Gujarat Board GSEB Class 11 Commerce Accounts Important Questions Part 2 Chapter 5 Financial Statements of Business Organisations Important Questions and Answers.

GSEB Class 11 Accounts Important Questions Part 2 Chapter 5 Financial Statements of Business Organisations

Answer the following questions in one sentence :

Question 1.

What is meant by debit balance of Trading account?

Answer:

Debit balance of Trading account means gross loss.

Question 2.

In which account is the result of Trading account transferred?

Answer:

The result of Trading account is transferred to Profit and Loss account.

Question 3.

In which side of Trading account is opening stock shown?

Answer:

Opening stock is shown on debit side of Trading account.

Question 4.

What is darmayo?

Answer:

Darmayo means monthly salary or wages.

![]()

Question 5.

What is called Kharajat expenses?

Answer:

Wages or expenses incurred on the goods due to wastage is called Kharajat expenses.

Question 6.

Where is the Gross loss shown in the Profit and Loss account?

Answer:

Gross loss is shown on the debit side of Profit and Loss account.

Question 7.

Which accounts are closed by preparing Trading account and Profit and Loss account?

Answer:

Goods accounts, expenses accounts and incomes accounts are closed by preparing Trading account and Profit and Loss account.

Question 8.

Which accounts are shown in the Balance Sheet?

Answer:

Only personal accounts and assets accounts are shown in the Balance Sheet.

Question 9.

Which account is the part of the Profit and loss account?

Answer:

Trading account is the part of Profit and Loss account.

Question 10.

What is called operating profit?

Answer:

Difference between gross profit and operating expenses is called operating profit.

Question 11.

Give the formula of operating expenses.

Answer:

Operating expenses = General admini¬strative expenses + Selling – distribution expenses + Depreciation.

Question 12.

Give the formula of operating profit.

Answer:

Operating profit = Gross profit -Operating expenses

![]()

Question 13.

What is meant by excess of the total of all incomes overall expenses?

Answer:

Excess of the total of all incomes overall expenses means Net profit.

Question 14.

What is called a credit balance of Profit and Loss account?

Answer:

A credit balance of Profit and Loss account is called Net profit.

Question 15.

Where is the balance of Profit and Loss account transferred?

Answer:

The balance of Profit and Loss account is transferred to Capital account in the Balance Sheet.

Question 16.

Which items are shown on the credit side of Trading account?

Answer:

Net sales, sale of scrap goods and closing stock of goods are shown on the credit side of the Trading account.

Question 17.

Which items are shown on the debit side of Profit and Loss account?

Answer:

Gross loss, administrative expenses, selling and distribution expenses, financial expenses and other expenses and losses are shown on the debit side of the Profit and Loss account.

Question 18.

Give the examples of other expenses and losses which are debited to Profit and Loss account.

Answer:

Donation, Depreciation on assets, Loss by fire or theft, Loss on sale of fixed assets, Loss on sale of investment, Bad debts, provision for expense or loss, etc. are the other expenses and losses.

Question 19.

Which items are deducted from capital?

Answer:

Net loss, Drawings, Goods are withdrawn for personal use and interest on drawings are deducted from capital.

Question 20.

What are called fictitious assets?

Answer:

Those assets which cannot be seen and have zero value in the market are called fictitious assets, e.g., Deferred revenue expenditure.

![]()

Question 21.

What are carriage inwards and carriage outwards?

Answer:

Carriage inwards represents the transport expenses incurred on the goods purchased. While carriage outwards represents the transport expenses incurred on the goods sold.

Question 22.

In how many different arrangements can Balance Sheet be prepared?

Answer:

Balance Sheet can be prepared in two different arrangements.

Question 23.

What are called current assets?

Answer:

Those assets which are convertible into cash in a short period are called current assets, e.g., Debtors, Bills receivables, etc.

Question 24.

Which assets are used to generate revenue income?

Answer:

Fixed assets are used to generate revenue income.

Question 25.

