Gujarat Board GSEB Textbook Solutions Class 12 Commerce Accounts Part 2 Chapter 2 Accounting for Debentures Capital Textbook Exercise Questions and Answers.

Gujarat Board Textbook Solutions Class 12 Accounts Part 2 Chapter 2 Accounting for Debentures

GSEB Class 12 Accounts Accounting for Debentures Text Book Questions and Answers

1. Select the correct option for each question :

Question 1.

Debenture is ……………………… for a company.

(A) capital

(B) receivable

(C) liability

(D) asset

Answer:

(C) liability

Question 2.

Company gives ………………………. on their debentures to debenture holders.

(A) dividend

(B) interest

(C) share in profit

(D) both interest and dividend

Answer:

(B) interest

Question 3.

At what rate debentures would be issued at discount?

(A) 10%

(B) 5%

(C) 20%

(D) rates as decided by board of directors

Answer:

(D) rates as decided by board of directors

Question 4.

The issued debentures by the company are shown under which head in the balance sheet?

(A) Non-current liabilities

(B) Share capital and reserves

(C) Current liabilities

(D) Investments

Answer:

(A) Non-current liabilities

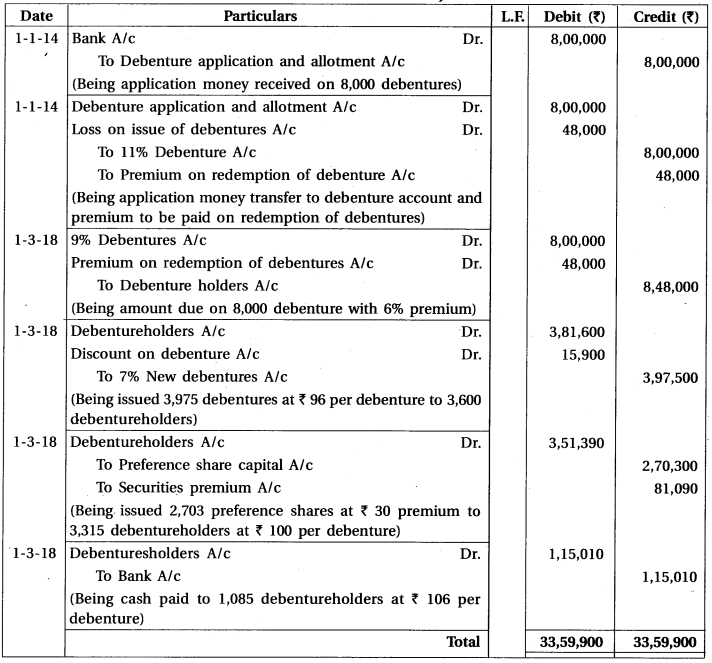

![]()

Question 5.

The amount of premium received on issuing debentures at premium is transferred to which account?

(A) Capital reserve A/c

(B) General reserve A/c

(C) Securities premium reserve A/c

(D) Statement of profit and loss A/c

Answer:

(C) Securities premium reserve A/c

Question 6.

The amount of premium received on issuing debentures at premium is ……………………… .

(A) revenue profit

(B) capital loss

(C) revenue loss

(D) capital profit

Answer:

(D) capital profit

Question 7.

When full amount of the debenture is called on application by the company then, that amount is credited to which account?

(A) Debenture application A/c

(B) Debenture application and allotment A/c

(C) Debenture allotment A/c

(D) Debenture holders A/c

Answer:

(B) Debenture application and allotment A/c

Question 8.

Before the company decides to redeem the debentures out of capital, the company has to transfer ………………… % of total face value of issued debentures to debenture redemption reserve A/c.

(A) 10

(B) 25

(C) 100

(D) 15

Answer:

(B) 25

Question 9.

Before the company decides to redeem the debentures out of profit, the company has to transfer …………………… % of total face value of issued debentures to debenture redemption reserve A/c.

(A) 10

(B) 25

(C) 100

(D) 15

Answer:

(C) 100

Question 10.

As per companies rules 2014, the amount that is at least ……………….. % of face value of the debentures to be redeemed by the end of financial year. i.e. 31st March, should be invested at the beginning of the year i.e. upto 30th April.

(A) 25

(B) 15

(C) 100

(D) 10

Answer:

(B) 15

![]()

2. Answer in two or three sentences :

Question 1.

What is debentures?

Answer:

The company borrow long term funds from the public and against this money, company issues a document or certificate acknowledging its debt to the investor which is known as debentures.

Question 2.

Who is called debenture holder?

Answer:

Those who get the debentures by giving money to the company or have purchased from the market are known as debenture holder.

Question 3.

According to Companies Act 2013, for what duration can a company issue debentures?

Answer:

As per Companies Act 2013, a company can issued debentures for maximum 10 years period. However, a company engaged in infrastructure projects can issue debentures for maximum 30 years period.

Question 4.

Under which head ‘Securities premium reserve account’ appears in balance sheet?

Answer:

‘Securities Premium Reserve Account is shown on the Equity and Liabilities side of the balance sheet under the head of ‘Reserve and Surplus’.

Question 5.

What is meant by debenture discount?

Answer:

When the company issues debentures at a price which is less than their face value or nominal value, the debentures are said to have been issued at discount. Thus, the difference between face value and issued price is known as debenture discount.

Question 6.

Give the provision for writing off the amount of discount on debentures.

Answer:

Discount or loss on issue of debentures is a capital loss. It should be written off as early as possible but within the lifetime of the debentures. Usually this amount is written off against securities premium reserve account or statement of profit or loss.

Question 7.

What is meant by ‘Issue of debentures for consideration other than cash’?

Answer:

When company issues debentures against purchase of assets like Land-Building, plant and machinery, purchase of business etc. than it is known as ‘Issue of debentures for consideration other than cash.

Question 8.

What is meant by ‘Loss on issue of debentures?

Answer:

If company has to pay ‘ premium’ to the debenture holder at the time of returning amount of debentures on maturity then ‘premium’ amount is considered as loss for the company. This is known as ‘Loss on issue of debentures.

Question 9.

What are arrangements by the company to fulfill the required amount for the redemption of debentures?

Answer:

Any one of the following arrangements can be made by company to fulfill the required amount for the redemption of debentures.

- Redemption of debentures from the fresh issue of shares and debentures.

- Redemption of debentures out of capital.

- Redemption of debenture out of profit.

Question 10.

Explain the methods of redemption of debentures.

Answer:

Following are the methods of redemption of debentures :

- To pay total amount on particular date.

- Payment through instalments.

- Purchase of own debentures from the open market.

- By converting debentures into shares.

![]()

3. Give answer of the following questions in detail :

Question 1.

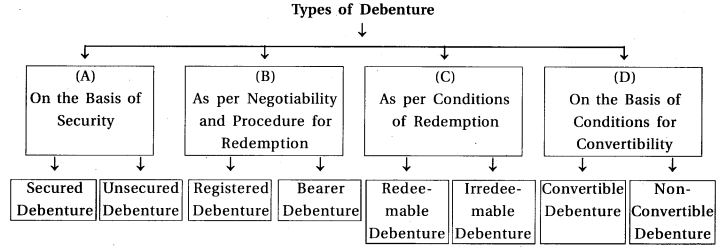

Explain the types of debentures.

