Gujarat Board GSEB Textbook Solutions Class 12 Commerce Accounts Part 1 Chapter 3 Valuation of Goodwill Textbook Exercise Questions and Answers.

Gujarat Board Textbook Solutions Class 12 Accounts Part 1 Chapter 3 Valuation of Goodwill

GSEB Class 12 Accounts Valuation of Goodwill Text Book Questions and Answers

Question 1.

Select the correct answer for each questions :

(1) ‘Goodwill’ is which type of asset ?

(A) Tangible asset

(B) Intangible asset

(C) Current asset

(D) Fictitious asset

Answer:

(B) Intangible asset

(2) Goodwill depends on which aspect ?

(A) On employee of business enterprise

(B) On management of business enterprise

(C) On assets of business enterprise

(D) On future maintainable profit

Answer:

(D) On future maintainable profit

![]()

(3) Goodwill is a financial value of ………………….

(A) Investment

(B) prestige of business enterprise

(C) fixed assets

(D) competition

Answer:

(B) prestige of business enterprise

(4) Goodwill is ………………. where individual skill is important.

(A) more

(B) less

(C) zero

(D) negative

Answer:

(B) less

(5) Which method is appropriate for the computation of goodwill when every year profit is increasing ?

(A) simple average

(B) weighted average

(C) annual growth rate

(D) compound growth rate

Answer:

(B) weighted average

(6) Expected profit = ……………….

(A) Capital employed × Expected rate of return

(B) Average profit × Expected rate of return

(C) Weighted average × Expected rate of return

(D) Assets × Expected rate of return

Answer:

(A) Capital employed × Expected rate of return

(7) Super profit means ……………..

(A) Capital employed – Expected profit

(B) Expected profit – Capital employed

(C) Average profit – Expected profit

(D) Expected profit – Average profit

Answer:

(C) Average profit – Expected profit

Question 2.

Answer the following questions in one sentence :

(1) What is goodwill ?

Answer:

“Goodwill is an intangible asset which shows the reputation of a firm in the market.”

OR

‘ “Goodwill is the value of the reputation of a firm in respect to the profit earning over and above the expected profit.”

![]()

(2) What is revaluation of goodwill ?

Answer:

At the time of reconstruction of partnership, with revaluation of assets and liabilities, new value of goodwill is determined. This is called revaluation of goodwill.

(3) Which type of asset is goodwill ?

Answer:

Goodwill is an intangible asset which cannot be seen but it has a value in the market.

(4) Under which head goodwill is shown in the balance sheet ?

Answer:

Goodwill is shown in the balance sheet on the assets side under the head of non-current assets as intangible asset.

(5) What is capitalized profit ?

Answer:

Capitalized profit means capitalized value of average profit on the basis of the expected rate of return.

(6) What is super profit ?

Answer:

When a business earns excess profit over average profit then the amount of excess profit is called super profit.

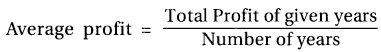

(7) What is average profit ?

Answer:

When total profit of some last years is divided by number of years then the value received is known as average profit.

(8) What is weighted average profit ?

Answer:

When profit of the last years is given weighted (i.e. 1, 2, 3 ….) and then average profit is found out then it is known as weighted average profit.

![]()

Question 3.

Answer the following questions :

(1) Give the meaning of goodwill and explain the factors affecting to its valuation.

Answer:

“Goodwill is an intangible asset which shows the reputation of a firm in the market.” Factors affecting valuation of goodwill :

(i) Nature of business : When a firm has more profit due to stable sales or it earns more profit due to some other reasons or a firm earns more profit than the expected profit or a firm earns profit due to high value added product we can say that there exists goodwill for that firm.

(ii) Location of business : If the business is centrally located or it is at a place having heavy customer traffic then more profit earning is possible in the business. For such kind of business, having prime location, may have high value of goodwill.

(iii) Period of business : Generally, older the firm higher the reputation in the market. Because majority of the customers are familiar and they have close and long term relations with business unit, value of goodwill of such business is bound to be high.

(iv) Market situation: The monopoly condition or limited competition enables the concerned firm earn to high profit. Therefore, the value of goodwill is high in such business.

(v) Efficiency of managers: The efficient management of a business increase the productivity and decrease the cost of a firm. Due to it, profit increases which ultimately increase the value of goodwill.

