in companies.

- The company in its Memorandum of Association on mentions whether the share-holder will have limited or unlimited liability.

Question 20.

How is it possible for a company to raise huge capital?

Answer:

Huge capital fund:

- To raise the capital a company divides the entire capital it needs in tiny fractions known as shares.

- This attracts people to invest in the company through buying their shares and hence become share holder or say part owner of the company.

- People also buy shares with an objective of earning profit by trading them in the share market.

- The voting right is per share so people get attracted and invest as much as possible which then helps the company to raise a very large capital.

Question 21.

How does a company gets advantage of large scale?

Answer:

Advantage of large scale:

- Due to its special characteristics a public limited company is able to raise a large capital.

- Large capital enables set-up of modern machineries, hiring experts, research and development, purchasing raw material at lower prices and hence large scale production and sales.

Question 22.

Explain the democratic management of a company.

Answer:

Democratic management:

A company is managed democratically by the elected representatives called the directors.

The decisions regarding the company’s operations, policy, etc. are taken by the majority in the general meetings of the directors.

Question 23.

Why the procedure of opening a company a lengthy and expensive?

Answer:

Lengthy and expensive incorporation procedure:

- Unlike other forms of businesses the formation of a company is lengthy, complicated and expensive.

- A company needs to hire services of experts who help the company to prepare the documents like Memorandum, Articles, etc. and submit them to the Registrar of Companies for obtaining certificate of incorporation.

- Over and above the registration fees the companies also pay fees to the experts for their services.

Question 24.

How can one say that a company may have autocratic management?

Answer:

Autocratic management:

- Although the share-holders or say members are entrusted several powers as per the law but they enjoy only a few of them.

- Due to the existence of voting right per share, people having a very large quantity of shares of a company might get associated and dominate the company management. They may use company’s money, assets and secrets for fulfilling their personal desires and goals.

Question 25.

How can a company speculate?

Answer:

Encouragement to speculation:

- The directors of the company are very well versed with company’s secrets. Hence, they can use these secrets to raise rumors in the market and create artificial changes in the stock market. This can encourage speculation of the shares which then badly affects the economic interests of small investors.

- For example, a company to raise additional capital may spread news in the market that it is planning to associate with international companies. The small investors unaware of the truth may start buying the shares in the hope of high profit and thus company’s capital increases.

Question 26.

State the disadvantages caused to the society due to companies.

Answer:

Disadvantages to the society:

- Large companies have huge powers to dominate the society.

- The decisions and behaviour of the companies may result in strikes of employees, removal of employees unless they agree to certain conditions of the employers, lock-outs, monopolistic evils, etc.

- Owing to these things there arise unequal distribution of income and wealth in the society.

Question 27.

Classify the companies with the help of a chart.

Answer:

Question 28.

Write a short note on companies from the view point of number of members.

OR

Write a short note on public company

OR

write a short note on private company.

OR

Write a short note on One Person Company.

Answer:

Companies from the view point of number of members:

(I) Public company:

- As per Companies Act, a company which is not a private company is called a public company.

- A public company needs to have minimum 7 members. There is no limit on maximum number of members.

- Such companies can invite public to buy its shares and debentures. Moreover, one can easily transfer the shares.

From liability of member’s point of view a public limited company can be divided In three parts. They are:

1. Company limited by share capital:

In such companies the liability of members is limited to the face value of the number of shares held by them. These companies put a word Limited’ at the end of the company. name. For example, National Insurance Company Limited.

2. Company limited by guarantee :

- A company limited by guarantee does not usually have a share capital or shareholders but instead has members who act as guarantors.

- The guarantors give an undertaking to contribute the amount guaranteed by them at the time of liquidation of the company.

3. Company by unlimited liability:

- A company in which the liability of members is unlimited is called a company by unlimited liability.

- If the debts of such companies exceed their assets or if the company goes under liquidation than the members may have to pay their contribution even by selling their personal assets.

(II) Private company:

- A private company is a company that has minimum 2 members and maximum 200 members.

- Unlike public company there are restrictions on the transfer of shares of a private company.

