Gujarat Board GSEB Class 11 Commerce Economics Important Questions Chapter 9 National Income Important Questions and Answers.

GSEB Class 11 Economics Important Questions Chapter 9 National Income

Short Answer Type Questions

Question 1.

On which three concepts in national income based / calculated?

Answer:

Production, income and expenditure

![]()

Question 2.

State Alfred Marshall’s (Production based) definition of calculating national income.

Answer:

The net production of physical (tangible) and non-physical (service) things by using natural wealth (land) with capital and labour in a country during the year is called the national income of the country.

Question 3.

State Irving Fisher’s (Consumption based) definition of national income.

Answer:

The proportion of direct consumption of goods and services by the people of a country during a year is called the national income.

Question 4.

State A.C Pigou’s (money based) definition of national income.

Answer:

The flow of those things (goods) and services whose payments have been done through money or which can be easily presented by money is called national income.

Question 5.

What is factor payment?

Answer:

Income received by people/households by supplying the factors of production is called factor payment.

Question 6.

State the factors of production and return they earn.

Answer:

Land: Land earns rent. Labour: On selling labour the labourer earns wages. Capital: On providing capital, one earns interest. Entrepreneur: Entrepreneur earns profit.

Question 7.

Define national income in terms factors of production.

Answer:

The sum of total income earned by the nation from the contribution of four factors of production in national production is called national income. Thus, National income = Rent + Wages + Interest + Profits.

Question 8.

Define national product.

Answer:

The sum of total production value of final products and services obtained by various factors of production in various sectors namely agriculture, industries and services within a year is called the national product.

∴ National Product = Total Production of (Agriculture + Industries + Service sector)

Question 9.

What is open economy?

Answer:

The economy in which foreign trade takes place and government intervenes and play an important role is called open economy

Question 10.

What is circular flow of closed economy?

Answer:

The circular flow of three important components namely production, income and expenditure in a closed economy is called the circular flow of closed economy

Question 11.

What is GDP?

Answer:

The market value of total goods and services produced within the boundary of a country by its citizens as well as foreigners is called gross domestic product (GDP).

Question 12.

What is Gross National Product (GNP)?

Answer:

The market value of the total goods and services produced, by citizens of a country, within the country or in foreign country is called Gross National Product (GNP).

Question 13.

State the major difference between GDP and GNP

Answer:

The major difference between GDP and GNP is that in GDP production done within the boundary of the country is considered irrespective whether it is done by Indians or foreigners in India. However, in GNP production done by citizens done in a country or in a foreign country is considered.

Question 14.

What is Net National Product?

Answer:

The monetary value of goods and services obtained after deducting depreciation from gross national product (GNP) is called the net national product (NNP).

∴ Net National Product (NNP) = GNP – Depreciation

Question 15.

Define current price per capita income or per capita income at current price.

Answer:

If the per capita income is calculated using national income at the prices of current year, it is called Current Price Per Capita Income.

Question 16.

Define fixed price per capita income.

Answer:

The per capita income calculated using national income at the prices of the base year (fixed price) it is called Fixed Price Per capita Income

Question 17.

What is the production (output) method of calculating national income?

Answer:

The sum of monetary value of finished goods and services produced in agriculture, industries and service sector in a country is called the national income of that country.

Question 18.

State the classification of sectors done for calculating national income with Marshall’s method.

Answer:

To obtain the national income the economy is classified into various sectors like agriculture, industries, services, mines, construction, manufacturing, trade- commerce, transportation, communication, banking, education, etc.

Question 19.

Who is an exception while considering production done for self-consumption into national income?

Answer:

Farmer producing for his own consumption.

Question 20.

Why goods produced for police or defence are not fconsidered in national income?

Answer:

Counting the value of same product or expenditure twice is known as doubte counting.

![]()

Question 21.

What is double counting?

Answer:

Indirect taxs are deducted and subsidy is added

Question 22.

How are indirect tax and subsidy treated while calculating national income?

Answer:

To avoid double counting, instead of counting the value of goods that are half-made or in interim use, the monetary value of the final good and raw material used in it is separately valued.

Question 23.

How do you count value of finished goods to avoid double counting?

Answer:

In production process, when the production of goods goes from one stage to another stage, its monetary value increases. If this increase in value can be measured out and added in national product, the problem of double counting can be resolved.

Question 24.

How does value added method avoids double counting?

Answer:

- Finished goods and services and

- Imputed rent

Question 25.