What are called intangible assets?

Answer:

Those fixed assets which can neither be seen nor touched are called intangible assets.

Question 26.

What is called Gross profit?

Answer:

If the total of credit side of Trading account is more than that of debit side, the balance amount is called as Gross profit.

Question 27.

Where is the Gross profit transferred?

Answer:

Gross profit is transferred to credit side of Profit and Loss account.

Question 28.

What is objective of Trading account?

or

Why Trading account is prepared?

Answer:

Trading account is prepared to know the gross profit or gross loss during the accounting period.

Question 29.

Which is the first component of final accounts?

Answer:

The first component of final accounts is Trading account.

![]()

Question 30.

State any three expenses related to production.

Answer:

Productive wages, royalty, depreciation of factory building, depreciation of plant and machinery, oil, grease, etc. are the expenses related to production.

Question 31.

Where are direct expenses recorded?

Answer:

Direct expenses are recorded on debit side of Trading account.

Question 32.

Where are indirect expenses indicated?

Answer:

Indirect expenses are indicated on debit side of Profit and Loss account.

Question 33.

Where are revenue incomes and revenue expenditures recorded?

Answer:

Revenue incomes and revenue expenditures are recorded in Trading account and Profit and Loss account.

Question 34.

State the different types of profit.

Answer:

There are three types or profit. They are Gross profit. Operating profit and Net profit.

Question 35.

From where is the operating profit obtained?

Answer:

Operating profit is obtained from the Profit and Loss account.

Question 36.

By which other name are operating expenses also called?

Answer:

Operating expenses are also called as managerial expenses.

Question 37.

Why is Profit and Loss account prepared?

Answer:

Profit and Loss account is prepared to ascertain nct profit or net loss.

Question 38.

What is Balance Sheet?

Answer:

A Balance Sheet Is a statement showing the financial position of the business In the form of Its assets and liabilities on a particular date.

Question 39.

Why is Balance Sheet prepared?

Answer:

Balance Sheet Is prepared to test arithmetical accuracy and to find out financial position of the business.

Question 40.

Explain the term: Net purchases

Answer:

When the amount of purchase returns and goods going out other than sales are deducted from the amount of purchases, the balancing amount is called net purchases.

Net purchases = Total Amount of purchases – (Amount of purchase returns + Amount of goods going out other than sales)

![]()

Question 41.

The following balances are taken from Debtors ₹ 1,00,000; Bad debts reserve

Net purchases = Total Amount of purchases – (Amount of purchase returns + Amount of goods going out other than sales) the trial balance of Bijal as on 31 -3 -’18: ₹ 6,000 Adjustment: provide bad debt reserve at 10 %, Pass adjustment entry.

Answer:

Adjustment Entry

| Date | Particulars | L.F. | Debit ₹ | Credit ₹ |

| 31-3-18 | Profit and Loss A/c Dr To Provision for bad debts account (Being the adjustment entry for additional provision made for bad debts.) |

4,000 |

4,000 |

Question 42.

The profit of a business at the end of the year is ₹ 3,30,000 and the manager is to be paid 10 % commission. Pass adjustment entry.

Answer:

Adjustment Entry

| Date | Particulars | L.F | Debit ₹ | Credit ₹ |

| Manager Commission A/c Dr To Outstanding Commission A/c (Being the adjustment entry for commission of manager on profit.) |

33,000 |

33,000

|

Question 43.

What do you mean by adjustment?

Answer:

Adjustment means those financial transactions of business which are not recorded or wrongly recorded in accounts and it is required for rectifications.

Question 44.

How many form of Balance Sheets are There? Name them

Answer:

There are two forms/structures prevail form and for presenting Balance Sheet:

- Horizontal or ‘T’

- Vertical or T form.

Question 45.

What are deferred revenue expenditures?

Answer:

Deferred revenue expenditures are fictitious assets.

