Gujarat Board GSEB Class 11 Organization of Commerce and Management Important Questions Chapter 8 Sources of Business Finance Important Questions and Answers.

GSEB Class 11 Organization of Commerce and Management Important Questions Chapter 8 Sources of Business Finance

Short Answer Type Questions

Question 1.

State the meaning of capital in terms of commerce.

Answer:

Funds raised to satisfy various financial needs of the business is called capital.

Question 2.

What does capital includes?

Capital includes owner’s invested capital and borrowed capital.

Question 3.

State few points where a business would need finance.

Answer:

[For establishing business, purchasing current and fixed assets, modernization and expansion, of business, etc.

Question 4.

What are fixed assets?

Answer:

Assets such as land, building, furniture, machinery, etc. which are purchased for long¬term business use and are not likely to be converted quickly into cash are called fixed assets

Question 5.

What are current assets (or working capital)?

Answer:

The capital required to meet short term expenses such as salaries and wages, utility bills, purchasing raw material, etc. form working capital or say current assets.

Question 6.

Into which major types can a business capital be classified?

Answer:

Into two types;

- Owner’s funds and

- Borrowed fund.

Question 7.

Name the major sources of owner’s funds.

Answer:

- Equity shares,

- Preference shares and

- Retained earnings or ploughing back profits.

![]()

Question 8.

State the forms of equity shares.

Answer:

- Ordinary equity shares

- Sweat equity shares

- Equity shares with voting rights and

- Equity shares with different rights in relation to dividend and having different voting rights.

Question 9.

Define share capital.

Answer:

The part of capital that a company raises by issuing shares is called share capital.

Question 10.

What is an equity share or ordinary share?

Answer:

An equity share, commonly known as ordinary share represents the fractional or part ownership of the person i.e. share holder in the company. Equity shares have the right to obtain dividend (i.e. earn income) as per company’s laws and right to claim repayment , of share value after the company has made all its payments.

Question 11.

State three characteristics of equity shares.

Answer:

- Share-holders are called true owners,

- They have a right to claim dividend and right to vote,

- They can attend general . meetings of the company.

Question 12.

Why equity share holders are called true owners of the company.

Answer:

Equity share holders take a very high risk by investing in equity. They are not sure whether they will get dividend or not or how much will they get, the prices of shares may go down anytime. Moreover, during liquidation they are the last to receive their capital back. Hence

Question 13.

On what basis does the company distributes the dividend?

Answer:

A company earning higher profit may distribute higher dividend and that making lesser profit or loss may distribute lesser

dividend or may not distribute at all.

Question 14.

How do share-holders receive their capital back from the company?

Answer:

Share capital is not repaid to the share-holders as long as the company exists. If the company winds up it returns the share capital after paying off all its business debts. That too if company has money.

Question 15.

What is share qualification?

Answer:

The number of shares that a person should hold to become the director of the company are called qualifying shares. Details of qualifying shares are mentioned in company’s Articles.]

Question 16.

What type of capital gains (benefits) can share-holders obtain?

Answer:

Share-holders can earn dividend, may get bonus shares and sell shares and earn profit.

Question 17.

Where can investors trade shares?

Answer:

Investors can buy-sell shares in the recognized stock-exchange where they are registered.

Question 18.

How is share capital obtained?

Answer:

The company first estimates the total capital it needs to raise through share capital. Then it divides the figure of share capital in small parts called ‘shares’. It then invites public to subscribe for these shares against the set price

Question 19.

Give an example of raising share capital.

Answer:

Suppose a company needs ₹ 1,00,00,000 (₹ 1 crore) as capital from shares. The company divides this amount into 10 lakh shares of ₹ 10 each. This means that the price of one share, (part) of this company is ₹ 10 and the share capital is divided into 1 lakh shares.

Question 20.

Why preference shares not very risky?

Answer:

The risk is quite less in preference shares because holders of these shares are first paid their capital back during liquidation of company.

![]()

Question 21.

What is retained profit or ploughing back profits?

Answer:

[In good times of business a company makes quite good profits. In such times instead of distributing the entire profit as dividend company saves i.e. retains some part of profit for future business needs. This is profit or ploughing back profits.

