Gujarat Board GSEB Class 11 Organization of Commerce and Management Important Questions Chapter 2 Business Services-1 Important Questions and Answers.

GSEB Class 11 Organization of Commerce and Management Important Questions Chapter 2 Business Services-1

Short Answer Type Questions

Question 1.

State the principles of insurance.

Answer:

- Principle of utmost good faith,

- Principle ofindemnity,

- Principle of insurable interest and

- Principle of subrogation.

Question 2

What is premium?

Answer:

The amount that an insuree pays to buy an insurance policy is known as premium.

![]()

Question 3.

What does principle of utmost good faith says?

Answer:

It says that both the insurer and insurer have complete faith on each other. Both, the insuree and insurer will provide all necessary information that is needed while entering into an insurance contract.

Question 4.

What happens if the principle of utmost faith is broken?

Answer:

The insurance policy stands null and void and the insuree can neither claim the compensation nor get back the premium he paid so far.

Question 5.

What does principle of indemnity say?

Answer:

It says that the insuree cannot earn profit from an insurance policy and that he can only get that much compensation for which he has taken the insurance.

Question 6.

What do you mean by principle o insurable interest? Give one example

Answer:

This principle says that the insuree should have financial interest in the product for which he seeks insurance. For e.g., if our house gets damaged or destroyed we will have interest in getting a financial compensation for it but if our neighbour’s house gets damaged we may not have any interest in his financial loss.

Question 7.

What is principle of subrogation?

Answer:

As per this principle when the insuree claims for the financial loss he facufr for a product and receives the compensation he losses the ownership of that product and the insurance company becomes the owner of the damaged product.

Question 8.

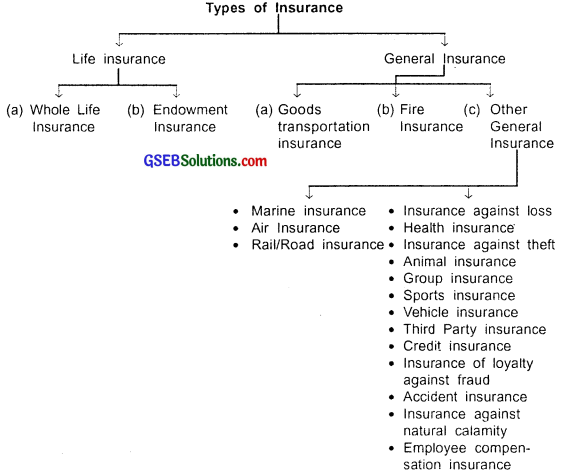

State the types of life insurance?

Answer:

- Whole life insurance and

- Endowment insurance.

Question 9.

Who is a heir or nominee in insurance?

Answer:

The person who receives the amount of insurance in case the insuree dies. The name of heir is to be mentioned in the insurance contract.

Question 10.

What is whole life insurance?

Answer:

A life insurance policy in which the insuree pays a premium periodically for the policy whole life is called whole life insurance. After the insuree dies his heir gets the pre-decided sum mentioned in the insurance agreement as compensation from the insurance company.

Question 11.

What is endowment insurance?

Answer:

A life insurance in which the insuree does not takes insurance for the whole life but only for a specific period is called endowment insurance. On maturity if the insuree is alive he gets the money from the insurance company. If he dies his heir gets it.

Question 12.

State the main types of general insurance.

Answer:

- Goods transportation insurance,

- Fire insurance and,

- Other general insurance.

Question 13.

What is goods transportation insurance?

Answer:

When goods are transported from one place to another there lies a risk of damage, loss, theft, etc. of goods. The insurance that covers such risks is called goods transportation insurance.

Question 14.

What is marine insurance?

Answer:

The insurance that covers the risk faced by ship and goods transported by ship is called marine insurance.

Question 15.

Who started marine insurance? When?

Answer:

Lloyd’s organization of London; More than 325 years ago.

Question 16.

What is aviation (air) insurance?

Answer:

Insurance against claims and losses arising from maintenance and . use of aircrafts or airports including damage to aircraft, personal injury, etc. is called aviation insurance.

Question 17.

Why air insurance is not advisable with respect to transportation of goods?

Answer:

Air insurance is very costly. Moreover, it cannot carry a large quantity of goods that too in various shapes and sizes.

Question 18.

Define rail/road insurance.

Answer:

An insurance that provides compensation against risks such as theft, robbery, damage to goods, etc. when they are transported either through trains or through road areas known as rail/road transport.

Question 19.

What is fire insurance?

Answer:

An insurance in which the insurance company agrees to pay compensation against the damage or destruction caused due to fire is known as fire insurance.

Question 20.

Give few examples of general insurance under the category other general insurance’.

Answer:

Third party insurance, vehicle insurance, medical insurance, travel insurance, insurance against cancellation of an event

or a match, etc.

Question 21.

What is medical insurance?

Answer:

An insurance that covers a person’s medical as well as surgical expenses is called medical insurance.

Question 22.

Who evolved insurance sector in India? Why did India decide to nationalize the insurance sector?

Answer:

The British; Because the British as well as Indian insurance companies were following unfair trade practices.

Question 23.

Why did LIC enjoy monopoly till 90s?

Answer:

When life insurance sector was nationalized the government established a national insurance company called the LIC. Since there was no other insurance company except LIC till the time insurance sector was again opened for private insurance companies in 90s, LIC enjoyed the monopoly.

Question 24.

Under which act and when was the general insurance industry nationalized?

Answer:

In 1972 the Government of India passed the General Insurance Business (Nationalism) Act and nationalized the General Insurance business with effect from 1 January, 1973.

Question 25.

Why was IRDA established?

Answer:

To analyze and develop the insurance industry in India.

Question 26.

What is IRDA?

Answer:

IRDA stands for Insurance Regulatory and Development Authority. It is a supreme, autonomous and legal institution which looks after me regulatory and development activities in the field of insurance.

Question 27.

How much ownership stake can foreign insurance companies have in India?

Answer:

Foreign insurance companies can have 49% stake in Indian insurance companies

Question 28.

State any two objectives of IRDA.

Answer:

To give more choices to policy buyers and holders while selecting an insurance company. To promote healthy competition among insurance companies so that customers can get better services at lower premium.

![]()

Question 29.

What is the primary function of a post office?

Answer:

To collect, process, transmit and deliver the mails.

Question 30.

State the mail services provided by the postal department.

Answer:

- General post letters,

- Registered posts,

- Parcel services

- Value payable post (VPP), etc.

Question 31.

List out the financial services provided by the postal department.

Answer:

- Recurring deposit,

- Time deposit,

- National Savings Certificate (NSC),

- Kisan Vikas Patra,

- Public Provident Fund (PPF),

- Monthly Income Scheme, etc.

Question 32.

Which agencies functions similar to post office?

Answer:

Courier agencies and aangadiyas.

Question 33.

What is a registered post?

Answer:

A registered post is a post which is handled with extra care by the postal department. The postal department keeps record of that post at all stages and also provides acknowledgement of post received to the sender if he wishes to.

Question 34.

What is VPP?

Answer:

VPP stands for Value Payable Post. Under VPP the buyer of a product can receive the product at his convenient address and make payment once he receives it. The postal department provides these services and charges a commission from the buyer once it delivers him the product.

Question 35.

What is speed post/parcel?

Answer:

It is a very quick service of the postal department. Under this service the postal department guarantees to deliver the post or parcel speedily with a specific period of time at almost all locations of India.

Question 36.

What is express parcel?

Answer:

Under express parcel service an individual or a business firm can send parcels to their concerned receivers very speedily that too within specified time limit. The postal department sends these parcels either by air or any other very fast means of transport.

