Gujarat Board GSEB Class 12 Commerce Economics Important Questions Chapter 4 Banking and Monetary Policy Important Questions and Answers.

GSEB Class 12 Economics Important Questions Chapter 4 Banking and Monetary Policy

Short Question And Answers

Question 1.

What are the main classifications of banks?

Answer:

Banks can be classified in two categories: Commercial Banks and Central Bank

Question 2.

Why banks are called commercial institutions?

Answer:

Banks undertake activities to mobilize peoples’ money in order to make profit. Hence, …

Question 3.

List the types of deposits that the banks accept.

Answer:

Current deposits, Savings deposits, Recurring deposits and Fixed/Long term deposits

![]()

Question 4.

What is overdraft facility?

Answer:

The facility provided by the banks to account holders wherein, the account holder is permitted to withdraw more money than he has in his account is called ……

Question 5.

What do you mean by recurring deposit?

Answer:

The facility provided by the banks wherein, the people who have regular incomes can deposit a fixed amount every month in their account and earn interest on the accumulated amount is called …….

Question 6.

What are fixed deposits?

Answer:

A fixed deposit (FD) is a financial instrument provided by banks which provides investors with a higher rate of interest than a regular savings account, until the given maturity date.

Question 7.

Which are the different payment and withdrawal facilities provided by the bank?

Answer:

Cheques, withdrawal slips and drafts, pay order, ATM facilities, debit cards, credit cards, internet banking, etc.

Question 8.

What is debit card?

Answer:

A card allowing the account holder to transfer money electronically from his bank account when making a purchase is called a debit card.

Question 9.

What is credit card?

Answer:

A card allowing the holder to purouase goods and services on credit is called a credit card. Here, the holder borrows money from the bank on credit with an agreement of returning the money within the grace period provided by the bank.

Question 0.

What is the ATM facility provided by banks?

Answer:

The full form of ATM is Automated Teller Machine. It allows the customer to perform various banking transactions like deposits, cash withdrawals, obtaining account information with the help of a card called ATM card.

![]()

Question 11.

What is letter of credit?

Answer:

A letter issued by bank acting as a mediating agent for payment between exporter (in India) and importer (in foreign country) especially when the parties are unknown to each other is called-…] [Underwriting is a detailed credit analysis by the bank before granting a loan to an individual or to a company. This analysis is done based on the information provided by the borrower.

Question 12.

What are underwriting services?

Answer:

Underwriting is a detailed credit analysis by the bank before granting a loan to an individual or to a company. This analysis is done based on the information provided by the borrower.

Question 13.

What is micro-finance facility provided by the banks?

Answer:

A facility where the banks provide finance to small business for overall development of the community and economy as a whole is called ……

Question 14.

What is the role of bank facilities – NEFT and RTGS?

Answer:

[NEFT (National Electronic Fund Transfer) and RTGS (Real Time Gross Settlement) help in money transfer through electronic medium from account of one customer to account of other customer in the same bank or different bank.

Question 15.

How is transferring money through NEFT and RTGS possible?

Answer:

Transferring money through electronic medium (NEFT and RTGS) is possible because of CORE banking i.e. Centralized Online Real Time Exchange.

Question 16.

What is CORE banking?

Answer:

CORE banking is a software application used for recording transactions, storing customer information, calculating interest and completing the process of passing entries in a single database. It enables accessing of complete customer account details centrally.

Question 17.

What do you mean by DEMAT account?

Answer:

The full form of DEMAT account is Dematerialized account. It is an account through which shares, debentures, bonds,etc. can be held, bought and sold in electronic form.

Question 18.

Which is the Central bank of India?

Answer:

Reserve bank of India

Question 19.

When did foreign banks enter India?

Answer:

Foreign banks entered India after the economic reforms in the year 1991.

![]()

Question 20.

What are money markets?

Answer:

In India, money markets are such markets that provide short term funds whose maturity period is from 1 day to 1 year. Money market is classified into organized market and unorganized market.

Question 21.

What are organized and unorganized money market in India?

Answer:

Organized money market refers to availability of short term funds by RBI, private banks, public banks, non-banking financial companies (E.g. LIC) Unorganized money market refers to availability of short term funds by money lenders, indigenous bankers etc.

Question 22.

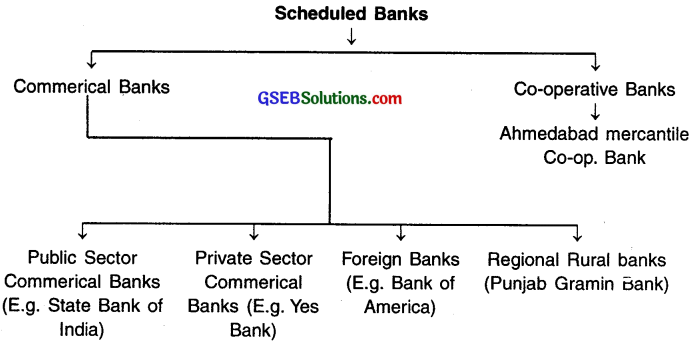

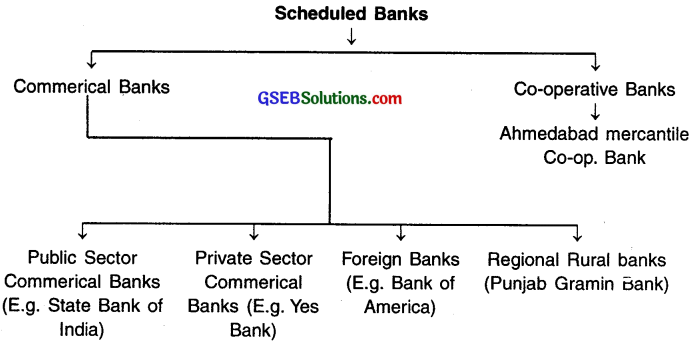

What are scheduled banks?

Answer:

Scheduled banks are those companies which are listed in the 2nd schedule of the RBI Act, 1934. Schedule banks can be classified into commercial banks and cooperative banks.

Question 23.

Which are the different types of commercial banks?

Answer:

Public sector commercial banks, private sector commercial banks, foreign banks in India and regional rural banks.

Question 24.

What is the meaning of promotional function of RBI?

Answer:

Promotional function means RBI tries to create banking awareness among people, encourages branch expansion in rural areas and promotes setting up of cooperative banks in the interest of people.

Question 25.

What is the main function of Reserve Bank of India?

Answer:

RBI is the apex bank of india which supervises and regulates the entire banking sector as well as formulates the monetary policy of India.

![]()

Question 26.

What is the meaning of ‘lender of last resort’?

Answer:

This means that when the commercial banks are in need of loan or credit, RBI/ Central Bank gives temporary financial arrangement to commercial banks in case of emergency. This helps the commercial banks to maintain their liquidity and thus allow smooth functioning of all the commercial banks.

Question 27.

How does RBI maintain the value of the value of Indian currency in the open market?

Answer:

By buying and selling of foreign exchange in the open market.

Question 28.

Define Financial Inclusion.

Answer:

Financial Inclusion means providing banking services to low income segments of society at an affordable price. It provides special credit facilities to agriculture, small scale industries, self-employed people and cottage industries.