From liability point of view a private company can be divided into three types. They are:

1. Company limited by share:

- The liability of the members is limited to the face value of the number of shares they possess.

- Such private company has to put the words ‘Private Limited’ at the end of its name. For example, ABC Private Limited.

2. Company limited by guarantee:

- A private company in which the liability of members of the company is limited to the amount of guarantee given by them is called a company limited by guarantee.

- In case of liquidation of the company the members have to pay the guaranteed amount to the company.

- Such companies add the word ‘private’ at the end of company name.

3. Company with unlimited liability:

- A company in which the liability of members is unlimited is called a company by unlimited liability.

- If the debts of such companies exceed their assets or if the company goes under liquidation than the members may have to pay their contribution even by selling their personal assets.

- Such companies add the word ‘private’ at the end of company name.

(III) One person company:

- The concept of One Person Company (OPC) is a new form of private company introduced by the Companies Act, 2013. It consists of only one member (person) and so the name.

- One Person Company can enter into contract with director who is its member (i.e. the person itself as a director) through written consent of that person.

- The OPC needs to present the Memorandum and Articles before the Registrar of Companies during the incorporation of the company.

![]()

Question 29.

Explain the types of companies from the view point of domination

OR

Explain : Government company

OR

Explain: Holding company

OR

Explain subsidiary company.

Answer:

Companies from the point of view of domination:

1. Government company:

- A company whose 51 % or more capital is held by either

- Central government or

- State government or

- more than one state governments or

- Central government and one or more than one state governments is called a government company.

- For example, Ashok Hotels Limited, Bharat Heavy Electricals Limited (BHEL), Bharat Sanchar Nigam Limited (BSNL), etc. are government companies.

2. Holding company:

A company which holds more than 50% shares of another company and holds the right to appoint majority of directors of that company is called a holding company.

3. Subsidiary company:

A company whose more than 50% shares are with the holding company and the right to appoint majority of its directors also lie with the holding company is called a subsidiary company.

Types of companies with the view point of place of registration.

1. Indian company:

- A company which is registered in India under the Indian Companies Act or under the special act passed by the parliament is called an Indian company.

- An Indian company can be private company, public company or government company.

2. Foreign company:

A company which is registered outside India and whose registered office is also outside India, but whose place of business is in India is called a foreign company. For example, Vodafone.

Question 30.

The development of a company as a form of business is due to the industrial revolution. Give reason.

Answer:

- After the industrial revolution the demand of newly produced goods went up drastically. To meet these demands there arose need of setting up huge factories and very large business establishments. A very large scale production was the need of the hour.

- Due to limited capital, unlimited liability, short life of the business firm, etc. sole proprietorship and partnership forms of business were unable to set-up such large establishments.

Question 31.

Company is an artificial person created by law. Give reason.

Answer:

As per Companies Act, 1956, a company is an artificial, invisible and intangible person created by-law.

- The companies act also treats the company as a separate entity from its owners. -4 Just like any physical person, a company can behave as an individual, can own property, enter into contract, can sue another company or can also be sued.

- Owing to such human characteristics of the company it is termed as an artificial person but created by law.

Question 32.

Easy transfer of shares attracts investors. Give reason.

Answer:

Investors always look for options to invest and earn. Buying and selling shares of the company is one of the most important routes of earning for investors or say shareholders.

- The shareholders sell and purchase the shares of the company in the stock market. They can easily do so subject to the provisions of the company and the law.

- If one sees that the company is performing well he can buy its shares from the stock market. On the other hand the holder of the shares can sell them at the stock market and book his profit.

- Thus, transfer of shares via. buying and selling attracts investors.

Question 33.

Maintaining faith of shareholders is utmost important for a company. Give reason.

Answer:

- For a public company, the capital to start the company is raised from the public in the form of shares.

The company asks the public to apply for purchasing shares of the company or in simple words ‘purchasing a share’ in the company. - People buy company’s shares from stock market and become share-holders. The company then starts its business with the share capital i.e. fund raised by selling the shares.

- So a company relies on public or say investors for its establishment.

- Moreover, when a company progresses its share value increases and so share-holders earn. As a result people buy more shares and the capital of the company rises.