Question 37.

List out four saving services offered by the postal department.

Answer:

Recurring deposit, Time deposit, Monthly Income Scheme, National Savings Certificate, etc.

Question 38.

What is recurring deposit scheme of Postal Department?

Answer:

A deposit scheme under which a person can open a recurring deposit account with the post office and deposit a specific amount every month for five years is called the recurring deposit scheme.

Question 39.

What is term deposit scheme of postal department?

Answer:

A deposit scheme of post office where in a person can choose to keep the money he deposited for 1, 2, 3 or 5 years with the post office is called term deposit. One needs to deposit a minimum of ₹ 200 and then in its multiple.

Question 40.

What is National Savings Certificate?

Answer:

National Savings Certificate is a government savings certificate or say government savings bond primarily used for small savings under which a person can buy an NSC from post office and claim its interest along with its principle at the end of 5 years or 10 years depending on the maturity of NSC.

Question 41.

What is Kisan Vikas Patra?

Answer:

KVP is a savings scheme of postal department under which a person can buy a KVP and in return obtain double his invested money in 100 months. It is available in denominations of rupees 1000, 5000, 10.000 and 50,000.

Question 42.

What is Monthly Income Scheme?

Answer:

Monthly income scheme is a savings scheme by the postal department which is targeted for people who wish to earn interest every month. One needs to maintain MIS account for a minimum 5 years. However, one can withdraw money after 1 year as per the terms and conditions of the postal department

Question 43.

What is PLI? Why was it started?

Answer:

PLI is the abbreviation for Postal Life Insurance. It was started as a welfare scheme for the postal department employees.

Question 44.

What is Money Order?

Answer:

A money order is an order issued by the post office to pay money to the person on whose name the money order is sent.

Question 45.

State the advanced forms of money order.

Answer:

- Electronic money order (eMO),

- Instant money order (iMO).

Question 46.

What is eMO?

Answer:

eMO means Electronic money Order. It is a web based rapid money transfer service where in a receiver can receive the money within 24 hours. One can send a minimum of ₹ 1 to ₹ 5000 through eMO.

Question 47.

What is iMO?

Answer:

iMO is a web based instant money transfer service where in a receiver can receive money within the next minute the sender sends the money. A minimum of ₹ 1000 to ₹ 50,000 can be sent to any part of India.

Question 48.

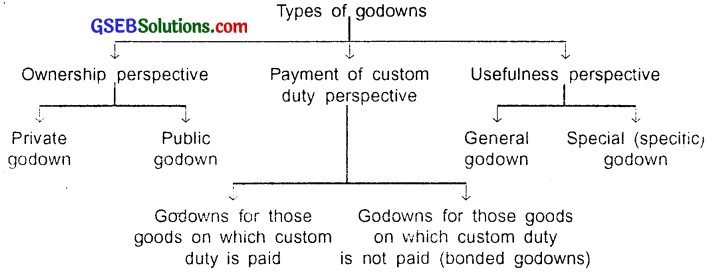

State the main types of godowns.

Answer:

- Godowns of ownership perspective,

- Godowns of payment perspective and

- Godowns of usefulness perspective.

![]()

Question 49.

Classify godowns under ownership perspective.

Answer:

- Private godowns and

- Public godowns.

Question 50.

Classify godowns as per payment perspective.

Answer:

- Godowns for those goods whose custom duty is paid and

- Godowns for those goods whose custom duty is not paid (Bonded godowns).

Question 51.

Classify godowns on the basis of their utility.

Answer:

- General godowns and

- Specific godowns.

Question 52.

What is a private godown?

Answer:

A godown owned by a manufacturer or trader exclusively for his own use is called a private godown.

Question 53.

What is a public godown?

Answer:

A godown built for storing goods owned by public is known as a public godown. Although these are also owned by individuals, institutions or businessmen but they are open for public storage.

Question 54.

How can the owner sell the goods stored in godowns without transporting them to market?

Answer:

The owner can show the sample of goods to someone and then sell the buyer the receipt he got from the godown. Based on this receipt the buyer can become the owner of the goods and claim the goods stored in godown.

Question 55.

What do you mean by a godown for goods whose custom duty is paid?

Answer:

As the name suggests these godowns store only those goods which are imported from other countries and on which custom i.e. import duty is already paid.

Question 56.

What is a bonded godown?

OR

What do you mean by a godown whose custom duty is not paid?

Answer:

A godown that can store imported goods on which custom duty is not yet paid is called a bonded godown.

Question 57.

How does a bonded godown prove blessing for an importer?

Answer:

Bonded godowns prove as a blessing for importers because: The importer may not be able to pay heavy custom duties immediately at the time of import. The importer may want to re-export the goods from the godown itself. These godowns provide facility to the owner to divide, mix and repack the goods so that he can prepare a variety of lots for export.

Question 58.

For which goods can a general godown be used?

Answer:

As the name suggests this godown is used for storing almost all types of goods having any shape, weight or form. In this regard any good that does not require any special care, maintenance or treatment can be stored in such godowns.

Question 59.

What do you mean by specific godowns? Give example of goods that one can store in them.

Answer:

Godowns used for storing goods that require special care, treatment and maintenance are called special or specific godowns. For example, goods such as explosive items, crackers, chemicals, cooking gas, petrol, etc. require special godowns. Perishable goods such as fruits, vegetables, milk and milk products, etc. also need to be stored in such godowns

Question 60.

What are the disadvantages for specific godown?

Answer:

- These godowns are costlier to build and maintain,

- They need to follow several rules and regulations,

- Only specific types of goods can only be stored in them.

Question 61.

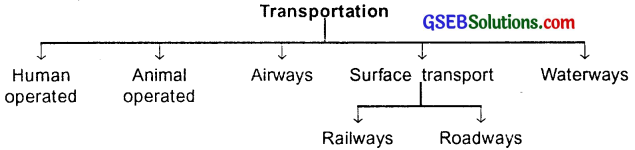

Into how many types can you classify modes of transport? Name them.

Answer:

Five;

- Human operated

- Animal operated

- Airways

- Surface transport and

- Waterways.

Question 62.

What do you mean by human operated transport?

Answer:

When human labour is used to transport goods or other humans it is called human operated transport.

Question 63.

How is air transport done in hostile regions?

Answer:

Through helicopters.

Question 64.

Which are various fuel sources to run a train?

Answer:

Electricity, gravitational force, magnetic force, CNG, diesel, etc.

Question 65.

Why roadways are the most convenient form of transport?

Answer:

Using roadways as a transport one can transport goods at own speed and time, change direction of vehicle as per need, take halts whereever one wishes, provide door step delivery, etc. So it is the most convenient form of transport.

Long Answer Type Questions

Question 1.

What do you mean by the term insurance? Explain.

Answer:

Insurance:

- Insurance is a written contract or agreement between two parties. The party that provides insurance is called ‘insurer’ and the party that receives the insurance is called ‘insuree’.

- To take insurance, the insuree needs to pay a specific amount known as ‘premium’ to the insuree. The insurer then undertakes to provide a guarantee of compensation for financial loss that the insuree might face.

Explanation:

- We as individuals and our business or profession may face several risks.

- For example, we or our family members may fall sick, meet with an accident, die, etc. Similarly, our business or profession may face risks such as fire, earth-quake, strikes, theft, robbery, etc. Any such loss to an individual, his family, his business or profession will need money to recover the loss.

- Under such unforeseen circumstances insurance plays a very important role. If a person undertakes an insurance he can remain peaceful and out of financial worries that may occur in these situations.