Question 29.

What is Prime Minister Jan Dhan Yojna?

Answer:

Prime Minister Jan-Dhan Yojana (PMJDY) is National Mission for Financial Inclusion to ensure access to financial services, namely, Banking? Savings & Deposit Accounts, Remittance, Credit, Insurance by all people of India.

![]()

Question 30.

What is bank rate?

Answer:

Bank rate is the rate of interest which Reserve Bank of India charges on the loans and advances given to commercial bank.

Question 31.

What was the bank rate in India in the year 2016?

Answer:

7%

Question 32.

Define inflation and depression (deflation).

Answer:

Inflation means the supply of money is higher than the demand for money which leads to high prices of goods and services in the economy. Deflation means the supply of money is less than the demand for money and hence the prices of the goods and services fall.

Question 33.

Define Repo rate and Reverse Repo rate?

Answer:

‘Repo rate’ refers to the rate at which Reserve Bank of India lends money to commercial banks when there is lack of funds in the commercial banks. ‘Reverse Repo’ rate is a short term borrowing rate at which RBI borrows money from commercial banks.

Question 34.

What was the repo rate and reverse repo rate in the year 2016?

Answer:

Repo rate: 6.5% and reverse repo rate: 6%.

![]()

Question 35.

What is the repo rate and reverse repo rate in the year 2017?

Answer:

Repo rate: 6.25% and reverse repo rate: 5.75%.

Question 36.

Explain marginal standing facility.

Answer:

Banks can borrow funds overnight from RBI against government securities in emergency. This facility is a very short term borrowing scheme for scheduled commercial banks and is known as ….

Question 37.

Define cash reserve ratio.

Answer:

Cash Reserve ratio is the specified percentage of the total deposits of customers of the commercial bank that has to maintained by the banks with the RBI

Question 38.

What is the cash reserve ratio in the year 2017?

Answer:

4%

Question 39.

Define statutory liquidity ratio.

Answer:

Statutory liquidity ratio is the percentage of total deposits (25% or more) that the commercial banks have to maintain with RBI inform of cash, gold, government approved securities.

Question 40.

What is the statutory liquidity ratio in the year 2017?

Answer:

20.5%

Question 41.

What is open market operations?

Answer:

Open market operations refer to sale of or purchase of government securities/bonds by the RBI in the open market.

Question 42.

What is the meaning of ‘ceiling on credit’?

Answer:

RBI fixes a limit on the loans and advances that the commercial banks can give to the people. Ceiling on credit is done by RBI to have a check of credit flow in a particular sector or industry.

![]()

Question 43.

Explain discriminatory interest rates

Answer:

Discriminatory interest rates are banks charges, different rate of interest on different types of loans and advances and also charges differently to different economic class of people.

Question 44.

What is meant by quantitative tools of monetary policy?

Answer:

Quantitative measures are general measures that influence the overall economy i.e. measures that have an impact on the economy in general

Question 45.

What is meant by qualitative tools of monetary policy?

Answer:

Qualitative tools of monetary policy are selected by RBI based on the impact of credit for development of certain sectors or segments of the economy

Question 46.

RBI has stopped using bank rate as an instrument to regulate money supply and is using repo and reverse repo rate instead. Why?

Answer:

[Bank rate is for long period and thus cannot be changed in a very short period whereas, repo and reverse repo rate can be altered in a very short periods and thus, help to regulate money supply in short term.

Question 47.

What is credit creation?

Answer:

[The policy process of banks for lending money from primary deposits and thereby creating new deposits and increased money supply is called credit creation.]

Question 48.

What are primary deposits?

Answer:

Deposits in the form of initial public savings with banks are called primary deposits.

![]()

Question 49.

What are secondary deposits?

Answer:

Additional deposits derived by banks when loans created from primary deposits are accounted in banks are called secondary deposits.

Question 50.

Define government securities.

Answer:

Interest bearing bonds floated by government in the market to raise money, which are purchased by people and are repurchased by the government after a fixed period are called government securities.

Long Answer Type Questions

Question 1.

Define banks and explain briefly.

Answer:

Banks:

- Banks are commercial/financial institutions whose main function is to receive deposits from people and lend them for investment purpose

- People deposit their excess money i.e. savings in the bank in return of which the bank provides them interest.

- The main services that bank provides to people are depositing money in the form of savings account or fixed deposits, giving loans, transferring money from one account to other, receiving LPG subsidy, cheque payment and withdrawal, like purchasing of assets like car and furniture, debit cards, credit cards, Internet banking, DEMAT account, etc.

Definition:

‘A bank is an institution which provides services of banking.’

- ‘Bank is an institution authorized to collect peoples’ savings/deposits with the purpose of lending those; under the condition of returning the same when the depositor demands’.

- ‘A bank is a commercial organization that functions for profit. It accepts peoples’ savings in the form of deposits and pays interest in return. It ensures the safety of these deposits, lends money from these deposits to people who need money by charging them with interest and invest the surplus funds for development of the nation.’

Question 2.

How have banks evolved to current scenario?

Answer:

(A) Evolution of banks:

- The word ‘bank’ means ‘mass’ or ‘heap’. ‘Bank’ word has been originated from the French word ‘Banque and Italian word ‘banca’ both meaning ‘Bench’ for money exchange.

- In Sanskrit, the word similar to bank is ‘bhanda’ which means collection of fund/capital.

- Traditionally, the money lenders in Europe displayed coins (currencies) of different countries in big heaps on benches or tables for lending or exchanging.

- Thus, the word bank means collection/fund/stock of money.

- The first bank to be set up in the world was ‘Bank of Barcelona’ in Spain in 1401.

- It was then, that the currency money was introduced in the world.

(B) Functions of money:

The currency money immediately came into action with following functions:

(a) Medium of exchange: Money immediately became a unit of exchange for all goods and services.

(b) Measure of value: Money became a common unit of account or measure of value i.e. all the goods and services started to be valued in terms of money.

(c) Standard of deferred payments: People also started using money for deferred payments i.e. payments to be made in future.

(d) Store of value: Money started getting stored and exchanged with other currencies to enhance its own worth or to increase ones’ wealth.

Going forward, the world realized the need to maintain the value of money at world level. This gave rise to banks as institutions for safety of money, transfer of money, and maintaining the value of money.

![]()

Question 3.

What are the functions of money?

Answer:

Functions of money:

The currency money immediately came into action with following functions:

(a) Medium of exchange: Money immediately became a unit of exchange for all goods and services.

(b) Measure of value: Money became a common unit of account or measure of value i.e. all the goods and services started to be valued in terms of money.

(c) Standard of deferred payments: People also started using money for deferred payments i.e. payments to be made in future.

(d) Store of value: Money started getting stored and exchanged with other currencies to enhance its own worth or to increase ones’ wealth.

Going forward, the world realized the need to maintain the value of money at world level. This gave rise to banks as institutions for safety of money, transfer of money and maintaining the value of money.

Question 4.

Define and explain commercial banks.

Answer:

Commercial banks:

- A commercial bank is a business unit which provides banking services for profit.