State the income that is considered while calculating national income using production method.

Answer:

- Service of housewives

- Self-consumption (Except that produced by Indian farmers)

- Things produced for defence or police

- Double counting of goods/services

- Resale of goods and services

Question 26.

State the incomes that are not considered while calculating national income using production method.

Answer:

Depreciation and subsidies

Question 27.

Which incomes are deducted while calculating national income using production method?

Answer:

The summation of the income earned by the citizens of a country and the state is called the national income of that country obtained as per the income method.

Question 28.

What is the income method of calculating national income?

Answer:

Goods produced for defence or police cannot be sold to open market. Hence, they are not considered in national income.

Question 29.

Why income of interest is not included in national income?

Answer:

The interest obtained from the government is not considered as income. The reason for this is that a state generates income through taxes and pays it as interest which means that the money is simply transferred.

Question 30.

What is production?

Answer:

The goods produced in a stipulated time with available factors is called production.

Question 31.

What is base year?

Answer:

A year used for comparing the level of a particular economic index such as national income is called base year.

Question 32.

State incomes that are not considered while calculating national income using income method.

Answer:

- Income generated from gifts, rewards, prizes, tips, thefts, unemployment allowances, government assistance to elders, lotteries, etc.

- The income earned by selling second hand goods.

Question 33.

Define expenditure method of calculating national income.

Answer:

The method of considering the total expenditure incurred in purchasing finished goods or services during a financial year is called the expenditure method of measuring national income. Thus, National Income = Consumption expenditure + Investment expenditure + Government expenditure + Net export expenditure.

![]()

Question 34.

What is consumption expenditure?

Answer:

The expenditure incurred by citizens, families and firms on consumable goods is called consumption expenditure. It includes expenditure done on durable goods like TV, scooter, car, etc., perishable goods like food grains, fruits, vegetables, services like education, medical treatment, transportation and communication, etc.

Question 35.

What is investment expenditure?

Answer:

It is the expenditure incurred on building a factory, plant, machinery and necessary goods, equipment for running a business or profession, etc.

Question 36.

What is government expenditure?

Answer:

The expenditure incurred by general government on various administrative services like defence, law and order,

education etc. is called government expenditure.

Question 37.

What is net export expenditure?

Answer:

The difference between export and import of a country during the period of 1 year is called net export expenditure.

Question 38.

What is monetary national income?

Answer:

Monetary national income is the money value of final goods and services produced by residents of a country in a year, measured at the prices of the current year.

Question 39.

What is real national income?

Answer:

When we multiply the production of all goods with the market price of respective goods what we get is called monetary national income. The calculation of national income at base-year price or fixed price is called real national income. Real national income is obtained by multiplying the production of all goods with the fixed price of respective goods during the year.

Question 40.

Why real national income is a true figure compared to monetary national income?

Answer:

Real national income calculates national income at base-year prices. This means any change in national income reflects the true increase/decrease in production and hence standard of living. Hence, ……

Question 41.

What is depreciation?

Answer:

It is a gradual and permanent reduction in price of capital factor due to consumption. The depreciation occurs to machinery and capital factor during production process.

Question 42.

What is tax avoidance?

Answer:

When a tax payer uses loopholes of law, to avoid the payments of tax it is called tax avoidance. Tax Avoidance is legal.

Question 43.

What is tax evasion?

Answer:

When a tax payer does not fulfill the responsibility of paying tax it is called tax evasion. Tax evasion is illegal.

Question 44.

What is monetary value?

Answer:

The property of having material worth (often indicated by the amount of money something would bring if sold) is called the monetary value.

Long Answer Type Questions

Question 1.

Why national income is one of the most important criteria to measure the economic prosperity of a country.

Answer:

- National income is a basic concept of macroeconomics and so it is studied while studying macroeconomics.

- In order to derive national income of a nation, the nation measures all the economic activity done in the nation or say in the whole economy of the nation.

- The national income of a country is a balance sheet of the performance of its economy. So, national income tells us with the economic health of the economy.

- If the national income of an economy increases it is generally a symbol of well-being and if the national incom of an economy decreases or increases slowly it can be said that it is a symbol of an unhealthy economy.

- Thus, we can say that national income is one of the most important criteria to measure the economic prosperity of a country.

![]()

Question 2.

Give the general meaning of national income and state the concepts on which it is based and defined.

Answer:

(A) National income:

- The monetary value of the total production done in agriculture, industries and service sector in a country during a year is called the national income of that country.

