Gujarat Board GSEB Textbook Solutions Class 11 Commerce Accounts Part 2 Chapter 5 Financial Statements of Business Organisations Textbook Exercise Questions and Answers.

Gujarat Board Textbook Solutions Class 11 Accounts Part 2 Chapter 5 Financial Statements of Business Organisations

GSEB Class 11 Accounts Financial Statements of Business Organisations

Text Book Questions and Answers

Question 1.

Write the correct option from those given below each question:

1. Debit balance of Trading Account means ……………………….. .

(a) Gross Profit

(b) Gross Loss

(c) Net Profit

(d) Net Loss

Answer:

(b) Gross Loss

2. Credit balance of Profit and Loss Account means ………………………….. .

(a) Gross Profit

(b) Gross Loss

(c) Net Profit

(d) Net Loss

Answer:

(c) Net Profit

3. Which balance of the following balances of trial balance is shown in the Profit and Loss Account?

(a) Salary-Wages

(b) Wages-Salary

(c) Outstanding Salary-Wages

(d) Outstanding Wages-Salary

Answer:

(a) Salary-Wages

4. Where closing stock of stationery of trial balance is shown?

(a) Debit side of Trading Account

(b) Credit side of Profit and Loss Account

(c) Deducted from stationery expense in Profit and Loss Account

(d) Assets side of Balance Sheet

Answer:

(d) Assets side of Balance Sheet

![]()

5. Where provident fund interest of trial balance is shown?

(a) Credit side of Profit and Loss Account

(b) Debit side of Profit and Loss Account

(c) Added in provident fund investment on Asset side of Balance Sheet

(d) Added in provident fund on Liabilities side of Balance Sheet

Answer:

(d) Added in provident fund on Liabilities side of Balance Sheet

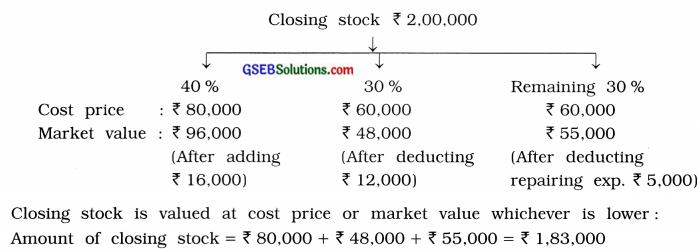

6. At which price closing stock is shown in the final accounts?

(a) Original Cost

(b) Cost Price

(c) Market Price

(d) Cost price or Market price whichever is lower

Answer:

(d) Cost price or Market price whichever is lower

7. Adjusted purchase means …………………….. .

(a) Purchase + Purchase expenses

(b) Purchase – Purchase return

(c) Opening Stock + Purchase – Closing stock

(d) Opening Stock + Purchase – Purchase return -Closing stock

Answer:

(d) Opening stock + Purchase – Purchase return – Closing stock

8. ……………………….. shows the financial-economic position of the business.

(a) Trial Balance

(b) Trading Account

(c) Profit and Loss Account

(d) Balance Sheet

Answer:

(d) Balance Sheet

9. If bad debt reserve is given only in trial balance then where its effect would appear in final accounts?

(a) Debit side of Profit and Loss Account

(b) Credit side of Profit and Loss Account

(c) Deducted from debtors, on Assets side of Balance Sheet

(d) Added in assets side of debtors in Balance Sheet

Answer:

(c) Deducted from debtors on Assets side of Balance Sheet

10. If goods destroyed by fire and Insurance company accepted a claim of full amount then where its effect would appear in final accounts?

(a) Only on credit side of Trading Account

(b) Debit side of Trading Account (deducted from purchase) and debit side of Profit and Loss Account

(c) Debit side of Trading Account (deducted from purchase) and Assets side of Balance Sheet

(d) Credit side of Trading Account, debit side of Profit and Loss Account and assets side of Balance Sheet

Answer:

(c) Debit side of Trading Account (deducted from purchase) and Assets side of Balance Sheet

![]()

11. If depreciation on fixed assets is shown in the trial balance then where its effects would appear in the Balance Sheet?

(a) Debit side of Profit and Loss Account

(b) Added in Fixed assets on Assets side of Balance Sheet

(c) Deducted from Fixed assets on Assets side – of Balance Sheet

(d) Credit side of Profit and Loss account

Answer:

(b) Added in Fixed assets on Assets side of Balance Sheet

Question 2.

Answer the following questions in one sentence:

1. What are financial statements?

Answer:

Financial statements are organised summaries of detail information about the financial position of an enterprise.

2. What are closing entries?

Answer:

At the end of the accounting year, to close the goods accounts and nominal accounts, entries are to be passed in a ‘Journal Proper’ book and these entries are known as closing entries.

3. What are adjustment entries?

Answer:

At the end of the accounting year, to know the correct profit or loss and correct financial position of the business and to make the necessary changes in the recorded transactions in the books and to record the unrecorded entries while preparing the annual accounts, entries are to be written which are known as Adjustment entries.

4. What is an adjusted purchase?

Answer:

Adjusted purchase means Opening stock + Purchase – Purchase returns – Closing stock.

5. What is Demurrage?

Answer:

The amount of penalty payable on late removal of goods from the railway or port is called demurrage.

6. What is Wharfage?

Answer:

The amount of difference payable when less freight is calculated from the place of goods consigned is called wharfage.

![]()

Question 3.

Answer the following questions in details:

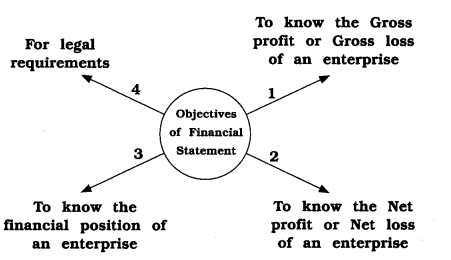

1. State objectives of financial statement.

Answer:

The main objectives of financial statements are as follows :

1. To know the Gross profit or Gross loss of an enterprise: At the end of the accounting year, to know the gross profit or gross loss of an enterprise, Trading Account is prepared. It means, from the Trading Account, Gross profit or Gross loss of the business can be known.

2. To know the Net profit or Net loss of an enterprise: During an accounting period, to know the net profit or net loss of an enterprise, Profit and Loss Account is prepared. By comparing the revenue expenses and revenue incomes of the business, Net profit and Net loss can be known from the Profit and Loss Account.

3. To know the financial position of an enterprise: At the end of the accounting year, to know the financial position of an enterprise, a Balance Sheet is prepared. In Balance Sheet, total assets and total liabilities are shown to get the idea of the financial position of an enterprise.

4. For legal requirements: Financial state¬ments are prepared for various legal requirements also, e.g., For taxation purposes.

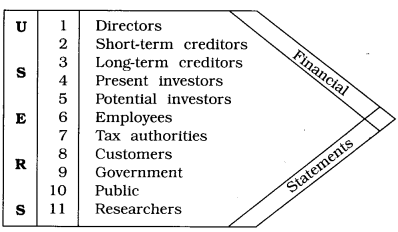

2. State the importance of financial statements.

Answer:

The importance (usefulness) of the financial statements for various users is as under :

1. Directors: Information of short-term solvency, long-term solvency, effectiveness of activities, profitability, etc. are obtained from financial statements and future investment decision can be made by directors.

2. Short-term creditors: Short-term creditors need financial information to determine the amount owing to them will be paid when due and whether they should extend, maintain or restrict the flow of credit to an individual enterprise. These decisions can be made on the basis of the financial statements.

3. Long-term creditors: Long-term creditors need information for whether their principals and the” interest will be paid in time or not when it becomes due. For making decision whether to extend, maintain or restrict the flow of credit to an enterprise. These decisions can be made on the basis of the financial statements.

4. Present investors: Present investors need information for whether they should buy or sell or hold shares. This information is obtained from the financial statements.

5. Potential investors: Potential investors need the information for how is the prospect of enterprise, and to determine whether they should invest or not. These decisions can be made on the basis of the financial statements.

6. Employees: Employees of an enterprise are interested in information about the stability and profitability of the enterprise. Information about the ability of enterprise to pay their salary or not, increments in their salary and retirement benefits will be paid or not can be received from financial statements.

7. Tax authorities: Government tax authorities need the information to assess the tax liabilities of the enterprise.

8. Customers; Customers are interested to get information about tire continuation of the enterprise.

9. Government: Government can get the information about the activities of the enterprise to form the policies regarding taxation from financial statements.

10. Public: Public gets various information just like, the enterprise’s contribution to economy of the country, employment opportunity at local place, social contribution, etc. from financial statements.

11. Researchers: Researchers can get the information from financial statements and analyse profitability, liquidity, solvency, etc, of tire enterprise.

3. Explain the meaning of Gross Profit, Operating Profit and Net Profit.

Answer:

1. Meaning of Gross Profit: Gross profit means difference between selling price and cost price of the goods sold. In other words, the credit balance of trading account is known as Gross profit.

2. Meaning of Operating Profit: Operating profit means difference between Gross profit and Operating expenses.

Operating profit = Gross profit – Operating expenses

Where. Operating expenses = General administrative expenses + Selling and Distribution expenses + Depreciation

3. Meaning of Net Profit: Net profit means difference between the total of all incomes and the total of all expenses. In other words, the credit balance of Profit and Loss Account is known as Net profit.

4. Explain the difference between Trading Account and Profit and Loss Account.

Answer:

| Difference | Trading Account | Profit and Loss Account |

| 1. Meaning | The account prepared to find out gross profit or gross loss after recording transactions of receipts and issues of goods and expenses of purchases as well as production is called Trading Account. | The account prepared to find out net profit or net loss by deducting other expenses and adding other incomes in the gross profit or gross loss is called Profit and Loss Account. |

| 2. Objectives | Trading Account is prepared to find out the gross profit or gross loss of the business. | Profit and Loss Account is prepared to find out the net profit or net loss of the business. |

| 3. Debit side | Opening stock of goods, net purchases of goods and other expenses relating to purchases of goods and production are shown on the debit side of the Trading Account. | Gross loss, administrative expenses, selling and distribution expenses, financial expenses and other expenses and various losses are shown on the debit side of the Profit and Loss Account. |

| 4. Credit side | Net sales, Sale of scrap goods and closing stock of goods are shown on the credit side of the Trading Account. | Gross profit and other revenue incomes of the business are shown on the credit side of the Profit and Loss Account. |

| 5. Balance of account | Credit balance of trading account is called Gross profit whereas debit balance of trading account is called Gross loss. | Credit balance of Profit and Loss Account is called Net profit whereas debit balance of profit and loss account is called Net loss. |

| 6. Where the Gross profit or Gross loss is shown? | In the Trading Account Gross profit or Gross loss are shown at last. | In the Profit and Loss Account, Gross profit or Gross loss are shown in the beginning. |

| 7. Where the balance of account is transferred? | The balance of Trading Account is transferred to Profit and Loss Account. | The balance of Profit and Loss Account is transferred to Capital account in the liability side of Balance Sheet. |

| 8. Compulsory | It is not Compulsory to prepare Trading Account. Many business units do not prepare separate Trading Account. | It is Compulsory to prepare Profit and Loss Account for all the business units. |

![]()

5. Explain the difference between Trial Balance and Balance Sheet.

Answer:

| Difference | Trial Balance | Balance Sheet |

| 1. Meaning | Statement showing debit and credit balance of accounts is called a Trial Balance. | Statement showing the financial position of the business on a particular date is called a Balance Sheet. |

| 2. Objectives | The objective of preparing Trial Balance is to know the arithmetical accuracy of the accounts. | The objective of preparing Balance Sheet is to know the financial positioning of the business. |

| 3. Columns or Sides | In the Trial Balance two columns of Debit balance and Credit balance are there. | In the Balance Sheet two sides, – ‘Liabilities’ and Assets’ are there. |

| 4. Part of accountancy | To prepare a Trial Balance is not a part of accountancy. | To prepare a Balance Sheet is a part of accountancy. |

| 5. Accounts to be shown | In the Trial Balance, every account is there. | In the Balance Sheet, only personal accounts and real accounts are shown. |

| 6. Time of preparing | Trial Balance can be prepared many times in a year. | Balance Sheet is normally prepared at the end of the accounting year. |

| 7. Adjustment | While preparing Trial Balance any adjustment will not be considered. | While preparing Balance Sheet all the necessary adjustments are to be considered. |

| 8. Necessity | It is not compulsory to prepare a Trial Balance. | It is compulsory to prepare a B/S because it is a part of the annual account. |

| 9. Financial position | From the Trial Balance financial position of the business cannot be known. | From the Balance Sheet financial position of the business can be clearly known. |

| 10. Net profit or Net loss | Information about Net profit or Net loss is not available in a Trial Balance. | Information about Net profit or Net loss is available in Balance Sheet. |

| 11. When is it prepared? | Trial Balance is prepared before preparing the annual accounts. | Balance Sheet is prepared at last while preparing the annual accounts. |

| 12. Arrangement of balances | There is no restriction for the arrangement of the balances which are to be shown in the Trial Balance. | Balance Sheet can be prepared in two different arrangements : (1) In the order of permanency and (2) In the order of liquidity. Generally, in most of the firms, Balance Sheet is prepared in the order of permanency. The order of liquidity is more suitable for banks and financial institutions. |

6. Explain objectives of Profit and Loss Account.

Answer:

Objectives of Profit and Loss Account are as under:

- The Profit and Loss Account Is prepared to ascertain the Net Profit and Net Loss incurred during the accounting period.

