GSEB Gujarat Board Textbook Solutions Class 11 Economics Chapter 10 Budget Textbook Exercise Important Questions and Answers, Notes Pdf.

Gujarat Board Textbook Solutions Class 11 Economics Chapter 10 Budget

GSEB Class 11 Economics Budget Text Book Questions and Answers

1. Choose correct option for the following from the options provided :

Question 1.

How many tiers of government are mentioned in the Indian Constitution?

(A) One tier

(B) Two tier

(C) Three tier

(D) Zero tier

Answer:

(C) Three tier

Question 2.

What is meant by a ‘Panchayat’?

(A) An assembly of 5 persons

(B) An assembly of 50 people

(C) An assembly of 500 people

(D) An assembly of 5 villages

Answer:

(A) An assembly of 5 persons

Question 3.

Who of the following favoured the concept of balanced budget?

(A) Adam Smith

(B) Marshall

(C) Keynes

(D) Hicks

Answer:

(A) Adam Smith

Question 4.

Education is the responsibility of which government?

(A) Central Government

(B) State Government

(C) Local Government

(D) Joint responsibility of centre and state

Answer:

(B) State Government

Question 5.

What does the government do with its expenditure during inflation?

(A) Keeps it stable

(B) Reduces it

(C) Increases it

(D) Makes it zero

Answer:

(B) Reduces it

![]()

Question 6.

Which of the following concepts of deficit does not have policy importance in India?

(A) Revenue deficit

(B) Budgetary deficit

(C) Fiscal deficit

(D) Primary deficit

Answer:

(D) Primary deficit

2. Answer the following questions in one sentence :

Question 1.

What is meant by a budget?

Answer:

A government budget is an annual accounting statement of the item-wise estimates of expected revenue and anticipated expenditure of the government for a new fiscal year

Question 2.

How many sides are there in the accounting statement of a budget? Which are those?

Answer:

Two:

- The credit side which shows income and

- The‘debit side which shows expenditure.

Question 3.

Mention some areas in the list of joint responsibilities of the centre and the states.

Answer:

The list that contains subjects that are common to both i.e. center as well as state. Both of them are jointly responsible for the areas mentioned in this list. These subjects are important for the country and are uniform in purpose for all states. However, the subjects may vary among states. Example: Economic planning, electricity, education, social security, etc.

Question 4.

Who presents the budget generally in the lok sabha?

Answer:

Generally, the finance minister of the country presents the budget in the Lok Sabha.

Question 5.

What is meant by a deficit budget?

Answer:

A budget in which the government’s anticipated total expenditure is more than the anticipated total income is called deficit budget. Thus, Deficit budget = Anticipated total expenditure > Anticipated total income.

Question 6.

Which is the general time period for which a budget is made?

Answer:

A budget is made for the period of 1st April to 31st March of next calendar year.

Question 7.

What is meant by revenue (current) income?

Answer:

In the current period, the direct and indirect taxes, profits of public enterprises, fees and fines from public utilities, etc. constitute the revenue income.

Question 8.

What is meant by development expenditures?

Answer:

Expenditure that provides a direct boost to economic development is known as developmental expenditure. For example, expenditure on irrigation.

Question 9.

Which expenditures are included in the non-developmental expenditures?

Answer:

Expenditure such as repayment of loans, general services like administration, etc. which do not have a direct impact on the development are called developmental expenditures.

Question 10.

State the sources of income of Panchayat.

Answer:

- The panchayats get a share in state taxes as suggested in the constitution and by the state finance commissions.

- They receive grants directly from central government.

- They also get funds from the state government to execute development projects announced by the state government.

Question 11.

From which year was Goods and Services Tax (GST) introduced in India?

Answer:

The Goods and Service Tax Act was passed in the Parliament on 29th March 2017 and came into effect on 1st July 2017. In other words,Goods and Service Tax (GST) is levied on the supply of goods and services

![]()

Question 12.

Who becomes the chairperson of the GST council?

Answer:

3. Answer the following questions in short :

Question 1.

Explain how resources are re-allocated through a budget?