Answer:

Types of debentures or classification of debentures are as follows :

(A) On the basis of Security :

(i) Secured or Mortgage Debenture: When this type of debentures are issued some or all the assets of the company are given as security. First mortgage debentures are those that have a first claim on the assets charged. Second mortgage debentures are those that have a second claim on the assets charged.

(ii) Unsecured or Simple or Maked Debentures: Unsecured debentures are issued without giving any security or creating any charge on the assets of the company.

(B) As per Negotiability and Procedure for Redemption :

(i) Registered Debenture: Registered debentures are recorded in the register of debenture holders maintain by company. This register contains the name, address and other particulars related to the debenture holders.

(ii) Bearer Debenture: This type of debenture are purchased by the purchaser by making payment to the seller of the debenture. Interests on like these debentures can be collected through the prescribed bank.

(C) As per Conditions of Redemption :

(i) Redeemable Debenture: Redeemable debentures are the debentures on which amount of debentures can be repaid after a certain period.

(ii) Irredeemable or Perpetual Debenture: Irredeemable debentures are those debentures which are not repayable by the company during its lifetime. Generally, these type of debentures are repayable only at the time of Liquidation of the company.

(D) On the basis of Conditions of Convertibility :

(i) Convertible Debenture: Convertible debentures are those debentures which are converted into equity shares or other securities at a stated rate of exchange.

(ii) Non-Convertible Debenture: Non-convertible debentures cannot be converted into shares or debentures or other securities.

![]()

Question 2.

Explain the procedure for issue of debentures.

Answer:

The procedure for issue of debenture is as follows :

- A resolution is passed at the meeting of Board of Directors of the company in which number of debentures, amount per debenture, total amount of debenture issued, rate of interest there on etc. are mentioned.

- At the time of issue of debentures, Companies Act and provisions of SEBI should be consider. A company should issue a prospectus or a statement in Lien of the prospectus with proper information imiting the public to subscribe for debentures.

- Allotment of debentures should be equal the number of issued debentures against the number of debenture application received. For this, company has to open separate bank account in any scheduled bank .

- As per rule of the Companies Act 2013, minimum subscription should be 90% of the issued amount.

- Full amount of debentures may be called by the company on application or may be called in installments.

- After subscription or issue is close, allotment letter is sent to the applicants to whom debentures were allotted and debenture application money is refunded to those applicants to whom debentures were not allotted.

- Debentures may be issued either at par at a premium or at a discount.

- Debentures can be issued at discount. The rate of premium or discount is to be decided by the directors.

Question 3.

Write a note on ‘Debentures issued at a premium’.

Answer:

When the debentures are issued at more than their face value they are said to be have been issued at premium, e.g. If a debenture of ₹ 100 is issued at ₹ 120 then it is called that this debenture is issued at premium of ₹ 20.

As per Companies Act 2013, premium amount on debentures is transferred to ‘Securities Premium Reserve Account.

Debenture premium is a capital profit and can be used to write off capital loss.

Debenture premium cannot be used for distribution of dividend.

Securities Premium Reserve Account is shown on the equity and liabilities side of the balance sheet under the heading of ‘Reserve and Surplus’.

Question 4.

Write a note on ‘Debentures issued at a discount.’

Answer:

When the debentures are issued at less than their face value, they are said to be have been issued at discount, e.g. A debenture of ₹ 100 face value is issued at ₹ 80 then ₹ 20 would be discount. As per Companies Act, there is no restriction regarding maximum discount to be given on the issue of debentures. If there is no restriction in the Articles of Association of the company, debenture can be issued at discount.

Amount of discount on debentures is debited to ‘Discount on Debenture A/c’.

Amount of debenture discount or loss on issue of debenture is shown in the balance sheet as per Accounting Standard-26. Debenture discount amount is shown under different heads which depends on terms of debentures.

Question 5.

Explain the accounting treatment of debentures issued as collateral security.

Answer:

When a company takes a loan from a bank or from some other party, the company may have to issue debentures as a subsidiary or secondary security in addition to the principal security. The debentures so issued are known as debentures issued as collateral securities. If the company repays its dues to the bank in right time, the bank will return the debentures to the company and the debentures received this way are cancelled by the company.

If the company fails to repay the amount of loan or interest on this in proper time then the lender will first realize its debt from the principal security and still anything is remained lender can recover balance amount from the sale of debenture. Entry for issue of debentures as collateral security will be recorded as follows: Debenture suspense A/c

Dr.

To Debenture A/c

(Being issue of debentures as collateral security against loan)

As and when the loan amount is fully paid up by the company, bank will return all the debentures to the company and entry passed above will be reversed in that case.

![]()

Question 6.

Write a note on ‘Interest on Debentures’.

Answer:

Interest on debentures is usually paid half-yearly. Interest on debentures is recorded in the statement of profit or loss. This interest is expense against profit. Interest on debentures has to be paid regularly even if the company suffers a loss or does not earn the profit.

- The rate of interest payable on debentures is prefixed.

- As per Income Tax Act, a company is required to deduct income tax at the prescribed rate from the gross amount of debenture interest before any amount is paid to the debenture holders. This tax amount is to be deposited with the income tax department on behalf of the debenture holders. It is known as Tax deducted at Source(TDS). While preparing the final accounts for an accounting period provision or effects must be made for any accrued interest on debentures due to variations of the dates.

- If a company pays interest on debentures on a half-yearly period and interest remains unpaid it will be called ‘Interest accrued and due’.

Question 7.

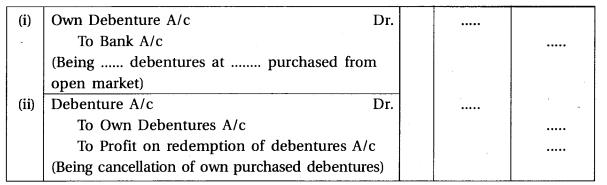

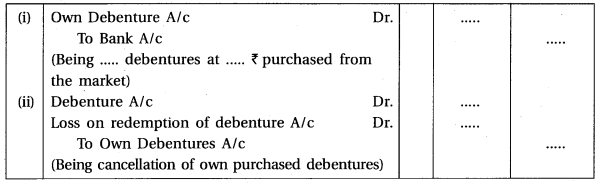

Write a note on ‘Redemption of debentures by the purchase of own debentures in the open market’.

Answer:

As per Companies Act if articles of association allows, Company can purchase the own debentures from the open market from recognized stock exchange. This procedure is usually adopted by the company only when debentures are quoted at a less price or at a discount on the stock exchange as compare to face value of debentures or amount of redemption of debentures.

After purchasing the debentures from the open market the company may use either of the following two options :

1. Company may immediately cancel the debenture purchased, after passing the resolution by Board of Directors.[A] When debentures are purchased at less price as compared to face value of the debentures :

[B] When debentures are purchased at more price as compared to face value of the debenture :

Company may not cancel the debentures but may keep with them. Company can issue them in future. Debentures purchased in this way are treated as ‘Investment in own debentures’.

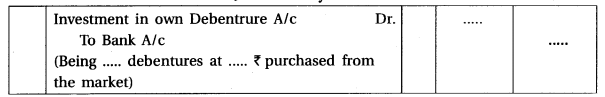

When the company purchases own debentures from the open market and those debentures are kept as investment:

Journal Entry

Here investment in own debentures will be shown as non-current assets on t assets side at purchase price in the balance sheet.

When investment in own debenture used for debentures cancellation :

| Debenture A/c

Dr. |

……….. | ||

| Loss redemption of debenture A/c (if any)

Dr. To Investment in own debenture A/c |

……….

|

………… |

Question 8.