- Excess total of credit side of Profit and Loss Account Is called Net profit.

- Excess total of debit side of Profit and Loss Account is called Net loss.

- The capital of the owner will be increased by Net profit.

- The capital of the owner will be decreased by Net loss.

- Indirect expenses, like as administrative expenses, selling and distribution expenses, financial expenses and other expenses and losses can be known from the Profit and Loss Account.

- Other incomes and benefits of the business can be known from the Profit and Loss Account.

- By comparing the Net profit or Net loss proportion with the past results of the business, the development of the business can be known.

7. Explain the objectives of Balance Sheet.

Answer:

Objectives of Balance Sheet are as under:

- The main objective of preparing Balance Sheet is to know the financial position of the business.

- To know the amount of Non-current assets and Current assets. :

- To know the amount of Non-current liabilities and Current liabilities.

- To know the amount receivable from various debtors.

- To know the amount payable to various creditors.

- To know the amount of net capital in the business.

- To calculate the various ratios for the purpose of financial analysis.

- To know the Reserves and Surplus of the business.

8. What is Trading Account? Write the particulars to be shown in Trading Account and Closing entries for preparing Trading Account.

Answer:

Trading Account: An account Is prepared to know the gross profit or gross loss of the business, at the end of the accounting year. which is known as Trading Account. Trading Account indicates profit or loss only for transactions related with goods. therefore the result is known as gross profit or gross loss.

Following particulars to be shown In Trading Account:

1. Debit side: OpenIng stock of goods. Net purchases of goods (total purchases minus purchase returns and Goods going out other than sales). direct expenses relating to purchase of goods (like wages, carriage inward, freight. octroi, etc.) are shown I recorded on the debit side of Trading Account.

Note: If it is a manufacturing unit, the expenses related to productions are also shown on debit side of Trading Account. e.g., productive wages, royalty, factory expenses. depreciation of factory building. plant and machinery, oil, grease,

etc.

2. CredIt side: Net sales (total sales minus sales returns), sale of Scrap goods and Closing stock of goods are shown on the Credit side of Trading Account.

Closing Entries: Trading account is an account which include the matter which is nothing but a posting of some journal entry. These journal entries are the closing entries for the accounts like purchase of goods, sales, purchase return, sales-return, direct expenses of purchase (Accounts-related with the goods and expenses of purchase), etc. And the Trading Account is prepared with the help of posting of the above accounts.

(1) The closing entry, for opening stock, purchase, sales return, direct expenses of the purchase like wages, carriage inward, etc. which have debit balance, is as follow:

Trading A/c Dr …………………..

To Opening stock A/c …………………..

To Purchase A/c …………………..

To Sales return A/c …………………..

To Wages A/c …………………..

To Carriage inward A/c …………………..

To Other direct expenses A/c …………………..

(Being the closing entry to close the accounts of debit side of Trading Account.)

Effect: As a result of this journal entry, all the accounts which are shown on credit side (which have debit balance) will be closed and to be written on the debit side of the Trading Account.

(2) The closing entry for sales, purchase return, goods going out for any other reason other than sales (like stolen away, burnt by lire, withdrawn for personal use, given for charity, given as samples), etc. which have credit balance in the book, is as follows :

Sales A/c Dr …………………..

Purchase return A/c Dr …………………..

To Trading A/c …………………..

(Being closing entry to close the accounts of the credit side of Trading account.)

Effect: As a result of this journal entry, Sales A/c, Purchase return A/c and goods going out for the other reason will be closed and balance of the concern account will be recorded on credit side of the Trading Account.

(3) For closing stock, brought into the books of accounts:

Closing stock A/c Dr …………………..

To Trading A/c …………………..

(Being the adjustment entry passed for the closing stock.)

Explanation: Closing stock of goods account is not there in any book. At the end of the accounting year, to prepare the final accounts, a list of the goods in stock is prepared and the value of it, is decided. This decided value, normally, is based on purchase value. Therefore, while writing the account regarding closing stock value, the market value or book value whichever is less, is to be considered. For this, a journal entry is to be passed which is known as adjustment entry. For the closing stock, one effect is to be given on the credit side of Trading Account and another effect is to be given on the Assets side of Balance Sheet, because closing stock is considered as an asset.

(4) A journal entry to close the Trading Account: If this account shows the credit balance, then it is known as Gross profit and if it shows the debit balance, then it is known as Gross loss. By transferring the Gross profit or Gross loss to Profit and Loss Account, Trading Account will be closed as below:

(A) If Gross profit is there :

Trading A/c Dr …………………..

To Profit and Loss A/c …………………..

(Being gross profit transferred to Profit and Loss account.)

(B) If Gross loss is there :

Profit and Loss A/c Dr …………………..

To Trading A/c …………………..

(Being gross loss transferred to Profit and Loss Account.)

![]()

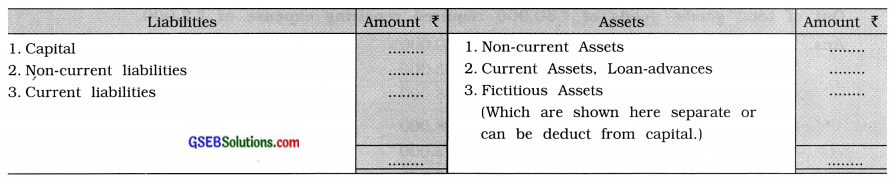

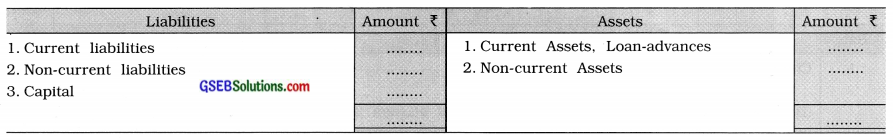

9. State the specimen of Balance Sheet in order of permanency and liquidity.

Answer:

Balance Sheet in order of Permanency

Balance Sheet in order of Liquidity

10. What are Final Accounts? State the objectives of preparing Final Accounts.

Answer:

Final Accounts: At the end of accounting year. 1.0 know the business result and financial position of the business, accounts and statements are prepared. They are known as Final or Annual Accounts. Another meaning of Final Accounts is to prepare the Trading Account. Profit and Loss Account and Balance Sheet, Generally. these types of accounts are prepared at the end of the accounting year, therefore, they are known as Final (Annual) Accounts. But sometimes at the end of six or nine months also these types of the accounts are prepared. Institutes like Bank. prepares such interim accounts at the end of six months also, which are known as Final Accounts.

Objectives: According to the meaning, Final (Annual) Accounts have two main objectives:

1. To know the business result and

2. To know the financial position of the business.

1. To know the business result: At the end of the accounting year, to know the result of the business. Trading Account and Profit and Loss Account are prepared. By comparing the expenses and incomes of the business, profit or loss can be found out. From the Trading account Gross profit or Gross loss and from the Profit and Loss Account. Net profit or Net loss can be known.

2. To know the financial position of the business: At the end of the accounting year, a statement is prepared which is known as Balance Sheet. In Balance Sheet. total assets and total liabilities are shown to get the Idea of the financial position of the business. Balance Sheet is a statement showing the financial position of the business.

Other objectives: Other objectives of the Final Accounts are explained below:

- To know the amount of Net capital in the business.

- To know the amount of Non-current Assets and Current Assets.

- To know the amount of Non-current liabilities and current liabilities.

- To know the amount of Reserves and Surplus.

- To know the amount receivable from various debtors.

- To know the amount payable to various creditors.

- To know the Trading profit. Operating profit and Abnormal gains and losses.

- To find out or ascertain the amount of various taxes. i.e.. service tax. income tax. VAT. wealth tax, etc. payable to the State and Central Government.

- To calculate the various ratios for the purpose of financial analysis.

- To enable businessmen to take policy decisions in respect to future business activities.

In the Final Accounts. Trading Account, Profit and Loss Account and a Balance Sheet are prepared. Trading Account and Profit and Loss Account are accounts, while Balance Sheet is statement or a list.

Question 4.

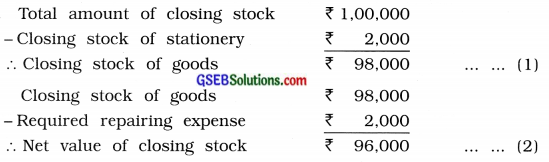

Pass adjustment entry for the following and also show its effect in final accounts: ( 1 ) Closing stock of ₹ 1,00,000 out of which ₹ 2,000 stationery stock. Out of total goods, goods of ₹ 50,000 required repairing expense of ₹ 2,000.

Answer:

Adjustment Entry

2. The following expenses are outstanding at the end of the year: Rent-taxes ₹ 5,000; Salary ₹ 3,000.

Answer:

Adjustment Entry

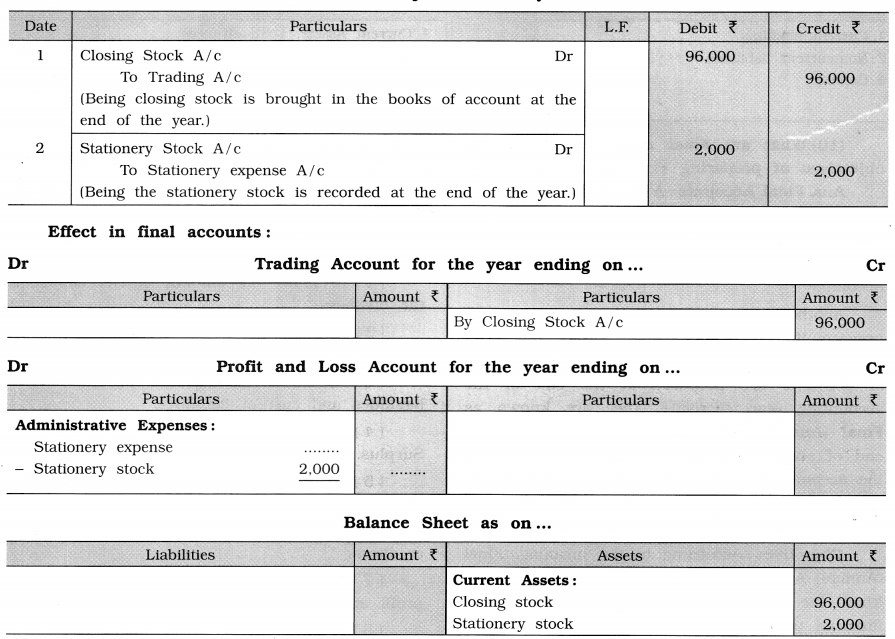

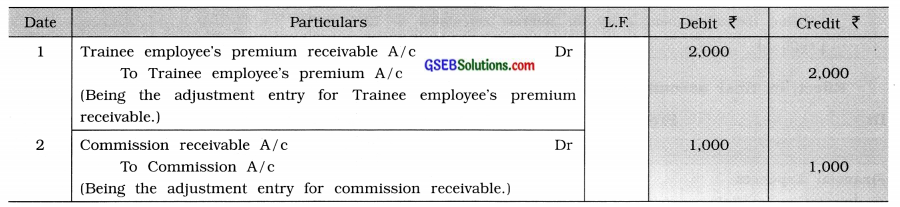

3. Following revenues are receivable at the end of the year: Trainee employee’s premium ₹ 2,000; Commission ₹ 1,000.

Answer:

Adjustment Entry

![]()

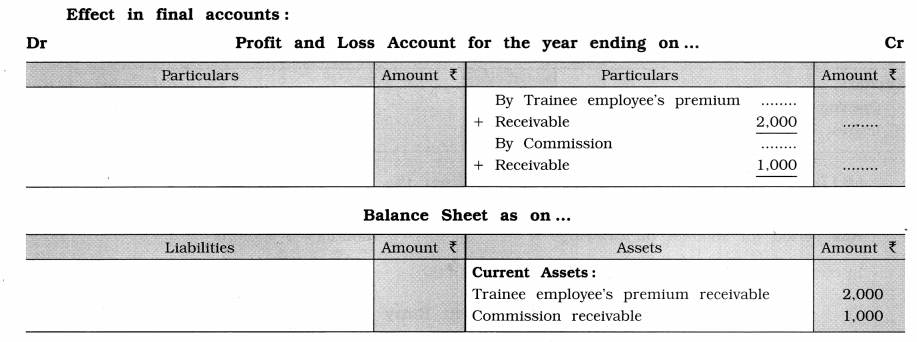

4. Brokerage of ₹ 2,700 is received in advance.

Answer:

Adjustment Entry

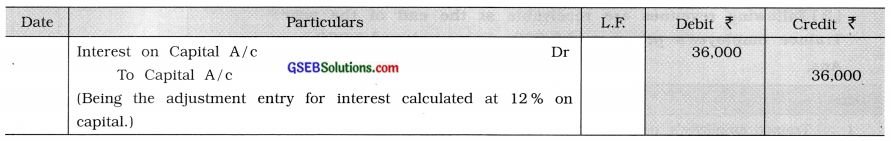

5. Proprietor’s capital in the business is ₹ 3,00,000 on which 12 % interest is payable.

Answer:

