Gujarat Board GSEB Textbook Solutions Class 12 Commerce Accounts Part 1 Chapter 2 Final Accounts (Financial Statements) of Partnership Firm Textbook Exercise Questions and Answers.

Gujarat Board Textbook Solutions Class 12 Accounts Part 1 Chapter 2 Final Accounts (Financial Statements) of Partnership Firm

GSEB Class 12 Accounts Final Accounts (Financial Statements) of Partnership Firm Text Book Questions and Answers

Question 1.

Select appropriate option for each question :

(1) In which year partnership Act was implemented in India ?

(A) 1923

(B) 1932

(C) 1947

(D) 1956

Answer:

(B) 1932

(2) In which proportion profit-loss will be shared between the partners made in the partnership deed ?

(A) Capital proportion

(B) Gaining ratio

(C) Sacrificing ratio

(D) if no provision is Equal proportion

Answer:

(D) if no provision is Equal proportion

![]()

(3) Credit balance of trading account represents …………………

(A) gross profit

(B) net profit

(C) gross loss

(D) net loss

Answer:

(A) gross profit

(4) Goods returned debit means ……………………

(A) purchase

(B) purchase return

(C) sales

(D) sales return

Answer:

(B) purchase return

(5) Goods returned credit means …………………

(A) purchase return

(B) sales return

(C) purchase

(D) sales

Answer:

(B) sales return

(6) Which balance is represented by bank overdraft ?

(A) Debit balance

(B) Credit balance

(C) Debit and Credit

(D) None of the above

Answer:

(B) Credit balance

(7) Where will you disclose the credit balance of profit and loss account which is shown in the trial balance ?

(A) Trading A/c

(B) Profit and loss A/c

(C) Profit and loss appropriation A/c

(D) Capital/current A/c

Answer:

(C) Profit and loss appropriation A/c

(8) Which transaction is shown at the debit side of the profit and loss appropriation account ?

(A) Interest on drawings

(B) Interest on debit balance of current A/c

(C) Net profit

(D) Amount to be transferred to general reserve

Answer:

(D) Amount to be transferred to general reserve

![]()

(9) Generally, which balance is maintained by current account ?

(A) debit

(B) credit

(C) debit or credit

(D) None of the above

Answer:

(C) debit or credit

(10) The financial position of business is disclosed by ………………

(A) Trial balance

(B) Trading A/c

(C) Balance sheet

(D) Profit and loss A/c

Answer:

(C) Balance sheet

Question 2.

Describe the objectives of the preparation of final accounts of a partnership firm.

Answer:

Following are the main objectives of preparing final accounts of a partnership firm :

(1) To ascertain gross profit or loss : Through the preparation of trading account, a partnership firm can ascertain gross profit or loss.

(2) To ascertain net profit or loss : A partnership firm can ascertain net profit or net loss through the preparation of profit and loss account. The profitability of the firm can be seen from the profit and loss account.

(3) To ascertain divisible profit or loss : All personal transactions and provision of the partners with the firm can be ascertained through the preparation of profit and loss appropriation account.

(4) To know the financial status of the firm : To know the financial status of the firm balance sheet is prepared. It provides information about assets, receivables, payables and capital of the firm.

(5) For taxation purpose : To know the taxable income of the firm final accounts are prepared.

![]()

Question 3.

Explain in brief, the method of the preparation of final accounts of a partnership firm.

Answer:

In the partnership firm all the economic transactions are firstly recorded in journal in subsidiary book. Then posting of all these transactions is done in the ledger and balance of every account is found out. All these accounts balances are recorded in the trial balance as on (particular) date.

Based on this trial balance balances and given adjustments/ other information to know financial results and financial position of business, final accounts of the business are prepared.

In the final accounts of partnership firm, following necessary accounts and a statement are prepared :

(1) Trading Account : In this account, transactions related to purchase and sales of goods, goods return, goods goes out by any means, purchase expenses and stock of goods are recorded and to find gross profit or gross loss . Trading A/c is to be prepared. Result of Trading A/c (gross profit or gross loss) is transferred to Profit and Loss A/c.

(2) Profit and loss Account : In the partnership firm, transactions of Revenue expenses and incomes are recorded in the Profit and Loss A/c to find net profit or net loss. On the debit side of profit and loss A/c, administrative exp., Selling-distribution exp., financial exp., and other exp. are recorded while on the credit side, revenue incomes are recorded. Net profit or net loss is to be transferred to Profit and Loss Appropriation A/c.

(3) Profit and Loss Appropriation Account : To show the distribution of profit and loss among the partners, a special account is prepared known as profit and loss Appropriation A/c, which is a part of profit and loss A/c on the debit side of this account partners’ interest on capital, interest on credit balance of current account, salary, bonus, commission, general reserve etc. amounts are shown. While on the credit side of this account, partners, interest on drawings, interest on debit balance of current account amounts are shown. From profit and loss Appropriation A/c, net divisible profit or loss can be known which is transferred to partners’ capital or current account.

(4) Partners Capital Accounts : To record the partners transactions with the firm, partners’ capital accounts are prepared.

When fluctuating capital account method is adopted, all the transactions related to partners are recorded in this account and final balance is transferred to the balance sheet.

When fixed capital account method is adopted, opening balance and transactions due to permanent increase/ decrease take place in the capital are recorded. In the partners capital account while other transactions concern with partners are recorded in the partners current account. Final balance of this account is also transferred to the balance sheet.

(5) Balance sheet: At the end of the year to know financial position of the business, balance sheet is to be prepared. On the capital liability side of balance sheet, partner capital account balance, current account balance, reserves, current and non-current liabilities are shown. While on asset-receivable side, fixed assets,, intangible assets, investments, current assets, deferred revenue expenditure, debit balance of partners current-account, etc. are shown. Remember total of both the sides of balance sheet should be equal.

Question 4.

State list of tangible and intangible assets.

Answer:

Tangible Assets : Land, Building, Leasehold properties, Vehicles, machines, Furniture and fittings, Loose Tools.

Intangible Assets : Patent, Trademark, Copyright, Goodwill.

Question 5.

Where will you disclose the following items given in a trial balance during the preparation

of a final account of a partnership firm : (1) Bad debts returned (2) Depreciation : factory’s building (3) Wages and salary (4) Providend fund investments (5) Bills payable (6) Goods withdrawn as drawings (7) Goods return credit (8) Goods return debit (9) Loan given to firm by a partner (10) Interest on investments of providend fund.

Answer:

| Name of Account | Recorded in account or statement |

| (1) Bad debts return | – Credit side of Profit and Loss Account. |

| (2) Depreciation : Factory’s building | – Debit side of Trading Account |

| (3) Wages and salary | – Debit side of Trading Account |

| (4) Providend fund investments | – Asset side of Balance Sheet |

| (5) Bills payable | – Capital liability side of Balance sheet |

| (6) Goods withdrawn as drawings | – Will be deducted from purchase of Trading Accountdebit side |

| (7) Goods return | – Will be deducted from sales, on the credit side of Trading Account. |

| (8) Goods return | – Will be deducted from purchase, on the debit side of Trading Account. |

| (9) Loan given to firm by a partner. | – Capital- Liability side of Balance sheet |

| (10) Interest on investments of Providend fund | – Capital-Liability side of Balance sheet, will be added to Providend fund account |

Question 6.

Where will you disclose the effects of the following adjustments during the preparation of final accounts of a partnership firm : (1) Closing stock of stationery (2) Unrecorded credit sales (3) Commission payable to partner on net profit (4) Goods withdrawn by partner for personal use. (5) Interest on debit balance of Partners’ current account (6) Certain amount is written off from leasehold property (7) Receivable income (outstanding income) (8) Prepaid expenses (9) Discount reserve on debtors.

Answer:

| Adjustments | Treatment |

| (1) Closing stock of stationery | (i) Will be deducted from stationery expense, on the debit side of Profit and Loss A/c.

(ii) On asset side of Balance sheet, as closing stock of stationery. |

| (2) Unrecorded Credit sales | (i) Will be added to sales A/c, on the credit side of Trading A/c

(ii) Will be added to debtors, on asset side, in Balance-sheet. |

| (3) Commission payable to partner on net profit. | (i) Debit side of profit and loss Appropriation A/c

(ii) Credit side of Partner’s capital/current A/c |

| (4) Goods withdrawn by partner for personal use | (i) Will be deducted from purchase A/c, on debit side of Trading A/c.

(ii) Debit side of partners’ capital/current A/c. |

| (5) Interest on debit balance of partner’s current account | (i) Debit side of partners current A/c

(ii) Credit side of profit-loss Appropriation A/c. |

| (6) Certain amount is written off from leasehold property. | (i) Debit side of Profit and Loss A/c. leasehold asset written off.

(ii) Deducted from leasehold asset on asset side of balance sheet. |

| (7) Receivable income (Outstanding income) | (i) Will be added to respective income, on credit side of Profit and Loss A/c.

(ii) Balance sheet -Asset side. |

| (8) Prepaid expense | (i) Will be deducted from respective expense, on debit side of Trading A/c or on debit side of Profit and Loss A/c.

(ii) Balance sheet -Asset side. |

| (9) Discount reserve on debtors | (i) Debit side of Profit and Loss A/c

(ii) Will be deducted from debtors, on asset side of Balance sheet. |

![]()

Question 7.

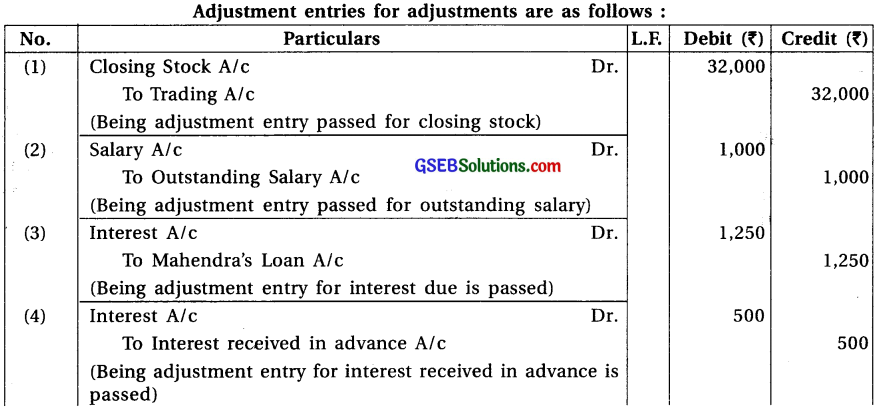

Write adjustment entries for the following adjustments :

(1) Book value of stock is ₹ 40,000, but its market value is 20% less than the book value. (2) Salary outstanding ₹ 1,000. (3) Mahendra landed loan of ₹ 25,000 to the firm, but 10% for 6 months is outstanding on it. (4) Interest received in advance ₹ 500. (5) Provide depreciation at 8% for 8 months on a building of ₹ 5,00,000. (6) Closing stock of stationery at the end of the accounting period is ₹ 250. (7) Closing balance at the end of accounting period, of debtors of business is ₹ 50,000, out which written off ₹ 4,500 as bad debts. Provide 10% bad debts reserve on debtors. (8) One partner has withdrawn goods of ₹ 5,000 for personal use, this transaction is not recorded. (9) Goods of ₹ 3,000 destroyed by fire. Insurance company has admitted the claim of 80%.

Answer:

Adjustment entries for adjustments are as follows :

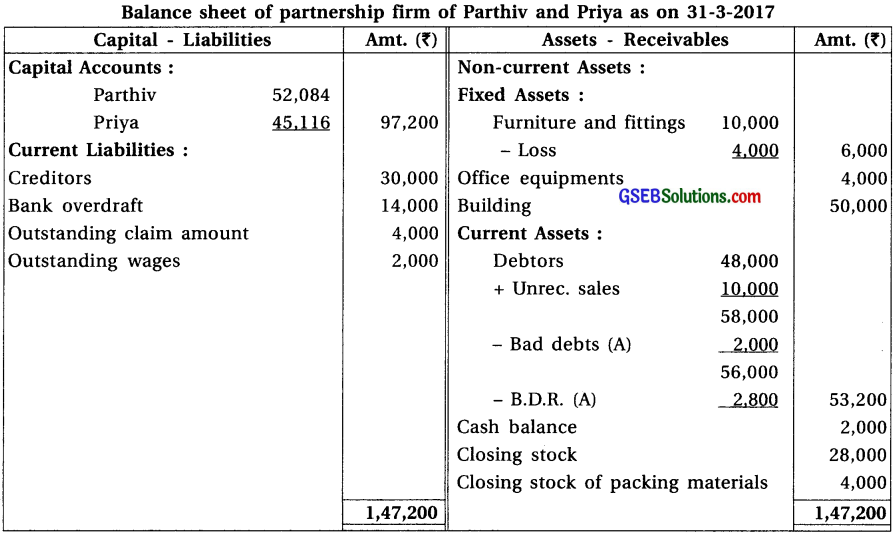

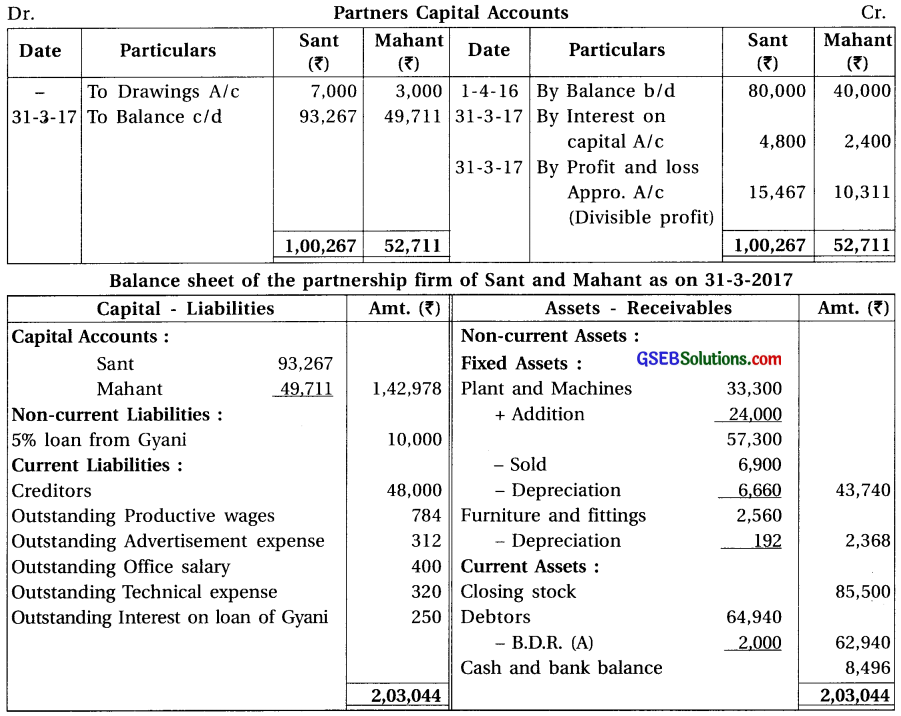

Question 8.

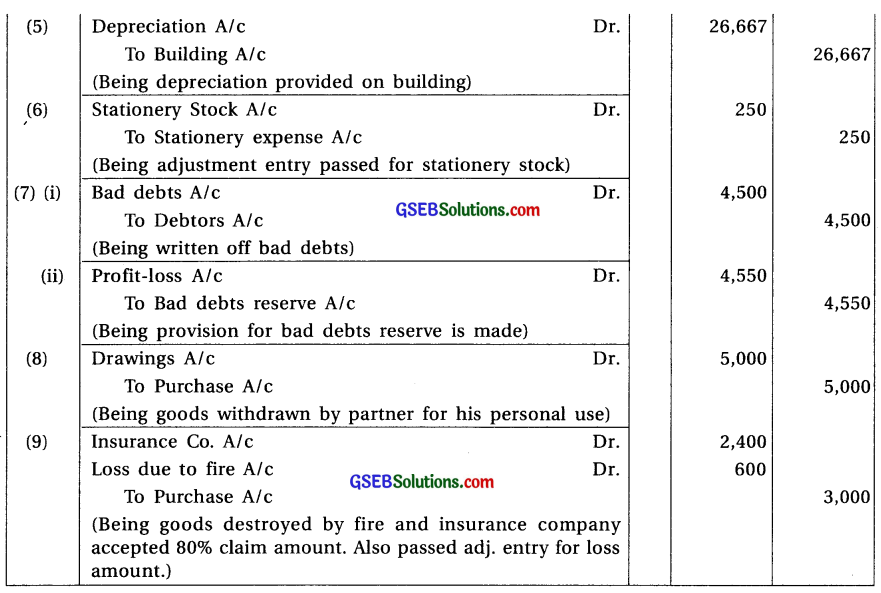

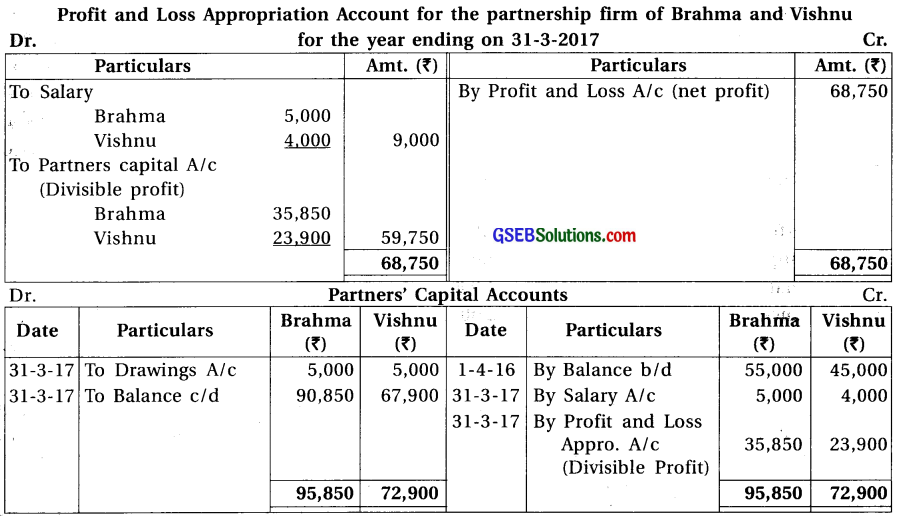

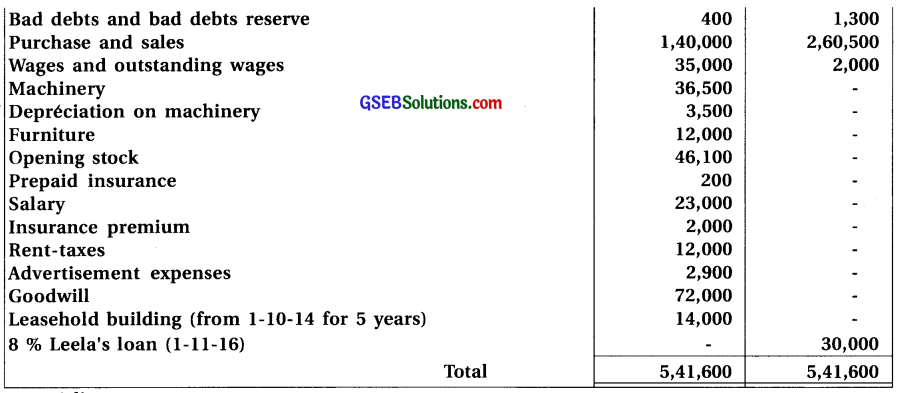

Brahma and Vishnu are partners of a firm sharing profit-loss in the proportion 3 : 2. From the trial balance dated 31-3-2017 and adjustments, prepare annual accounts of the firm :

Adjustments : (1) Provide depreciation 6% on machinery and 20% on furniture fixtures. (2) Written off ₹ 500 from debtors as bad debts. (3) Annual salary of ₹ 5,000 and ₹ 4,000 payable to Brahma and Vishnu respectively. (4) Commission ₹ 500 is receivable. (5) Outstanding salary ₹ 3,000.

Answer:

Profit and Loss Account of partnership firm Brahma and Vishnu

![]()

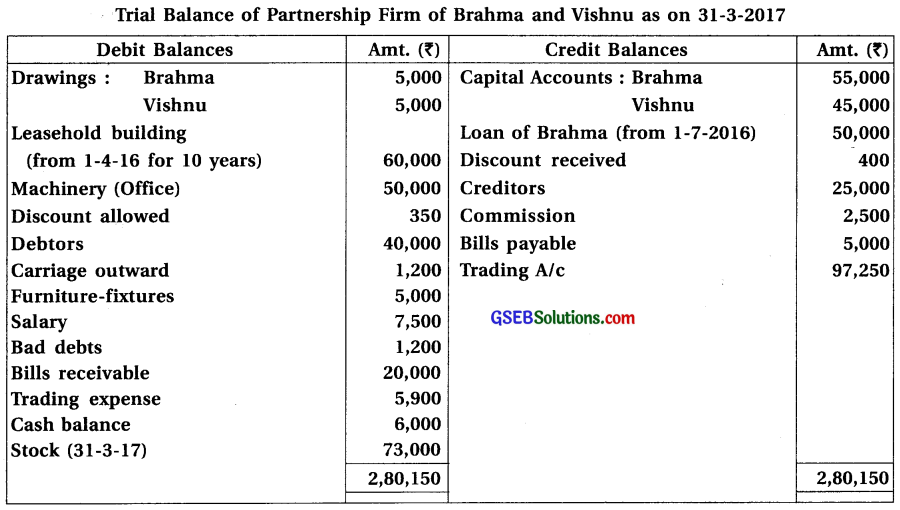

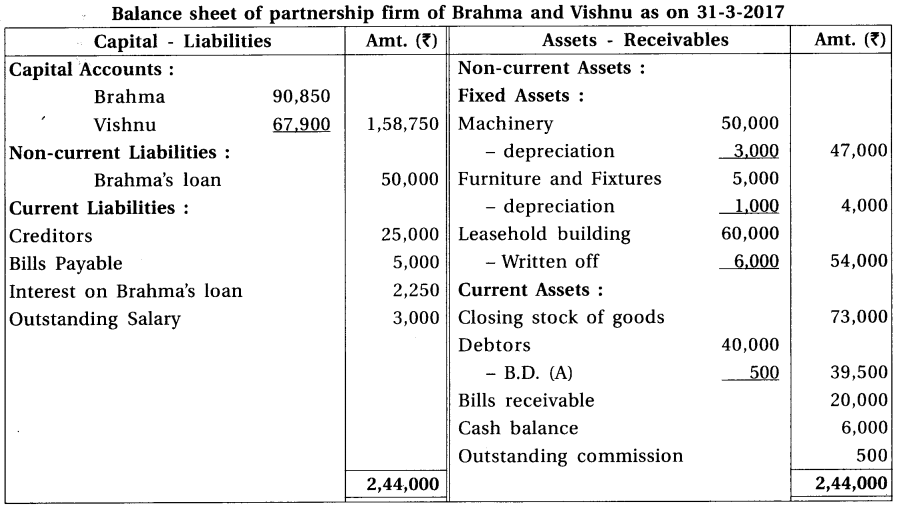

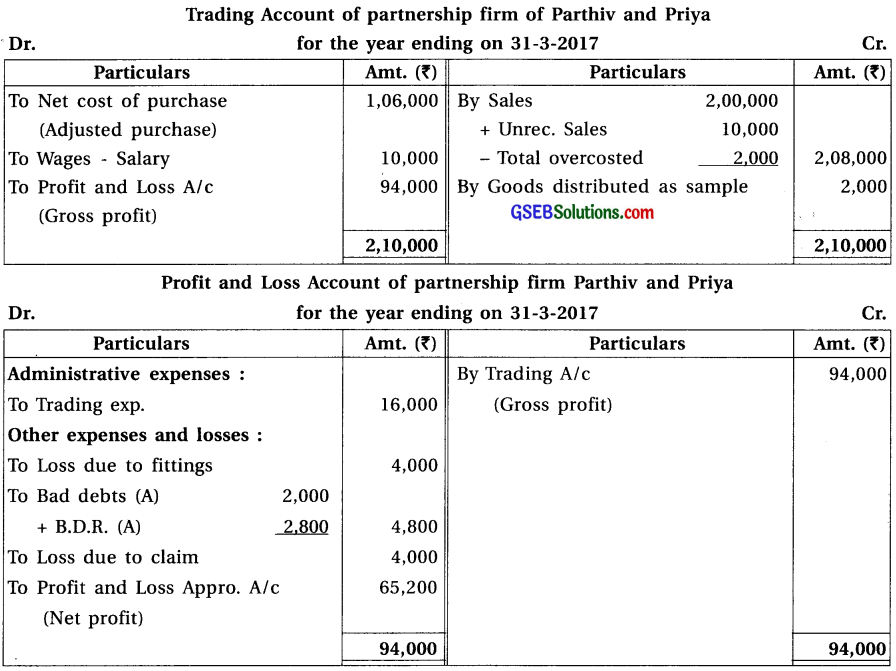

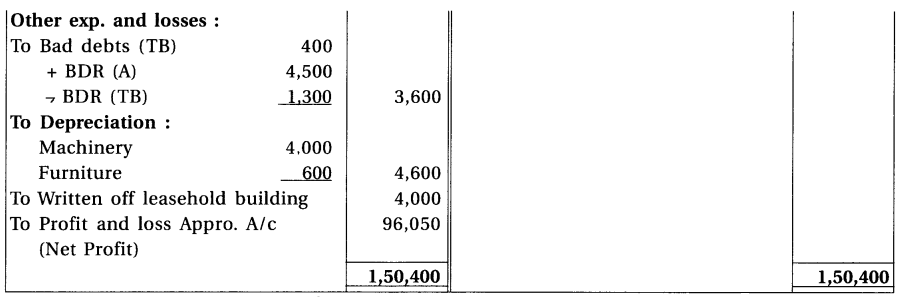

Question 9.

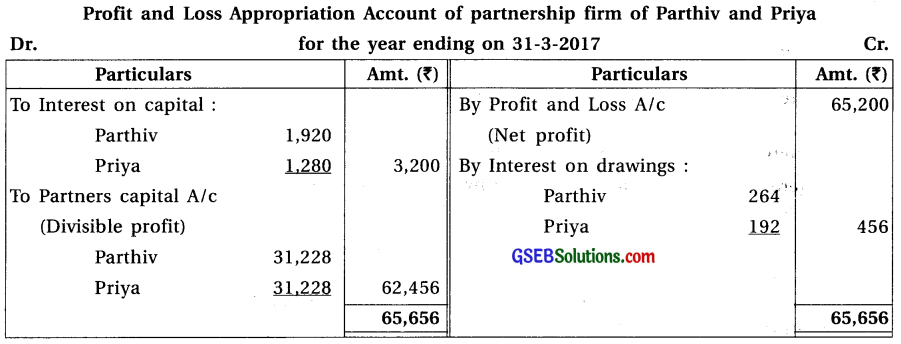

Parthiv and Priya are the partners of a partnership firm. From the Trial balance dated 31-3-2017 and adjustments, prepare final accounts of a partnership firm.

Note : Net cost of purchase means adjusted purchase.

Adjustments : (1) Provide interest 8% on capital and 12% on drawings. Parthiv had withdrawn ₹ 400 at the end of each month and Priya had withdrawn on 1-10-16. (2) Credit sales of ₹ 10,000 is not recorded and total of sales book of March is overcast by ₹ 2,000. (3) Write off additional bad debts of ₹ 2,000 and provide 5% bad debts reserve on debtors. (4) Furniture of ₹ 4,000 became obsolete, which is not recorded in the books. (5) A court has finalised claim of ₹ 4,000; for not meeting agreement to provide goods to a customer. (6) Outstanding wages of ₹ 2,000 is recorded to wages account but outstanding wages account is not recorded in the trial balance.

Answer:

Note :

(1) Interest on drawings for partners :

Interest on drawings – Parthiv = 400 × \(\frac{12}{100} \times \frac{66}{12}\) = ₹ 264

Interest on drawings – Priya = 3,200 × \(\frac{12}{100} \times \frac{6}{12}\) = ₹ 192

(2) Here, sales book total is overcosted by ₹ 2,000 and also unrecorded o/s wages is ₹ 2,000 which is an example of compensating error. ∴ only one effect of both this balance we have pass. Accordingly, total overcasted is to be subtracted from sales A/c on credit side of trading A/c and unrecorded o/s wages ₹ 2,000 will be recorded on capital-liability side of Balance Sheet.