- Hence, to keep its capital strong and rising a company needs to perform well and maintain the faith of share-holders.

Question 34.

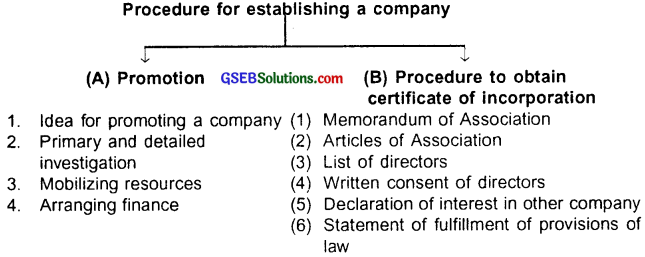

Enlist the procedure of establishing a company.

Answer:

Question 35.

Write a short note on procedure for establishing a company.

Answer:

Establishing a company can be broadly classified into:

(A) Promotion and

(B) Procedure for obtaining certificate of incorporation.

Let us understand both in detail.

(A) Promotion:

Promotion refers to the thought or idea that comes into mind for establishing a company and prepare for the same.

The person(s) or partnership firm or even a Joint stock company who executes the idea is called a promoter of the company.

Points to consider by promoter:

1. Idea of promoting the company:

The promoter first need to research and assess the need of the new company. He needs to be clear whether the new company will be established for developing and selling a new product or a service, etc. .

2. Primary and detailed investigation:

- Once the promoter gets clarity about the new product or service he wish to sell through the new company, he needs to conduct thorough primary as well as detailed investigation to test if the idea will work in the market.

- The idea is now to be tested on practical grounds with a strong business perspective. Various aspects such as selecting the right product and service for the business, profitability of the business, etc. are thoroughly investigated for successful implementation of the business.

- Initially a primary test and survey is done. Based on the results, detailed study and analysis is done is the market.

- Also, information regarding how much capital will be needed, how will it be raised, sourcing raw material, demand and market trend, equipment and machinery needed, land and human resources, transport facilities, power, water availability, etc. is gathered at in depth.

3. Mobilizing resources:

The promoter needs to mobilize i.e. start deploying human and physical resources. -» The promoters enter into contracts to obtain land, raw material, machinery, services, hire employees, etc.

4. Financial arrangement:

- The promoters need to decide how and from where they will raise the finance i.e. capital for the company.

- For example, whether they should raise their own funds or obtain it by issuing shares, obtain loan, borrow, etc.

(B) Procedure for obtaining certificate of incorporation:

Once the promotion phase is over the process of obtaining certificate of incorporation begins. A certificate of incorporation is to be obtained from the Registrar of Companies.

Following documents need to be prepared and submitted to the Registrar of Companies to obtain the certificate:

1. Memorandum of Association (MOA):

- A Memorandum of Association (MOA) is a legal document prepared during the formation and registration process of the company. MOA defines company’s relationship with shareholders.

- General public can access company’s MOA. It contains company’s name, physical address of registered office, name of share-holders, etc.

- The MOA and Articles of Association together serve as a constitution of the company. Just like a constitution describes the country, a company’s MOA and Articles of Association describe the company.

An MOA must compulsorily include the following clauses:

(A) Name clause:

- As per the name clause, a public company with liability by share needs to insert the word ‘Limited’ at the end of company name whereas a private company needs to insert the words ‘Private Limited’ at the end of its name.

- A company cannot not select a name which resembles name of other registered company in India or which can harm the national interest.

(B) Address of Registered office clause:

The company needs to mention the physical address of its registered office so that the Registrar of Companies and public can communicate with the company. Moreover, based on the address the court can decide the jurisdiction of the company.

(C) Object clause:

- Object clause is the most important clause of memorandum.

- Under this clause, the company needs to clearly mention the objective and the type of business it would conduct. It cannot conduct activities other than mentioned in this clause.

(D) Liability clause:

- Under this clause the company mentions if the liability of members is limited, unlimited or limited by guarantee.

- In case of One Person Company, the company needs to mention name of the person who will replace the original person in case of death, inability to enter into contracts, etc. of the original person.