- Thus, as per the definition if we say that the national income of India is ₹ 128 lakh crores, it means that in the given year India produced goods and services of ₹ 128 lakh crores in agriculture, industries and service sector combined.

(B) Concepts on which national income is based:

Production, consumption and money are three important concepts of national income and hence there are three corresponding definitions to each of these concepts. They are:

- Production-based definition

- Consumption-based definition

- Money based definition

Question 3.

State the various definitions of the national income based on various concepts and evaluate them.

Answer:

1. Alfred Marshall’s definition (Production based definition):

- The net production of physical (tangible) and non-physical (service) things by using natural wealth (land) with capital and labour in a country during the year is called the national income of the country. *

- Prof. Marshall lays stress on net production of goods and services in the definition and so this definition is based on production.

2. Irving Fisher (Consumption based definition):

- The proportion of direct consumption of goods and services by the people of a country during a year is called the national income.

- Fisher lays stress on consumption of physical and non-physical goods and services in this definition. Hence, his definition is based on consumption.

3. A.C. Pigou (Money based definition):

- The flow of those things (goods) and services whose payments have been done through money or which can be easily presented by money is called national income. In other words, the total income of society along with foreign income which can be easily measured with the help of money is called its national income.

- Pigou lays stress on money and so his definition is based on money.

Evaluation of the meaning of national income on the basis of various definitions:

- National income is a measurement of income obtained in a definite period of one year.

- In national income, the final products and services are only considered i.e. partially produced products and services are not considered.

- National income is a monetary value of final products and services.

- National income is calculated after deducting depreciation.

- Goods and services should either be produced or consumed in order to consider them in national income.

Question 4.

What do you infer about the national income after studying the definition given by various economists?

Answer:

Evaluation of the meaning of national income on the basis of various definitions:

- National income is a measurement of income obtained in a definite period of one year.

- In national income, the final products and services are only considered i.e. partially produced products and services are not considered.

- National income is a monetary value of final products and services.

- National income is calculated after deducting depreciation.

- Goods and services should either be produced or consumed in order to consider them in national income.

Question 5.

What do you mean by factor payment? Explain briefly

Answer:

Factor payment:

An economy is dependent on the production of goods and services. To produce goods and services the economy needs factors of production. Land, labor, capital and entrepreneur are four factors of production. Land is the primary factor of production.

- These factors of production serve some or the other purpose in the economy and earn returns.

- Land: Land earns rent.

- Labour: On selling labour the labourer earns wages.

- Capital: On providing capital, one earns interest.

- Entrepreneur: Entrepreneur earns profit.

- Thus, from the four factors of production four forms of earnings namely rent, wages, interest and profit are generated in the economy.

- All these four factors of production are owned by households. They supply these factors of production to firms and in return earn rent, wages, interest, and profit. Households buy goods and services with this money.

- Thus, factor payment means the income received by people by supplying the factors of production.

Question 6.

Define national income and national product and explain.

Answer:

(A) National income:

- The sum of total income earned by the nation from the contribution of four factors of production in national production is called national income.

- Thus, national’income is the summation of factor payments i.e.

National income = Rent + Wages + Interest + Profit

(B) National product:

- The sum of total production value of final products and services obtained by various factors of production in various sectors namely agriculture, industries and services within a year is called the national product.

- In other words, national product means the goods and services produced by various firms in a country during a year.

- National Product = Total Production of (Agriculture + Industries + Service sector)

Relationship between national product and national income:

- If a state neither levy any taxes, etc. nor involves in foreign trade i.e. import-export then the national income and national product remain similar.

- Price of a commodity is higher than production expenditure due to taxes charged on it and so the national product is higher than national income.

- When the government gives subsidies, the national product becomes lower than national income.

Question 7.

Define national product and explain it briefly.

Answer:

National product:

- The sum of total production value of final products and services obtained by various factors of production in various sectors namely agriculture, industries and services within a year is called the national product.

- In other words, national product means the goods and services produced by various firms in a country during a year.

- National Product = Total Production of (Agriculture + Industries + Service sector)

Question 8.

How are national product and national income related?

Answer:

Relationship between national product and national income:

- If a state neither levies any taxes, etc. nor involves in foreign trade i.e. import-export then the national income and national product remain similar.

- Price of a commodity is higher than production expenditure due to taxes charged on it and so the national product is higher than national income.

- When the government gives subsidies, the national product becomes lower than national income.