Question 22.

State two advantages of ploughing back profits?

Answer:

[Retained earnings can be useful in recession, implementation of future plans, purchasing new assets, etc.

Question 23.

How can retained profit help in removing burden from assets?

Answer:

[If the businessman borrows money from financial institutions like banks it has to mortgage its assets. If the business can retain its profit it can keep its assets free of burden of mortgage.

Question 24.

How can a fixed dividend policy formed company?

Answer:

By retaining profits a company can prepare due to retained profit help a a stable policy to distribute dividends. This will keep the share-holders happy and motivated to re-invest in the company.

Question 25.

What is cost of capital?

Answer:

When money is borrowed from banks or other financial institutions one needs to pay interest on it. The interest paid can be termed as the ‘cost of capital’.

Question 26.

How retained profit help a company to decrease its cost of capital?

Answer:

If a company has retained profit it may not need to borrow capital from financial institutions and can save itself from paying interest. This is how company can reduce its cost of capital.

Question 27.

How does retained profit encourage monopoly?

Answer:

When a company retains its profit too much it becomes economically quite strong. If can then dominate the market by over-stocking very large amount of raw material, forcing vendors and suppliers to follow company’s policies, ask them to create artificial scarcity etc. and hence create monopoly.

Question 28.

Why retained profit may not be beneficial for small investors?

Answer:

Small investors invest in company’s shares with an aim of earning high dividends. When directors retain more earnings than necessary or speculates small investors cannot earn dividends or earn very less dividends and hence they are in loss. Also, small investors may become victim of speculation done by directors through retained profit.

Question 29.

What is debenture?

Answer:

A debenture is a certificate issued by a company to public in order to obtain public money as loan. It is issued to public just like shares.

Question 30.

Why debenture holders are called creditors of the company?

Answer:

Since the amount of debenture is considered as loan debenture is a debt of the company and the debenture holders are the creditors of the company.

Question 31.

What are debenture holders paid?

Answer:

Fixed rate of interest decided by the company.

Question 32.

What is fixed charge (burden) on assets?

Answer:

A company mortgages assets as security to obtain capital through debentures. The company needs to pay interest on debentures to the debenture holders. This interest is considered as a ‘fixed charge on the assets’ or say on the profits. This means that the company has to pay this charge even if it makes no profit.

Question 33.

State the types of debentures.

Answer:

- Secured debentures

- Convertible debentures and

- Non-convertible debentures.

Question 34.

What is secured debentures?

Answer:

Debentures that are secured against company’s assets are called secured debentures.

Question 35.

What are non-convertible debentures?

Answer:

Debentures that are not converted into shares and whose money is returned to the debentures holders as per specific conditions and time frame are called non-convertible debentures.

Question 36.

What is a bond?

Answer:

A debt instrument issued for a period of more than one year with the objective of raising borrowed capital is called a bond.

Question 37.

Who can issue bonds?

Answer:

Companies, government and municipal corporations.

Question 38.

How are bonds named?

Answer:

Bonds are named based on the projects they are raised for. For example, Sardar Sarovar Bond was named for raising the capital for Sardar Sarovar dam project.

![]()

Question 39.

What is public deposits?

Answer:

When a company accepts deposits of about 6 months to 36 months from public to satisfy its short-term financial need such as working capital, the amount it receives is called public deposits.

Question 40.

Why public deposits is called unsecured debts? OR Why investors feet unsecured in public deposits?

Answer:

Company does not give underwriting like in case of shares and debentures and so investor consider it as risk and feels insecure. Hence, public deposits are also called unsecured debts.

Question 41.

Why public deposits is called fair weather friends?

Answer:

When the company is under financial crisis and if such news or rumors gets spread in the market then depositors rush to company to withdraw their money even before the maturity date. This creates financial problems for the company and so…

Question 42.

Why raising public deposits difficult for new and weak companies?

Answer:

Investors feel insecure in trusting new and financially weak companies. So

Question 43.

State two functions (or forms of capital assistance) of financial institutions?

Answer:

- Provides loan

- Provides finance by buying shares of company

- Provides guarantee, etc.

