Gujarat Board GSEB Class 12 Commerce Accounts Important Questions Part 1 Chapter 2 Final Accounts (Financial Statements) of Partnership Firm Important Questions and Answers.

GSEB Class 12 Accounts Important Questions Part 1 Chapter 2 Final Accounts (Financial Statements) of Partnership Firm

Answer the following questions in one sentence.

Question 1.

Write the formula for Adjusted purchase.

Answer:

Adjusted purchase = Opening stock of goods + Purchase – Closing stock of goods

Question 2.

In the trial balance, when closing stock of goods is given ?

Answer:

When closing stock of goods is given in the trial balance means – Result of Trading A/c, gross profit or gross loss is given or Adjusted purchase is given or Revised Trading A/c is to be prepared.

![]()

Question 3.

Write the formula for cost of goods sold.

Answer:

Cost of goods sold = Net sales – Gross profit OR

Cost of goods sold = Opening stock of goods + Net purchase + purchase exp. – closing stock of goods.

Question 4.

Interest on investments of providend fund shown in the trial balance, will be shown in the final accounts on …………….

Answer:

Interest on investments of P.F shown in the trial balance will be shown on capital-liability side of Balance Sheet in the amount of providend fund.

Question 5.

Bad debts reserve is calculated on which debtors ?

Answer:

Bad debts reserve is calculated on doubtful debts.

Question 6.

Discount reserve on debtors is calculated on which debtors ?

Answer:

Discount reserve on debtors is calculated on goods debtors.

Question 7.

Where would you show credit balance of suspense account in the final accounts ?

Answer:

On the Capital-Liabilities of balance sheet, Credit balance of suspense account will be shown in the final accounts.

Question 8.

Where would you show particulars of profit and loss appropriation account, if it is not prepared separately ?

Answer:

When profit and loss appropriation account is not to be prepared then particulars of that account is to be shown in the profit and loss account.

![]()

Question 9.

Where would you show Goods return (credit) and salary-wages in the final accounts given in the trial balance ?

Answer:

Goods return (Credit) on the credit side of Trading A/c and will be subtracted from sales, while salary- wages will be recorded on debit side of profit and loss account.

Question 10.

Where would you shown depreciation balance given in the trial balance in the final accounts ?

Answer:

Depreciation balance given in the trial balance will be shown as the debit side of profit and loss account.

Give answer of the following questions :

Question 1.

Where will you disclose the following items given in a trial balance during the preparation of a final account of a partnership firm ?

(1) Providend fund (2) Bank overdraft (3) Drawings of a partner (4) Depreciation on ma¬chine (5) Provisions for taxes (6) Loan taken from bank (7) Stationery stock (8) Salary or Partner (9) Advertisement suspense A/c (10) Apprentice premium.

Answer:

Balance – To be shown in and on side

(1) Providend fund – Balance sheet, on Capital-Liability side

(2) Bank overdraft – Balance sheet, on Capital-Liability side

(3) Drawings of a partner – Profit and loss Appro. A/c, debit side

(4) Depreciation on machine – Profit and loss A/c, debit side

(5) Provisions for taxes – Balance sheet, on Capital-Liability side

(6) Loan taken from bank – Balance sheet, on Capital-Liability side

(7) Stationery stock – Balance sheet, on Assets-Receivable side

(8) Salary of partner – Profit and Loss Appro. A/c, debit side

(9) Advertisement suspense A/c – Balance sheet, on Assets-Receivable side

(10) Apprentice premium A/c – Profit and Loss A/c, debit side

Question 2.

Where will you disclose the effects of the following adjustments during the preparation of final accounts of a partnership firm ?

(1) Goods given for advertisement. (2) Unrecorded purchase (3) Interest on credit balance of current account of partner (4) Pre received income. (5) Outstanding /unpaid expenses (6) Discount reserve on creditors (7) Interest on drawings of a partner. (8) Provision for doubtful debts (9) Interest on loan given by partner to the firm (10) Depreciation on assets.

Answer:

Effects of adjustments :

| (1) Goods given for advertisement | – On debit side of profit and loss A/c (As adv. Exp.) – On debit side of Trading A/c Subtract it from purchase A/c |

| (2) Unrecorded purchase | – On debit side of Trading A/c (Added it to purchase A/c) – On capital-Liability side of Balance sheet (Add it to creditors) |

| (3) Interest on credit balance of current account of a partner | – On debit side of profit and loss Appro. A/c – On credit side of partners current A/c |

| (4) Pre received income | – On credit side of profit and loss A/c (Subtract it from respective income) – On capital-Liability side of Balance sheet |

| (5) O/s or unpaid expense | – On debit side of Trading /profit- loss A/c (Add it to respective expense) – On capital-liability side of Balance sheet |

| (6) Discount reserve on creditors | – On credit side of profit and loss A/c – On capital -Liability side of Balance sheet (Add it to creditors) |

| (7) Interest on drawings of a partner | – On debit side of capital/ current A/c – On credit side of profit-loss Appro. A/c |

| (8) Provision for doubtful debts | – On debit side of profit-loss A/c – On Asset-receivable side of Balance sheet (Subtract it from debtors) |

| (9) Interest on loan given by partner to the firm | – On debit side of profit-loss A/c – On capital-liability side of Balance sheet |

| (10) Depreciation on asset | – On debit side of profit-loss A/c – On Asset-receivable side of Balance sheet (Subtract it from respective asset) |

![]()

Question 3.