- One can take insurance for an individual, family members, building, business assets like machinery, raw material, finished goods, etc.

- The insurance provider i.e. insurer is not an individual but a company or an organization.

- While taking insurance the insuree and insuree sign a contract known as ‘Insurance policy’. Note that the insurance cannot eliminate the risk a person or a business may face but it can only compensate the ‘financial loss’ caused by the risk.

![]()

Question 2.

Explain the principle of insurance in detail.

Answer:

- The roots of insurance are connected with society and it is an agreement between two parties.

- Insurance is not an ordinary contract and so we cannot compare it with ordinary rules or laws. Insurance is a special type of contract and hence has got specific principles too.

Principles of insurance are as follows:

1. Principle of utmost good faith:

- The main objective of selling insurance is not profit but to fulfill specific social objectives of providing financial compensation in cases of pre-defined risks.

- This principle says that both the parties i.e. the insurer and insuree should have mutual and complete faith on each other. This means that the insuree will claim for financial losses only for genuine and pre-defined losses as mentioned in the insurance policy and the insuree will pay the full compensation in case of genuine claims raised by the insuree.

- While entering into an insurance contract both the parties i.e. the insurer and insuree should provide all the necessary information even if it is not asked by either party but if it is felt that the information may have an impact on the contract during claims.

- Any information that one hides and if it affects the claims made for financial loss can be termed as fraud and a breach of the principle of utmost good faith.

- In case the insuree provides wrong information or does not provide some important information during signing the contract and if he faces a financial loss, the insurance company i.e. the insurer will reject the claim and will not refund the paid premium. The insuree then loses all the rights of compensation for the risk.

2. Principle of indemnity:

- Indemnity means protection against future loss. The main objective of an insurance contract is to compensate a future loss.

- This principle is used to decide how much amount does an insurance company needs to pay to the insuree in case he faces a loss.

- The insuree can only get the actual compensation for his loss and cannot earn profit i.e. cannot get additional amount other than pre-decide in his insurance policy.

- In case the insuree takes the insurance for a lesser amount then he will get only that much amount for which he has taken the insurance. The remaining loss will have to be borne by him.

- For example, if the market value of a car is rupees five lakh and if the insuree takes insurance only of rupees two lakh and if his car gets stolen he can claim for a loss of rupees two lakh only i.e. the insured value.

3. Principle of insurable interest:

- The person seeking insurance should have insurable interest for which he ‘ seeks insurance. In other words, the insuree should have interest in recovering the financial loss he suffers.

- For example, if your house gets damaged/destroyed you will be interested in having a financial recovery for it but if your neighbour’s house gets destroyed you may have sympathy but no insurable interest in his house.

4. Principle of subrogation:

- As per this principle when the insuree claims for the financial loss he encountered and receives the compensation, he loses the ownership of the damaged product.

- For example, in case of accident to a vehicle, after receiving the compensation from the insurance company, the insuree cannot sell the damaged part because thereafter the insurance company becomes the owner of that part.

- This principle is not applicable in life insurance.

Question 3.

Classify the various type of insurance with the help of a chart.

Answer:

Question 4.

Explain briefly whole life insurance.

Answer:

Whole life insurance:

- A life insurance policy in which the insuree pays a periodic premium for the policy whole life is called whole life insurance. After the insuree dies his heir gets the pre-decided sum mentioned in the insurance agreement as compensation from the insurance company.

- Life is priceless and no amount can ever compensation its loss but to save the heirs or say family members from financial loss and burden one takes life insurance.

- The insurance company decides how much insurance can a person buy based on his income and premium paying capacity and then decides the premium the insuree needs to pay.

- Unlike other insurances, the principle of indemnity cannot be applied in life insurance in the event of death of the insuree.

- When the insurance company gets satisfied that the death of insure took place naturally i.e. he did not commit suicide or something, the insurance company pays the full amount as per the contract to the heir.

Question 5.

Explain briefly endowment insurance.

Answer:

Endowment insurance:

- An insurance in which the insurance company promises to pay the policy amount to the insuree at the end of policy period i.e. on maturity of policy or to his legal heir is known as endowment insurance.

- In this type of policy, the insuree decides to insure himself not for whole life but only for a specific number of years. The insuree pays the premium decided by the insurance company upto the decided period for example, upto the age of 50 years.

- Once the insuree reaches the age of 50 years the policy matures and the insuree receives the amount of his policy. In case the insuree dies before the set period of policy, his heir receives the policy amount.

Question 6.

Differentiate between whole life insurance and endowment insurance.

Answer:

| Whole life insurance | Endowment insurance |

| 1. It is taken for whole life. | 1. It can be taken for a fix period of time. |

| 2. The insuree never sees the money he gets because his heir receives the money when he dies. | 2. The insuree can see the money he gets from the insurance company if the policy matures before he dies. |

| 3. The insuree can use this policy only to safeguard his family from financial loss after he dies. | 3. The insuree can use this policy as a saving tool in case the policy matures before he dies. |

Question 7.

Write a detailed note on general insurance.

Answer:

General insurance:

- Any insurance other than life insurance is known as general insurance.

- General insurance can be classified into three main types as discussed below.

(A) Goods transportation insurance. This includes:

When goods are transported from one place to another, there is a risk of full or partial loss/damage to the goods.

The insurance that covers this risk is called Goods Transportation Insurance.

- Marine insurance

- Air insurance

- Rail/road insurance

1. Marine insurance:

- Transporting goods through ships is one of the most economical form of transport. However, there are several risks in it like damage or destruction of ship, goods carried by ship, etc. Marine insurance covers all these risks and compensates the insuree.

- It is one of the oldest from of transport between countries and was the most common mode till 18th century.

- Due to very slow movement of ship and several associated risks it is a very important form of insurance.

The premium of marine insurance is quite less. - Marine insurance was started by Lloyd’s organization of London about 325 years ago.

2. Aviation (Air) insurance:

- Insurance against claims and losses arising from maintenance and use of aircrafts or airports including damage to aircraft, personal injury, etc. is called aviation insurance.

- In 19th century, goods started getting transported through air and so began the air insurance.

- Air freights are very costly and so only those goods that are light weight and highly valuable are transported through air.

- The premium of air insurance is much higher than marine and rail/road transport.

3. Rail/road insurance:

Insurance that provides compensation against risks such as theft, robbery, damage to goods, etc. when they are transported either through trains or through road is known as rail/road transport.

(B) Fire insurance:

- An insurance in which the insurance company agrees to pay compensation against the damage or destruction caused due to fire is known as fire insurance.

- Fire insurance works on the principle of insurable interest which means that the insuree should get a compensation equivalent to the loss of value of property or belongings caused due to fire.

(C) Other general insurance:

- There are several other types of insurance over and above discussed so far.

- These insurances have come up with need of time.

Examples:

- Insurance for voice of a singer Insurance for labourers Third party insurance Insurance of employee

- Student insurance to protect general and social damage Medical insurance (Mediclaim)

- Insurance of loss caused due to closure of business units

- Insurance against fraudulent activities that an employee may do and the loss that the employer may suffer

- Insurance against cancellation of match or an entertainment event like concerts either due to man-made or natural reasons

Question 8.

Write a short note on marine industry.

Answer:

Marine insurance:

- Transporting goods through ships is one of the most economical form of transport. However, there are several risks in it like damage or destruction of ship, goods carried by ship, etc. Marine insurance covers all these risks and compensates the insuree.

- It is one of the oldest from of transport between countries and was the most common mode till 18th century.

- Due to very slow movement of ship and several associated risks it is a very important form of insurance.

The premium of marine insurance is quite less. - Marine insurance was started by Lloyd’s organization of London about 325 years ago.

![]()

Question 9.

Explain briefly air insurance.

Answer:

Aviation (Air) insurance:

- Insurance against claims and losses arising from maintenance and use of aircrafts or airports including damage to aircraft, personal injury, etc. is called aviation insurance.

- In 19th century, goods started getting transported through air and so began the air insurance.

- Air freights are very costly and so only those goods that are light weight and highly valuable are transported through air.

- The premium of air insurance is much higher than marine and rail/road transport.

Question 10.

Explain briefly fire insurance.

Answer:

Fire insurance:

- An insurance in which the insurance company agrees to pay compensation against the damage or destruction caused due to fire is known as fire insurance.

- Fire insurance works on the principle of insurable interest which means that the insuree should get a compensation equivalent to the loss of value of property or belongings caused due to fire.

Question 11.

Differentiate between Life insurance and General insurance.

Answer:

| Life insurance | General insurance |

| 1. Insurance taken for a human life is called life insurance. | 1. Any form of insurance other than that of life insurance of humans is called general insurance. |

| 2. The premium is paid for covering the risk of human life. | 2. The premium is paid for covering risk material things, accidents, events like flood, tsunami, etc. |

| 3. There are two sub types namely (a) whole life insurance and (b) endowment insurance. | 3. There are three sub types namely (a) Goods transportation insurance, (b) Fire insurance, (c) Other general insurance |

| 4. The insure may or may not see the money he gets from insurer. | 4. In most cases, the insuree can always see the money he gets from insurer. |

Question 12.

Write a short note on nationalization and privatization of insurance sector and establishment of IRDA.

Answer:

Nationalization of Life Insurance:

- During colonial time, The British heavily evolved insurance sector in India.

- During colonial era, several private insurance companies both British and Indian provided insurance services in India. However, these companies were blamed for unfair trade practices. As a result when India got independence, it decided to cancel the private sector insurance and nationalize the insurance business (i.e. to bring it under the ownership of nation’s government).

- On 19 January 1956, the Government of India issued an ordinance to nation¬alize the Life Insurance sector of India. Life Insurance Corporation (LIC) of India which was a government undertaking was established in the same year LIC took over large number of insurance companies that existed in India that time. As a result, LIC became the largest insurance company of India which enjoyed monopoly till the 90s.

Nationalization of General Insurance:

- The General Insurance business was set-up in India by the British.

- A code of conduct was framed to ensure fair trade practices.

- In 1972 the Government of India passed the General Insurance Business (Nationalism) Act. And nationalized the General Insurance business with effect from 1st January, 1973.

- All the private sector general insurance companies were merged and brought under nationalized sector.

Establishment of IRDA:

- In mid 90s a committee submitted its report to Government of India and recommended that private sector should be permitted to again enter the insurance industry. They also recommended that even foreign insurance companies should be allowed to enter Indian insurance industry through joint venture with Indian companies. In other words it was recommended that the nationalized insurance industry should again privatized.

- Following the recommendations from this committee, the Insurance Regulatory and Development Authority (IRDA) was established in 1999 to analyse and develop the insurance industry in India.

![]()

Question 13.

‘Life insurance is a saving scheme along with protection’. Explain. OR The main objective of Life insurance is to fulfill specific social objective of providing financial companies. Give reason.

Answer:

- Every person feels that when he reaches old age or is no more in this world his family should not be burdened under financial stress. He also feels, education, daily expenses, etc. his family needs like should not be compromised in case he cannot earn further or if he dies.

- Owing to all these reasons a person buys a life insurance. He pays a fix amount i.e. premium periodically to the insurance company until his insurance policy matures or he dies.

- This premium is returned either to the insuree (in case of endowment plan) or his family along with interest. As a result the invested money in insurance becomes a saving scheme whose benefits can be reaped in later years. By doing so the insurance company fulfills its social objective of providing financial compensation as promised.

Question 14.

‘The contribution of insurance in the development of commerce is not insignificant’. Explain.

Answer:

- Insurance in India evolved heavily during the British time.

- Since then several British and foreign companies emerged as insurance providers in India.

- After independence the insurance sector was nationalized, it contributed to India’s trade and commerce significantly.

- The establishment of Insurance Regulatory and Development Authority (IRDA) further boosted the insurance sector by its strategic policies and allowing foreign insurance companies to enter Indian market.

- Moreover, India has developed tremendously post-independence which created a huge demand for both life and general insurance.

- Owing to all these reasons we can say that contribution of insurance in the development of commerce is quite significant.

Question 15.

The principle of indemnity cannot be implemented in life insurance. Give reason.

Answer:

- Indemnity means protection against future loss. The main objective of an insurance contract is to compensate a future loss.

- The principle of indemnity is used to decide how much amount an insurance company needs to pay to the insuree in case he faces a loss.

- Human life is priceless and no one can decide a value for the life of a person.

- Indemnity cannot be implemented in life insurance.

Question 16.

List out the various postal services offered by the postal department.

Answer:

The postal department of India known as India Post provides a variety of services. Few of them are classified and listed below.

(A) Mail services:

- General postal letters

- Registered posts

- Parcel service

- Value Payable Post (VPP)

(B) Premium services:

- Speed post (For both, post and parcel)

- Express parcel

(C) Financial services: These services can be further classified as:

(I) Saving services:

- Recurring Deposit Scheme (RDS)

- Time deposit

- National Savings Certificate (NSC)

- Kisan Vikas Patra (KVP)

- Public Provident Fund (PPF)

- Monthly Income Scheme (MIS)

(II) Postal Life Insurance (PLI)

(III) Money Remittance Services:

- Money order (MO)

- Electronic Money Order (eMO)

- Instant Money Order (iMO)

(D) The foreign Exchange (Forex) services of postal department provides following services:

- Purchase and sale of foreign exchange

- Traveller’s cheque on foreign currency

- Debit card

- Demand draft

(E) Other services:

- Mutual Fund (MF)

- Banking services

- Service to maintain pension account for pension depositors.

- Railway ticket booking, etc.

Question 17.

Write a short note on postal services.

Answer:

Postal services:

- The primary function of a post office or say the postal department is to collect, process, transmit and deliver the mails.

- Postal services play a vital role in exchanging written information and communication services between people. In today’s fast world it is extremely important that people can send and receive their letters, documents, message, etc. from one place to another quickly and without any interruption.

- Apart from Indian Postal Department there are numerous private postal service providers operating in the entire world. These private operators are called courier service providers.

- There are also several aangadiyas who provide services similar to courier service agencies.

- The Indian postal department called the India Post has been providing information and communication services for more than 150 years.

Over and above basic postal services our postal department provides a variety of services like:

- Money order

- Saving schemes

- Accepting several government forms

- Postal life insurance

- Rural insurance schemes

- Mutual funds

- Facility to become agents on behalf of government of India

- Facilities paying retirement pension, etc.

The postal department has also got a license to work as a bank and hence it provides banking facilities as well. Today there are about 1,50,000 post offices in India out of which 90% are based in rural areas.

Question 18.

Explain the mail services provided by the postal department.

Answer:

Mail services:

1. General postal services:

This service includes providing information and communication services by delivering post cards, inland letters, etc.

2. Registered post:

- A mail or article sent under registered post is handled with extra care by the postal department. The postal department keeps record of such post at all stages. The post sender can obtain proof in case of misplaced or lost posts. The sender can obtain an acknowledged copy i.e. copy carrying signature of

the person to whom the post is sent from the postal department by paying some extra charges. - The charges of a registered post are quite high compared to a general post.

3. Parcel service:

- Under parcel service one can send anything except items prohibited by the law. From one place to another. One can also take insurance for the parcel he sends.

- One can book a parcel at any post office by paying respective parcel charges.

4. Value Payable Post (VPP):

- VPP is a service from postal department where in the buyer of a product wishes to pay for that product after he receives it through post. (Note: It is somewhat similar to Cash On Delivery (COD) offered by online stores these days.)

- In this system when a producer or a seller receives an order from a buyer he packs the demanded good, goes to post office and asks it to deliver through VPP to the buyer.

- When the buyer receives the product he pays the postman the predetermined price plus postal department’s service charges.

- The producer/seller then receives his money from postal department.

- VPP is quite popular parcel service.

Question 19.

Write a brief note on registered post.

Answer:

Registered post:

- A mail or article sent under registered post is handled with extra care by the postal department. The postal department keeps record of such post at all stages. The post sender can obtain proof in case of misplaced or lost posts. The sender can obtain an acknowledged copy i.e. copy carrying signature of the person to whom the post is sent from the postal department by paying some extra charges.

- The charges of a registered post are quite high compared to a general post.

Question 20.

What is VPP? Explain.

Answer:

Value Payable Post (VPP):

- VPP is a service from postal department where in the buyer of a product wishes to pay for that product after he receives it through post. (Note: It is somewhat similar to Cash On Delivery (COD) offered by online stores these days.)

- In this system when a producer or a seller receives an order from a buyer he packs the demanded good, goes to post office and asks it to deliver through VPP to the buyer.

- When the buyer receives the product he pays the postman the predetermined price plus postal department’s service charges.

- The producer/seller then receives his money from postal department.

- VPP is quite popular parcel service.

Question 21.

Explain briefly premium postal service.

Answer:

The postal department provides few services under premium service category. Two of them are:

1. Speed post/parcel:

- Under this service the postal department guarantees to deliver the post or parcel speedily with a specific period of time at almost all the locations of India.

- The charges of speed post/parcel are higher than the general post/parcel. One can also take insurance for the items sent.

2. Express parcel:

- Under express parcel service an individual or a business firm can send parcels to their concerned receivers very speedily that too within specified time limit. The postal department sends these parcels either by air or any other very fast means of transport.

- The charges of express parcel service are even higher than the speed post.

Question 22.

What do you mean by saving services offered by the postal department? List out the saving services offered by the department.

Answer:

Saving services:

The postal department provides several saving services similar to those offered by the banks.

Just like we open and maintain a savings bank account we can open a savings account in post office as well. The post office also issues cheque books and ATM cards to the account holders.

List of services offered:

- Opening a saving account

- Recurring deposit scheme

- Time deposit

- National Saving Certificate (NSC)

- Kisan Vikas Patra (KVP) for 5 or 10 years

- Public Provident Fund (PPF) for 15 years

- Monthly Income Service (MIS)

- Senior Citizen Savings Scheme (SCSS)

- Sukanya Samridhi Account

![]()

Question 23.

Explain briefly the saving services offered by the post office.

Answer:

Saving services of post office:

1. Banking services

Just like we open and maintain a savings bank account we can open a savings account in post office as well. The post office also issues cheque books and ATM cards to the account holders.

2. Recurring deposit scheme:

- In this scheme a person can open recurring deposit account with the post office and deposit a specific amount every month for 5 years.

- At the end of 5 years the account matures. The account holder gets back his principle amount plus interest earned in 5 years.

- If the account holder wishes the account can be extended for another 5 years.

3. Term deposit:

- Term deposit service is just like the fixed deposit service. A person can choose to keep his money deposited for 1, 2, 3 or 5 years in the post office

- A person can open time deposit account with a minimum of ₹ 200/- and then in its multiple.

Post-office calculates the interest every quarter i.e. every 3 months but pays the interest to the account holder every year. - This account can be transferred from one post office to another and can also be closed before it matures.

4. National Savings Certificate (NSC):

- NSC is an Indian government savings bond primarily used for small savings.

- These bonds or certificates are managed by the postal department.

- One can buy an NSC from a post office. Its maturity period is either 5 or 10 years.

- The postal department informs the buyer in advance about the interest he will earn on maturity.

- On maturity the NSC owner can go to the post office, complete the formalities and obtain the matured amount.

5. Kisan Vikas Patra (KVP):

- Under this scheme the depositor buys a KVP from the post office and gets double the invested money after 100 months i.e. 8 years and 4 months. This certificate is available only for specific denominations of ₹ 1000, 5000, 10,000 and 50,000.

- On maturity the depositor can complete the formalities at the post office and withdraw his money along with interest.

6. Public Provident fund:

- A PPF account once opened cannot be closed before 15 years.

- After 15 years the account can be extended for another 5 years depending, upon the government rules at that time.

- This account can be opened with a minimum amount of ₹ 500.To keep this account active one needs to deposit a minimum of ₹ 500 every year.

- The interest earned out of PPF is exempted from income tax i.e. one does not need to pay income tax on the money he earns through PPF scheme. In case the account holder dies the PPF money will be given to the nominee.

7. Monthly income scheme (MIS):

- This scheme is targeted for investors who wish to obtain the earned interest every month and hence the name monthly income scheme.

- A person can open an individual or joint account.

- The account is to be maintained for 5 years. However one can withdraw the deposited money after 1 year subject to terms and conditions of the postal department.

- The account can be transferred from one post office to another.

Question 24.

Write short notes on the following services offered by the postal department.

Answer:

Saving services of post office:

1. Banking services

Just like we open and maintain a savings bank account we can open a savings account in post office as well. The post office also issues checkbooks and ATM cards to the account holders.

2. Recurring deposit scheme:

- In this scheme a person can open recurring deposit account with the post office and deposit a specific amount every month for 5 years.

- At the end of 5 years the account matures. The account holder gets back his principle amount plus interest earned in 5 years.

- If the account holder wishes the account can be extended for another 5 years.

3. Term deposit:

- Term deposit service is just like the fixed deposit service. A person can choose to keep his money deposited for 1, 2, 3 or 5 years in the post office

- A person can open time deposit account with minimum ₹ 200/- and then in its multiple.

- Post-office calculates the interest every quarter i.e. every 3 months but pays the interest to the account holder every year.

- This account can be transferred from one post office to another and can also be closed before it matures.

4. National Savings Certificate (NSC):

- NSC is an Indian government savings bond primarily used for small savings.

- These bonds or certificates are managed by the postal department.

- One can buy an NSC from a post office. Its maturity period is either 5 or 10 years.

- The postal department informs the buyer in advance about the interest he will earn on maturity.

- On maturity the NSC owner can go to the post office, complete the formalities and obtain the matured amount.

5. Kisan Vikas Patra (KVP):

- Under this scheme the depositor buys a KVP from the post office and gets double the invested money after 100 months i.e. 8 years and 4 months. This certificate is available only for specific denominations of ₹ 1000, 5000, 10,000 and 50,000.

- On maturity the depositor can complete the formalities at the post office and withdraw his money along with interest.

6. Public Provident fund:

- A PPF account once opened cannot be closed before 15 years.

- After 15 years the account can be extended for another 5 years depending , upon the government rules at that time.

- This account can be opened with a minimum amount of ₹ 500.To keep this account active one needs to deposit a minimum of ₹ 500 every year.

- The interest earned out of PPF is exempted from income tax i.e. one does not need to pay income tax on the money he earns through PPF scheme. In case the account holder dies the PPF money will be given to the nominee.

7. Monthly income scheme (MIS):

- This scheme is targeted for investors who wish to obtain the earned interest every month and hence the name monthly income scheme.

- A person can open an individual or joint account.

- The account is to be maintained for 5 years. However one can withdraw the deposited money after 1 year subject to terms and conditions of the postal department.

- The account can be transferred from one post office to another.

Question 25.

Explain briefly Postal Life Insurance (PLI).

Answer:

Postal Life Insurance (PLI)

- The postal life Insurance was started in India before independence as a part of welfare scheme for the postal department employees.

- This scheme was later extended for employees of state as well as central government of all departments.

- The salient feature of PLI is that it charges lowest premium and returns high bonus.

Question 26.

Write a short note on money remittance service of the postal department.

OR

Write a short note on money order, e-money order (eMO) and instant money order (iMO).

Answer:

Money Order (MO):

- A money order is an order issued by the post office to pay money to the ‘ person on whose name the money order is sent.

- Through this arrangement one can send money from one place to another under post office. The post office will charge a commission to the sender.

- The person who receives the money order will have to sign a receipt which will work as a proof that the receiver has received the money. The signed receipt will be then sent to the sender for confirmation of payment.

The postal department has also started Electronic Post office i.e. e-Post Office. Under this system it offers two advanced level money order procedures. They are:

- Electronic Money Order (eMO)

- Instant Money Order (eMO)

1. Electronic Money Order (eMO):

- eMO is a web based rapid money transfer service where in a receiver can receive the money within 24 hours at his address.

- Through eMO a minimum of ₹ 1 to ₹ 5000/- can be sent to any part of India. Once the sender pays the desired amount to the postal department he gets a receipt for the same. The sender needs to properly fill the name and address of the receiver to whom money is to be sent.

- The receiver receives money at his home within 24 hours by showing a photo-id.

- The postal department also sends message to the sender informing the confirmation of payment.

- The sender of eMO will have to go to post office to fill up a form or visit the website of postal department through his computer or mobile to use this service.

2. Instant Money Order (iMO):

- iMO is a web based instant money transfer service where in a receiver can receive money within the next minute the sender sends the money.

- A minimum of ₹ 1000 to ₹ 50,000 can be sent to any part of India.

- Once the sender pays the desired amount to the postal department he gets a 16 digit iMO number. The sender needs to give this number to the receiver secretly i.e. without showing it to anyone.

- The receiver then needs to go to any designated post office, show the iMO number and his photo-id proof on the counter and receive the money.

![]()

Question 27.

Differentiate between eMO and iMO.

Answer:

1. Electronic Money Order (eMO):

- eMO is a web based rapid money transfer service where in a receiver can receive the money within 24 hours at his address.

- Through eMO a minimum of ₹ 1 to ₹ 5000/- can be sent to any part of India. Once the sender pays the desired amount to the postal department he gets a receipt for the same. The sender needs to properly fill the name and address of the receiver to whom money is to be sent.

- The receiver receives money at his home within 24 hours by showing a photo-id.

- The postal department also sends message to the sender informing the confirmation of payment.

- The sender of eMO will have to go to post office to fill up a form or visit the website of postal department through his computer or mobile to use this service.

2. Instant Money Order (iMO):

- iMO is a web based instant money transfer service where in a receiver can receive money within the next minute the sender sends the money.

- A minimum of ₹ 1000 to ₹ 50,000 can be sent to any part of India.

- Once the sender pays the desired amount to the postal department he gets a 16 digit iMO number. The sender needs to give this number to the receiver secretly i.e. without showing it to anyone.

- The receiver then needs to go to any designated post office, show the iMO number and his photo-id proof on the counter and receive the money.

Question 28.

The postal department of India is one of the lifelines of Indian prosperity. Give reason. OR the role of postal department is multi-faceted. Give reason.

Answer:

- Sending messages, documents both private and government, exchanging written information and communication services, etc. has always been one of

the top most priority of trade and commerce. This task lies on the shoulder of postal department. - The Indian postal department called the India Post has been providing information and communication services for more than 150 years.

- Over and above postal services, our postal department provides a variety of – services like, money order, accepting several government forms, postal life insurance, rural insurance schemes, mutual funds, etc.

- The postal department has also got a license to works as a bank and hence it provides banking facilities as well.

- Today there are about 1,50,000 post offices in India out of which 90% are in rural areas.

Owing to the several services that the postal department provides daily to crores of Indians since years has worked as the lifeline of Indian prosperity.

Question 29.

Government and other important documents, legal notices, etc. are sent through registered post. Give reason.

Answer:

Government and other important documents, legal notices, etc. are quite important documents. These documents should safely reach the receiver properly and on time.

- Moreover, in case of misplacement or loss, the sender generally requires proof that the documents were sent by him.

- A mail or article sent under registered post is handled with extra care by the postal department. The postal department keeps record of such post at all stages for which a sender can obtain proof in case of misplaced or lost posts.

- The sender can also obtain an acknowledged copy i.e. copy carrying signature of the person to whom the post is sent from the postal department by paying some extra charges.

- Hence, government and other important documents, legal notices, etc. are sent through registered post.

Question 30.

VPP is a boon for a customer who wants to make sure he receives his product once he makes the payment and for new sellers. Give reason.

Answer:

Trusting the seller is one of the biggest concerns for the buyer especially when the product a buyer wants to buy is not available in nearby shops. The problems that haunts the buyers may be will he receive the produci in proper form and as expected, will the seller be honest to him, etc.

- Moreover, at times a customer may be located in such a remote area where the seller may not have a proper dealer network to sell his goods.

- VPP is a service from postal department where in the buyer of a product wishes to pay for that product after he receives it through post.

- In this system when a producer or a seller receives an order from a buyer he packs the ordered good, goes to post office and asks it to deliver through VPP to the buyer.

- When the buyer receives the product he pays the postman the pre-decided price plus postal department’s service charges.

- The producer/seiler receives his money from postal department.

- Hence, VPP is a boon for a customer who wants to make sure he receives his product or for a new seller.

Godowns (Warehouses)

Question 31.

What is a godown (Warehouse)? Explain its need.

Answer:

Godown:

A godown is a place for storing large amount of products before sending – them to the market for selling. The service of storing the products is called godown service or warehouse service.

Need of a godown:

- Generally, after production a product is not immediately sold or consumed and hence it needs to be stored.

- On many occasions raw material or partly produced products also need to be stored for further processes.

- Some food items may be produced only during a specific season of the year but would require its storage for selling them throught the year.

- Some goods may be produced and stored in godowns but would be sold when the demand arises.

Perishable goods like fruits, ice-cream, etc. need proper storage so that they can be distributed and sold as and when needed. - Thus, godowns do not produce anything but create time utility.

Question 32.

Classify the types of godowns with the help of a chart.

Answer:

Question 33.

Write a detailed note on various types of godowns.

Answer:

The various types of godowns are as follows:

(A) Types of godowns on the basis of ownership:

1. Private godowns:

- A godown owned by a manufacturer or trader exclusively for his own use is called a private godown.

- Such godowns are built as per the space needed by the manufacturer or trader to store his goods.

2. Public godowns:

- A godown built for storing goods owned by public is known as a public godown. Although these are also owned by individuals, institutions or businessmen but they are open for public storage.

- People who want to store their goods can store in these godowns by paying rent and other charges. Normally, these godowns are situated near railway stations, ports and airports.

- Today, public godowns have become an independent activity just like a business. These godowns provide safe storage of goods and proper maintenance.

- These godowns provide receipts to the owners of the products against storage. Moreover, these receipts are transferable. This means if the owner of the ^joods sells the goods stored in godown to someone, the buyer can claim the ownership of the goods based on the receipt he gets from the existing owner.