Definition: - According to Banking Company Act, “Commercial bank is one which transacts the business of banking that is, accepting deposits from the people for the purpose of lending or investment, repayable on demand or otherwise and withdrawable by cheque, draft, and pay-order or otherwise.

Meaning:

- People give their money to the banks in the form of savings (deposits). The bank then uses these deposits to invest in various sectors such as agriculture or industry.

- The bank may even buy government securities, or give loans to people who want to borrow money from the bank.

- The bank then earns profit in the form of interest by all these activities.

- The banks keep a part of interest as profit and pass away the rest as interest to the depositors.

- The banks lend the money at higher rate of interest compared to the interest they give on the money deposited in the banks. The difference of interest that the banks earn is their profit and hence they are called commercial banks.

Question 5.

Explain in detail the primary functions of the banks.

Answer:

Primary functions:

I. Accepting deposits:

A bank acts as a custodian by accepting people s’ savings in the form of deposits and gives interest in return.

Types of deposits a bank accepts:

There are four different ways in which a bank accepts deposits. They are:

- Current Account Deposits,

- Savings Account Deposits,

- Recurring Deposit Account and

- Fixed Deposits.

A customer may deposit money in banks by opening any of these accounts.

1. Current account deposits:

A business, firm or an individual can open a current account with the bank. The main objective of this account is to conduct business related transactions.

- Bank provides more liquidity to current account i.e. money can be withdrawn number of times during a day.

- No interest is given to the customers of current account. At times, bank charges service charge on this account.

- The bank also provides over-draft facility on this account i.e. the customer is able to withdraw more money than the available balance in the account

- This overdraft facility helps the business or an individual to overcome short term money deficiency.

2. Savings account deposits:

- A savings account is an account provided by a bank for individuals to save money and earn interest on the cash held in the account.

- Majority of people use savings account to deposit their savings as bank provides interest on this account.

- The account holder can withdraw money using cheque, withdrawal slip, debit card and credit card.

3. Recurring deposits:

- This type of deposit accounts allows people to deposit small amount of money every month.

- The deposit gradually increases and the bank provides interest on the accumulated amount.

- Some banks may charge penalty along with some interest loss if a person is not able to deposit money in this account in a particular month.

4. Fixed/ Long term deposits:

- People who want to deposit their money for long duration opt for fixed deposits.

- These deposits are fixed in nature and thus, money cannot be withdrawn as # and when required by the depositor.

Banks pay highest rate of interest as compared to other deposit accounts. Banks also provide overdraft facility on such deposits.

II. Providing credit facilities:

- Banks provide credit facilities to different individuals such as farmers, different professionals, etc. who are in need of money.

- Under this system, the needy ones borrow from the bank and the bank charges interest for the credit facility that it provides. The interest charges depends on the purpose of credit i.e. whether the credit is used for personal use, agricultural activity or business activity.

- The credit can be for short term (up to 1 year), medium term (1 year – 5 years), or long term (5 years – 15 years).

III. Payment and withdrawal facilities:

- A bank provides easy payment and withdrawal facility to its customers.

- The various facilities are cheque, withdrawal slips and drafts, pay order, ATM Facilities (Automatic Teller Machine), internet banking, debit card and credit card.

IV. Credit creation:

- Credit creation is the power of commercial banks to expand deposits, through loans, advances and investments.

- In other words, on the basis of cash deposits of the customers in the bank, the bank makes loans and advancement and thus increases the money supply in the market.

- They advance much more than what they collect from people in the form of deposits, thus, creating credit in the economy.

- Through the process of credit creation, commercial banks provide finance to all sectors of the economy thus, making them more developed.

- When the credit creation of bank increases, the supply of money in the economy increase and vice – versa.

V. Inter-banking transactions:

- A bank can provide short or long term credit in the form of loans or advance to the other bank as and when required.

- Short term credit is provided by one bank to another through central bank and is called ‘call money’ and the interest rate of call money is called ‘call money rate’

![]()

Question 6.

Explain in detail the secondary functions of the Danxs.

Answer:

Secondary functions:

Agency and utility services:

1. Under this a bank provides various facilities to its customers as follows:

- Letter of credit – Bank acts as a mediating agent for payment between exporter (in India) and Importer (in foreign country) especially when the parties are unknown to each other.

- Underwriting services .

- To pay tax challans

- Safe deposit vaults (lockers) – to store precious jewelry and documents safely

- Micro finance facilities – providing finance to small business for overall development of the community and economy as a whole

2. Provide various facilities with changing time:

- In today’s scenario, banks have shifted from physical presence to digitalization i.e. services in electronic form.

- The transfer of money from one customer of a bank to the other customer of the same or different bank is made easy by using electronic medium (done through facilities like NEFT and RTGS) without using cheques.

- Customers can now buy movie ticket, goods, and make payments through internet banking or mobile banking.

- DEMAT account is also one of the latest facilities provided by banks in which the customers can hold buy or sell shares and debentures through electronic form.

Question 7.

Explain the concept of credit creation.

Answer:

1. Credit creation is the power of commercial banks to expand deposits, through loans, advances and investments.

2. In other words, on the basis of cash deposits of the customers in the bank, the bank makes loans and advances and thus increases the money supply in the market.

3. Banks advance much more than what they collect from people in the form of deposits, thus, creating credit in the economy.

4. The borrower i.e. the person who requires loan is supposed to open an account with the bank when the bank lends him the money from the primary deposits/cash deposits.

5. This account has to be opened so that the borrower can deposit the cheque of the loan (the amount that he has borrowed). When the borrower deposits the loan money (derived deposits) in the account, the bank can create another loan account for third person on this derived deposit.

6. Thus, bank creates several deposits from primary deposits.

7. From every deposit, bank keeps a certain proportionate (cash reserves) money from the full deposit and can lend only remaining money.

8. Credit creation = Primary deposit (1/cash reserve ratio)

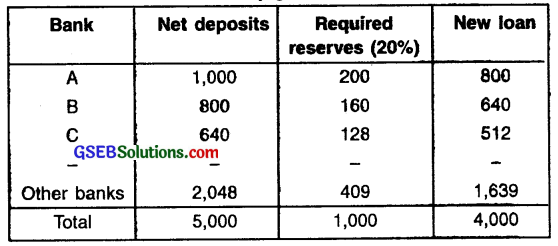

Example:

Primary deposit/Cash deposit of Bank = ₹ 1,000

Cash Reserve Ratio = 20 %

Thus, bank can create credit up to: (1,000 × 1/20%) = ₹ 5,000

Thus, the bank can create money supply of ₹ 5,000 from primary deposit of ₹ 1,000 and thus, creating credit of ₹ 4,000 in the economy

In the following table, we have net deposits of Bank A, B, C and other banks respectively i.e. the amount credited in the account of the borrower (loan amount) and the cash reserve ratio to be maintained is 20%. New loan is the amount of loan that is actually given to the borrower

Note: Here, the loan amount is calculated by – Net deposit – (Net deposit cash reserve ratio (20%))

![]()

Question 8.

Explain credit facilities as a function of banks.

Answer:

Primary functions:

Accepting deposits:

A bank acts as a custodian by accepting people s’ savings in the form of deposits and gives interest in return.