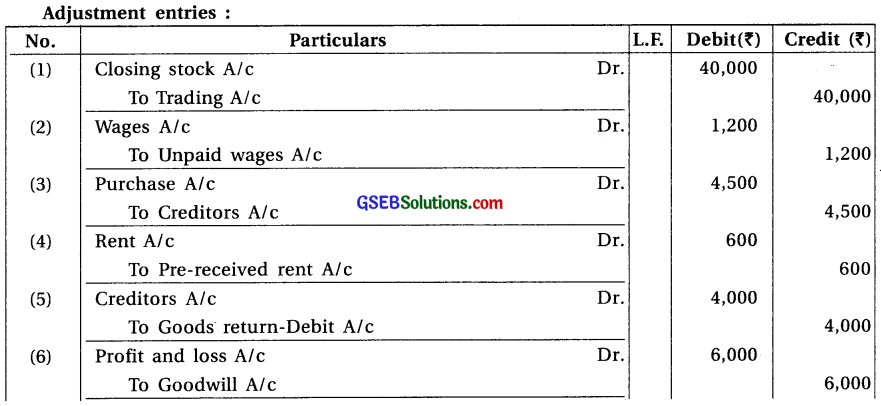

Pass adjustment entry for the following adjustments : (Narration is not required)

(1) Closing stock is valued at ₹ 48,000 which is more than its market value by 20%.

(2) Unpaid wages is ₹ 1,200

(3) Credit purchase of ₹ 4,500 is not recorded in the books.

(4) Rent ₹ 600 is received in advance

(5) Goods return (Debit) ₹ 4,000 is not recorded in the books.

(6) Goodwill value is ₹ 12,000, write off 50% of its value

(7) At the end of the account year, closing stock of stationery is ₹ 1,500.

(8) Calculate 6 months depreciation at 10% p.a. on furniture of ₹ 12,000.

(9) In a cash balance, one note of Rs.100 is face.

(10) Goods of ₹ 8,000 were stolen away, Insurance company accepted the claim of 80% amount.

Answer:

Note : As per New Blue Print given by H.S.C. Board, no question will be asked from Section-C, Section-D and Section-E.

Select appropriate option from the following :

Question 1.

Which account is prepared to know gross profit or gross loss for partnership firm ?

(A) Trading A/c

(B) Profit and loss A/c

(C) Capital A/c

(D) Current A/c

Answer:

(A) Trading A/c

Question 2.

For the Trading A/c, when credit side total is more than it is known as …………………

(A) Gross loss

(B) Gross profit

(C) Net profit

(D) Net loss

Answer:

(B) Gross profit

Question 3.

What debit balance of Trading A/c ?

(A) Gross profit

(B) Gross loss

(C) Net profit

(D) Divisible loss

Answer:

(B) Gross loss

![]()

Question 4.

Where would you show net loss amount ?

(A) Dr. side of profit and loss A/c

(B) Cr. side of profit and loss A/c

(C) Cr. side of capital A/c

(D) Cr. side of profit-loss Appro. A/c

Answer:

(B) Cr. side of profit and loss A/c

Question 5.

What is discount fund -credit ?

(A) Discount received

(B) Discount allowed

(C) Discount reserve on creditors

(D) Discount reserve on debtors

Answer:

(D) Discount reserve on debtors

Question 6.

Discount fund-Debit has ……………… balance.

(A) Debit

(B) Credit

(C) Debit and credit

(D) None of the given

Answer:

(B) Credit

Question 7.

Where would you show Royalty amount ?

(A) Debit side of Trading A/c

(B) Capital-liability side of B/s

(C) Debit side of profit and loss A/c

(D) Asset-Receivable side of B/s.

Answer:

(A) Debit side of Trading A/c

Question 8.

Interest on investments of providend fund will be shown on ……………..

(A) Credit side of profit and loss A/c

(B) On Capital -Liability side of B/s, added it to P.F. balance

(C) Debit side of profit and loss A/c

(D) On Asset-Receivable side of B/s, added it to P.F. Inv. Balance

Answer:

(B) On Capital -Liability side of B/s, added it to P.F. balance

Question 9.

Closing stock of goods balance given in the trial balance is to be shown on ……………..

(A) Debit side of Trading A/c

(B) Credit side of Trading A/c

(C) On capital- Liability side of B/s

(D) On Asset-Receivable side of B/s

Answer:

(D) On Asset-Receivable side of B/s

Question 10.

Depreciation on machine (Factory) balance given in the trial balance is to be shown on ……………..

(A) debit side of Trading A/c

(B) On Asset-Receivable side of B/s

(C) debit side of profit- loss A/c

(D) None of the given

Answer:

(A) debit side of Trading A/c

![]()

Question 11.

Which one of the following is not administrative expense ?

(A) Bad debts

(B) Insurance premium

(C) Taxes

(D) Miscellaneous expense

Answer:

(A) Bad debts

Question 12.

Which one of the following is financial expense ?

(A) Stationery expense

(B) Interest on loan

(C) Taxes

(D) Interest on drawings

Answer:

(B) Interest on loan

Question 13.

Which one of the following is permanent asset ?

(A) Vehicles

(B) Closing stock

(C) Investments

(D) Bills receivables

Answer:

(A) Vehicles

Question 14.

Which one of the following is not a permanent asset ?

(A) Debtors

(B) Debentures

(C) Bills receivables

(D) O/s interest

Answer:

(B) Debentures

Question 15.

Closing stock of goods is valued at ₹ 23,000 which is 15% more then its market value what will be the amount to be recorded on credit side of Trading A/c ?

(A) ₹ 23,000

(B) ₹ 19,550

(C) ₹ 20,000

(D) ₹ 26,450

Answer:

(C) ₹? 20,000

Question 16.

Closing stock is valued at ₹ 20,000. Out of which the market value of 10% goods is 20% less and the market value of 20% goods is 10% more. What is the closing stock value now ?

(A) ₹ 20,000

(B) ₹ 24,000

(C) ₹ 19,600

(D) ₹ 18,000

Answer:

(C) ₹ 19,600

![]()

Question 17.

Carriage charges ₹ 4,500 is shown in the trial balance on debit side. In the adjustment it is given that 10% carriage charges is outstanding. What is carriage charges value to be shown on debit side of Trading A/c ?

(A) ₹ 4,950

(B) ₹ 5,400

(C) ₹ 5,000

(D) ₹ 4,050

Answer:

(C) ₹ 5,000

Question 18.

For the year ending on 31-3-17, Leasehold building value ₹ 70,000 is given which was taken over on 1-10-14 for 5 years. Find the amount to be written off for leasehold building in the current year.