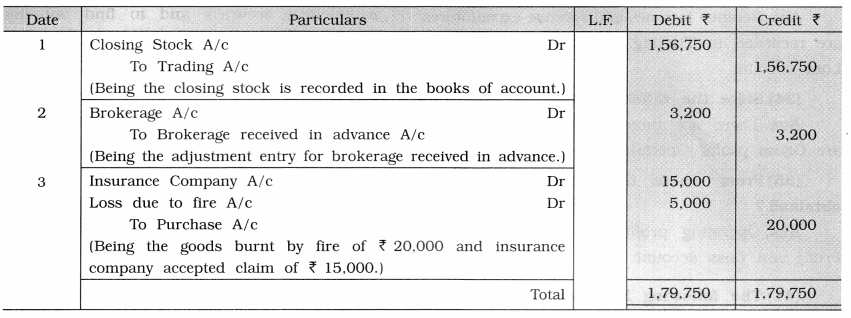

Pass / Write adjustment entries for the given information:

Question 1.

Pass adjustment entries for the following :

1. Closing Stock of ₹ 1,65,000 out of which value of 50 % of stock is 10 % more and market value of remaining goods is 10 % less.

2. Brokerage of ₹ 3,200 is received in advance.

3. Goods of ₹ 20,000 destroyed by fire. Insurance company has accepted a claim of ₹ 15,000.

Answer:

Journal Proper of Shri…

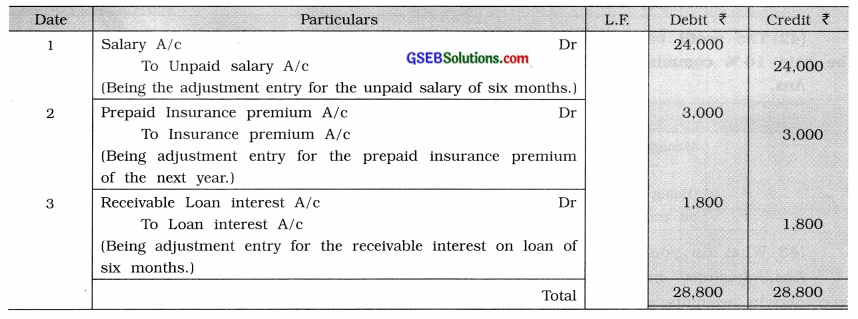

Question 2.

What adjustment entries will you pass in the following situations?

1. Salaries to six employees is outstanding for one month at a rate of ₹ 4,000 per month.

2. Insurance premium paid during the year was ₹ 15,000 of which ₹ 3,000 pertain to the next year.

3. A loan of ₹ 20,000 @ 18 % is given to a friend before six months. He has not paid any interest, so far, on this loan.

Answer:

Journal Proper of Shri…

![]()

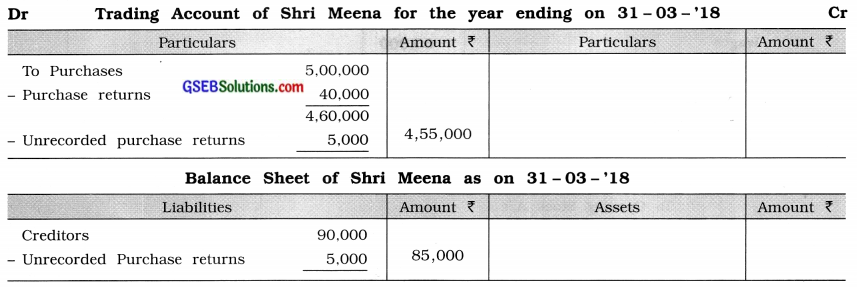

Question 3.

Show effect for the following in final accounts:

Trial Balance of Shri Meena as on 31-3-’18

| Particulars | L.F | Debit ₹ | Credit ₹ |

| Purchase | 5,00,000 | ||

| Purchase returns | 40,000 | ||

| Creditors | 90,000 |

Adjustment: Credit purchase returns of ₹ 5,000 were not recorded.