Question 9.

Explain closed economy and open economy.

Answer:

Theoretically, there are two types of economy namely

- Closed economy and

- Open economy.

1. Closed economy:

- The closed economy is the one in which there is no role of foreign trade.

- Such economy does not undergo economic transactions with other countries.

- Neither any goods, services and factors of production are exported from such country nor any goods, services and factor of production are imported in such country.

- Thus, closed economy is self-dependent or self-reliant.

2. Open economy:

- In open economy, foreign trade plays an important role.

- Government also plays an important role in such economy.

- Such an economy has import-export relations with other countries.

![]()

Question 10.

State the assumptions of the circular flow of national income.

Answer:

Assumptions:

- The closed economy is the one in which there is no role of foreign trade.

- Such economy does not undergo economic transactions with other countries.

- Neither any goods, services and factors of production are exported from such country nor any goods, services and factor of production are imported in such.country. Thus, closed economy is self-dependent or self-reliant.

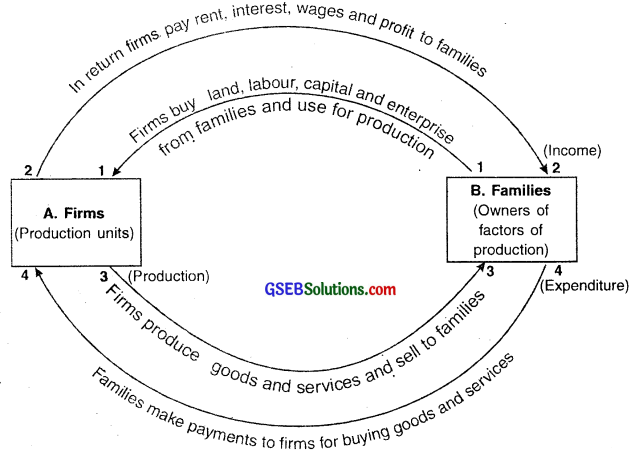

Question 11.

Draw a diagram for circular flow of national income in a closed economy and label it.

Answer:

Circular flow of production, income and expenditure in closed economy

Question 12.

What is per capita income? Explain with the help of an example.

Answer:

Per capita income (PCI):

- The way national income is an indicator of economic growth, the per capita income is an indicator of national economic development.

- The division of gross national income with total population of that nation is called the per capita income.

Per captia income = \(\frac{\text { Gross National Income }}{\text { Total Population }}\)

Example:

- Suppose the national income of a country in a given year is ₹ 60,000 crores. The population of that country in that year is 2 crores.

- Then, Per Capita Income (PCI) = \(\frac{60,000 \text { crore }}{2,000 \text { crore }}\) = ₹ 30,000

- The per capita income of the given country is ₹ 30,000. It means that on an average every citizen of this country earns an income of ₹ 30,000 during a year.

- Thus, per capita income is the average income per individual. Since, PCI is an average income of entire nation, some individuals might be earning less and some more. Hence, PCI is just an indicative figure and not a true figure of individual income.

- If the per capita income is high, the citizens will able to afford more goods and services and their standard of living will improve.

Question 13.

State the two methods by which per capita income can be calculated.

Answer:

’Per capita income can be calculated in two ways as shown below:

(A) Current price per capita income:

If the per capita income is calculated using national income at the prices of current year, it is called Current Price Per Capita Income.

(B) Fixed price per capita income:

If per capita income is calculated using national income at the prices of the base year (fixed price) it is called Fixed Price Per capita Income.

Question 14.

Per capita income is not a true criterion of individual income. Give reason.

Answer:

- When we divide gross national income with total population of a nation we get the per capita income of the nation.

- As per this definition, per capita income is just a simple mathematical average. It does not show the spread of income among individuals.

- Since, PCI is an average income of entire nation, some individuals might be earning less and some more. Hence, PCI is just an indicative figure and not a true criterion of individual income.

Question 15.

State the various methods of calculating national income and define them.

Answer:

There are three concepts of national income namely

- Production

- Income and

- Expenditure.

Based on these three methods there are methods to calculate national income. They are:

- Production Method

- Income Method and

- Expenditure Method.

I. Production (output) method:

- The sum of monetary value of finished goods and services produced in agriculture, industries and service sector in a country is called the national income of that country.

- This method of calculating national income has been developed from the definition given by Prof. Marshall.

1. Income method:

- The summation of the income earned by the citizens of a country and the state is called the national income of that country obtained as per the income method.