(vi) Other special benefits : When a firm/company acquire license, patent or trademark or has been earning more profit then the value of goodwill in that case is very high. Apart from the above given factors, services after sales, past achievements of a firm, good labour relations etc. also become the reasons to earn more profit. In this circumstances goodwill of the firm is again very high.

(2) Explain the nature of the goodwill.

Answer:

At the time of reconstructions of partnership firm business assets and liabilities are revaluated with this, the value of goodwill is also to be decided.

(i) For business goodwill is an intangible assets included in the group of non-current assets.

(ii) Intangible assets cannot be seen but it has its value in the market over a period of time, a well-established business develops an advantage of good name, reputation and wide business connections which benefits the business. Monetary value of such advantage is the main reason for the goodwill.

(iii) Goodwill does not exists in those business which earn normal profit or incur loss.

(iv) Goodwill is shown in the balance sheet on the assets side under the head of noncurrent assets as intangible asset.

![]()

(3) Explain the simple average method for the valuation of goodwill.

Answer:

In the simple average method for the valuation of goodwill the average profit of the past certain years are taken into consideration. Then, this average profit is to be multiplied by the certain number of years for the valuation of goodwill. Here it is assumed that a new business will take certain number of years to earn the same profit. Therefore, the business purchaser is ready to pay the value of goodwill equal to the number of years of average profit.

Generally, the multiplication of average profit and the number of years during which the anticipated profit are expected is known as goodwill.

Illustration : Profit of a firm for last four years is 40,000; ₹ 45,000; ₹ 35,000 and ₹ 60,000 respectively. Value of the goodwill to be determined on the basis of 3 year purchase of last 4 years average profit.

Total profit = ₹ 40,000 + ₹ 45,000 + ₹ 35,000 + ₹ 60,000 = ₹ 1,80,000

Goodwill = Average profit × No. of years of purchase

(4) Explain the weighted average method for the valuation of goodwill.

Answer:

In the weighted average profit method there is continuous increase in the profit, then we should give more weightage to the profit of recent years and give comparatively less weightage to the profits of previous years. Generally, weightage of different year’s profit are numbered as 1, 2, 3 …………

After finding out the product of weightage with profit, average is workout which is known as weighted average profit. If specific instruction is given or profit of the business have continuous increasing or decreasing trend then one must find out goodwill by weighted average profit.

Illustration : Profit of a firm for last 3 years is ₹ 22,000; ₹ 25,000 and ₹ 30,000 respectively. Determine the value of goodwill on the basis of 2 years purchase of last 3 year weighted average profit.

Goodwill = Weighted average profit × No. of years of purchase = ₹ 27,000 × 2 = ₹ 54,000

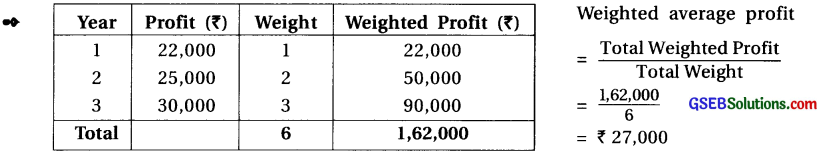

(5) Explain the super profit method for the valuation of goodwill.

Answer:

For the valuation of goodwill by super profit method, capital employed by business, expected rate of return, expected profit, average profit etc. are used.

Excess of average profit over the expected profit is called ‘Super Profit’ means when a business earns excess profit over average profit then the amount of excess profit is called super profit.

While calculating goodwill on the basis of super profit method, following points should be kept in mind.

– Capital Employed = Total Assets – Total External Liabilities.

– Generally expected rate of raturn is given.

– Expected profit = \(\frac{\text { Capital Employed } \times \text { Expected rate of return }}{100}\)

– Average profit is considered after adjustment.

– Super profit = Average profit – Expected profit

– Goodwill = Super profit × No. of years of purchase

Illustration : On the basis of the following information of a firm, determine the valuation of goodwill on the basis of three years purchase of super profit.

Total Assets ₹ 1,40,000; Total Liabilities ₹ 5,00,000; Expected rate of return 10%.

