This GSEB Class 12 Commerce Accounts Notes Part 1 Chapter 5 Admission of a Partner covers all the important topics and concepts as mentioned in the chapter.

Admission of a Partner Class 12 GSEB Notes

In current partnership firm, admission of a new parnter is given because of requirement of more capital in the firm, requirement of managerial capacity, in situation of retirement or death of current partner, for keeping skillful and efficient employee in the firm and for distribution of risk of business of a firm. Admission of a partner means reconstitution of the partnership with the admission of a partner the existing agreement comes to an end and a new agreement among all the partners including the new partner comes into existance. Thus, at the time of admission of a new partner, calculation of new profit and loss sharing ratio and old partners’ sacrifice ratio, accounting effects relating to goodwill, revaluation of assets and liabilities, accounting effects of accumulated profits, loss and reserves and adjustment of change of capital etc. points are arising. These points we will study in this chapter.

Admission of a Partner:

Admission of a partner means reconstitution of the partnership. According to Indian Partnership Act, 1932, Admission of a new partner in existing partnership can be given by following two ways :

- With the consent of all existing partners.

- There is a provision regarding admission of a new partner in partnership agreement.

Point to be occured while Admission of a New Partner:

At the time of admission of a new partner, following points are taken into consideration.

1. Change in Profit and Loss sharing ratio : After the admission of a new partner in the firm, new profit and loss ratio is came into existence. After admission of a new partner, profit share of existing partner is reduced. It is necessary to determine the profit share of new partner and new profit and loss ratio of existing partners. On the basis of old partners’ profit-loss ratio, profit share of a new partner and sacrifice done by old partners, new profit-loss sharing ratio is determined by keeping different situation in the mind. When the capital of all partners are keep in new profit and loss ratio then it is necessary to find out new profit and loss sharing ratio.

2. Sacrificing ratio of Existing (old) Partners : At the time of admission of a new partners in existing partnership firm, old partners have to give certain share of profit in favour of the new partner. This ratio of sacrifice is known as sacrificing ratio.

Sacrifice of partner in profit = Old share of profit – New share of profit.

Amount of goodwill bring by a new partner in the ratio of sacrifice done by old partners is credited to their accounts. Goodwill is compensation of sacrifice of profit done by old partners.

3. Accounting Treatment of Goodwill: To compensate the profit share acquired by the new partner, he is required to give his share in goodwill to the firm which is called as premium for goodwill.

![]()

Following matters are taken into consideration while giving accounting effects of goodwill.

1. At the time of admission of a new partner, goodwill appearing in the books (balance sheet) of the old partners is written off among the old partner in their old profit – loss sharing ratio :

| Old Partners’ Capital/Current A/c Dr. To Goodwill A/c |

……….. | ……….. |

2. When the goodwill permium is paid privately by the new partner to the old partners no entry recorded in the books of accounts of the firm.

3. When premium for goodwill brought in cash by the new partner :

| Cash/Bank A/c Dr. To Premium for Goodwill A/c |

……….. | ……….. |

4. When premium for goodwilll brought in by new partner i.e. land, building, moter car brought in firm as a goodwill :

| Respective Assets A/c Dr. To Premium for Goodwill A/c |

……….. | ……….. |

Net worth of the firm should be found out on the basis of capital bring by new partner in the ratio of his profit share :

5. For the distribution of premium for goodwill among the partners in their sacrificing ratio :

| Premium for Goodwill A/c Dr. To Old partners’ Capital/Current A/c |

……….. | ……….. |

6. If out of old partners’ any partner gains in new profit and loss sharing ratio compared to old profit – loss sharing ratio, then goodwill has to be given to old sacrificing partners :

| Premium for Goodwill A/c Dr. Old Partners’ (gaining partners) Capital/ Current A/c Dr. To Old partners’ (sacrificing partners) Capital/Current A/c |

………..

……….. |

……….. |

7. When new partner brings his share of goodwill premium in cash and it is withdraws by the old partners :

| Old partners’ Capital/Current A/c Dr | ……….. | |||

| To Cash A/c | ……….. |

8. When the new partner is not able to bring his share of premium for goodwill in cash:

| New Partners’ Capital A/c Dr. To Old partners’ Capital/ Current A/c |

……… | ……… |

9. When only a part of the premium for goodwill is brought by a new partner in cash :

| (a) | Cash A/c Dr. To New partners’ capital A/c To Premium for goodwill A/c (goodwill brought in cash) |

……… | ||

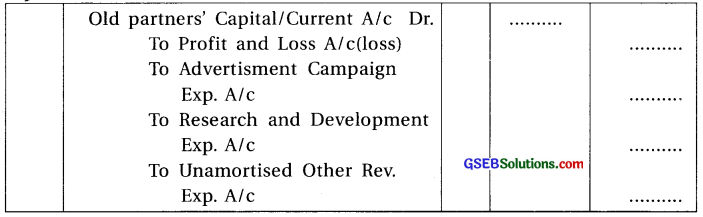

| (b) | Premium for goodwill A/c Dr. (goodwill brought in cash) New partners’ capital A/c (goodwill not brought in cash) Dr. |

![]()

10. When the amount of goodwill is not given at the time of admission of a partner, goodwill of the firm is valued on the basis of net worth of the firm or capital of partners.

