Gujarat Board GSEB Textbook Solutions Class 11 Commerce Accounts Part 1 Chapter 9 Ledger Posting Textbook Exercise Questions and Answers.

Gujarat Board Textbook Solutions Class 11 Accounts Part 1 Chapter 9 Ledger Posting

GSEB Class 11 Accounts Ledger Posting Text Book Questions and Answers

Question 1.

Write the correct option from those given below each question:

1. What is called a ‘King of Books’?

(a) Journal book

(b) Journal proper book

(c) Ledger book

(d) Book for noting of transactions

Answer:

(c) Ledger book

2. Which book is called the Original book?

(a) Journal

(b) Ledger

(c) Journal proper

(d) Cash book

Answer:

(a) Journal

![]()

3. In which forms of ledger, the new pages can’t be added as per requirement?

(a) Card ledger

(b) Computer accounts

(c) Loose leave ledger

(d) Bound book ledger

Answer:

(d) Bound book ledger

4. Which type of account is called Squared up account ?

(a) When the total amount of the debit side is more.

(b) When the total amount of both the sides is equal. ‘

(c) When the total amount of the credit side is more.

(d) When there is no transaction in the account.

Answer:

(b) When the total amount of both the sides is equal.

5. Normally, which type of balance is found in asset account?

(a) Credit balance

(b) Debit balance

(c) Debit or credit balance

(d) Account is settled

Answer:

(b) Debit balance

6. Goodwill is which type of asset and what is the type of its balance ?

(a) Tangible asset, debit balance

(b) Fictitious asset, credit balance

(c) Tangible asset, credit balance

(d) Intangible asset, debit balance

Answer:

(d) Intangible asset, debit balance

7. How to show the closing balance of account in the column of particulars?

(a) Balance carried forward

(b) Balance carried down

(c) Difference of balance

(d) Difference of amount

Answer:

(a) Balance carried forward

Question 2.

Answer the following questions in one or two sentences:

(1) What is Ledger ?

Answer:

Ledger means, a book kept in a business in which different accounts are opened, based on journal entry or subsidiary books.

![]()

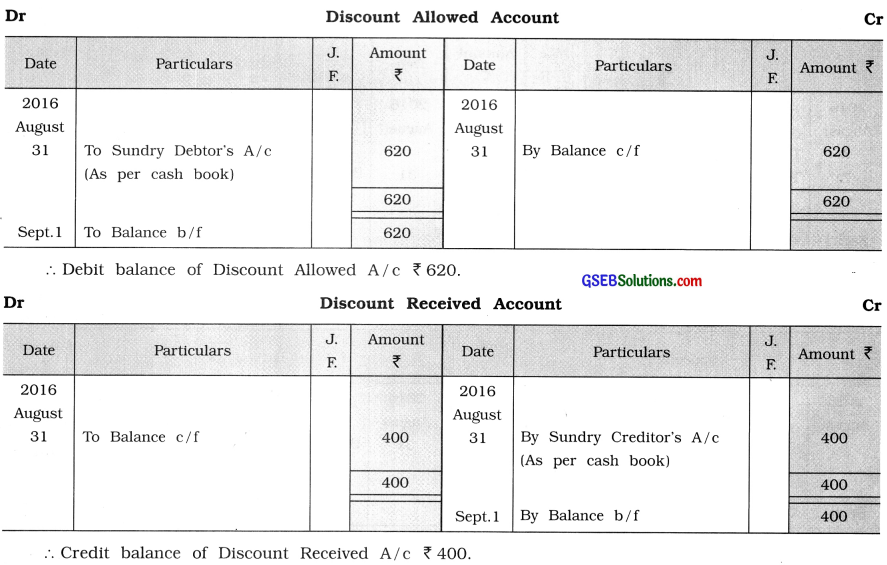

(2) How many sides are there in an account ? Which are they ?

Answer:

There are two sides in an account. The left-hand side of an account is known as debit side and the right-hand side of an account is known as credit side.

(3) What is an Index of a Ledger ?

Answer:

In the beginning of ledger, a list of all accounts is maintained, which is known as an Index or Exponent of a Ledger.

(4) When do we have a debit balance or credit balance in an account?

Answer:

(i) Debit balance : If in an account the total of debit side is more than the total of credit side then such an account is said to have a Debit balance.

(ii) Credit balance : If in an account the total of credit side is more than the total of debit side then such an account is said to have a Credit balance.

(5) What is Squared up account ?

Answer:

While making the totals in any account, if the totals of both the sides (the debit and the credit side) are same or equal, in such a case, there will be no balance to that account as there is no surplus on either side. Such account is known as Squared up account or Settled account.

(6) Which columns are drawn in an account ?

Answer:

The account is divided into two sides. Left-hand side of an account is known as Debit side while right-hand side of an account is known as Credit side. On each side of an account four columns are kept for date, particulars, J. F. No. (Journal Folio Number) and amount (₹) respectively.

(7) What is Positing?

Answer:

From journal or subsidiary books a process of recording as per the rules of accounting, either on debit or credit side of a concerned account, is known as Positing.

![]()

(8) Which types of ledgers are popular ?

Answer:

Three types of ledgers are popular :

- Bound book ledger,

- Loose leaves ledger and

- Card ledger.

(9) What is the classification of ledger ?

Answer:

Classification of ledger means, “An arrangement of a ledger in which accounts are classified systematically and that classified accounts are recorded in the separate ledger.”

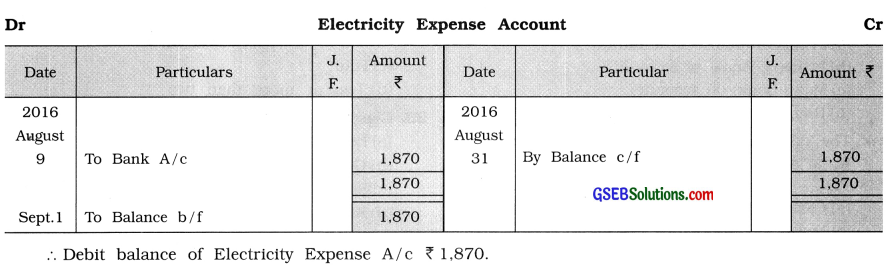

(10) Ledger of individuals are shown under which type of classification?

Answer:

Ledger of individuals is shown into two types :

- Creditors ledger (Purchase ledger) and

- Debtors ledger (Sales ledger). These two ledgers can further divided into two types as followed:

(i) Alphabetically and (ii) Areawise.

(11) Normally, which accounts are prepared in General ledger?

Answer:

Normally, out of total accounts of the business, except the accounts of debtors and creditors, accounts of all remaning individuals and other accounts are prepared in General ledger.

Question 3.

Answer the following questions in detail :

(1) What is an Account ? Explain it.

Answer:

Account: A systematic summary showing the debit and credit effects of the transactions taking place during a specific period relating to a specific person, asset, income or expense in a one separate book, is known as an Account.

Meaning of an account: An account is a summary of the specific transactions, affecting some specific items during a specific period, e.g., Account of Bhaskarbhai Trivedi, means a summary of economic transactions entered into with Bhaskarbhai Trivedi. Similarly, salary account, sales account, bank account, etc.

Definition:

(1) A systematic summary showing the debit and credit effects of the transactions taking place during a specific time, relating to a specific person, asset, income or expense is known as Account.

(2) A systematic and chronological record, in some specific format of the transactions, relating to one particular aspect, on the debit and credit side according to the specific rules of accountancy is known as an Account.

Explanation : While preparing any account, effects of different transactions relating to that account are grouped in two parts and by recording similar effects on one side and opposite effects than the same, on other side, an account is prepared. In journal entry, the account which is debited, is to be posted on its debit side and in journal entry, the account which is credited, is to be posted on its credit side. Therefore, two sides of an account should be maintained and effects should be given accordingly therein.

![]()

(2) Prepare a specimen of an account and explain its each column.

Answer:

Explanation :

(1) Name of every account and period for which that account is prepared that period is written on the top of the account.

(2) The account is divided into two sides. Left hand side of a person is known as Debit side while right hand side of a person is known as Credit side.

(3) On the debit side of an account and on the credit side of an account four columns are kept for date, particulars, J. F. No. (Journal Folio Number) and amount (₹) respectively.

(4) From the journal entry if posting is to be done then, in the date column transaction date, in the particular column concern account name, in the J. F column the page number of the journal on which the journal entry is recorded and in the last column the amount will be recorded.

(5) On the debit side of an account, after writing the particular, amount will be written and it is known as Debting the account and on the credit of an account, after writing the particular, amount will be written and it is known as Crediting the account.

(3) What is a ledger ? Give the information regarding its utility.

Answer:

Meaning of ledger: Ledger means, a book kept in a business in which different accounts are opened like – accounts related to individuals, accounts related to goods and assets and accounts related to various items of income and expense, based on journal entry or entries in subsidiary books. The term ‘Ledger’ is derived from the word ‘Legger’ which means ‘To keep’. Thus, the entry for a transaction will be recorded in ledger from journal. In short, a book in which different accounts are prepared is known as Ledger or Book of ledger.

Utility: Ledger is the book of accounts in which all types of accounts are kept. On the basis of journal entry, posting is to be made in these accounts. One of the main objects of accounting is to known the financial position of the business on a particular day. Whereas the main object of the ledger is to show, the position of each account in the business. Thus, the purpose of accounting is easily achieved by keeping a ledger.

Initially, transaction is recorded in the journal, therefore it is known as Primary book of accounts. Entries for various transactions are posted from the journal to the ledger. Therefore ledger is known as the Principal or Main book of accounts.

(1) Accounts related to individuals, goods, assets, incomes and expenses are maintained separately in the ledger.

(2) Information related to the transactions of all the accounts is easily available from the ledger.

(3) With the help of ledger, the businessman can easily obtain important business information in future.

Hence, purpose of accounting is not only limited to a recording of monetary receipts and payments. Based on various accounts, a trader can have an idea regarding the financial position, as well as profit-loss of a business. On the basis of summarised summary of accounts, proper decisions regarding business policy can be taken. Necessary and useful information to a trader can be easily and quickly obtained from the ledger. Ledger is an important book of accounts for getting information and making analysis. Therefore, ledger is also known as King of Books.

(4) Explain the importance of a ledger.

Answer:

Points of importance of a ledger are as under:

1. Necessary information : With the help of ledger, the necessary information of an account can be obtained at any particular date.

2. Transaction : Summary of transaction can be known with the help of ledger, e.g.,

(1) Information regarding the total purchase, total sales, total purchase return or sales return of the specific period can be obtained.

(2) Information regarding the amount receivable from which customers (debtors) and the amount payable to which traders (creditors), on a particular date, can be obtained.

(3) Accountwise information regarding the expenses and incomes can be obtained on any particular date.

(4) Accountwise information regarding the amount of capital invested and the value of different assets in a specific period can be obtained.

3. Mathematical checking : Mathematical checking of accounts is possible, by preparing a ‘Trial balance’ from the balance of each account of a particular date.

4. Policy related decision: For the policy related decision of the business, collection of necessary information and summary statements to be prepared, are on the basis of the ledger.

5. Clear position: Ledger is a reflection or an image of the transactions entered into. Only on the basis of this, a trader will have a clear picture of his position.

![]()

(5) “Ledger is a principal book of accounts.’’ OR “Ledger is a King of Books.” Explain in detail.

Answer:

To get the information easily and to know the business result, are the main objects of the accounts. With this view point, ledger is known as a second important step in the process of accounts. Initially transaction is recorded in the journal, therefore journal is known as Primary books of accounts. While from the journal entries are posted in the ledger therefore ledger is known as the Principal or Main book of accounts. Out of all the books of accounts, ledger is known as the very important book, because from this book, transactions related to the business can be easily understood.

In short, ledger is a book in which systematic and separate summary of all the types of transactions is prepared. In this way, from the ledger, information related to the transactions of all the accounts is easily avialable. And from that, the financial position of the business and result of the business can be clearly known. Thus, with the view point of utilities and importance, ledger is the principal book of accounts or ledger is the King of Books.

(6) Give the detailed information regarding different forms (types) of ledger.

Answer:

Different forms (types) of ledger are as follows :

1. Bound book ledger,

2. Loose leaves ledger and

3. Card ledger.

1. Bound book ledger: This ledger is in the form of bound book. Most of the small traders follow such type of ledger to maintain their accounts. In the beginning of it, index is given and thereafter each page is serially numbered. As and when it is required, new pages can’t be added in this type of ledger because it is a book in bound form. This type of ledger is less expensive and easy from the view point of preservation.

2. Loose leaves ledger : This type of ledger is in filed form. In this system, in place of card, loose leaves or registers with necessary columns are kept. These loose leaves are kept in-between two thick papers or in-between two metal sheets. On the left-hand side of the page sufficient blank space is kept so that it can be systematically punched and can be kept in a binder. In this system, old pages can be removed and new pages can be added just like the card ledger. The structure is connected with a special type of lock. As it is with lock system, it ensures facility of safety. Of course, overall it is an expensive form. This system of ledger generally used by the banks, insurance companies, big companies, etc.

3. Card ledger: In this system, a separate card is maintained for each account. These cards are kept in a steel cabinet. They are arranged on a steel bar in order so that necessary card is easily available. In this system unnecessary or unwanted cards can be removed and new card can be placed in-between. This type of ledger is more safely because all the cards are preserved in a special steel or wooden cabinet and cabinet can be looked also. However, this is an expensive form.

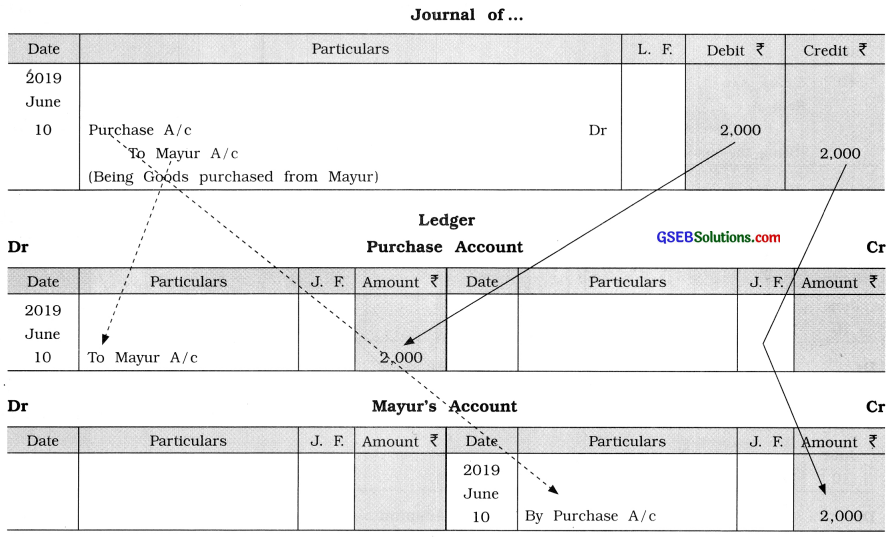

(7) What is posting ? Explain the process of posting with the help of simple journal entry.

Answer:

Meaning of posting : From the recorded transactions in the journal or in the subsidiary books, the process of recording the debit or credit effect of a transaction in the relevant accounts is known as posting. From journal or subsidiary books, the process of recording as per the rules of accounting, either on debit or credit side of a relevant account, is known as posting.

Posting of simple journal entry : According to double entry accounting system, every transaction has two effects : one on debit side and other on credit side, so if the amount is posted in one account on debit side, then on opposite side with the same amount, entry is posted in the other account on credit side. In simple journal entry posting on debit side of any account means, to write the amount on debit side of an account with the name of credited account is to be written in the particulars column. While posting credit side of any account means to write the amount of credit side of an account with the name of debited account is to be written in the particulars column. We try to understand this explanation by the following example :

Example: On 10 June, 2019; Goods purchased from Mayur worth ? 2,000. Write journal entry and post the same in ledger.

In the journal entry of above transaction two accounts are there. In the ledger, therefore two accounts will be opened. Purchase account and Mayur’s account. As per the rule of posting, as discussed earlier, the account which is to be debited (Here purchase account), then on debit side of that account the amount will be written (Here ₹ 2,000). And in the particulars column, the account which is on credit side, the name of that account will be written (Here Mayur’s account), And in the amount column ₹ 2,000 will be written. Thereafter, the account which is to be credited (Here Mayur’s account), on credit side of that account, the amount will be written (Here ₹ 2,000). And in the particulars column, the account which is on debit side, the name of that account will be written (Here Purchase account). And in the amount column ₹ 2,000 will be written.

![]()

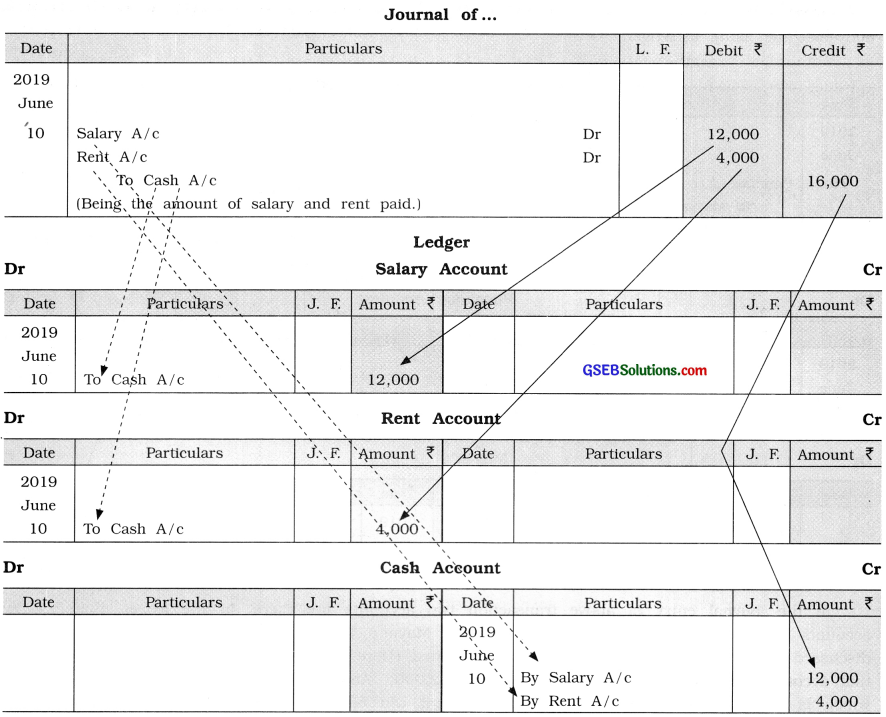

(8) Explain the process of posting of a combined journal entry.