Types of deposits a bank accepts:

There are four different ways in which a bank accepts deposits. They are:

- Current Account Deposits,

- Savings Account Deposits,

- Recurring Deposit Account and

- Fixed Deposits.

A customer may deposit money in banks by opening any of these accounts.

Providing credit facilities:

- Banks provide credit facilities to different individuals such as farmers, different professionals, etc. who are in need of money.

- Under this system, the needy ones borrow from the bank and the bank charges interest for the credit facility that it provides. The interest charges depends on the purpose of credit i.e. whether the credit is used for personal use, agricultural activity or business activity.

- The credit can be for short term (up to 1 year), medium term (1 year – 5 years), or long term (5 years – 15 years).

Question 9.

List down different methods of payment and withdrawal facility provided by banks

Answer:

Primary functions:

1. Accepting deposits:

A bank acts as a custodian by accepting people s’ savings in the form of deposits and gives interest in return.

Types of deposits a bank accepts:

There are four different ways in which a bank accepts deposits. They are:

- Current Account Deposits,

- Savings Account Deposits,

- Recurring Deposit Account and

- Fixed Deposits.

A customer may deposit money in banks by opening any of these accounts.

2. Payment and withdrawal facilities:

- A bank provides easy payment and withdrawal facility to its customers.

- The various facilities are cheque, withdrawal slips and drafts, pay order, ATM Facilities (Automatic Teller Machine), internet banking, debit card and credit card.

![]()

Question 10.

Explain inter-banking transactions.

Answer:

Inter-banking transactions:

- A bank can provide short or long term credit in the form of leans or advance to the other bank as and when required.

- Short term credit is provided by one bank to another through central bank and is called ‘call money’ and the interest rate of call money is called ‘call money rate’

- In other words, call money are funds borrowed and lent by one bank to other. These loans are very short term in nature and usually lasts not more than 1 week.

- The main reason for call money between banks is mostly to meet reserve requirement.

Question 11.

State the various utility and agent banking facilities.

Answer:

Agency and utility services:

Under this a bank provides various facilities to its customers as follows:

- Letter of credit – Bank acts as a mediating agent for payment between exporter (in India) and Importer (in foreign country) especially when the parties are unknown to each other.

- Underwriting services .

- To pay tax challans

- Safe deposit vaults (lockers) – to store precious jewelry and documents safely

- Micro finance facilities – providing finance to small business for overall development of the community and economy as a whole

Question 12.

What is internet banking and how is it useful?

Answer:

- Internet Banking helps customers to use all the facilities provided by the bank through internet. The customers can also get all the details of their account and make payments through internet. Customers can purchase goods, buy movie tickets as well as purchase and sell shares through DEMAT account over the internet.

- Nowadays, internet banking is very useful as the customers do not have to go to the banks and can do all the transactions over internet being in any part of the world thus, making it more convenient for people.

- Now, Internet banking can also be done using mobile applications which has further increased the mobility of banking services.

- Internet banking has reduced the cost of thg7 banks (physical space, employees), thus, indirectly benefitting the cost to tffe customers.

![]()

Question 13.

Give two differences between savings account and current accounts.

Answer:

| Savings account | Current account |

| 1. This account is meant for individuals to save their money and meet their future financial requirements | This account is a running account, for daily operations i.e. no. of transactions can take place during a day |

| 2. Less liquidity as compared to current account | More liquidity as compared to savings account |

| 3. Bank provides interest on this account | No interest is provided |

| 4. Withdrawals during a day are limited | Withdrawals during a day are unlimited |

| 5. Overdraft facility is not allowed on savings account | Overdraft facility is allowed on current account |

| 6. Less amount is required to open a savings account | More amount is required to open a current account |

Question 14.

Write a note on presence of commercial banks in India.

Answer:

The banking system in India is classified into scheduled banks and unscheduled banks.

Scheduled bank:

- A bank which is listed in the 2nd schedule of the RBI Act, 1934 is known as a scheduled bank. Scheduled bank is a real bank.

- There are two types of scheduled banks. They are:

(A) Commercial banks and

(B) Co-operative banks. - RBI (Reserve Bank of India) directly governs and controls the scheduled banks.

(A) Commercial banks:

- A commercial bank is a business unit which provides banking services for profit.

- Commercial banks work as per the rules laid down by the Reserve Bank.

- Examples of commercial banks are State Bank of India, Yes Bank, etc.

- Commercial Banks can be further classified into private sector commercial banks, public (nationalized) sector commercial banks, foreign banks and regional rural banks.

- Economic Reforms in India took place in the year 1991, after which, Foreign banks were allowed to function in India.

(B) Co-operative banks:

- Cooperative bank is a retail and commercial bank but formed on a co-operative basis.

- Co-operative banks work as per the rules laid down by the Registrar of Co-operative Societies.

Question 15.

What do you mean by a scheduled bank? Classify it in various types along with one example of each.

Answer:

Schedule bank:

- A bank which is listed in the 2nd schedule of the RBI Act, 1934 is known as a scheduled bank. Scheduled bank is a real bank.

- There are two types of scheduled banks. They are:

- Commercial banks and

- Co-operative banks.

- RBI (Reserve Bank of India) directly governs and controls the spheduled banks.

Classification:

![]()

Question 16.

Explain the monetary functions of Reserve Bank of India.

Answer:

Monetary functions (Monetary responsibilities):

1. Bank of issue:

- In every country, the Central bank of the country is empowered fully or partially for issuing/making of the currency.

- RBI is authorized to issue all the currency notes except for ₹ 1 currency note and the currency coins.

- It is the Finance Ministry of Government of India who issues Rs 1 note currency and currency coins.

- The distribution of all the currencies including Re 1 currency note and currency coins lies in the hands of RBI.

2. Banker to the government:

- RBI is a banker to government i.e. it works as a bank for the government.

- It maintains all the banking accounts of the government departments.

- As a banker, RBI gives loan to government, deposits money of the government, gives cash for payments of salaries and wages to staff, collects cheques, etc.

3. Bankers’ bank and lender of last resort:

- RBI functions as banker to all the scheduled banks in India.

- The three functions as a banker to banks are:

(a) Manages cash reserves of banks

(b) Determines direction of credit as well as directs credit policy.

(c) Determines rate of interest for all banks i.e. interest rates for saving deposits, fixed deposits, loans, etc. - RBI also lends money to scheduled banks in case of emergency.

4. Controller of credit:

RBI controls credit creation of the banks by various monetary policy tools like Repo rate, Reverse repo rate, SLR, CRR etc.

5. Custodian of foreign exchange reserves:

- RBI holds all the important foreign exchange reserves/currencies like U.S dollars, British pounds, gold, etc. in its custody.

- RBI maintains these reserves with them so as to maintain the value of rupee as compared to other currencies under the fixed exchange rate process of IMF (International Monetary Fund).

- Fixed exchange rate regime is when the value of a country’s currency, in relation to the value of other currencies, is maintained at a fixed conversion rate by the central bank of a country.

- RBI maintains the value of rupee in the world economy by buying and selling these foreign exchange reserves in the open market.

![]()

Question 17.