Distinguish between Shares and Debentures.

Answer:

Following are the points of differences between shares and Debentures :

| Points of Distinction | Shares | Debentures |

| 1. Meaning | Capital of a company is called share capital which can be divided into transferable small denominations. Each unit of denomination is known as share. | Company borrow long term funds from the public and against this borrow money company issued a document or certificate acknowledging its debt to the investor. This certificate is known as debenture. |

| 2. Type of capital | Share is a capital showing ownership. A shareholder is considered as an owner of company. | Debentures is a borrowed capital. A debentures holder is considered as a creditor of the company. |

| 3. Certainty of return | No return will be available to the shareholder if the company does not make any profit. Thus, there is no surety of the return. | Irrespective of the fact that whether the company makes a profit or loss, debenture holders are to be paid interest as per the terms of issue of debentures. |

| 4. Charge or security | Share being an ownership security, the company has not this to offer any security against. | Debenture being credit or ship security the company is generally required to create a fixed or floating charge on assets. |

| 5. Rights | The shareholders have a right to take part in the administration of the company and have voting right. | Debenture holder do not have voting rights or right to take part in the administration. |

| 6. Discount | Except sweat equity shares, shares cannot be issued at discount. | Debentures can be issued at discount. |

| 7. Convertibility | Shares cannot be converted into debentures. | Debentures can be converted into shares. |

| 8. For redemption | A company is not required to return the share capital during its lifetime. | Generally, proceeds of debenture are to be repaid after a fixed period. |

![]()

Question 4.

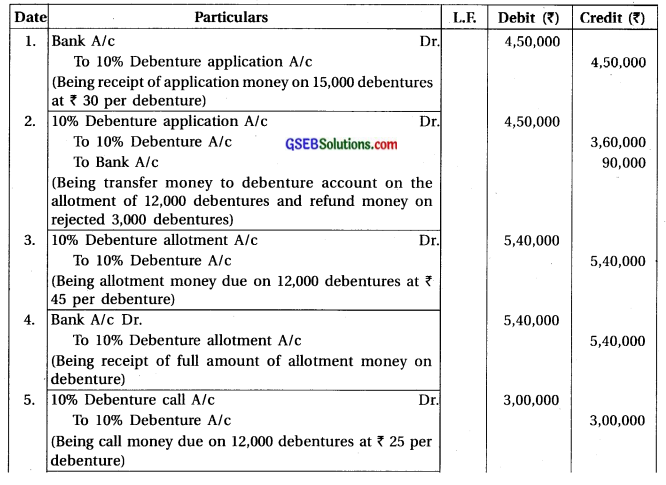

Sachin Marble Limited issued 12,000 debentures of ₹ 100 each for public subscriptions. Interest is to be paid at the rate of 10% p.a. The amount were called upper debenture as under :

With application ₹ 30, On allotment ₹ 45, On-call ₹ 25

Application were received by company of 15,000 debentures. After allotment of 12,000 debentures, rejected excess applications of debentures and refunded the money to applicants. All the amounts due on allotment and call were duly received.

Write journal entries in the books of the company.

Answer:

Necessary Calculation :

(1) At the time of application : 15,000 debentures x ₹ 30 = ₹ 4,50,000

(2) At the time of allotment : 12,000 debentures x ₹ 45 = ₹ 5,40,000

(3) At the time of call : 12,000 debentures x ₹ 25 = ₹ 3,00,000

Journal entries in the books of Sachin Marble Limited

Question 5.

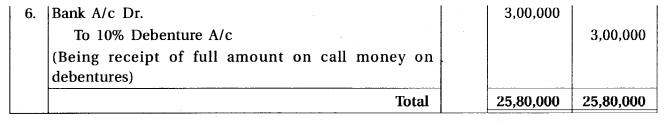

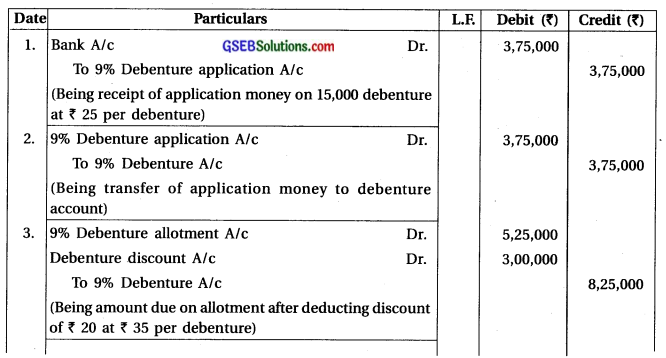

Pasvadal Steel Limited issued 15,000.9% debentures of ₹ 100 each at a price of ₹ 80 per debenture. The amount per debenture was payable as under: ₹ 25 with application, ₹ 35 on allotment (After discount), ₹ 20 on call.

The company received applications for 15,000 debentures and all are sanctioned. The company received the full money called on allotment and received full amount on call. Except call on 800 debentures. Pass necessary journal entries in the books of company.

Answer:

Necessary Calculation :

Journal entries in the books of Pasvadal Steel Limited.

Question 6.

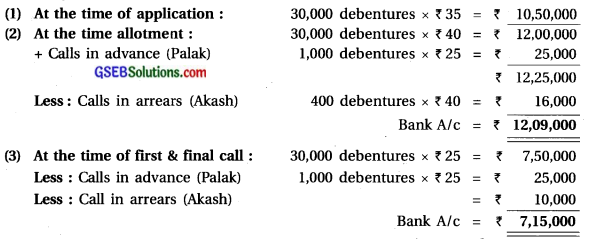

Dynamic Limited of Ankleshwar issued 30,000, 12% debentures of ₹ 100 each, on which the amount per debenture was payable as under: With application ₹ 35, On allotment ₹ 40, On first and final call ₹ 25

All the debentures were applied. Palak, the holder of 1000 debentures paid the entire amount on his holding on allotment. Where, Akash, the holder of 400 debentures failed to pay the allotment and call amount.

Answer:

Necessary Calculation :

Journal entries in the books of Dynamic Limited

Question 7.

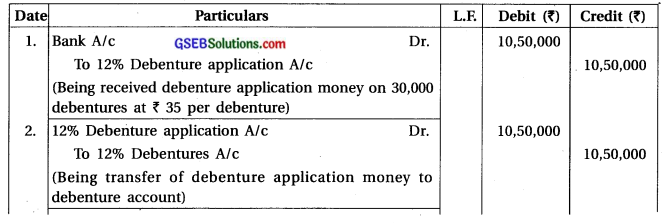

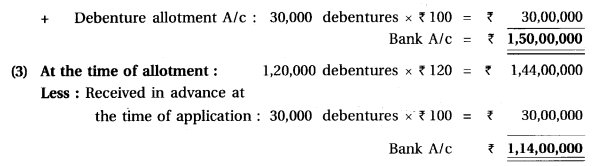

Charmi Fashion Limited issued 1,20,000, 10% debentures at the face value of ₹ 200 each at a premium of 10%. Amount was payable as under: With application ₹ 100 (including premium) and balance amount on allotment.

These debentures are redeemable after 7 years. Application are received by company for 1,50,000 debentures and the allotment of 1,20,000 debentures is made on a pro-rata basis. Excess amount on application is credited to allotment account Amount due on allotment is fully received. Pass journal entries on the issue of debentures in the books of company.