(A) ₹ 14,000

(B) ₹ 20,000

(C) ₹ 7,000

(D) ₹ 28,000

Answer:

(B) ₹ 20,000

Question 19.

In the trial balance, furniture is shown at ₹ 18,000 and depreciation on furniture ₹ 2,000 is given. If 5% then find the depreciation amount.

(A) ₹ 2,100

(B) ₹ 3,000

(C) ₹ 2,700

(D) ₹ 1,000

Answer:

(B) ₹ 3,000

Question 20.

Closing stock is valued at ₹ 30,000. From the following information find the value of closing stock. Market value (₹) 9,000, Cost price (₹) 7,500 and Market value (₹) 7,500, Cost price (₹) 9,000.

(A) ₹ 16,500

(B) ₹ 15,000

(C) ₹ 18,000

(D) ₹ 28,500

Answer:

(D) ₹ 28,500

Question 1.

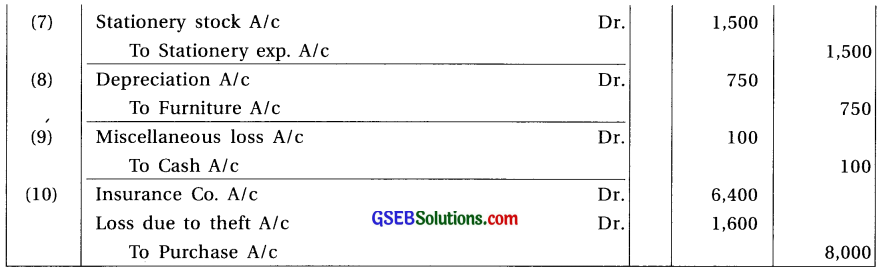

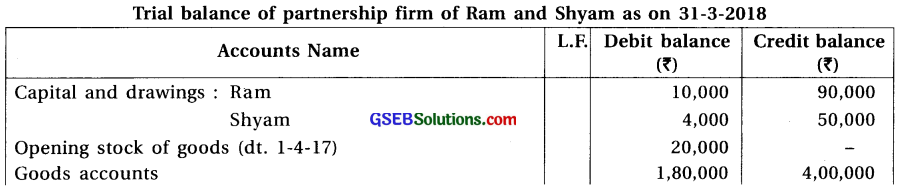

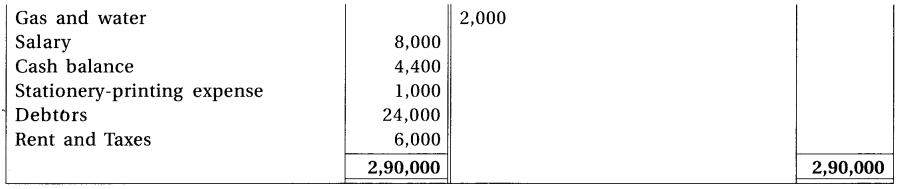

Akash and Alap are partner of a firm sharing profit and in the ratio of 2 : 3. Trial balance of the firm as on 31-3-2018 was as follows :

Adjustment: (1) Closing stock is of ₹ 80,000, Market value of this stock is ₹ 75,000 (2) Goods of ₹ 5,000 purchased on credit by mistake it was recorded as credit sales (3) Alap brought personal furniture of ₹ 10,000 on 1-10-2017 in the business, which was not recorded in the books of accounts. (4) Write of ₹ 10,000 as bad debts from debtors. Alap provide 10% for bad debts reserve and 2% for discount reserve on debtors. (5) Provide depreciation at 10% p.a. on furniture (6) Calculate interest on capital at 10% p.a. in excess of drawings amount (Capital-drawings = New capital)

Prepare final accounts from the above information for the partnership firm.

Answer:

Gross profit = ₹ 2,04,000; Net profit = ₹ 1,34,190 divisible profit = ₹ 1,14,190; Out of which for Akash = ₹ 45,676 and For Alap = ₹ 68,514; Closing balance of capital : Akash = ₹ 1,39,179; Alap = ₹ 2,00,014; Total of balance sheet = ₹ 3,89,190; Depreciation on furniture = ₹ 4,500

![]()

Question 2.

Arti and Bharti are partners sharing profit and loss of in 2 : 3 proportion of a partnership firm. From the trial balance dated 31-3-2018 and adjustments prepare final accounts for the firm.

Adjustments : (1) Closing stock of goods includes closing stock of stationery ₹ 3,000. (2) Goods return (credit) ₹ 2,000 is not recorded in the books of accounts. (3) Increase rate of depreciation on machines at 20%. (4) Provide 5% bad debts reserve on debtors. (5) Calculate 10% interest on capital.

Answer:

Gross profit = ₹ 1,40,000; Net profit = ₹ 52,500; divisible loss = ₹ 17,500; Out of which for Arti = ₹ 7,000 and for Bharti ₹ 10,500; Closing balance of Capital Arti : ₹ 3,23,000; Bharti : ₹ 4,03,500; Total of Balance sheet = ₹ 9,84,000

Question 3.

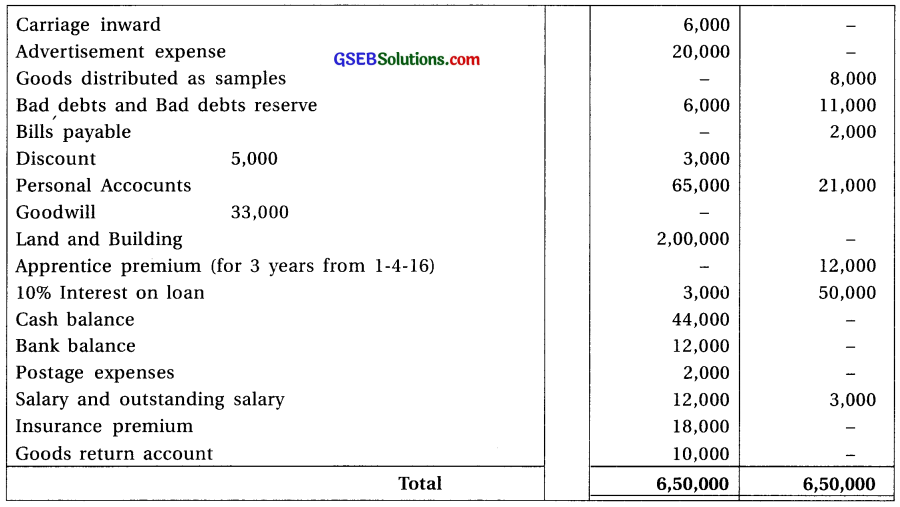

Ram and Shyam are partners of a partnership firm sharing profit and loss equally. Trial balance of their firm as on 31-3-18 was as follows :