Here, Net worth of the firm on the basis of capital bring by new partner = \(\frac{\text { Capital of New Partner }}{\text { Profit share of New Partner }}\)

Here, Net worth of the firm excluding goodwill = Capital of old partners + Reserves + Capital of New Partners

- Goodwill of the Firm = Net worth of firm on the basis of new Partners’ capital – Net worth of firm excluding goodwill.

- New partners’ share of goodwill = Firm’s goodwill x Profit share of New partner Note : When capital accounts of partners are kept by fixed capital method then goodwill will be recorded to current accounts of partners otherwise it should be noted to capital accounts of partners.

Revaluation of Assets and Liabilities:

At the time of admission of a new partner, with a object to no injustice with old and new partner, question of revaluation of assets and liabilities arise. To record the accounting effects of revaluation of assets and liabilities, revaluation account is prepared in the books of firm. It is also called as profit and loss adjustment account.

Decrease in assets and increase in liabilities are shown on debit side of Revlauation Account and increase in assets and decrease in liabilities are shown on credit side of Revaluation Account. Profit or Loss of revaluation account is distribution among the old partners in old profit-loss sharing ratio.

Distribution of Reserves and Accumulated Profit-Losses among old (existing/current) partners:

At the time of admission of a new partner, reserves and accumulated profit or losses shown in old balance sheet can be recorded by two methods :

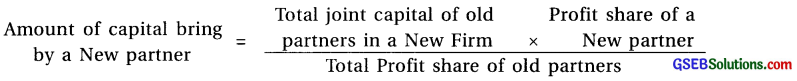

1. Reserves and accumulated profit-losses distributed by old partners of a firm :

(a) Following journal entry will be done.

From the workmen accident compansation fund, if any liability arise regarding compensation given to worker then this payable amount is deducted from reserve and remaining reserve is distributed among the old partners in their old profit – loss sharing ratio. If the amount of claim accepted is more than the reserve then the additional amount of claim is debited to Revaluation Account.

If the value of investment decreased then that amount is deducted from investment fluctuation reserve and remaining reserve is distributed among the old partners in their old profit-loss sharing ratio. If the loss due to decrease in the value of investment is more than the balance of reserve then the additional amount of loss is debited to the Revaluation Account.

(b) Following entry is done for accumulated loss and other unamortised revenue expenditure.

2. When partners decide to show the balance of reserve and accumulated profit – loss at the same value without any changes then

In the new balance sheet of a firm, show reserves and accumulated profit-loss at their old values.

From the increased amount of reserves shown in the books of the firm and from total of accumulated profit, deduct loss balances and unamortised revenue exp. and find out of the net amount.

- If the net amount has credit balance then it is debited to the capital account of gaining partner including new partner by the amount of gain and credited to sacrificing partners’ capital accounts by the amount of sacrifice.

- If the net amount has debit balance then it is credited to the capital accounts of gaining partner by the amount of gain and debited to sacrificing partners’ capital accounts by the amount of their sacrifice.

![]()

Capital bring by New Partner:

In a firm there is a question regarding how much and in which form a new partner bring capital.

1. If a new partner bring his capital in cash then it is debited to cash/bank account and credited to new partners’ capital account.

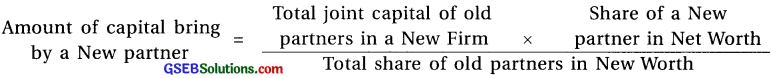

2. If a new partner has to bring his share of capital in the ratio of profit share then capital of a new partner can be found out as under :

3. When a new partner has to bring capital same as some part of net worth of a firm then;

Net Worth of a New partner = Total capital of a New Firm

4. If the new partner brings some assets and liabilities as a capital then its debited to assets account and credited to liabilities account and difference amount is credited to partners’ qapital account. In the new balance sheet these assets and liabilities are shown by additing to assets and liabilities of old firm.

5. If the manager of a firm admitted as a partner and if his loan in a firm is considered as a capital then that amount is debited to loan account and credited to his capital account and under this situation in the new balance sheet of a firm, this loan will not be appeared.

Changes in capital of Old Partners:

If the capital of a partners will be keep in new profit- loss ratio then there will be change in the capital of old partners. Under this situation, adjustment of difference amount of capital of partners will be done to cash account or partners’ current account.

Necessary particulars to be prepared at the time of admission of a New Partner :

- Revaluation Account

- Capital accounts of partners

- Current accounts of partners

- Cash/Bank Account

- Balance sheet after admission of a New partner.