Answer:

Posting of combined journal entry: When combined journal entry is recorded, one effect is given in one account and second effect is given to two or more accounts, at that time the account in which the first effect is there, in that, the name of all accounts having second effect will be written.- While in the accounts having second effect the name of the first effect account will be written.

Example: On June 10, 2019 : Paid ? 12.000 for salary and ? 4,000 for rent. Pass the journal entry and post it in ledger.

Explanation : Here, in the transaction Salary account, Rent account and Cash account are connected. Salary account and Rent account are debited while only Cash account is credited. So, on the debit side of Salary account and Rent account, the name of credited account, i.e., Cash account will be written in the particulars column and in the amount column, the amount of every account will be shown separately, while in the Cash account, on the credit side, the name of debited accounts, i.e., Salary account and Rent account will be written in the particulars column and in the amount column, against each account the debited amount will be written.

However, in the combined journal entry, when the debit effect is given to more than one account, and credit effect is also given to more than one account, at that time, against every debited account which account is to be credited or against every credited account which account is to be debited, is a difficult task to decide. In such circumstances, in each account, whether debited or credited, in the particulars column write ‘Miscellaneous account’ and write the concern account amount which is written in the journal entry against that account.

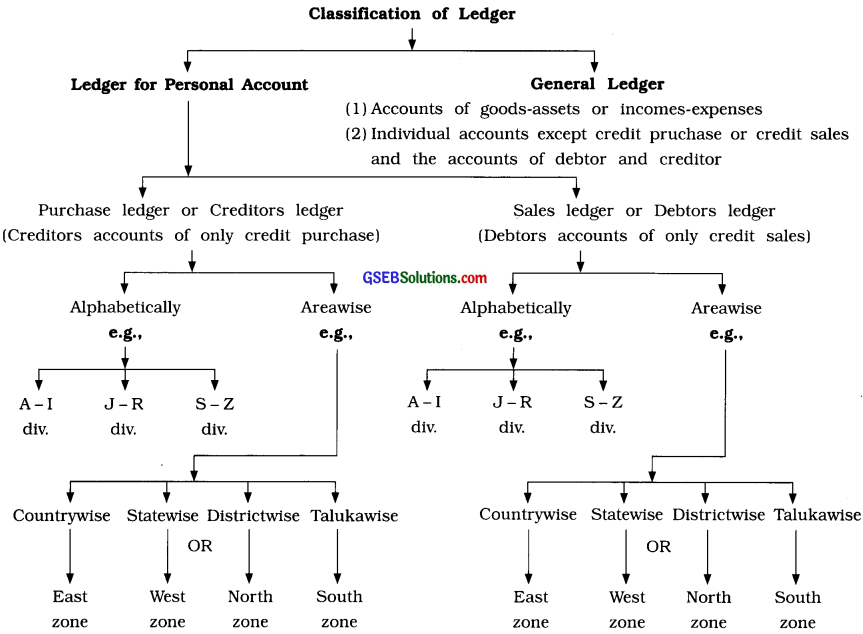

(9) Give the meaning of the classification of ledgers and explain this classification in detail.

Answer:

Ledger: A systematic summary of the transactions related to every individual, goods-assets and incomes-expenditures means an account. A book is known as Ledger in which accounts of individuals, goods-assets and incomes-expenses are kept.

Generally when the size of business is small and number of transactions are very much limited, in that case all the accounts are included in one ledger only. But when the size of the business and number of transactions are increased then certain difficulties arises for maintaining all the accounts in one ledger. Therefore question of division of ledger arose.

Classification (i.e., division) of ledger means, “An arrangement of a ledger in which accounts are classified systematically and that classified accounts are recorded in the separate ledger.” Method of classification: With the different view points classification of ledger is possible but a trader can classify a ledger in his how convenient way. Ledger is usually classified as follows :

Generally, trader sub-divide the ledger in the following way:

(A) Ledger for Personal Accounts and

(B) General ledger.

(A) Ledger for Personal Accounts: At the end of specific period to know the receivables and payables amount of the business, credit transactions are written separately. Because of the credit transactions of purchase and sales, it is necessary to have individual accounts respective parties (debtors and creditors). When a separate ledger is kept for such individual accounts, it is known as Ledger of Personal Accounts. Such a ledger is further divided into two types :

1. Creditors ledger: Accounts of creditors are required to be opened because of the credit purchase transactions. Creditors ledger is prepared from the entries of purchase book and purchase return book, which is also known as Purchase ledger. Mostly big traders keep a separate creditors ledger.

2. Debtors ledger: Accounts of debtors are required to be opened because of the credit sales transactions. Debtors ledgers is prepared from the entries of sales book and sales return book, which is also known as Sales ledger. Mostly big traders keep a separate debtors ledger.

Above ledger can further be classified as follows :

(i) Alphabetically: Ledger is classified on the basis of first letter of individual account while preparing ledger, e.g., According to English alphabet, from A to I, J to R and S to Z. Similarly, according to Gujarati alphabet it can be a ledger from![]()

(ii) Areawise: This type of ledger is classified on the basis of residence area or the business area of traders, e.g., Village, City, Taluka, District, State, Country or it can be divided into zones for sales or purchase, e.g., East zone, West zone, etc.

(B) General ledger: When a separate ledger is prepared for the accounts of goods-assets and incomes-expenses, excluding the debtors and creditors accounts, then it is known as General ledger, in which accounts of purchase, sales and goods returns are also opened.

Above classification can also be done as follows :

(1) Debtors ledger,

(2) Creditors ledger and

(3) General ledger.

![]()

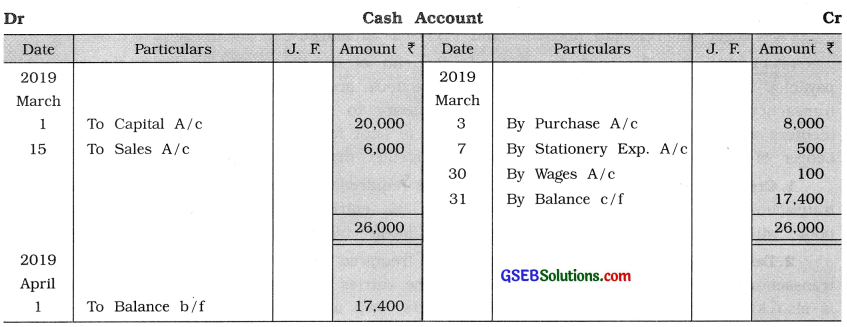

(10) Explain the process of balancing an account with an illustration.

Answer:

Balance: A trader is required to close the books of accounts in order to know the profit or loss of his business. This is done at the end of a particular period. Thus, it is necessary to find out the balance of every account opened in the books. “Balance means the difference between the totals of debit side and credit side of an account.” In any account, the excess of the total of the credit side over that of the debit side amount or the excess of the total of the debit side over that of the credit side amount is known as the Balance of that account.

Process of balancing: To find out the balance of an account or to close the account following

process is to be followed :

(1) Out of the total of both sides of an account, the side having more total than the other is to be written on both the sides.

(2) The difference of amount in the amount column on a side having less total is to be calculated and recorded and in the particulars column against the difference of amount it is necessary to write words ‘balance carried forward’ which is in short shown as ‘balance c/f’.

(3) Draw one horizontal line above the total amount and draw two parallel horizontal line below the total amount. This means the account is considered and closed.

(4) Debit or Credit balance of an account will be written in the particulars column as ‘balance brought forward’ while opening an account in the next year and it is necessary to write the amount of balance in amount column with ‘balance b / f in particulars column.

Debit balance : If in an account the total of debit side is more than the total of credit side than such an account is said to have a debit balance.

Illustration :

Here, the total of amount on debit side is ₹ 26,000 (20,000 + 6,000) while the total of amount on credit side is ₹ 8,600 (8,000 + 500 + 100). Thus, amount of difference is found to be ₹ 17,400 (₹ 26,000 – ₹ 8,600). Here, the total of the debit side is more than the total of the credit side. Therefore, Cash account has a debit balance of ₹ 17,400.

Credit balance: If in an account the total of credit side is more than the total of debit side then such an account is said to have a credit balance.

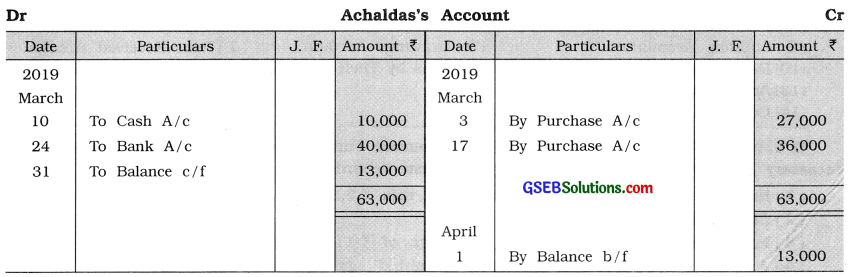

Here, the total of amount on credit side is ₹ 63,000 (27,000 + 36,000) while the total of amount on debit side is ₹ 50,000 (10,000 + 40,000). Thus, amount of difference is found to be ₹ 13,000 (₹ 63,000 – ₹ 50,000). Here, the total of credit side is more than the total of the debit side. Therefore, Achaldas’s account has a credit balance of ₹ 13,000.

Squared up account/Zero balance : Sometimes, while balancing the account, the totals of the both sides (the debit and the credit side) are same or equal, in such a case there will be no balance (zero balance) to that account as there is no surplus on either side. Such account is known as Squared up account or Setted account.

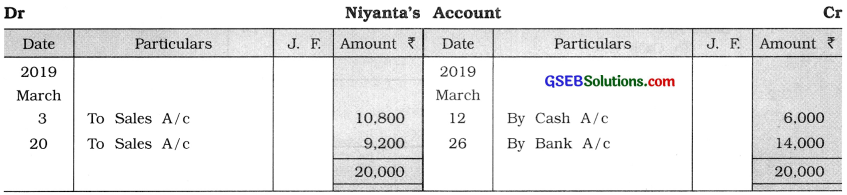

Illustration:

Here, the total of amount on debit side is ₹ 20,000 (10,800 + 9,200) and the total of amount on credit side is also ₹ 20,000 (6,000 + 14,000). Thus, amount of difference will be zero (₹ 20,000 -₹ 20,000 = 00). Therefore, there will be no balance to that account. So Niyanta’s account is squared up.

Question 4.

State whether the balances of the following accounts will have a debit balance or credit

balance :

(1) Purchase Account

(2) Sales Account

(3) Sales Return Account

(4) Debtor’s (Customer’s) Account

(5) Capital Account

(6) Salary Account

(7) Rent Received Account

(8) Building Account

(9) Drawings Account

(10) Bad Debts Account

(11) Goods Burnt by Fire Account

(12) Loss by Theft Account

(13) Advertisement Expenses Account

(14) Contribution to Provident Fund Account

Answer:

Debit Balance

(1) Purchase Account

(3) Sales Return Account

(4) Debtor’s (Customer’s) Account

(6) Salary Account

(8) Building Account

(9) Drawings Account

(10) Bad Debts Account

(12) Loss by Theft Account

(13) Advertisement Expenses Account

(14) Contribution to Provident Fund Account

Credit Balance

(2) Sales Account

(5) Capital Account

(7) Rent Received Account

(11) Goods Burnt by Fire Account (Credited to Purchase A/c)

![]()

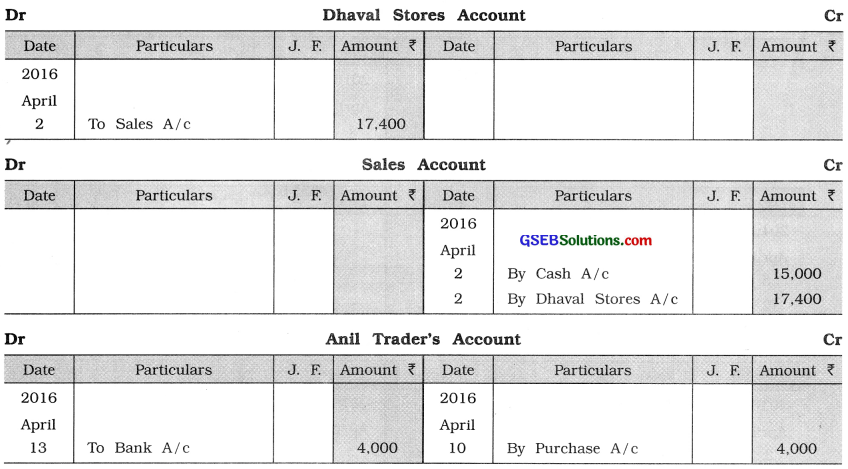

Question 5.

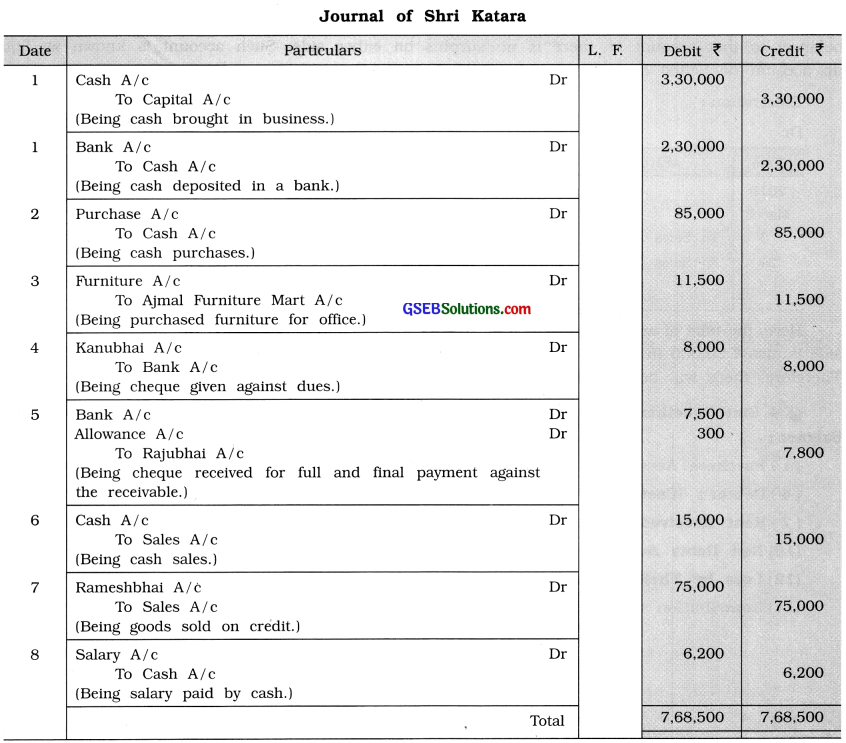

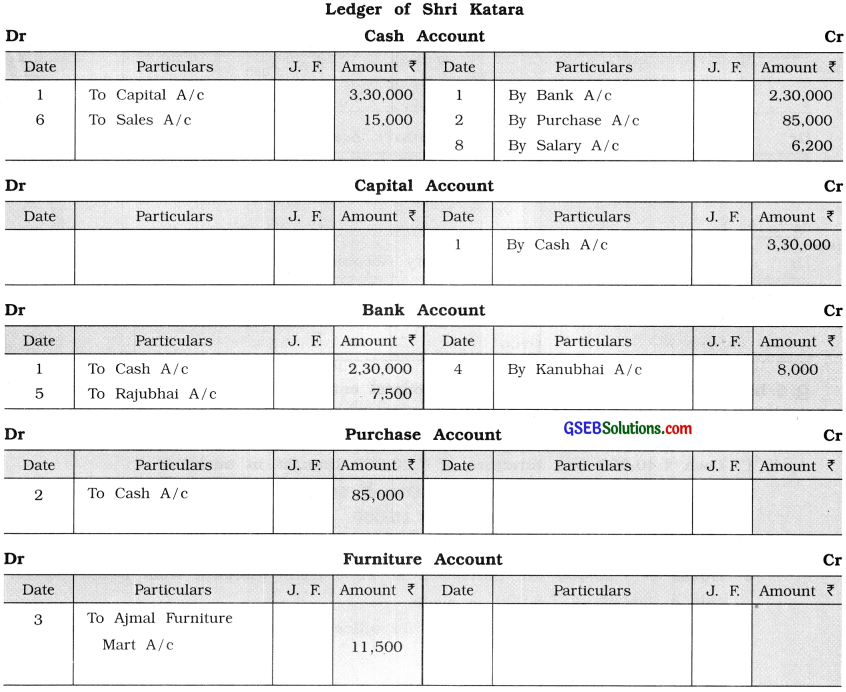

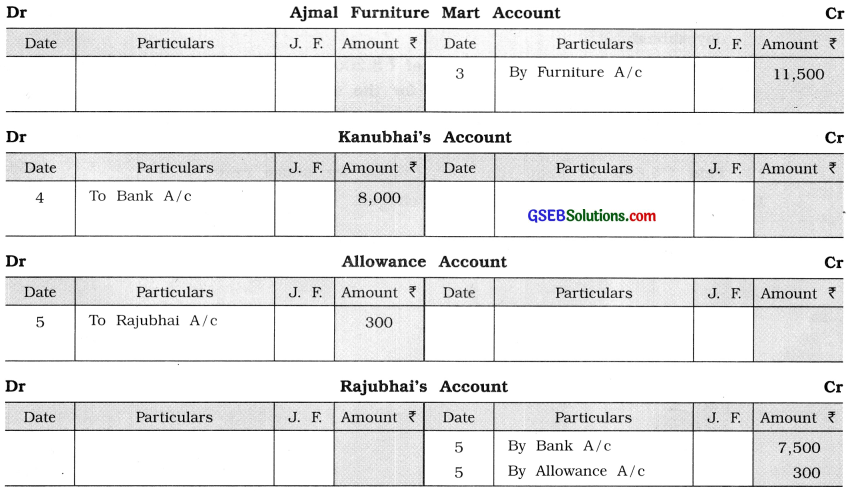

In the books of Shri Katara, write journal entries, for the following transactions, draw necessary accounts in the ledger and post them accordingly:

(1) Brought ₹ 3,30,000 in business. From this ₹ 2,30,000 deposited in a bank.

(2) Cash purchase ₹ 85,000.

(3) From Ajmal Furniture Mart, a furniture of ₹ 11,500 is purchased for office use.

(4) A cheque of ₹ 8,000 is given to Kanubhai against dues.

(5) Against the receivables of ₹ 7,800 from Rajubhai, cheque received ₹ 7,500 for full and final payment.

(6) Cash sales of ₹ 15,000.

(7) Credit sales to Rameshbhai of ₹ 75,000.