![]()

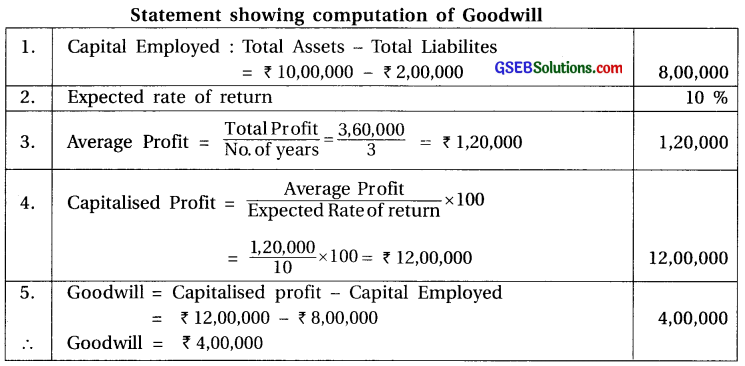

(6) Explain the profit capitalization method for the valuation of goodwill.

Answer:

In the capitalization of profit method, average profit of the business is computed and it is used to determine its capitalized value on the basis of normal/expected rate of return of the business. Thus, profit arrived at is known as capitalization of profit.

Capitalized profit means capitalized value of average profit on the basis of the expected rate of return.

Goodwill = Capitalized profit – Capital employed

If capitalized amount is equal to the capital employed or less, then there is no goodwill of the business.

Illustration : From the following information of a firm, determine the value of goodwill on the basis average profit capitalization method.

Total Assets ₹ 10,00,000; Total liabilities ₹ 2,00,000; Expected rate of return 10%; last three years profit of the firm is ₹ 1,10,000; ₹ 1,30,000 and ₹ 1,20,000 respectively.

Question 4.

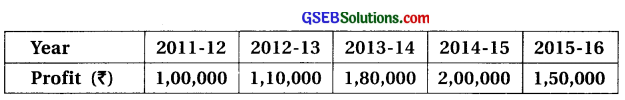

From the following information of Bhavesh and Vipul’s firm, compute the value of goodwill on the basis of 4 years purchase of last five years average profit. Information of last five years profit is as under :

Answer:

Statement showing computation of average profit :

| Year | Profit (₹) |

| 2011-12 | 1,00,000 |

| 2012-13 | 1,10,000 |

| 2013-14 | 1,80,000 |

| 2014-15 | 2,00,000 |

| 2015-16 | 1,50,000 |

| Total | 7,40,000 |

Average profit =  = \(\frac{7,40,000}{5}\) = ₹ 1,48,000

= \(\frac{7,40,000}{5}\) = ₹ 1,48,000

Goodwill = Average profit × No. of years purchased

= ₹ 1,48,000 × 4 = ₹ 5,92,000

∴ Goodwill = ₹ 5,92,000

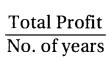

Question 5.

Mahendra and Pravin are partners of a firm sharing profit and loss in the ratio of 3 : 2. They want to change their profit-loss sharing ratio to 1 : 1. Therefore, they decided to make valuation of goodwill. As per partnership agreement, value of goodwill to be determine on the basis of 5 years purchase of last 4 years average profit.

Answer:

Statement showing computation of average profit :

| Year | Profit (₹) |

| 2013-14 | 60,000 |

| 2014-15 | 80,000 |

| 2015-16 | (20,000) |

| 2016-17 | 30,000 |

| Total | 1,50,000 |

Average profit =  = \(\frac{1,50,000}{4}\) = ₹ 37,500

= \(\frac{1,50,000}{4}\) = ₹ 37,500

No. of years

Goodwill = Average profit × No. of years of purchased

= ₹ 37,500 × 5 = ₹ 1,87,500

∴ Goodwill = ₹ 1,87,500

Note : Amount mentioned in bracket () indicates loss.

![]()

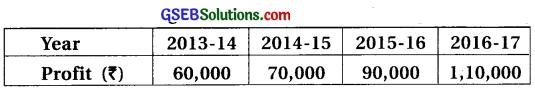

Question 6.

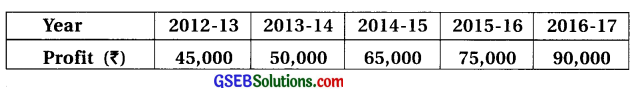

From the following information find out weighted average profit.