Answer:

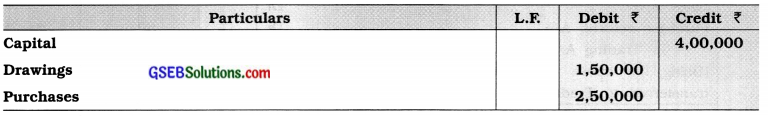

Question 4.

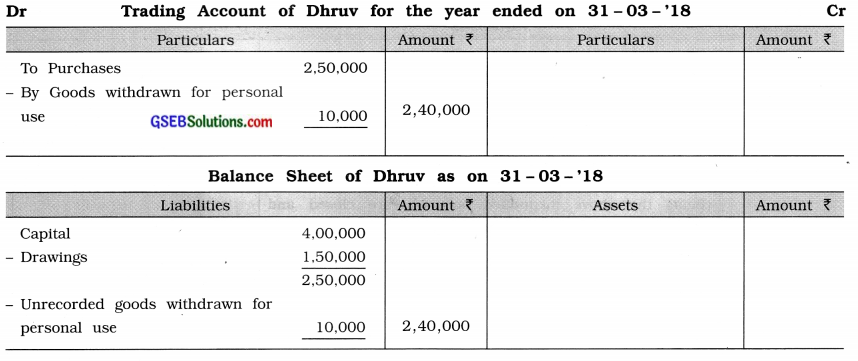

Show effect for the following in final accounts:

Trial Balance of Shri Dhruv as on 31-3-’18

Adjustment: Goods of ₹ 10,000 withdrawn for personal use.

Answer:

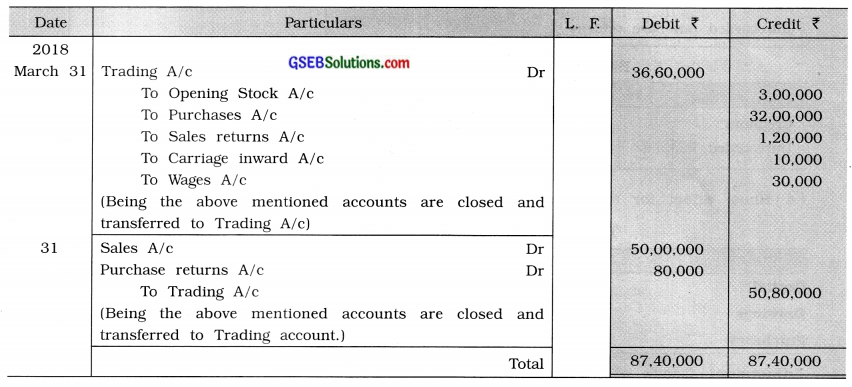

Question 5.

Following balance extracted from the trial balance of Shripal as on 31-3-’18. Pass closing entries for

1. Trading Account and 2. Profit and Loss Account.

| Particulars | Amount ₹ | Particulars | Amount ₹ |

| Stock (Dt. 1-4-’17) | 3,00,000 | Rent paid | 3,60,000 |

| Purchases | 32,00,000 | Rent received | 40,000 |

| Sales | 50,00,000 | Interest on long term loan | 25,000 |

| Purchase returns | 80,000 | Loss on sale of fixed assets | 15,000 |

| Sales returns | 1,20,000 | Profit on sale of fixed assets | 20,000 |

| Carriage inward | 10,000 | Dividend | 8,000 |

| Carriage outward | 15,000 | ||

| Wages | 30,000 | ||

| Salary | 1,70,000 |

Answer:

1. Closing entries for Trading Account:

2. Closing entries for Profit and Loss Account:

Write the correct option from those given below each question:

Question 1.

What is capital for the business?

(a) Income

(b) Expense

(c) Dues

(d) Debts

Answer:

(d) Debts

Question 2.

What is known from the study of Balance Sheet?