Additional Information : (1) Closing stock is valued at ₹ 20,000, out of which market value of 10% goods is 10% less while 20% goods is 10% more. (2) Unrecorded purchase return goods is of ₹ 2,000 (3) Write off ₹ 2,000 as bad debts and provide ₹ 4,000 for bad debts reserve. (4) Insurance premium ₹ 2,000 is paid in advance. (5) Provide depreciation at 8% on land and building. (6) Provide interest on capital at 5% and interest on drawings at 10% p.a.

Prepare final accounts from the above information for the partnership firm.

Answer:

Gross profit = ₹ 2,13,800; net profit = ₹ 1,45,800; divisible profit ₹ 1,40,200; out of which for Ram ₹ 70,100 and for Shyam ₹ 70,000; Closing balance of capital Ram : ₹ 1,53,600; Shyam ₹ 1,18,200; Total of balance sheet = ₹ 3,53,800

![]()

Question 4.

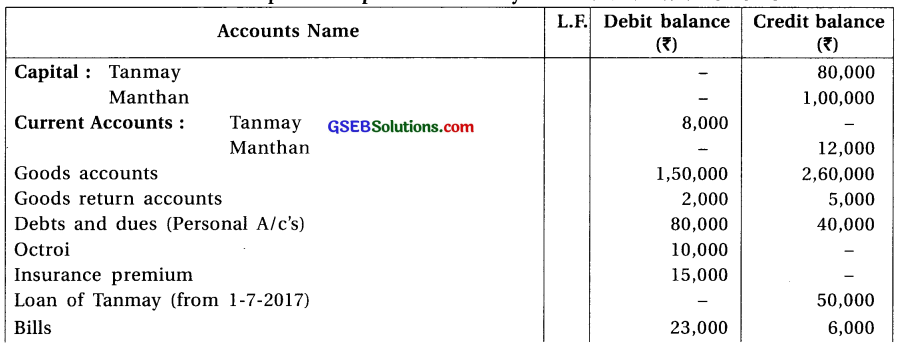

Tanmay and Manthan are partners of a firm sharing profit and loss in 2 : 1 ratio. Trial balance of their firm as on 31-3-2018 is as follows :

Adjustments : (1) Closing stock of goods is of ₹ 50,000 out of which market value of 10% goods is only 40%. (2) Unrecorded purchase is of ₹ 5,000. (3) Bad debts reserve on debtors is not required now. (4) Provide 5% depreciation on plant and machines. (5) Provide 5% interest on capital and 10% interest on opening balance of current accounts of partners.

Prepare final accounts of a partnership firm form the above information.

Answer:

Gross profit = ₹ 1,36,000; net profit = ₹ 91,150; divisible profit = ₹ 81,750; Out of which for Tanmay ₹ 54,500 and for Manthan ₹ 27,250; Closing balance of partners current accounts = Tanmay ₹ 49,700 (Cr.) Manthan ₹ 45,450; Total of balance sheet = ₹ 3,87,500

Question 5.

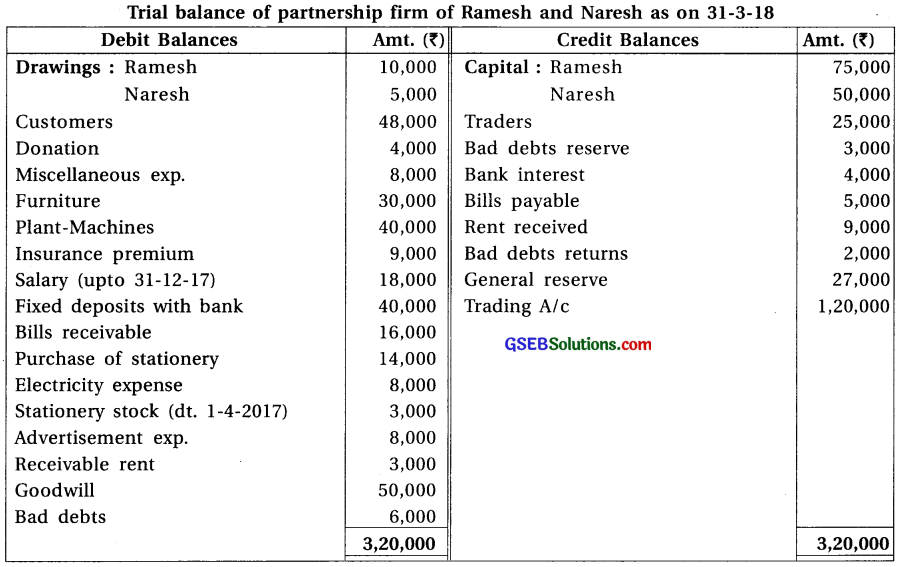

Ramesh and Naresh are partners of a firm sharing profit and loss in 4 : 1 proportion. Trial balance of their firm as on 31-3-18 was as follows :

Adjustments : (1) Unrecorded credit purchase is of ₹ 5,000. (2) Goods given for charity ₹ 2,000 is not recorded in the books. (3) Closing stock of stationery ₹ 2,000 (4) Write off ₹ 2,000 as bad debts and provide 5% for bad debts reserve. (5) Unpaid wages is of ₹ 8,000 (6) Provide deprecation at 7.5% on plant and machines.