(8) Salary paid of ₹ 6,200.

Answer:

![]()

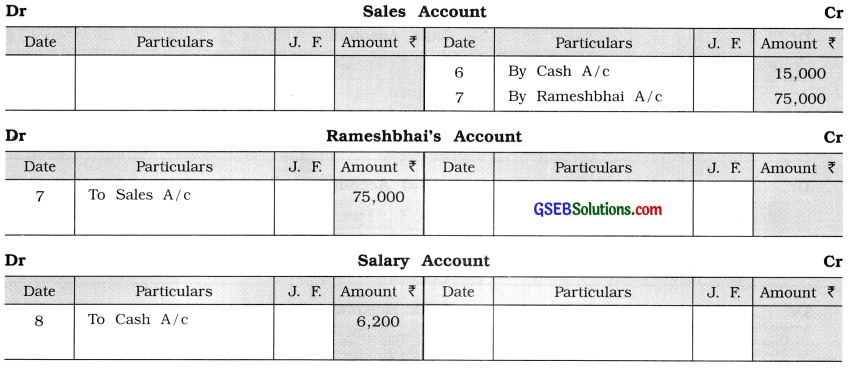

Question 6.

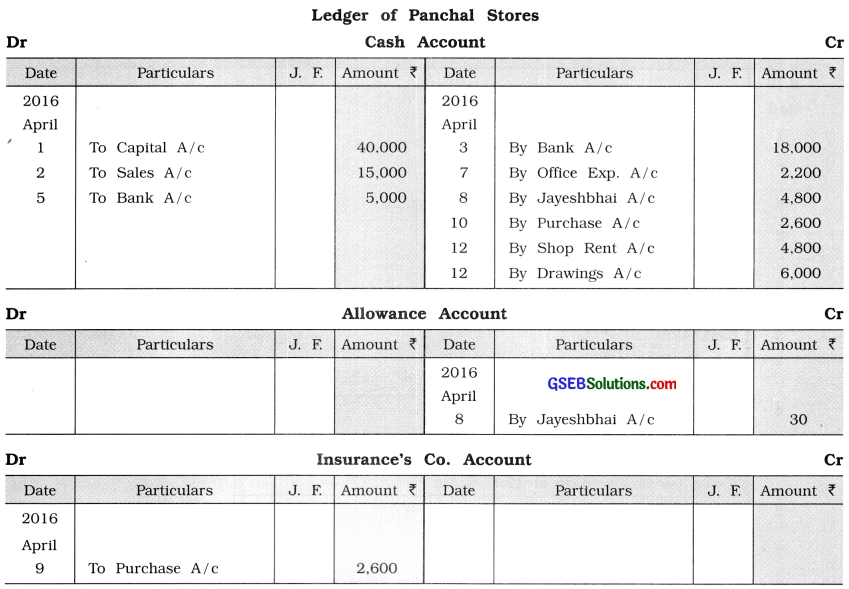

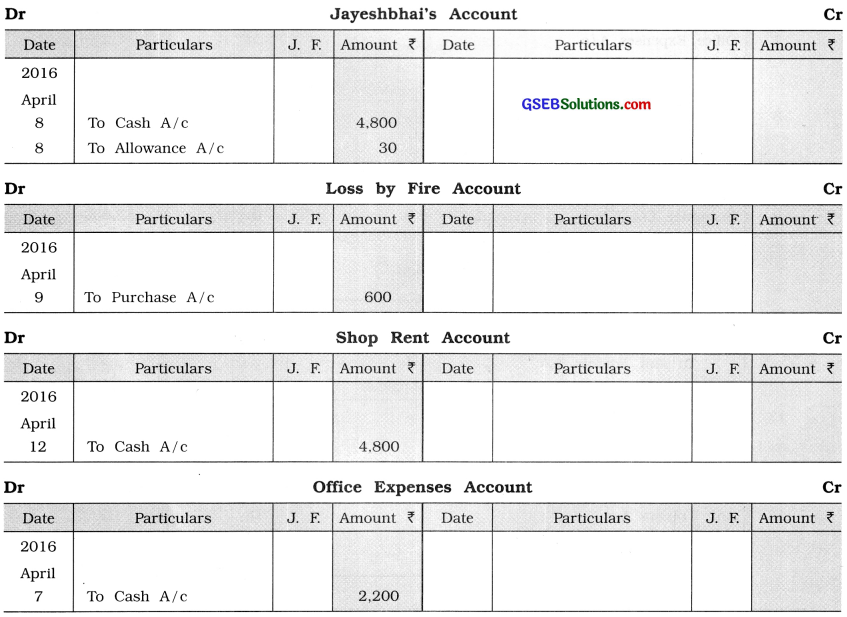

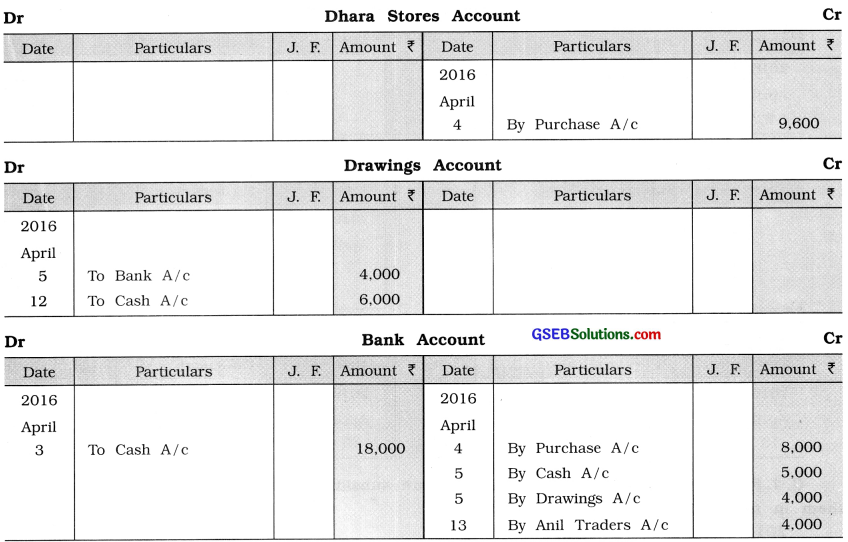

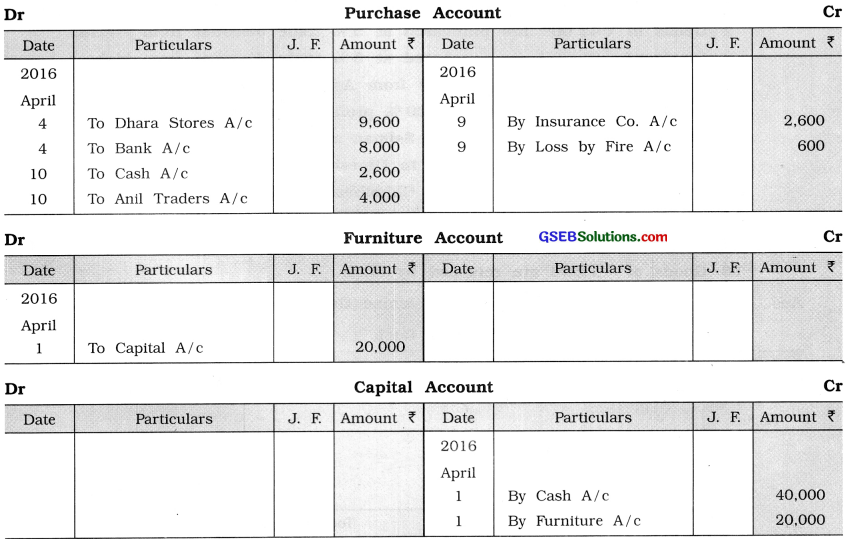

In the book of Panchal Stores, write journal entries, for the following transactions, draw the necessary accounts, in the ledger and post them accordingly :

2016

April 1 Cash ₹ 40,000 and furniture of ₹ 20,000 brought in business.

2 Goods of ₹ 36,000 are sold to Dhaval Stores at 10 % trade discount. For this, Dhaval Stores had paid a cash ₹ 15,000.

3 ₹ 18,000 is deposited in a bank.

4 Goods of ₹ 20,000 are purchased at 12 % trade discount from Dhara Stores. For

. this a cheque of ₹ 8,000 is given.

5 Withdrawn from the bank ₹ 5,000 for office expenses and ₹ 4,000 for the household expenses.

7 Office expenses paid ₹ 2,200.

8 Against the dues of ₹ 4,830, paid ₹ 4,800 in cash for the final settlement to Jayeshbhai.

9 Due to the fire in godown, goods of ₹ 3,200 is burnt by fire and insurance company has accepted a claim of ₹ 2,600 for the same.

10 Goods of ₹ 6,600 are purchased from Anil Traders and towards this, payment of ₹ 2,600 is made in cash.

12 Paid ₹ 4,800 for shop rent and ₹ 6,000 for house rent.

13 Paid ₹ 4,000 to Anil Traders by cheque.

Answer:

![]()

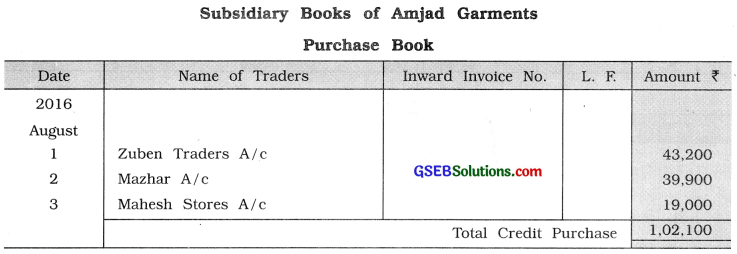

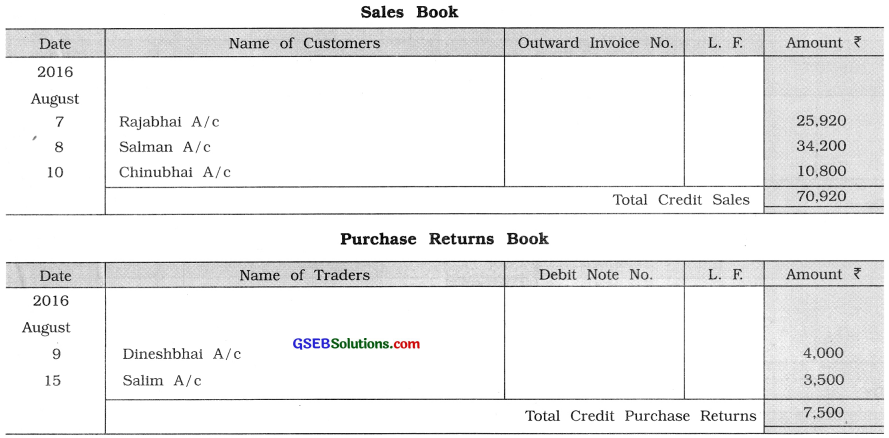

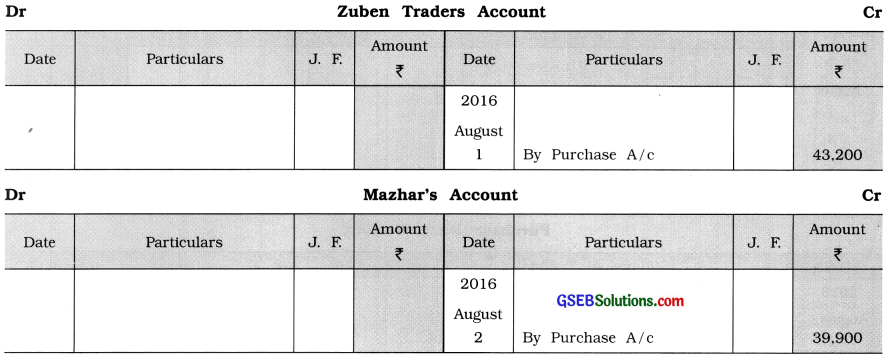

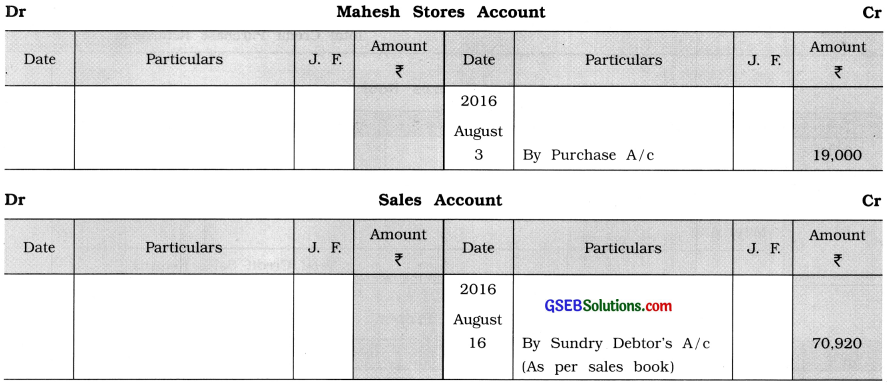

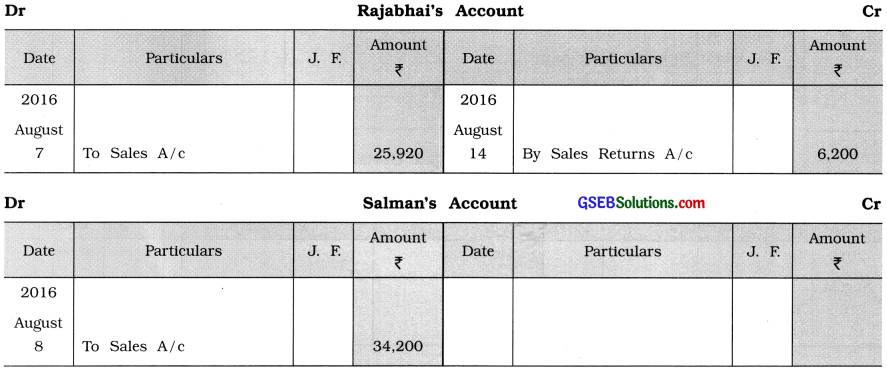

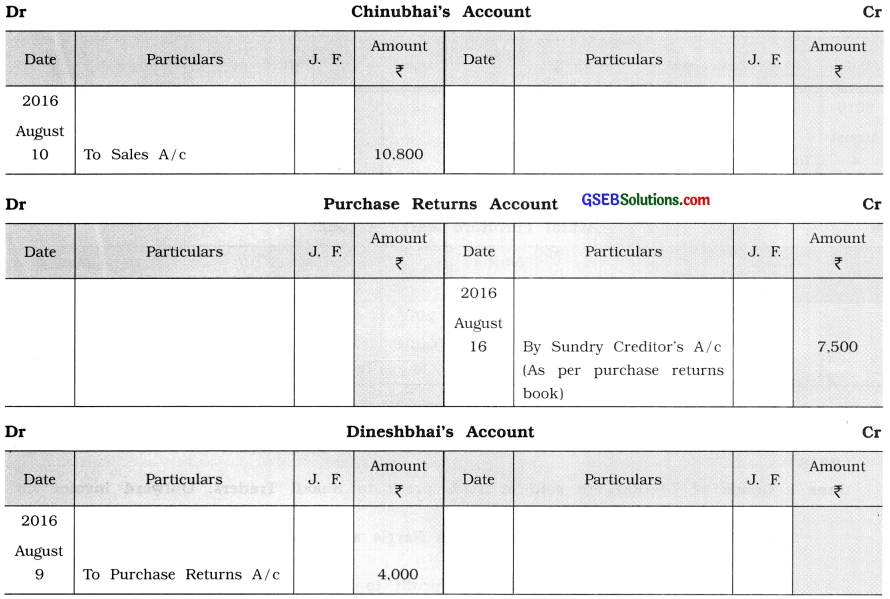

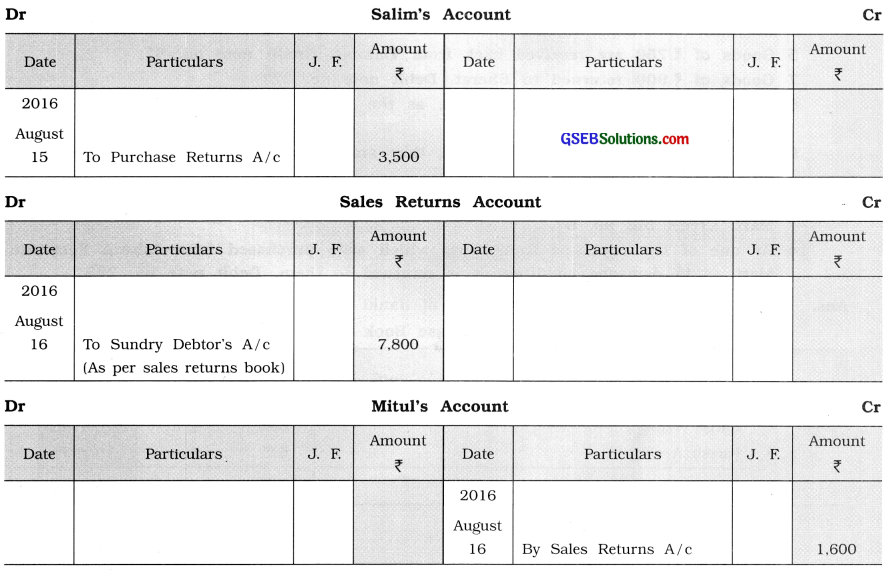

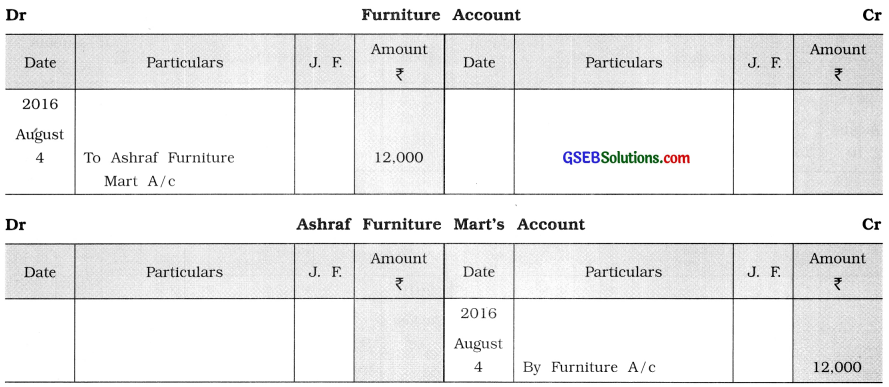

Question 7.