Explain the non-monetary functions of the Reserve Bank of India

Answer:

Non-monetary functions of Reserve Bank of India:

1. Regulatory and supervisory functions:

RBI- controls all the functions of commercial and cooperative banks. It supervises various functions like

(a) licensing of banks,

(b) branch expansion,

(c) liquidity of their assets and

(d) management and methods of working.

2. Promotional functions:

- In India, there are many people who still do not hold bank accounts. Due to this, these people are forced to do all the dealings of money, credit in the unorganized money market.

- This creates problem for the RBI to find out exact National Income of country as they do*not have any track of the money transacted.

- Thus, due to the above mentioned problems faced by RBI, it has to do promotional activities of banks

- RBI encourages people to open bank account and also promotes banks to open their branches in the rural areas where people staying there can take benefit of banking services

- It also promotes setting up of cooperative banks for the interest of people.

3. Financial inclusion and development:

- Owing to India’s highly diversified economy, it becomes difficult for RBI to reach to all sections of people.

- Thus, RBI promotes Financial Inclusion which means providing banking services to low income segments of society at an affordable price.

- It provides special credit facilities to agriculture, small scale industries, self- employed people and cottage industries.

- RBI also manages the Prime Minister Jan Dhan Yojna.

- RBI has made its website very user friendly. It publishes various banking related information and statistics as well as articles of experts on its website. Such publication helps people to promote research related to banking and bringing monetary improvement in the country.

Question 18.

What is the role of Reserve Bank of India in issuance of currencies in the country?

Answer:

Monetary functions (Monetary responsibilities):

Bank of issue:

- In every country, the Central bank of the country is empowered fully or partially for issuing/making of the currency.

- RBI is authorized to issue all the currency notes except for ₹ 1 currency note and the currency coins.

- It is the Finance Ministry of Government of India who issues Rs 1 note currency and currency coins.

- The distribution of all the currencies including Re 1 currency note and currency coins lies in the hands of RBI.

![]()

Question 19.

Why is Reserve Bank of India known as banker to the government?

Answer:

Monetary functions (Monetary responsibilities):

Banker to the government:

- RBI is a banker to government i.e. it works as a bank for the government.

- It maintains all the banking accounts of the government departments.

- As a banker, RBI gives loan to government, deposits money of the government, gives cash for payments of salaries and wages to staff, collects cheques, etc.

Question 20.

‘Reserve Bank of India acts as a controller of credit and custodian of foreign exchange reserves’, Explain.

Answer:

Monetary functions (Monetary responsibilities):

Controller of credit:

RBI controls credit creation of the banks by various monetary policy tools like Repo rate, Reverse repo rate, SLR, CRR etc.

Custodian of foreign exchange reserves:

- RBI holds all the important foreign exchange reserves/currencies like U.S dollars, British pounds, gold, etc. in its custody.

- RBI maintains these reserves with them so as to maintain the value of rupee as compared to other currencies under the fixed exchange rate process of IMF (International Monetary Fund).

- Fixed exchange rate regime is when the value of a country’s currency, in relation to the value of other currencies, is maintained at a fixed conversion rate by the central bank of a country.

- RBI maintains the value of rupee in the world economy by buying and selling these foreign exchange reserves in the open market.

Question 21.

Why and how does RBI promote banking activities in India?

Answer:

Non-monetary functions of Reserve Bank of India:

Promotional functions:

- In India, there are many people who still do not hold bank accounts. Due to this, these people are forced to do all the dealings of money, credit in the unorganized money market.

- This creates problem for the RBI to find out exact National Income of country as they do*not have any track of the money transacted.

- Thus, due to the above mentioned problems faced by RBI, it has to do promotional activities of banks

- RBI encourages people to open bank account and also promotes banks to open their branches in the rural areas where people staying there can take benefit of banking services

- It also promotes setting up of cooperative banks for the interest of people

![]()

Question 22.

What is financial inclusion? Explain in detail.

Answer:

Non-monetary functions of Reserve Bank of India:

Financial inclusion and development:

- Owing to India’s highly diversified economy, it becomes difficult for RBI to reach to all sections of people.

- Thus, RBI promotes Financial Inclusion which means providing banking services to low income segments of society at an affordable price.

- It provides special credit facilities to agriculture, small scale industries, self- employed people and cottage industries.

- RBI also manages the Prime Minister Jan Dhan Yojna.

- RBI has made its website very user friendly. It publishes various banking related information and statistics as well as articles of experts on its website. Such publication helps people to promote research related to banking and bringing monetary improvement in the country.

Question 23.

Explain monetary policy Monetary Policy.

Answer:

Monetary, policy:

“The policy undertaken by the apex bank for regulating the supply of money in order to maintain economic stability keeping into consideration the process of economic development and interest of the public is called monetary policy.” In simple words, the policy which regulates the demand for money and supply of money in the economy is called the monetary policy. It is framed by the central bank (apex bank) i.e. Reserve bank of India.

Need of monetary policy:

- RBI controls the demand for money and supply of money in the economy. In other words it manages the liquidity in the economy.

- If there arises an imbalance in the demand and supply of money then it can lead to inflation or deflation in the economy.

Inflation and deflation brings economic instability and affects the value of currency of the country.

- Monetary policy helps to maintain the demand for money and its supply in the economy and hence stabilize the financial market of the country.

- Since the monetary policy stabilizes the demand and supply and hence the inflation and deflation in the economy it is also known as ‘Stabilization policy.

![]()

Question 24.

State various definitions of monetary policy.

Answer:

Various policies of monetary policy on the basis of economic theory:

- “The conscious steps undertaken by the monetary authority which bring about changes in the stock of money, source/generation of money and cost of money is called the monetary policy.”

- “The policy which entrusts various tools of regulating supply of money in the hands of the apex bank with the purpose of achieving general economic objectives is called monetary policy.”

- “The policy undertaken by the apex bank for regulating the supply of money in order to maintain economic stability keeping into consideration the process of economic development and interest of the public is called monetary policy.”

Question 25.

What do you mean by Quantitative and Qualitative measures of monetary policy?

Answer:

There are two types of instruments or say measures of monetary policy.

They are:

(A) Quantitative measures and

(B) Qualitative measures.

(A) Quantitative measures:

- Quantitative measures are general measures that influence the overall economy i.e. measures that have an impact on the economy in general.

- They are not bifurcated based on sectors or segments in the economy. They have a common impact in all the sectors.

(B) Qualitative measures:

- Qualitative measures are those measures which are selected by RBI based on the impact of credit for development of certain sectors or segments of the economy.

- These measures have unique impact on the certain sector and unlike quantitative measures do not impact all sectors present of the economy.

![]()

Question 26.

What is bank-rate? How does bank-rate helps to control infiation/deflation?

Answer:

Bank rate:

- Bank rate is the rate of interest which Reserve Bank of India charges on the loans and advances to a commercial bank.

- At times, the commercial banks have shortage of funds and due to this reason, they borrow money which has to be repaid back with interest within . the stipulated time period (generally, long period of time).

- Bank rate acts as a quantitative measure to control inflation in the economy.

Explanation:

- If the bank rate is increased, commercial banks will borrow less money as it is expensive to borrow. Also, they will offer less amount of loan that too at higher rate of interest to their customers. The customers will not be willing to take loans. This reduces the demand of customers for buying certain goods and services such as buying a car, house, international travel, etc. When demand of such goods and services will come down inflation will come in control.