Answer:

Revised gross profit = ₹ 1,09,000, divisible profit = ₹ 35,700 Out of which for Ramesh ₹ 28,560 and for Naresh ₹ 7,140; Closing balance of capital = Ramesh ₹ 93,560, Naresh = X 52,140; Total of balance sheet = ₹ 2,21,700

![]()

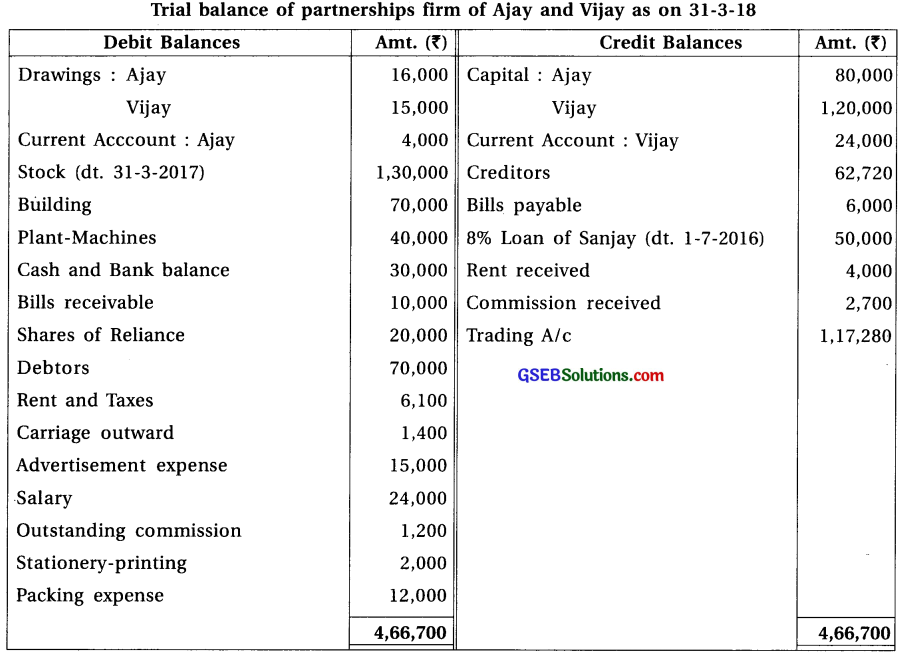

Question 6.

Ajay and Vijay are partners of a firm sharing profit and loss in 1 : 2 proportion. Trial balance of their firm as on 31-3-18 is as follows :

Adjustments : (1) 50% of advertisement expense is to be carried forward to next year. (2) Dividend at 12% is receivable on shares of Reliance. (3) Provide 5% for bad debts reserve on debtors and 2% for discount reserve on debtors. (4) Provide 10% depreciation on building and 5% on plant-machines. (5) Provide 10% interest on opening balance of capital, 12% interest on drawings and 5% interest on opening balance of current accounts. (6) Ajay is to be paid commission at 5% on divisible profit.

Prepare final account of the firm from the above information.

Answer:

Net profit = ₹ 56,550; divisible profit = ₹ 37,306; out of which for Ajay = ₹ 12,436 and for Vijay ₹ 24,870; Commission to Ajay = ₹ 1,964, Balance of current accounts of partners = Ajay ₹ 280 (Cr.), Vijay ₹ 45,270 (Cr.); Total of balance sheet = ₹ 3,67,270

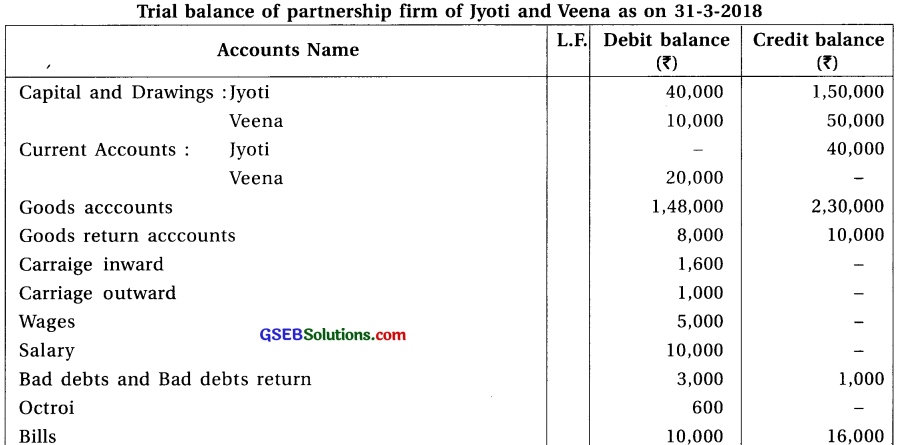

Question 7.

Jyoti and Veena are partners of a firm sharing profit and loss in capital proportion. Trial balance of their partnership firm as on 31-3-18 was as follows :

Adjustments : (1) Goods given for advertisement ₹ 4,000 is not recorded in the books. (2) Transfer ₹ 2,900 to General reserve form divisible profit. (3) Book value of Closing stock is ₹ 80,000. Out which market value of 50% stock is lose by 10% and market value of remaining stock is more by 20%. (4) Write off ₹ 10,000 as bad debts from debtors and provide 5% for bad debts reserve. (5) Provide 10% depreciation on building and increase rate of depreciation on machine to 10%. (6) Provide 10% interest on capital, 5% interest on opening balance of current account and 5% interest on drawings.

Based on above information prepare final accounts of the partnership firm.

Answer:

Gross profit = ₹ 1,16,800, Net profit = ₹ 65,400 Divisible profit = ₹ 44,000 out of which for Jyoti = ₹ 33,000 and for Veena ₹ 11,000, Closing balance of current account : Jyoti ₹ 48,000 (Cr.), Veena ₹ 15,500 (Dr.) Total of balance sheet = ₹ 3,48,400

![]()

Question 8.