From the following transactions prepare subsidiary books of Amjad Garments and post them in necessary accounts in the ledger:

2016

Goods of ₹ 48,000 are purchased at 10 % trade discount from Zuben Traders. Goods of ₹ 42,000 are purchased at 5 % trade discount from Mazhar.

Goods of ₹ 20,000 are purchased at 5 % trade discount from Mahesh Stores. Purchased furniture of ₹ 12,000 from Ashraf Furniture Mart.

Goods of ₹ 24,000 is sold at 20 % profit to Rajabhai at 10 % trade discount. Goods of ₹ 36,000 are sold to Salman at 5 % trade discount.

Goods of ₹ 4,000 are returned to Dineshbhai.

Goods of ₹ 12,000 are sold to Chinubhai at 10 % trade discount,

Goods of ₹ 6,200 are returned by Rajabhai.

Goods of ₹ 3,500 are returned to Salim.

Goods of ₹ 1,600 are returned by Mitul.

Answer:

![]()

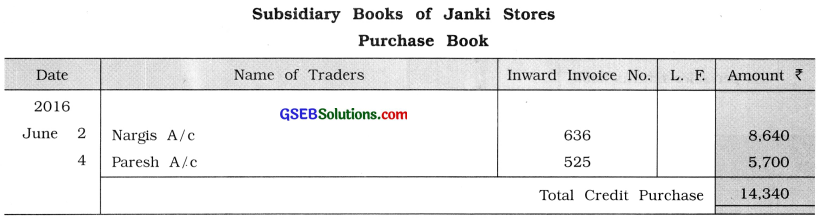

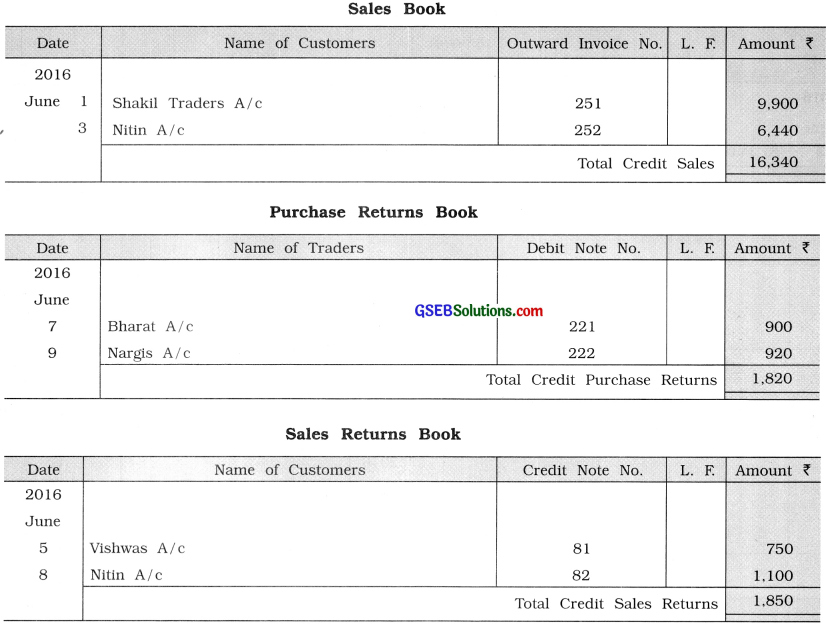

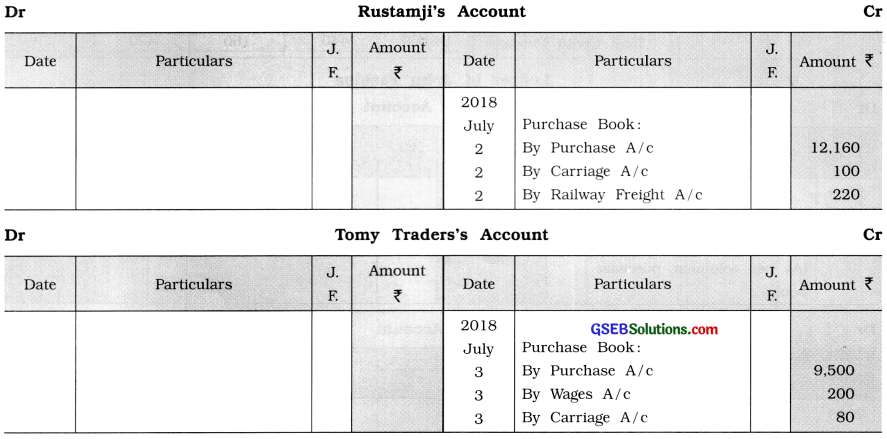

Question 8.

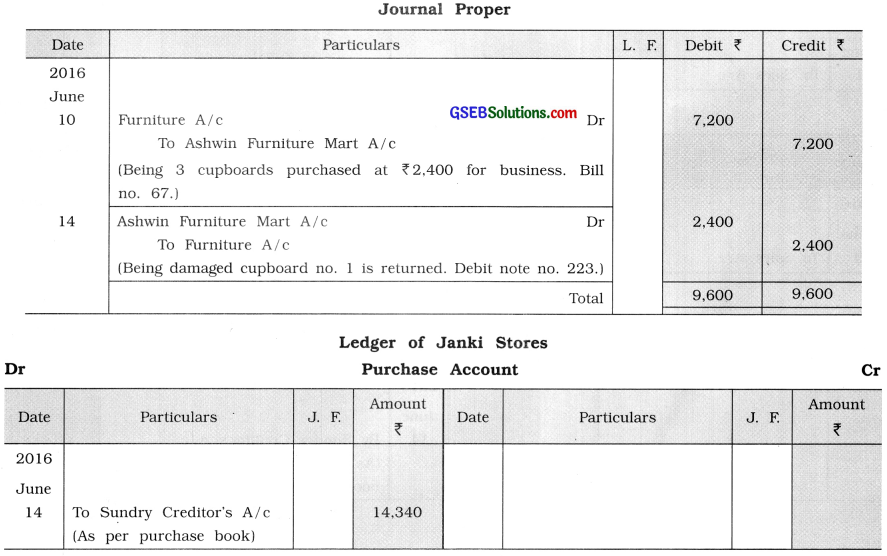

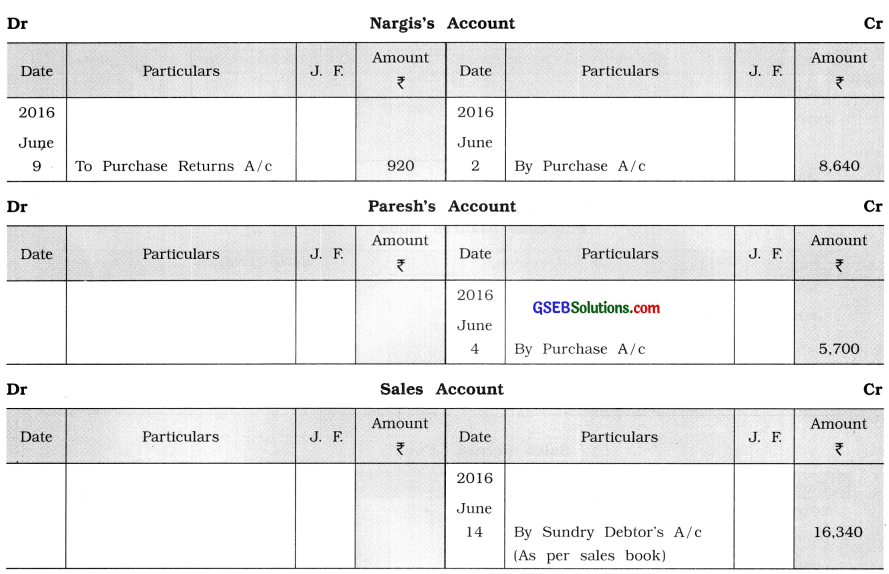

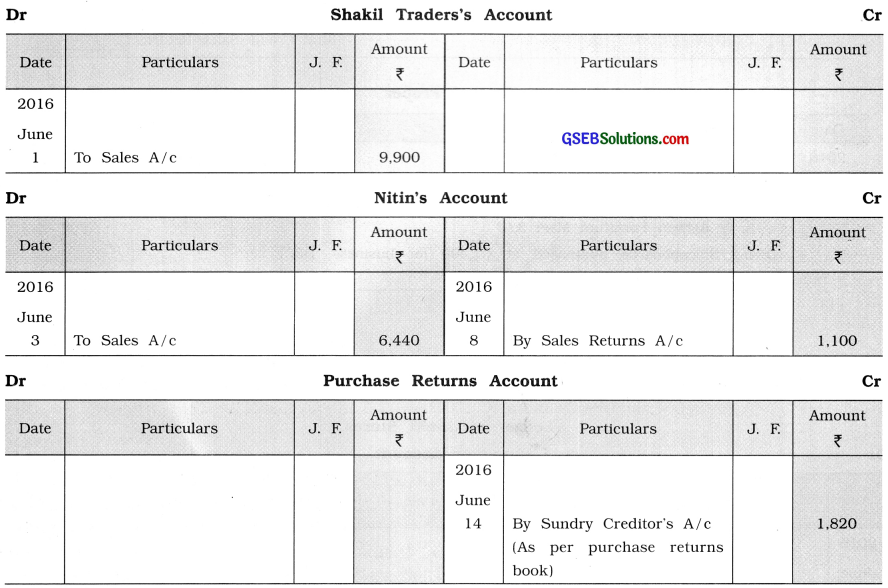

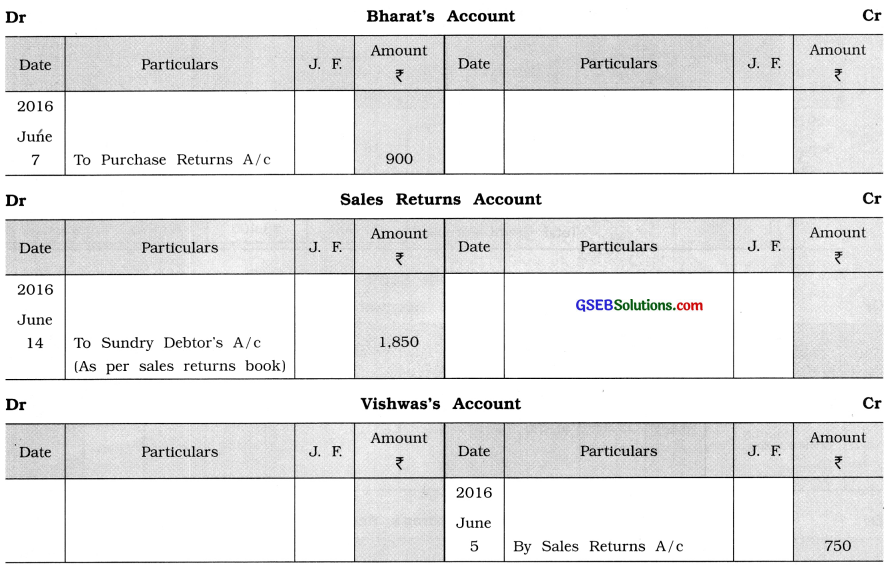

From the following transactions prepare subsidiary books of Janki Stores and post them in necessary accounts :

2016

June 1 Goods of ₹ 9,000 are sold at 10 % profit to Shakil Traders. Outward invoice no. 251.

2 Goods of ₹ 9,600 are purchased from Nargis at 10 % trade discount. Inward invoice no. 636.

3 Goods of ₹ 5,600 are sold at 15 % profit to Nitin. Outward invoice no. 252.

4 Goods of ₹ 6,000 are purchased from Paresh at 5 % trade discount. Inward invoice

no. 525.

5 Goods of ₹ 750 are received back from Vishwas. Credit note no. 81.

7 Goods of ₹ 900 returned to Bharat. Debit note no. 221.

8 Goods of ₹ 1,100 returned by Nitin, as the goods were not according to sample.

Credit note no. 82.

9 As the goods of ₹ 920 are damaged, they are returned back to Nargis. Debit note no. 222.

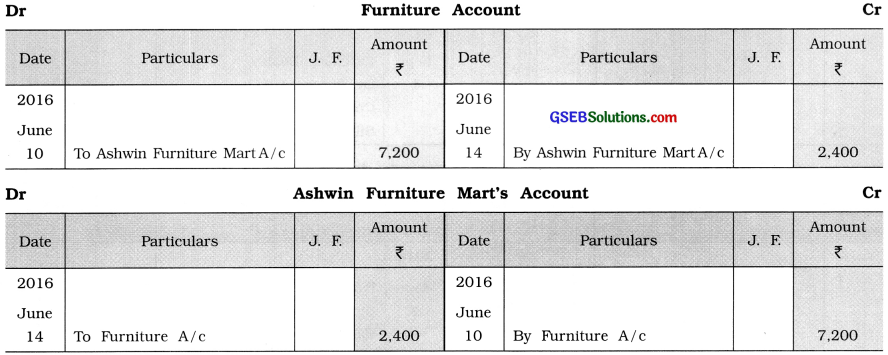

10 Three cupboards at the rate of ₹ 2,400 each are purchased from Ashwin Furniture Mart. Credit bill no. 67.

14 As one of the cupboard from those which were purchased from Ashwin Furniture Mart, is in damaged condition it is returned to them. Debit note no. 223.

Answer:

![]()

Question 9.

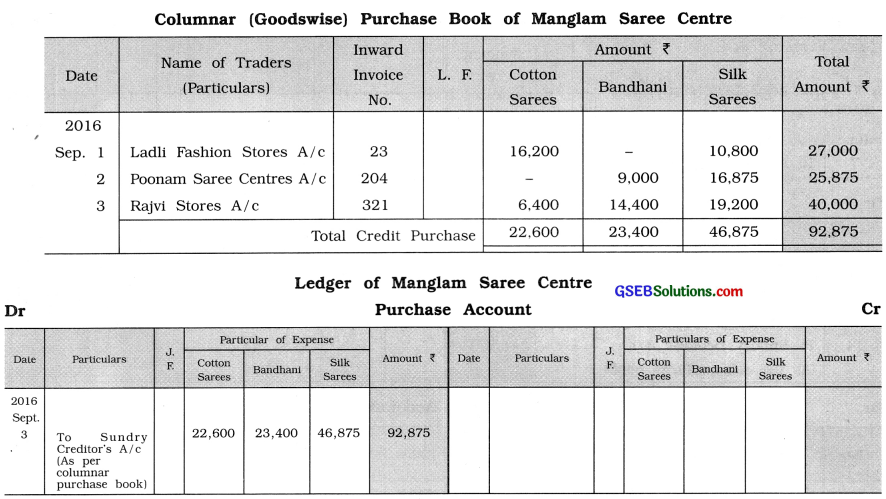

The following is the information relating to purchase of goods by Manglam Saree Centre.

From this prepare their goodswise columnar purchase book and post them in ledger.

2016

Sept. 1 40 Cotton sarees at the rate of ₹ 450 and 20 Silk sarees at the rate of ₹ 600 are purchased from Ladli Fashion Stores at 10 % trade discount. Inward invoice no. 23.

2 25 Silk sarees at the rate of ₹ 750 and 10 Badhani at the rate of ₹ 1,000 are purchased from Poonam Saree Centres at 10 % trade discount. Inward invoice no. 204.

3 20 Cotton sarees at the rate of ₹ 400, 30 Silk sarees at the rate of ₹ 800 and 15 Bandhani at the rate of ₹ 1,200 are purchased from Rajvi Stores at 20% trade discount. Inward invoice no. 321.

Answer:

![]()

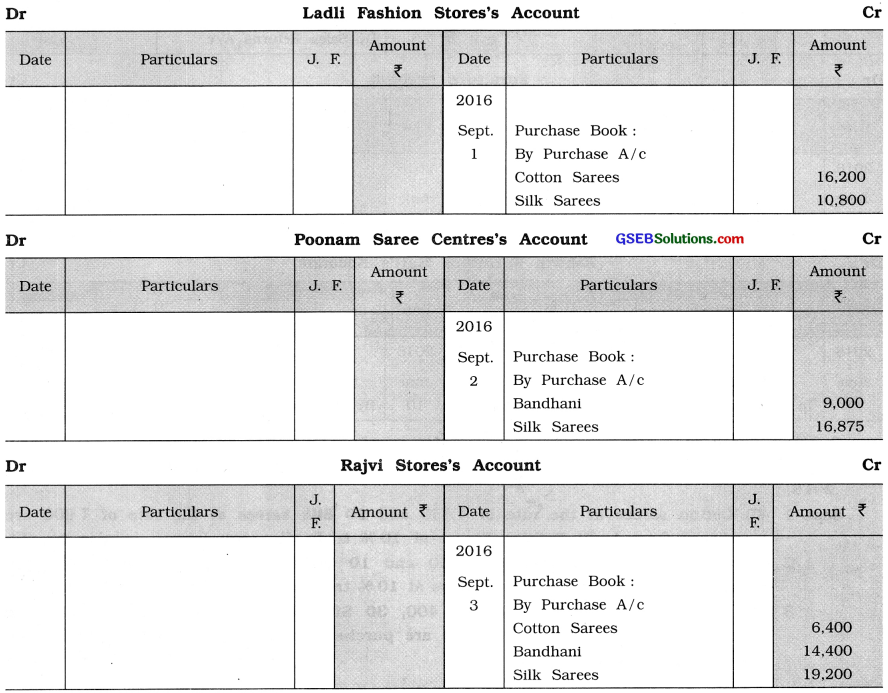

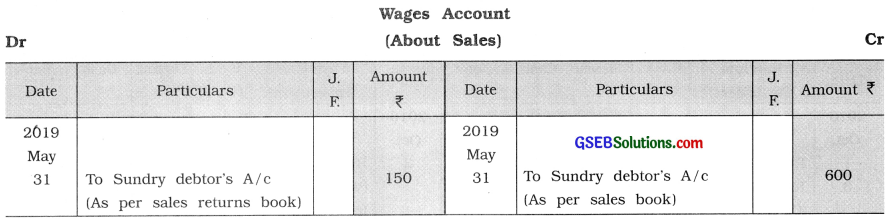

Question 10.