(E) Capital clause:

Under the capital clause the company mentions the amount of share capital with which the company proposes to register and the division of capital into shares of fixed amount.

(F) Association clause:

In this clause minimum 7 members in case of a public company and minimum 2 members in case of a private company need to give a slatement along with their signatures showing their desire to establish the company.

2. Articles of Association:

- The Articles of Association is a document that contains the purpose of the company as well as the duties and responsibilities of its members.

- It also contains the rules and regulations under which the company will conduct its administration.

- Rights of members, share installment, share forfeiture, powers of Board of Directors, etc.

- Both the documents i.e. Memorandum of Association and Articles of Association become public documents after they get registered.

3. List of directors:

- The company needs to provide and register the list of persons who wish to work as directors to the Registrar of Companies.

- The list contains name of persons, address, age, sex, occupation, nationality, etc.

- The company must compulsorily include one female director in its Board of Directors.

4. Written consent of directors:

People whose name is mentioned as directors in the company need to give a written consent that they wish to work with the company on their own will.

5. Declaration of interest in other companies:

If the directors of company, managers, secretary or subscribers have interest in any other company, firms, etc, then they need to disclose it by filing a statement.

6. Statement of fulfillment of provisions of law:

- Once the company fulfills all the legal provisions discussed so far it needs to prepare a statement in the prescribed format and register it before the Registrar of Companies stating that the company has fulfilled all the legal provisions needed for incorporating a company.

- On completing all the procedures and documents the Registrar of Companies after verification and thorough investigation issues certificate of incorporation and Corporate Identification Number (CIN) to the company. The date of issue of this certificate becomes the date of establishment of company.

Question 36.

Explain how the Registrar of Companies issues the certificate of incorporation to the company after the company has finished all the procedures and furnished all the documents.

Answer:

- The company needs to submit all the documents as required by the provision of law at the office of Registrar of Companies.

- The Registrar office investigates all the documents. If it finds all the documents proper, it records the name of the company in the book of companies.

- The registrar then issues ‘a certificate of incorporation’. The date mentioned in the certificate of incorporation becomes the date of foundation of the company.

- The Registrar of companies also issues Corporate Identification Number (CIN) to the company. The CIN works as a unique identification code for the companies. The CIN is mentioned on the certificate of incorporation.

- The company needs to preserve all the original documents and statement of information at its registered office as long as the company exists.

- Once this procedure is over the private company can immediately start the business. In case of a public company, it can allot the shares after fulfilling the condition of minimum subscription by issuing a prospectus.

![]()

Question 37.

How a promoter does the promotion?

Answer:

Promotion:

Promotion refers to the thought or idea that comes into mind for establishing a company and prepare for the same.

The person(s) or partnership firm or even a Joint stock company who executes the idea is called a promoter of the company.

Points to consider by promoter:

1. Idea of promoting the company:

The promoter first need to research and assess the need of the new company. He needs to be clear whether the new company will be established for developing and selling a new product or a service, etc.

2. Primary and detailed investigation:

- Once the promoter gets clarity about the new product or service he wish to sell through the new company, he needs to conduct thorough primary as well as detailed investigation to test if the idea will work in the market.

The idea is now to be tested on practical grounds with a strong business perspective. Various aspects such as selecting the right product and service for the business, profitability of the business, etc. are thoroughly investigated for successful implementation of the business. - Initially a primary test and survey is done. Based on the results, detailed study and analysis is done is the market.

- Also, information regarding how much capital will be needed, how will it be raised, sourcing raw material, demand and market trend, equipment and machinery needed, land and human resources, transport facilities, power, water availability, etc. is gathered at in depth.

3. Mobilizing resources:

- The promoter needs to mobilize i.e. start deploying human and physical resources.

- The promoters enter into contracts to obtain land, raw material, machinery, services, hire employees, etc.

4. Financial arrangement:

- The promoters need to decide how and from where they will raise the finance i.e. capital for the company.

- For example, whether they should raise their own funds or obtain it by issuing shares, obtain loan, borrow, etc.

Question 38.

What is Memorandum? Explain.