(B) Types of godowns on the basis of custom (import) duty:

1. Godowns for those goods on which custom duty is paid:

- As the name suggests these godowns store only those goods which are imported from other countries and on which custom i.e. import duty is already paid.

- The need of these godowns arise because many times after importing the goods the owners do not have immediate facility to transport them to the desired destination.

- Owing to such conditions these godowns are located near the place of import such as sea ports, airports or border area. Generally such godowns are also public godowns.

2. Godowns for those goods on which custom duty is not paid (Bonded godowns) :

- A godown that can store imported goods on which custom duty is not yet paid is called a bonded godown.

- These godowns are situated near the place of import such as sea ports, airports,.or border areas.

- These godowns prove blessing for importers because:

- The importer may not be able to pay heavy custom duties immediately at the time .of import.

- The importer may want to re-export the goods from the godown itself.

- These godowns provide facility to the owner to divide, mix and repack the goods so that he can prepare a variety of lots for export.

(C) Godowns based on usefulness perspective:

1. General godown:

- As the name suggests this godown is used for storing almost all types of goods having any shape, weight or form.

- In this regard any good that does not require any special care, maintenance or treatment can be stored in such godowns.

- These godowns are quite common and are large sized.

2. Special (specific) godowns:

- Godowns used for storing goods that require special care, treatment and maintenance are called special or specific godowns.

- For example, goods such as explosive items, crackers, chemicals, cooking gas, petrol, etc. require special godowns. Perishable goods such as fruits, vegetables, milk and milk products, etc. also need to be stored in such godowns.

- These godowns are costlier to build and maintain. They need to adhere to several laws, rules and regulations too. For example, underground tanks needed to store petrol are prepared with special types of bricks and building materials.

Question 34.

Explain godowns with respect to their ownership.

Answer:

Types of godowns on the basis of ownership:

1. Private godowns:

- A godown owned by a manufacturer or trader exclusively for his own use is called a private godown.

- Such godowns are built as per the space needed by the manufacturer or trader to store his goods.

2. Public godowns:

- A godown built for storing goods owned by public is known as a public godown. Although these are also owned by individuals, institutions or businessmen but they are open for public storage.

- People who want to store their goods can store in these godowns by paying rent and other charges. Normally, these godowns are situated near railway stations, ports and airports.

- Today, public godowns have become an independent activity just like a business. These godowns provide safe storage of goods and proper maintenance.

- These godowns provide receipts to the owners of the products against storage. Moreover, these receipts are transferable. This means if the owner of the goods sells the goods stored in godown to someone, the buyer can claim the ownership of the goods based on the receipt he gets from the existing owner.

Question 35.

Write a short note on bonded godowns.

Answer:

Godowns for those goods on which custom duty is not paid (Bonded godowns) :

- A godown that can store imported goods on which custom duty is not yet paid is called a bonded godown.

- These godowns are situated near the place of import such as sea ports, airports,.or border areas.

- These godowns prove blessing for importers because:

- The importer may not be able to pay heavy custom duties immediately at the time .of import.

- The importer may want to re-export the goods from the godown itself.

- These godowns provide facility to the owner to divide, mix and repack the goods so that he can prepare a variety of lots for export.

![]()

Question 36.

Explain general godowns.

Answer:

General godown:

- As the name suggests this godown is used for storing almost all types of goods having any shape, weight or form.

- In this regard any good that does not require any special care, maintenance or treatment can be stored in such godowns.

- These godowns are quite common and are large sized.

Question 37.

Differentiate between godowns for goods whose custom duty is paid and bonded godowns.

Answer:

| Godowns for goods whose custom duty is paid | Godowns for goods whose custom duty is not paid (Bonded godowns) |

| 1. As the name suggests these godowns store only those goods which are imported from other countries and on which custom i.e. import duty is already paid. | 1. A godown that can store imported goods on which custom duty is not yet paid is called a bonded godown. |

| 2. The need for these godowns arises when the goods that are imported cannot be immediately transported due to lack of transport facilities. | 2. The need for these godowns arises to save the importer from paying heavy import duty for entire lot immediately or to facilitate him re export. |

| 3. The ownership and supervision of these godowns is under individual godown owner. | 3. The ownership and supervision of these godowns is mostly with the government. |

Question 38.

Differentiate between general godowns and specific godowns.

Answer:

| General godowns | Specific godowns |

| 1. These godowns are used to store any product having any shape, weight or form. | 1. These godowns are used to store specific goods only. |

| 2. These godowns are cheap to build and maintain. | 2. These godowns are costly to build and maintain. |

| 3. No particular specifications are to be maintained while building them. | 3. The specifications for building these godown change from product to product. |

| 4. There are no strict rules and regulations to be followed for these godowns. | 4. The rules and regulations to maintain these godowns are quite comprehensive and strict. |

Question 39.

Public godowns help in availing financial facilities. Give reason.

Answer:

- Public godowns are used for storing products owned by public.

- As the name suggests these godowns store only those goods which are imported from other countries and on which custom i.e. import duty is already paid.

- This facility helps the goods owner to directly sell the goods with the help of receipt. This saves him from the expenses of loading and transporting goods.

- A businessmen can also divide the large stock of goods into small lots within the godown and sell them to separate traders.

- All these facilities help the businessman to avail several financial facilities and free his invested money.

Question 40.

Bonded godowns are blessings for re-export trade.

Answer:

- When a good imported from a country is directly exported to another country it is called re-export trade.

- The goods to be re-exported are kept in bonded godowns during the time of import.

- Since the goods are to be re-exported the importer may be saved from passing import duty immediately at the time of import.

- Moreover, bonded godowns also provide importer the facility to divide, mix and repack the products 30 that he can re-export as per his orders.

- Hence, bonded godowns are blessings for re-export trade.

Question 41.

Classify the major modes of transportation.

Answer:

Question 42.

Write a short note on various types of transportation.

Answer:

Transportation service:

The facility/activity of trasporting people or goods from one place to another is called trasportation service.

In older times animals and waterways were used. Then other means like railways and airways were developed.

Types of transportation:

1. Human operated:

- When human labour is used to transport goods or other humans it is called human operated transport.

Although it is quite laborious it is environment friendly. - At places like Delhi and Kolkata people us^ pedal rickshaw to transport people within city.

- Hand carts and pedal rickshaws are used in almost all parts of India to transport goods from one place to another.

2. Animal operated:

Transport of goods done for short distances using horse-cart, bullock-cart, camel-cart, etc. falls under animal operated transport.

3. Air-ways:

- Airways is used to transport goods and humans speedily especially for long distances.

- If the transport is done through aeroplanes then runways are needed for take-off and landing. However, if the transport is to be carried out for short distances or for small quantity of goods or few people, or at hostile regions then helicopters are a very good option.

4. Land transport:

(a) Railways:

- Railways are one of the fastest and cheapest forms to transport humans and goods.

- Trains run on electricity, diesel, gravitational force, magnetic force, CNG, etc.

- There are also several multiple unit (MU) trains used in transportation.

- Indian railways connect a very large number of towns and cities and hence work as the spinal cord of Indian transportation.

(b) Roadways:

- Roadways are one of the most convenient and flexible way to transport. Through this mean one can transport at own speed and time, change direction of vehicle as per need, take halt where ever one wishes and reach the destination. Such flexibility is not available in other means of fast transport. , Moreover one can also provide doorstep delivery of goods and humans.

- Buses are used to effectively transport people where as trucks are used to transport goods.

- Recently, to avoid traffic and provide faster transport to people within the city, the government has started Bus Rapid Transit System (BRTS).

5. Waterways:

- Oceans, rivers, lakes and canals are some of the waterways on which ships, boats, ferries, hovercrafts, etc. move and transport goods and people.

- The goods may be transported through sea and then land and again to another part of sea in places where the sea is not present on a continuous stretch. Hovercrafts have a giant high speed fan and a balloon like structure at the bottom in which air is filled to move them. Canals are constructed across rivers and dams which serve as means of transport.

- Trade and commerce between countries is mainly done through waterways.

- Even though waterways is a slow means of transport it is widely used because of its ability to carry a variety of goods of any size and form at a much lower cost than airways.

6. Transport/transit through pipelines:

- Pipelines are a very effective means of transport for transporting gaseous and liquid products.

- Pipelines are used for transporting water, petroleum, natural gas, etc.

- They are also very useful for removal of sewage and as drainage.

- For example, pipeline has been laid to transport gas from few parts of India Oil and petroleum products are transported through pipelines in the state of Assam, Bihar, Gujarat, Uttar Pradesh and Haryana.

Question 43.

What do you mean by human operated transport? Explain.

Answer:

Human operated:

- When human labour is used to transport goods or other humans it is called human operated transport.

Although it is quite laborious it is environment friendly. - At places like Delhi and Kolkata people us^ pedal rickshaw to transport people within city.

- Hand carts and pedal rickshaws are used in almost all parts of India to transport goods from one place to another.

![]()

Question 44.

Give a brief idea about airways as a means of transport.

Answer:

Air-ways:

- Airways is used to transport goods and humans speedily especially for long distances.

- If the transport is done through aeroplanes then runways are needed for take-off and landing. However, if the transport is to be carried out for short distances or for small quantity of goods or few people, or at hostile regions then helicopters are a very good option.

Question 45.

Write a short note on railway transport.

Answer:

Railways:

- Railway is one of the fastest and cheapest forms to transport humans and goods.

A railway engine generally uses diesel or electricity to drive the train. There are also multiple unit (MU) trains where in there are several or say multiple units that drive the train rather than one engine. In MU trains there is one ‘Unit’ for every three compartments that powers the train and make it run. Trains run on electricity, gravitational force, magnetic force, etc. - Recently, Compressed Natural Gas (CNG) trains have also been introduced in India.

- Indian railways connect a very large number of towns and cities and hence work as the skeleton of Indian transportation.

Question 46.

Write a short note on roadways.

Answer:

- Roadways are one of the most convenient and flexible way to transport. Through this mean one can transport at own speed and time, change direction of vehicle as per need, take halt where ever one wishes and reach the destination. Such flexibility is not available in other means of fast , transport. Moreover one can also provide doorstep delivery of goods and humans.

- Buses are used to effectively transport people where as trucks are used to transport goods.

- With increasing population and excessive vehicles the problems of air pollution, noise pollution, traffic congesion and parking have increased tremendously. To fight this and promote public transport government has started Bus Rapid Transit System (BRTS) in many cities of India.

- Special lanes have been built for these buses which help them to travel very fast. Moreover, the duration between buses is kept quite less due to which one does not need to wait much for another bus and can reach his destination on time.

- In Gujarat, BRTS service is available in cities like Ahmedabad, Surat, Rajkot, etc.

Question 47.

Write a short note on BRTS.

Answer:

- Roadways are one of the most convenient and flexible way to transport. Through this mean one can transport at own speed and time, change direction of vehicle as per need, take halt where ever one wishes and reach the destination. Such flexibility is not available in other means of fast , transport. Moreover one can also provide doorstep delivery of goods and humans.

- Buses are used to effectively transport people where as trucks are used to transport goods.

- With increasing population and excessive vehicles the problems of air pollution, noise pollution, traffic congesion and parking have increased tremendously. To fight this and promote public transport government has started Bus Rapid Transit System (BRTS) in many cities of India.

- Special lanes have been built for these buses which help them to travel very fast. Moreover, the duration between buses is kept quite less due to which one does not need to wait much for another bus and can reach his destination on time.

- In Gujarat, BRTS service is available in cities like Ahmedabad, Surat, Rajkot, etc.

Question 48.

Explain waterways as a means of transport.

Answer:

Waterways:

- Oceans, rivers, lakes and canals are some of the waterways on which ships, boats, ferries, hovercrafts, etc. move and transport goods and people.

- The goods may be transported through sea and then land and again to another part of sea in places where the sea is not present on a continuous stretch. Hovercrafts have a giant high speed fan and a balloon like structure at the bottom in which air is filled to move them. Canals are constructed across rivers and dams which serve as means of transport.

- Trade and commerce between countries is mainly done through waterways.

- Even though waterways is a slow means of transport it is widely used because of its ability to carry a variety of goods of any size and form at a much lower cost than airways.

Question 49.

Give a brief idea about pipelines.

Answer:

Transport/transit through pipelines:

- Pipelines are a very effective means of transport for transporting gaseous and liquid products.

- Pipelines are used for transporting water, petroleum, natural gas, etc.

- They are also very useful for removal of sewage and as drainage.

- For example, pipeline has been laid to transport gas from few parts of India Oil and petroleum products are transported through pipelines in the state of Assam, Bihar, Gujarat, Uttar Pradesh and Haryana.

Question 50.

BRTS proves wonder to solve traffic and pollution issues. Give reason.

Answer:

With increasing population and excessive vemcies the problems of air pollution, noise pollution, traffic congestion and parking have increased tremendously.

- To fight this and promote public transport government has started Bus Rapid Transit System (BRTS) in many cities of India.

- Special lanes have been built for these buses which help them to travel very fast. Moreover, the duration between buses is kept quite less due to which one does not need to wait much for another bus and can reach his destination on time.

- Hence, BRTS proves wonder to solve traffic and pollution issues.

Question 51.

International trade mostly takes place through waterways. Give reason.

Answer:

- Waterways have been used by humans since the day they learnt to trade.

- A very large number of goods that too of various types are needed across the world on a daily basis. To transport such a large quantity of goods is a costly affair.

- It is impossible to transport goods in such large quantity and various sizes through airways. Even if goods are smaller in size they cannot be transported through airways unless they are quite valuable.

- Waterways though slow, provide facility to transport any type of goods in any size and volume that too at cheaper rates. Hence, international trade mostly takes place through waterways.

Multiple Choice Questions

Question 1.

How many parties sign an insurance contract?

(A) 2

(B) 3

(C) 4

(D) 5

Answer:

(A) 2

Question 2.

The amount paid by insuree to the insurer is

(A) Fees

(B) Commission

(C) Profit

(D) Premium

Answer:

(D) Premium

Question 3.

How many principles does insurance have?

(A) 2

(B) 4

(C) 6

(D) 8

Answer:

(B) 4

![]()

Question 4.

Which of the following is not a principle of insurance?

(A) Principle of indemnity

(B) Principle of insurable interest

(C) Principle of utmost good faith

(D) None of these

Answer:

(D) None of these

Question 5.

The main objective of insurance is

(A) To earn profit

(B) To serve financial loses

(C) To cover financial loss

(D) To eliminate risk

Answer:

(C) To cover financial loss

Question 6.

Providing insufficient information to the insurer or by the insuree to the insurer is a breach of principle of

(A) Indemnity

(B) Utmost good faith

(C) Subrogation

(D) Insurable interest

Answer:

(B) Utmost good faith

Question 7.

If the principle of utmost good faith is broken, the insurance policy

(A) Is transferred to the nominee

(B) The insuree is penalized

(C) Stands null

(D) Both (B) and (C)

Answer:

(C) Stands null

Question 8.