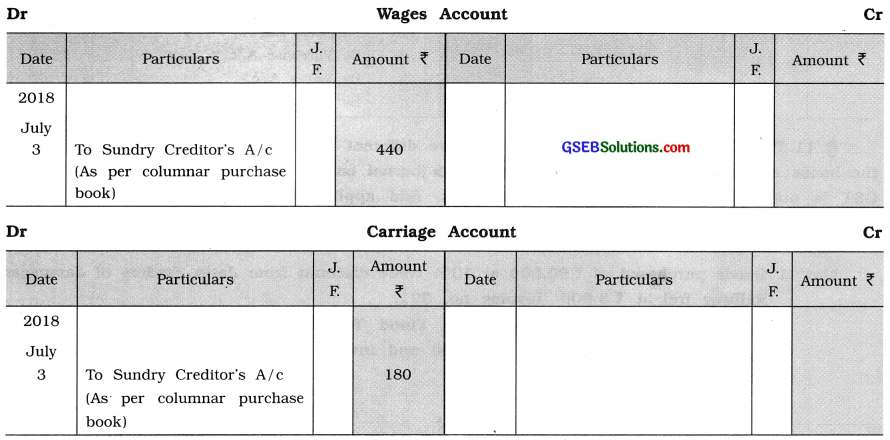

From the following informations, prepare a columnar (expensewise) purchase book of John Fashion and post them in ledger:

2018

July 1 Goods of ₹ 14,000 are purchased from Pestanji at 10% trade discount. Trader has given a bill along with Wages of ₹ 240 and railway freight of ₹ 200.

2 Goods of ₹ 12,800 are purchased from Rustamji at 5 % trade discount. In the invoice of the trader is shown ? 220 for the railway freight and ₹ 100 for carriage.

3 Goods of ₹ 10,000 are purchased from Tomy Traders at 5 % trade discount. In the invoice which is sent by the trader, it is shown ₹ 200 for Wages and ₹ 80 for carriage.

Answer:

![]()

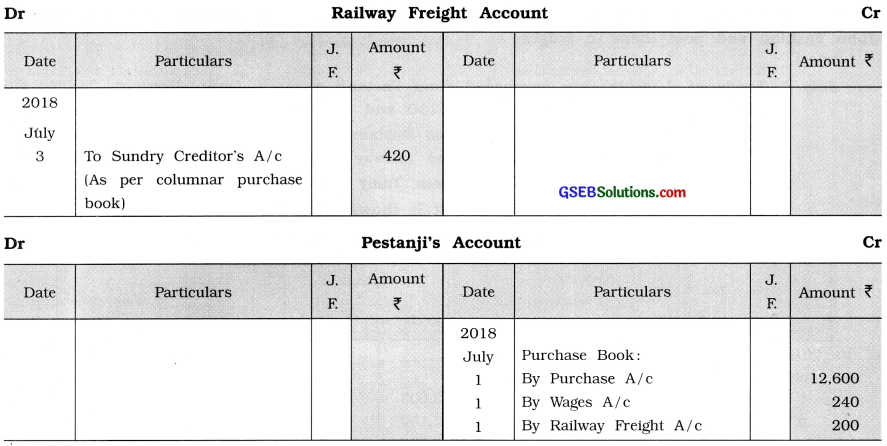

Question 11.

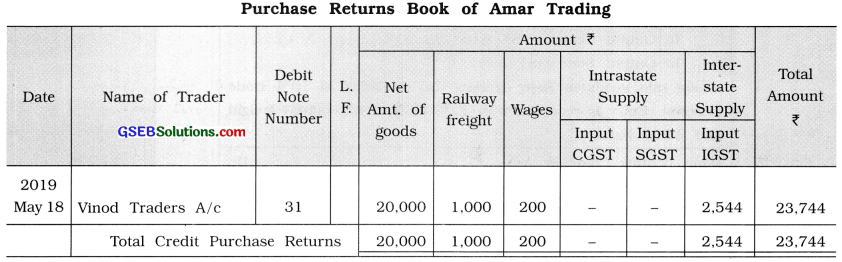

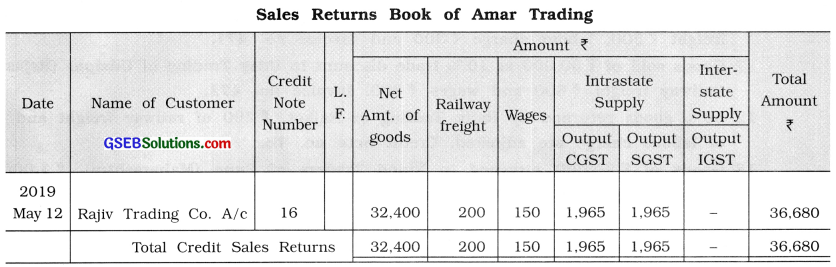

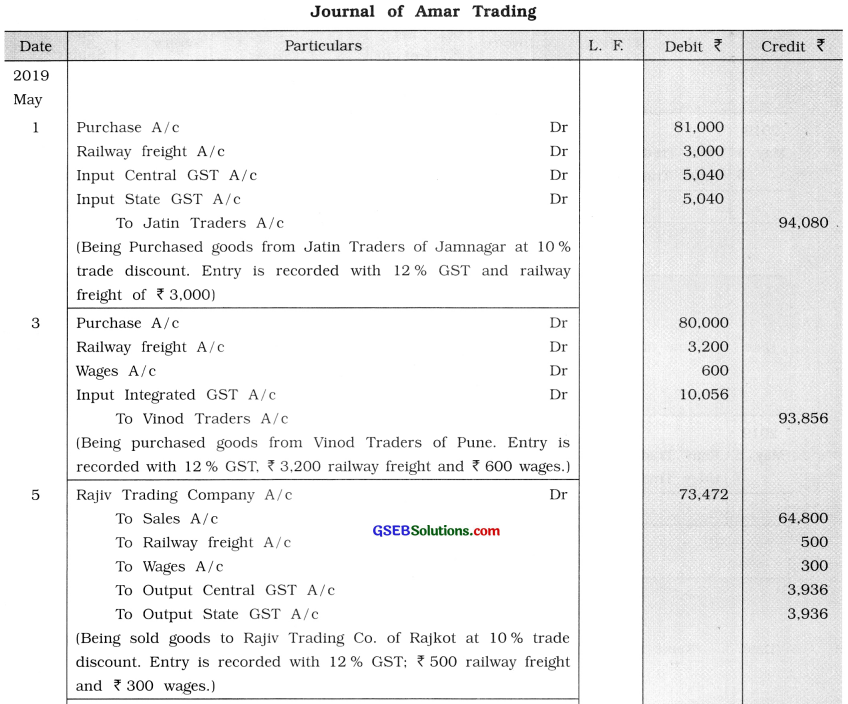

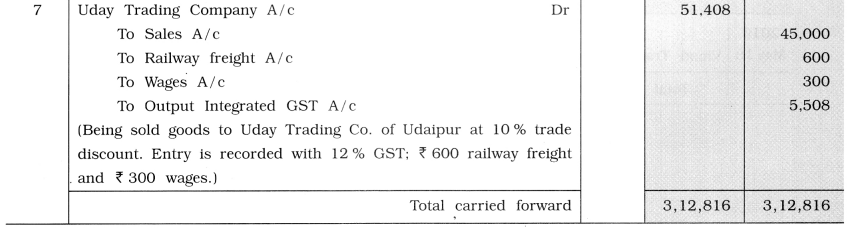

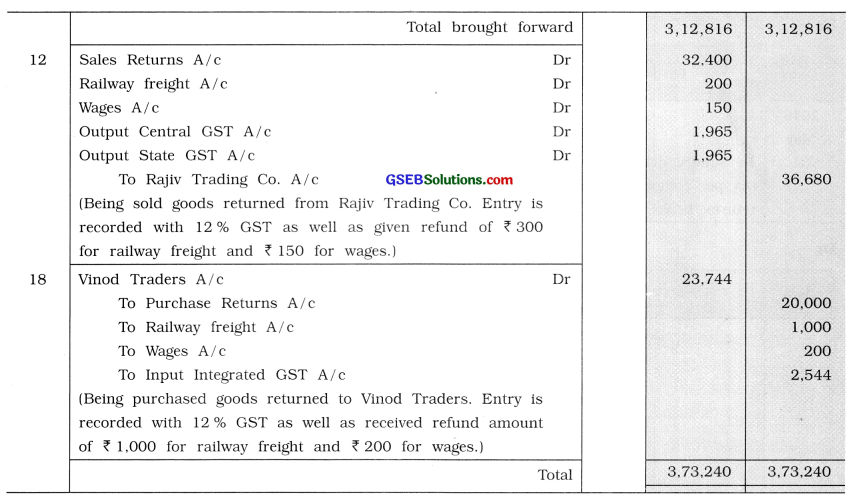

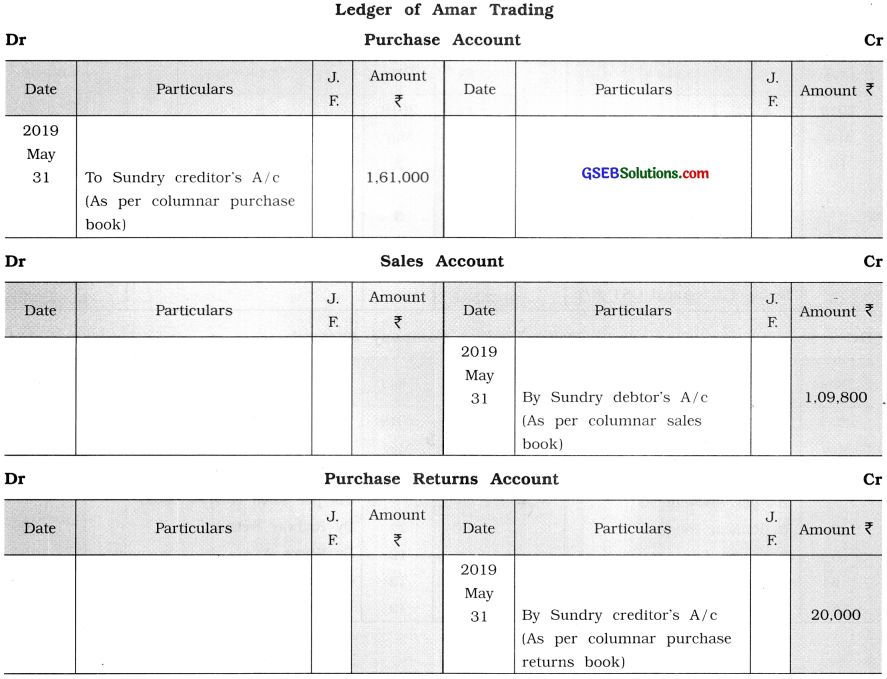

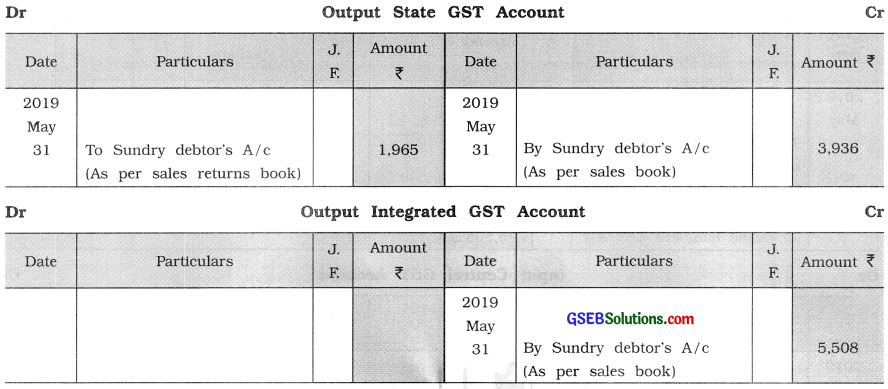

From the following transactions prepare different subsidiary book with GST at 12% in the books of Amar Trading of Ahmedabad. Write journal entries also and make posting of them. GST is not included for following transactions. Add applicable amounts of GST and prepare subsidiary books, journal entries and posting of them.

2019

May 1 Goods purchased of ₹ 90,000 at 10 % trade discount from Jatin Traders of Jamnagar. Railway freight ₹ 3,000. Invoice no. 321.

3 Goods purchased of ₹ 80,000 from Vinod Traders of Pune (Maharashtra). Railway freight 3,200, labour charges ₹ 600 and invoice no. 322.

5 Goods sold of ₹ 72,000 at 10 % trade discount to Rajiv Trading of Rajkot. Railway freight ₹ 500, labour charge ₹ 300 and invoice no. 471.

7 Goods sold of ₹ 50,000 at 10% trade discount to Uday Trading of Udaipur (Rajasthan). Railway freight ₹ 600 and wages ₹ 300. Invoice no. 472.

12 50 % goods returned by Rajiv Trading of Rajkot. ₹ 200 of railway freight and ₹ 150 of labour charge are adjusted. Credit note no. 16.

18 Goods of ₹ 20,000 returned to Vinod Traders of Pune (Maharashtra). ₹ 1,000 and railway freight and ₹ 200 of labour charge are adjusted. Debit note no. 31.

Answer:

![]()

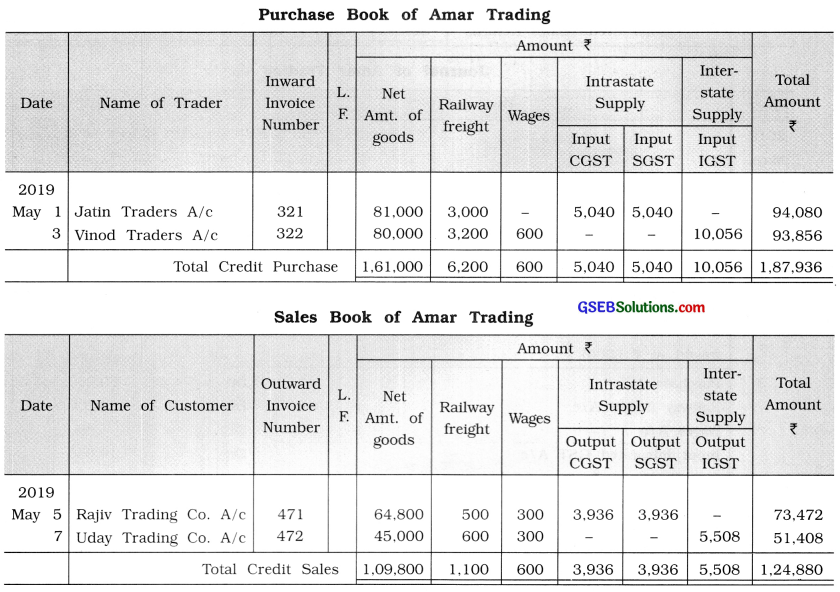

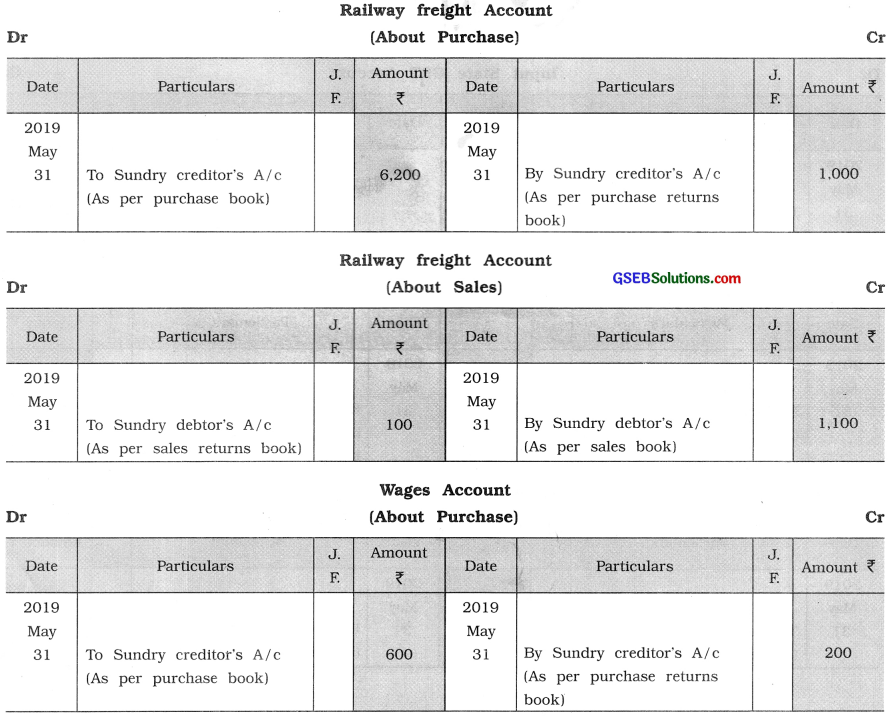

Question 12.