Answer:

Memorandum of Association (MOA):

- A Memorandum of Association (MOA) is a legal document prepared during the formation and registration process of the company. MOA defines company’s relationship with shareholders.

- General public can access company’s MOA. It contains company’s name, physical address of registered office, name of share-holders, etc.

- The MOA and Articles of Association together serve as a constitution of the company. Just like a constitution describes the country, a company’s MOA and Articles of Association describe the company.

Question 39.

State and explain the various clauses included in MOA?

Answer:

Memorandum of Association (MOA):

- A Memorandum of Association (MOA) is a legal document prepared during the formation and registration process of the company. MOA defines company’s relationship with shareholders.

- General public can access company’s MOA. It contains company’s name, physical address of registered office, name of share-holders, etc.

- The MOA and Articles of Association together serve as a constitution of the company. Just like a constitution describes the country, a company’s MOA and Articles of Association describe the company.

An MOA must compulsorily include the following clauses:

(A) Name clause:

- As per the name clause, a public company with liability by share needs to insert the word ‘Limited’ at the end of company name whereas a private company needs to insert the words ‘Private Limited’ at the end of its name.

- A company cannot not select a name which resembles name of other registered company in India or which can harm the national interest.

(B) Address of Registered office clause:

The company needs to mention the physical address of its registered office so that the Registrar of Companies and public can communicate with the company. Moreover, based on the address the court can decide the jurisdiction of the company.

(C) Object clause:

- Object clause is the most important clause of memorandum.

- Under this clause, the company needs to clearly mention the objective and the type of business it would conduct. It cannot conduct activities other than mentioned in this clause.

(D) Liability clause:

- Under this clause the company mentions if the liability of members is limited, unlimited or limited by guarantee.

- In case of One Person Company, the company needs to mention name of the person who will replace the original person in case of death, inability to enter into contracts, etc. of the original person.

(E) Capital clause:

Under the capital clause the company mentions the amount of share capital with which the company proposes to register and the division of capital into shares of fixed amount.

(F) Association clause:

In this clause minimum 7 members in case of a public company and minimum 2 members in case of a private company need to give a statement along with their signatures showing their desire to establish the company.

![]()

Question 40.

Establishing a company is extremely lengthy and costly procedure. Give reason.

Answer:

A promoter of the company who wish to establish or say promote a company needs to pass through several lengthy and legal processes.

- He needs to first understand the need of the product/service he wishes to sell through the new company. For this he conducts thorough investigation, research, seeks advice from industry experts and prepares its feasibility Then he does a thorough study of managing resources such as raising capital, raw material, availability of land, power, water and electricity etc.

- He enters into contracts for purchasing land, raw material, machinery, hiring employees, etc.

- Once these things are done he prepares MOA and Articles of Association, prepare a list of directors and take their written consent.

- Finally, the promoter completes all the procedures and submits all these documents along with fees to the Registrar of Companies to obtain the certificate.

- Owing to so many procedures, tasks and preparing and furnishing documents ‘ the incorporation of a company become quite lengthy, complex and costly.

Question 41.

Memorandum and Articles of Association are the constitution of a company. Give reason.

Answer:

A Memorandum of Association (MOA) is a legal document prepared during the formation and registration process of the company. MOA defines company’s relationship with share-holders.

- General public can access company’s MOA. It contains company’s name, physical address of registered office, name of share-holders, etc.

- The Articles of Association is a document that contains the purpose of the company as well as the duties and responsibilities of its members.

- It also contains the rules and regulations under which the company will conduct it’s administration.

- Rights of members, share installment, share forfeiture, powers of Board of Directors, etc.

- Both the documents i.e. Memorandum of Association and Articles of Association become public documents after they get registered.

Both these documents together give all the information about the type of company, how will it function, liability of members, rights and duties, etc. These documents serve the same purpose for a company that a country’s constitution does for the country - Hence, Memorandum of Association and Articles of Association together can be termed as the constitution of a company maximum 200 for a private company.

Question 42.

Differentiate between partnership firm and company.

Answer:

| Points of difference | Partnership firm | Company |

| 1. Process of establishing | Easy establishment. Registration is voluntary. It does not have a separate legal entity. | Lengthy and complicated establishment process. Registration is compulsory. It has a separate legal |

| 2. Number of members | Minimum 2 members and maximum 10 for a banking firm and maximum 20 for any other firm. | Minimum 7 members and maximum unlimited members for a public company. Minimum 2 and maximum 200 for a private company. |

| 3. Capital | Can raise less capital. | Can raise very large capital. |

| 4. Transfer of part or interest | Partner cannot transfer his part or interest without consent of other partners. | In a public company, members can freely and easily transfer their shares. In a private company there are certain restrictions for transfer. |

| 5. Liability | Partners have unlimited liability. | Members i.e. shareholders are liable only upto the face value of number of shares they hold. |

| 6. Management | Partners themselves manage the firm. | Share-holders elect directors through voting who then manage the company. |

| 7. Life | The partnership dissolves in case a partner dies, wishes to quit, becomes insane, or becomes insolvent. Thus, life of partnership firm is short. | Existence of company does not come to an end in case of death, insolvency or insanity of member. Thus, life of a company is almost perpetual. |

| 8. Maintaining secrets | The partners can maintain business secrets among themselves. | Difficult to maintain secrets. |

| 9. Flexibility | Partnership firm is quite flexible. | Company is not as flexible as a partnership firm. |

| 10. Personal contact | Partners can maintain direct contact with employees and customers. | This is not possible in company (Though it is possible in small private companies.) |

| 11. Winding-up | A partnership firm can wind up easily as per the contact or situations either with the help of law or consent of partners. | It is quite a lengthy and legal process to wind-up a company. It can be done only using lawful procedures. |

Multiple Choice Questions

Question 1.

Which of the following does not aims at profit?

(A) Company

(B) Co-operative society

(C) Sole proprietorship

(D) Partnership

Answer:

(B) Co-operative society

Question 2.

‘Each for all and all for each’ is the mantra of

(A) Co-operative society

(B) Public company

(C) Partnership firm

(D) OPC

Answer:

(A) Co-operative society

Question 3.

The primary objective of a co-operative society is

(A) Compete against profit hungry businesses

(B) Economic upliftment of members

(C) Prevent members from exploitation by businessman

(D) All of these

Answer:

(B) Economic upliftment of members

![]()

Question 4.

On what basis do people join in a co-operative society?

(A) Save themselves from exploitation

(B) Feeling of co-operation

(C) Earn profit

(D) Equality

Answer:

(D) Equality

Question 5.

In which form of business members may be discriminated on the basis of the capital they invest?

(A) Partnership

(B) Co-operative society

(C) Private Ltd. Company

(D) Both (A) and (C)

Answer:

(D) Both (A) and (C)

Question 6.

In a co-operative society importance is given to ____

(A) Capital

(B) Person

(C) Contribution in work

(D) Attitude and approach

Answer:

(B) Person

Question 7.

A co-operative society can be called as

(A) Engine of economic growth

(B) Institute of humanity

(C) Training school of democracy

(D) Pillar of villagers

Answer:

(C) Training school of democracy

Question 8.

Aim of consumer’s co-operative society is to

(A) Provide good quality goods at fair prices

(B) Inculcate consumer awareness

(C) Save consumers from exploitation

(D) Produce consumer goods

Answer:

(A) Provide good quality goods at fair prices

Question 9.

The excess profit of a co-operative society is distributed as

(A) Bonus

(B) Shares

(C) Divided

(D) Capital gain

Answer:

(C) Divided

Question 10.

With respect to shares the biggest advantage of a co-operative society is

(A) Easy transfer

(B) Low price

(C) Easy availability

(D) High dividends

Answer:

(B) Low price

Question 11.

Conference and training classes are held to promote brotherhood and knowledge in ____

(A) Public company

(B) Private company

(C) Co-operative society

(D) Partnership firm

Answer:

(C) Co-operative society

Question 12.

in which form of business there is no restriction on maximum number of members?

(A) Co-operative society

(B) Partnership

(C) Public company

(D) Both (A) and (C)

Answer:

(D) Both (A) and (C)

Question 13.

Death, insolvency or resignation of a member does not affect

(A) Partnership firm

(B) Co-operative society

(C) Public company

(D) Both (B) and (C)

Answer:

(D) Both (B) and (C)

![]()

Question 14.

In which form of business there are maximum chance of getting grant and subsidies?

(A) Public company

(B) Sole proprietorship

(C) Private company

(D) Co-operative society

Answer:

(D) Co-operative society

Question 15.

A co-operative society can get the advantage of

(A) Large capital

(B) Honorary service

(C) Easy transfer of shares

(D) Flexible management

Answer:

(B) Honorary service

Question 16.

The management of a co-operative society is

(A) Quite economical

(B) Extremely professional

(C) Highly trained

(D) Very co-operative

Answer:

(A) Quite economical

Question 17.

In which industry has co-operative society not progressed?

(A) Sugar

(B) Cotton

(C) Leather

(D) Iron

Answer:

(D) Iron

Question 18.

In which form of business can political party interfere ?

(A) Co-operative society

(B) Private limited company

(C) Partnership

(D) All of these

Answer:

(A) Co-operative society

Question 19.

Which of the following cannot raise a very large capital?

(A) Partnership

(B) Proprietorship

(C) Co-operative society

(D) All of these

Answer:

(D) All of these

Question 20.

Unlimited liability is a characteristic of ____

(A) Co-operative society

(B) Public company

(C) Partnership

(D) Private company

Answer:

(C) Partnership

Question 21.

We can call all forms of joint stock companies in short as

(A) Company

(B) Private company

(C) Public company

(D) All of these

Answer:

(A) Company

Question 22.

The need of which form of business was felt after the industrial revolution?

(A) Partnership firm

(B) Company

(C) Sole proprietorship

(D) Co-operative society

Answer:

(B) Company

Question 23.

Is considered as an artificial person.

(A) Company

(B) Co-operative society

(C) Proprietorship

(D) Partnership

Answer:

(A) Company

Question 24.

What cannot be true for a company?

(A) Unity of ownership and management

(B) Cannot be sued

(C) Cannot enter into contract

(D) Cannot buy property

Answer:

(A) Unity of ownership and management

Question 25.

Which form of business can be brought to end only through liquidation process?

(A) Partnership

(B) Joint Stock company

(C) Proprietorship

(D) Both (B) and (C)

Answer:

(B) Joint Stock company

![]()

Question 26.

With respect to capital is an important characteristic of a company.

(A) Raised by all partners

(B) Division in small fractions

(C) Only raised by proprietor

(D) Mandatory government contribution

Answer:

(B) Division in small fractions

Question 27.

A company cannot provide consent to any contract unless

(A) It has a common seal

(B) It is mentioned in Memorandum

(C) It is attached with Articles of Association

(D) All of these

Answer:

(A) It has a common seal

Question 28.

The Board of Directors manage as per the

(A) Memorandum of Association

(B) Common seal

(C) Articles of Association

(D) Both (A) and (C)

Answer:

(D) Both (A) and (C)

Question 29.

Which form of business is managed by Board of Directors?

(A) Joint stock company

(B) OPC

(C) Partnership firm

(D) Both (A) and (B)

Answer:

(A) Joint stock company

Question 30.

In a company, a member

(A) Can enter into a contract with company

(B) Cannot enter into contract on behalf of company

(C) Both (A) and (B)

(D) None of these

Answer:

(C) Both (A) and (B)

Question 31.

A private company must have minimum ____ members.

(A) 2

(B) 10

(C) 3

(D) 7

Answer:

(A) 2

Question 32.

There can be maximum ____ members in a private company.

(A) 2

(B) 10

(C) 200

(D) Unlimited

Answer:

(C) 200

Question 33.

A public limited company should have minimum members.

(A) 2

(B) 3

(C) 7

(D) 10

Answer:

(C) 7

Question 34.

Unlimited liability is rarely seen in

(A) Partnership firm

(B) Public company

(C) Proprietorship

(D) HUF

Answer:

(B) Public company

Question 35.

A company must specify the liability of members in

(A) Articles of Association

(B) Memorandum of Association

(C) General meeting

(D) Both (A) and (B)

Answer:

(B) Memorandum of Association

Question 36.

Though company is treated as a person, it cannot

(A) Be considered a citizen

(B) Have fundamental rights

(C) Cannot buy property

(D) Both (A) and (B)

Answer:

(D) Both (A) and (B)

Question 37.

Voting right per share is a very important characteristics of ____

(A) HUF

(B) Co-operative society

(C) Partnership

(D) Company

Answer:

(D) Company

Question 38.

A person can buy and sell shares of a company from ____

(A) Stock exchange

(B) The company

(C) Bank

(D) All of these

Answer:

(A) Stock exchange

![]()

Question 39.

Generally, which of the following form can pay highest tax to the government?

(A) HUF

(B) Public company

(C) Co-operative society

(D) All of these

Answer:

(B) Public company

Question 40.

Formation of which form of business is easiest?

(A) Company

(B) Co-operative society

(C) Proprietorship

(D) Partnership

Answer:

(C) Proprietorship

Question 41.

In which form of business there are very high chances of paying fees to experts for setting up the business?

(A) HUF

(B) Partnership

(C) Company

(D) Co-operative society

Answer:

(C) Company

Question 42.

Who keeps a close watch on companies?

(A) SEBI

(B) TRAI

(C) RBI

(D) IRDA

Answer:

(A) SEBI

Question 43.

Which form of business can speculate in stock-exchange?

(A) HUF

(B) Company

(C) Co-operative society

(D) All of these

Answer:

(B) Company

Question 44.

Into how many types can we broadly classify a company?

(A) 3

(B) 4

(C) 6

(D) 5

Answer:

(B) 4

Question 45.

Which form of company comes into existence by special law of parliament?

(A) Subsidiary company

(B) Foreign company

(C) Statutory company

(D) Holding company

Answer:

(C) Statutory company

Question 46.

In company limited by guarantee the liability of members is ____

(A) Upto the face values of shares purchased

(B) Upto the amount guaranteed by member

(C) Unlimited

(D) Unlimited as guaranteed

Answer:

(B) Upto the amount guaranteed by member

Question 47.

From the view point of liability, there are types of companies.

(A) 2

(B) 3

(C) 4

(D) 7

Answer:

(B) 3

Question 48.

The provisions of OPC were made in ____

(A) Companies Act, 1956

(B) Companies Act, 1967

(C) Companies Act, 2001

(D) Companies Act, 2013

Answer:

(D) Companies Act, 2013

Question 49.

In order to be a government company the government should hold minimum ____ % capital.

(A) 39%

(B) 51%

(C) 27%

(D) 100%

Answer:

(B) 51%

Question 50.

Which of the following is not a ____government company?

(A) BHEL

(B) Ashok Hotels Limited

(C) MTNL

(D) Taj Group Limited

Answer:

(D) Taj Group Limited

![]()

Question 51.

Which of the following possess the right to appoint majority of directors of another company?

(A) Holding company

(B) Government company

(C) Subsidiary company

(D) Both (B) and (C)

Answer:

(A) Holding company

Question 52.

A promoter can be ____

(A) A company

(B) A partnership firm

(C) An individual

(D) Any of these

Answer:

(D) Any of these

Question 53.

Which clause is not compulsory in MOA?

(A) Object clause

(B) Capital clause

(C) Association clause

(D) Loan clause

Answer:

(D) Loan clause

Question 54.

Articles of Association determines ____

(A) Rules of internal administration

(B) Structure of company

(C) Capital, borrowings and liability

(D) All of these

Answer:

(A) Rules of internal administration

Question 55.

Which document can people access after registration of a company?

(A) Articles of Association

(B) Memorandum of Association

(C) Declaration of interest

(D) Both (A) and (C)

Answer:

(D) Both (A) and (C)

Question 56.

Full form of CIN is ____

(A) Company Index Number

(B) Corporate Identification Number

(C) Corporation Indentification Number

(D) Company Identification Number

Answer:

(B) Corporate Identification Number