Answer:

Statement showing computation of weighted profit :

∴ Weighted Average Profit = ₹ 91,000

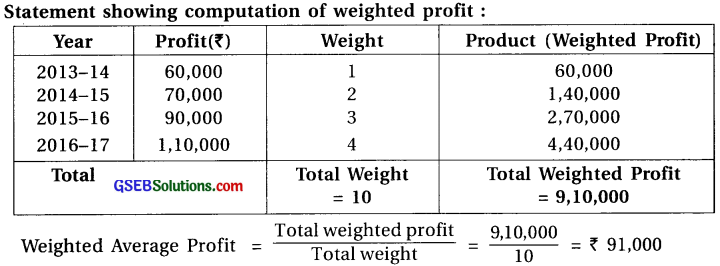

Question 7.

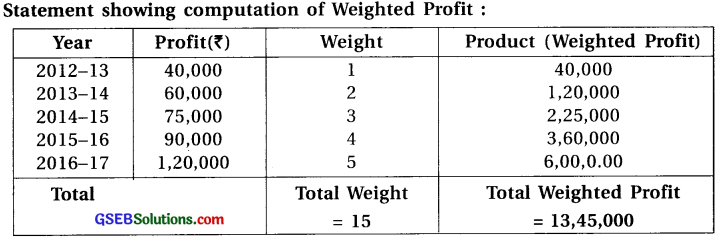

From the following information of Babulal and Kantilal’s firm, determine the value of goodwill on the basis of 3 years purchase of last five years weighted average profit :

Answer:

Weighted average profit

=  = \(\frac{13,45,000}{15}\)

= \(\frac{13,45,000}{15}\)

= ₹ 89,666.67 OR ₹ 89,667

Goodwill = Weighted average profit × No. of years of purchase

= ₹ 89,666.67 × 3 = ₹ 2,69,000 ∴ Goodwill = ₹ 2,69,000

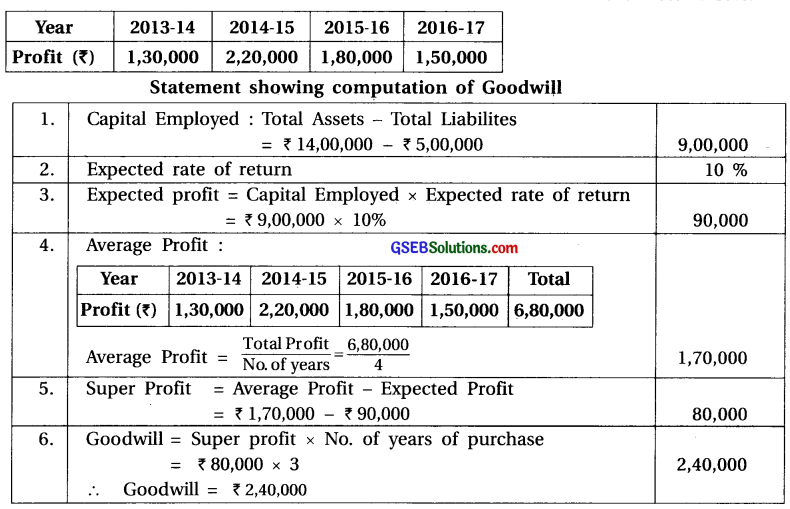

Question 8.

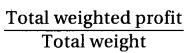

Pushapa, Pratibha and Bhavna are partners of a partnership firm. They decided to change their profit-loss sharing ratio from 3 : 2 : 1 to 1 : 1 : 1. Therefore they decided to make the valuation of goodwill. On the basis of partnership firm’s profit and other information, determine the value of goodwill on the basis of three years purchase of super profit.

Assets : ₹ 6,00,000; Liabilities : ₹ 2,50,000; Expected rate of return : 10%

Actual Profit:

| Year | Profit (₹) |

| 2014-15 | 80,000 |

| 2015-16 | 70,000 |

| 2016-17 | 90,000 |

Answer:

![]()