- Thus, due to higher bank rate, there is lesser creation of money, lower demand for goods and lower circulation of money in the economy which then helps in controlling inflation.

- Thus, bank rate acts as a quantitative measure to control inflation in the economy.

- Vice-versa happens when the RBI decrease bank-rate.

![]()

Question 27.

Explain the qualitative measures of monetary policy/credit control.

Answer:

Selective/Qualitative measures of monetary policy/ Credit control:

- Qualitative measures are those measures which are selected by RBI based on the impact of credit for development of certain sectors or segments of the economy.

- These measures have unique impact on certain sector and unlike quantitative measures do not impact all sectors present of the economy.

1. Collateral security:

When bank lends money to individual, it demands some asset as mortgage for security of the loan. This is known as collateral security.

- This security can be jewelry, fixed deposits, car, house, land, etc.

- The bank asks for such assets against the loan because if the borrower is not able to pay back the loan amount, bank uses this asset to recover the dues.

- The type of security that the bank demands various from person to person. For example, a poor farmer may get a loan from bank with almost no or less security whereas, a rich businessman may have to keep more as security with the bank to get loan.

- RBI promotes and encourages commercial banks to take such steps so that all the segments of people in India can attain the benefit of bank credit.

2. Margin requirement:

- Margin requirement is the limit that is set by RBI for granting loans against security.

- An individual is offered only certain percentage of the total value of the asset (security) as loan.

3. Ceiling on credit:

- RBI fixes a limit on the loans that the commercial banks can give to the people.

- In other words, commercial banks cannot exceed the maximum limit (ceiling) that the RBI has fixed for specific categories.

4. Discriminatory interest rates:

- Banks charges different rate of interest on different types of loans and advances and also charges differently to different economic class of people.

- For example, the bank may charge less interest rate on the loan given to a farmer for agricultural development and may charge more interest rate on the loan given to a businessman.

Question 28.

What is dear money policy and cheap money policy? Explain in detail.

Answer:

1. Inflation means the supply of money is higher than the demand for money which leads to high prices of goods and services in the economy.

2. If RBI increases the bank rate, the commercial banks borrow less money as they have to pay higher rate of interest on the borrowed money.

3. To tackle with shortage of funds and high bank rate, commercial bank give fewer loans and advances that also at higher rate of interest to people. This reduces the demand of some goods and services.

4. When the demand of goods and services fall, there is less circulation of money in the economy, restricting people to spend money. With less spending of money by people, the economy slows and this reduces inflation.

5. This is known as ‘dear money policy’. During the times of deflation/depression, i.e. when the supply of money is less than the demand for money, the prices of the goods and services fall.

6. To reduce the impact of price fall, RBI decreases the Bank rate. The commercial banks are in a better position to borrow money from the RBI as they have to repay the loan with low interest rate.

7. Due to easy availability of loans from RBI, the commercial banks decrease the interest rate of the loans provided to the bank customers.

8. This in turn, increases the purchasing power of the customer and increase circulation of money in the economy leading economy stability.

9. This is known as ‘cheap money policy’.

![]()

Question 29.

List down different quantitative and qualitative measures of monetary policy.

Answer:

There are two types of instruments or say measures of monetary policy.

They are:

(A) Quantitative measures and

(B) Qualitative measures.

(A) Quantitative measures:

- Bank rate

- Repo rate and reverse repo rate

- Stabilization under emergency situation

- Cash Reserve Ratio(CRR)

- Statutory Liquidity Ratio (SLR)

- Open Market Operation (OMOs)

- Sterilization of RBI accounts against shocks arising from the excessive increase or decrease in amount of foreign exchange

(B) Qualitative measures:

- Collateral security

- Margin requirement

- Ceiling on credit

- Discriminatory interest rates

![]()

Question 30.

What is repo rate and reverse repo rate? Why does bank use repo and reverse repo rate instead of bank rate?

Answer:

1. Bank rate:

- Bank rate is the rate of interest which Reserve Bank of India charges on the loans and advances that it gives to the commercial banks for long term.

- At times, the commercial banks have shortage of funds and due to this reason, they borrow money which has to be repaid back with interest within the stipulated time period.

- If the bank rate is increased, commercial banks will borrow less money as it is expensive to borrow. Also, they will offer less amount of loan that too at higher rate of interest to their customers. The customers will then not be willing to take loans. Hence demand of goods and services will come down and inflation will be controlled.

- Thus, bank rate acts as a quantitative measure to control inflation in the economy.

2. Repo rate and reverse repo rate:

- RBI has stopped using bank rate as an instrument to regulate money supply. It now uses repo rate and reverse repo rate.

- When banks need money they approach RBI. The rate at which banks borrow money from the RBI by selling their surplus government securities to RBI is known as “Repo Rate.”

- Banks enter into an agreement with the RBI to repurchase the same pledged government securities at a future date at a pre-determined price.

- ‘Repo rate’ is short form of ‘Repurchase Rate’. Generally, these loans are for short durations up to 2 weeks. This means a bank may even take up loan for as low as 1 day.

- Thus, we can say that the Banks sell government securities to RBI in order to raise money for a very short term with a condition to repurchase them at some discount. Such a discounting rate is repurchase rate/repo rate.

Repo rate as a measure to control inflation:

- In case of inflation in the economy the RBI increases repo rate.

- Increasing repo rate discourages commercial banks to take loans as they would have to pay more interest to the RBI.

- Increase in repo rate forces commercial banks to increase interest rate of the loans it provides to the customer. Customers then borrow less money due to increased rates.

- This in turn reduces the purchasing power of the people thereby, reducing supply of money in the economy. Thus, increase in repo rate helps to curb inflation in the economy

Reverse repo rate:

- Reverse Repo rate is a short term borrowing rate at which RBI borrows money from commercial banks.

- Here, the RBI sells certain government securities to the commercial banks with an agreement of purchasing them back at a discounted rate at the end of short term period.

- RBI borrows money from commercial banks in two conditions:

- when they require additional funds and

- when they feel, there is too much money floating in the economy.

- Increase in reverse repo rate leads to increase in the incentives or interest that the commercial banks receive from RBI.

- Thus, the commercial banks will prefer giving loan to RBI instead of people. This will in turn reduce the supply of money in the market and thus, help in controlling inflation in the economy.

- It is a vice versa situation if the reverse repo rate is reduced i.e. it helps in controlling the deflation.

Question 31.

What is Marginal Standing Facility? Explain.

Answer:

Stabilization under emergency situation:

- At times there might occur some emergency of acute shortage of cash with the commercial banks.

- Under such situations there is a special window for banks where RBI provides money to commercial banks against approved government securities.

- This rate is higher than repo rate and is known as ‘Marginal standing facility’. This helps in stabilizing the inflation under emergency situation

![]()

Question 32.

Explain CRR and SLR in detail.

Answer:

1. Cash Reserve Ratio (CRR):

- Under the RBI Act, 1934, all commercial banks have to keep certain minimum cash reserves with the RBI.

- Cash Reserve Ratio is the specified percentage of the total deposits of customers of the commercial bank that the bank has to maintain with the RBI.

- Initially CRR was decided to be 5% of demand deposits and 2% of term deposits.

- Since 1962, CRR is variable from 3% to 15% of the total deposits of individual banks.

- The main reason behind the cash reserves of commercial banks is to have enough liquidity in the market.

- The increase or decrease in the rate of CRR directly effects controlling inflation and deflation respectively.

- Higher CRR leads to more reserve with RBI. This lessens the total deposits of the commercial banks which forces them to provide less credit/loan to people.

- Due to less credit in the economy, people have less supply of money which in turn controls the inflation and increases economic stability.

2. Statutory Liquidity Ratio (SLR):

- Statutory Liquidity Ratio is the percentage of total deposits (25% or more) that the commercial banks have to maintain with RBI in form of cash, gold and government-approved securities.

- If the SLR is high, instead of banks giving loans and advances to customers, it will buy government securities.

- These government securities help RBI to fulfill the government expenses. A high SLR reduces the capacity of banks to give loans to customers thereby, reducing the supply of credit/money in the economy,

- A low SLR increases the capacity of banks to give loans thus increasing credit creation in the economy.

Question 33.

How does Reserve Bank of India curtail inflation in the economy?

Answer:

Reserve Bank of India plays a very important role in controlling inflation and maintains stability in the economy.

Following are the various measures taken by RBI to control inflation:

1. Dear money policy: RBI increases the bank rate due to which the commercial banks also increase the interest rate charged on the loans and advances for the customers. Increase in interest rate lead to reduction of credit in the market which in turn reduces the money supply. Thus, controlling the inflation.

2. Increase in repo rate: Increasing repo rate discourages commercial banks to take loans and advances from RBI as they would have to pay more interest at an increase repo rate. Increase in repo rate forces commercial

banks to increase interest rate of the loans it provides to the customer. This in turn reduced the purchasing power of the people thereby, reducing supply of money in the economy. Thus, increase in repo rate helps to curb inflation in the economy.

3. Increase In reverse repo rate: Increase in reverse repo rate leads to increase in the incentives or interest that the commercial banks receive from RBI. Thus, the commercial banks will prefer giving loan to RBI instead of people. This will in turn reduce the supply of money in the market and thus, help in controlling inflation in the economy.

4. Increasing Cash Reserve Ratio: Higher the CRR leads to more reserve with RBI. This lessens the total deposits of the commercial banks which forces them to provide less credit/loan to people. Due to less credit in the economy, people have less supply of money which in turn controls the inflation and increases economic stability.

5. Increasing statutory liquidity ratio: A high SLR reduces the capacity of banks to give loans to customers thereby, reducing the supply of credit/ money in the economy. Thus, controlling Inflation in the economy.

6. Selling government bonds in the open market: When RBI sells government bonds in the open market, there is a decrease in money supply which controls the inflation in the economy.

Question 34.

Explain margin requirement set by RBI with the help of an example.

Answer:

Margin requirement:

- Margin requirement is the limit that is set by RBI for granting loans against security.

- An individual is offered only certain percentage of the total value of the asset (security) as loan.

![]()

Question 35.

Write a note on qualitative tools of monetary policy.

Answer:

Qualitative measures:

1. Collateral security:

- When bank lends money to individual, it demands some asset as mortgage for security of the loan. This is known as collateral security.

- This security can be jewelry, fixed deposits, car, house, land, etc.

- RBI promotes and encourages commercial banks to take such steps so that all the segments of people especially poor in India can attain the benefit of bank credit and hence help to improve country’s economy.

2. Margin requirement:

- Margin requirement is the limit that is set by RBI for granting loans against security.

- An individual is offered only certain percentage of the total value of the asset (security) as loan.

3. Ceiling on credit:

- RBI fixes a limit on the loans that the commercial banks can give to the people. ‘

- In other words, commercial banks cannot exceed the maximum limit (ceiling) that the RBI has fixed for specific categories.

4. Discriminatory interest rates:

- Banks charges different rate of interest on different types of loans and advances and also charges differently to different economic class of people.

- For example, the bank may charge less interest rate on the loan given to a farmer for agricultural development and may charge more interest rate on the loan given to a businessman.

Multiple Choice Questions

Question 1.

Which was the first bank established in the world?

(A) Bank of Barcelona

(B) Bank of New York

(C) State BanK of india

(D) Hamiltonian National Bank

Answer:

(A) Bank of Barcelona

![]()

Question 2.

In which year was the first bank established?

(A) 1407

(B) 1401

(C) 1487

(D) 1435

Answer:

(B) 1401

Question 3.

______ is a business unit that provides banking services (like savings account and fixed deposits) for profit.

(A) Central bank

(B) Investment bank

(C) Commercial bank

(D) Cooperative bank

Answer:

(C) Commercial bank

Question 4.

What is the facility to provide finance to small business known as?

(A) Letter of credit

(B) Underwriting facility

(C) Micro finance facility

(D) Safe deposit vault

Answer:

(A) Letter of credit

![]()

Question 5.

______ is the facility for payment provided by the banks between exporter of one country and importer of other country who have never met each other.

(A) Underwriting

(B) Micro finance facility

(C) Letter of credit

(D) Credit creation

Answer:

(B) Micro finance facility

Question 6.

Why is the function of DEMAT account facility provided by banks?

(A) To deposit money for long period i.e. 5-10 years

(B) To store, purchase and sell shares, debentures and bonds in electronic form

(C) To provide finance to small businesses

(D) To transfer money from one account to other account

Answer:

(B) To store, purchase and sell shares, debentures and bonds in electronic form

Question 7.

In which type of deposits does the customer get the highest interest rate?

(A) Current deposits

(B) Savings’ deposits

(C) Recurring deposits

(D) Fixed deposits

Answer:

(D) Fixed deposits

![]()

Question 8.

What is safe deposit vaults used for?

(A) To transfer money from exporter to importer safely

(B) To store jewelry and documents safely

(C) To deposit money for long period of time

(D) To deposit money invested in equity market

Answer:

(B) To store jewelry and documents safely

Question 9.

When can a commercial bank earn profit?

(A) When the lending rate(interest on loans) is higher than the rate of interest that banks give on deposits

(B) When the lending rate(interest on loans) is lower than the rate of interest that banks give on deposits

(C) When the lending rate(interest on loans) and the rate of interest on deposits are same

(D) In all these scenarios

Answer:

(A) When the lending rate(interest on loans) is higher than the rate of interest that banks give on deposits

Question 10.

NEFT and RTGS facility of bank is used

(A) To make payments for goods and services

(B) To transfer money from one account to other account through electronic medium

(C) To buy movie tickets online

(D) None of these

Answer:

(B) To transfer money from one account to other account through electronic medium

![]()

Question 11.

When providing credit facilities to its customers, in theoretical sense, is the long term period for the banks

(A) 5-10 years

(B) Less than 6 months

(C) Up to 1 year

(D) Less than 15 days

Answer:

(A) 5-10 years

Question 12.

Commercial banks in India operate in

(A) Only Public sector

(B) Only Private sector

(C) Both, Public sector and Private sector

(D) Public and Government sector

Answer:

(C) Both, Public sector and Private sector

Question 13.