Interest on capital = \(\frac{3,00,000 \times 12 \times 1}{100}\) = ₹ 36,000

Adjustment Entry

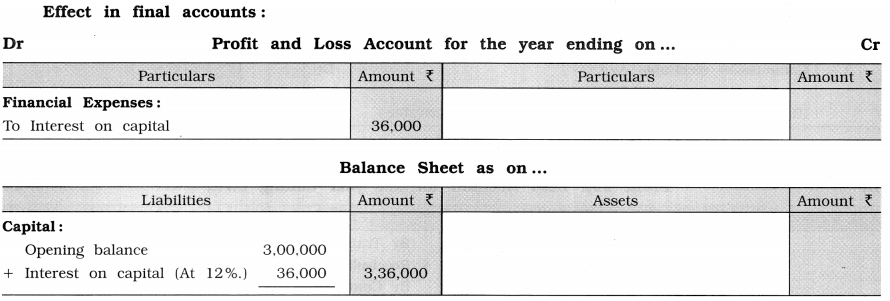

6. Drawings of proprietor after 9 months from the business amounted ₹ 40,000. Calculate interest on drawings at 12 %.

Answer:

Period for interest on drawings N = 12 months-9 months = 3 months

Interest on drawings = \(40,000 \times \frac{12}{100} \times \frac{3}{12}\) = ₹ 1,200

Adjustment Entry

Effect in final accounts:

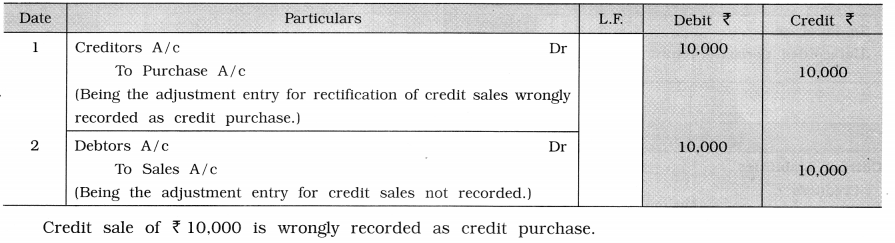

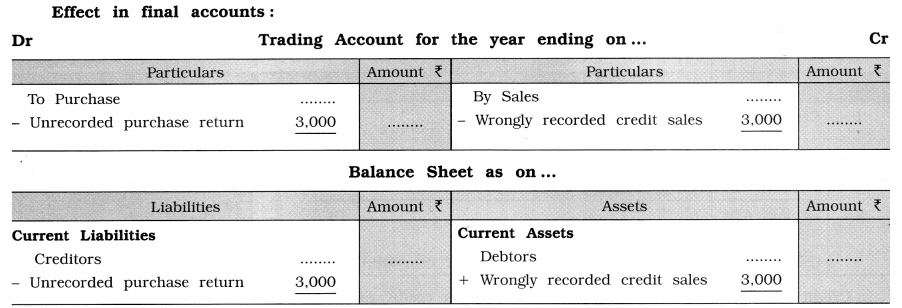

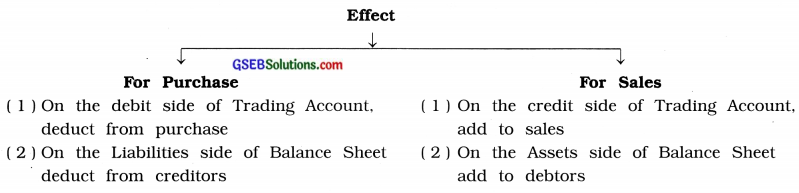

7. Credit sale of ₹ 10,000 is recorded as credit purchase.

Answer:

Adjustment Entry

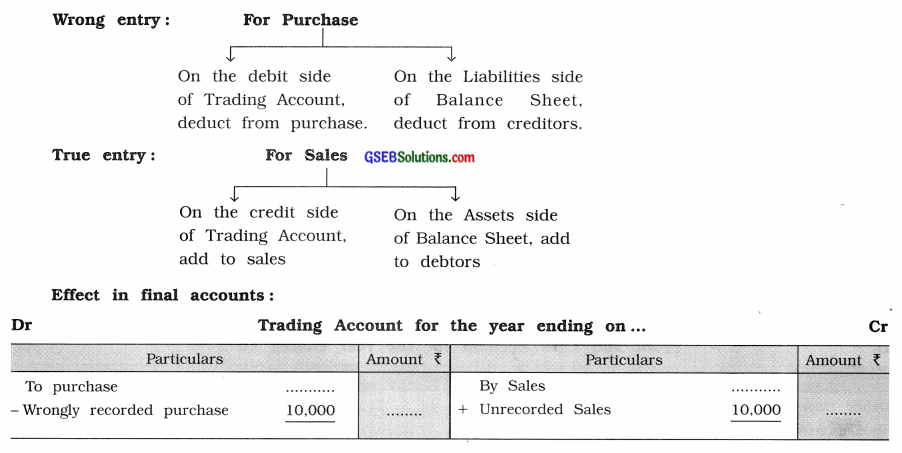

8. Purchase return of 13,000 is recorded as credit sales.

Answer:

Adjustment Entry

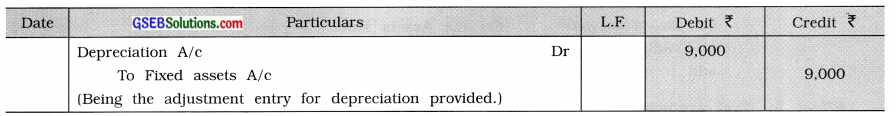

9. Fixed assets of ₹ 1,00,000 is purchased on dt. 1-07-’15. Accounting year of firm is ended as on 31-03-’16. Calculate depreciation at 12%.

Answer:

Amount of fixed assets = ₹ 1,00,000; Depreciation rate =12%;

Period for depreciation = From 1-7-T5 to 31-3-’16 = 9 months

Depreciation = \(1,00,000 \times \frac{12}{100} \times \frac{9}{12}\) = ₹ 9,000

Adjustment Entry

![]()

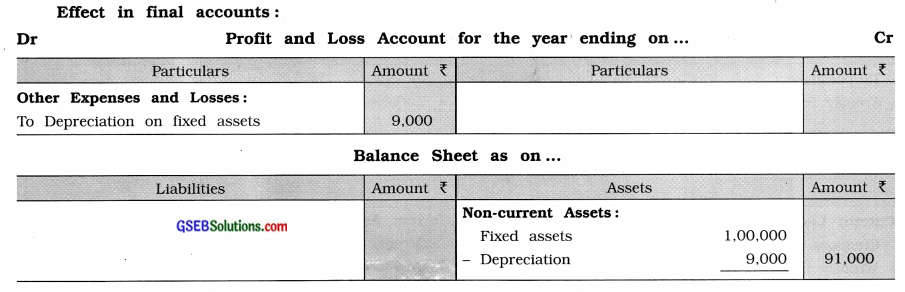

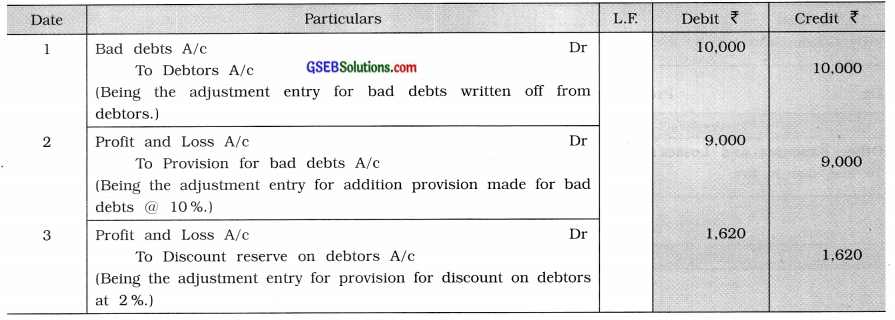

10. Debtors are amounting to ₹ 1,00,000 out of which write off ₹ 10,000 as bad debts, provide 10 % as bad debts reserve and 2 % as discount reserve on debtors.

Answer:

Necessary calculation :

Adjustment Entry

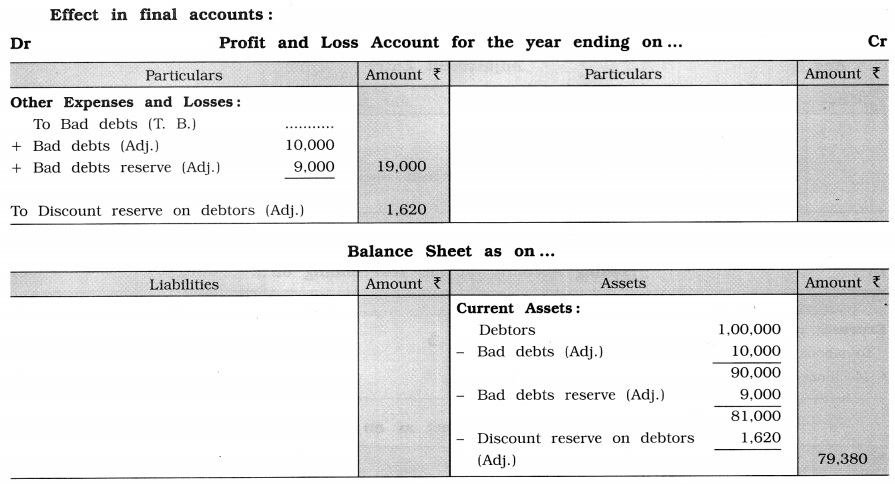

11. Goods of ₹ 10,000 destroyed by fire. Insurance company has accepted a claim of ₹ 8,000.

Answer:

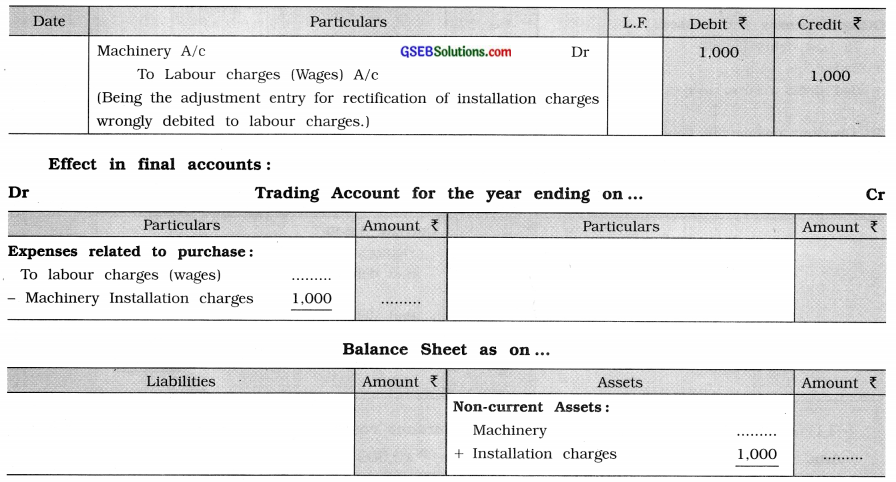

12. ₹ 1,000 labour charge of machinery installation is wrongly debited to labour account.

Answer:

Adjustment Entry

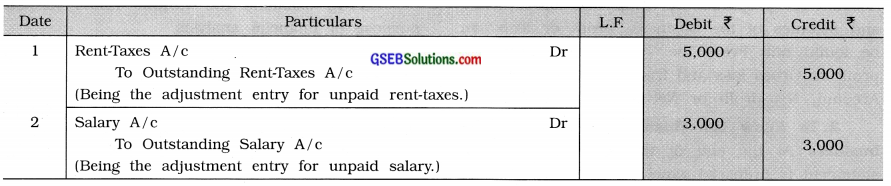

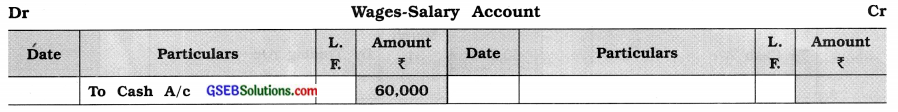

Question 5.

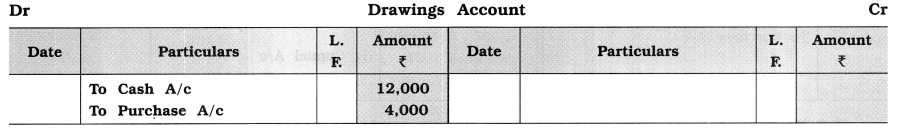

While preparing final accounts of Suresh for the year ended 31-3-’15, close the following accounts and write journal entries to close the accounts:

(1) Wages-Salary A/c :

(2) Interest received A/c :

(3) Sales A/c:

(4) Suresh’s Drawings A/c :

Answer:

Journal Proper of Suresh

Ledger of Suresh

![]()

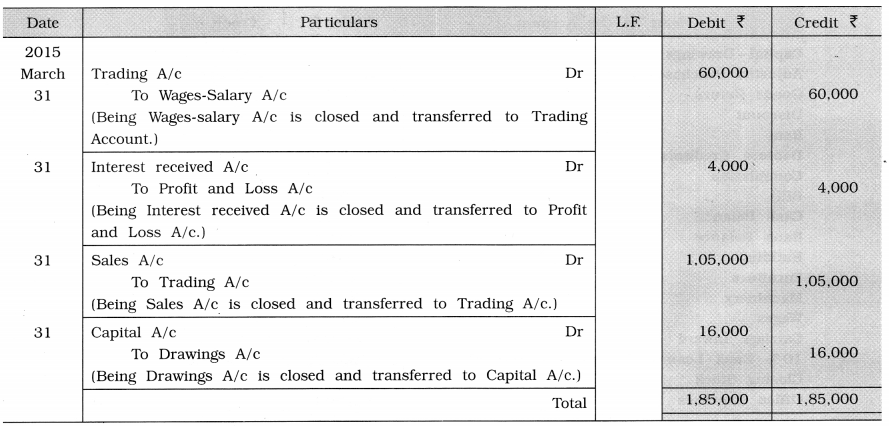

Question 6.