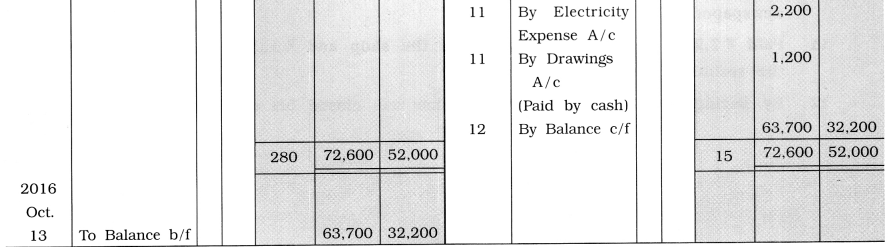

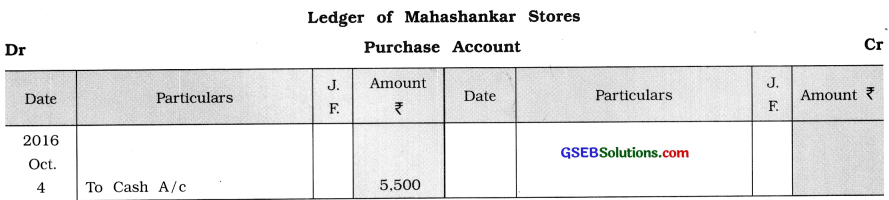

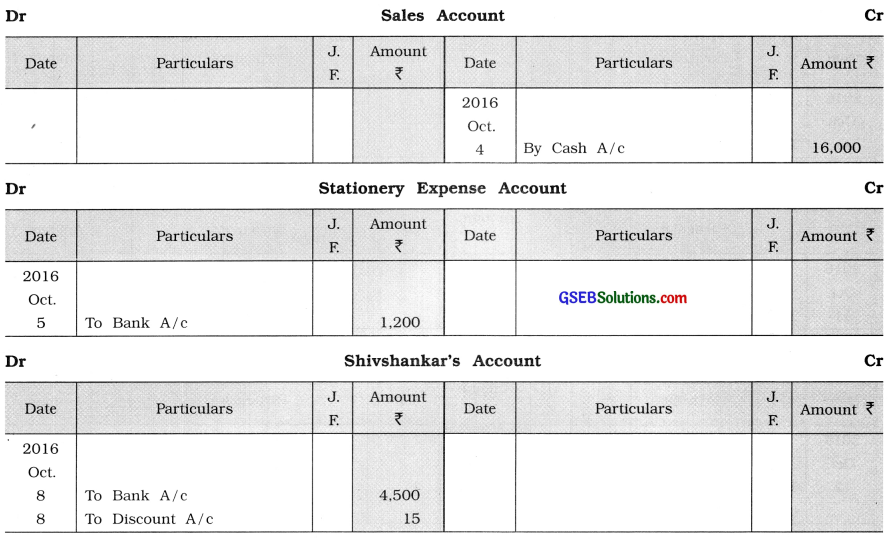

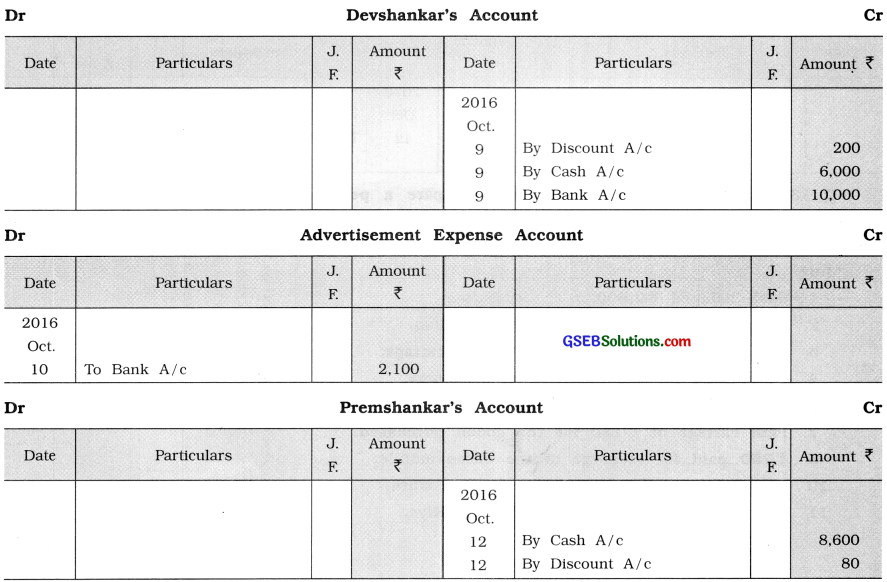

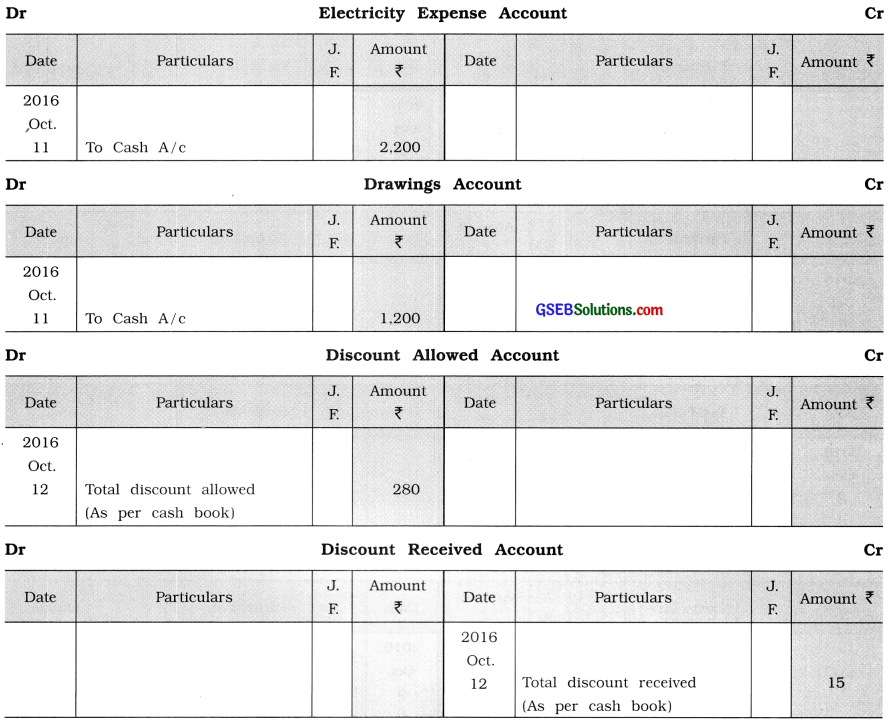

From the following informations of Mahashankar Stores, prepare three columnar cash book and post it in ledger:

2016

October

1 Cash balance ₹ 30,000; bank balance ₹ 42,000.

3 Withdraw ₹ 12,000 from bank for business.

4 Cash purchase ₹ 5,500; cash sales ₹ 16,000.

5 Gave a cheque of ₹ 1,200 for the purchase of office stationery.

8 A cheque of ₹ 4,500 is given to Shivshankar for full settlement towards payables of ₹ 4,515.

9 Against the receivables of ₹ 16,200, due from Devshankar, received ₹ 6,000 in cash and ₹ 10,000 by cheque in full settlement.

10 A cheque of ₹ 2,100 is given to Umashankar News Agency, for the advertisement in newspaper.

11 Paid ₹ 2,200 as the electricity bill of the shop and ₹ 1,200 as the electricity bill of the residence from the business.

12 By paying cash of ₹ 8,600, Premshankar has closed his account of ₹ 8,680.

Answer:

![]()

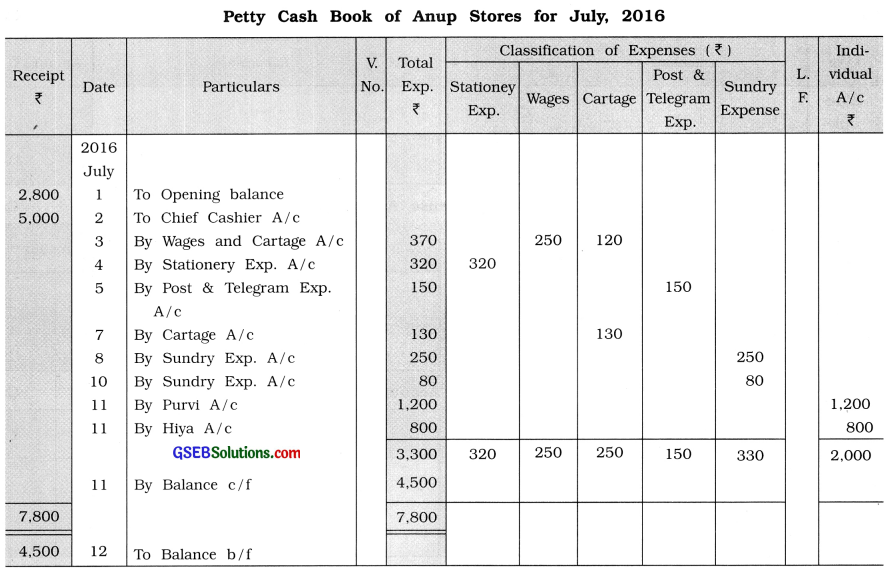

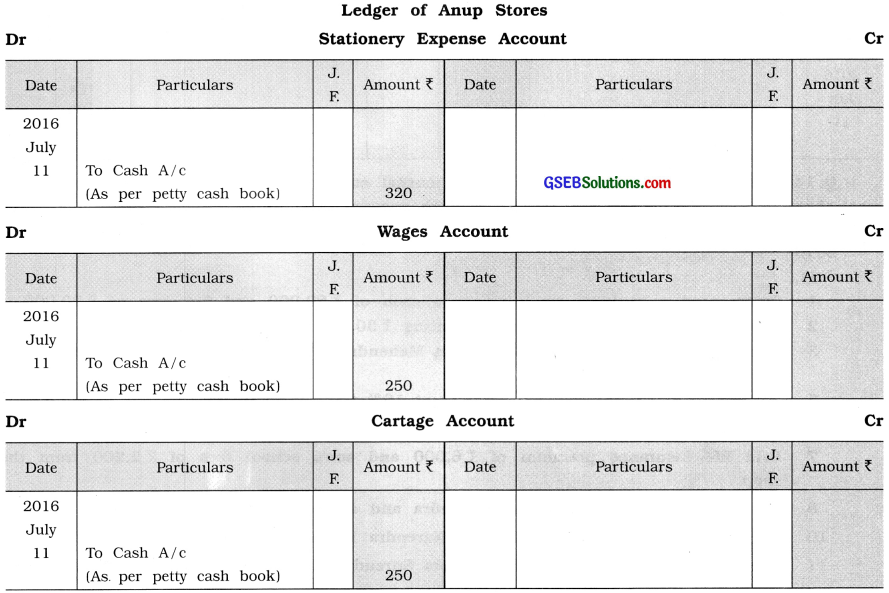

Question 13.

From the following informations prepare a petty cash book in the books of Anup Stores and post them in ledger:

2016

July

1 Cash balance ₹ 2,800.

2 Received ₹ 5,000 from the cashier, Ishan.

3 Paid ₹ 250 for wages and ₹ 120 for cartage.

4 ₹ 320 paid for the purchase of stationery.

5 ₹ 150 paid for sending the post.

7 Paid cartage of ₹130 for the goods purchased.

8 ₹ 250 paid for recharge of the office mobile.

10 Paid ₹ 80 for the photocopy of office work.

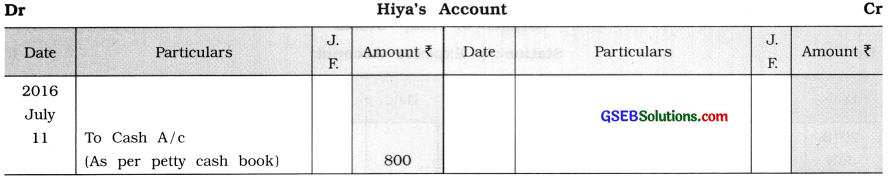

11 Paid ₹ 1,200 to Purvi and ₹ 800 to Hiya.

Answer:

![]()

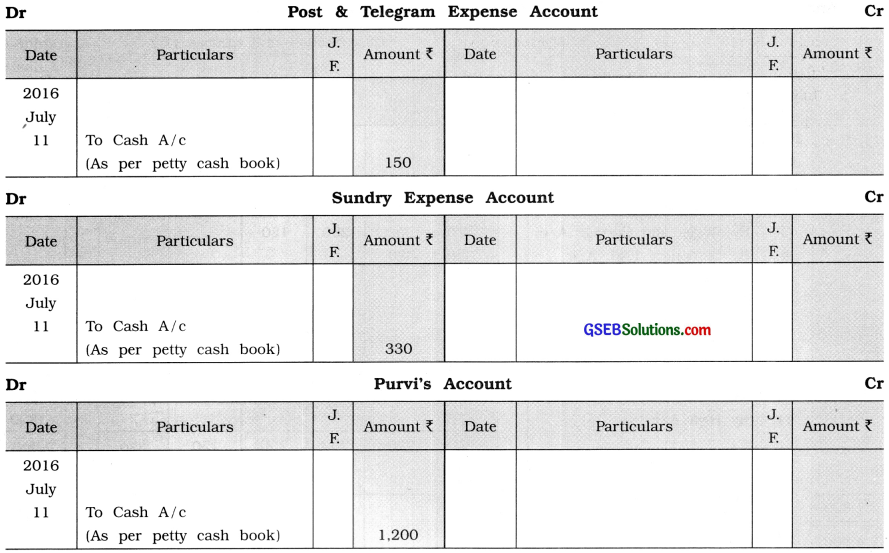

Question 14.

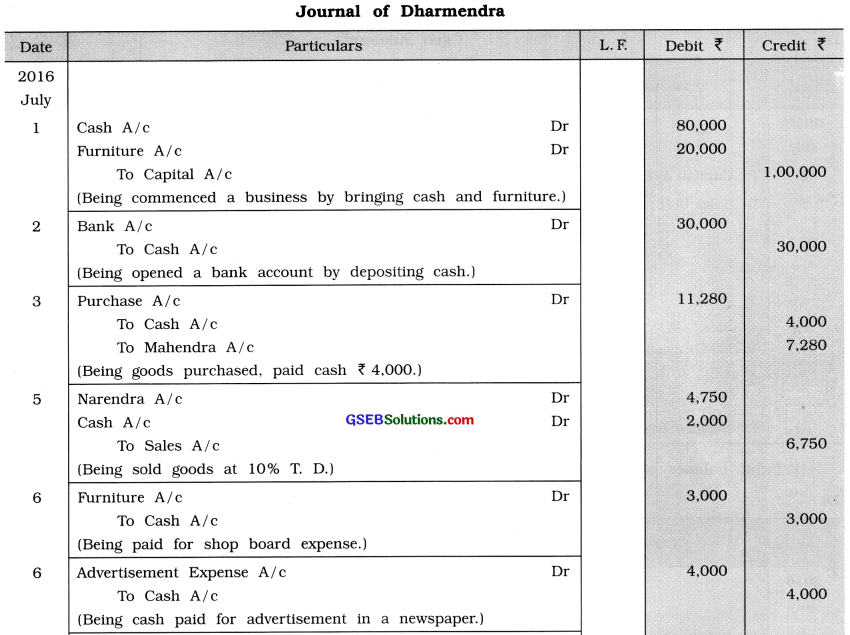

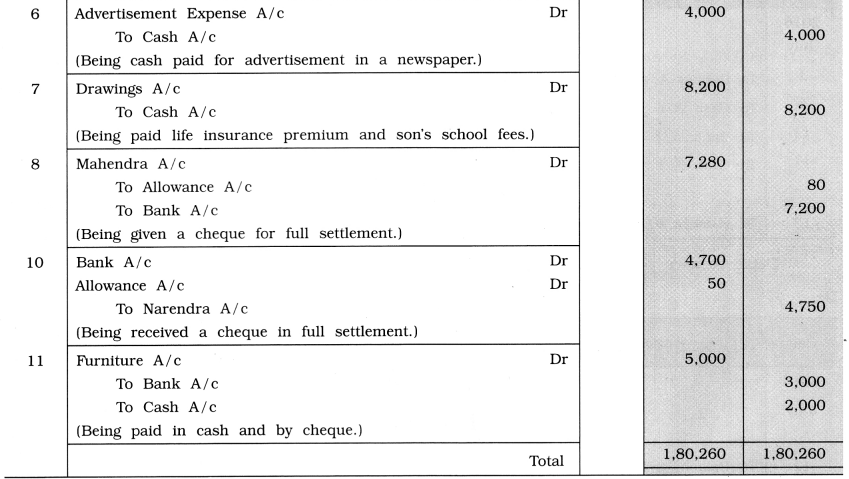

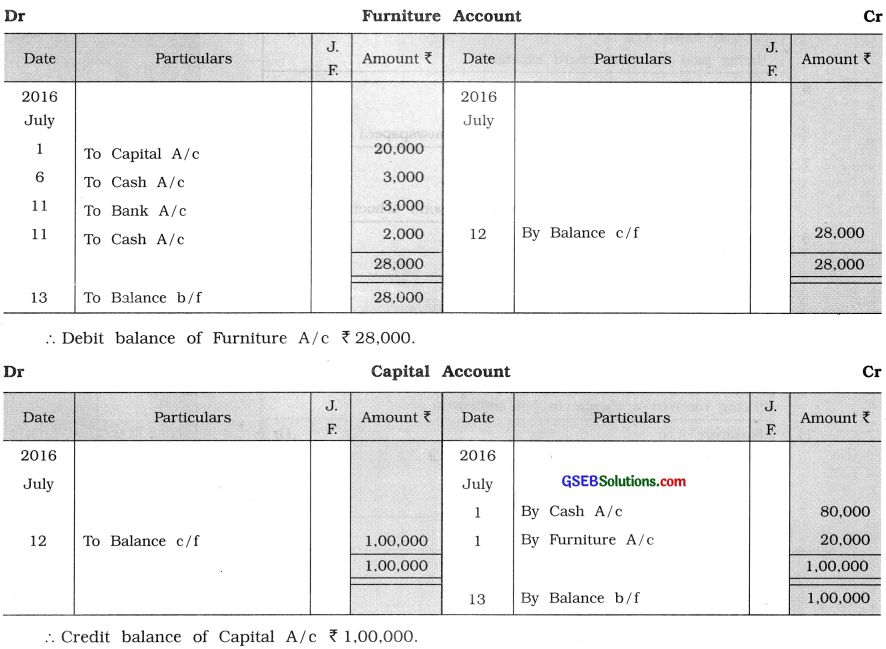

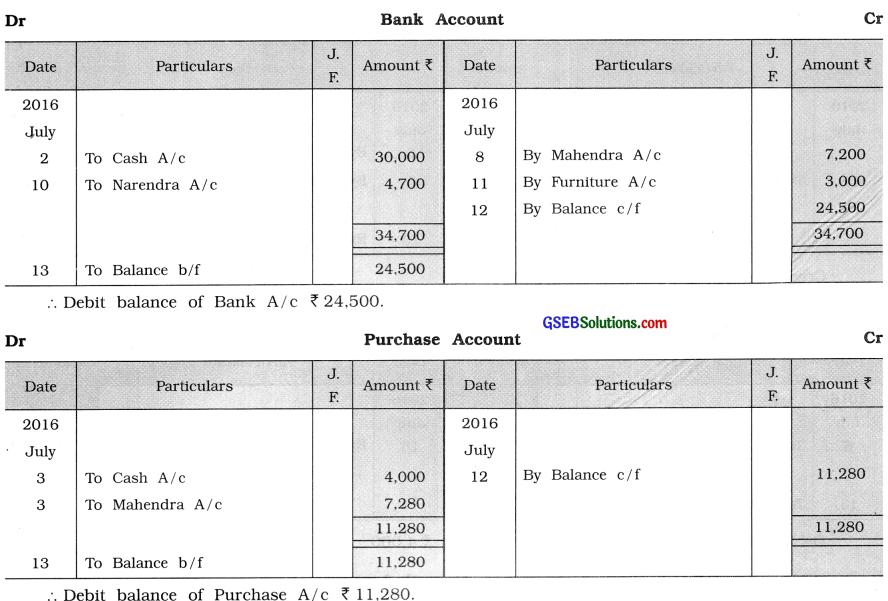

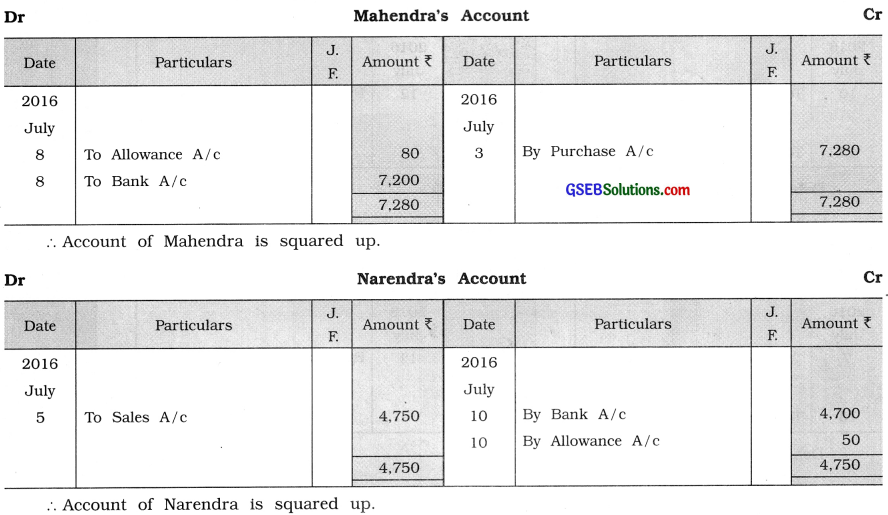

From the following transactions pass journal entries in the books of Dharmendra and post them in ledger. Find out the balance of each account and decide which account has which balance.