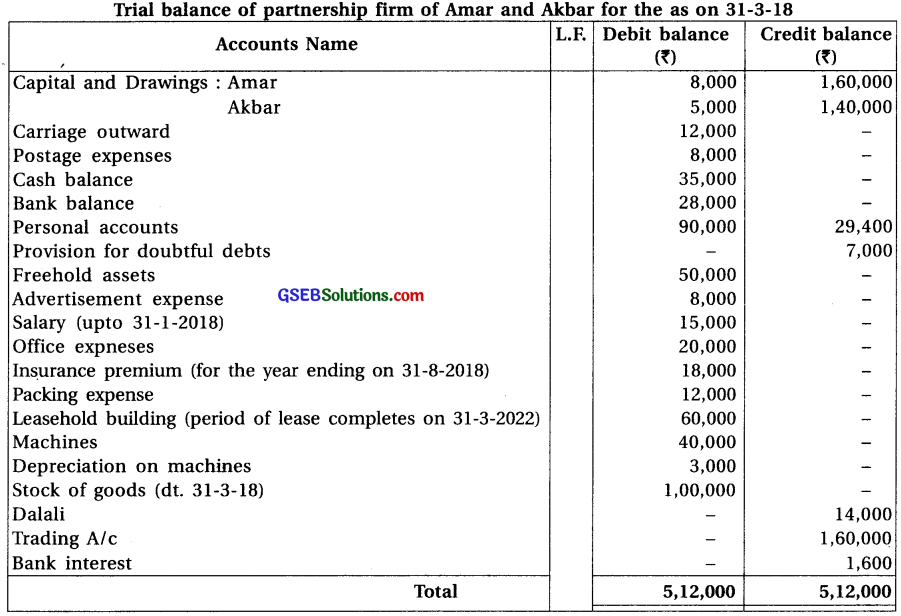

Amar and Akbar are partners of a firm sharing profit and loss in 4 : 1. Proportion. Trial balance of their firm as on 31-3-2018 was as follows :

Adjustments : (1) Provide interest on capital at 8% and interest on drawings at 10% p.a. (2) Decrease the rate of depreciation at 5% on machines. (3) Write off bad debts ₹ 3,000 from debtors and increase debts reserve by ₹ 4,000. (4) Unpaid advertisement expense is ₹ 2,000. (5) Dalali ? 4,000 is received in advance.

Prepare final accounts for the partnership firm form the above information.

Answer:

Net profit: ₹ 59,950; divisible profit = ₹ 37,250; Out of which for Amar ₹ 29,800 and for Akbar ₹ 7,450. Closing balance of capital accounts : Amar ₹ 1,93,800; Akbar ₹ 1,53,150; Total of balance sheet = ₹ 3,85,350

Question 9.

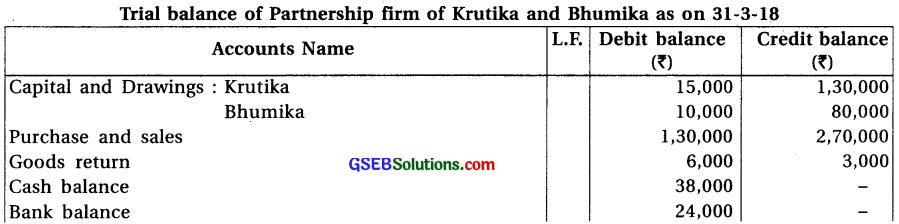

Krutika and Bhumika are partners of a firm. They shared profit upto ₹ 1,00,000 equally and remaining profit in the ratio of 3 : 2. Prepare final accounts of their firm from the given trial balance as on 31-3-2018 and adjustments as follows.

Additional Information : (1) Closing stock is of ₹ 80,000, Out of which goods of ₹ 2,000 need repairing of ₹ 800. (2) Sales return book total is under casted by ₹ 1,500. (3) Interest on debentures is outstanding (4) A bill receivable of ₹ 2,000 is returned dishonoured. Amount of this is irrecoverable (5) Bills payable book total is under casted by ₹ 1,500 (6) Increase rate of depreciation on machines at 10%.

Answer:

Gross profit = ₹ 1,80,575; net profit = ₹ 1,80,525; Out of which for Krutika ₹ 98,315 and for Bhumika ₹ 82,210. Closing balance of capital : Krutika = ₹ 2,13,315; Bhumika ₹ 1,52,210. Total of balance sheet = ₹ 4,31,900

![]()

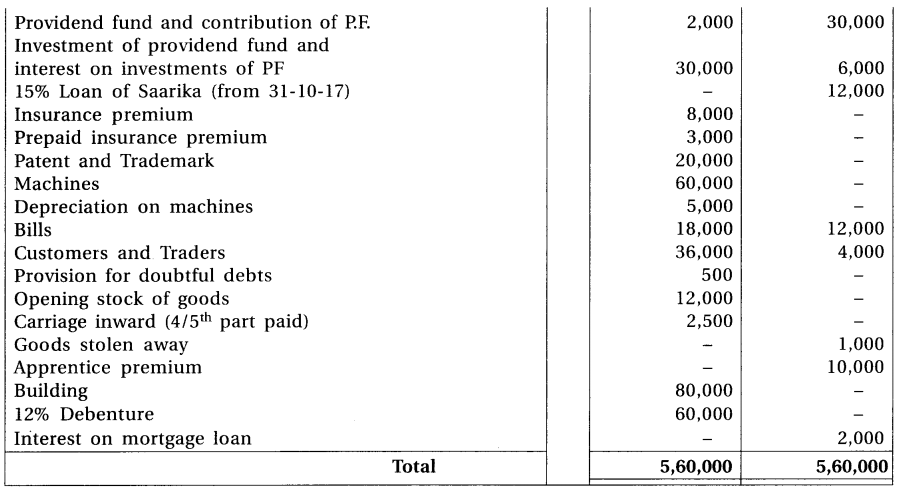

Question 10.

Ketan and Viral are partners sharing profit and loss in the ratio of 3 : 2. Trial balance of Ketan and Viral Partnership firm was as follows :

Additional Information : (1) On dt.31-3-18 closing stock of goods is of ₹ 38,000. (2) closing stock of goods includes stationery stock of Rs. 200. (3) A customer returned goods of ₹ 1,000 which was not recorded in the books but is was included in the closing stock. (4) Rent and Taxes are to be distributed in 2 : 3 ratio for factory and for office resp. (5) On 1-4-16 plant-machines of ₹ 2,000 was sold for ₹ 1,600 which was recorded as goods sold. (6) On 1-10-16 plant machines of ₹ 4,000 were purchased, which was recorded as goods purchased. (7) Provide 10% depreciation on plant- machines (8) Provide bad debts reserve at 1% of net sales amount.

From the above information prepare final accounts for the firm.

Answer:

Gross profit = ₹ 43,000; net divisible profit ₹ 24,250 out of which for Ketan ₹ 14,550 and for Viral ₹ 9,700; Closing balance of capital : Ketan = ₹ 68,550; Viral= ₹ 46,100; Total of balance sheet = ₹ 1,54,226; Depr. On plant Machines : ₹ 4,200; B.D.R. : ₹ 1,374

Question 11.

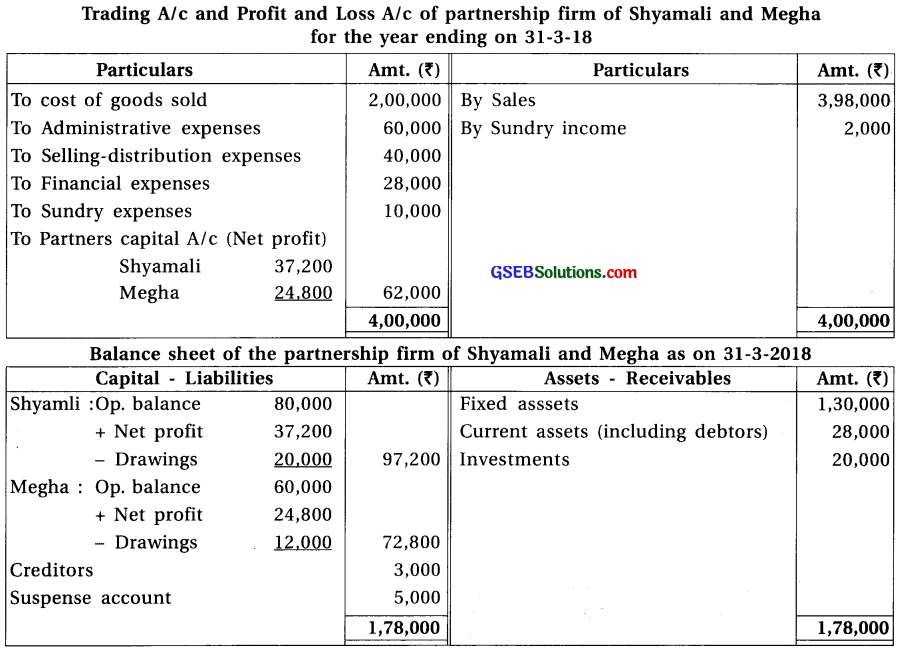

Trading A/c, profit and loss A/c and Balance sheet of a partnership firm of Shyamali and Megha are as follows.

After preparation of final accounts, it is found that,

(1) 10% interest on capital is not calculated. (2) 10% depreciation on fixed assets is to be provided. (3) Prepaid rent is of ₹ 500. (4) Interest on investments not received ₹ 800 (5) Provide ₹ 1,000 for bad debts reserve. (6) Credit purchase of ₹ 2,000 is not recorded in the books. ,(7) Total of sales account is under casted by ₹ 5,000.

Prepare revised Trading A/c, Profit and loss A/c, Profit and loss Appropriation A/c and Balance sheet.

Answer:

Gross profit = ₹ 2,01,000, Net divisible profit = ₹ 38,300; Out of which for Shyamali t 22,980 and for Megha ₹ 15,320; Closing balance of capital accounts : Shyamali = ₹ 90,980; Megha : ₹ 69,320; Total of balance sheet = ₹ 1,65,300

![]()

Question 12.

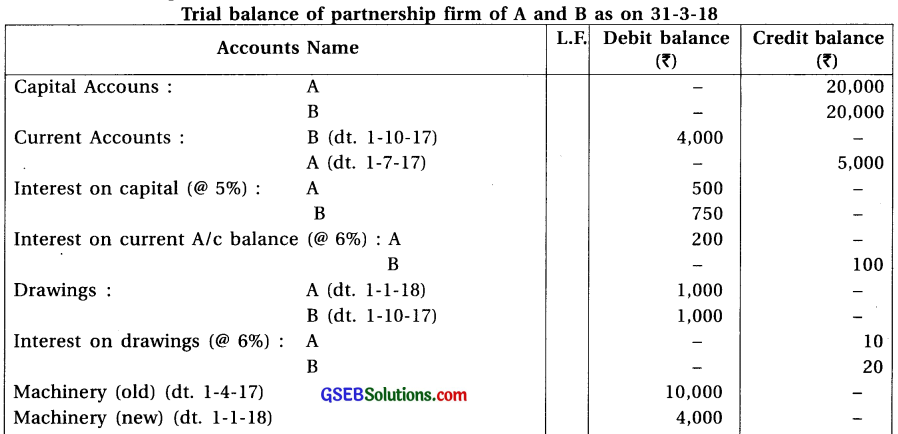

A and B are partners of a firm. Trial balance of their firm as on 31-3-18 is as follows :

Note : Calculate depreciation at 10% on old and new machinery.

From the above information prepare final accounts of the partnership firm.

Answer:

Divisible loss ₹ 29,290; Out of which for A – ₹ 14,645 and for B – ₹ 14,645; Closing balnce of current accounts : A = ₹ 8,125 (Dr.); B = ₹ 19,375 (Dr.); Total of Balance sheet = ₹ 65,000; Depreciation on machine = ₹ 1,100; prepaid ins. prem = ₹ 600

Question 13.

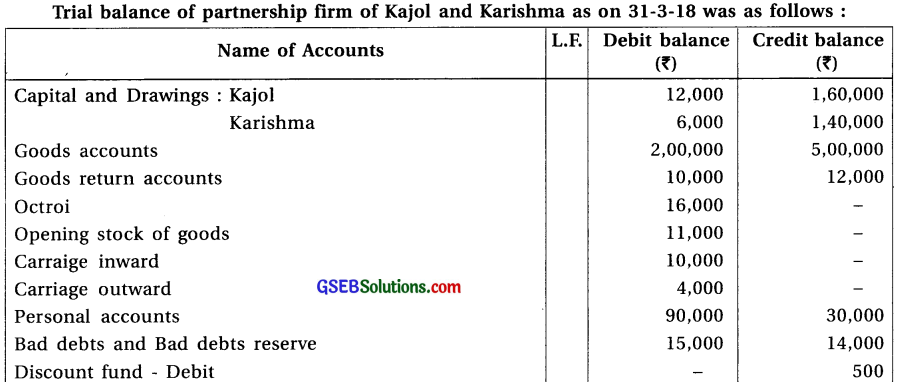

Kajol and Karishma are partners of a firm sharing profit-loss in 3 : 2 proportion. Trial balance of their firm as on 31-3-18 was as follows :

Adjustments : (1) On dt.31-3-18 the closing stock is of ₹ 45,000 while its market value is ₹ 41,000. (2) Goods of ₹ 5,000 is purchased on credit, which ws not recorded in the books of accounts. (3) Karishma withdraws goods of ₹ 1,000 for personal use Which was not recorded in the books. (4) Goods of ₹ 10,000 was burnt by fire, insurance company accepted the clain 70% amount. (5) Write off ₹ 5,000 from debtors and provide 10% for bad debts reserve and 2% for discount reserve on debtors. (6) Insurance premium includes ₹ 1,200 of the next year. (7) Provide depreciation at 10% on land-building, at 20% on machines and at 5% on furniture and fixtures. (8) Commission ₹ 1,000 is receivable outstanding.

Prepare final accounts of the partnership firm from the above information.

Answer:

Gross profit = ₹ 3,12,000; Divisible profit = ₹ 1,65,920 out of which for Kajol = ₹ 99,552 and for Karishma ₹ 66,368; Closing balance of partners’ capital accounts : Kajol = ₹ 2,47,552, Karishma = ₹ 1,99,368; Total of balance sheet = ₹ 5,44,220

![]()

Question 14.

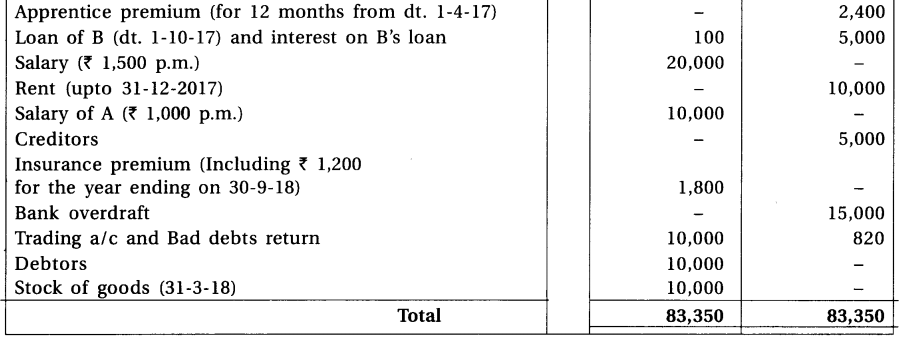

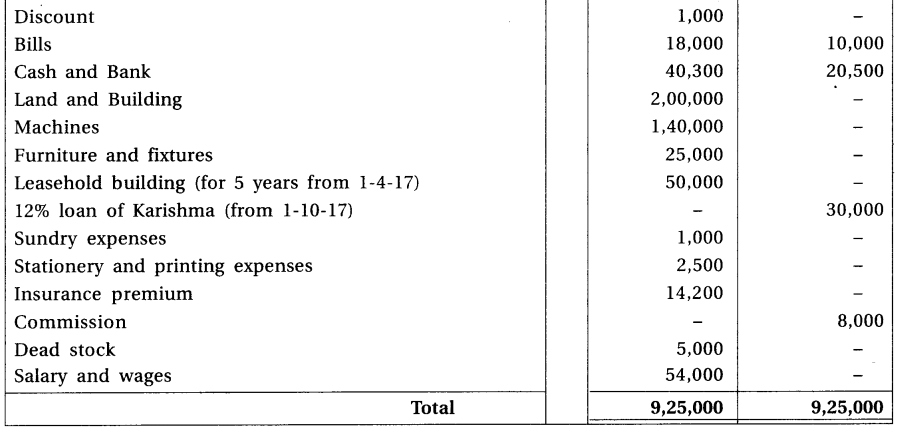

Neelam and Neerali are partners of a firm. Trial balance of their firm as on 31-3-2018 was as under :

Additional information : (1) Closing stock is valued at ₹ 50,000, Out of which market value of 20% goods is 25% less. Remaining stock is valued at ₹ 45,000. (2) Neerali brought furniture of ₹ 10,000 in the business on 1-10-17. Which was not recorded in the books. (3) Unrecorded credit purchase is of ₹ 4,000. (4) Write off ₹ 1,500 as bad debts from debtors and provide 5% bad debts reserve and 2% discount reserve on debtors. (5) Decrease rate of depreciation on plant and machines to 10% and provide 20% depreciation on furniture. (6) For the active participation in the firm, Neelam has right monthly salary of ₹ 500. (7) Carriage charges 2/5th part is unpaid. While carriage inward and carriage outward is in the ratio of 2 : 3. (8) Calculate interest on capital at 10% on fixed capital, interest on current account balance at 6% and interest on drawings at 12% for 6 months.

From the above information prepare final accounts for the partnership firm.

Answer:

Gross profit = ₹ 57,100; Net profit = ₹ 23,533; Divisible profit = ₹ 3,953; Out of which for Neelam ₹ 1,976 and for Neerali ₹ 1,977; Closing balance of Current accounts = Neelam ₹ 3,107 (Dr.), Neerali ₹ 27,637 (Cr,); Total of balance sheet ₹ 2,62,437.