![]()

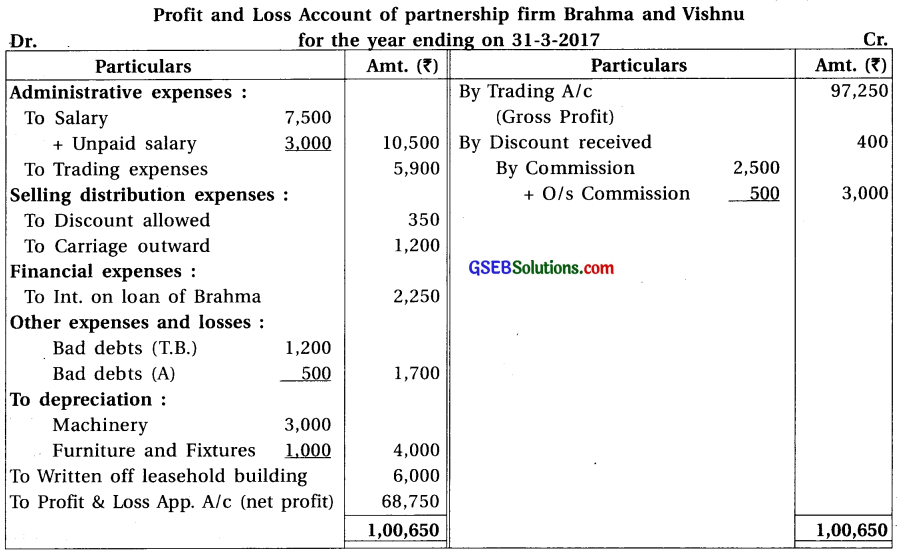

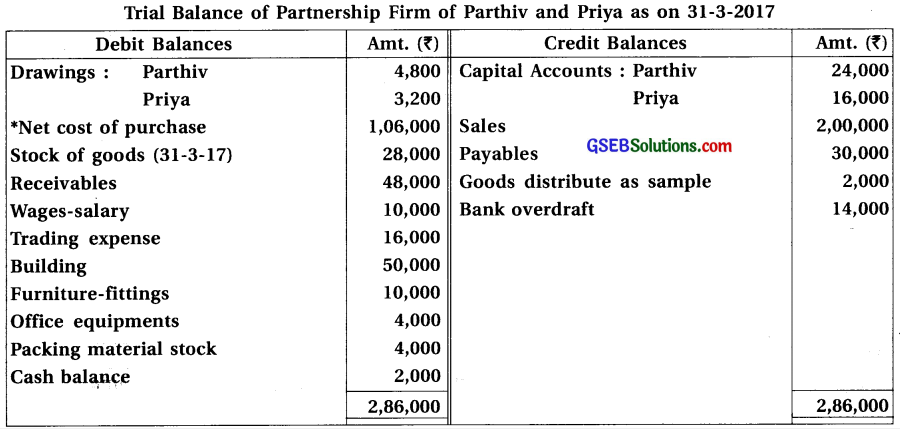

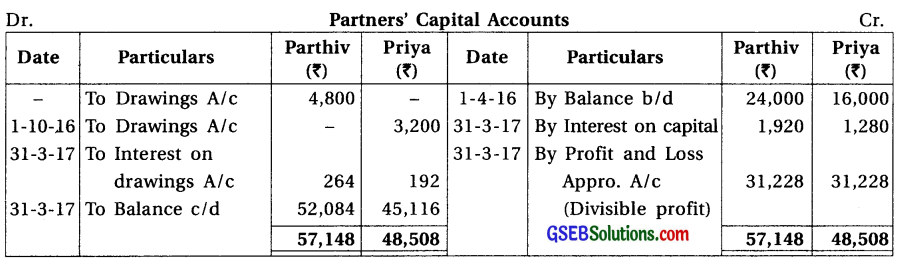

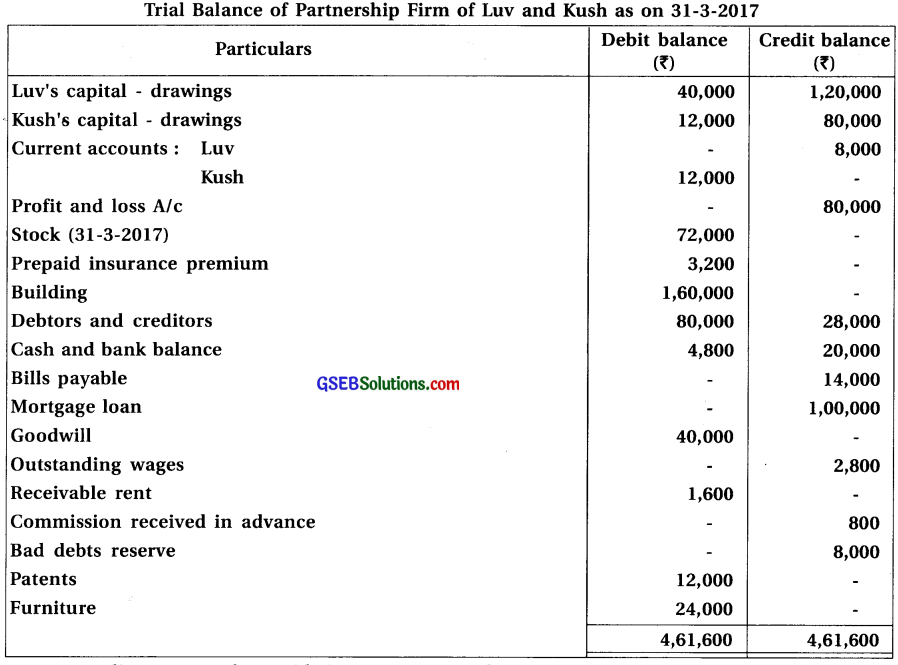

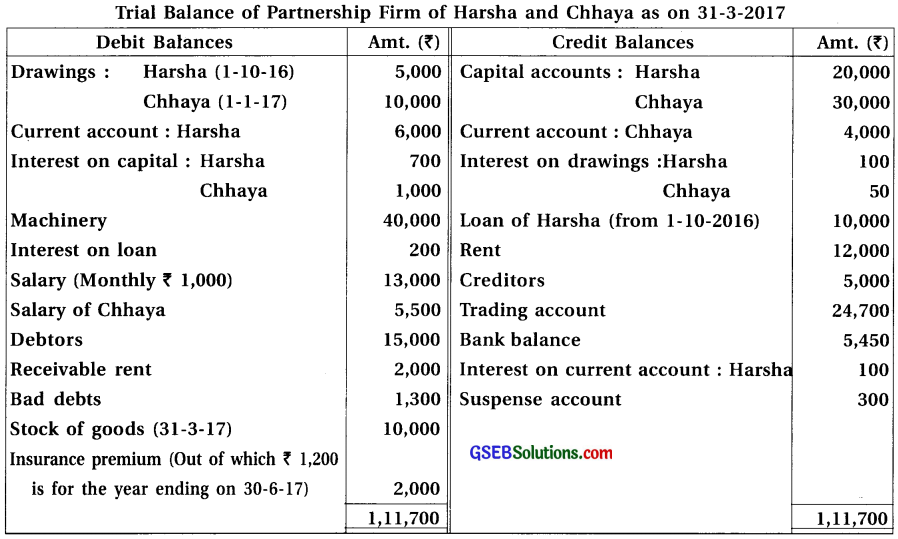

Question 10.

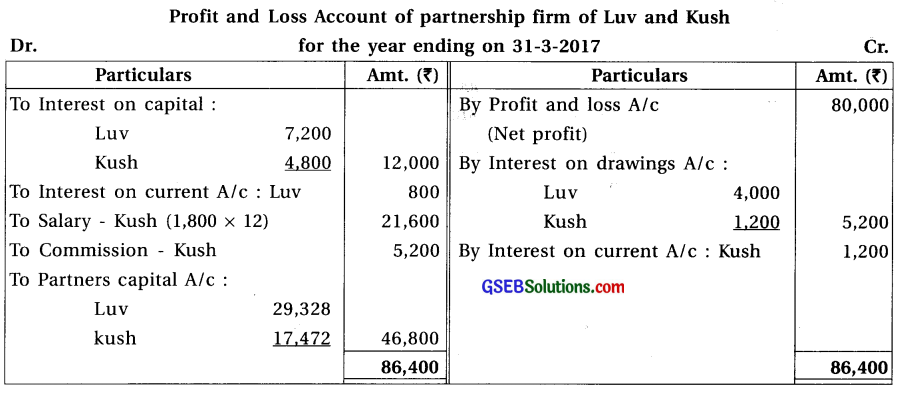

Luv and Kush are partners of a partnership firm. They distribute 60% profit in the ratio of 3 : 2 and remaining in the proportipn of 2 : 1. From the trial balance of the firm dated 31-3-17 and adjustments prepare profit a nd loss appropriation account, current accounts of partners and balance sheet of the firm.

Adjustments : (1) Provide interest on capital at 6% and on drawings at 10 %. (2) Provide 10% interest on opening balance of current accounts. (3) Monthly salary of ₹ 1,800 is outstanding, payable to Kush. (4) After information of above mentioned adjustments, on remaining profit 10% commission is payable to Kush.

Answer:

Thus, Total profit for Luv = 16,848 + 12,480 = ₹ 29,328

Total profit for Kush = 11,232 + 6,240 = ₹ 17,472

![]()

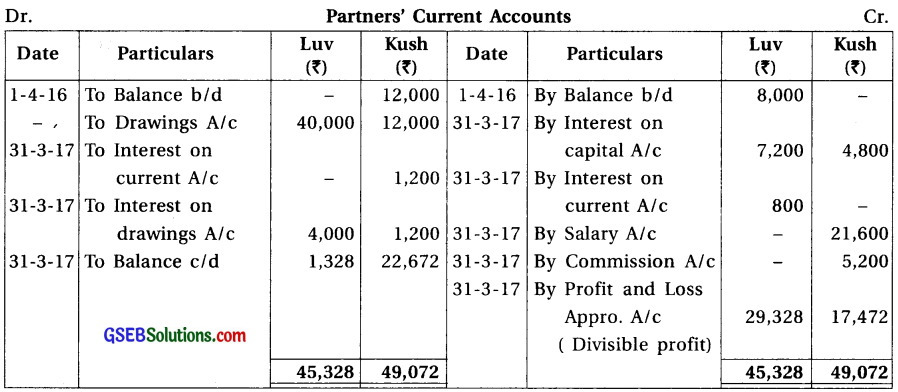

Question 11.

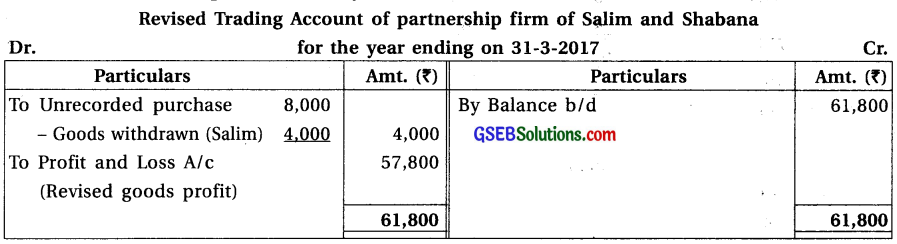

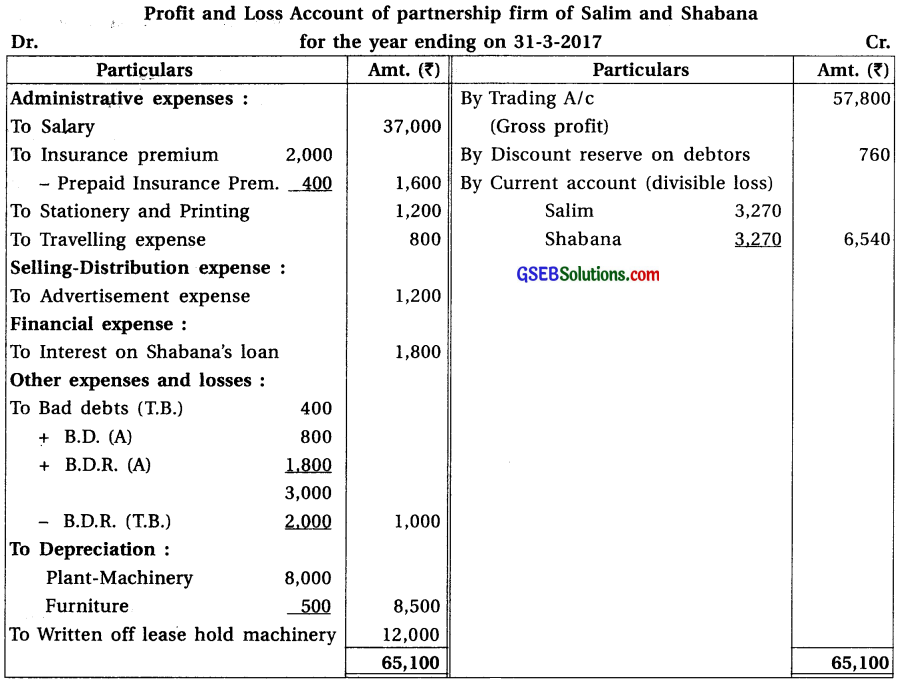

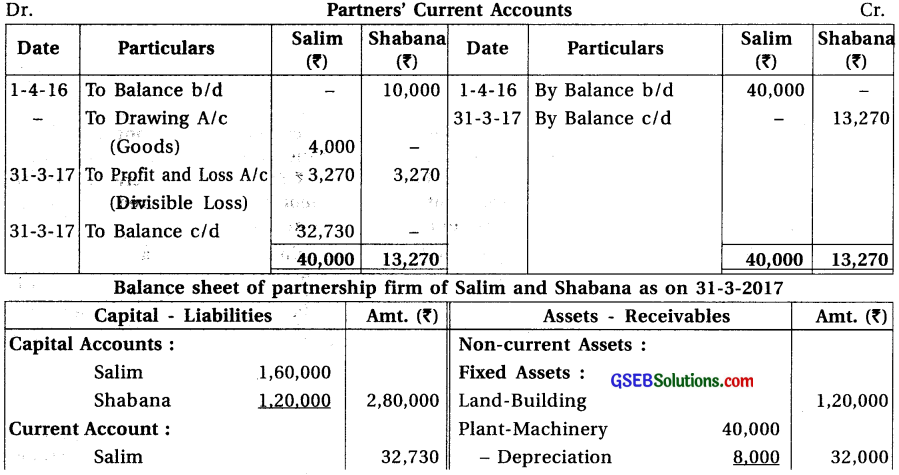

From the Trial Balance and adjustments of partnership firm of Salim and Shabana, prepare final accounts of partnership firm.

Trial Balance of partnership firm of Salim and Shabana as on 31-3-2017

Adjustments : (1) Salim withdrew goods of ₹ 4,000 for personal use. It is not recorded in the books. (2) Goods of ₹ 8,000 purchased at the end of the accounting year, which is not recorded. (3) Prepaid insurance is ₹ 400. (4) From debtors ₹ 800 is not recoverable. Provide 5% bad debts reserve on debtors. (5) Discount reserve on debtors is not required. (6) Provide depreciation on plant-machinery at 20% and on furniture at 5%.

Answer:

Note : (1) Here, partners transactions with the firm like interest on capital, interest on drawing, interest on current account, salary etc. are not given. Profit and loss appropriation A/c is not prepared here. (2) Discount reserve on debtors is not required (Adj. 5) ∴ It is shown on credit side of profit and loss A/c. (3) Here, profit and loss ratio is not given ∴ divisible loss is distributed equally among partners. (4) Period for leasehold machinery is for 5 years

∴ Current year’s written off amount = \(\frac{60,000}{5}\) = ₹ 12,000.

![]()

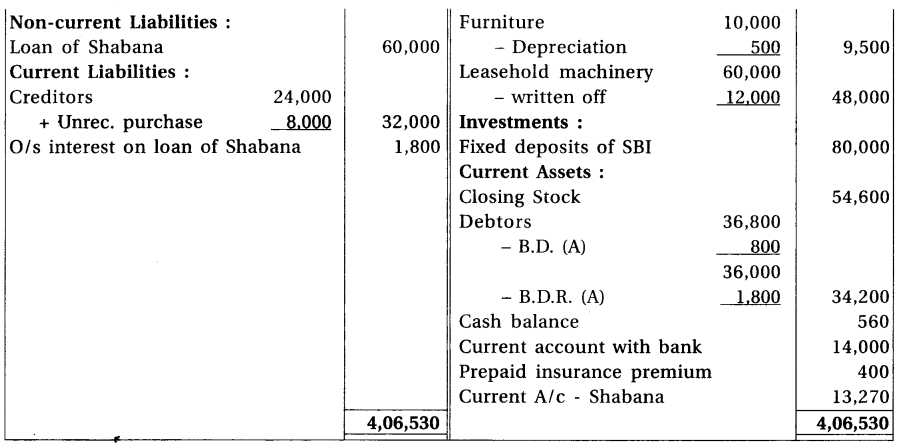

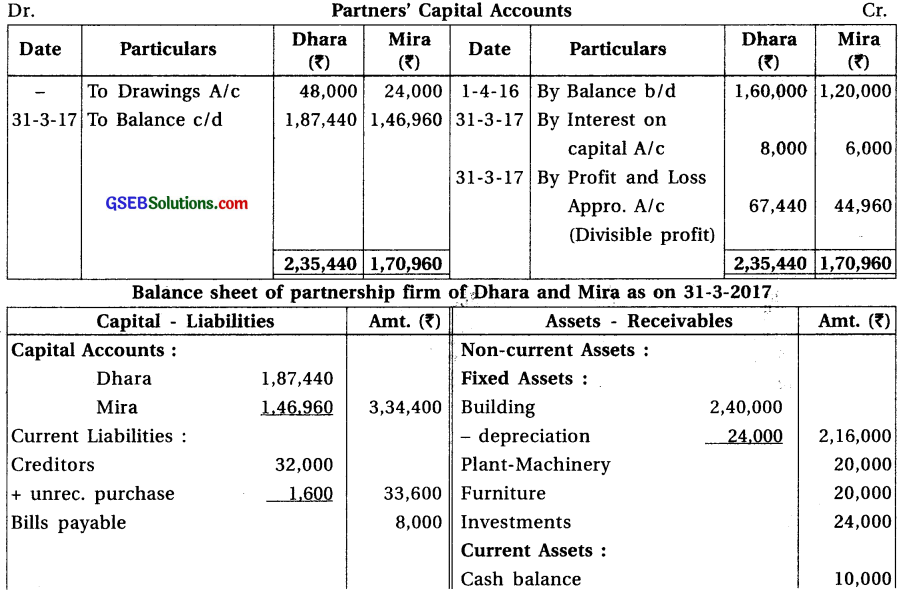

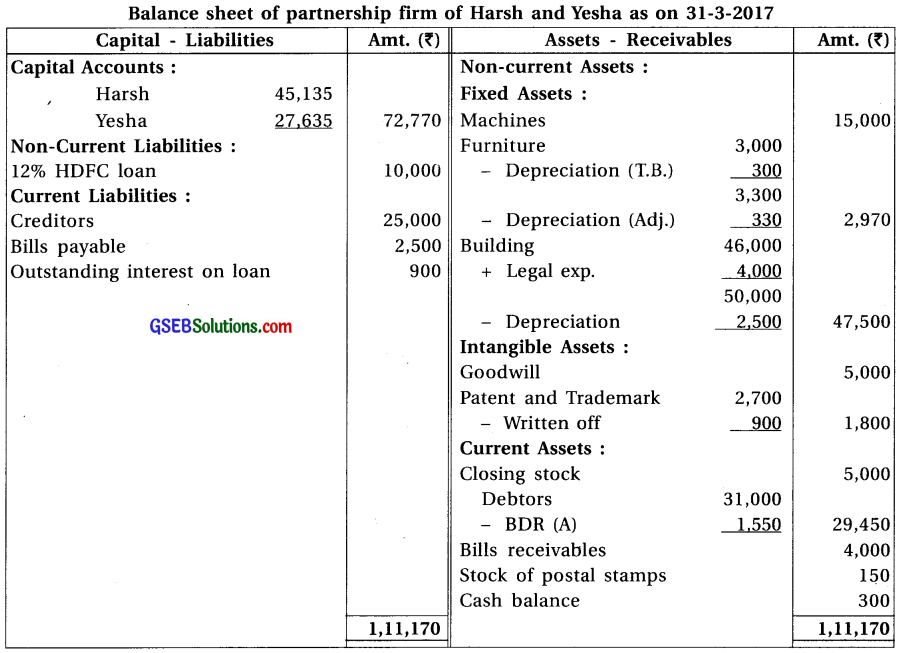

Question 12.

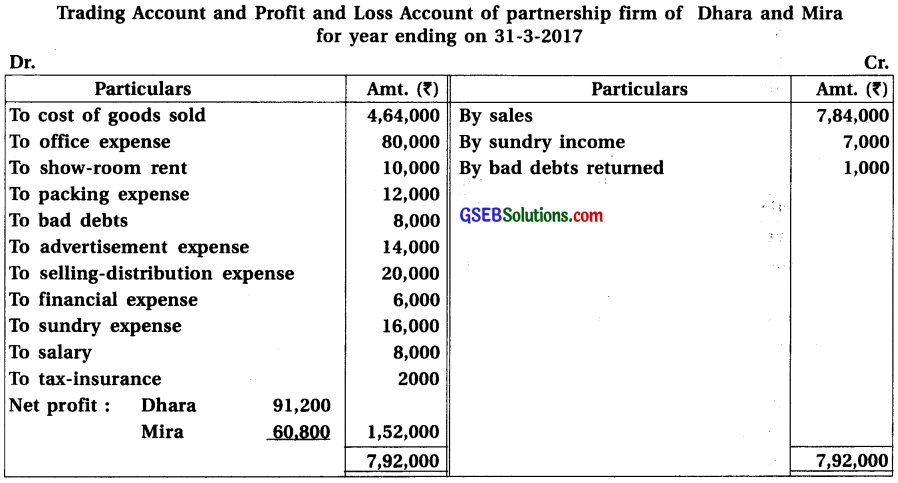

Dhara and Mira are partners sharing profit-loss in the proportion of 3 : 2. Final accounts of their partnership firm are as follows :

After preparation of annual accounts, it is found that :

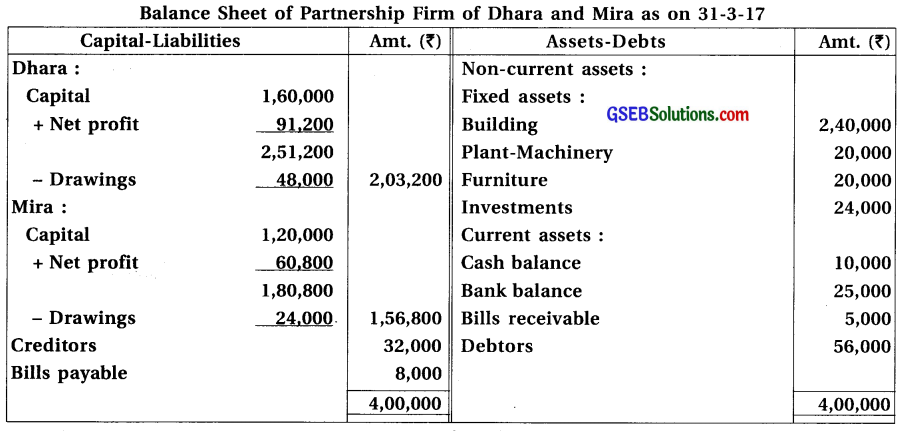

(1) 5% interest on capital is not calculated. (2) 10% depreciation on building is to be provided. (3) Prepaid salary is of ₹ 400. (4) Interest on investments not received ₹ 800. (5) Bad debts reserve of ₹ 1,200 is to be maintained. (6) Credit purchase of ₹ 1,600 is not recorded.

Prepare revised Trading account/Profit and loss a/c, Profit and loss appropriation a/c and Balance sheet.

Answer:

Note : (1) Cost of goods sold = Opening stock + Purchase – Closing stock. (2) Unrecorded credit purchase, recorded on the credit side of trading A/c and will be added on the capital-liability side in the creditors amount.

![]()

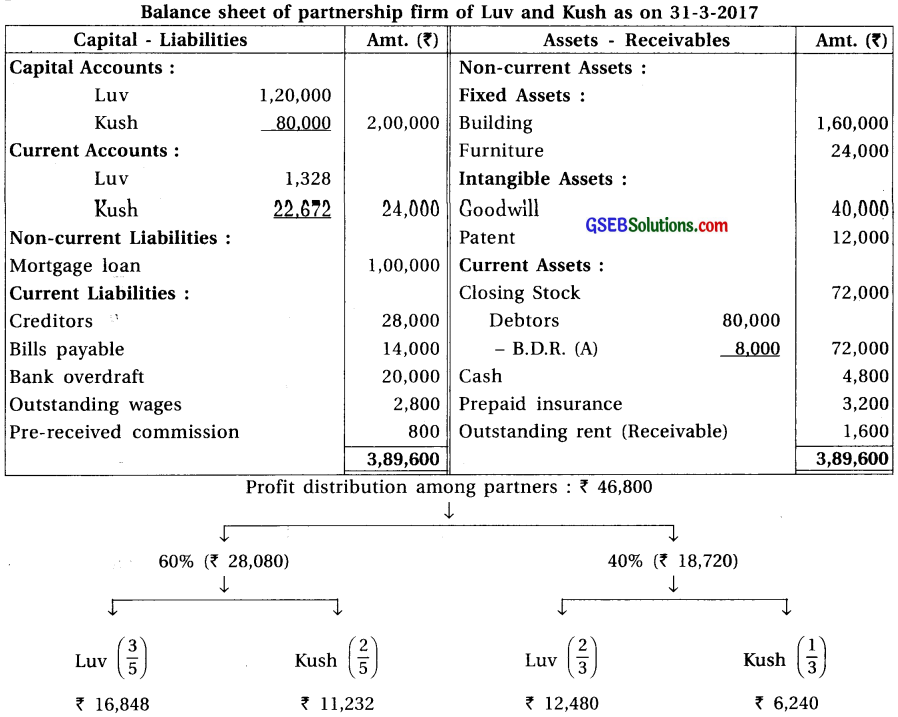

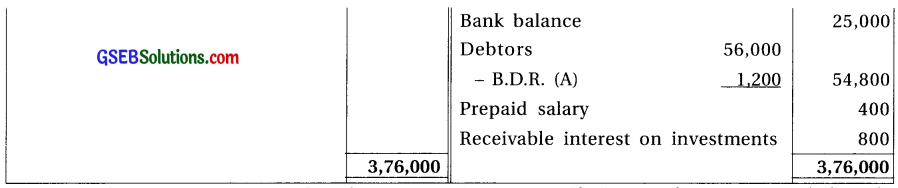

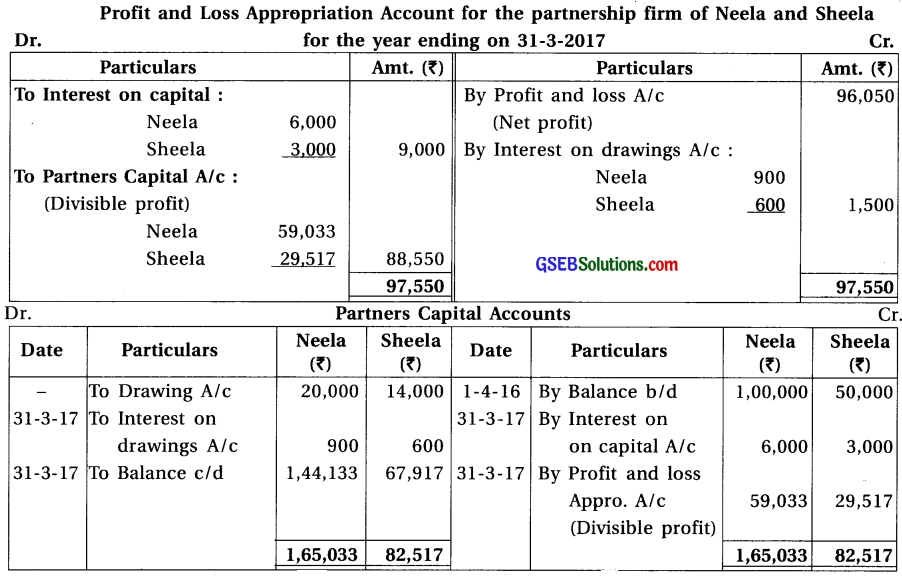

Question 13.

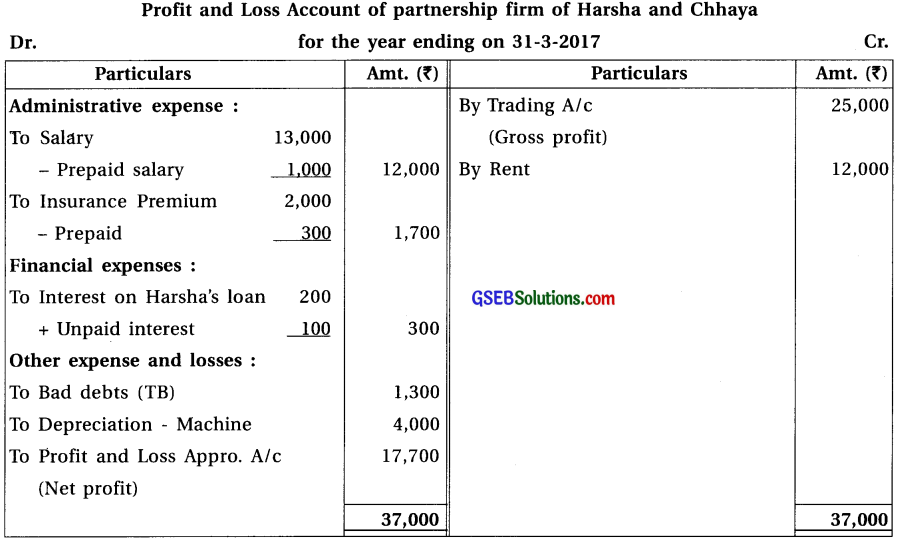

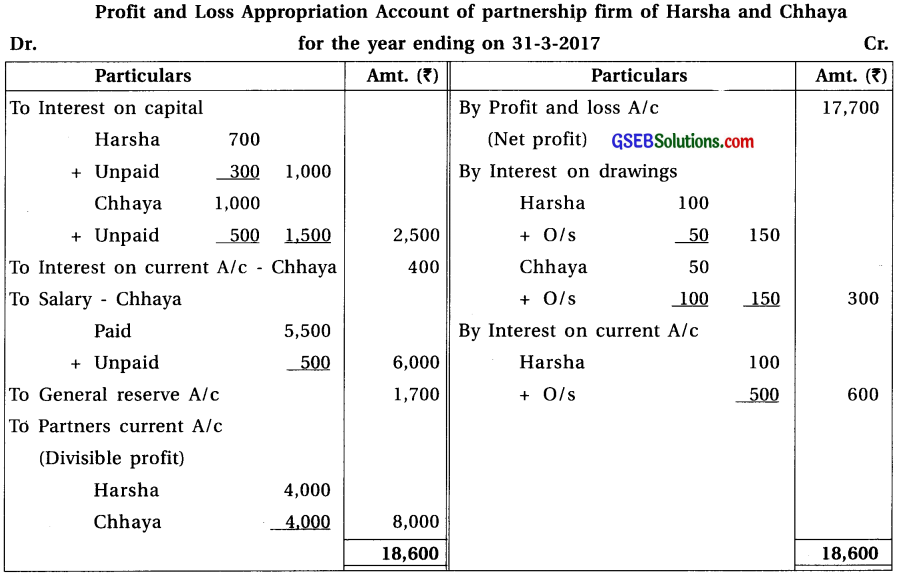

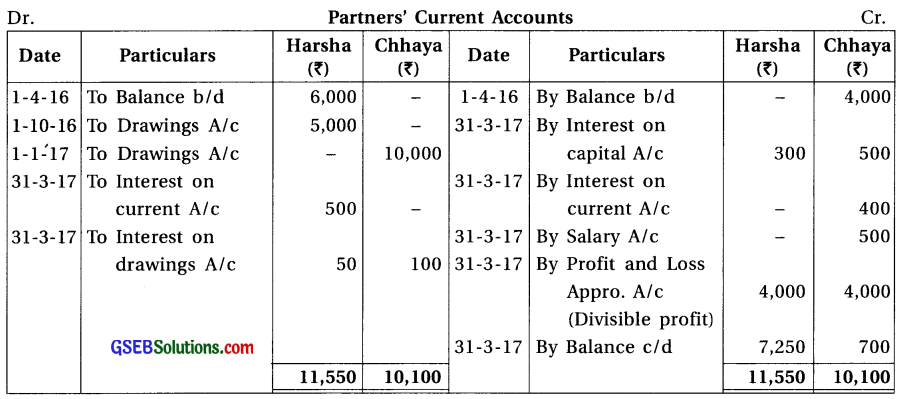

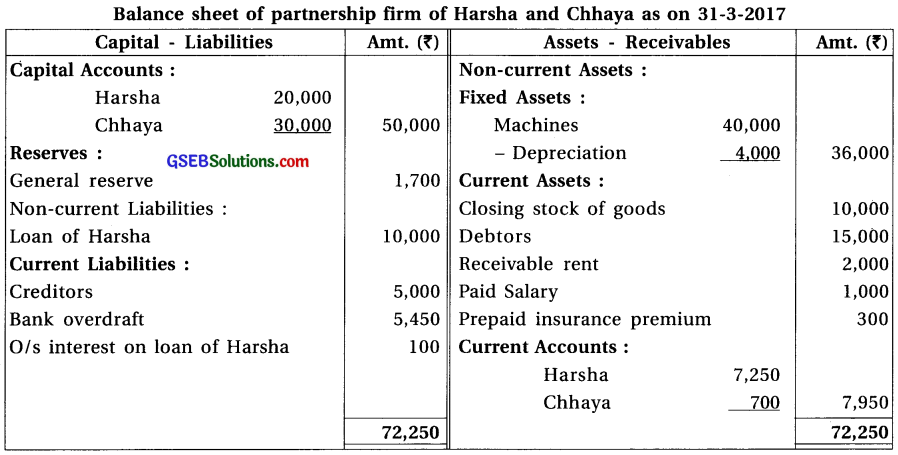

Harsha and chhaya are partners of a partnership firm. From the following information prepare final accounts :

Adjustments : (1) Provide interest 5% on capital, 6% on drawings and 10% on opening balance of current a/c. (2) Provide 10% depreciation on machines. (3) Monthly salary of Chhaya is ₹ 500. (4) Total of sales book is under cast by ₹ 300. (5) ₹ 1,700 are to be transferred to general reserve.

Answer:

Notes :

(1) Total of sales book is undercasted by ₹ 300, which is shown on credit side of Trading A/ c. Against that, total difference in Trial balance ₹ 300 is there, which nuclify the effects, (i.e. pass only one effect.)

(2) Salary ₹ 1,000 p.m. total ₹ 13,000 is given ∴ Prepaid salary = ₹ 1,000 (as books of accounts are prepared for 12 months only)

(3) Prepaid insurance premium is of 3 months (from 1-4-17 to 30-6-17) = 1200 × \(\frac{3}{12}\) = ₹ 300 prepaid insurance premium.

(4) Total interest on Harsha’s loan = 10,000 × \(\frac{6}{100} \times \frac{6}{12}\) = ₹ 300. Against that interest ₹ 200 is already paid. ∴ Unpaid interest on loan = ₹ 100.

(5) Interest on capital : @ 5%

For Harsha = 20,000 × \(\frac{5}{100}\) = ₹ 1,000 – ₹ 700 (paid int.) = ₹ 300 (o/s int.)

For Chhaya = 30,000 × \(\frac{5}{100}\) = ₹ 1,500 – ₹ 1,000 (paid int.) = ₹ 500 (o/s int.)

(6) Salary to Chhaya : Monthly ₹ 500 × 12 months = ₹ 6,000 ; already paid amount = ₹ 5,500 ∴ o/s salary = ₹ 500.

(7) Interest on drawings @ 6% :

For Harsha = 5,000 × \(\frac{6}{100} \times \frac{6}{12}\) = ₹ 150 – ₹ 100 (int. reed.) = ₹ 50 (receivable int.)

For six months from (1-10-16 to 31-3-17)

For Chhaya = 10,000 × \(\frac{6}{100} \times \frac{3}{12}\) = ₹ 150 – ₹ 50 (int. reed.) = ₹ 100 (receivable int.)

(8) Interest on current account: Harsha – 6,000 × \(\frac{10}{100}\) = ₹ 600 – ₹ 100 (int. paid) = ₹ 500 (o/s int.)

(9) Profit-loss sharing ratio between partners is not given ∴ Divisible profit is distributed among partners in 1 : 1 ratio (equally).

![]()

Question 14.

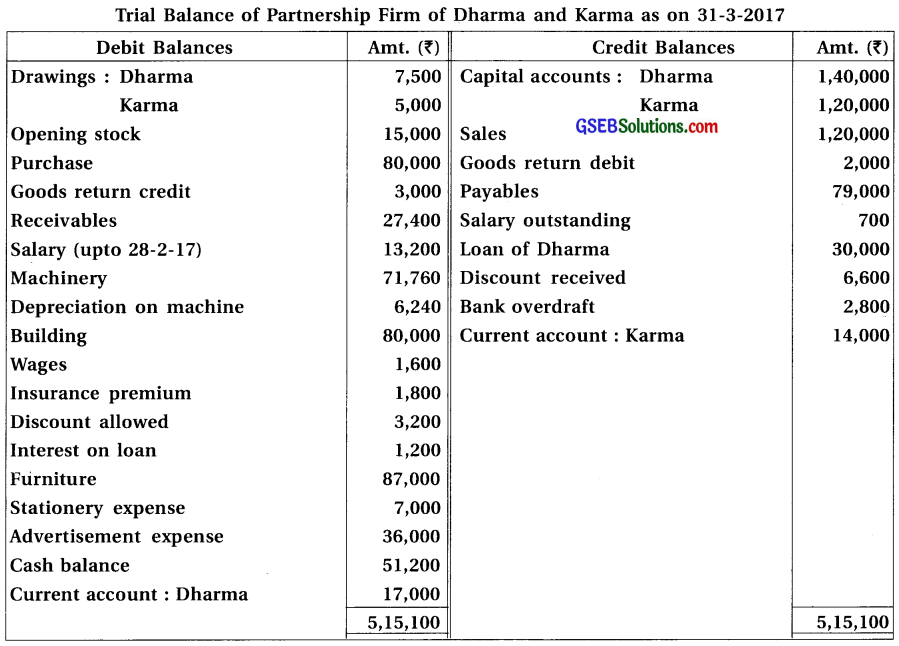

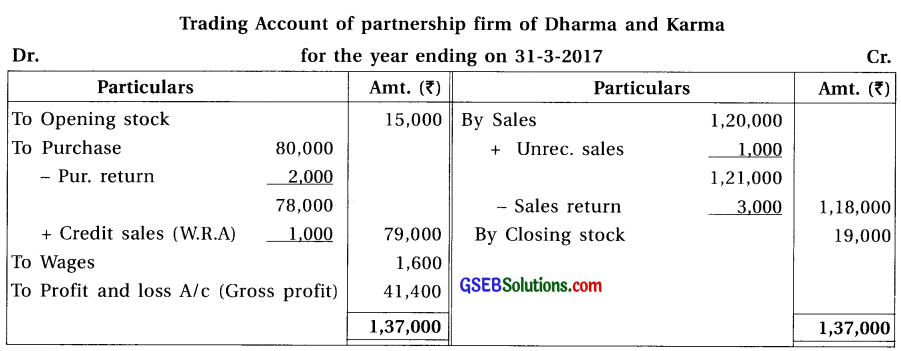

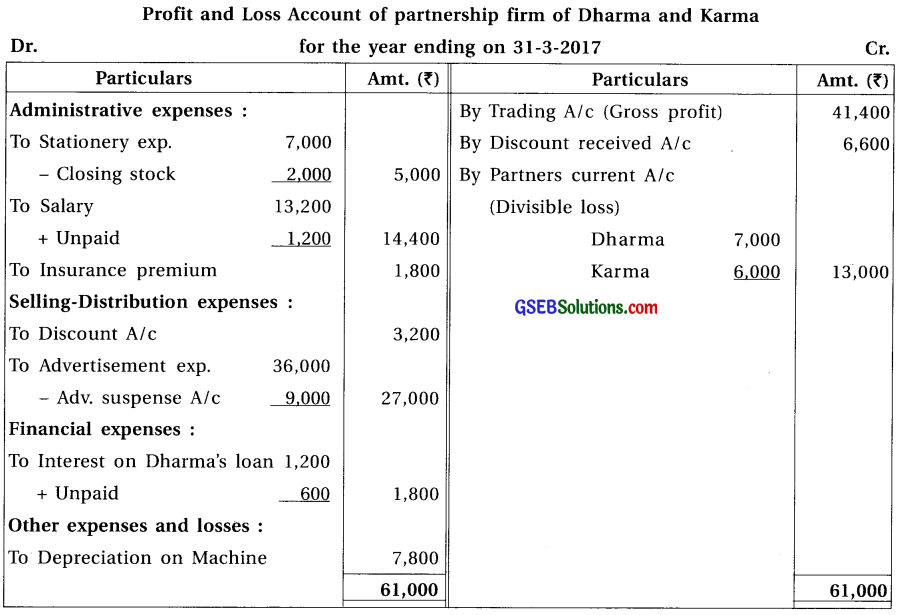

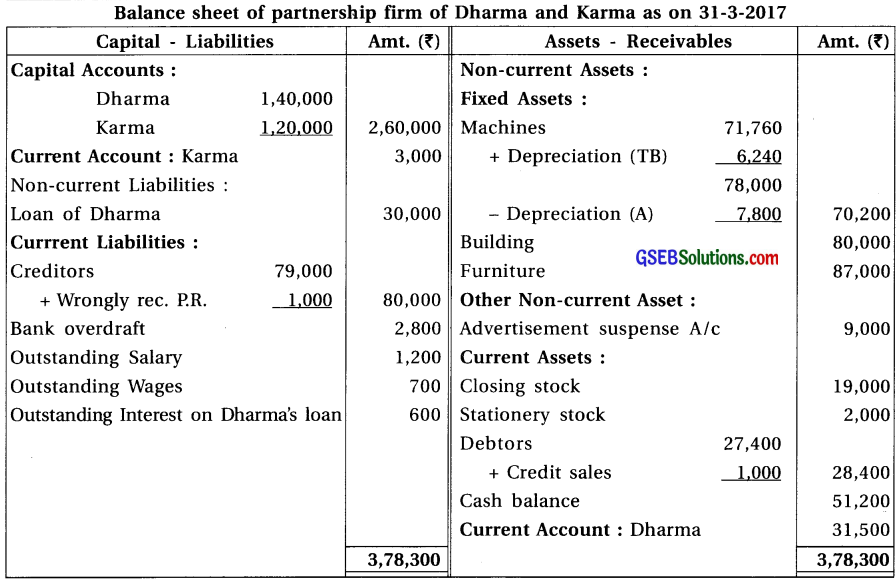

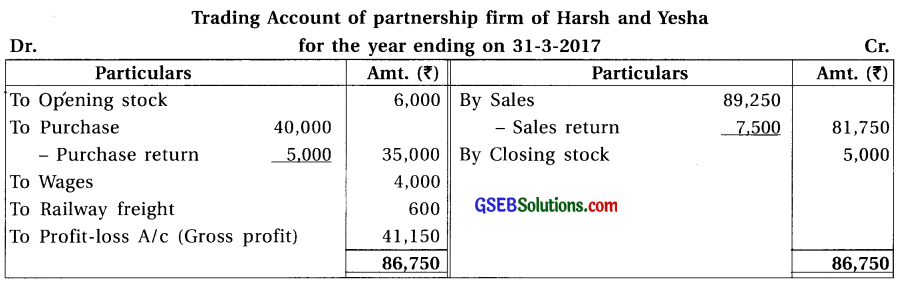

Dharma and Karma are partners sharing profit-loss in their capital ratio. From the following information prepare their final accounts.

Adjustments :

(1) Closing stock is of ₹ 21,000; in which stock of stationery of ₹ 2,000 is included.

(2) On machinery, depreciation rate is to be increased up to 10%.

(3) Credit sales of ₹ 1,000 is recorded in the purchase return book by mistake.

(4) \(\frac{1}{4}\) share of advertisement expense is to be carry forwarded to the next year.

Answer:

Notes :

(1) Salary is paid upto 28/2/17 = ₹ 13,200 i.e. 11 months

Outstanding salary for one month = \(\frac{13,200}{11}\) = ₹ 1,200.

(2) Interest on loan of Dharma @ 6% p.a. = 30,000 × \(\frac{6}{100}\) = ₹ 1,800 – 1,200 (interest paid)

= ₹ 600 (outstanding interest)

(3) \(\frac{1}{4}\)th part of Adv. exp. ₹ 36,000 = ₹ 9,000 is to be carried forward to Adv. Suspense A/c.

(4) Here, transaction of partners with firm related data/adj. is not given.

∴ Profit and Loss Appro. A/c is not prepared.

![]()

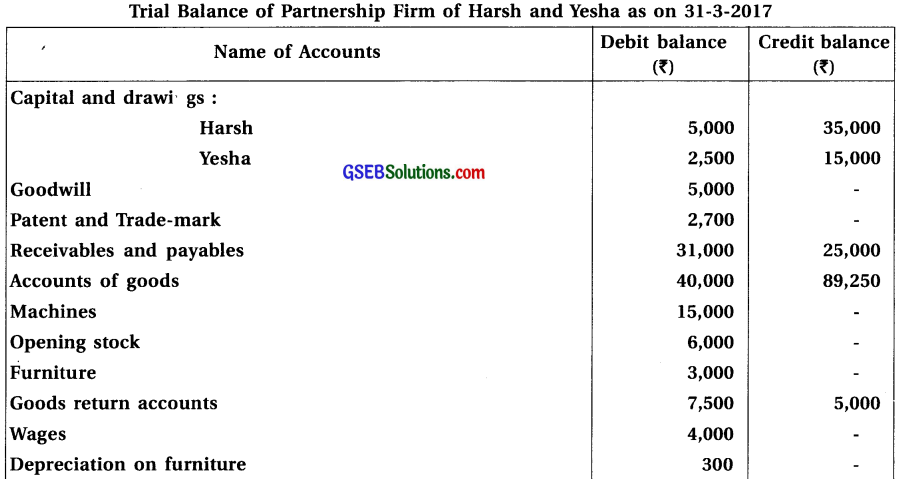

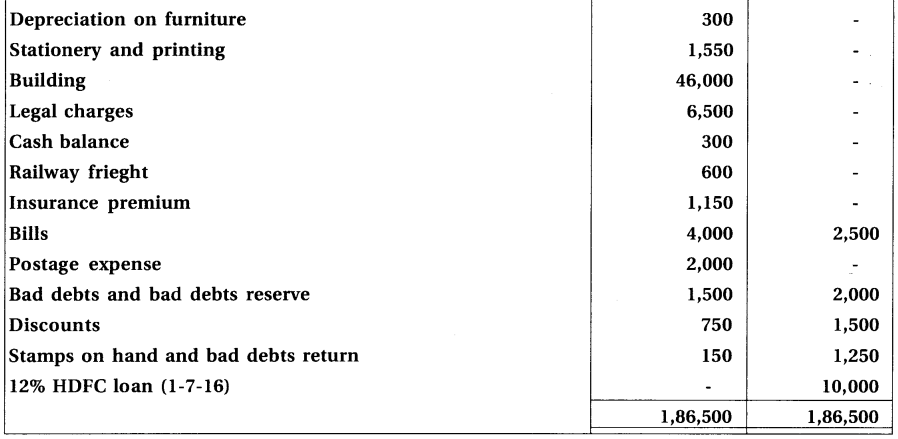

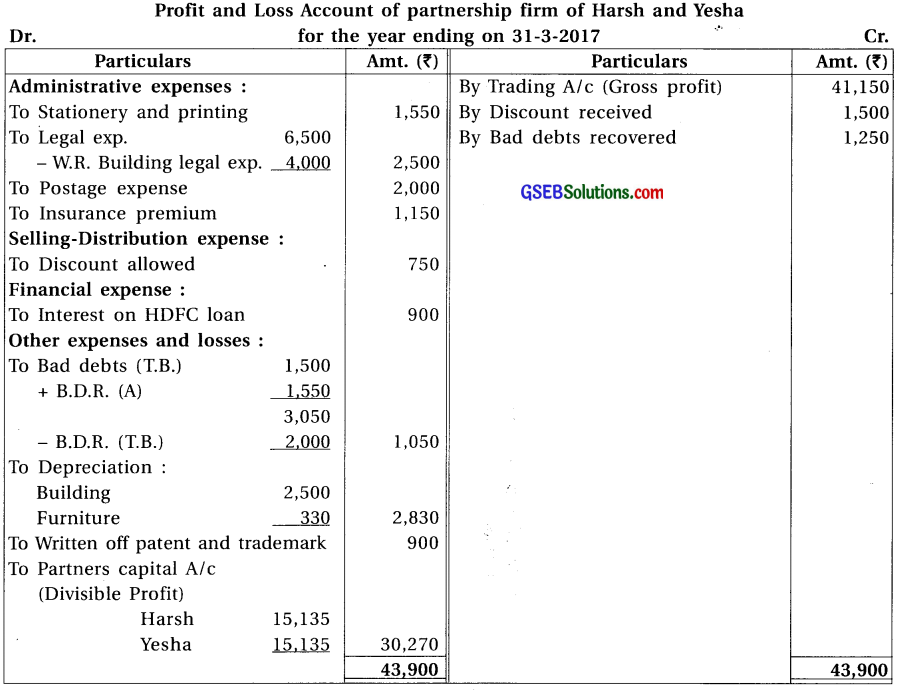

Question 15.

With consideration of following trial balance and adjustments of Harsh and Yesha, prepare final accounts for the year ending on 31-3-17 of their firm.

Adjustments :

(1) Closing stock ₹ 10,000 out of which 50% has no market value.

(2) Legal charges included of legal charges of building purchase ₹ 4,000.

(3) Provide 5% bad debts reserve on debtors.

(4) Provide depreciation 10% on furniture and 5% on building.

(5) \(\frac {1}{3}\) share of patent and trade mark is to be written off.

Answer:

Notes :

(1) Legal exp. paid for building purchase is a capital exp. ∴ It will be added to building cost.

(2) Depreciation on furniture is to be calculated at 10% on opening balance, i.e. on ₹ 3,300.

∴ Depreciation on furniture = ₹ 330.

(3) O/s int. on loan of HDFC for nine months = 10,000 × \(\frac{9}{12} \times \frac{12}{100}\) = 900.

(4) Transactions of partners with firm related data/adj. is not given. ∴ Profit and loss Appro. A/c is not prepared.

(5) Profit-loss ratio is not given. ∴ Divisible profit is distributed equally among partners.

![]()

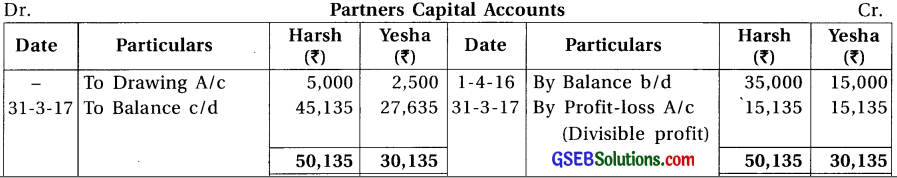

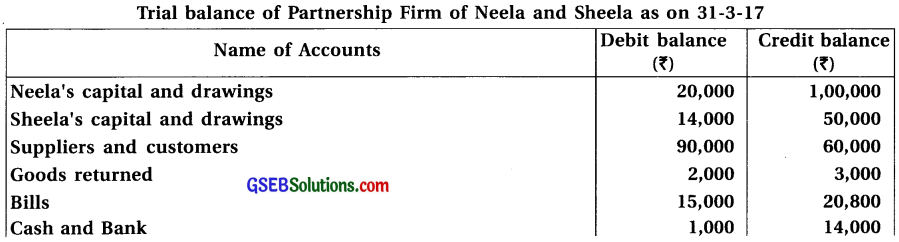

Question 16.

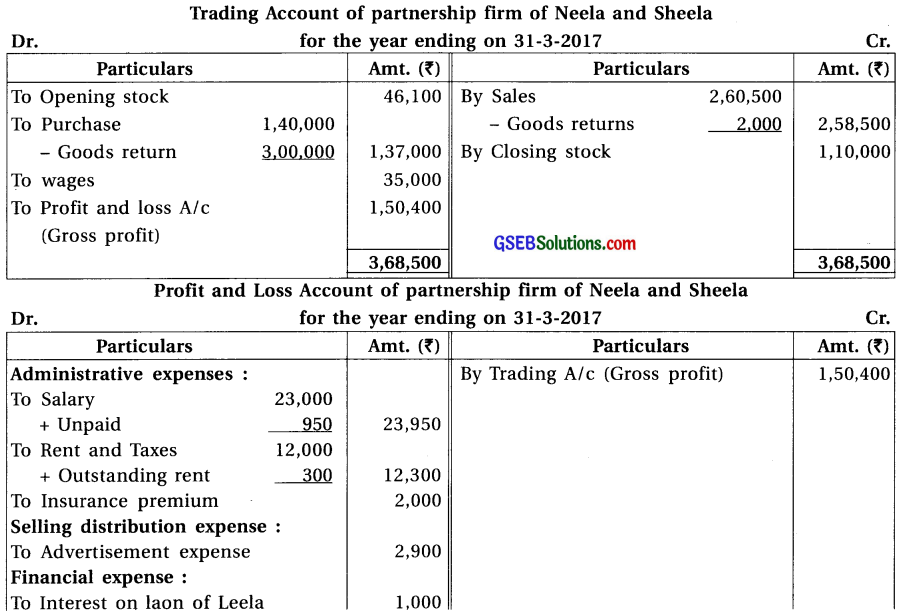

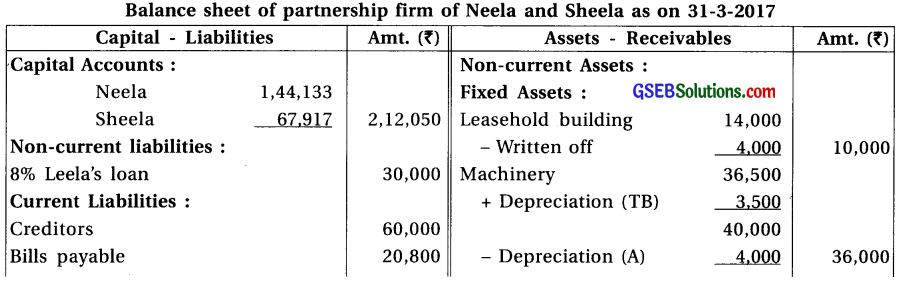

Neela and Sheela are partners of partnership firm sharing profit-loss in capital proportion.

From the following trial balance and adjustments prepare final accounts of the firm.

Adjustments :

(1) Closing stock ₹ 1,10,000 and having market value 20% more than book value. (2) Per annum 6% interest is payable on Partners’ capital. (3) Interest on drawings recoverable from partners : Neela ₹ 900, Sheela ₹ 600. (4) Provide 5% bad debt reserve on debtors. (5) Outstanding expenses at the end of accounting year : rent ₹ 300 and salary ₹ 950. (6) Provide depreciation : 10% on machinery and 5% on furniture.

Answer:

Notes :

(1) Period for leasehold building is 5 years from 1-10-2014, out of which 1.5 years period is completed. (From 1-10-14 to 31-3-16) ∴ Remaining amount ₹ 14,000 is to be written off for 3.5 years i.e. \(\frac{14,000}{3.5}\) = ₹ 4,000 per year.

(2) Amount for outstanding interest on Leela’s loan = 30,000 × \(\frac{8}{100} \times \frac{5}{12}\) = ₹ 1,000.

(3) Depreciation @ 10% p.a. is to be calculated on machinery (Adj.) and Depreciation on machine is given in the trial balance. ∴ Depreciation is calculated on the opening balance of machinery as shown in balance sheet.

![]()

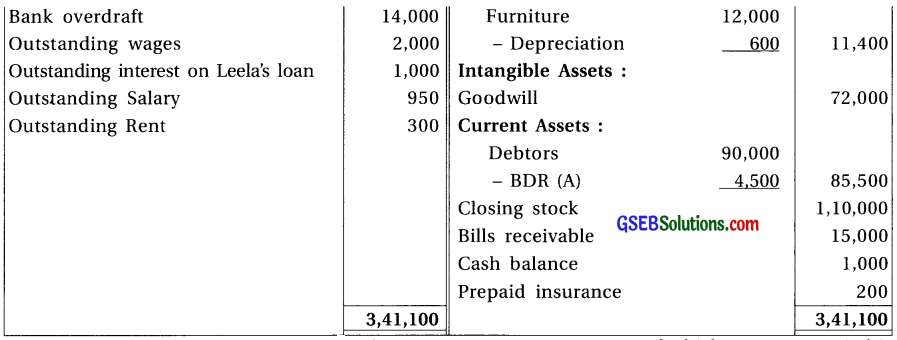

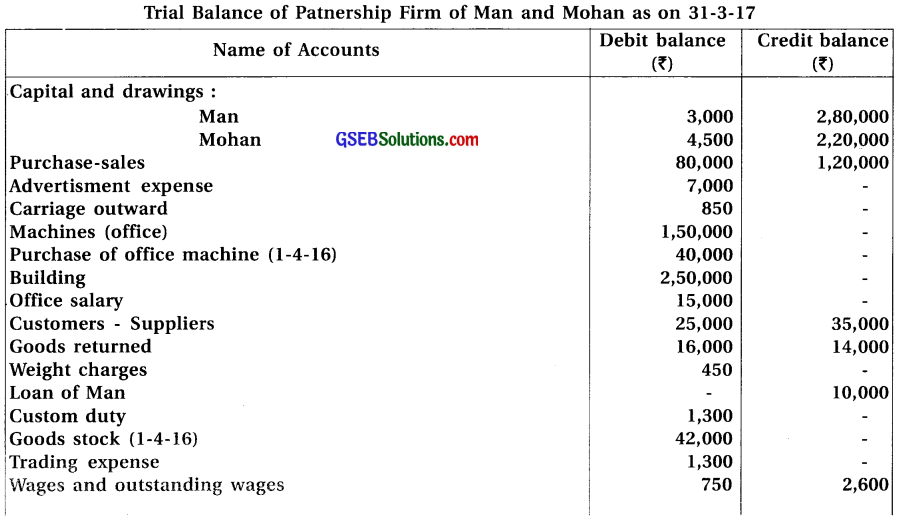

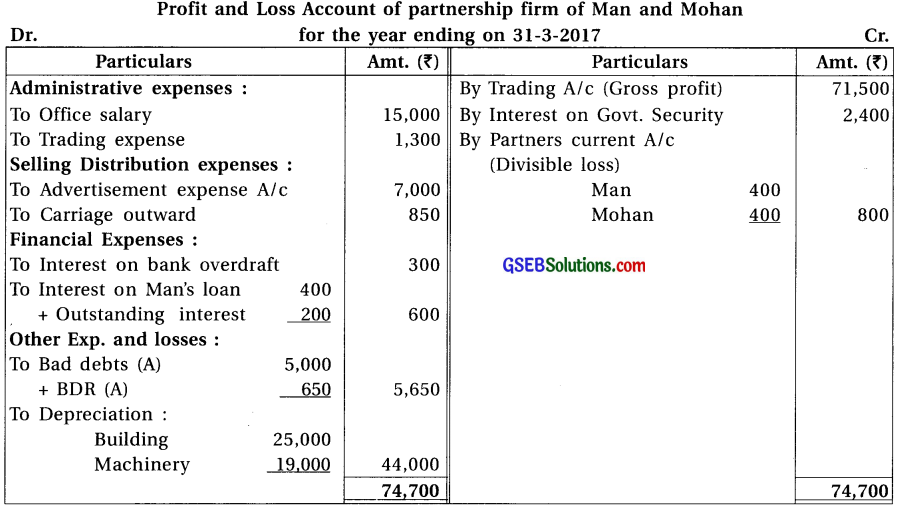

Question 17.

Man and Mohan are partners of a firm sharing profit and loss in the proportion of 1 : 1. From the given below trial balance and adjustments prepare final accounts for the year ending on 31-1-2017

Adjustments :

(1) The value of closing stock is ₹ 80,000. It’s market value is 10% more. (2) Provide depreciation at 10% on machines and building. (3) Debtor of ₹ 10,000 became insolvent. 50% amount will be received as per instructions of his receiver. Provide 5% bad debt reserve. (4) 10% interest is outstanding on bank overdraft. (5) Goods of ₹ 2,000 is missed out to record in sales return book.

Answer:

Notes:

(1) Interest on loan of Man = 10,000 × \(\frac{6}{100}\) = ₹ 600; out of which ₹ 400 is paid.

∴ Outstanding interest on loan = 600 – 400 = ₹ 200

(2) Bad debts reserve is to be provided on doubtful debts only. ∴ B.D.R. is calculated @5% on ₹ 13,000 (₹ 23,000 – ₹ 10,000 insolvent debtor).

(3) Transactions of partners with firm are not given ∴ Profit and Loss Appro. A/c is not prepared.

![]()

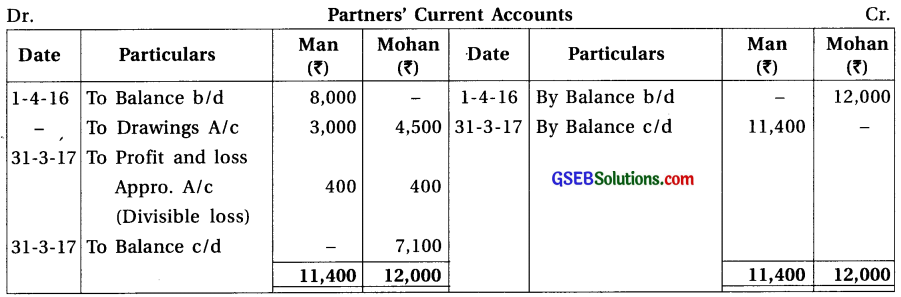

Question 18.

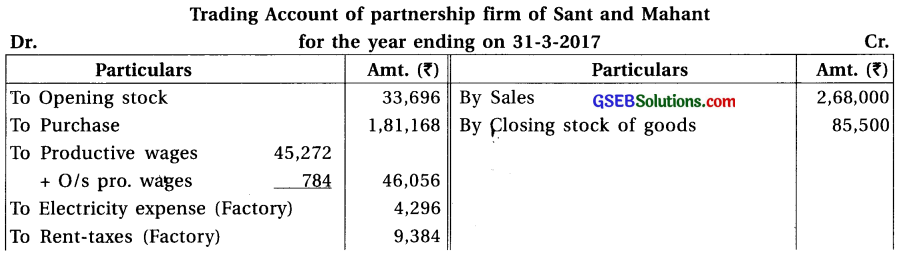

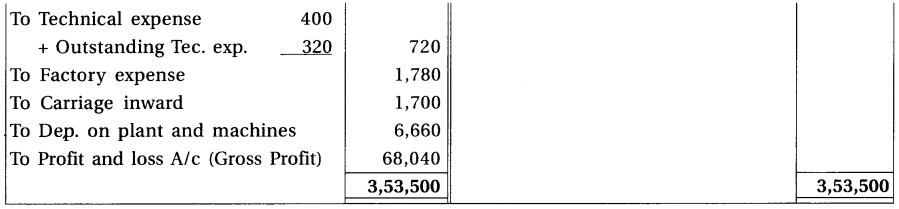

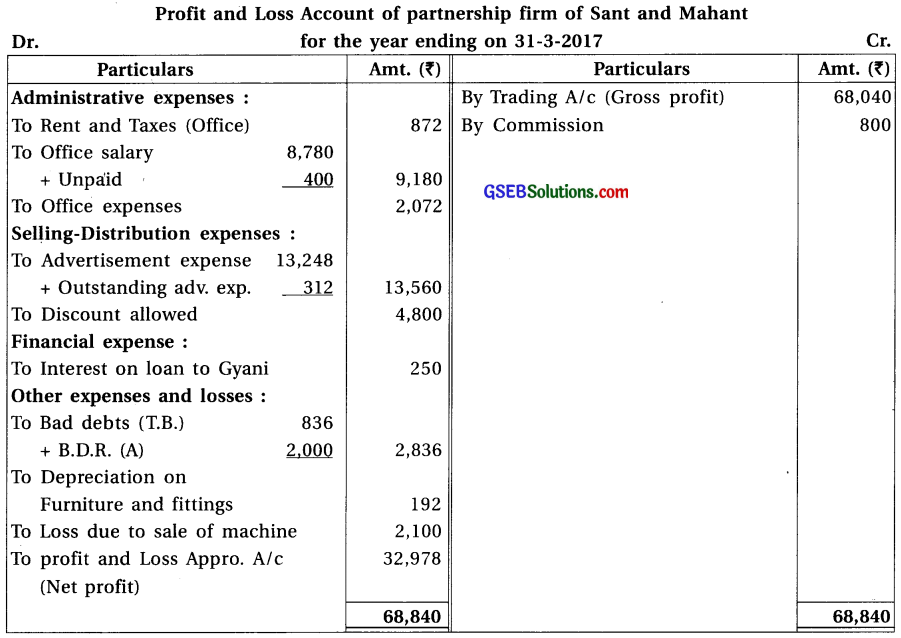

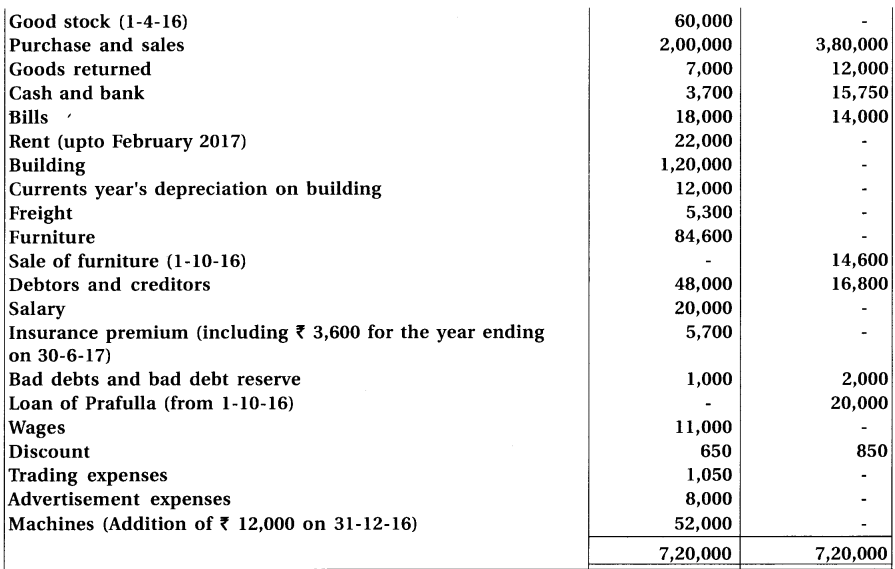

Sant and Mahant are partners of a firm sharing profit and loss in the proportion of 3 : 2. From the trial balance of 31-3-2017 and adjustments prepare final accounts of the partnership firm.

Adjustments :

(1) There was stock of ₹ 85,500. (2) Provide 15% depreciation on plant and machines and 7.5% on furniture and fittings. (3) Provide bad debts reserve of ₹ 2,000 on debtors. (4) 6% interest is payable on capital of partners. (5) Outstanding expenses : Productive wages ₹ 784, advertisement expense ₹ 312, office salary ₹ 400, technical expense ₹ 320.

Answer:

Notes :

(1) This partnership frim is engaged in the production.

∴ Production expenses are debited to Trading A/c.

(2) Depreciation on Plant and Machines : 33,300 – 6,900 = 26,400 × \(\frac{15}{100}\) = ₹ 3,960

On addition of Machine of ₹ 24,000 = 24,000 × \(\frac{15}{100} \times \frac{9}{12}\) = ₹ 2,700

∴ Total Depreciation = 3,960 + 2,700 = ₹ 6,660.

![]()

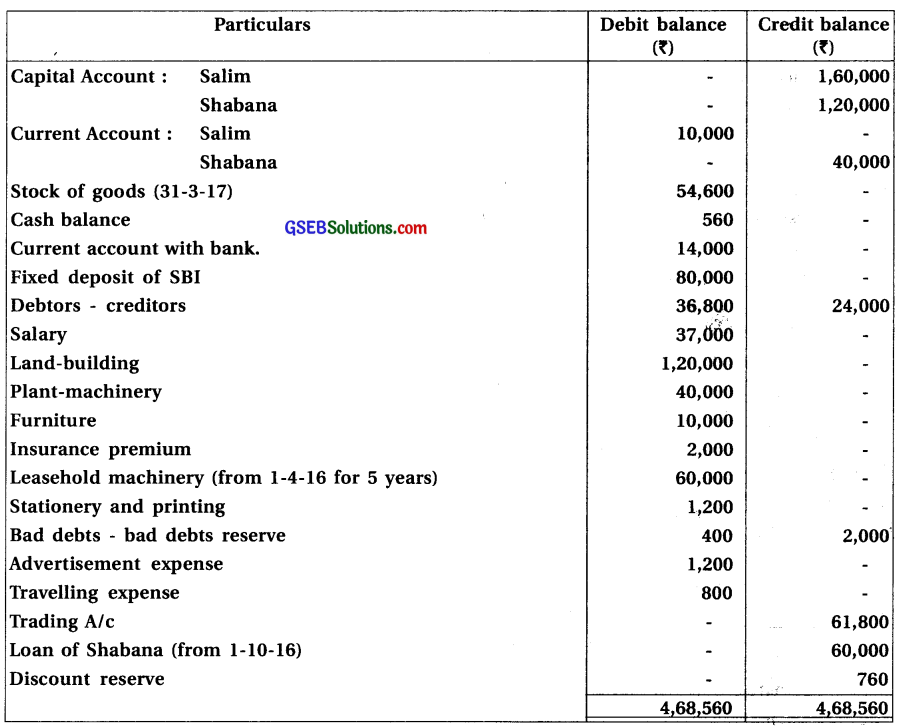

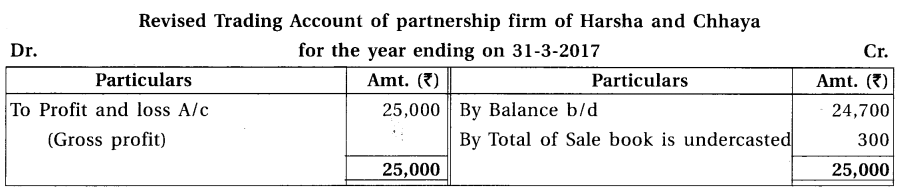

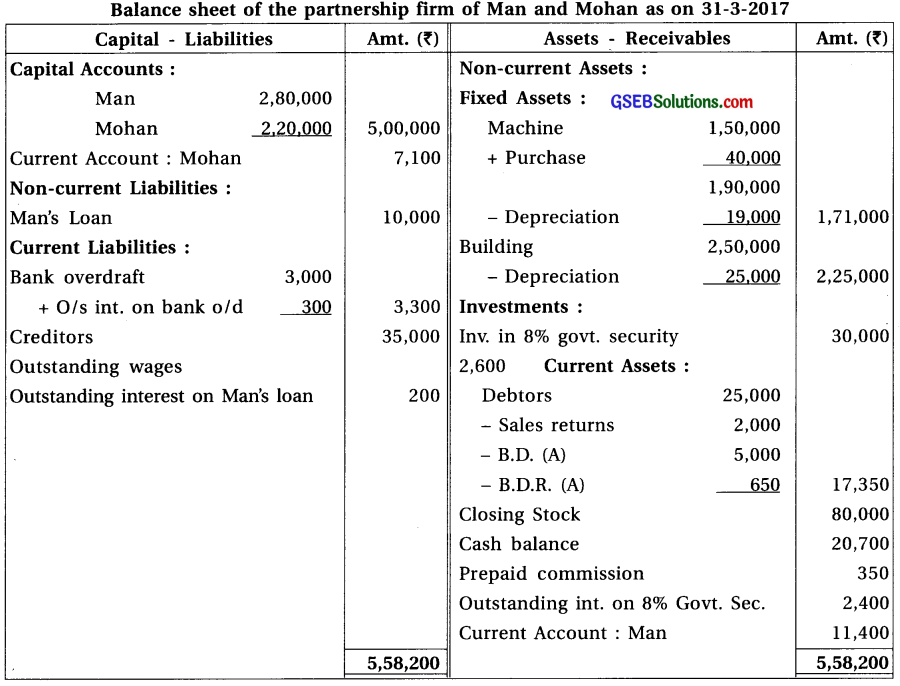

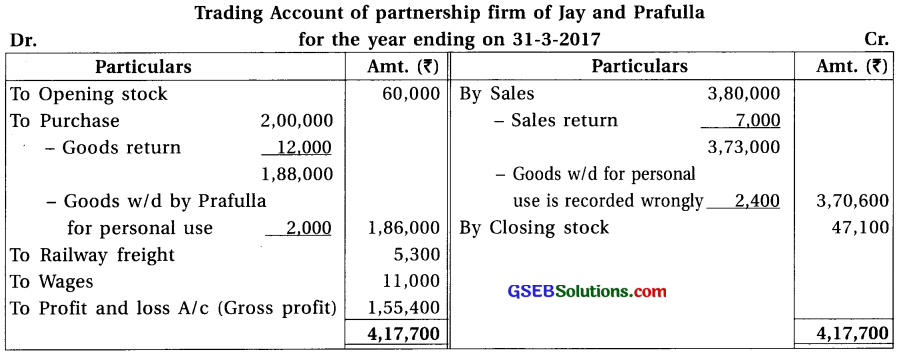

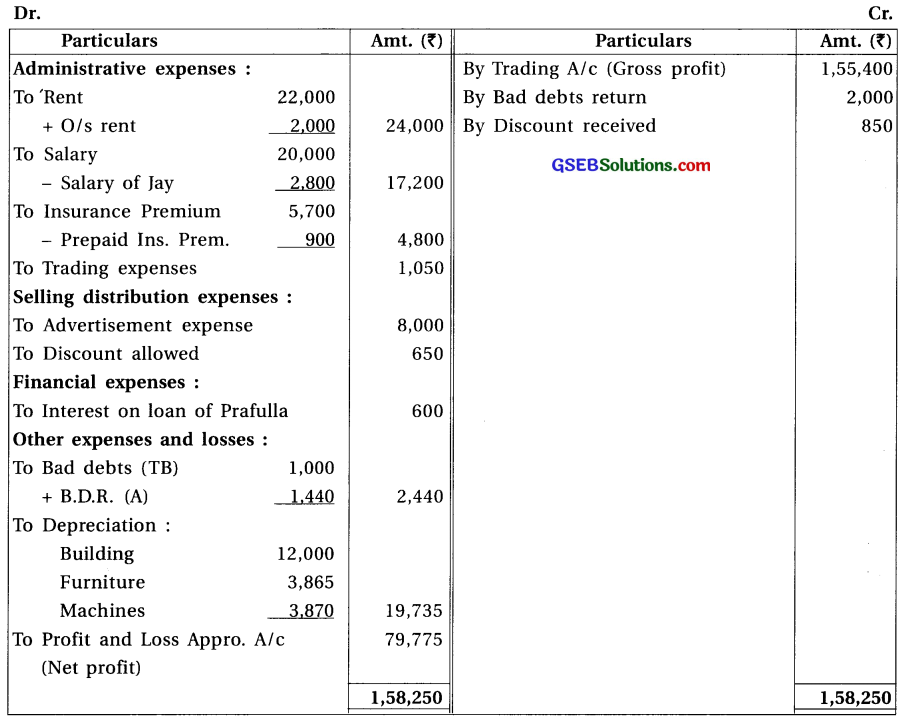

Question 19.

Jay and Prafulla are partners of a partnership firm sharing profit and loss in equal proportion. From the trial balance dated 31-3-17 and additional information, prepare financial accounts of the firm.

Adjustments : (1) The value of closing stock is ₹ 60,000. Out of which the market value of 10% goods is 20% less and the market value of 20% goods is 10% less. The remaining goods of ₹ 42,000 is valued at 25% less then book value. (2) Provide 10% interest on capital, 9% on balance of current accounts and 12% on drawings. (3) Monthly salary of ₹ 700 is payable to Jay. He has withdrawn salary of 4 months which is included in salary. (4) Prafulla has introduced additional capital of ₹ 20,000 on 1-1-17. (5) Jay has withdrawn ₹ 1,000 per month on the last date of each month. Prafulla has withdrawn on 1-10-2016. (6) Calculate depreciation at 9% on machines and 5% on furniture. (7) Prafulla has withdrawn goods of ₹ 2,000 on 1-12-2016, which is recorded in the sales book at ₹ 2,400. (8) One debtor of ₹ 2,400 became insolvent and 40 paise per rupee dividend is receivable.

Answer:

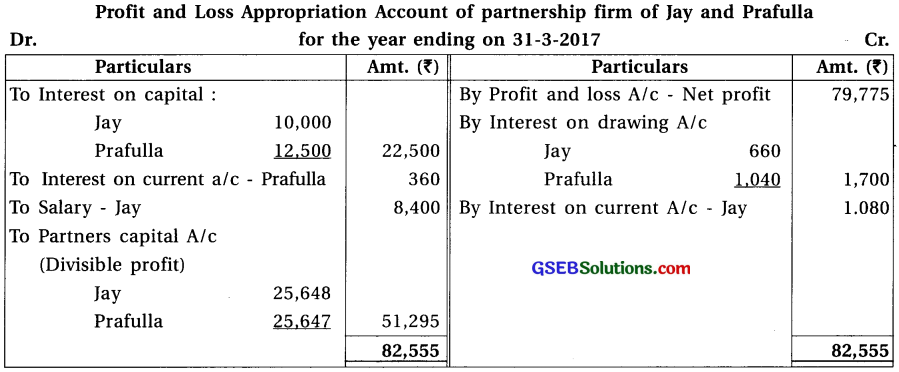

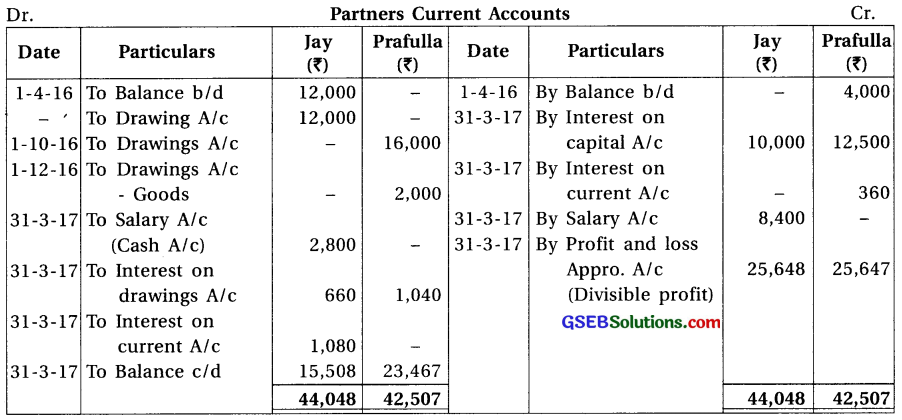

Profit and Loss Account of partnership firm of Jay and Prafulla for the year ending on 31-3-2017

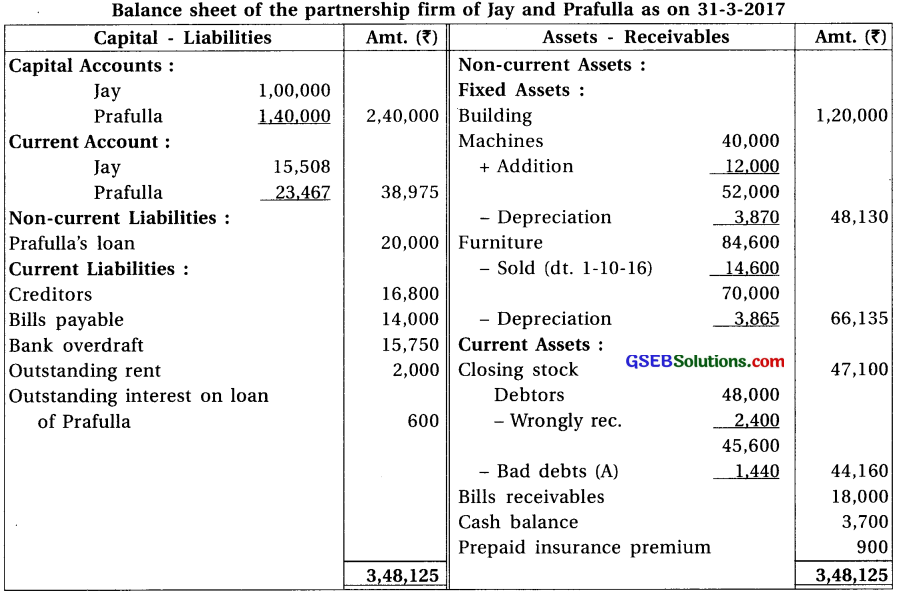

Notes :

(1) Rent is paid upto Feb. 2017. i.e. for 11 months.

∴ Outstanding rent of one month = \(\frac{22,000}{11}\) = ₹ 2,000 per month.

(2) Prepaid insurance premium of three months = 3,600 x \(\frac{3}{12}\) = ₹ 900.

(3) Goods withdrawn for personal use by Prafulla is of ₹ 2,000; which will be subtracted from purchase A/c on the debit side of Trading A/c and will be debited to Drawings A/c by ₹ 2,000. Moreover, ₹ 2,400 will be deducted from sales A/c on the credit side of Trading A/c and also subtracted from debtors.

(4) From debtors of ₹ 2,400; 40 paise is receivable means there was a bad debts of 60%.

∴ Bad Debts = 2,400 x \(\frac{60}{100}\) = ₹ 1,440.

(5) Machine are of ₹ 52,000; out of which machines of ₹ 12,000 were added on 31-12-16

∴ Depreciation @ 9% p.a. will be calculated for full year on ₹ 40,000 and on ₹ 12,000 for

3 month’s ∴ Depreciation 40,000 x \(\frac{9}{100}\) = ₹ 3,600; 12,000 \(\frac{9}{100} \times \frac{3}{12}\) = ₹ 270

∴ Total Depreciation = ₹ 3,600 + ₹ 270 = ₹ 3,870.

(6) Opening balance of furniture A/c = ₹ 84,600. Out of which on 1-10-16, sold furniture valued at ₹ 14,600. .-. Full year depreciation will be calculated @ 5% on ₹ 70,000 and on ₹ 14,600; depreciation will be calculated @ 5% for 6 months.

i. e. 70,000 x \(\frac{5}{100}\) = ₹ 3,500 ; 14,600 x \(\frac{5}{100}\) = ₹ 365.

∴ Total Depreciation = ₹ 3,500 + ₹ 365 = ₹ 3,865.

(7) Jay will be paid total salary ₹ 8,400 at ₹ 700 p.m. which will be debited to profit and loss Appro. A/c and credited to Jay’s current A/c. Salary of 4 months withdrawn by Jay ₹ 2,800 (which is included in the salary amount) will be subtracted from salary A/c on debit side of Profit and Loss A/c and shown as drawing in Jay’s current account.

(8) Interest on capital of Prafulla : On opening balance of ₹ 1,20,000 @ 10% p.a. for full year and on ₹ 20,000 for 3 months interest will be calculated.

(9) Interest on Drawing A/c :

Interest on drawings (Jay) : 1,000 × \(\frac{12}{100} \times \frac{66}{12}\) = ₹ 660

Interest on drawings (Prafulla) : 16,000 × \(\frac{12}{100} \times \frac{6}{12}\) = ₹ 960

Interest on drawings for goods : 2,000 × \(\frac{12}{100} \times \frac{4}{12}\) = ₹ 80

Thus, Interest on drawing for Jay = ₹ 660

Interest on drawing for Prafulla = ₹ 960 + ₹ 80 = ₹ 1,040

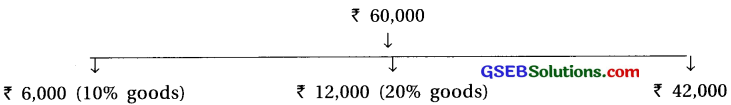

(10) Calculation for Closing Stock Value :

∴ Total Loss = 1,200 + 1,200 + 10,500 = ₹ 12,900

∴Closing stock = 60,000 – 12,900 = ₹ 47,100