- This method of measuring national income has been developed from the definition given by Prof. Pigou.

2. Expenditure method:

- The method of considering the total expenditure incurred in purchasing finished goods or services during a financial year is called the expenditure method of measuring national income.

- This method has been devefoped from the definition given by Prof. Fisher.

Question 16.

Double counting gives a false picture of national income. Give reason.

Answer:

- Double counting means counting the value of the same product (or expenditure) twice i.e. more than once.

- According to production method while calculating national income, the value of only final products and services should be considered.

- For example, for an iron manufacturer, iron is a final product and for a machine manufacturer the machine which consists of iron is a final product. In this sense, the value of iron gets double counted.

- This is incorrect and so double counting should be removed from national income accounting.

- When the value of a commodity is calculated for more than one time in national income it gives an over-valued national income and hence a false picture.

![]()

Question 17.

List out the incomes/items that are considered, not considered or deducted while calculating national income through production method.

Answer:

Types of incomes and their role while calculating national income:

(I) Incomes that are considered:

- Finished goods and services

- Imputed rent

- Export

(II) Incomes that are not considered:

- Service of housewives

- Self-consumption (Except that produced by Indian farmers)

- Things produced for defence or police

- Double counting of goods/services

- Resale of goods and services

- Smuggled/Illegal goods

(III) Incomes or items that are deducted:

- Depreciation

- Indirect taxes are deducted whereas subsidies are added

Question 18.

Define and explain in brief the production method of calculating national income.

Answer:

Production (output) method:

- The sum of monetary value of finished goods and services produced in agriculture, industries and service sector in a country is called the national income of that country.

- Thus, National income – (Production in agriculture + Production in industries + Production in service sector) x Market value

- This method of calculating national income has been developed from the definition given by Prof. Marshall.

Classification of economy in different sectors:

To obtain the national income the economy is classified into various sectors like agriculture, industries, services, mines, construction, manufacturing, trade-commerce, transportation, communication, banking, education, etc.

Question 19.

Give an idea about the incomes that are considered while calculating the national income with production method.

Answer:

Incomes that are considered:

1. Selection of goods or services:

Value of only finished goods and services produced in the economy is considered i.e. value of goods and services still in the process of production are not calculated.

2. Imputed rent:

- Those who live in their own house do not need to pay rent. This benefit of rent that they get is a part of their income and is called imputed rent.

- Here we assume that if the house is given to someone on rent it can earn rental income and so that value is considered in national income.

3. Export:

Value of total export is added.

Question 20.

Give an idea about the incomes that are not considered while calculating the national income with production method.

Answer:

Incomes that are not considered:

1. Service of housewives:

Household work done by housewives is not sold in the market. Hence, its monetary value cannot be measured anci so is not considered while calculating national income.

2. Self-consumption:

- Goods produced for seif-consumption are not sold in market so their monetary value cannot be measured. Hence, such goods are not considered in national income.

- However, as an exception the food-grain produced by Indian farmers for self-consumption is considered in national income.

3. Defence (Police):

There are no markets for goods produced for defence and police services except using them in defence/police. Hence, these goods are not considered in calculation of national income.

4. Double counting:

- Double counting means counting the value of the same product (or expenditure) twice i.e. more than once.

- According to production method while calculating national income, the value of only final products and not the interim products or products and services in process.

- This is incorrect and so double counting should be removed from national income accounting because it over-values national income.

There are two ways to avoid double counting. They are:

(a) To count the value of finished goods only.

(b) Value Added Method.

5. Resale:

- If a good was produced in the past its value was counted in the national product at that time. When it is resold its value is not counted. If it is counted, it will be double counting.

- For example, if a house purchased in year 2000 is resold today this resale is not considered in national product.

6. Smuggled/lllegal goods:

The value of smuggled or illegal goods is not considered in calculation.

Question 21.

Give an idea about the incomes that are deducted while calculating the national income with production method.

Answer:

Incomes or items that are deducted:

1. Depreciation:

During the process of production the depreciation related to capital factor is deducted from the national product.

2. Indirect tax and subsidy:

- While deriving the market value of a good, the indirect taxes of the government levied on the goods are added.

- Hence, while finding out national product, the indirect taxes are deducted whereas the subsidy given by government is added.

Question 22.

List out the incomes/items that are considered, not considered or deducted while calculating national income through income method.