Which of the following is a function of Central bank?

(A) Aid, regulate and promote entire banking sector

(B) Maintain monetary stability in the economy

(C) Provide financial advice and suggestion to government

(D) All of these

Answer:

(D) All of these

![]()

Question 14.

The reserve bank of India was established on

(A) April 1, 1935

(B) January 1, 1949

(C) April 1, 1937

(D) January 10, 1935

Answer:

(A) April 1, 1935

Question 15.

What was the paid up capital with which the Reserve bank of India was established?

(A) ₹ 10 crores

(B) ₹ 5 crores

(C) ₹ 15 crores

(D) ₹ 1 crore

Answer:

(B) ₹ 5 crores

Question 16.

Reserve Bank of India was nationalized on

(A) April 1, 1935

(B) January 1, 1949

(C) April 1, 1937

(D) January 10, 1935

Answer:

(B) January 1, 1949

![]()

Question 17.

Who issues Re. 1 currency notes and currency coins in India?

(A) Reserve Bank of India .

(B) Finance Ministry of Government of India

(C) Commercial bank

(D) Regional rural bank

Answer:

(B) Finance Ministry of Government of India

Question 18.

Who issues all the currencies except Re. 1 currency notes and currency coins in India?

(A) Reserve Bank of India

(B) Finance Ministry of Government of India

(C) Commercial bank

(D) Regional rural bank

Answer:

(A) Reserve Bank of India

Question 19.

RBI is a ______ of India’s reserves of foreign currency

(A) Agent

(B) Custodian

(C) Advisor

(D) Supervisor

Answer:

(B) Custodian

![]()

Question 20.

What is the rate at which RBI lends to the commercial banks for long term?

(A) Reverse repo rate

(B) Repo rate

(C) Bank rate

(D) Cash reserve ratio

Answer:

(C) Bank rate

Question 21.

The policy of keeping the bank rate very low is known as

(A) Cheap money policy

(B) Dear money policy

(C) Low money policy

(D) Poor’s money

Answer:

(A) Cheap money policy

Question 22.

When commercial banks need funds for short period, they sell some securities which are held by them to RBI with a repurchase agreement at a particular date. This rate is called

(A) Reverse repo rate

(B) Repo rate

(C) Bank rate

(D) Cash reserve ratio

Answer:

(B) Repo rate

![]()

Question 23.

During inflation, the central bank ______ the repo rate to reduce the money supply in the market.

(A) Increases

(B) Decreases

(C) Does not change

(D) First decreases then increases

Answer:

(A) Increases

Question 24.

What is a short term borrowing rate at which RBI borrows money or repurchases its securities from commercial banks?

(A) Reverse repo rate

(B) Repo rate

(C) Bank rate

(D) Cash reserve ratio

Answer:

(A) Reverse repo rate

Question 25.

What is a special window for banks to borrow from RBI against approved government securities in an emergency situation?

(A) Loan facility

(B) Marginal standing facility

(C) Cash reserve ratio

(D) Repo rate

Answer:

(B) Marginal standing facility

![]()

Question 26.

How much percentage of total deposits of individual banks is kept as CRR with RBI?

(A) 5% to 10%

(B) 3% to 15%

(C) 15% to 20%

(D) 3% to 25%

Answer:

(B) 3% to 15%

Question 27.

According to Banking Regulation Act, 1949, all banks have to maintain equal to and not less than 25% of their total deposits in the form of cash, gold and government approved securities. This is known as

(A) Cash reserve ratio

(B) Statutory liquidity ratio

(C) Reverse repo rate

(D) Repo rate

Answer:

(B) Statutory liquidity ratio

![]()

Question 28.

______ refers to sale of and purchase of government securities by the RBI in the open market.

(A) Open market shopping

(B) Open market operations

(C) Marginal standing facility

(D) None of these

Answer:

(B) Open market operations

Question 29.

In which of the following conditions, does the supply of money fall?

(A) When RBI purchases government bonds

(B) When RBI sells government bonds

(C) Both (A) and (B)

(D) When RBI prints more note currencies

Answer:

(B) When RBI sells government bonds

Question 30.

What does the bank do, if a borrower is not able to pay back his loan?

(A) Incur loss and let go off the borrower

(B) Uses the security to recover the dues.

(C) Files a police complain

(D) Includes RBI in the loop

Answer:

(B) Uses the security to recover the dues.

Question 31.

Banks charges different rate of interest on different types of loans and advances and also charges differently to different economic class of people. This is called

(A) Ceiling on credit.

(B) Discriminatory Interest Rate

(C) Margin Requirement

(D) Sterilization of RBI accounts

Answer:

(B) Discriminatory Interest Rate

![]()

Question 32.

When RBI fixes a limit on the loans and advances that the commercial banks can give to the people it is called

(A) Ceiling on credit

(B) Discriminatory Interest Rate

(C) Margin Requirement

(D) Sterilization of RBI accounts

Answer:

(A) Ceiling on credit

Question 33.

______ is National Mission for Financial Inclusion to ensure access to financial services, namely, Banking/ Savings & Deposit Accounts, Remittance, Credit, Insurance by all people of India.

(A) Pradhan Mantri Jeevan Jyoti Bima Yojna

(B) Gramin Bhandaran Yojna

(C) Prime Minister Jan Dhan Yojna

(D) Digital India Programme

Answer:

(C) Prime Minister Jan Dhan Yojna

Question 34.

Only those companies which are listed in the 2nd schedule of the RBI Act, 1934 (are established accordingly) are called

(A) Unscheduled banks

(B) Foreign banks

(C) Scheduled banks

(D) Private companies

Answer:

(C) Scheduled banks

![]()

Question 35.

What does the word ‘bank’ in English mean?

(A) Mass

(B) Capital

(C) Money

(D) Bench

Answer:

(A) Mass

Question 36.

Which type of deposit account is in the most liquid state?

(A) Current

(B) Savings

(C) Recurring

(D) All of these

Answer:

(A) Current

Question 37.

What is short term credit provided by one bank to another through the central bank called?

(A) Primary deposits

(B) Call money

(C) Bank rate

(D) Put money

Answer:

(B) Call money

![]()

Question 38.

What is the main function of RBI?

(A) To regulate only the commercial banks of India

(B) To penalize the banks for their wrong doings

(C) To form the monetary policy of India

(D) To benefit the customers of all the banks by providing proper banking services

Answer:

(C) To form the monetary policy of India

Question 39.

RBI provides credit facilities to which of the following priority sector?

(A) Agriculture

(B) Defence

(C) Large scale industries

(D) All of these

Answer:

(A) Agriculture

Question 40.

Which institution publishes all types of banking related information and statistics?

(A) Private banks

(B) Public banks

(C) RBI

(D) Foreign banks

Answer:

(C) RBI

![]()

Question 41.

Monetary policy is also known as

(A) Money policy

(B) Stabilization policy

(C) Inflation reduction policy

(D) Economic policy

Answer:

(B) Stabilization policy

Question 42.

What is monetary policy used for in the present times?

(A) To regulate the value of money

(B) To control the value of money

(C) For credit creation

(D) For balancing the money and goods exchange

Answer:

(C) For credit creation