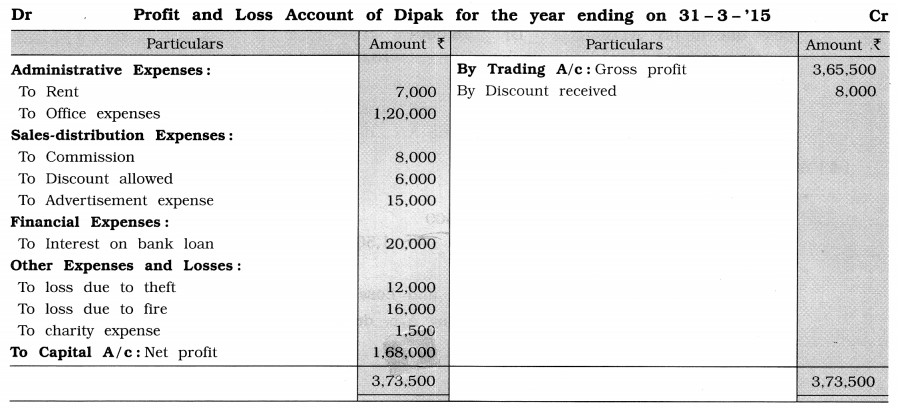

Prepare final account from the Trial Balance and adjustments of Dipak as on31-3-’15:

Trial Balance as on 31-3-’15

| Name of the Account | Debit ₹ | Credit ₹ |

| Capital – Drawings | 18,000 | 3,00,000 |

| Adjusted Purchase – Sales | 8,00,000 | 12,91,000 |

| Goods Return | 50,000 | – |

| Discount | 6,000 | 8,000 |

| Rent | 7,000 | – |

| Debtors – Creditors | 1,10,000 | 90,000 |

| Commission | 8,000 | – |

| Bills | 20,000 | 30,000 |

| Cash Balance | 20,000 | – |

| Bank Balance | 90,000 | – |

| Building | 1,50,000 | – |

| Furniture | 40,000 | – |

| Machinery | 3,00,000 | – |

| Wages | 60,000 | – |

| Carriage Inward | 60,000 | – |

| 10 % Bank Loan and Bank loan Interest | 20,000 | 2,00,000 |

| Closing Stock | 40,000 | |

| Office Expenses | 1,20,000 | |

| Total | 19,19,000 | 19,19,000 |

Adjustments :

(1) Goods of ₹ 12,000 lost due to theft.

(2) Goods of ₹ 15,000 distributed as sample.

(3) Goods of ₹ 16,000 burnt by fire.

(4) Goods of ₹ 1,500 given as charity.

Answer:

Trading Account of Dipak

Explanation: Following are the adjustment entries and effects in final accounts for every adjustment:

(1) Adjustment No. 1 :

Adjustment entry:

Loss due to theft A/c Dr 12,000

To Purchase A/c 12,000

Effect in final accounts:

Effect No. 1: On the debit side of Profit and Loss A/c, as loss due to theft – Debit effect Effect No. 2 : On the debit side of Trading A/c, deduct from purchase – Credit effect

(2) Adjustment No. 2 :

Adjustment entry:

Advertisement expense A/c Dr 15,000 To Purchase A/c 15,000

Effect in final accounts:

Effect No. 1: On the debit side of Profit and Loss A/c, added to Advertisement expense – Debit effect

Effect No. 2: On the debit side of Trading A/c, deduct from purchase – Credit effect

(3) Adjustment No. 3 :

Adjustment entry:

Loss due to fire A/c Dr 16,000

To Purchase A/c 16,000

Effect in final accounts:

Effect No. 1: On the debit side of Profit and Loss A/c, as loss due to fire – Debit effect

Effect No. 2: On the debit side of Trading A/c, deduct from purchase – Credit effect

(4) Adjustment No. 4 :

Adjustment entry:

Charity expense A/c Dr 1,500

To Purchase A/c 1,500

Effect in final accounts:

Effect No. 1: On the debit side of Profit and Loss A/c, as charity expense – Debit effect

Effect No. 2: On the debit side of Trading A/c, deduct from purchase – Credit effect

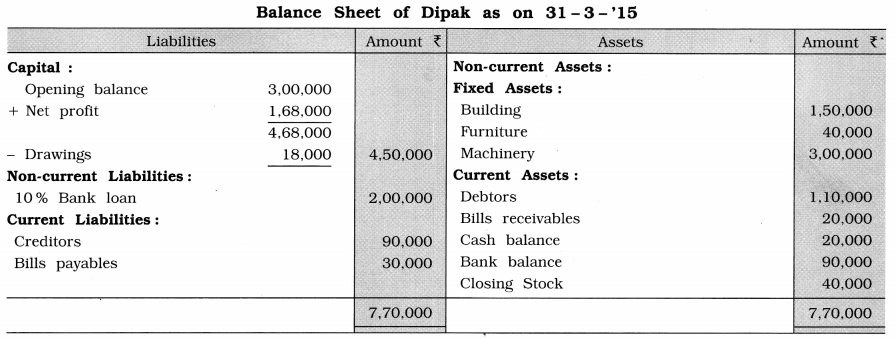

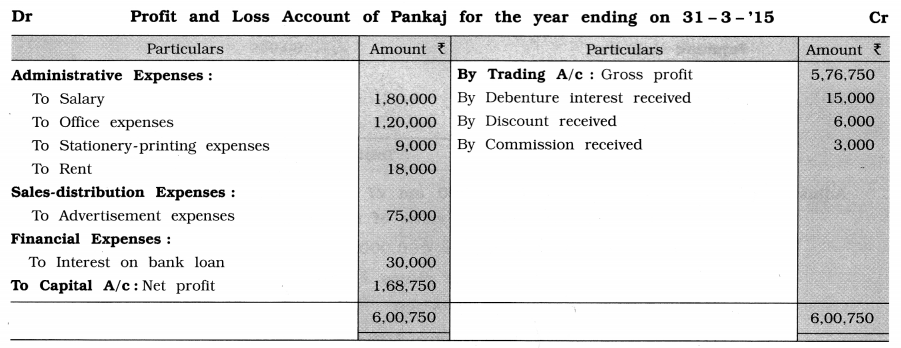

Question 7.

Prepare final accounts from the Trial Balance and adjustments of Pankaj as on 31 – 3 – ’15

Trial Balance as on 31 – 3 – ’15

Adjustments:

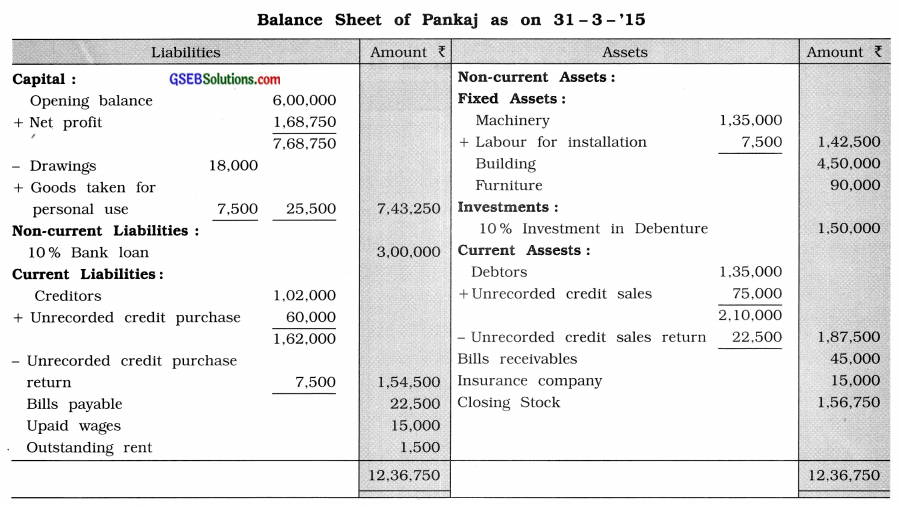

(1) Closing Stock of ₹ 1,65,000 out of which market value of 50% of stock is 10 % more and market value of remaining stock of goods is 10 % less.

(2) Unrecorded credit purchase ₹ 60,000.

(3) Unrecorded credit purchase return ₹ 7,500. .

(4) Unrecorded credit sales ₹ 75,000.

(5) Unrecorded credit sales return ₹ 22,500.

(6) Outstanding wages ₹ 15,000.

(7) Goods of ₹ 15,000 destroyed by fire and insurance company accepted a claim of whole amount.

(8) Goods of ₹ 7,500 withdrawn for personal use.

(9) Labour charges for installation of machinery ₹ 7,500 wrongly debited to labour charges.

Answer:

Explanation :

(1) Adjustment No. 1 :

(2) Adjustment No. 2: Unrecorded credit purchase of ₹ 60,000

Effect No. 1: On the debit side of Trading Account, added to purchase.

Effect No. 2: On the Liabilities side of Balance Sheet, added to Creditors.

(3) Adjustment No. 7 :

Effect No. 1: Amount of goods destroyed by fire is deducted from purchase, on the debit side of Trading Account.

Effect No. 2: Receivable amount from Insurance company is shown on the Asset side of Balance Sheet, Insurance Company as a debtor.

(4) Adjustment No.9: Installation labour charges of ₹ 7,500 has been wrongly debited to wages, so which has been deducted from wages amount, on the debit side of Trading Account and has been added to Machinery amount, on the Assets side of Balance Sheet.

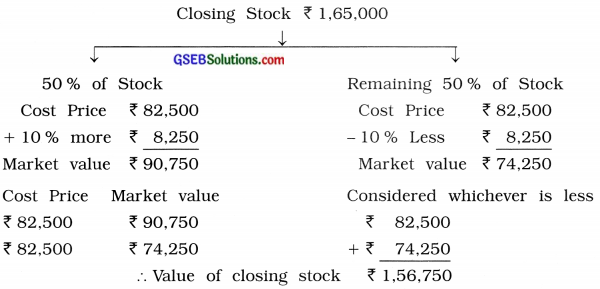

Question 8.

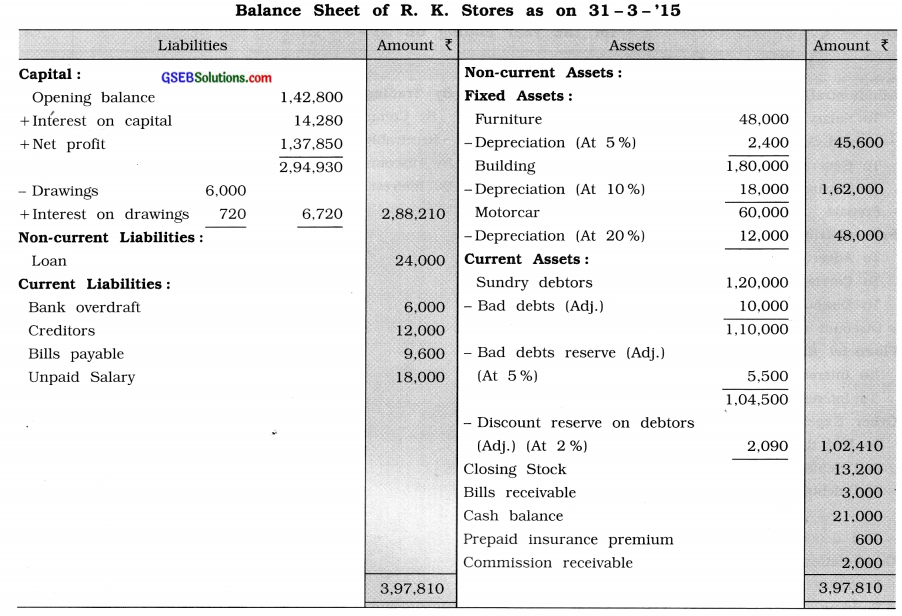

Following is the Trial Balance of R. K. Stores as on 31-3-’15:

Trial Balance as on 31 – 3 – ’15

| Name of the Account | Debit ₹ | Credit ₹ |

| Gross Profit | – | 3,00,000 |

| Salary | 54,000 | – |

| General Expenses | 6,000 | – |

| Tax-Insurance | 7,200 | – |

| Sundry Debtors | 1,20,000 | – |

| Closing Stock | 13,200 | – |

| Bank Overdraft | – | 6,000 |

| Commission | – | 9,000 |

| Advertisement Expenses | 9,000 | – |

| Interest | 3,000 | – |

| Furniture | 48,000 | – |

| Building | 1,80,000 | – |

| Motorcar | 60,000 | – |

| Capital | – | 1,42,800 |

| Drawings | 6,000 | – |

| Bad – debts | 3,600 | – |

| Bad – debts Reserve | – | 6,000 |

| Loan | – | 24,000 |

| Creditors | – | 12,000 |

| Bills Receivable | 3,000 | – |

| Bills Payable | – | 9,600 |

| Carriage-outward | 4,000 | – |

| Discount given | 3,200 | – |

| Discount received | – | 2,400 |

| General Reserve | – | 30,000 |

| Cash Balance | 21,000 | – |

| Total | 5,41,800 | 5,41,800 |

Adjustments:

(1) Salary was paid up to 31-12-’14.