Answer:

Necessary Calculation :

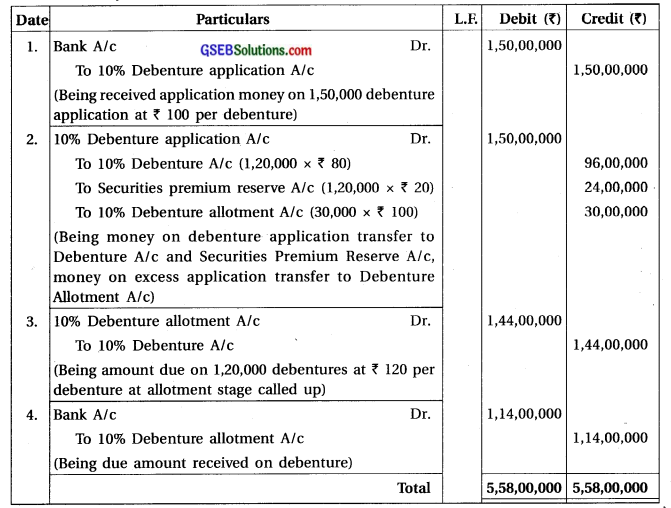

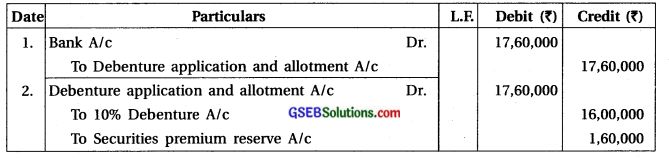

Journal entries in the books of Charmi Fashion Limited

Question 8.

Janki Marbal Ltd. of Palanpur issued 50,000, 11% Debenture of ₹ 100 each at a premium of ₹ 20 per debenture. The full amount was payable on application. Applications were received by company for 60,000 debentures. Application for 10,000 debentures were rejected and the amount thereon was refunded to the applicants. Debentures were allotted to the remaining applications. Pass necessary journal entries for the above transactions in the books of Janki Marbal Ltd.

Answer:

Journal entries in the books of Janki Marbles Limited

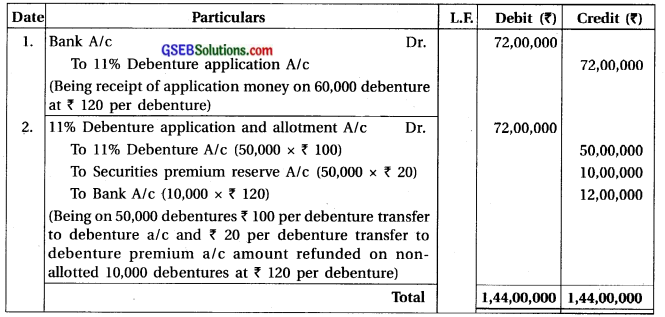

Question 9.

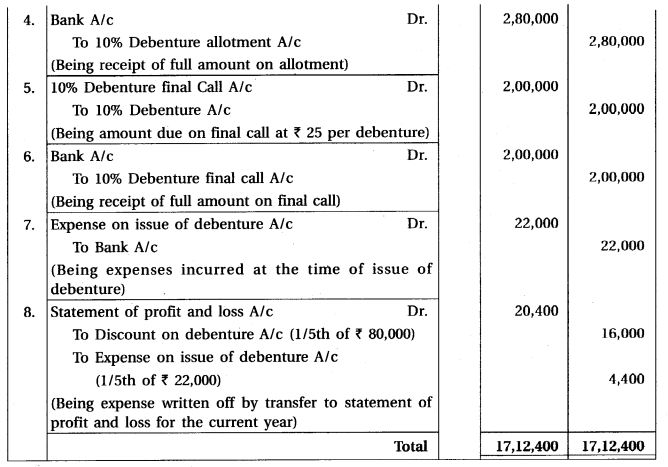

Mansuri Limited of Dahod issued 8,000, 10% debentures of ₹ 100 each at a discount of 10% as on 1-4-2017. The amount were payable as under: ₹ 30 wIth application; ₹ 35 on allotment and balance amount on final call.

Company received application of 10,500 debentures, of which 8,000 debentures are

allotted. Amount was refunded to the applicants on rejected applications. All the moneys due on

debentures were duly received.

Expenses on Issue of debentures amounted ₹ 22,000. DIrectors decided to write off 1/5th amount of “Expenses on Issue A/c” and “Discount on Debenture A/c” from statcmcnt of profit and loss each year.

Write journal entries for first year only from the above transactions in the books of company.

Answer:

Journal entries in the books of Mansuri Limited

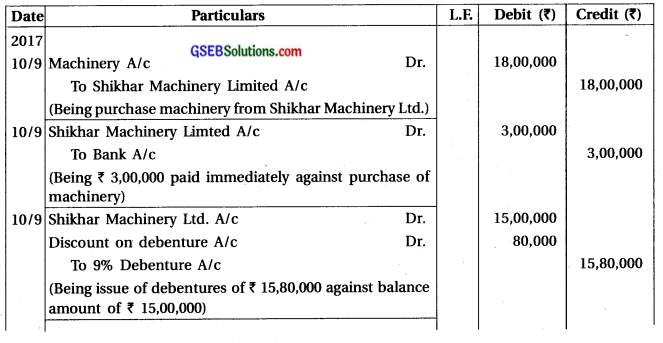

Question 10.

Aadinath Limited purchased machinery worth ₹ 18,00,000 from Shikhar Machinery Ltd. on 10-9-2017. ₹ 3,00,000 were paid immediately and the balance was paid by issue of ₹ 15,80,000,9% debentures in Aadinath Limited. Pass necessary journal entries in the books of Aadinath Ltd. If for the balance amount Aadinath Ltd. pays ₹ 14,10,000 by 9% debentures, then how will they write journal entry.

Answer:

Journal entries in the books of Aadlnath Limited

![]()

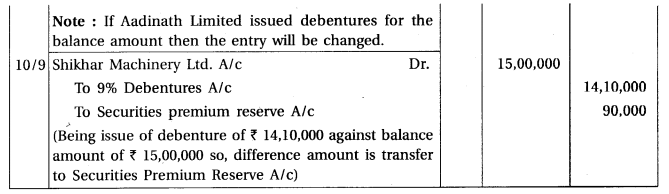

Question 11.

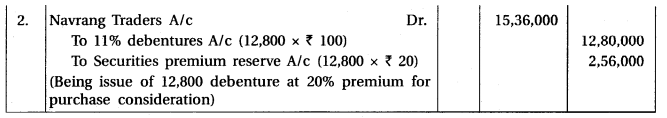

Voltas Electric Limited purchased following assets and liabilities from Navrang Traders :

Decided to pay for a purchase consideration of ₹ 15,36,000. Voltas Electric Ltd. paid the purchase consideration by issuing 11% debentures of ₹ 100 each at a premium of 20%.

Pass journal entries in the books of company.

Answer:

Necessary Calculation :

Purchase consideration = ₹ 15,36,000 it is given

Total assets (given) = Land-Building + Machinery + Furniture + Stock + Debtors

= ₹ 8,00,000 + ₹ 2,75000 + ₹ 1,20,000 + ₹ 2,25.000 + ₹ 80,000

= ₹ 15,00,000

Total liabilities Creditors = ₹ 80,000

Net Assets = Total Assets – Total Liabilities Goodwill Purchase consideration – Net assets

= ₹ 15,00,000 – ₹ 80,000 = ₹ 15,36,000 – ₹ 14,20,000

= ₹ 14,20,000 = ₹ 1,16,000

Here, purchase consideration of ₹ 15,36,000 is paid by issuing 11% debentures of ₹ 100 at a premium of 20%. Here, number of debentures is not given.