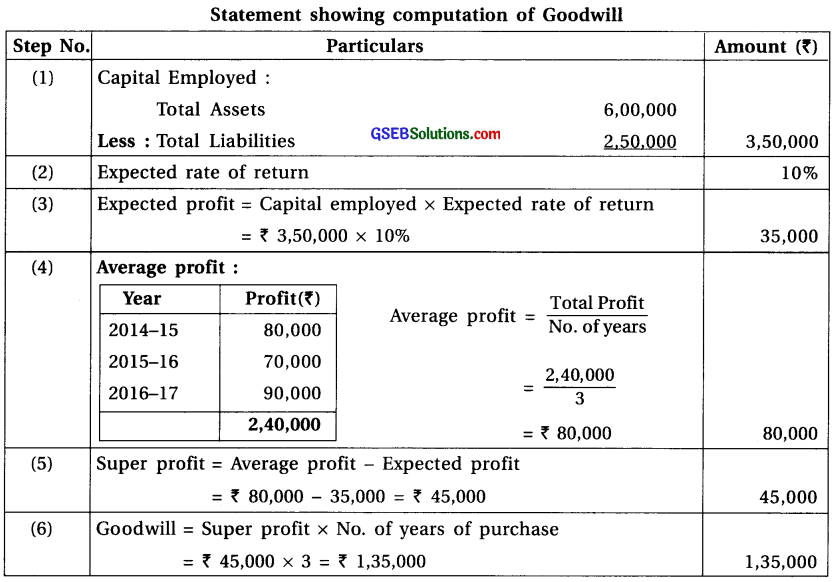

Question 9.

Capital of Meena and Manju’s firm is ₹ 4,00,000 and expected rate of return is 10%. Last three year’s profits are ₹ 1,20,000 ₹ 1,10,000 and ₹ 1,00,000 respectively. Compute the value of goodwill two times of super profit on the basis weighted average method.

Answer:

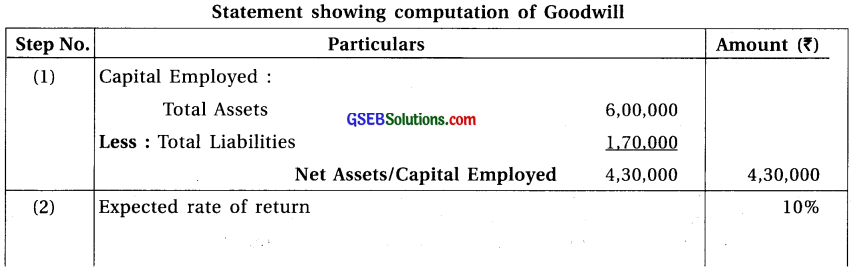

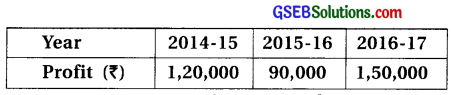

Question 10.

From the following information of Nairutva and Rutvik’s firm determine the value of goodwill of partnership firm on the basis of capitalization of weighted average profit method.

Additional information : (1) Business assets : ₹ 6,00,000. (2) Business liabilities : ₹ 1,70,000. (3)Normal expected return of business is 10%.

Answer:

![]()

