This GSEB Class 12 Commerce Accounts Notes Part 2 Chapter 3 Company Final Accounts covers all the important topics and concepts as mentioned in the chapter.

Company Final Accounts Class 12 GSEB Notes

Like other form of mercantile system, in company form also after completion of accounting period and accounting process, statements are prepared to present the accounting information in brief which are known as financial statements. Financial statements of a company are most important for its shareholders, tax authorities, analyst, management and other stakeholders. As per section-129(1) of the Companies Act, 2013, financial statements provides true and fair view of the statement of affairs of the company. Financial statement of the companies are prepared as per scheduel-III of Companies Act 2013. In this chapter we will study about final accounts of the company as per Companies Act 2013.

![]()

Financial Statement:

Financial statements are statements presenting accounting information in brief at the end of accounting process for an accounting period. As per section-2(40) of Companies Act 2013, financial statement in relation to company includes

- A profit and loss account or any activity not for profit then an income and expenditure account

- Balance sheet

- Cash flow statement

- A statement of changes in equity if applicable

- Notes related to the accounts.

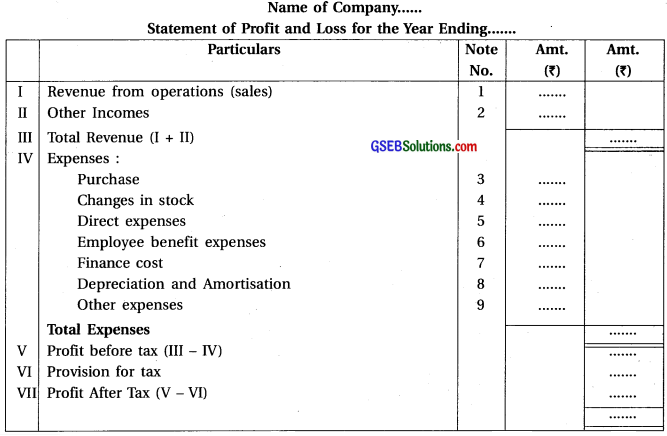

Profit and Loss Statement:

Profit and loss statement of the company must be prepared as per part-II of schedule-III of Companies Act-2013. The Proforma of this statement is as under :

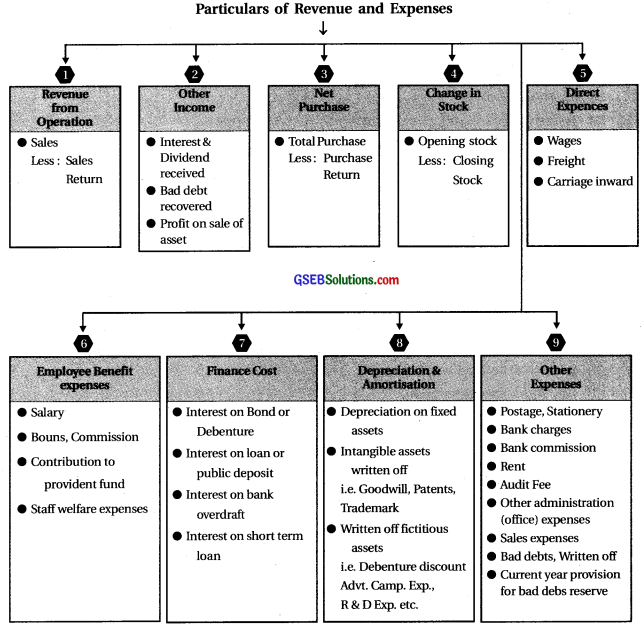

Following particulars of revenue and expenses must be keep in mind while preparing Profit and Loss Statement of a company :

Balance Sheet:

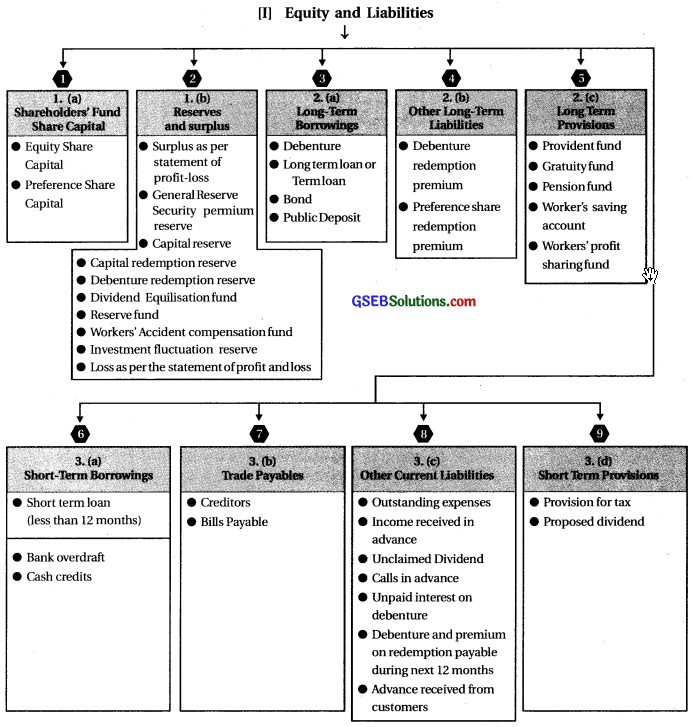

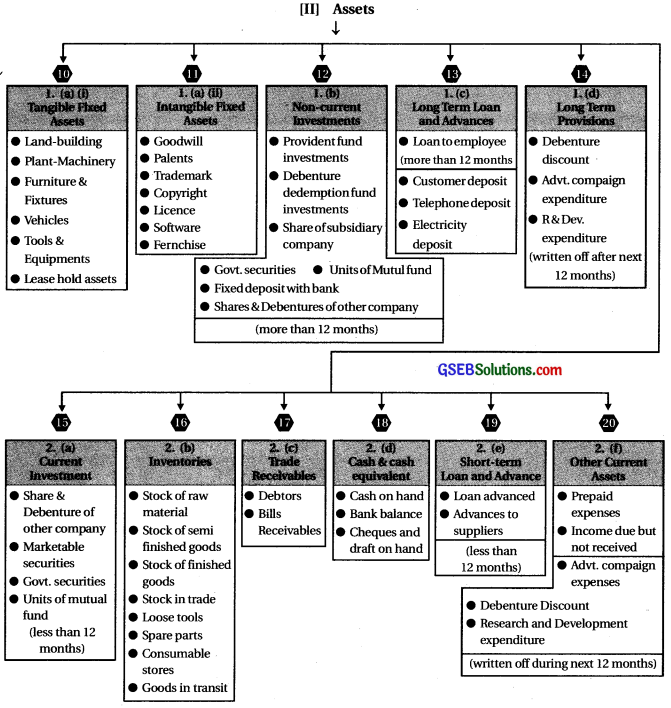

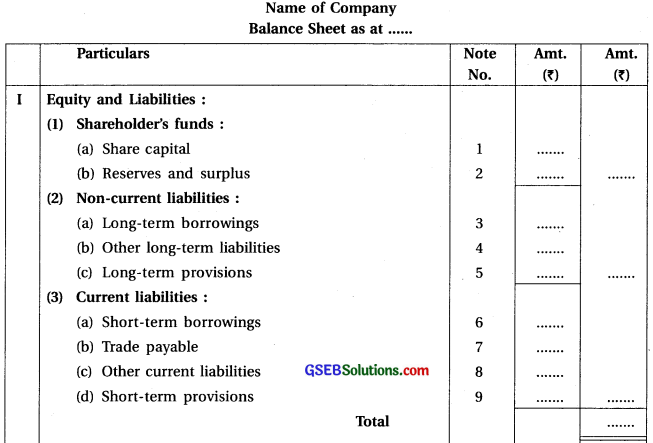

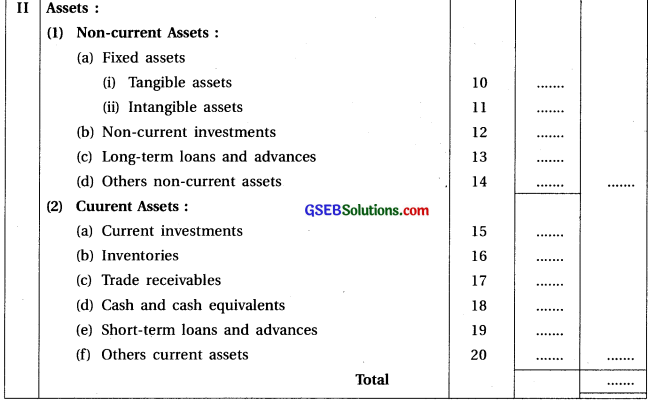

Balance sheet of a company must be prepared as per the part-I of schedule-III of the Companies Act, 2013. Proforma of balance sheet is as under :

Classification of particulars of main heading and sub heading while preparing balance sheet of a company.