Answer:

Types of incomes and their role while calculating national income:

(I) Incomes that are considered:

- Income earned from factors of production namely,

(A) Income of rent,

(B) Income of interest,

(C) Income of wages and

(D) Income of profit. - Net foreign income i.e. income through export-import.

- Income generated as commission or brokerage on sale of consumable goods.

- Incomes which show flow of production of goods or services in economy which increase the monetary value of goods of the economy.

(II) Incomes that are not considered:

- Income generated from gifts, rewards, prizes, tips, thefts, unemployment allowances, government assistance to elders, lotteries, etc.

- The income of the second hand goods.

(III) Incomes that are deducted:

Subsidy given by the government.

Question 23.

Define and explain in brief the income method of calculating national income.

Answer:

Income method:

- The summation of the income earned by the citizens of a country and the state is called the national income of that country obtained as per the income method. .

- To calculate the national income through this method, the rent, interest, wages and profits obtained from the four factors of production namely land, capital, labour, and entrepreneur are added together.

- Moreover, the income obtained from foreign countries is added and the payment done in the form of rent, interest, wages and profits for foreign factors used in the country is deducted.

- This method of measuring national income has been developed from the definition given by Prof. Pjgou.

Question 24.

Give an idea about the incomes that are considered while calculating the national income with income method.

Answer:

Incomes that are considered:

1. Income earned from factors of production:

(A) Income of rent:

- The rent obtained on land/building.

- Those who live in their own house do not need to pay rent. This benefit of rent that they get is a part of their income and is called imputed rent. ‘ It is considered in national income.

- The income obtained through various rights such as copy right of a book, patent, etc.

(B) Income of interest:

- The interest obtained by people on their capital during a year.

- The interest obtained from the government is not considered as income. The reason for this is that a state generates income through taxes and pays it as interest which means that the money is simply transferred.

(C) Income of wages:

The wage or salary given to labourers for their work during a year.

(D) Income of profit:

The income obtained in the form of profit or dividend by investor/. It includes reserved profit and taxes paid on it.

2. Other incomes:

(A) Net foreign income i.e. income through export-import.

(B) Income generated as commission or brokerage on sale of consumable goods.

(C) Incomes which show flow of production of goods or services in the economy and which increase the monetary value of goods of the economy.

![]()

Question 25.

Give an idea about the incomes that are not considered while calculating the national income with income method.

Answer:

Incomes that are not considered:

- Income generated from gifts, rewards, prizes, tips, thefts, unemployment allowances, government assistance to elders, lotteries, etc.

- The income of the second hand goods is not considered. For example, the income obtained by selling old mobile phones.

Question 26.

State and explain the income obtained through factors of production.

Answer:

Incomes that are considered:

1. Income earned from factors of production:

(A) Income of rent:

- The rent obtained on land/building.

- Those who live in their own house do not need to pay rent. This benefit of rent that they get is a part of their income and is called imputed rent. ‘ It is considered in national income.

- The income obtained through various rights such as copy right of a book, patent, etc.

(B) Income of interest:

- The interest obtained by people on their capital during a year.

- The interest obtained from the government is not considered as income. The reason for this is that a state generates income through taxes and pays it as interest which means that the money is simply transferred.

(C) Income of wages:

The wage or salary given to labourers for their work during a year.

(D) Income of profit:

The income obtained in the form of profit or dividend by investor/. It includes reserved profit and taxes paid on it.

Question 27.

Which method should a nation adopt to calculate national income?

Answer:

There are three methods of calculating national income. They are

- Production method

- Income method and

- Expenditure method.

- All the methods are equally reliable and so one can adopt any of these three methods for calculating national income.

- If true data is available, national income will be the same irrespective of the method of calculation used.

- However, every method has one or the other limitation. Hence, it is said that these methods are mutually complementary to each other and can be used to cross-verify the figures obtained from any method.

- For example, if national income is calculated in form of production its truthfulness can be tested in terms of expenditure.

- As per the practice of economics, the method of production is suitable for developing countries like India whereas for countries like America and Russia, the methods of income and expenditure are suitable.

- So we can say that all the methods have their own pros and cons and hence the decision of using the method of calculation of nation lies on the country.

Question 28.

Define and briefly explain the expenditure method of calculating national income.

Answer:

Expenditure method:

- All domestically produced goods and services are produced for final use either by consumers for consumption or by producers for investment. Individuals incur expenditure (i.e. need to spend money) for using these gpods and services. The total expenditure in a given year is called the GDP i.e. Gross Domestic Product.

- The method of considering the total expenditure incurred in purchasing finished goods or services during a financial year is called the expenditure method of measuring national income.

- This method has been developed from the definition given by Prof. Fisher.

- In this method, the national inosiepe is measured by summing up the total monetary expenditure incurred on goods and services by individuals, families, firms and government during a year.

- Thus, National Income = Consumption expenditure + Investment expenditure + Government expenditure + Net export expenditure.

Question 29.

State and explain the four factors of monetary expenditure to be considered while calculating national income with expenditure method.

Answer:

Four factors of monetary expenditure:

The various components of final expenditure considered in national income can be divided into four parts. They are:

(A) Consumption expenditure:

- The expenditure incurred by citizens, families and firms on consumable goods is called consumption expenditure.

- It includes expenditure done on durable goods like TV, scooter, car, etc., perishable goods like food grains, fruits, vegetables, services like education, medical treatment, transportation and communication, etc.

(B) Investment expenditure:

It is the expenditure incurred on building a factory, plant, machinery and necessary goods, equipment for running a business or profession, etc.

(C) Government expenditure:

- It refers to the expenditure incurred by government on various administrative services like defence, law and order, education, etc.

- Consumption expenditure, investment expenditure, administrative expenditure, etc. are different types of expenditures done by central government, state government and local bodies.

(D) Net export expenditure i.e. Export minus Import:

- It refers to the difference between exports and.imports of a country during a period of one year.

- The expenditure done on importing foreign goods by citizens of country is the expenditure of the country. Similarly, our export is expenditure incurred by foreign citizens on domestic goods.

- Therefore, the difference between these two is the net export which is included in the national income.

Question 30.

Explain with an example the difficulty experienced while calculating national income with expenditure method.

Answer:

Difficulty in calculating national income through expenditure:

The official data of people’s expenditure cannot be obtained correctly and therefore it becomes difficult to calculate national income by this method.

Example:

- Suppose a business person named Arav gives ₹ 30,000 as salary to Milap, who works as his accountant and considers ₹ 30,000 as the expenditure incurred.

- Now Milap gives ₹ 3000 to Khushbu who is his domestic helper. This becomes Milap’s expenditure. Now, the question that arises is ‘What is the actual expenditure? ₹ 30,000 or ₹ 30,000 + ₹ 3000 = ₹ 33,000?

- So, even in this method the problem of double counting arises in calculating national income.

Question 31.

What is the importance of monetary income or real income in calculation of national income?

OR

One cannot neglect the importance of monetary income and real income in calculating national income. Give reason.

Answer:

National income is measured by the criterion of money. The question that arises here is that value of money keeps on fluctuating.

- The instability of money causes price to fluctuate i.e. increase or decrease. -> If we do not consider, calculate and compare national income with some stable prices, we don’t get a correct figure.

- For example, if the price increases, national income also increases in spite of no rise in production.

- Hence, increase in national income can be considered true only if there is increase in production too.

- These concepts are clarified by monetary income and real income. Hence, it is utmost important to study them for calculating national income.

Question 32.

Differentiate between monetary national income (National income at current price) and Real national income (National income at base price).

Answer:

table-5

Question 33.

Monetary national income is not a true measure of national income. Give reason.

Answer:

- When we multiply the production of all goods with the market price of respective goods of the current year what we get is called monetary national income.

- Suppose if the prices have doubled in the current year whereas the production has remained same as the previous year. It means that the national income will be double in the current year.

- Although the national income has doubled, it has increased because the prices have increased and not because production has increased.

- This means that people have been consuming same amount of quantity in the current year as they used to in the previous year.

- So, we can say that consumption of product has not increased among people and so the overall standard of living has not improved.

- Hence, monetary national income is not a true measure of national income.

![]()

Question 34.

Real national income is what a country should focus on. Give reason. OR Real national income gives the true picture of people’s standara of living. Give reason.

Answer:

- The calculation of national income at base-year price or fixed price is called real national income.

- Since real national income is obtained by considering the price of base- year, it reflects the change in production. In other words, rise in national income also show rise in production and hence rise in consumption.

- If national income increases due to increase in production it means that people consume more products or more people consume the products. In either case, since the production has increased the consumption and standard of living of people have become higher.

- Hence, real national income is a better measure of national income as compared to monetary income and so a country should focus on real national income.

Multiple Choice Questions

Question 1.

The national income of a country is a _______ of the performance of its economy.