PurchaseConsideration 15 36 000

∴ Number of debentures = \(=\frac{\text { Purchase Consideration }}{\text { Amount per debenture }}\) = \(\frac{15,36,000}{120}\) = 12,800 debentures

Journal entries in the books of Voltas Electric Limited

Question 12.

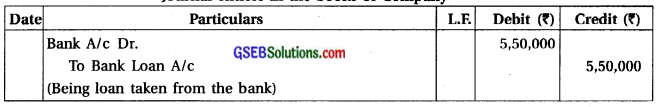

A company had ₹ 21,00,000 issued 10.5% debentures as on 1st April, 2017. During the year company took a loan of ₹ 5,50,000 from the bank as on 10th August 2017. Against this company issued new 10.5% debentures of ₹ 5,00,000 as collateral security.

Pass necessary journal entries under following methods from the above transactions in the books of the company.

If debentures are issued as collateral security:

(1) is recorded in the books of company and

(2) is not recorded in the books of company.

Show the details about debentures and bank loan in the company’s balance sheet as on 31st March 2018.

Answer:

(a) As per first method :

Journal entries in the books of Company

Here, no entry is passed for the issue of debentures as security against loan.

Balance sheet as on 31st March 2018

| Particulars | Note No. | 31/3/2018 (₹) |

31/3/2017 (₹) |

| Equity and Liabilities : Shareholders Fund : Non-current Liabilities : Long term borrowings : 10.5% Debentures (Above this debenture of ₹ 5,00,000 issued as collateral securities) Bank loan (Debentures of ? 5,00,000 as collateral security) |

21,00,000

5,50,000 |

(b) As per second method:

Journal entries in the books of Company

Balance sheet as on 31st March 2018

| Particulars | Note No. | 31/3/2018(₹) | 31/3/2017(₹) |

| Equity and Liabilities: Shareholders Fund : Non-current Liabilities: Long term borrowings: 10.5% Debentures 10.5% Debentures issued as collateral secutiry 5,00,000 Less: Debenture suspense A/c 5.00.000Bank loan (on collateral security of debentures of ₹ 5,00,000) |

21,00,000

– 5,50,000 |

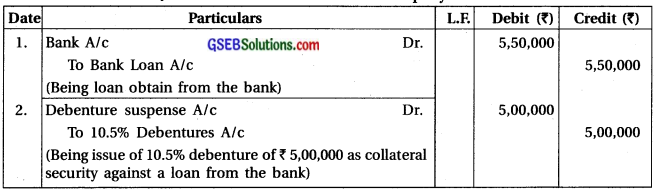

Question 13.

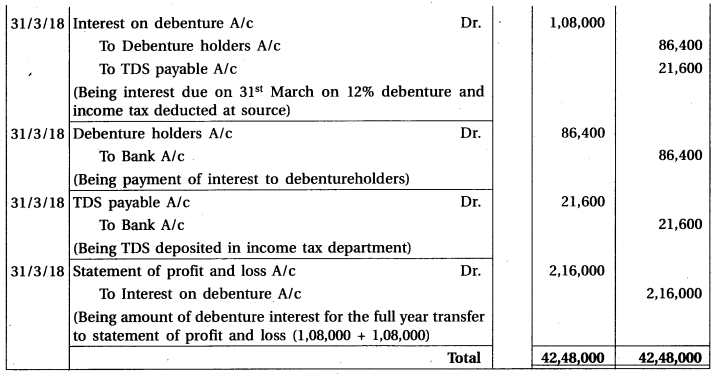

Alibaba Limited issued 18,000, 12% debentures at the face value of ₹ 100 as on 1st April 2017. Interest on these debentures is paid on 30th September and 31st March.

Pass journal entries of the above transactions for the year ended 31st March 2018. Assuming income tax rate is 20% for the calculation.

Answer:

Journal entries in the books of Alibaba Limited Company

Question 14.

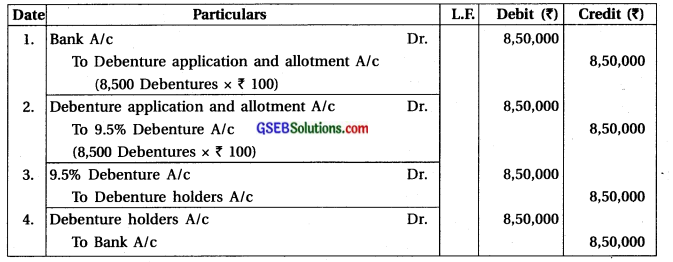

Write the journal entries only for the issue of debentures from the following transactions. (Without narration)

(1) Issued 8,500, 9.5% debentures of ₹ 100 each at par, redeemable also at par.

(2) Issued 9,500, 9.5% debentures of ₹ 100 each at discount of 10% redeemable at par.

(3) Issued 8,000, 10% debentures of ₹ 200 each at a premium of 10%, redeemable at par.

Answer:

(1) Debenture issued at ₹ 100 each, redeemable at ₹ 100 each :

Journal entries in the books of Company

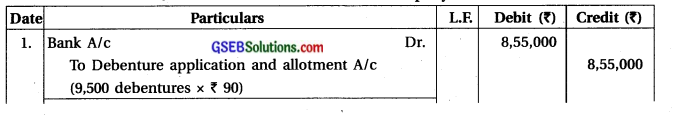

(2) Debenture issued price of ₹ 90 each, redeemable at ₹ 100 each :

(3) Debenture issued price of ₹ 220 each and redeemable at ₹ 200 each :

Journal entries in the books of Company

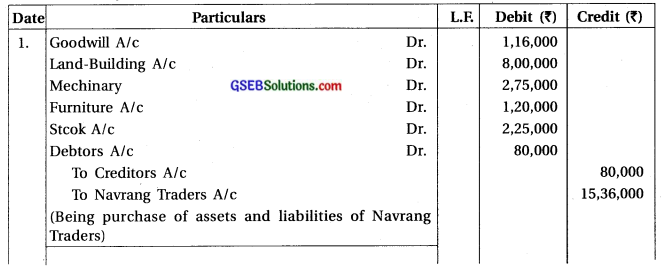

Question 15.

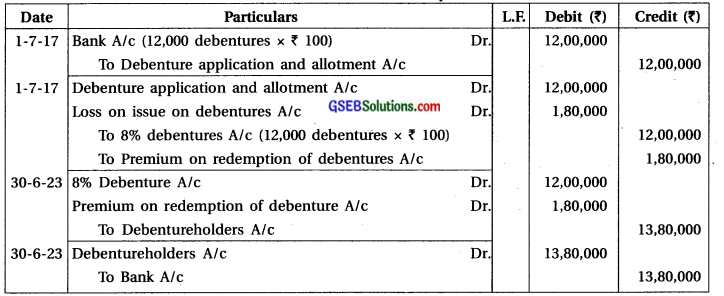

Satyam Limited issued 12,000,8% debentures of ₹ 100 each at par as on 1-7-2017. These debentures are to be redeemed on 30-6-2023 at ₹ 115 per debenture.