2016

July

1 Commenced a business by bringing in cash of ₹ 80,000 and furniture of ₹ 20,000.

2 A bank account is opened, by depositing ₹ 30,000.

3 Goods of ₹ 12,000 are purchased from Mahendra at 6 % trade discount and paid cash ? 4,000.

5 Goods of ₹ 7,500 are sold to Narendra at 10% trade discount and he has paid ? 2,000.

6 Paid in cash ₹ 3,000 for shop board and ₹ 4,000 for advertisement in a newspaper.

7 Paid life insurance premium of ₹ 6,000 and son’s school fees of ₹ 2,200 from the shop.

8 Given a cheque of ₹ 7,200 to Mahendra and settled his account.

10 Received a cheque of ₹ 4,700 from Narendra in full settlement.

11 Purchased the furniture of ₹ 5,000 from Surendra Hardware. Against this given ₹ 3,000 by cheque and ₹ 2,000 in cash.

Answer:

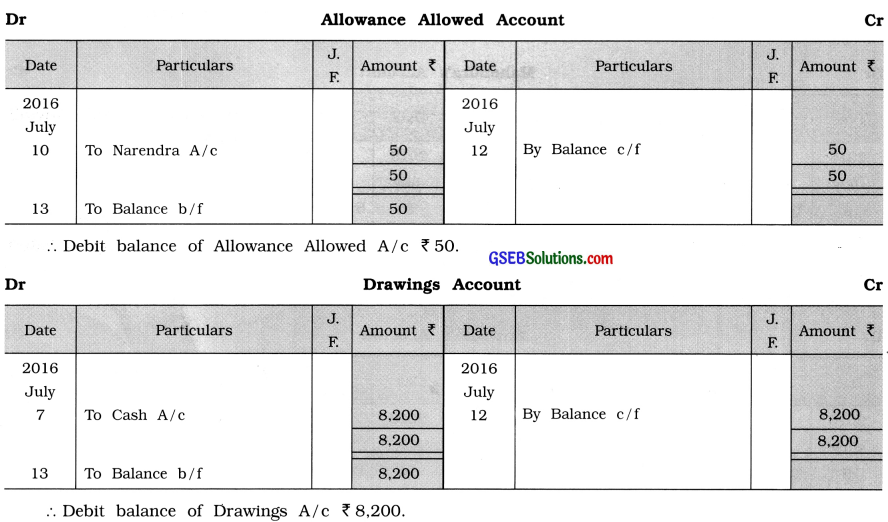

Credit balance Allowance Received A/c ₹ 80.

Note :

(1) Amount paid for shop board is debited to Furniture A/c.

(2) In the transaction of date 8, given a cheque of ₹ 7,200 against the payable amount ₹ 7,280 for full settlement, therefore difference amount ₹ 80 (₹ 7,280 – ₹ 7,200) will be recorded as allowance and it is credited.

(3) In the transaction of date 10, received a cheque of ₹ 4,700 against the receivable amount ₹ 4,750 in full settlement, therefore difference amount ₹ 50 (₹ 4,750 4,700) will be recorded as allowance and it is debited.

![]()

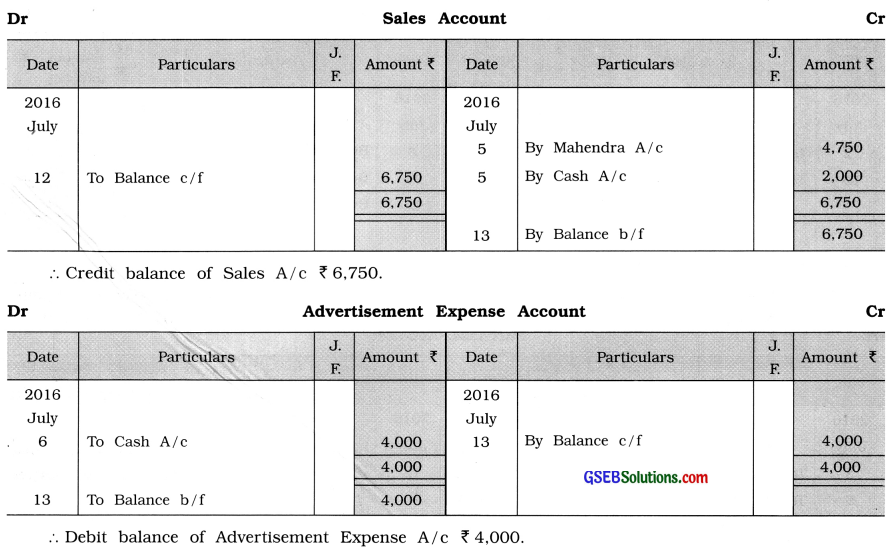

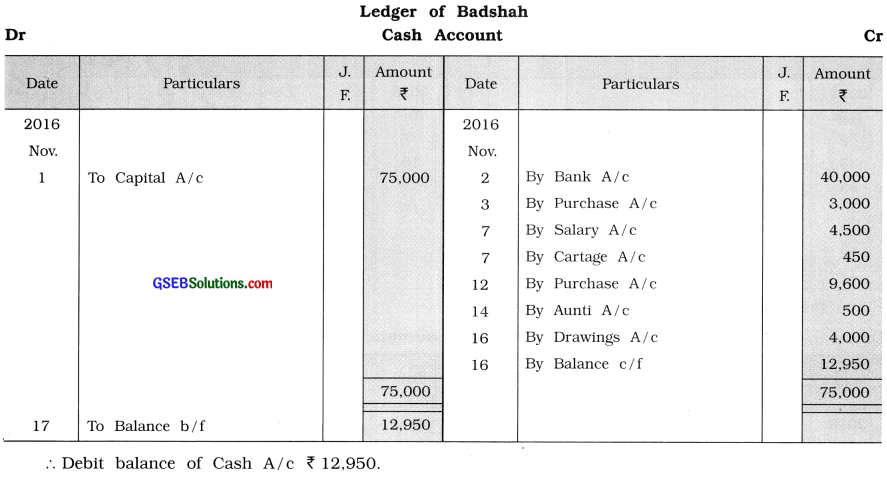

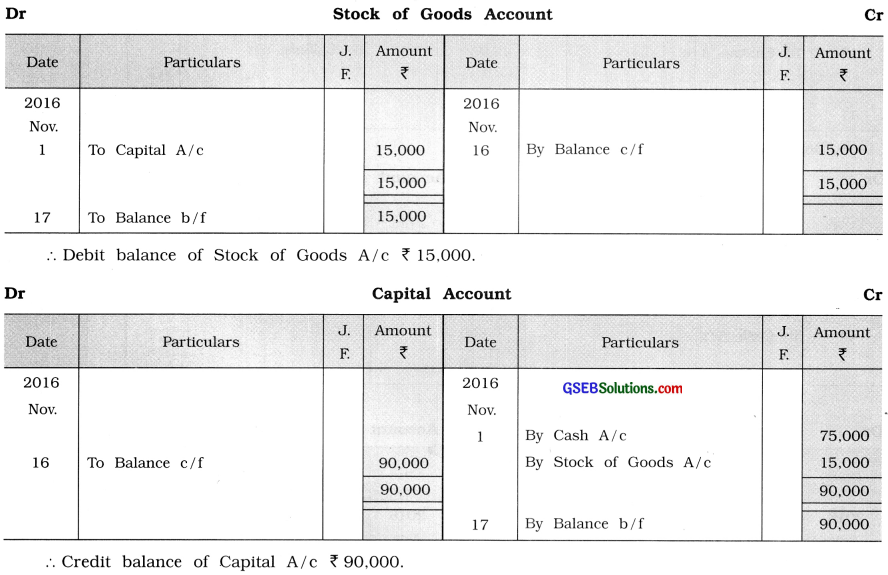

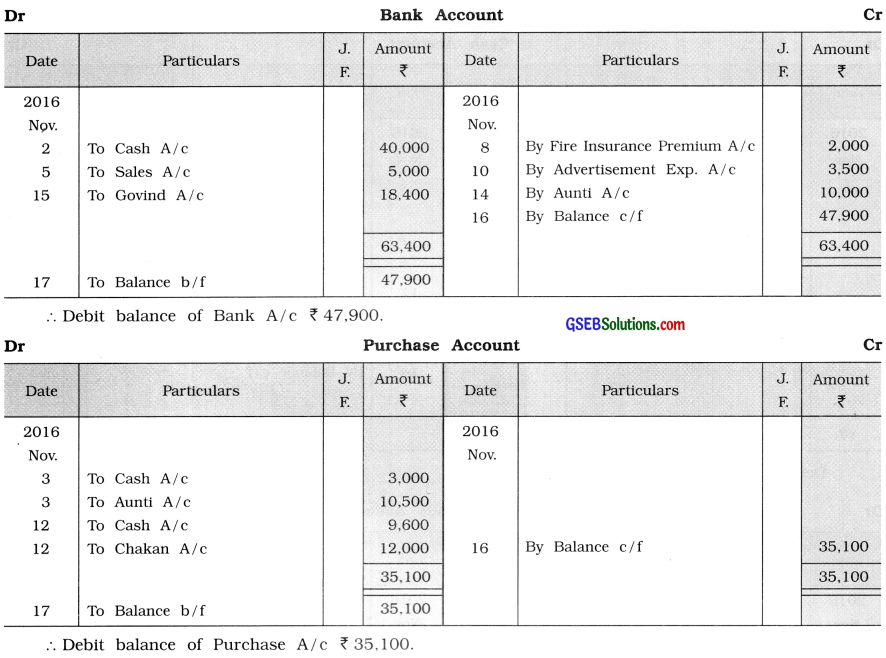

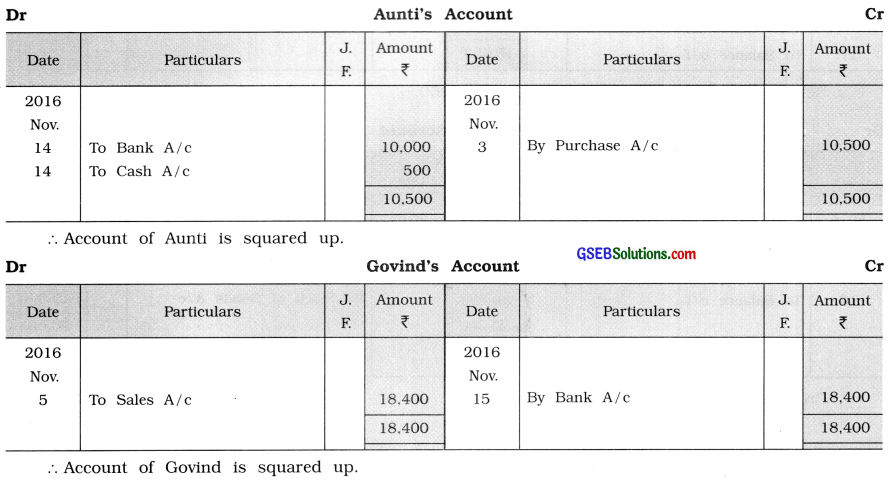

Question 15.

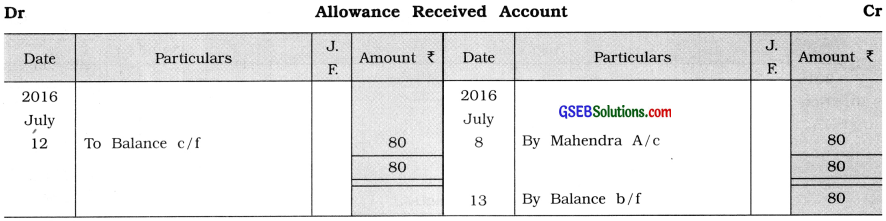

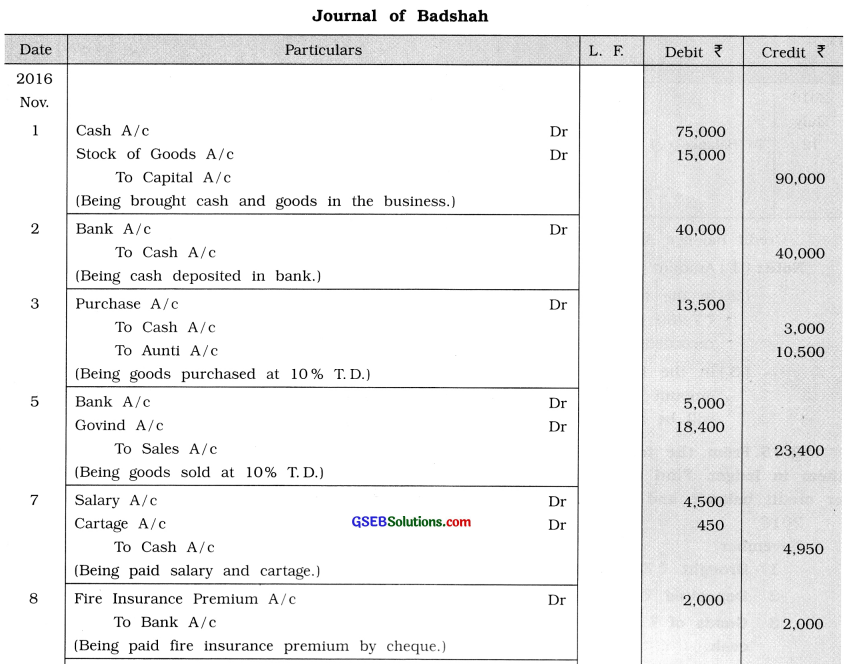

From the following transactions pass journal entries in the books of Badshah. Post them in ledger. Find out the balance of each account and state whether it is a debit balance or credit balance and also mention the amount.

2016

November

1 Brought ₹ 75,000 cash and stock of goods of ₹ 15,000 in the business.

2 Deposited ₹ 40,000 in bank.

3 Goods of ₹ 15,000 are purchased from Aunti at 10 % trade discount and paid ₹ 3,000 cash.

5 Goods of ₹ 20,000 are sold at 30 % profit to Govind, at 10 % trade discount. Govind has given a cheque of ₹ 5,000, which is deposited in the bank.

7 Paid salary ₹ 4,500 and cartage ₹ 450.

8 Fire insurance premium of ₹ 2,000 is paid by cheque.

10 Paid ₹ 3,500 by cheque to Shah Agency for an advertisement in a newspaper.

12 Goods of ₹ 24,000 purchased from Chakan at 10 % trade discount and paid ₹ 9,600 cash to Chakan.

14 Paid ₹ 10,000 by cheque to Aunti and the balance amount in cash.

15 A cheque of ₹ 18,400 send by Govind. Which is deposited in the bank,

16 Paid ₹ 4,000 from the business for the school fees of daughter, Urja.

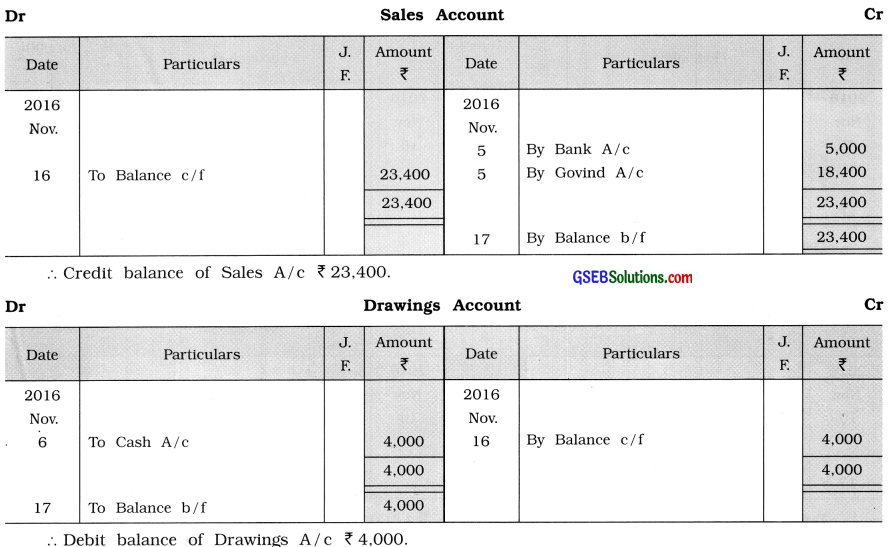

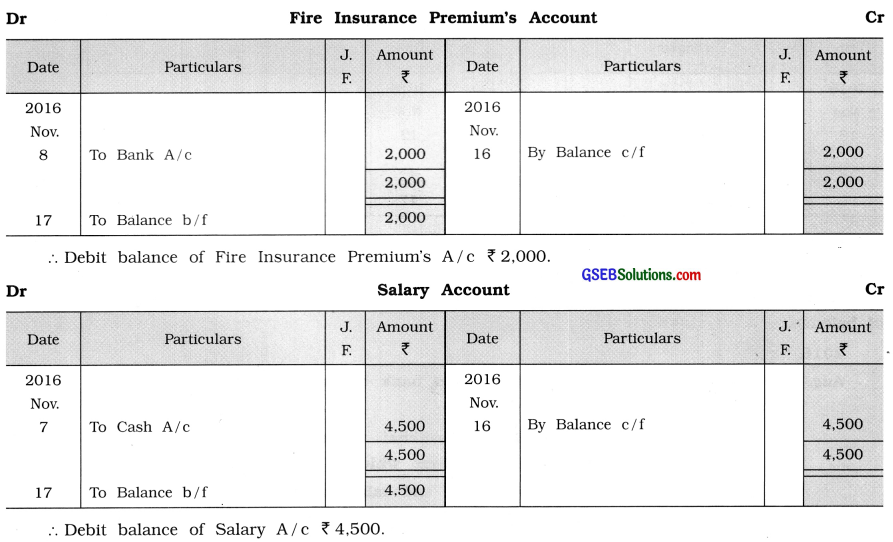

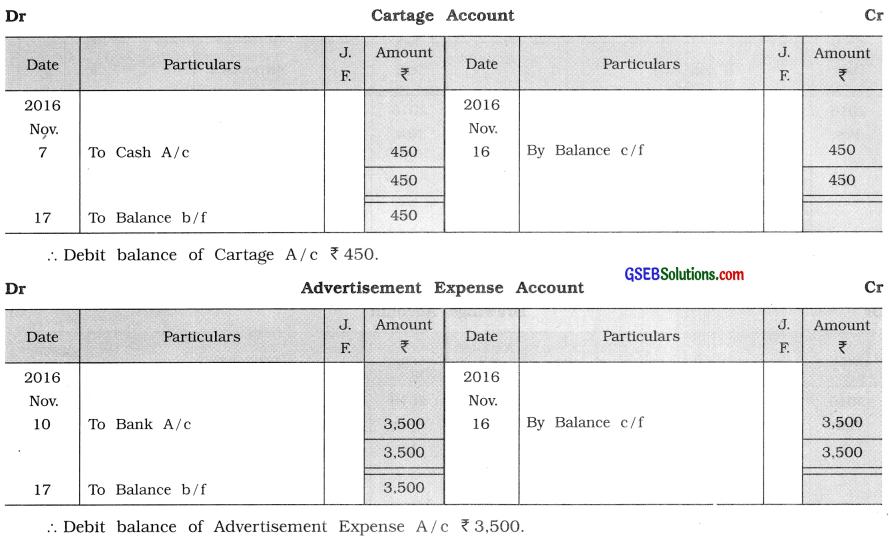

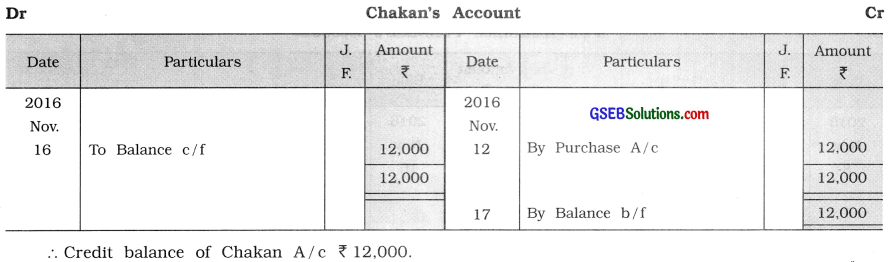

Answer:

![]()

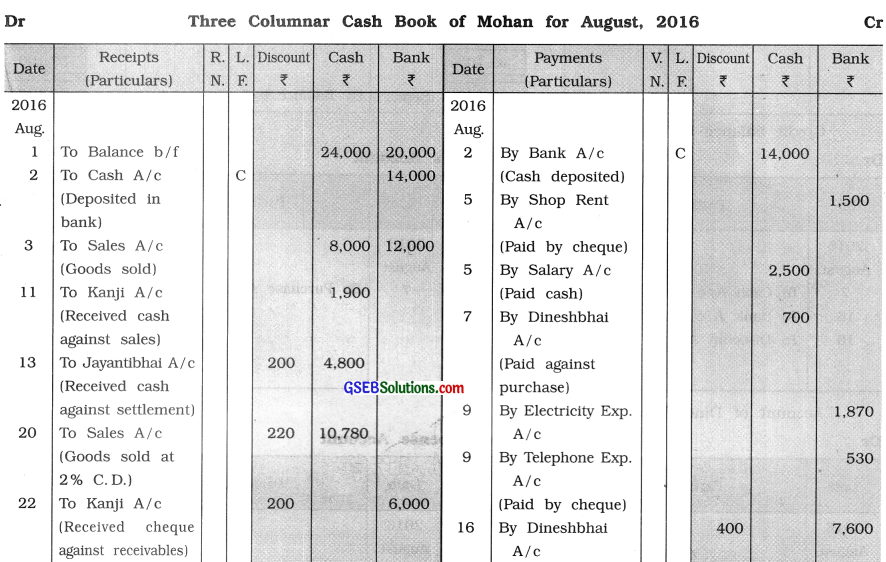

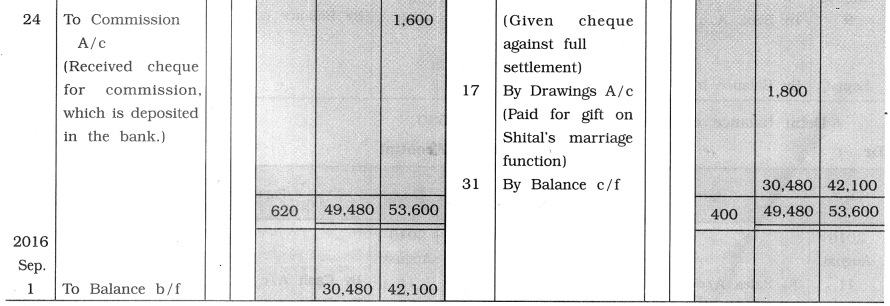

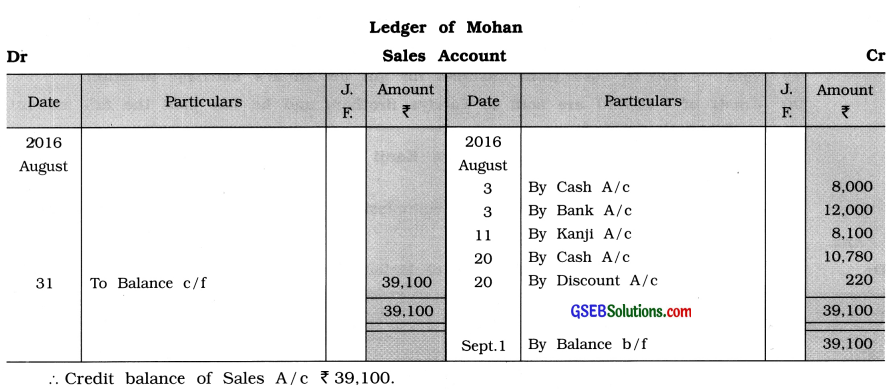

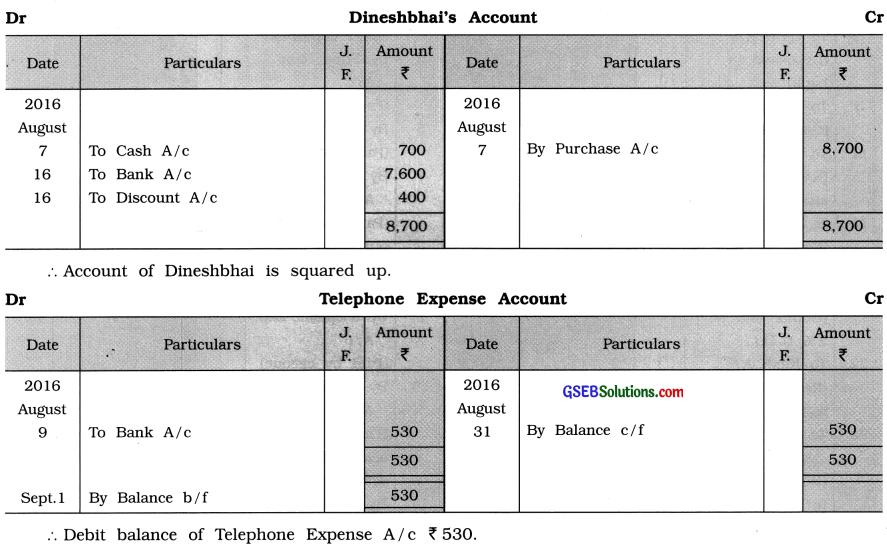

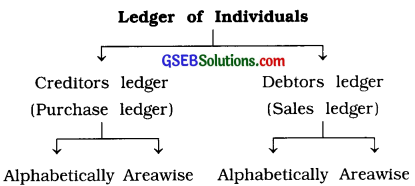

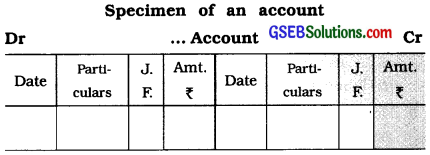

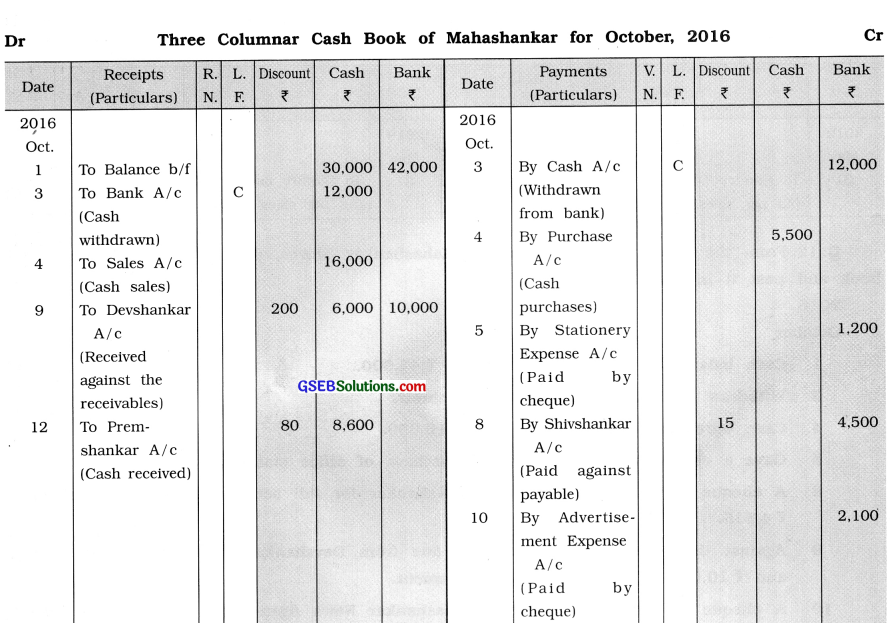

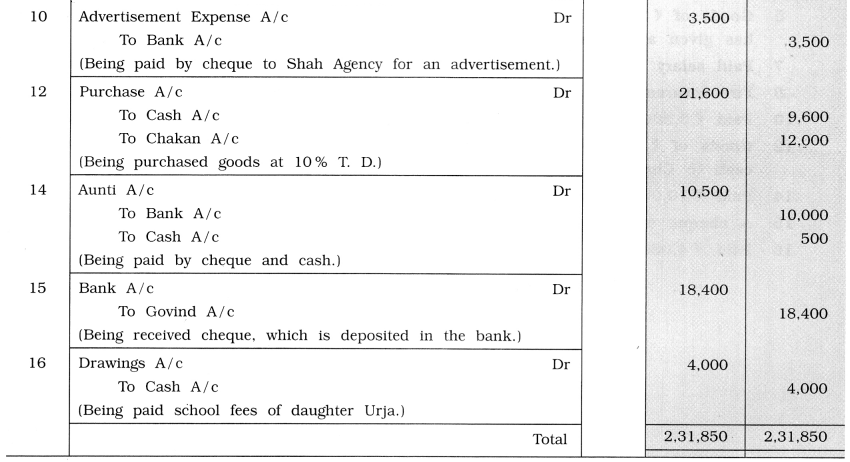

Question 16.

Record the following transactions in three columnar cash book of Mohan. Post them in necessary accounts. Find out the balance of each account and show the amount and type

of balance.

1 Opening cash balance ₹ 24,000 and bank balance ₹ 20,000.

2 Cash deposited in bank ₹ 14,000.

3 Goods of ₹ 20,000 are sold to Sureshbhai, for which we received cash ₹ 8,000 and for the balance we received a cheque which is deposited in the hank.

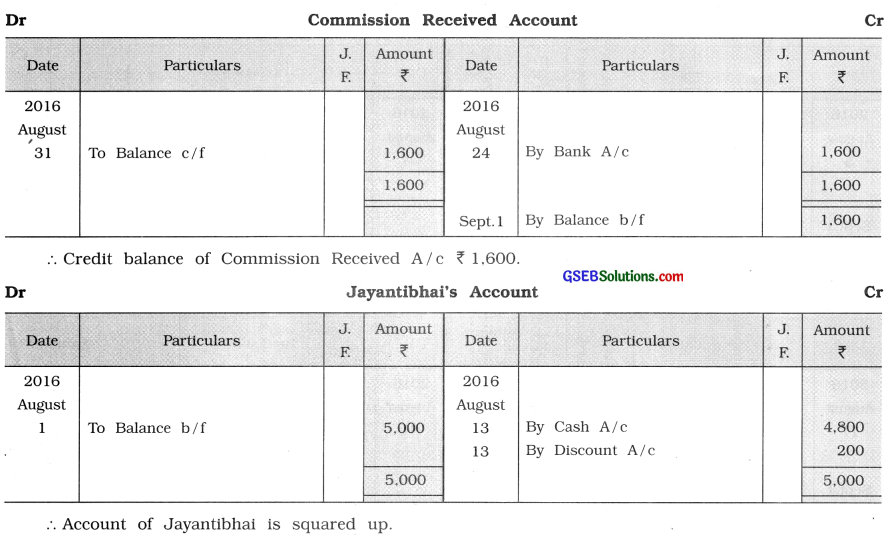

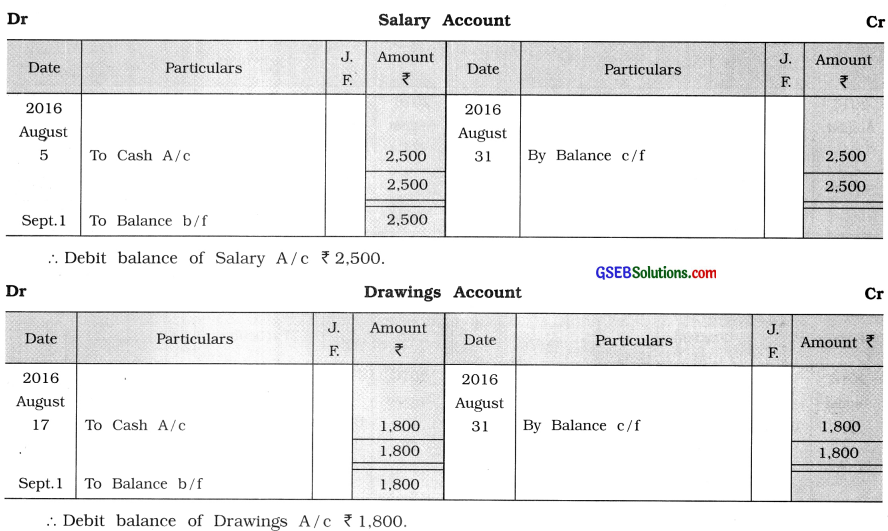

5 Paid shop rent ₹ 1,500 by cheque and salary of ₹ 2,500 in cash.

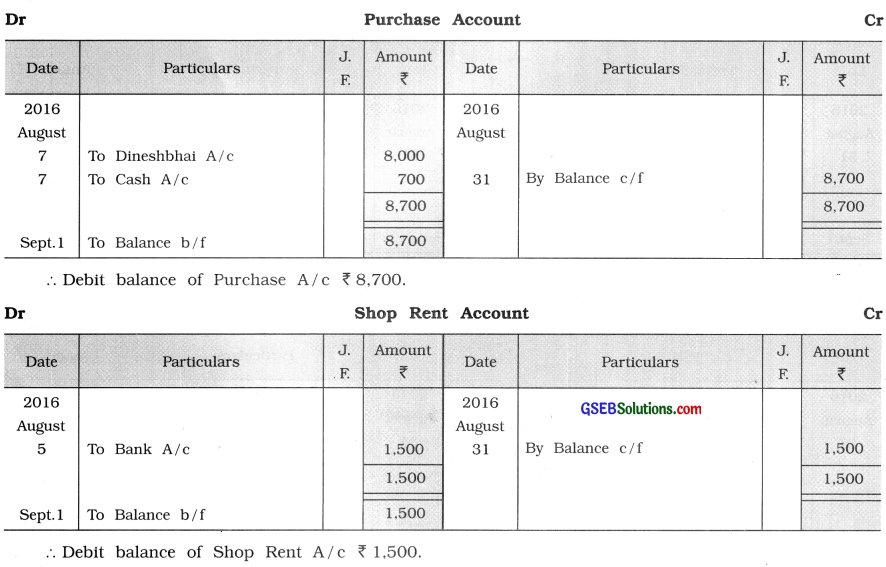

7 Goods of ₹ 8,700 are purchased from Dineshbhai, for which paid ₹ 700 in cash. 9 Paid electricity bill of ₹ 1,870 and telephone bill of ₹ 530 by cheque.

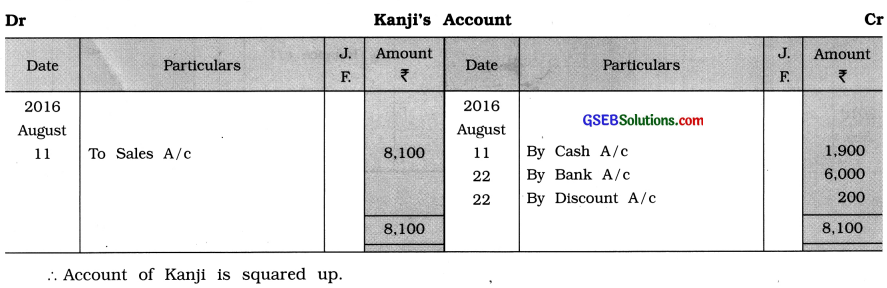

11 Goods of ₹ 9,000 are sold to Kanji at 10% trade discount. For which, received ₹ 1,900 in cash.

13 Jayantibhai has paid ₹ 4,800 for his dues of ₹ 5,000 and settled his account.

16 Gave a cheque of ₹ 7,600 to Dineshbhai and settled his account.

17 Paid ₹ 1,800 in cash from business for gift on Shital’s marriage function.

20 Goods of ₹ 11,000 are sold to Pandya Brothers and he has paid the full amount

at 2% cash discount.

22 Received a cheque of ₹ 6,000 from Kanji in full settlement against his dues of ₹ 6,200.

24 Received a cheque of ₹ 1,600 for commission, which is deposited in the bank.

Three Columnar Cash Book of Mohan for August, 2016 Cr

Answer: