Gujarat Board GSEB Textbook Solutions Class 11 Commerce Accounts Part 1 Chapter 5 Accounting Equation and Business Transactions Textbook Exercise Questions and Answers.

Gujarat Board Textbook Solutions Class 11 Accounts Part 1 Chapter 5 Accounting Equation and Business Transactions

GSEB Class 11 Accounts Accounting Equation and Business Transactions Text Book Questions and Answers

1. Write the correct option from those given below each question :

Question 1.

When an owner introduces capital in business …………..

(a) increase in capital – increase in liability.

(b) increase in capital – increase in assets.

(c) increase in one liability – decrease in another liability.

(d) increase in one asset – decrease in another assets.

Answer:

(b) increase in capital – increase in assets.

Question 2.

When goods purchased on credit ……………….

(a) increase in assets – increase in liability.

(b) decrease in assets – decrease in liability.

(c) increase in assets – decrease in liability.

(d) decrease in assets – increase in liability.

Answer:

(a) increase in assets – increase in liability.

![]()

Question 3.

When revenue expenses are paid in cash ……………

(a) increase in assets – increase in liability.

(b) decrease in assets – decrease in capital.

(c) increase in assets – increase in capital.

(d) decrease in assets – decrease in liability.

Answer:

(b) decrease in assets – decrease in capital.

Question 4.

When revenue income is received in cash ………………

(a) increase in assets – increase in liability.

(b) increase in assets – decrease in liability.

(c) increase in assets – increase in capital.

(d) increase in capital – decrease in liability.

Answer:

(c) increase in assets – increase in capital.

Question 5.

When goods distributed as sample

(a) decrease in assets – decrease in liability.

(b) increase in assets – increase in liability.

(c) increase in assets – increase in capital.

(d) decrease in assets – decrease in capital.

Answer:

(d) decrease in assets – decrease in capital.

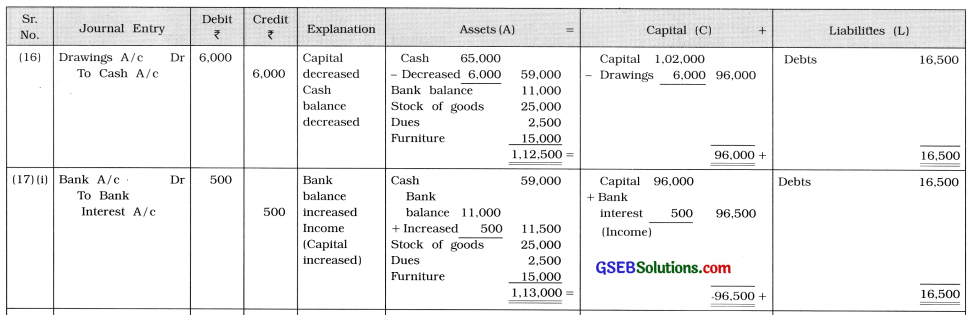

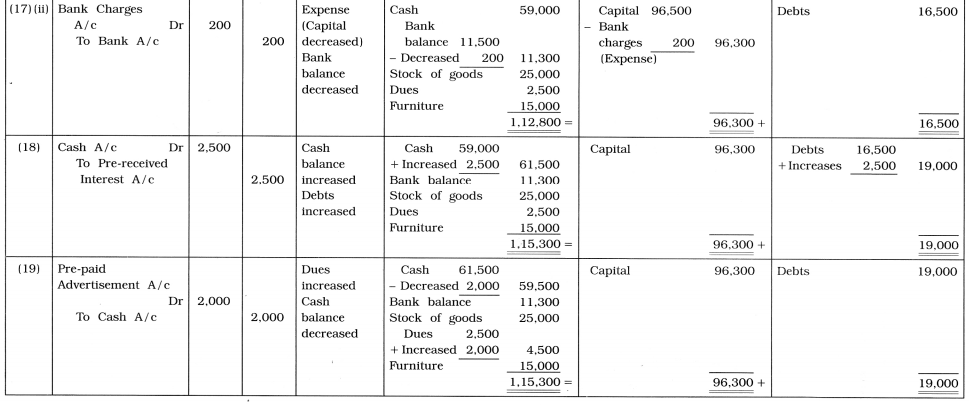

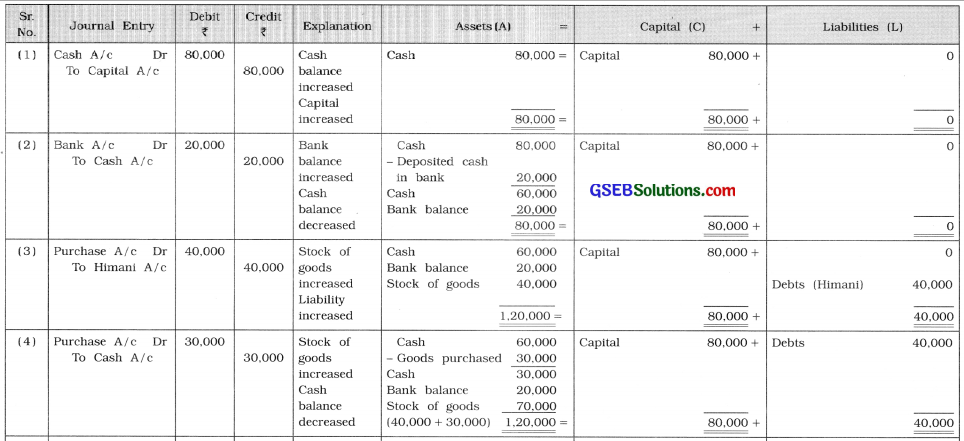

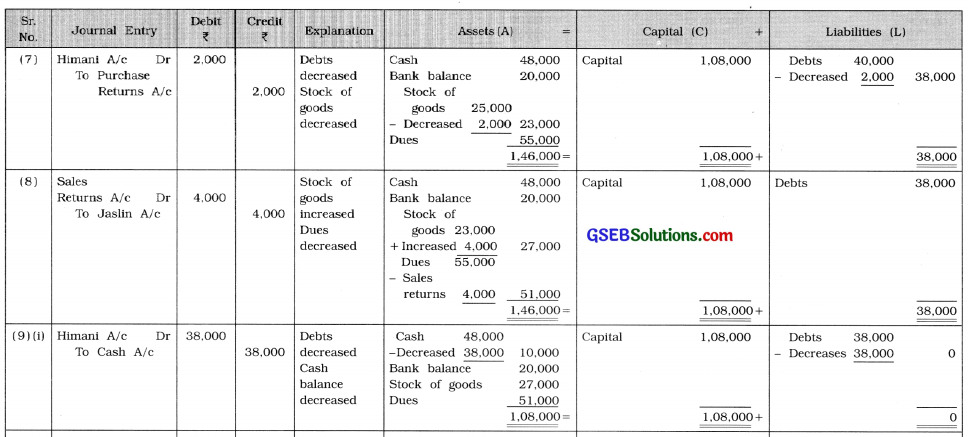

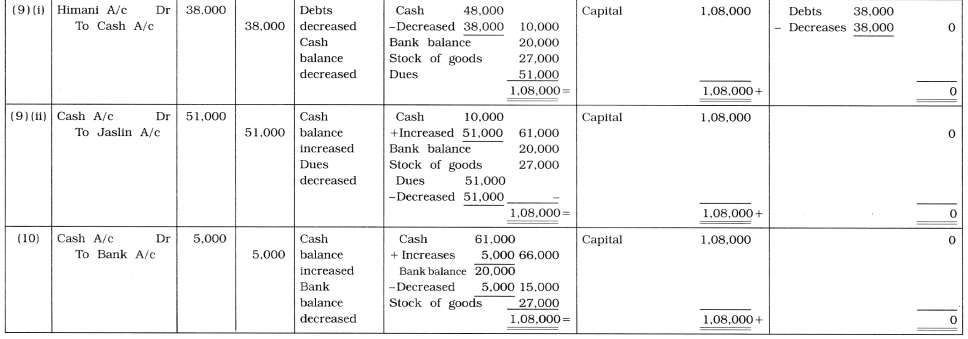

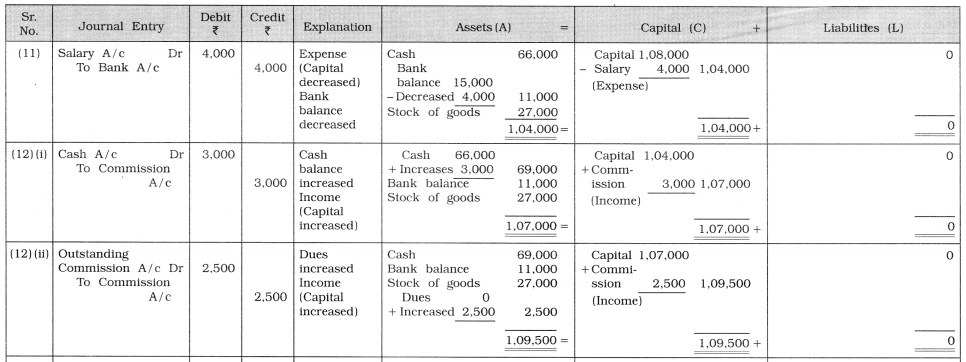

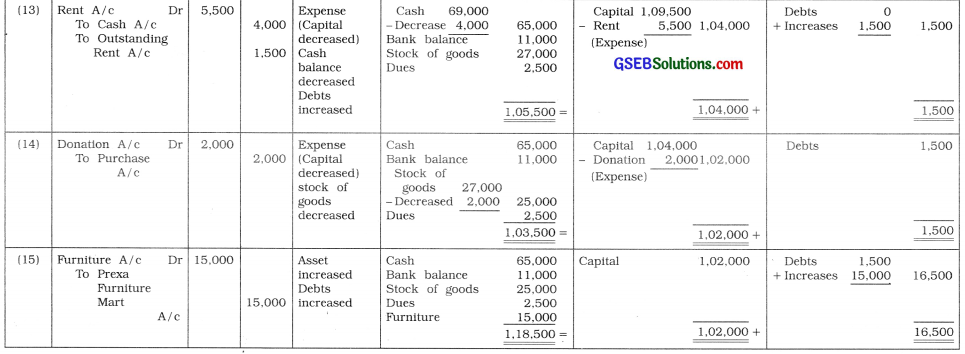

2. Write journal entries for the following transactions and explain accounting treatments based on equation :

Questions

(1) Commenced business with capital of ₹ 80,000.

(2) ₹ 20,000 deposited with bank and opened account.

(3) Goods of ₹ 40,000 purchased from Himani on credit.

(4) Goods of ₹ 30,000 purchased for cash.

(5) Goods of ₹ 35,000 sold for ₹ 55,000 to Jaslin on credit.

(6) Goods of ₹ 10,000 sold for ₹ 18,000 in cash.

(7) Goods of ₹ 2,000 returned to Himani.

(8) Goods of ₹ 4,000 returned by Jaslin.

(9) Accounts are settled with Himani and Jaslin.

(10) Withdrew ₹ 5,000 from bank.

(11) Salary of ₹ 4,000 paid by cheque.

(12) Commission received in cash ₹ 3,000 and ₹ 2,500 are outstanding.

(13) Rent paid in cash ₹ 4,000 and ₹ 1,500 are outstanding.

(14) Goods donated ₹ 2,000.

(15) Furniture of ₹ 15,000 purchased from Prexa Furniture Mart.

(16) College fees of daughter paid ₹ 6,000.

(17) ₹ 500 bank has credited for interest and debited ₹ 200 for bank charges.

(18) ₹ 2,500 received in advance for interest.

(19) Advertisement expense paid in advance ₹ 2,000.

Answer:

![]()