(a) Only paid Income tax

(b) Profit-Loss

(c) Only Assets and Receivables

(d) Financial position

Answer:

(d) Financial position

Question 3.

What is known from the study of Profit and Loss A/c?

(a) Profit

(b) Loss

(c) Result of the business

(d) Financial position

Answer:

(c) Result of the business

Question 4.

What is Demurrage for the business?

(a) Expense

(b) Income

(c) Loss

(d) Asset

Answer:

(a) Expense

![]()

Question 5.

At the end of accounting year, all goods accounts are transferred …………………… .

(a) to Trading A/c by closing entries

(b) to Profit and Loss A/c by closing entries

(c) to profit and Loss-Adjustment A/c by closing entries

(d) to Balance Sheet

Answer:

(a) to Trading A/c by closing entries

Question 6.

What is called to unsold goods at the end of the current accounting period?

(a) Opening stock

(b) Closing stock

(c) Average stock

(d) Dead stock

Answer:

(b) Closing stock

Question 7.

Where is salary-wages of trial balance shown in final accounts?

(a) In Trading A/c

(b) In Profit and Loss A/c

(c) In Balance Sheet

(d) In Suspense A/c

Answer:

(b) In Profit and Loss A/c

Question 8.

What is prepared to know the gross profit or gross loss during the accounting period?

(a) Trading Account

(b) Profit and Loss Account

(c) Trial balance

(d) Balance Sheet

Answer:

(a) Trading Account

Question 9.

In which account closing balance of Profit and Loss A/c is transferred?

(a) To Capital A/c

(b) To Drawings A/c

(c) To Bank A/c

(d) To Cash A/c

Answer:

(a) to Capital A/c

Question 10.

What is Balance Sheet?

(a) an account

(b) a statement

(c) a secondary book

(d) a basic book

Answer:

(b) a statement

Question 11.

What will be increased by net profit?

(a) Debt

(b) Dues

(c) Capital

(d) Drawings

Answer:

(c) Capital

![]()

Question 12.

What is the list of balances of unclosed accounts?

(a) Trial balance

(b) Balance Sheet

(c) Trading A/c

(d) Profit and Loss A/c

Answer:

(b) Balance Sheet

Question 13.

What is provident fund for the business?

(a) Liability

(b) Asset

(c) Reserve

(d) Dues

Answer:

(a) Liability

Question 14.

What is indicated by debit balance of Profit and Loss A/c?

(a) Gross profit

(b) Gross loss

(c) Net profit

(d) Net loss

Answer:

(d) Net loss

Question 15.

Opening stock + Purchases – Closing stock = ……………………. .

(a) Sales

(b) Total purchases

(c) Adjusted purchases

(d) Net purchases

Answer:

(c) Adjusted purchases

Question 16.

By which other name is right side of Balance Sheet known?

(a) Capital – Payables

(b) Liabilities

(c) Assets – Recivables

(d) Dues

Answer:

(c) Assets – Receivables

Question 17.

What is prepared on the basis of closing balance of each account?

(a) Balance Sheet

(b) Trial balance

(c) Trading A/c

(d) Profit and Loss A/c

Answer:

(b) Trial balance

Question 18.

After preparation of trial balance, next stage is called ………………….. .

(a) Balance Sheet

(b) Statement

(c) Final Accounts

(d) Trading A/c

Answer:

(c) Final Accounts

Question 19.

External Liabilities + Capital = …………………….. .

(a) Net value of business

(b) Total Assets

(c) Net profit

(d) Gross profit

Answer:

(b) Total Assets

Question 20.

On which type of assets depreciation is always charged?

(a) Current

(b) Fixed

(c) Fictitious

(d) Intangible

Answer:

(b) Fixed

Question 21.

On which side of Balance Sheet pre received income is shown?

(a) Assets

(b) Liabilities

(c) Credit

(d) Debit

Answer:

(b) Liabilities

![]()

Question 22.

Where is royalty of trial balance shown?

(a) Credit side of Profit and Loss A/c

(b) Debit side of Profit and Loss A/c

(c) Credit side of Trading A/c

(d) Debit side of Trading A/c

Answer:

(d) Debit side of Trading A/c

Question 23.

Closing stock is always valued at cost or market price whichever is ………………… .

(a) more

(b) less

(c) equal

(d) none of these

Answer:

(b) less

Question 24.

What is called wear and tear on fixed asset?

(a) depreciation

(b) appreciation

(c) gain

(d) loss

Answer:

(a) depreciation

Question 25.

What is called excess of assets over outside liabilities?

(a) Drawings

(b) Capital

(c) Income

(d) Net profit

Answer:

(b) Capital

Question 26.

To which account is net loss transferred?

(a) Capital A/c

(b) Drawings A/c

(c) Suspense A/c

(d) Capital loss A/c

Answer:

(a) Capital A/c

Question 27.

On which side of the Balance Sheet are prepaid expenses shown?

(a) Assets

(b) Liabilities

(c) Credit

(d) Debit

Answer:

(a) Assets

Question 28.

Which type of expense contributes to provident fund?

(a) Financial Expenses

(b) Administrative Expenses

(c) Selling and Distribution Expenses

(d) Other Expenses

Answer:

(b) Administrative Expenses

![]()

Question 29.

Which type of expense is donation?

(a) Selling and Distribution expenses

(b) Financial expenses

(c) Administrative expenses.

(d) Other expenses and losses

Answer:

(d) Other expenses and losses

Question 30.

What is wages or expenses incurred on the goods due to wastage called?

(a) Demurrage

(b) Darmayo

(c) Wharfage

(d) Kharajat

Answer:

(d) Kharajat

Question 31.

Darmayo means ………………………. .

(a) Annual salary or wages

(b) Half yearly salary or wages

(c) Monthly salary or wages .

(d) Weekly salary or wages

Answer:

(c) Monthly salary or wages

Question 32.

The capital of the owner will be decreased by which of the following?

(a) Net profit

(b) Net loss

(c) Net gain

(d) Net income

Answer:

(b) Net loss

Question 33.

How many types of profit are there?

(a) Two

(b) Three

(c) Four

(d) Five

Answer:

(b) Three

Question 34.

From the following which is formula of operating profit?

(a) Gross profit + Operating expenses

(b) Gross profit – Operating expenses

(c) Net profit – Operating expenses

(d) Gross profit – General expenses

Answer:

(b) Gross profit – Operating expenses

Question 35.

Which type of liability is a bill discounted in the bank?

(a) Short-term liability

(b) Long-term liability

(c) Current liability

(d) Contingent liability

Answer:

(d) Contingent liability

Question 36.

Which type of assets are deferred revenue expenditures?

(a) Fixed assets

(b) Intangible assets

(c) Fictitious assets

(d) Current assets

Answer:

(c) Fictitious assets

![]()

Question 37.

If interest on provident fund investment is given only in trial balance then where would its effect appear in final accounts?

(a) Credit side of Trading A/c

(b) Credit side of Profit and Loss A/c

(c) Added in assets side of provident fund investments in Balance Sheet.

(d) Added in Liabilities side of provident fund in Balance Sheet.

Answer:

(d) Added in Liabilities side of provident fund in Balance Sheet.

Question 38.

If closing stock of goods is given only in trial balance then where would its effect appear in the final accounts?

(a) Debit side of Trading A/c

(b) Credit side of Trading A/c

(c) Assets side of Balance Sheet

(d) Liabilities side of Balance Sheet

Answer:

(c) Assets side of Balance Sheet

Question 39.

Which balance has a reserve for discount on creditors?

(a) Credit

(b) Debit

(c) Nil

(d) Positive

Answer:

(b) Debit

Question 40.

Which type of expense is Wharfage?

(a) Expense relating to purchase

(b) Expense relating to production

(c) Expense relating to sell

(d) Expense relating to distribution

Answer:

(a) Expense relating to purchase