Answer:

Allocation of resources is one of the important objectives of the government budget. In such a situation, the government through the budgetary policy, aims to reallocate resources in accordance with the economic (profit maximisation) and social (public welfare) priorities of the country.

Question 2.

Explain the types of budget.

Answer:

Types of budget:

1. Balanced budget:

- A budget in which the government plans its expenditures in such a way that all the expenditures can be fully made from the available sources of revenue is called a balanced budget.

- A balanced budget is an ideal as well as a theoretical situation. In reality a balanced budget is impractical.

2. unbalanced budget:

A budget in which the total expenditure is not equal to the total income i.e. either the expenditure, is more or less than the income is called unbalanced budget.

Types of unbalanced budget:

(a) Deficit budget:

- A budget in which the government’s anticipated total expenditure is more than the anticipated total income is called deficit budget.

- Thus, Deficit budget = Anticipated total expenditure > Anticipated total income.

- In present times, government budgets are mostly deficit budgets.

(b) Surplus budget:

- A budget in which the government’s anticipated total expenditure is less than the anticipated total income is called deficit budget.

- Thus, Surplus Budget = Anticipated Expenditure < Anticipated Income.

- In reality most governments do not have a surplus budget.

Question 3.

Give the merits of a surplus budget.

Answer:

Merits of surplus budget:

- Surplus budget is useful in times of severe inflation. When the government spends less, employment, income and demand reduce. This helps in restricting inflation.

- Since the budget is surplus, there is no burden of borrowing.

- Savings of the government increase which can be used for development in future periods.

Question 4.

Give the meaning of Goods and Services Tax (GST)

Answer:

The goods and services tax (GST) is a tax on goods and services sold domestically for consumption. The tax is included in the final price and paid by consumers at point of sale and passed to the government by the seller. The GST is a common tax used by the majority of countries globally.

Question 5.

In how many categories is Goods and Services Tax (GST) classified? Which are those?

Answer:

There are four different types of GST as listed below:

- The Central Goods and Services Tax (CGST)

- The State Goods and Services Tax (SGST)

- The Union Territory Goods and Services Tax (UTGST)

- The Integrated Goods and Services Tax (IGST)

![]()

Question 6.

Give the full form of GST, CGST, SGST, UTGST, IGST.

Answer:

- GST: Goods and Services Tax

- CGST: Central Goods and Services Tax

- SGST: State Goods and Services Tax

- UTGST: Union Territory Goods and Services Tax

- IGST: Integrated Goods and Services Tax

4. Answer the following questions in brief points :

Question 1.

Give the meanings of Revenue deficit, Budgetary deficit, Fiscal deficit and Primary deficit.

Answer:

1. Revenue deficit:

When the total expenditure of the government on revenue (current) account is more than total receipts of the government on the revenue account it results in revenue deficit.

2. Budgetary deficit:

When the total expenditure (current as well as capital) is greater than the , total income (current as well as capital) it results in budgetary deficit.

3. Fiscal deficit:

- When a government’s total expenditures exceed the revenue that it generates, excluding money from borrowings, it gives rise to fiscal deficit.

- Thus, Fiscal deficit = Total expenditure – Total income (excluding market borrowings)

4. Primary deficit:

- Primary deficit is a relatively new concept in Indian budget.

- The difference between fiscal deficit of the current year and interest payments on the previous borrowings is called primary deficit.

- Thus, primary deficit = Fiscal deficit – Interest payments

Question 2.

Discuss effects of a budget.

Answer:

Effects of preparing a budget:

- Through budgets the government attempts to incur expenditures with respect to incomes so that the deficits can be kept in control. Thus, budget brings fiscal discipline in government.

- Budget justifies allocation of resources among various sectors according to need and priority.

- It gives direction to investment by allocating budgetary funds in various sectors. Also, it regulates demand by regulating the disposable incomes of people by imposing right amount of taxes.

- With the help of taxes and directing expenditures in the necessary sectors. A budget also helps in providing stability against inflation and deflation.

- A budget helps to fulfill objectives of economic growth and development of a nation or a state.

Question 3.

Explain the concepts of

(A) Revenue expenditure

Answer:

Revenue expenditure:

Current expenditures include expenditure made in the current year on salaries of government employees, interest payment on loan taken by the government, pension, subsidies, grants, current expenses on defence, etc.

(B) Revenue income

Answer:

Revenue (Current) income:

The revenue income includes direct and indirect taxes, profits of public enterprises, fees and fines from public utilities etc.

(C) Capital income

Answer:

Capital income:

- Income generated by the government in the form of borrowings from the market in own country and abroad, borrowing from central bank, income from disinvestment, etc. are a part of capital income and are recorded in this account in the budget.

- The section of capital income records receipts of those transactions which have long term or continuous impacts on government funds.

(D) Capital expenditure.

Answer:

Capital expenditures:

- These are expenditures on those transactions which have long term or continuous impacts on government funds.

- This account includes loans given by the government to other governments, repayment of previously taken loans, capital expenses on social and economic services, as well as capital expenses on defence, etc.

Question 4.

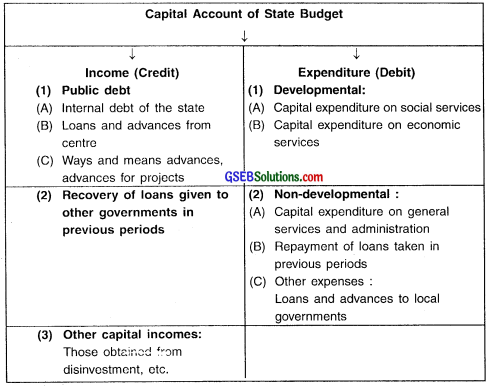

Give details of the income and expenditure sides of the capital account of a state budget.

Answer:

Question 5.

Give the functions and sources of income of ‘Panchayats’.

Answer:

Sources of income of a panchayat:

- The panchayats get a share in state taxes as suggested in the constitution and by the state finance commissions.

- They receive grants directly from central government.

- They also get funds from the state government to execute development projects announced by the state government.

Functions of a panchayat (i.e. items of expenditure):

Panchayats are mainly responsible for raising facilities of water supply, water pumps, sewage, roads, cleanliness, public health, electricity, etc. in their concerned region.

![]()

Question 6.

Give the reasons responsible for introduction of GST in India.

Answer:

GST in India is introduced to:

- Impose a single tax on a particular good/service by eliminating taxing it multiple times by states and centre, the way it used to happen before GST.

- Eliminate the difference in tax rates between states for similar good/services.

- Reduce the cost of collecting the tax as well as making its administration simpler.

- Ease the digital procedures of tax collection.

- Reduce tax evasion and avoidance and make the indirect tax structure more productive in terms of raising revenues.

- Reduce the burden of indirect taxes on people.

5. Answer the following questions in detail :

Question 1.

Give the meaning and objectives of a budget.

Answer:

Budget:

A government budget is an annual accounting statement of the item-wise estimates of expected revenue and anticipated expenditure of the government for the new fiscal year.

Main elements of the budget:

- It is a statement of estimates of government receipts and expenditures.

- Budget estimates are for a fixed period, generally a year.

- The objective of budget of any government is economic development of the region and public welfare.

- A budget must be approved by Lok Sabha or Assembly or some such public body before its implementation.

- Usually the finance minister of the country, state-or the head of the governing body declares the budget.

With respect to double entry book keeping system, all budgets are balanced because the credit (income side) and debit (expenditure side) must always balance. However, in reality, government budgets -may be balanced or unbalanced.

Purpose (Objective) of the budget:

The government must plan its expenditures and raise its income in such a way that the following objectives can be fulfilled:

1. To obtain approval of the body of elected representatives:

The ruling government need to take approval of the elected representatives of the democratic government for the expenditures and incomes estimated to incur in the coming financial year.

2. To get an idea regarding available resources and areas requiring expenses:

To get an idea regarding:

(a) The activities which the government can and should undertake

(b) The expenses to be incurred in various sectors and

(c) The sources from where the necessary income may be raised

3. Provide direction for allocation of resources:

- To allocate the resources i.e. income earned into different sectors with respect to their priority and need.

- If proper estimates are not made for each sector then it is quite possible that ‘ some sectors may receive more than necessary funds and some seciors may get neglected.

4. For knowledge of the public:

- Through the budget people come to know which sectors is the government favouring and how much resource is it allocating to those sectors.

- People also come to know the change in the tax structure that will be done in the commodities and the sectors.

- All this information helps people to understand which commodities will become costlier and which will become cheaper.

Conclusion:

- Thus, the budget is an important component of planning of the government.

- Various economic policies get guided by the budget allocations in concerned sectors.

Question 2.

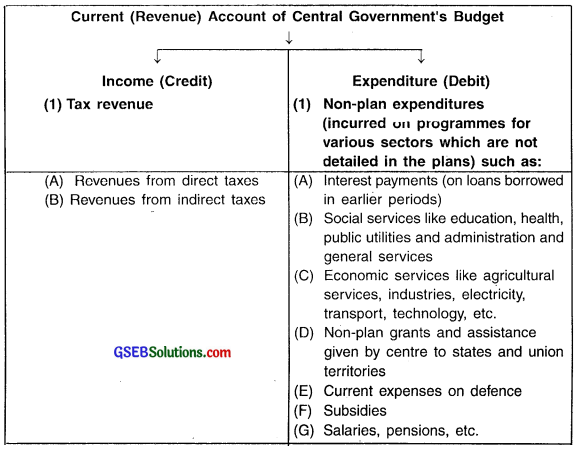

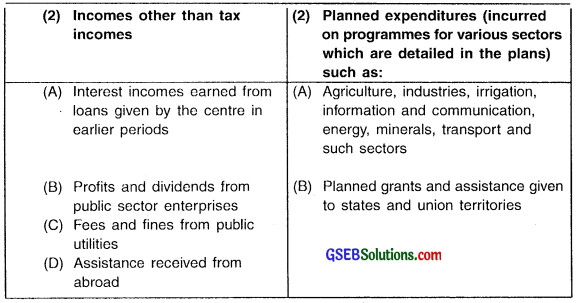

Give details of the budgetary accounts of the central government of India.

Answer:

Central government’s budget:

- The finance minister of India presents the budget of the Central Government in the Lok Sabha usually in the last week of February every year.

- The Lok Sabha approves the budget after discussions and if necessary, amendments are made later.

- The budget is implemented from April 1 and lasts till March 31 of the next calendar year.

An example of the budget of Central Government of India

Note that the expenditure of central government is classified into non-plan and plan expenditures as per changes made in the budget of 2016. On the other- hand, the expenditure of state governments is classified into developmental and non-developmental expenditures.

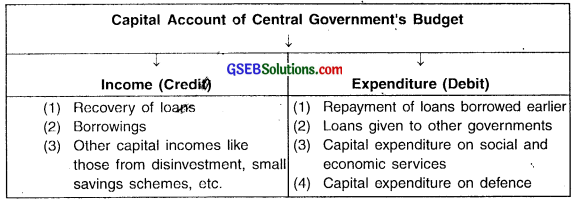

Question 3.

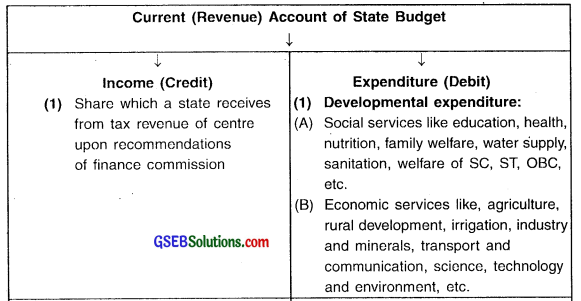

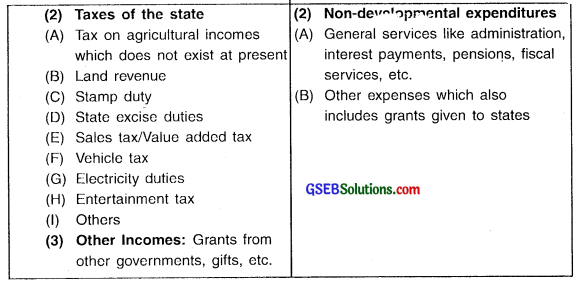

Write a note on budget of a state government in India.

Answer:

Budget of the State Governments in India:

The Indian states have less productive income sources than the centre while they have greater responsibilities to fulfill in several sectors. The ‘ following table gives an idea of the accounts of a state budget.

Note that the expenditure of state governments is classified into (1) Developmental expenditures and (2) Non-developmental expenditures.

![]()

Question 4.

Explain the various types of deficits in a budget.

Answer:

Types of budget deficits:

An unbalanced budget can be either surplus or deficit.

The types of deficits in a budget with specific reference to India are:

1. Revenue deficit:

- When the total expenditure of the government on revenue (current) account is more than total receipts of the government on the revenue account it results in revenue deficit.

- Revenue account contains current transactions of the government. A deficit in this account means that the government is not able to meet its routine ‘ expenditures from its current income.

- Revenue deficit shows’ inefficient working of government.

Solution:

Revenue deficit can be overcome by increasing borrowings on the capital account.

2. Budgetary deficit:

When the total expenditure (current as well as capital) is greater than the . total income (current as well as capital) it results in budgetary deficit.

Solution:

The central government undertakes deficit financing (i.e. borrows from RBI) to meet this deficit. The state governments borrow more from the central government which is then called overdraft.

3. Fiscal deficit:

- When a government’s total expenditures exceed the revenue that it generates, excluding money from borrowings, it gives rise to,fiscal deficit.

- Thus, Fiscal deficit = Total expenditure – Total income (excluding market borrowings).

- The borrowings that a government does from the market are considered as income on the capital account. In fact this borrowing is a debt created by the government and must not be included as a source of income.

4. Primary deficit:

- Primary deficit is a relatively new concept in the Indian budget.

- The difference between fiscal deficit of the current year and interest payments on the previous borrowings is called primary deficit.

- Thus, Primary deficit = Fiscal deficit – Interest payments

- The interest payment is an important part of government expenditures. However, these expenditures actually do not incur on current activities but are an inevitable burden to be paid for amounts borrowed in the past.

- Hence, the concept of primary deficit takes out interest payments from fiscal deficit.

- This concept does not have an impact on the policy.

Question 5.

Write a detailed note on important aspects pertaining to enforcement of Goods and Services Tax (GST) in India.

Answer:

- India introduced GST from July 1,2017 after making amendment in the constitution.

- GST replaced about 17 different indirect taxes which were imposed by the central and state government in India.

Some important enforcement areas of GST in India:

1. Respective rates of central and state indirect taxes were determined by the centre and state with different considerations.

- Since one single GST was applied on the entire country, it became necessary for the government to set up a nodal agency to determine GST rates and regulate the GST procedures.

- This nodal agency came in the form of GST council. The finance minister of India was made its chairperson whereas the finance ministers of states were made its members. The council meets every three month.

2. Rates of GST:

There are five different rates of GST applied on various types of goods and services. They are:

1. Zero GST:

The government does not charge GST.on certain goods and services and hence they fall under the zero (0%) GST rate.

Example:

Certain agricultural goods like vegetables, fruits, cereals, education and health services.

2. Levels of rates:

The goods and services not exempted from GST attract 5%, 12%, 18% or 28% depending on the type of needs which they satisfy. The highest GST rate of 28% is imposed mostly on entertainment and luxury goods and services.

3. Compensation to states:

With the introduction of GST it was calculated that some states may incur loss in revenue. Hende the government decided to provide compensation to such states for 5 years since the introduction of GST.

4. Goods and Services kept outside the realm of GST:

In the initial phase, government has not levied GST on certain goods and services. These are to be taxed according to the earlier rates of various indirect taxes. Gradually these goods may be brought under the purview of GST.

These goods are:

(a) Alcohol and

(b) Petroleum products (petrol, diesel, crude, Aviation Turbine Fuel (ATF) and natural gas)