(A) Result

(B) Calculation

(C) Balance sheet

(D) Overview

Answer:

(C) Balance sheet

Question 2.

A low national income represents _______ of the nation.

(A) Poor health

(B) Downtrodden development

(C) Poverty

(D) All of these

Answer:

(A) Poor health

Question 3.

Irving’s definition of national income is based on

(A) Production

(B) Consumption

(C) Expenditure

(D) Income

Answer:

(B) Consumption

Question 4.

Pigou stresses on _______ to define national income.

(A) Production

(B) Consumption

(C) Income

(D) Money

Answer:

(D) Money

Question 5.

National income considers _______

(A) Interim plus final products and services

(B) Unsold stock of previous year plus production of current year

(C) Final product and services

(D) Unsold stock plus interim goods and services plus final goods and services

Answer:

(C) Final product and services

Question 6.

Which of the following is not generated out of the factors of production?

(A) Rent

(B) Interest

(C) Wages

(D) None of these

Answer:

(D) None of these

![]()

Question 7.

National income = National product if _______

(A) There are no government taxes

(B) There is no foreign trade

(C) There are no taxes and subsidies

(D) Both (A) and (B)

Answer:

(D) Both (A) and (B)

Question 8.

In closed economy, there is no role of

(A) Government taxes

(B) Foreign trade

(C) Government subsidies

(D) Capital goods

Answer:

(B) Foreign trade

Question 9.

Which of the following is not a component of the circular flow of closed economy?

(A) Income

(B) Production

(C) Expenditure

(D) None of these

Answer:

(D) None of these

Question 10.

There are _______ ways to measure national income.

(A) 2

(B) 3

(C) 4

(D) Several

Answer:

(B) 3

Question 11.

Which of the following focuses on production done within the boundary limits of a nation?

(A) GDP

(B) PCI

(C) NNP

(D) GBP

Answer:

(A) GDP

Question 12.

NDP = _______

(A) GDP + Depreciation

(B) GDP – Depreciation

(C) GDP + net income obtained from foreign countries

(D) GNP – Depreciation

Answer:

(B) GDP – Depreciation

Question 13.

In GNP, the most important part is _______

(A) Depreciation must be deducted

(B) Net income from foreign countries must be deducted

(C) Production must have been done by citizens irrespective from wherever

(D) Production must be done within the boundary of the nation

Answer:

(C) Production must have been done by citizens irrespective from wherever

![]()

Question 14.

GNP = _______

(A) GDP – Depreciation

(B) NNP + Depreciation

(C) GDP + total income from foreign countries – Total payment to foreign countries

(D) Both (B) and (C)

Answer:

(D) Both (B) and (C)

Question 15.

Per capita income gives _______

(A) Average income of a person

(B) Net income of a person

(C) Individual income of a person

(D) Total income of a person

Answer:

(A) Average income of a person

Question 16.

A higher per capita income represents _______

(A) Higher individual income

(B) Higher proportion of goods and services obtained by citizens

(C) Higher national income

(D) None of these

Answer:

(B) Higher proportion of goods and services obtained by citizens

Question 17.

Which of the fallowing is not a method of calculating national income?

(A) Income method

(B) Production method

(C) Expenditure method

(D) None of these

Answer:

(D) None of these

Question 18.

Division of sectors into agriculture, industries, mines, trade-commerce, etc. is done in _______ method.

(A) Production

(B) Expenditure

(C) Income

(D) All of these

Answer:

(A) Production

Question 19.

Which of the following is not included in counting national income through production method?

(A) Service of house-wife

(B) Goods for self-consumption

(C) Goods produced for defense

(D) All of these

Answer:

(D) All of these

Question 20.

Double counting can be avoided with the help of

(A) Value added method

(B) Counting value of finished goods only

(C) Depreciation Calculation method

(D) Both (A) and (B)

Answer:

(D) Both (A) and (B)

Question 21.

Who gave the income method of calculating national income?

(A) Marshall

(B) Fisher

(C) Pigou

(D) Samuelson

Answer:

(C) Pigou

![]()

Question 22.

Which method assumes income = expenditure?

(A) Income

(B) Production

(C) Expenditure

(D) Both (A) and (C)

Answer:

(C) Expenditure

Question 23.

Factors of monetary expenditure includes

(A) Consumption and net export expenditure

(B) Consumption and government expenditure

(C) Investment and government expenditure

(D) Both (A) and (C)

Answer:

(D) Both (A) and (C)