(2) ₹ 1,200 being insurance premium for the year ending on 30-9-’15.

(3) Commission of ₹ 2,000 is receivable.

(4) Calculate 10 % interest on Capital and 12 % interest on Drawings.

(5 ) Calculate depreciation at 5 % on furniture, at 10 % on building and at 20 % on motorcar.

(6) From debtor of ₹ 20,000 write off 50 %.

(7) Provide 5 % bad debt reserve.

(8) Provide 2 % debtors discount reserve.

(9) Transfer ₹ 10,000 to General Reserve.

From the above information, prepare final account of R. K. Stores for the year ending as on 31 – 3 – ’15.

Answer:

Explanation:

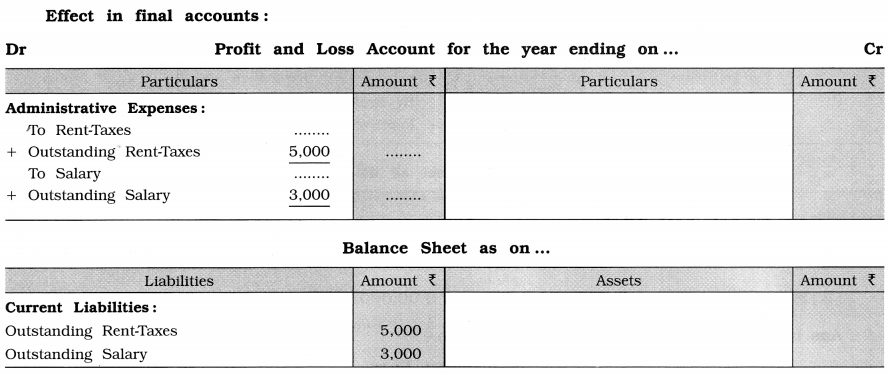

(1) Adjustment No. 1: Salary ₹ 54,000 shown in the trial balance, which is paid up to 31 – 12-’14, means it is paid for 9 months.

∴ ₹ 54,000 ÷ 9 = ₹ 6,000 is the salary of 1 month.

While salary for 3 months, i.e., from 1-1-’15 to 31-3-’15, is not paid.

∴ Unpaid salary for 3 months = ₹ 6,000 × 3 = ₹ 18,000

(2) Adjustment No. 2: Insurance premium ₹ 1,200 is for the year ended on 30-9-’15. Means, from Dt. 1-4-’15 to Dt. 30-9-’15, six months insurance premium is prepaid.

∴ Prepaid insurance premium = \(1,200 \times \frac{6}{12}\) = ₹ 600

![]()

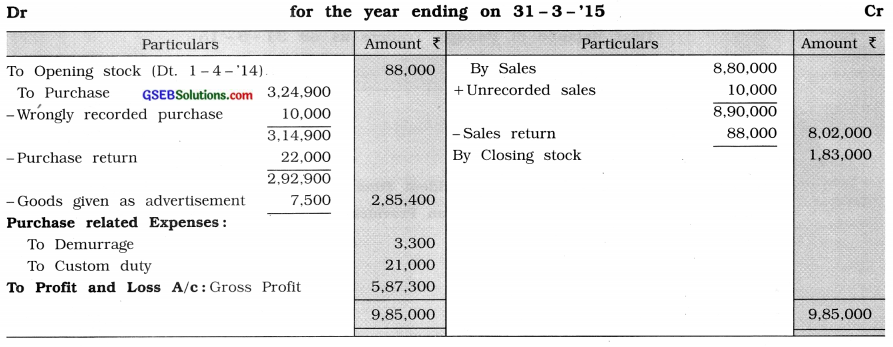

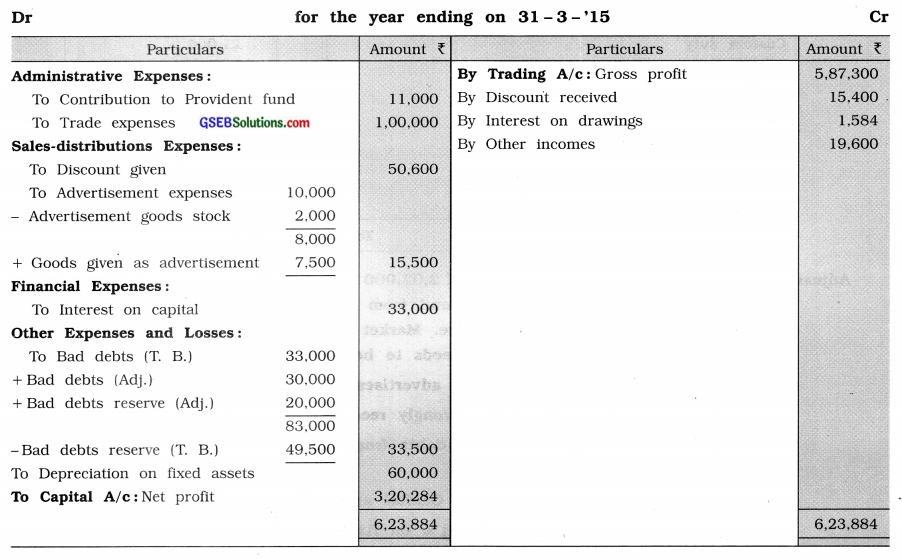

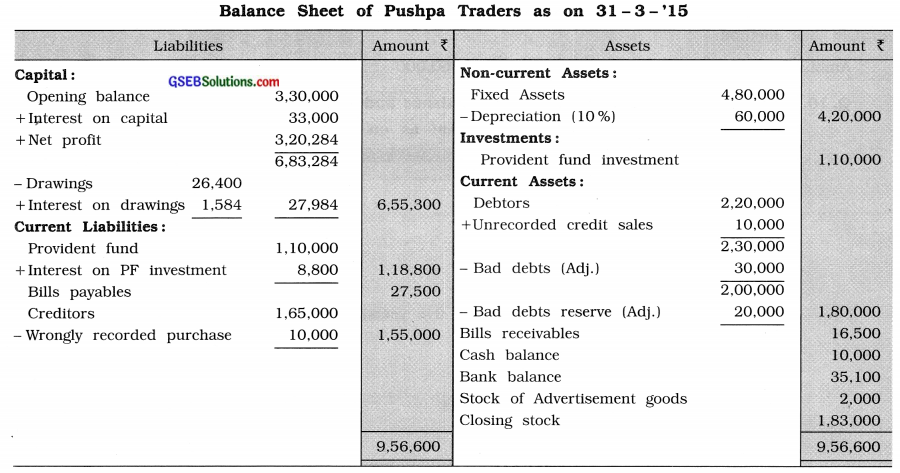

Question 9.

Prepare final accounts from the Trial Balance and adjustments of Pushpa Traders as on 31-3 – ’15 :

Trial Balance of Pushpa Traders as on 31-3-’15

| Name of the Account | J.F. | Debit ₹ | Credit ₹ |

| Drawings – Capital | 26,400 | 3,30,000 | |

| Purchase – Sales | 3,24,900 | 8,80,000 | |

| Goods Returns | 88,000 | 22,000 | |

| Provident Fund and Contribution to Provident Fund | 11,000 | 1,10,000 | |

| Provident Fund Investment and Interest on Provident | 1,10,000 | 8,800 | |

| Fund Investment Debtors – Creditors | 2,20,000 | 1,65,000 | |

| Discount | 50,600 | 15,400 | |

| Bad Debts and Bad Debts Reserve | 33,000 | 49,500 | |

| Bills | 16,500 | 27,500 | |

| Goods stock (1-4-’14) | 88,000 | – | |

| Demurrage | 3,300 | – | |

| Custom duty | 21,000 | – | |

| Trade Expenses | 1,00,000 | – | |

| Cash Balance | 10,000 | – | |

| Bank Balance | 35,100 | – | |

| Fixed Assets (Cost Price ₹ 6,00,000) | 4,80,000 | – | |

| Advertisement Expenses | 10,000 | – | |

| Other Incomes | – | 19,600 | |

| Total | 16,27,800 | 16,27,800 |

Adjustments:

(1) Stock as on 31-3-’15 is ₹ 2,02,000 out of which ₹ 2,000 of stock was for advertisement goods stock and from the remaining stock the market value of 40 % stock is 20 % more. Market value of 30 % stock is less by 20 %. Whereas remaining stock needs to be repaired at the expenses of ₹ 5,000.

(2) Goods of ₹ 7,500 given as advertisement.

(3 ) Credit sales of ₹ 10,000 wrongly recorded as credit purchase.

(4) Write off ₹ 30,000 as bad debts from debtors and provide 10% bad debt reserve.

(5 ) Calculate 10 % interest on Capital and 6 % interest on Drawings.

(6) Calculate depreciation at 10 % on fixed assets as per straight-line method.

Answer:

Trading Account of Pushpa Traders

Profit and Loss Account of Pushpa Traders

Explanations :

(1) Adjustment No. 1:

Stock of goods on 31-3-’15 ₹ 2,02,000

– Stock of goods for advertisement ₹ 2,000

∴ Net stock of goods ₹ 2,00,000

(2) Adjustment No. 3: This adjustment is for rectification. Rectification entry:

Creditor A/c … Dr 10,000

Debtors A/c … Dr 10,000

To Purchase A/c 10,000

To Sales A/c 10,000

(3) Adjustment No. 6 :

Depreciation is to be calculated at 10% on fixed assets of ₹ 6,00,000 by straight-line method.

Amount of depreciation = \(₹ 6,00,000 \times \frac{10}{100} \) = ₹ 60,000.

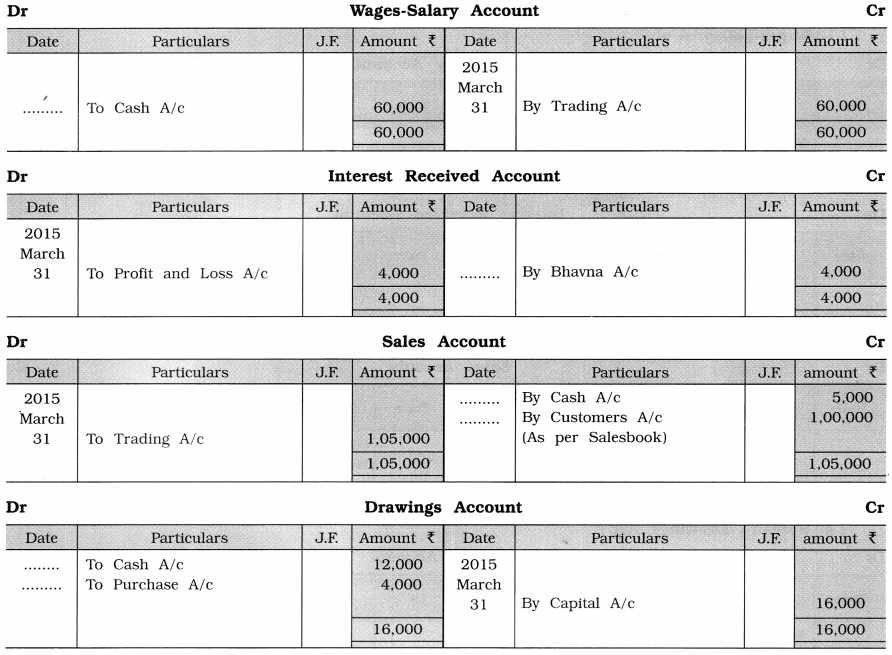

Question 10.

Prepare final accounts from the Trial Balance and adjustments of Nirmi as on 31 – 3-’15 :

Trial Balance of Nirmi as on 31-3-’15

| Name of the Account | Debit ₹ | Credit ₹ |

| Capital | – | 2,70,000 |

| Drawings | 16,200 | – |

| Land and Building | 1,80,000 | – |

| Machinery | 1,26,000 | – |

| Furniture | 22,500 | – |

| Leasehold Building (Date: 1-4-’14 for five years) | 45,000 | – |

| Sales | – | 4,50,000 |

| Purchase Return | – | 10,800 |

| Debtors | 81,000 | – |

| 12% Loan from Dattu (Date : 1 – 10-’14) | – | 27,000 |

| Purchase | 1,80,000 | – |

| Sales return | 9,000 | – |

| Freight – Octroi | 13,500 | – |

| Sundry expenses | 3,150 | – |

| Insurance premium | 14,200 | – |

| Bad Debts | 12,080 | – |

| Bad Debts Reserve | – | 12,600 |

| Discount Reserve on Debtors | – | 450 |

| Commission received | – | 6,000 |

| Goods Stock (Date: 1-4-’14) | 9,900 | – |

| Salary | 42,000 | – |

| Wages | 6,600 | – |

| Creditors | – | 28,200 |

| Dead Stock | 4,500 | – |

| Bank Overdraft | – | 18,900 |

| Cash Balance | 36,720 | – |

| Carriage Inward | 6,000 | – |

| Carriage Outward | 7,500 | – |

| Bills | 12,000 | 7,000 |

| Discount | 5,100 | 2,000 |

| Total | 8,32,950 | 8,32,950 |

Adjustments :

(1) Closing stock as on 31-3-’15 was valued at ₹ 50,000.

(2) Fire occurred in business on 31-1-’15 due to which goods of ₹ 8,000 were destroyed and the insurance company accepted a claim of 70%.

(3) Out of debtors, ₹ 6,000 are not recoverable so they are to be written off. Provide Bad debt reserve 5 % and discount reserve 2 %.

(4) Credit purchases of ₹ 6,000 and Credit purchase return of ₹ 1,000 were not recorded.

(5 ) Calculate depreciation, at 10 % on fixed assets.

(6 ) Insurance premium includes ₹ 3,200 for the next year.

(7) 50% commission is received.

Answer:

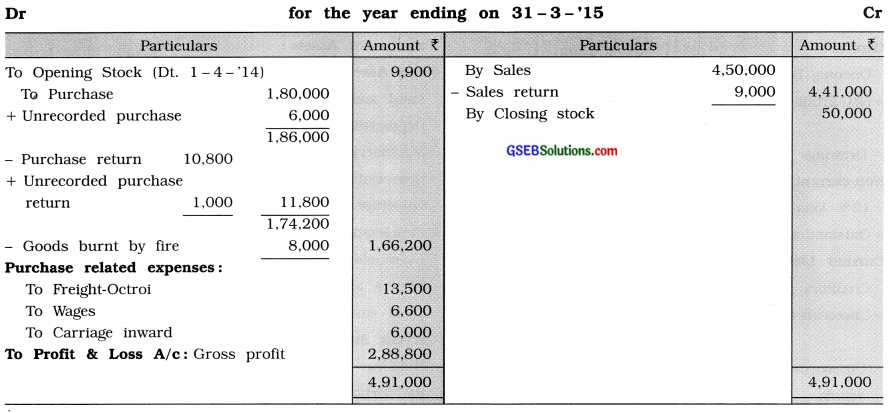

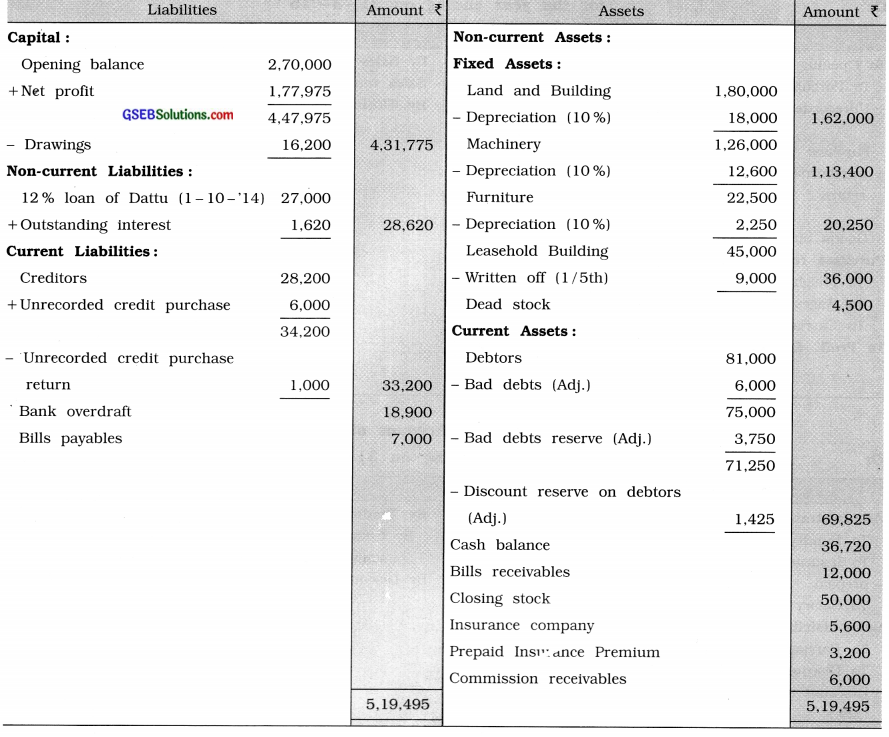

Trading Account of Nirmi

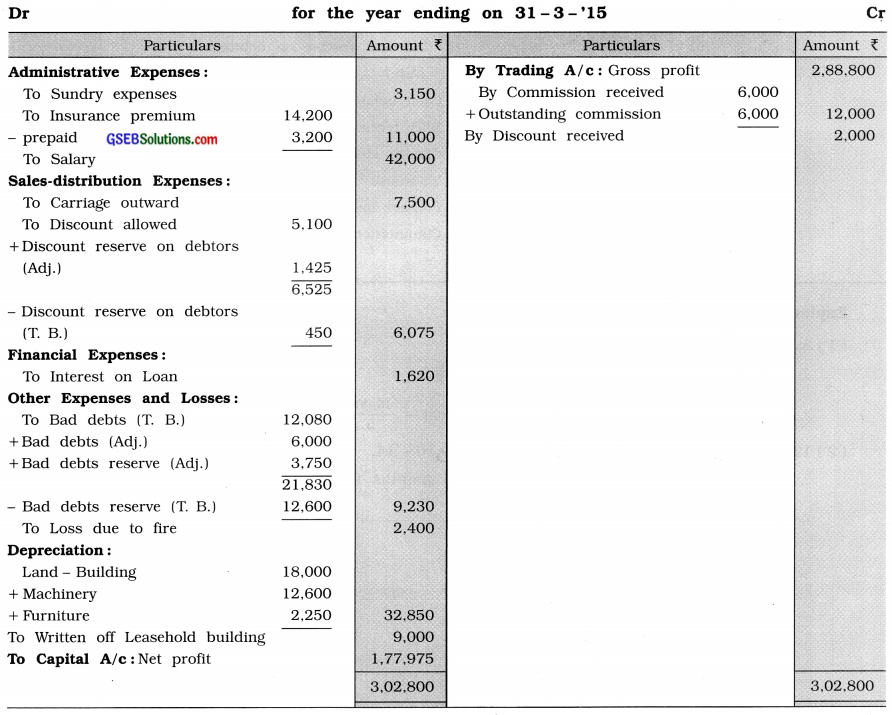

Profit and Loss Account of Nirmi

Balance Sheet of Nirmi as on 31-3-’15

Explanation :

(1) As the leasehold building is for 5 years.

∴ \(\frac{1}{5}\)th of its value is written off every year.

∴ Amount written off during the current year =\(\frac{45,000}{5}\) = ₹ 9,000

(2) 12% loan was taken from Dattu as on 1-10-’14.

∴ Interest on loan will be calculated for 6 months (from 1-10-’14 to 31-3-’15).

Interest on loan = \(27,000 \times \frac{12}{100} \times \frac{6}{12}\) = ₹ 1,620

Outstanding interest on loan = ₹ 1,620

![]()

Question 11.

Prepare final accounts from the Trial Balance and adjustments of Sajan Readymade Stores as on 31-3-’15.

Trial Balance of Sajan Readymade Stores as on 31-3-’15

| Name of the Account | J.F. | Debit ₹ | Credit ₹ |

| Capital | – | 1,08,000 | |

| Drawings | 4,800 | – | |

| Opening stock | 8,000 | – | |

| Purchase | 70,000 | – | |

| Sales | – | 1,30,000 | |

| Goods return | 6,000 | 10,000 | |

| Salary | 30,000 | – | |

| Audit fees | 5,000 | – | |

| Rent – Taxes – Insurance | 4,800 | – | |

| Stationery – Printing | 1,200 | – | |

| Unpaid Salary | – | 2,500 | |

| Prepaid Insurance Premium | 400 | – | |

| Duty on Import goods | 900 | – | |

| Commission | – | 800 | |

| Debtors – Creditors | 29,600 | 14,000 | |

| Building | 40,000 | – | |

| Addition in Building (31-12-’14) | 10,000 | – | |

| Machinery | 20,000 | – | |

| Vehicles | 8,000 | – | |

| Bills | 5,000 | 6,000 | |

| Dividend | – | 1,000 | |

| Investment in Ram-Rahim Company’s Shares | 10,000 | – | |

| Advertisement suspense account | 4,000 | – | |

| Furniture | 6,000 | – | |

| Maintenance expense | 3,000 | – | |

| Electricity Expense | 3,600 | – | |

| Bonus | 2,500 | – | |

| Discount | 1,000 | – | |

| Bad Debt Reserve | – | 1,500 | |

| Total | 2,73,800 | 2,73,800 |

Adjustments:

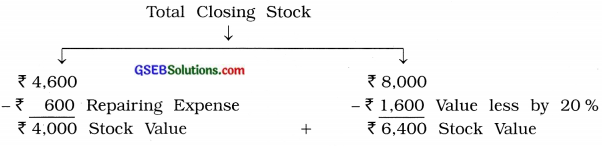

(1) Closing stock is of ₹ 12,600, out of which goods worth ₹ 4,600 requires’ repairing of ₹ 600. Remaining stock’s market value is less by 20 %.

(2) Unrecorded credit sales ₹ 4,400.

(3) Expense incurred for an advertisement campaign on 1-10-’14 is transferred to advertisement suspense account. This expense is to be written off in 5 years.

(4) Vehicles of ₹ 20,000 were purchased on 1-04-’09. Scrap Value of Vehicles is ₹ 4,000 and estimated life is 10 years. Depreciation is to be calculated by straight-line method.

(5) Purchase of furniture of ₹ 2,000 is wrongly debited to purchase account. Furniture was purchased on 1-10-’14. Rate of depreciation on furniture is 20%.

(6) Calculate interest on capital at 6 %. Addition capital of ₹ 8,000 was brought into business on 1-10-’14.

(7) Calculate depreciation on building at 10 % and rate of depreciation on machinery is 20 %.

Answer:

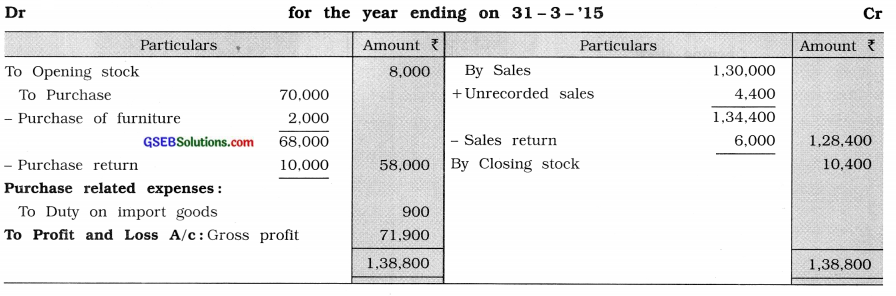

Trading Account of Sajan Readymade Stores

Profit and Loss Account of Sajan Readymade Stores

Balance Sheet of Sajan Readymade Stores as on 31 -3- ‘15

Explanation :

(1) Adjustment No 1 :

∴ Hence, closing stock has’ been valued at ₹ 10,400 (₹ 4,000 + ₹ 6,400)

(2) Adjustment No. 3 : As Advertisement Suspense A/c is to be written off over 5 years.

∴ Annual amount written off = \(\frac{4,000}{5}\) = ₹ 800

∴ Amount written off for six months, i.e., from Dt. 1 – 10-’14 to 31 – 3-’15 = \(₹ 800 \times \frac{6}{12}\) = ₹ 400

(3) Adjustment No. 4: Depreciation is to be calculated on vehicles by straight line method.

∴Amount of annual depreciation for vehicles = \(\frac{\text { Cost price – Scrap value }}{\text { Estimated life }} \)

= \(\frac{20,000-4,000}{10}\) = \(\frac{16,000}{10}\) = ₹ 1,600.

(4) Adjustment No. 5: First of all, In debit side of Trading A/c, purchase of furniture of ₹ 2,000 is deducted from Purchase A/c and then, in Assets of Balance Sheet, it is added to furniture.

Calculation of depreciation on furniture:

Depreciation on opening balance = ₹ 6,000 x 20 % = ₹ 1,200

+ Depreciation on new purchase furniture of ₹ 2,000 for 6 months = \(2,000 \times \frac{20}{100} \times \frac{6}{12}\) = ₹ 200

∴ Total Depreciation on total furniture = ₹ 1,400

(5) Adjustment No. 6: Addition capital of ₹ 8,000 was brought into business on 1-10-’14.

∴ Amount of opening capital on 1 – 4 – ’14 = Total capital – Additional capital

= ₹ 1,08,000 – ₹ 8,000

= ₹ 1,00,000

Calculation of interest on capital:

Interest on opening capital = ₹ 1,00,000 x 6% = ₹ 6,000

+ Interest on addition capital for 6 months, i.e.,

from 1 – 10-’14 to 31 – 3-15 = \(8,000 \times \frac{6}{100} \times \frac{6}{12}\) = ₹ 240

∴ Total interest on total capital = ₹ 6,240

(6) Necessary note: For the bad debts reserve on debtors shown in the Trial Balance, nothing is mentioned in the adjustment, therefore it will be deducted from the debtors on the Assets side in the Balance Sheet.

Question 12.

Prepare final accounts from the following Trial Balance and adjustments of Baldev as on 31 – 3 – ’16 :

Trial Balance of Baldev as on 31-3-’16

| Debit Balance | Amount ₹ | Credit Balance | Amount ₹ |

| Drawings | 45,000 | Trading Account | 5,70,000 |

| Fixed Assets | 6,75,000 | Capital | 7,50,000 |

| Office expenses | 82,500 | Bank overdraft | 18,000 |

| Rent | 22,500 | Traders | 3,00,000 |

| Insurance | 45,000 | Bills payables | 37,500 |

| Salaries – Wages | 3,75,000 | Bad debt reserve | 21,000 |

| Customers | 2,25,000 | Discount received | 10,500 |

| Bills receivables | 22,500 | Outstanding office expenses | 3,000 |

| Discount allowed | 7,500 | Prepaid insurance premium | 3,750 |

| Closing Stock | 45,000 | Cash Balance | 22,500 |

| Selling and Distribution expenses | 1,20,000 | Bonus | 18,750 |

| Total | 17,10,000 | Total | 17,10,000 |

Adjustments:

(1) After preparing trading account, it was found that Bhavesh has taken goods for personal use of ₹ 7,500, which is not recorded in the book. Outstanding Carriage inward ₹ 3,750.

(2) Calculate interest on capital at 5%.

(3) Outstanding Interest on Bank overdraft ₹ 750.

(4) After preparing trading account, it was found that ₹ 22,500 received from debtors, which is wrongly credited to sales account.

(5) Provide depreciation on fixed assets at 10 %.

(6) Unrecorded credit purchases ₹ 12,000.

(7) Goods of ₹ 22,500 are destroyed by fire, for which the Insurance company has accepted a claim of 90 % amount.

(8) A fixed asset of ₹ 30,000 sold for ₹ 22,500 for cash on Dt. 1-10-’15 which is not recorded in the book.

Answer:

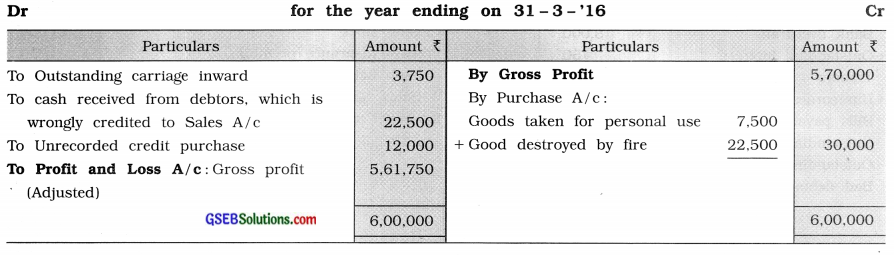

Adjusted Trading Account of Baldev

Profit and Loss Account of Baldev

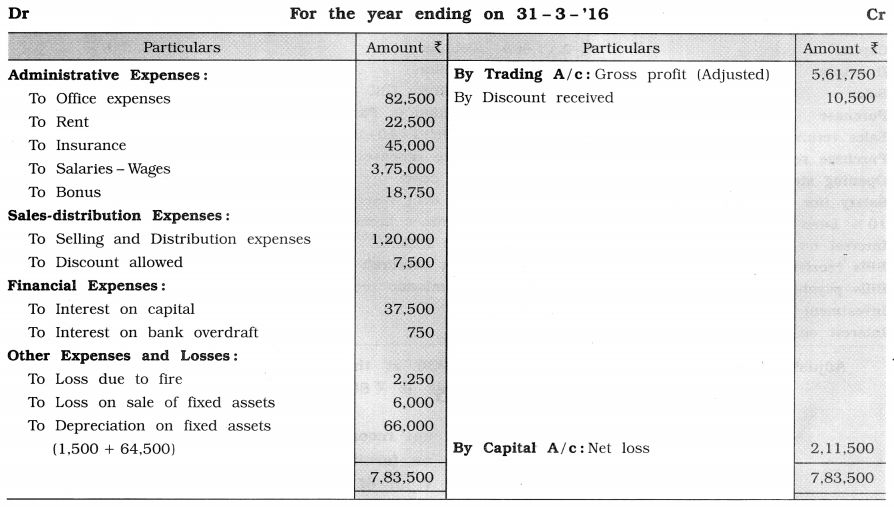

Balance Sheet of Baldev as on 31-3-’16

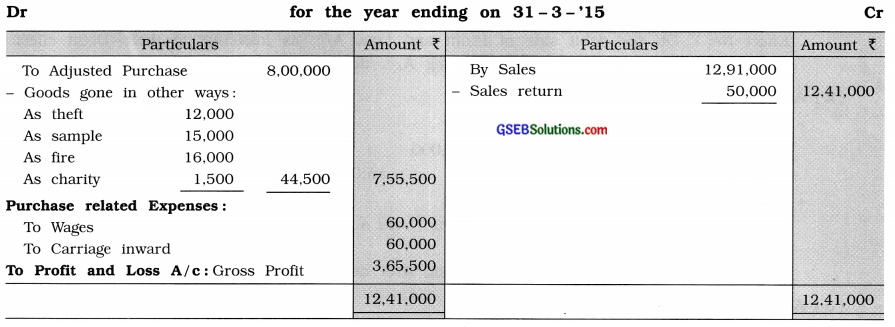

Question 13.

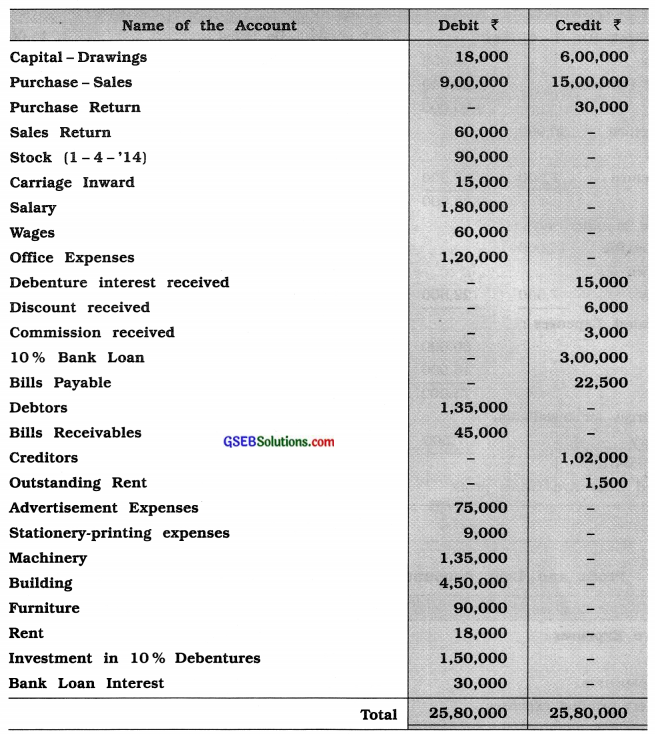

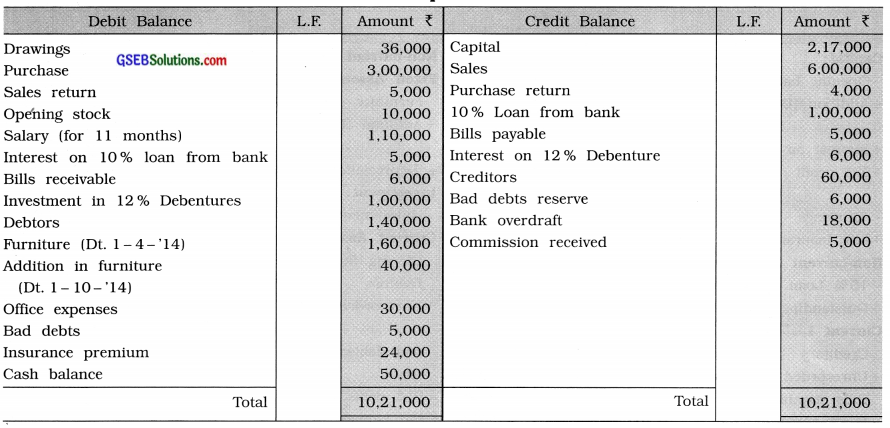

The following balances are taken from the books of Vipul as on 31-3-’15. Prepare final accounts.

| Name of Account | Amount ₹ | Name of Account | Amount ₹ |

| Capital | 2,17,000 | Debtors | 1,40,000 |

| Drawings | 36,000 | Creditors | 60,000 |

| Sales | 6,00,000 | Furniture (Dt. 1 – 4 – ’ 14) | 1,60,000 |

| Purchase | 3,00,000 | Addition in Furniture | 40,000 |

| Sales return | 5,000 | (Dt. 1-10-’14) | – |

| Purchase return | 4,000 | Office expenses | 30,000 |

| Opening stock | 10,000 | Bad debts | 5,000 |

| Salary (for 11 months) | 1,10,000 | Bad debt reserve | 6,000 |

| 10% Loan from bank | 1,00,000 | Insurance premium | 24,000 |

| Interest on 10% loan from bank | 5,000 | Cash balance | 50,000 |

| Bills receivable | 6,000 | Bank overdraft | 18,000 |

| Bills payable | 5,000 | Commission received | 5,000 |

| Investment in 12% Debenture | 1,00,000 | ||

| Interest on 12% Debenture | 6,000 |

Adjustments:

(1) Stock of goods is ₹ 1,50,000 at the end of the year. From which the market value of 50 % goods is ₹ 80,000 and the market value of 50 % goods is ₹ 70,000.

(2) Credit sales of ₹ 60,000 is not recorded.

(3) Calculate 20 % depreciation on furniture.

(4) Life Insurance premium of Vipul of ₹ 3,000 is included in the insurance premium.

(5) Write off additional bad debts of ₹ 15,000 and provide 5 % bad debt reserve on debtors.

(6) Additional capital of ₹ 17,000 brought in the business as on Dt. 1-10-’14. Calculate 10 % interest on capital.

(7) Invoice of ₹ 10,000 for purchase is received from the creditor which is not recorded by an error.

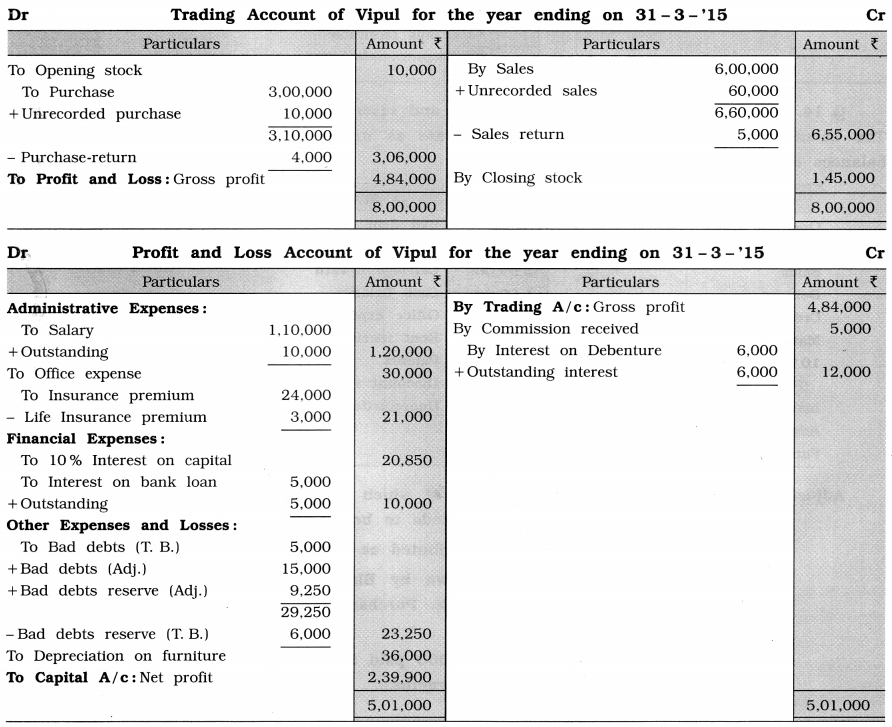

Answer:

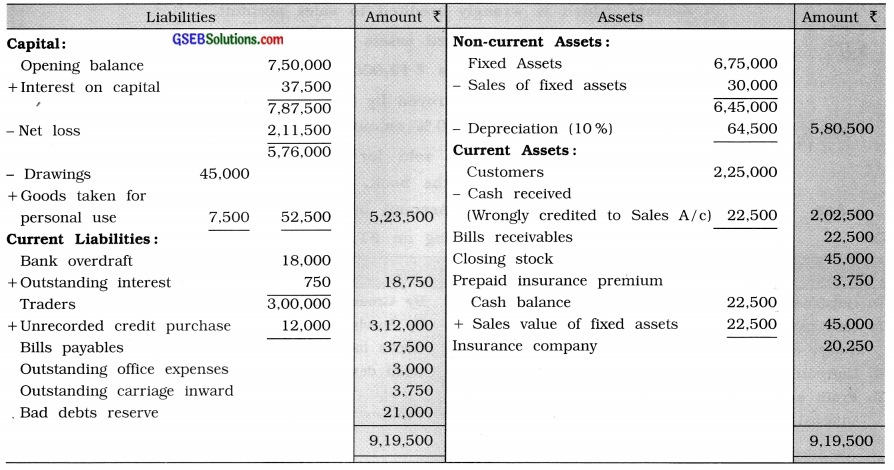

Trial Balance of Vipul as on 31-3-’15

Balance Sheet of Vipul as on 31-3-’15

![]()

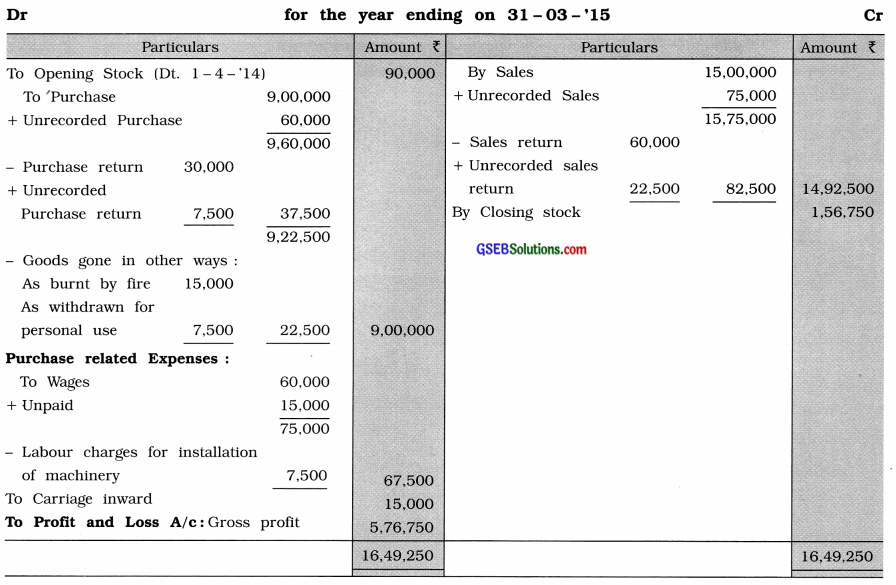

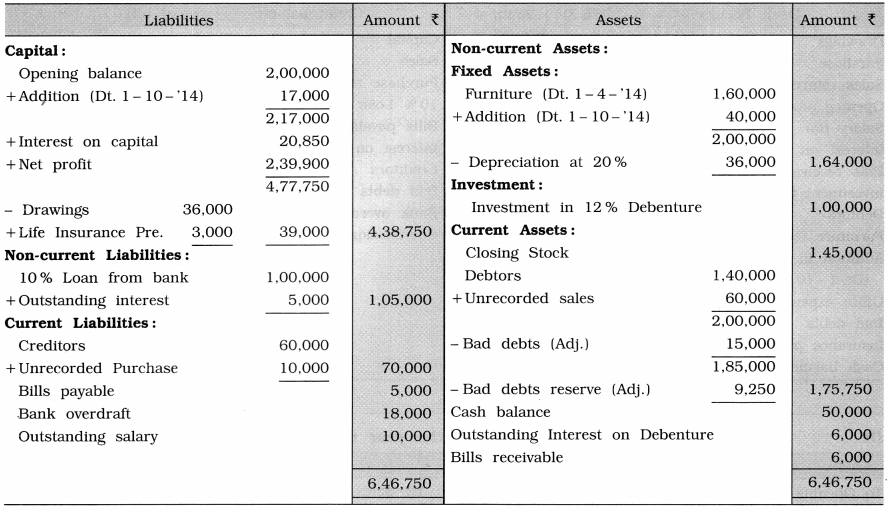

Question 14.

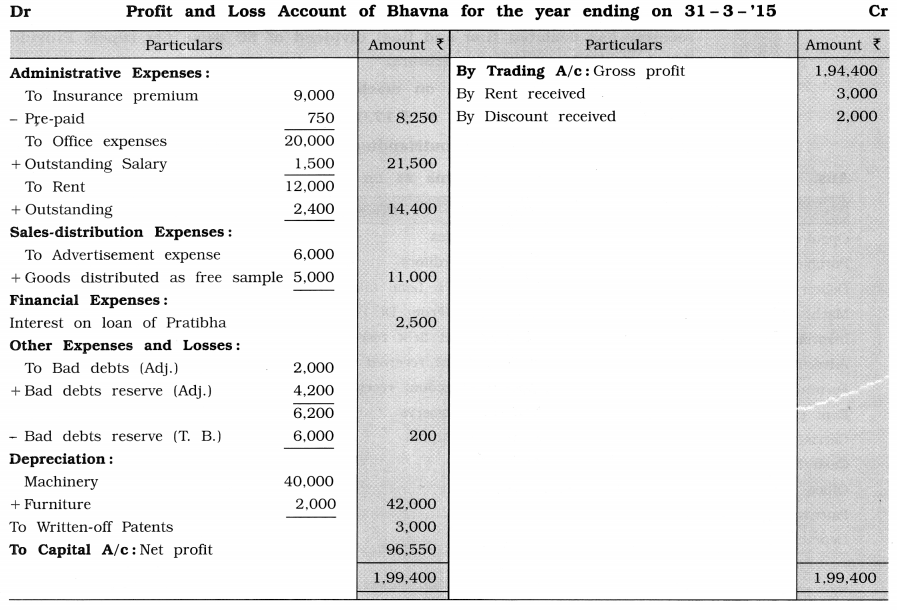

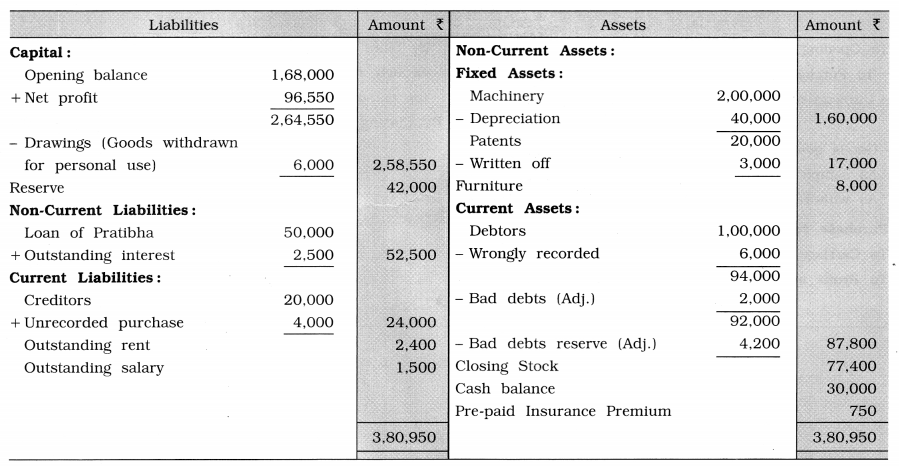

As on 31-3-’15, the ratio of capital and reserve is 4:1 in the business of Bhavna. The balances of other accounts on that date are as under. Prepare final accounts from the balances and adjustments.

| Name of Account | Amount ₹ | Name of Account | Amount ₹ |

| Opening Stock | 30,000 | Bad debt reserve | 6,000 |

| Purchase | 1,00,000 | Rent paid (₹ 1,200 per month) | 12,000 |

| Sales | 2,50,000 | Carriage inward | 4,000 |

| Debtors | 1,00,000 | Cash balance | 30,000 |

| Creditors | 20,000 | Office expenses | 20,000 |

| Machinery | 2,00,000 | Rent received | 3,000 |

| 10 % loan taken from Pratibha | 50,000 | Patents | 20,000 |

| (From Dt. 1-10-’14) | 2,000 | Discount received | 2,000 |

| Insurance premium | 9,000 | Depreciation on furniture | 2,000 |

| Advertisement expense | 6,000 | ||

| Furniture | 8,000 |

Adjustments:

(1) Closing stock is ₹ 80,000 of which market value of 10 % goods is 20 % less. Goods of ₹ 10,000 needs to be repaired for ₹ 1,000.

(2) Goods of ₹ 5,000 are distributed as free sample, which is not recorded.

(3) Goods of ₹ 6,000 withdrawn by Bhavna for her personal use, which is recorded in the sales book. Purchase invoice of ₹ 4,000 is not recorded in the purchase book.

(4) Insurance premium of ₹ 3,000 paid for the year ending as on 30-06-’15 is included in insurance premium.

(5) Out of total debtors a debtor of ₹ 10,000 is declared insolvent and his receiver has declared first and final dividend of 80 paise per rupee. Provide 5 % bad debt reserve on debtors.

(6) Calculate 20 % depreciation on machinery.

(7) Patents are to be revalued at ₹ 17,000.

(8) Office salary of ₹ 1,500 is outstanding which is included in office expenses.

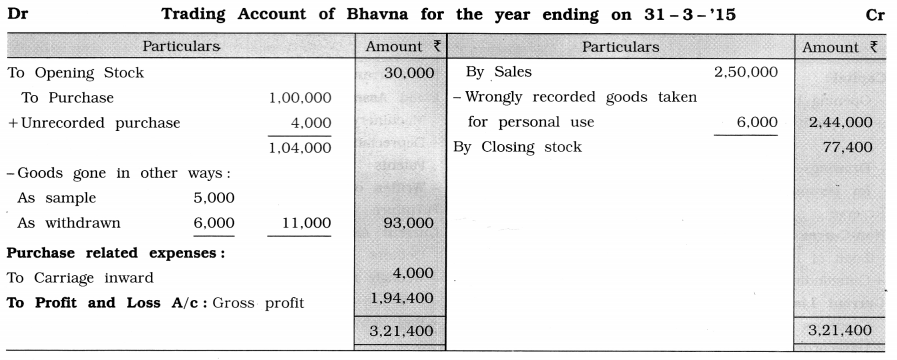

Answer:

Trial Balance of Bhavna as on 31-3-’15

| Debit Balances | Amount ₹ | Credit Balances | Amount ₹ |

| Opening Stock | 30,000 | Sales | 2,50,000 |

| Purchase | 1,00,000 | Creditors | 20,000 |

| Debtors | 1,00,000 | 10% Loan taken from Pratibha (From Dt. 1- 10-14) | 50,000 |

| Machinery | 2,00,000 | ||

| Insurance premium | 9,000 | Bad debt reserve | 6,000 |

| Advertisement expense | 6,000 | Rent received | 3,000 |

| Furniture | 8,000 | Discount received | 2,000 |

| Rent paid (₹ 1,200 per month) | 12,000 | Reserve | 42,000 |

| Carriage inward | 4,000 | Capital | 1,68,000 |

| Cash balance | 30,000 | ||

| Office expenses | 20,000 | ||

| Patents | 20,000 | ||

| Depreciation on furniture | 2,000 | ||

| Total | 5,41,000 | Total | 5,41,000 |

Balance Sheet of Bhavna as on 31-3-’15

Explanation :

(1) Before writing capital and reserve amount in Trial Balance. Total of debit balances is ₹ 5,41,000 and total of credit balances is ₹ 3,31,000. So, difference of both total is arrived ₹ 2,10,000. Now according to instruction given, the ratio of Capital and Reserve is 4:1.

∴ Amount of capital = \(2,10,000 \times \frac{4}{5}\) = ₹ 1,68,000 and

Amount of reserve =\(2,10,000 \times \frac{1}{5}\) = ₹ 42,000

(2) Adjustment No. 1:10% of the stock of ₹ 80,000 is ₹ 8,000 and its market value is less by 20%, i.e, by ₹ 1,600 (8000 x \(\frac{20}{100}\) ) and required repairing expense is ₹ 1,000. Hence, closing stock has been valued at ₹ 80,000- ₹1,600- ₹ 1,000 = ₹ 77,400

(3) Adjustment No. 2: First effect: On the debit side of Profit and Loss A/c added ₹ 5,000 to Advertisement expense. Second effect: On the debit side of Trading A/c deduct ₹ 5,000 from purchase.

(4) Adjustment No. 4: Insurance premium includes ₹ 3,000 for the year ended on 30-06-15. Means, prepaid insurance premium for the three months (from 1-4-15 to 30-6-15) is ₹ 750 (3,000 x \(\frac{3}{12} \) ).

(5) Adjustment No. 5: A debtor of ₹ 10,000 is declared insolvent and his receiver has declared first and final dividend of 80 paise per rupee. It means bad debts is 20 paise per rupee.

The total debtors are ₹ 94,000 out of which ₹ 2,000 (20% of ₹ 10,000) is bad debts. Therefore the net debtors are ₹ 92,000 out of which ₹ 8,000 is sure to be received. So no reserve should be kept on this ₹ 8,000. Hence Bad debts reserve should be provided on doubtful debtors ₹ 84,000 (₹ 92,000 – ₹ 8,000) only.

Amount of Bad debts reserve = ₹ 84,000 x \(\frac{5}{100}\) = ₹ 4,200

(6) Adjustment No. 7 :

Book value of patents = ₹ 20,000

– Revised value of patents = ₹ 17,000

∴ Written off amount = ₹ 3,000