Question 44.

How do financial institutions provide help in payment of technological services?

Answer:

A company planning for establishing or obtaining technological infrastructure and services can tie up with financial institutions and ask them to pay directly to the technology service provider’s on behalf of the company.

Question 45.

What is trade credit?

Answer:

When a businessman buys raw material, finished goods etc. from procedures or traders and pays after a pre-decided time he is said to have obtained trade credit.

Question 46.

What is inter-corporate deposit?

Answer:

When a company having surplus funds deposits a part or whole in another company it is called inter-corporate deposit.

Long Answer Type Questions

Question 1.

How did the need of business finance arise?

Answer:

- After industrial revolution the demand of newly produced goods went up drastically. To meet these demands there arose the need of setting up huge factories and very large business establishments. Also, mechanization and scientific inventions led to large scale production.

- To meet the high production and large establishment challenges a large amount of capital was needed. It was practically impossible for individuals or partnership firms to arrange such huge capital. These situations gave rise to the need of sourcing money through organized methods of business finance.

Question 2.

What are current assets? How can one raise capital for current assets?

Answer:

For current assets:

- Once a business is set up it requires working capital i.e. capital to manage daily expenses. These expenses include salaries and wages, various utility bills, purchasing raw material, production and transportation charges, etc.

- Working capital can be either raised by oneself or even borrowed as loan from banks or other sources.

Question 3.

Explain the need of capital with respect to modernization and expansion of business.

Answer:

For modernization and expansion of business:

Scientific inventions and technology upgradations take place constantly across the world. This leads to faster production of newer products and quality enhancement. A businessman needs to keep pace with these changes so that he can maintain and expand his business. For this, he may have to invest in modern equipment and machineries and production methods.

Question 4.

Explain the importance of finance in business.

Answer:

Importance of finance in business:

- Capital to the business is blood to the body. The way blood runs the entire body, capital runs the entire business.

- Capital is needed to establish the business, raise fixed and current assets and for modernization and expansion.

- One also needs an efficient financial management so that right amount of capital is available to business as and when required.

- A well planned and optimum use of capital is must to keep going the business activities smoothly and efficiently.

- Deficiency of capital can pose several problems to the business. The credit of business may go down if one is unable to make payment on time.

- The businessman may also lose opportunity of cash discounts or early payment discounts, purchasing raw materials when they are cheaper, etc.

Question 5.

Explain share capital or say owner’s capital as source of owner’s funds form of business finance.

Answer:

Share capital/owner’s capital investment:

The capital raised by issuing shares to the public is called share capital.

Equity share:

- Share capital is one of the leading sources of raising capital for the business. The company first estimates the share capital fund it needs to set up and run the business.

- If then divides the amount of capital in small parts which are called shares. It sells these shares to public and raise the funds.

- The shares can be mainly of two types namely (i) Equity shares and (ii) Preference shares.

Example:

Suppose a company needs ₹ 1,00,00,000 (₹ 1 crore) as capital from shares. The company divides this amount into 10 lakh shares of ₹ 10 each. This means that the price of one share (part) of this company is ₹ 10 and the share capital is divided into 1 lakh shares.

![]()

Question 6.

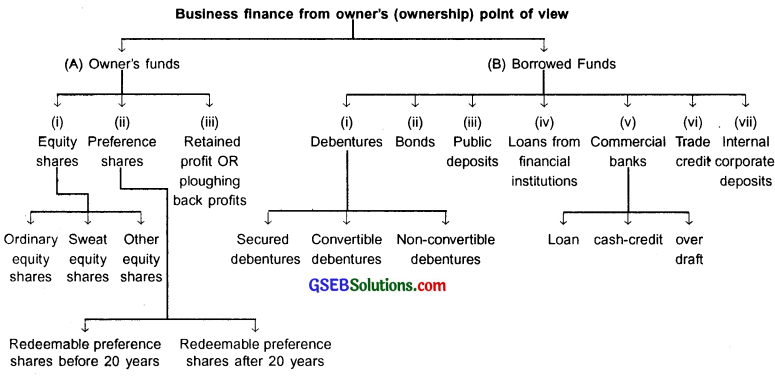

Classify with the help of chart the various sources (forms) of business finance from the ownership point of view.

Answer:

Question 7.

Explain various types of equity shares.

Answer:

Types of equity shares:

1. Ordinary equity share:

- An equity share, commonly known as ordinary share represents the fractional or part ownership of the person i.e. share holder in the company. Equity shares have the right to obtain dividend (i.e. earn income) as per company’s laws and right to claim repayment of share value after the company has made all its payments.

- These shares are very important for a company. A company needs to compulsorily issue equity shares if it wants to raise share capital.

- Ordinary shares are issued by the promoters based on .their short-term, medium-term and long-term capital requirements.

- The promoters divide the total capital needed into small parts known as ‘shares’ and invites public to buy them. Buyers of these shares after buying are called investors or share-holders.

- Investors purchasing these shares are considered to be the true owners of the company. Only these share-holders bear the real risk of the company. They know that they may or may not get dividend and also that the amount of dividend will never be fix.

- These share-holders also known that if the company becomes insolvent and has to undergo liquidation than they will be the last ones to receive their capital back after the company pays off all its business debts and also pay capital invested by preference share-holders.

2. Sweat equity shares:

Equity shares issued by a company to its directors or employees at a discounted price or for consideration other than cash for their specialized knowledge and skills that they provide to the company are known as sweat equity shares.

3. Other equity shares:

These shares includes,

(a) Equity shares with voting rights

(b) Equity shares with different rights in relation dividend and having different voting rights.

Question 8.

What do you mean by ordinary equity shares? Explain.

Answer:

Ordinary equity share:

- An equity share, commonly known as ordinary share represents the fractional or part ownership of the person i.e. share holder in the company. Equity shares have the right to obtain dividend (i.e. earn income) as per company’s laws and right to claim repayment of share value after the company has made all its payments.

- These shares are very important for a company. A company needs to compulsorily issue equity shares if it wants to raise share capital.

- Ordinary shares are issued by the promoters based on .their short-term, medium-term and long-term capital requirements.

- The promoters divide the total capital needed into small parts known as ‘shares’ and invites public to buy them. Buyers of these shares after buying are called investors or share-holders.

- Investors purchasing these shares are considered to be the true owners of the company. Only these share-holders bear the real risk of the company. They know that they may or may not get dividend and also that the amount of dividend will never be fix.

- These share-holders also known that if the company becomes insolvent and has to undergo liquidation than they will be the last ones to receive their capital back after the company pays off all its business debts and also pay capital invested by preference share-holders.

Question 9.

How does ploughing back of profit leads to speculation? OR Ploughing profits works as a catalyst for speculation. Give reason.

Answer:

Promotes speculation:

At times the directors of the company may distribute very less dividends and put the excess profits in company’s reserve.

- This would led people believe that company is not doing well and so price of company’s share would decrease.

- The directors would then buy lots of shares in low prices and later announce high dividends.

- Higher dividends would again lure investors and they will start buying the shares. At that time the directors would sell their shares and make huge personal profits out of difference they get in the share trading.

Question 18.

How retaining profit leads to evil of monopoly?

Answer:

Encourages monopoly:

When a company retains its profit too much it becomes economically quite strong. If can then dominate the market by over stocking very large amount of raw material, forcing vendors and suppliers to follow company’s policies, ask them to create artificial scarcity etc. and hence create monopoly

![]()

Question 10.

What is debenture? State its characteristics.

Answer:

Debentures:

- A debenture is a certificate issued by a company to public in order to obtain public money as loan.

- The way a company invites public to buy shares it can ask public to buy debentures.

- The basic difference between a share and a debenture is that a share-holder becomes the part owner of the company whereas a debenture holder becomes creditor of the company from whom the company has taken the money as loan.

- Debentures are issued when company is in need of additional capital but does not want to issue shares. The total capital needed is divided into small parts i.e. debentures and then public is invited to subscribe for them.

- Debenture is a liability to the company. Buyers of debentures become creditors of the company. The company needs to pay them interest at pre-decided rates and period. At the end of the pre-decided time frame the company as per conditions returns the entire money to the debenture holders or convert the money equal to the share value and gives shares to the debenture holders.

- Issuing debentures is a good medium-term as well as long-term nnance option for the company.

- When a company issues debentures it appoints trustees who work for protecting the interests of debenture holders as per the Trust Deed.

Characteristics:

- Creditors of company: Since the amount of debenture is considered as loan debenture is a debt of the company and the debenture holders are the creditors of the company.

- Fixed rate of interest: Debenture holders are paid interest at fixed-rate at a pre-decided time.

- Fixed burden and charge on asset: A Company mortgages assets as security to obtain capital through debentures.

- The company needs to pay interest on debentures to the debenture holders. This interest is considered as a ‘fixed charge on the assets’ or say on the profits. This means that the company has to pay this charge even if it makes no profit. Moreover, company cannot raise loan on such assets unless it fully pays up capital borrowed from debentures. However, it can use the assets.

- Satisfy need: Debenture is a useful tool to satisfy the needs of medium term and long-term finance.

- Registration at stock-exchange: If the debentures are listed at stock-exchange, one can trade them just like shares.

- Repayment: At the end of the duration, the company returns the debenture money to debenture holders either all at once or in installments as per the pre-decided conditions.

- First preference for payment: Since debentures are debt of the company the debenture holders get the preference to receive the money before the share-holders at the time of dissolution of the company.

Question 11.

Explain debentures in detail.

Answer:

Debentures:

- A debenture is a certificate issued by a company to public in order to obtain public money as loan.

- The way a company invites public to buy shares it can ask public to buy debentures.

- The basic difference between a share and a debenture is that a share-holder becomes the part owner of the company whereas a debenture holder becomes creditor of the company from whom the company has taken the money as loan.

- Debentures are issued when company is in need of additional capital but does not want to issue shares. The total capital needed is divided into small parts i.e. debentures and then public is invited to subscribe for them.

- Debenture is a liability to the company. Buyers of debentures become creditors of the company. The company needs to pay them interest at pre-decided rates and period. At the end of the pre-decided time frame the company as per conditions returns the entire money to the debenture holders or convert the money equal to the share value and gives shares to the debenture holders.

- Issuing debentures is a good medium-term as well as long-term nnance option for the company.

- When a company issues debentures it appoints trustees who work for protecting the interests of debenture holders as per the Trust Deed.

Question 12.

Debentures come with a fixed charge and burden on assets. Give reason.

Answer:

Fixed burden and charge on asset:

A Company mortgages assets as security to obtain capital through debentures. -» The company needs to pay interest on debentures to the debenture holders. This interest is considered as a ‘fixed charge on the assets’ or say on the profits. This means that the company has to pay this charge even if it makes no profit. Moreover, company cannot raise loan on such assets unless it fully pays up capital borrowed from debentures. However, it can use the assets.

Question 13.

State and explain the types of debentures.

Answer:

Types of debentures:

1. Secured debentures:

Debentures that are secured against company’s assets are called secured debentures. This means that at the time of dissolution if the company does not . have sufficient funds to repay the debentures than it will sell the mortgaged assets to repay. These assets carry floating charge when mortgaged.

2. Convertible debentures:

- If a company has announced that after a specific time debentures will be converted fully or partly into equity shares then such debentures are known as convertible debentures.

- If the company has made a provision of converting debentures in its Memorandum of Association then the company would give equity shares against the debentures in a pre-decide ratio.

3. Non-convertible debentures:

Debentures that are not converted into shares and whose money is returned to the debenture holders as per specific conditions and time frame are called non-convertible debentures.

Question 14.

What do you mean by secured debentures? Explain.

Answer:

Secured debentures:

Debentures that are secured against company’s assets are called secured debentures. This means that at the time of dissolution if the company does not . have sufficient funds to repay the debentures than it will sell the mortgaged assets to repay. These assets carry floating charge when mortgaged

Question 15.

Explain convertible debenture.

Answer:

Convertible debentures:

- If a company has announced that after a specific time debentures will be converted fully or partly into equity shares then such debentures are known as convertible debentures.

- If the company has made a provision of converting debentures in its Memorandum of Association then the company would give equity shares against the debentures in a pre-decide ratio.

Question 16.

Convertible debenture holders come into existence as creditors, but their rebirth is like owners. Give reason.

Answer:

- Convertible debenture holders are considered as the creditors of the company. They get fixed interest till the debentures are converted into shares. So, in the beginning these debentures exist as creditors.

- When the debentures get converted into shares, the debenture holder gets all the rights that an equity share holder enjoys. They can attend general meetings and enjoy voting rights. They also get dividends.

- Hence, convertible debentures come into existence as creditors, but their re-birth is like owners.

Question 17.

Why and how were financial institutions developed in India. Name few of them.

Answer:

Financial institutions in India:

- Changes in science and technology led to rapid growth in the field of industry and commerce. As a result various business units established. These units needed capital for short-term as well as long-term. Traditional financers i.e. individual investors and commercial banks were unable to satisfy the huge demand of finance.

- Under such situations India saw the need of establishing specific financial institutions that could lend money to business units for their long-term capital requirements.

- When India started huge projects under its five year planning it laid strong emphasis on industrial development. It also put emphasis on establishing financial institutions for both private and public sector for long term financial needs.

- Government of India established few national level financial institutions as well as state finance corporations with an aim to help small, medium sized and even large scale business units obtain finance.

Some of the main financial institutions providing long-term finance are:

- IFCI (Industrial Finance Corporation of India)

- IDBI (Industrial Development Bank of India)

- ICICI (Industrial Credit and Investment Corporation of India)

- GSFC (Gujarat State Finance Corporation)

- GIIC (Gujarat Industrial Investment Corporation)

Question 18.

Write a short note on commercial banks as a source of finance and their finance options.

Answer:

Commercial banks:

- Commercial banks serve a very important function of providing short term as well as long term finance.

- These banks also provide long term loans for buying assets and short term loans to business units for working capital.

- The banks accept deposits from public at lower interest and lend them at higher interest.

Banks provide mainly three types of finance:

- Loan

- Cash credit and

- Over draft.

1. Loan:

- As per the policies and rules and regulations commercial banks lend money to business units as loans.

- Banks thoroughly analyses the financial requirement of a business, its ability to repay, Income tax returns, old and current accounts, profit, etc. If the bank gets assured that the businessman’s documents are ocdsfaJory then it provides him loan.

- When the banks offer loan they mortgage businessman’s assets in bank’s favour as security.

- Once the businessman receives the loan he needs to pay it back in monthly installment along with the interest pre-decided with the bank. One can also make part-payments in addition of installments and even make full payment before the loan term ends.

2. Cash credit:

- A cash credit is a drawing account for drawing money within a specific credit limit approved by the bank against some security.

- Overdraft and cash credit are similar except that for withdrawing under cash- credit one needs to provide some security like raw-material, finished goods, etc. as hypothecation.

3. Over-draft:

As per rule, one cannot withdraw more than the amount present i.e. deposited in one’s account. When a current account holder is allowed to withdraw more money than present in his account for a short duration it is said that the bank has lent him money through overdraft facility.

![]()

Question 19.

State differences between short term capital and tong term capital.

Answer:

| Points of difference | Short term capital | Long term capital |

| Meaning | Capital needed for a short duration of upto 5 years is called short term capital | Capital needed for a longer duration of 10 or more years is called long term capital |

| Utility | Such capital is used for current assets like raw material, outsourcing some processes, paying short term debts, etc. | Such capital is used for fixed assets like buying building, machinery, etc. |

| Interest rate | The interest rate is fix because the term is short. | Since the term is long the interest rate varies based on market situations. |

| Sources | This capital is raised through bank loans, overdraft, cash- credit, trade credit, public deposits, etc. | This capital can be raised through equity shares, preference shares, debentures, etc. |

Question 20.

Differentiate between shares and debentures.

Answer:

| Points of difference | Shares | Debentures |

| 1. Form of capital | It is the owner’s funds | It is borrowed fund |

| 2. Ownership | Share-holders are

considered true owners of company. |

Debenture holders are considered creditors of company |

| 3. Returns | Company pays dividend to share holders | Company pays interest to debenture holders |

| 4. Refund | Share capital is not returned to share-holders except in case of liquidation | Debenture capital is returned to the debenture holders after a specific time |

| 5. Preference of paying back | During liquidation, shareholders are the last to obtain their capital | During liquidation

debenture holders get their capital quite before. |

| 6. Rate of return | Rate of dividend varies | Rate of interest remains fixed |

Multiple Choice Questions

Question 1.

Buying a c machine for processing works is an

(A) Current asset

(B) Short-term capital

(C) Fixed asset

(D) Long-term capital

Answer:

(C) Fixed asset

Question 2.

Immovable property comes under

(A) Fixed rate

(B) Current asset

(C) Working capital

(D) Short-term capital

Answer:

(A) Fixed rate

Question 3.

Which of the following is an example of current asset?

(A) Machinery

(B) Salary

(C) Transport vehicle

(D) Office

Answer:

(B) Salary

Question 3.

_______ is an axis around which all business activities rotate.

(A) Finance

(B) Debentures

(C) Equity shares

(D) Assets

Answer:

(A) Finance

Question 4.

For businessman what can be considered equal to human blood?

(A) Assets

(B) Deposits

(C) Shares

(D) Capital

Answer:

(A) Assets

Question 5.

Into how many major types can we classify owner’s funds?

(A) 2

(B) 3

(C) 4

(D) 5

Answer:

(D) 5

![]()

Question 6.

Which of the following is not a form of equity shares?

(A) Ordinary

(B) Redeemable

(C) Sweat

(D) Both (A) and (B)

Answer:

(B) Redeemable

Question 7.

Redeemable preference shares can be

(A) Redeemed before 20 years

(B) Redeemed after 20 years

(C) Only partly redeemed after 20 years

(D) Both (A) and (B)

Answer:

(B) Redeemed after 20 years

Question 8.

Which of the following have the right to claim at the end?

(A) Debentures

(B) Preference shares

(C) Equity shares

(D) Bonds

Answer:

(D) Bonds

Question 9.

Equity share holders are also called

(A) Creditors

(B) Debtors

(C) True owners

(D) Maximum preference holders

Answer:

(C) True owners

Question 10.

Who of the following are called faithful companies of the company?

(A) Equity share holders

(B) Debenture holders

(C) Preference share holders

(D) Public depositors

Answer:

(C) Preference share holders

Question 11.

Who of the following do not have any voting right in the company?

(A) Equity share holders

(B) Debenture holders

(C) Preference share holders

(D) Both (B) and (C)

Answer:

(A) Equity share holders

Question 12.

Who earns dividends?

(A) Debenture holders

(B) Preference share holders

(C) Equity share holders

(D) Both (B) and (C)

Answer:

(B) Preference share holders

Question 13.

Who earns dividends?

(A) Debenture holders

(B) Preference share holders

(C) Equity share holders

(D) Both (B) and (C)

Answer:

(D) Both (B) and (C)

Question 14.

Who are the last ones to claim dividend?

(A) Equity share holder

(C) Dividend

(B) Bond holder

(D) Preference share holder

Answer:

(A) Equity share holder

![]()

Question 15.

Arrange the following in ascending order with respect to priority of receiving capital during liquidation of the company.

(1) Preference share holders

(2) Debenture holders

(3) Equity share holders

(A) (1), (3), (2)

(B) (2), (1), (3)

(C) (3), (2), (1)

(D) (1), (2), (3)

Answer:

(B) (2), (1), (3)

Question 16.

Who of the following gets a fixed amount from company?

(A) Bond holders

(B) Preference share holders

(C) Debenture holders

(D) All of these

Answer:

(D) All of these

Question 17.

Arrange the following ¡n ascending order with respect to priority of receiving capital during liquidation of the company.

(1) Preference share holders

(2) Debenture holders

(3) EquIty share holders

(A) (1), (3), (2)

(B) (2), (1), (3)

(C) (3), (2), (1)

(D) (1), (2), (3)

Answer:

(B) (2), (1), (3)

Question 18.

Who of the following gets a fixed amount from company?

(A) Bond holders

(B) Preference share holders

(C) Debenture holders

(D) All of these

Answer:

(D) All of these

Question 19.

What keeps on fluctuating?

(A) Dividend paid to preference share holders

(B) Interest paid to debenture holders

(C) Interest paid to bond holders

(D) Dividend paid to equity share holders

Answer:

(D) Dividend paid to equity share holders

Question 20.

What is not repaid during the existence of company?

(A) Capital of debenture

(B) Share capital

(C) Bond capital

(D) Public deposit

Answer:

(B) Share capital

Question 21.

With reference to shares what is not a part of capital gain?

(A) Bonus share

(B) Benefit due to rise in price of shares

(C) Interest

(D) Both (B) and (C)

Answer:

(C) Interest

Question 22.

Which of the following is the most important form of equity share for a company?

(A) Preference share

(B) Equity share with different voting rights

(C) Ordinary equity share

(D) Sweat shares

Answer:

(C) Ordinary equity share

Question 23.

Shares issued to directors and employees due to the contribution of their skills and knowledge are called

(A) Sweat equity shares

(B) Ordinary equity shares

(C) Preference shares

(D) Equity shares with different voting rights

Answer:

(A) Sweat equity shares

Question 24.

Which of the following is preferred by investors due to steady income and secured capital?

(A) Preference shares

(B) Ordinary equity shares

(C) Sweat equity shares

(D) Shares with different voting rights

Answer:

(A) Preference shares

Question 25.

Ploughing back profits is a type of

(A) Retained earnings

(B) Cash liquidation

(C) Re-investment

(D) Both (A) and (C)

Answer:

(D) Both (A) and (C)

Question 26.

Which of the following cannot be considered as an advantage of retained earnings?

(A) Stable dividend policy

(B) Burden free assets

(C) Decreased cost of capital

(D) Does not favors small investors

Answer:

(D) Does not favors small investors

Question 27.

Is not a company’s liability.

(A) Debentures

(B) Public deposits

(C) Bonds

(D) Equity shares

Answer:

(D) Equity shares

Question 28.

The company appoints to maintain faith of debenture holders.

(A) Directors

(B) Managers

(C) Trustees

(D) Brokers

Answer:

(C) Trustees

Question 29.

Company creates _______ on assets while issuing debentures.

(A) Interest

(B) Charge

(C) Profit

(D) Borrowings

Answer:

(B) Charge

![]()

Question 30.

Which of the following is not a form of debenture?

(A) Secured

(B) Non-convertible

(C) Convertible

(D) Unsecured

Answer:

(D) Unsecured

Question 31.

One can become owner of the company if he has

(A) Non-convertible debentures

(B) Secured debentures

(C) Convertible debentures

(D) Mortgage debentures

Answer:

(C) Convertible debentures

Question 32.

Who can issue bonds?

(A) Companies

(B) Government

(C) Municipality

(D) All of these

Answer:

(D) All of these

Question 33.

Generally, public deposits are accepted for a period of years.

(A) 6 months to 3 years

(B) 3 years to 6 years

(C) 4 months to 24 months

(D) 12 months to 36 months

Answer:

(A) 6 months to 3 years

Question 34.

Which of the following cannot accept public deposits?

(A) Private companies

(B) Banking finance companies

(C) Non-banking finance companies

(D) Both (B) and (C)

Answer:

(A) Private companies

Question 35.

Which is the easiest and cheapest source of business finance?

(A) Debentures

(B) Public deposits

(C) Equity shares

(D) Bonds

Answer:

(B) Public deposits

Question 36.

Public deposits are considered

(A) Faithful companies

(B) Fair weather friends

(C) Opportunity in disguise

(D) Partners in profit only

Answer:

(B) Fair weather friends

Question 37.

In Which form a bank does not provide finance?

(A) Loan

(B) Over draft

(C) Cash credit

(D) None of these

Answer:

(D) None of these

Question 38.

When a business buys goods but pays later he has used capital.

(A) Over draft

(B) Trade credit

(C) Cash credit

(D) Loan

Answer:

(B) Trade credit