Pass the necessary journal entries in the books of the company for issued and redemption of debentures (without narration).

Answer:

Journal entries in the books of Satyam Limited

![]()

Question 16.

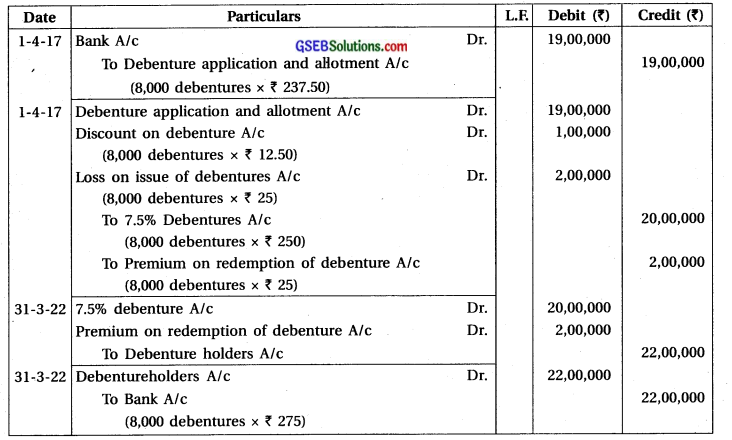

On 1-4-2017 Shivam Limited issued 8,000, 7.5% debentures of ₹ 250 each at a discount of 5%. All the debentures are to be redeemed after 5 years as on 31-3-2022 at a premium of 10%. Write the necessary journal entries in the books of company (without narration).

Answer:

Journal entries in the books of Shivam Limited

Question 17.

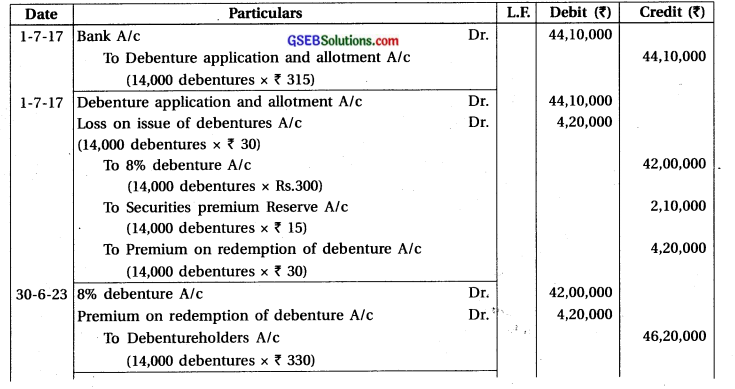

On 1-7-2017 Sundaram Limited issued 14,000, 8% debentures of ₹ 300 each at a premium of 5%. These debentures are redeemed on 30-6-2023 at ₹ 330 per debenture.

Write the necessary journal entries in the books of company (without narration).

Answer:

Journal entries in the books of Siddhpur Sundaram Limited

Question 18.

On 1-7-2017 Paras Pharma Limited issued 20,000,9% debentures of ₹ 400 each, are to be redeemed after 7 years at a premium of 12%. As per conditions in prospectus, the amount is payable on application ₹ 125 per debenture and balance amount at the time of allotment.

Pass the necessary journal entries for the issue of debentures in the books of the company.

Answer:

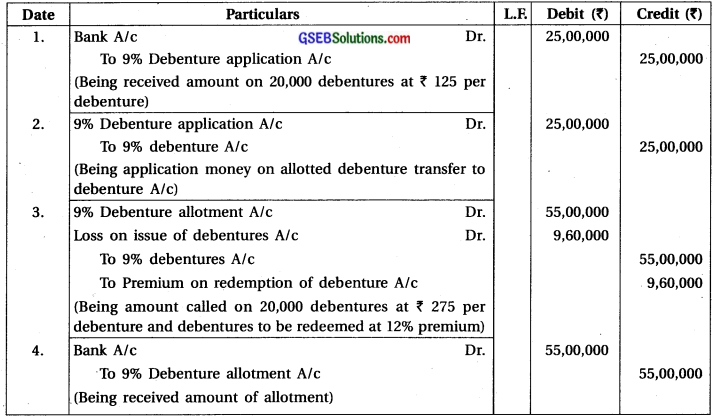

Journal entries in the books of Paras Pharma Limited

Question 19.

Star Technology Limited issued 16,000,8.5% debentures of ₹ 100 each at a discount of 10% as on 1-9-2017. All the debentures are redeemable at a premium of 8% after 6 years. The amount was payable as follows :

On application ₹ 60 per debenture, On allotment balance amount per debenture.

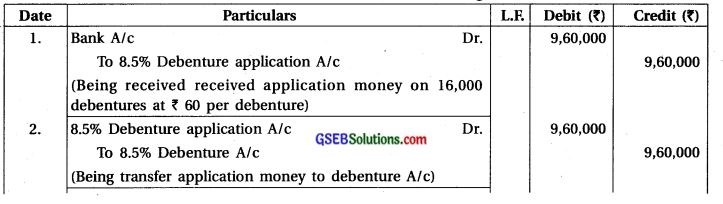

Pass the necessary journal entries for issue of debentures in the books of company.

Answer:

Journal entries in the books of Star Technologies Limited

Question 20.

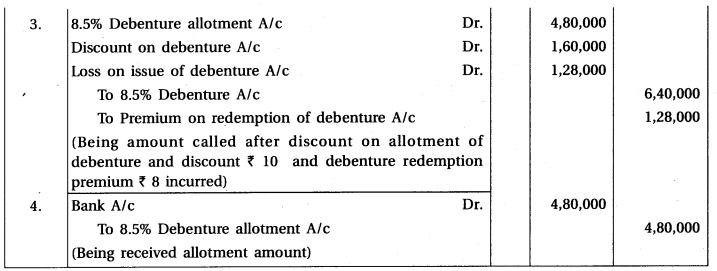

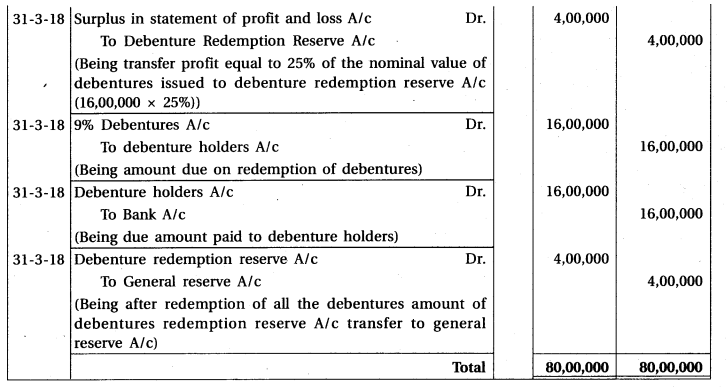

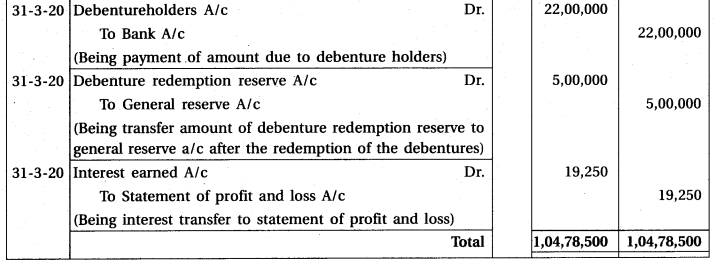

Nupur Limited issued 16,000,9% debentures of ₹ 100 each at a premium of 10% on 1st April 2013, redeemable on 31st March 2018. The issue was fully subscribed. The board of directors decided to transfer the required amount to Debenture Redemption Reserve as on 31st March 2018 and debentures to be redeemed out of capital. They were also decided to invest required amount into Debenture Redemption Investment on 30th April 2017.

Investments were sold on the date of redemption of debentures and required amount for redemption of debentures were paid to debenture holders. Pass necessary journal entries for issue and redemption of debentures in the books of company and also prepare Debenture Redemption Investment A/c and Debenture Redemption Reserve A/c.

Answer:

Journal entries in the books of Nupur Limited

Question 21.

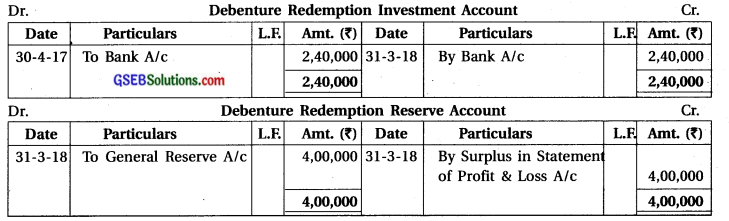

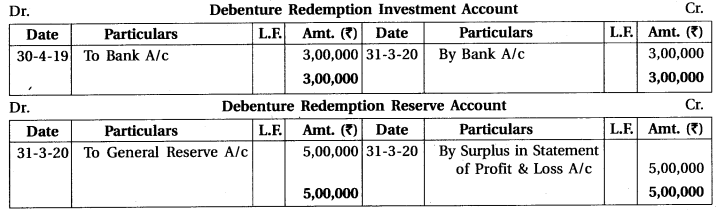

Hiteshi Limited issued 10,000,11% debentures of ₹ 200 each on April 1, 2014, at a premium of 6%, which redeemable at a premium of 10% on March 31, 2020. According to provisions of Companies Act, the required investment was made in 7% Gujarat State Government unencumbered securities on April 30 of the financial year in which redemption is due. For the redemption of debentures, the provision for money is to be made out of capital. Debentures were redeemed on the due date. Pass journal entries for issue and redemption of debentures. Also prepare Debenture Redemption Investment A/c and debenture redemption reserve A/c.

Answer:

Journal entries in the books of Hiteshi Limited

Question 22.

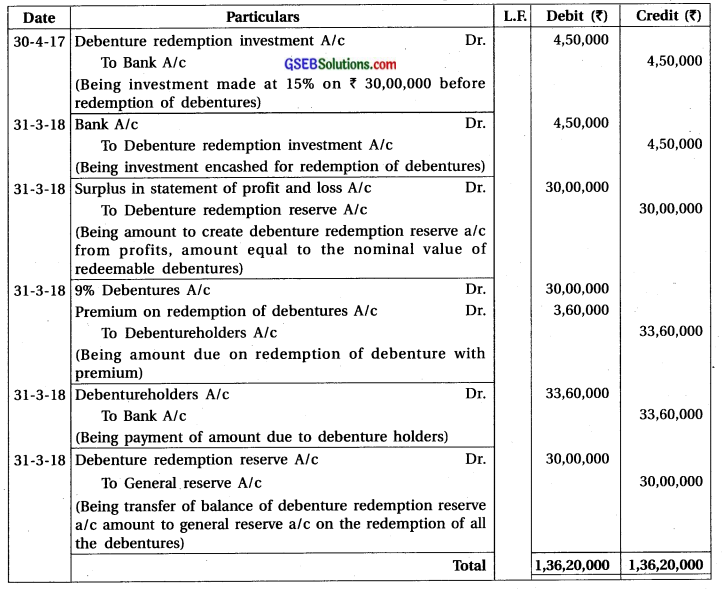

Parth Engineering Limited redeemed 9% debentures at face value of ₹ 30,00,000 at a premium of 12% as on 31-3-2018. For this, provision for money was made out of profit of the company. The company invested the required amount as on 30th April 2017.

Pass journal entries for the redemption of debentures in the books of company with the assumption that company has fulfilled provisions of Companies Act. Also prepare Debenture Redemption Investment A/c and Debenture Redemption Reserve A/c.

Answer:

Journal entries in the books of Parth Engineering Limited

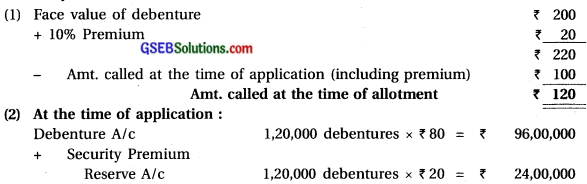

![]()

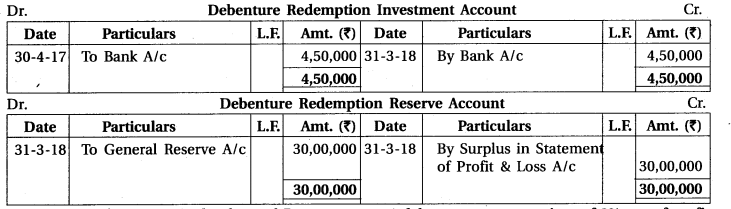

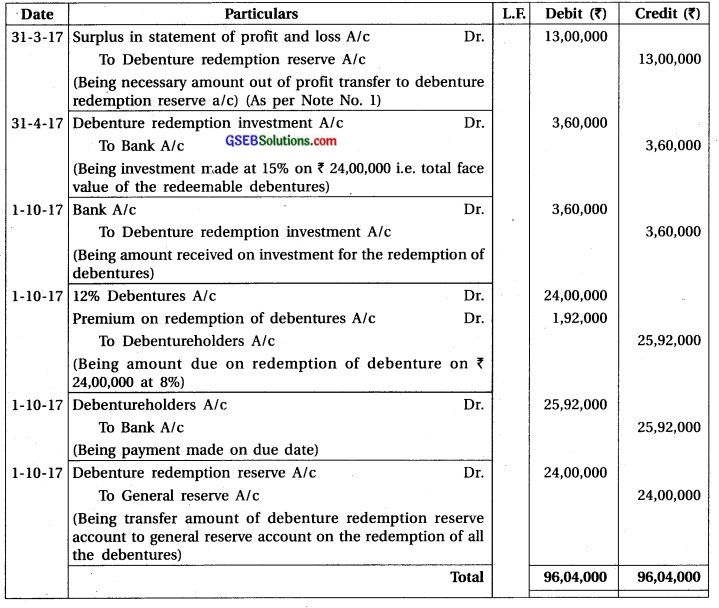

Question 23.

Munj Software Limited redeemed ₹ 24,00,000, 12% debentures at a premium of 8% out of profit on 1-10-2017. The company had a Debenture Redemption Reserve of ₹ 11,00,000. It was decided to invest the required amount in proper time in debenture redemption investment as per companies act.

Pass necessary journal entries for the redemption of debentures in the books of company.

Answer:

Journal entries in the books of Munj Software Limited

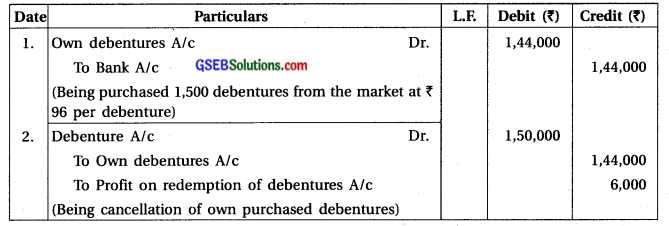

Question 24.

A company purchased its own 1500 debentures of ₹ 100 each at ₹ 96 in the open market and immediately cancels them after purchase. Pass journal entries in the books of company.

Answer:

Journal entries in the books of Company

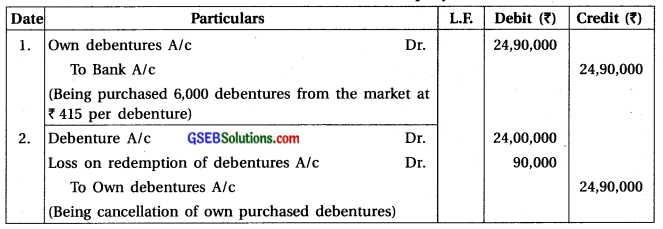

Question 25.

A company purchased its own 6000 debentures of ₹ 400 each at ₹ 415 in the open market and immediately cancels them after purchase. Pass journal entries in the books of company.

Answer:

Journal entries in the books of Company

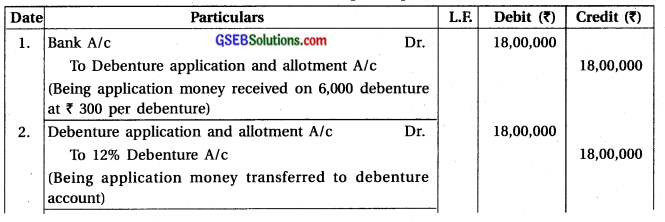

Question 26.

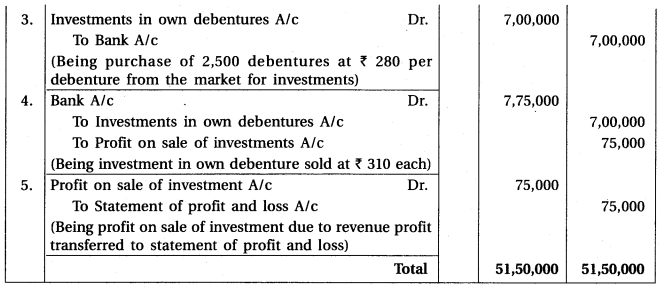

Jaspreet Aperals Limited issued 6000, 12% debentures of ₹ 300 each. The board of directors was purchased 2500 own debentures from the market at a price of ₹ 280 each for investment purpose. After few months, company sold these purchased debentures at ₹ 310 per debenture in the market.

Record necessary journal entries from the above transactions.

Answer:

Journal entries in the books of Jaspreet Aperals Limited –

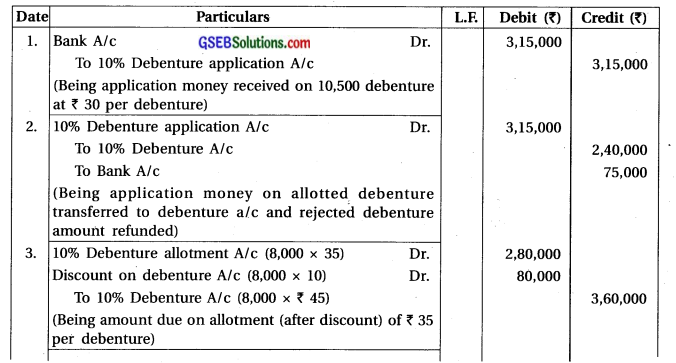

Question 27.

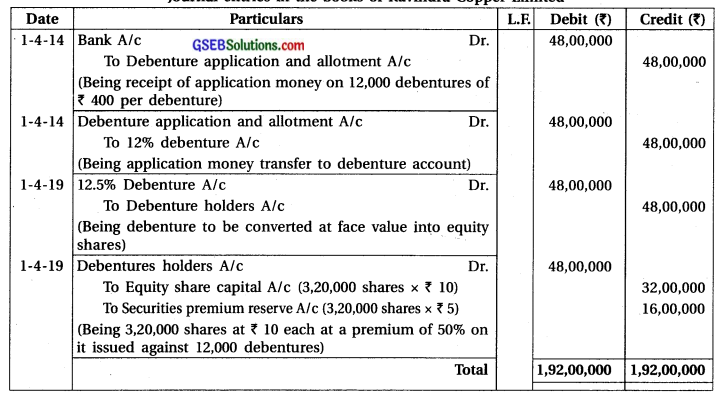

As on 1st April 2014, Ravindra Copper Limited issued 12,000, 12.5% convertible debentures of ₹ 400 each at par. As per the terms of issue of debentures, all the debentures will be converted into equity shares of ₹ 10 each at a premium of 50% after 5 years.

On 1st April 2019, debentures were converted into equity shares as per the agreed terms. Pass the necessary journal entries in the books of company.

Answer:

Necessary Calculation :

Total amount received on issued of debentures = 12,000 debenture x ₹ 400 = ₹ 48,00,000

Price of each equity share to be issued against debentures =

= ₹ 10 original price + ₹ 5 premium = ₹ 15

No. of equity share to be issued against debentures =\(\frac{48,00,000}{15}\) = 3,20,000 shares

Journal entries in the books of Ravindra Copper Limited

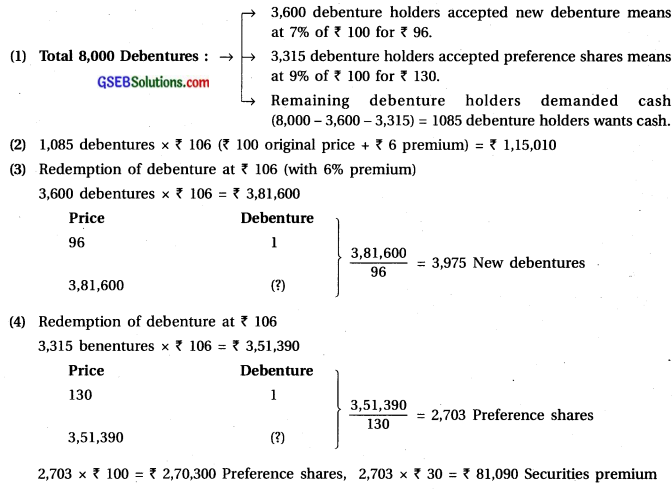

Question 28.

On 1st January 2014, Rajan Limited issued 8000, 11% debentures of ₹ 100 each. According to terms of the issue of debentures, the debentures were to be redeemed at 6% premium by giving 6 months notice at any time after 4 years. The redemption of debentures was to be made by cash or by preference shares or by new debentures as per the option to be exercised by the debenture holders.

On 1st March 2018, the company issued the required notice to the debenture holders for the redemption of the debentures.

The company gave three option for the redemption of the debentures on 1st March 2018.

(1) Amount will be paid in cash.

(2) 9% preference shares of ₹ 100 each will be issued at ₹ 130 per share.

(3) New 7% debentures of ₹ 100 each will be issued at ₹ 96 each.

Holders of 3600 debentures accepted new debentures, holders of 3315 debentures accepted preference shares and rest opted for cash.

Write the necessary journal entries to record above transactions.

Answer:

Necessary Calculation :

Journal entries in the books of Rajan Limited