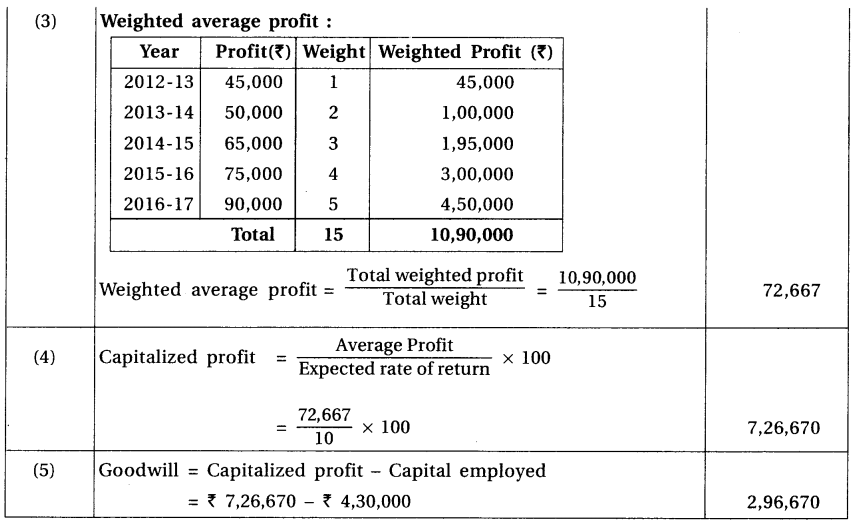

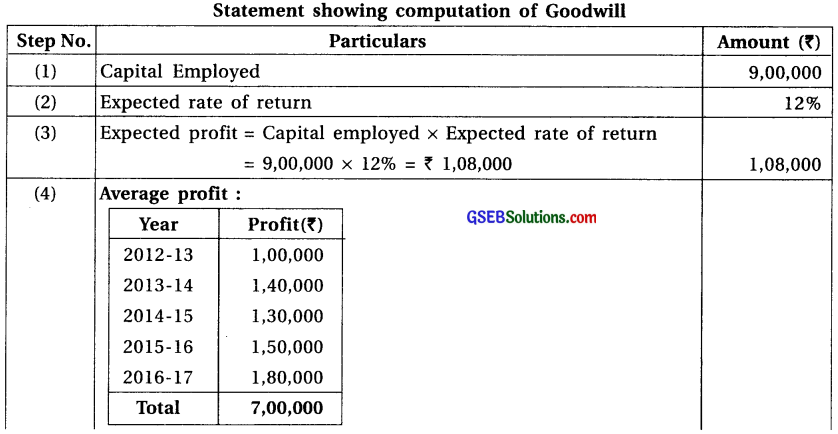

Question 11.

Determine the value of goodwill of Prabha and Prabhu’s firm on the basis of capitalized super profit method.

(1) Capital employed : ₹ 9,00,000 (2) Expected rate of return : 12 % (3) Last five years profit :

Answer:

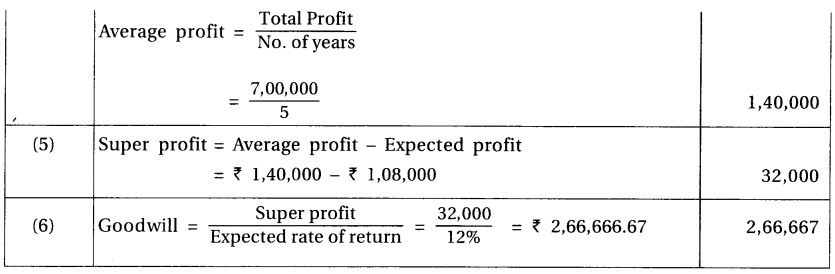

Question 12.

Rajesh and Harish are partners of a partnership firm. On the basis of their partnership firm’s profit and other information, determine the value of goodwill on the basis of two years purchase of super profit.

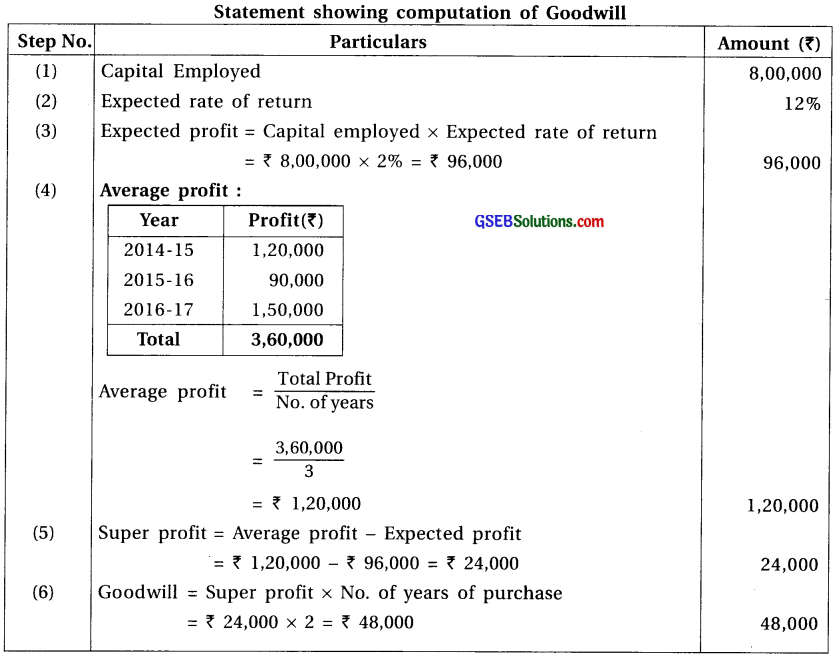

(1) Capital employed : ₹ 8,00,000 (2) Expected rate of return : 12 % (3) Previous year’s profit :

Answer: