Gujarat Board GSEB Class 12 Organization of Commerce and Management Important Questions Chapter 9 Financial Market Important Questions and Answers.

GSEB Class 12 Organization of Commerce and Management Important Questions Chapter 9 Financial Market

Short Answer Type Questions

Question 1.

What is the chief objective of financial system of the any country?

Answer:

Converting savers into investors and hence promote faster economic development.

![]()

Question 2.

Classify Indian financial system major into parts.

Answer:

The Indian financial system can be broadly classified as:

(I) Unorganized (informal) financial system and

(II) Organized (formal) financial system.

Question 3.

Into which parts financial institutions can be classified?

Answer:

Two; Organized and Unorganized

Question 4.

Name the main types of financial market.

Answer:

Capital market and money market

Question 5.

State few instruments of capital market.

Answer:

Preference/Equity shares, debentures, bonds, etc., gold, silver, real estate, etc.

Question 6.

Define financial market. State its types.

Answer:

The market that deals with financial securities (or instruments) and financial services is called financial market;

- Money market and

- Capital market.

Question 7.

Which type of transactions take place in financial market?

Answer:

Financial transactions related to finance such as issue of equity shares by a company, purchase of shares and bonds in the secondary market, depositing money in bank account, etc.

Question 8.

What is money market?

Answer:

Money market refers to a section of financial market where financial instruments (assets) with high liquidity and , short-term maturities are traded.

Question 9.

Classify money market.

Answer:

(a) Organized money market and

(b) Unorganized money market.

Question 10.

Financial instruments with what market?

Answer:

Short term assets or instruments, whose maturity are traded in the money maturity period is one year or less.

Question 11.

What is an organized money market?

Answer:

The organized money market is a formal money market. It consists of Reserve Bank of India, commercial banks, mutual fund houses, etc.

Question 12.

Which financial instruments are traded in the money market?

Answer:

The financial instruments (assets) traded in organized money market include treasury bills, certificate of deposits, call money, etc.

Question 13.

How is unorganized money market controlled?

Answer:

Since unorganized market is an informal market, there is neither any regulation to run it nor there is any centralized institution on it. Thus, activities in this market are carried out without any rules and regulations.

Question 14.

What is a T-Bill? Who issues it? Why?

Answer:

A T-Bill (Treasury bill) is a short term financial instrument (government security). It is issued by Reserve Bank of India on behalf of Government of India to raise short term fund for the central government.

Question 15.

What is a commercial paper?

Answer:

The way central government issues T-bills to fulfill its financial needs, commercial papers are issued by large private corporations having very high and strong reputation as well as financial credit in the market.

Question 16.

What is the chief difference between a T-Bill and commercial bill?

Answer:

T-Bill is issued by RBI on behalf of Government of India whereas commercial bill is issued by corporate companies.

Question 17.

Why T-Bill is also called ‘zero coupon bond’?

Answer:

Government does not pay any interest to people who buy T-bills, but sells these bills at a discounted rate. Hence, T-bill is also called ‘zero coupon bond’.

Question 18.

What is a certificate of deposit?

Answer:

A certificate of deposit (CD) is a money market instrument to procure short term finance from people. CD can be issued to individuals, firms, companies, etc. by scheduled commercial banks and financial institutions.

Question 19.

Are certificate of deposit and fixed deposit same? Why?

Answer:

No. They are different. There is no minimum limit of deposit in Fo. Moreover, certificate of deposits is negotiable and can be sold whereas fixed term deposit receipt is neither negotiable nor ¡t can be sold.

![]()

Question 20.

What is call money?

Answer:

The money that bank borrows from another bank at a fixed interest rate is called ‘Call money’ or ‘Inter-bank-call money’.

Question 21.

What is notice money?

Answer:

The money that bank borrows from another bank at a fixed interest rate for 2 to 14 days is called notice money.

Question 22.

What is capital market? Into which parts is it divided?

Answer:

A capital market (locally – share market) is an organized market in which capital is raised by the investment made by general public in the form of shares, debentures, bonds, etc.

- Primary market and

- Secondary market.

Question 23.

State two characteristics of capital market.

Answer:

- Capital market is a market for raising long term capital fund.

- Ownership of shares and debentures is easily transferable.

Question 24.

What is the objective of primary capital market?

Answer:

To raise capital fund for the company issuing the securities

Question 25.

Define secondary market.

Answer:

The market in which securities such as shares (stock), bonds, etc. which were originally issued in the primary market can be purchased and sold (traded/exchanged) is called secondary market.

Question 26.

What is the main difference between primary market and secondary market?

Answer:

In primary market, the companies issue securities for sale for the first time whereas in secondary market, the securities issued in primary market are traded over and over.

Question 27.

Under whose approval does the stock exchange work?

Answer:

Under the approval of the central government as per the provision of Securities Contracts (Regulation) Act, 1956.

Question 28.

Define secondary market as per K. L. Garg.

Answer:

According to K. L. Garg, “Stock exchange means a place for buying and selling industrial and financial securities like shares and debentures of a company, government securities and municipal securities.”

Question 29.

What was Bombay Stock Exchange initially known as?

Answer:

The native share and stock brokers’ Association.

Question 30.

How does stock exchange work as an intermediary to generate capital for the corporate?

Answer:

Stock exchange provides platform for the When the securities are traded the capital gets generated. This is how

Question 31.

How does stock exchange help in boosting national economy?

Answer:

Investors invest in share market. This way public savings gets converted as capital for industries and companies. When companies grow by using these funds the investors further invest in the market. This boosts the overall economy.

Question 32.

Which important information does the stock exchange provide to the investors?

Answer:

Information about changes in the price of securities, flow of purchase and sale of securities, new economic policies helpful for the investors, etc.

Question 33.

How were shares sold to the investors in the past? What was the purchaser of the share called?

Answer:

In the past, when an investor wanted to invest in the shares of a company, he was given a share in the physical form (paper). This share was known as share certificate and the purchaser or the holder of the share certificate was known as share-holder.

Question 34.

What is rematerialization?

Answer:

Converting electronic securities into physical form is called rematerialization.

Question 35.

What is a depository?

Answer:

Afinancial institution that provides financial services to individuals and business firms is called a depository institution.

Question 36.

State any two functions of depository.

Answer:

- Convert physical shares (paper format) into electronic format (dematerialized format).

- Transfer the ownership of shares from one investor’s account into another when the two investors involve in buying and selling.

Question 37.

State full form of NSDL and CDSL.

Answer:

NSDL: National Securities Depository Limited and CDSL: Central Depository Services (India) Limited

![]()

Question 38.

What is a depository participant?

Answer:

Intermediaries or agents that provide depository services on behalf of depositories to the customers are called depository participant (DP).

Question 39.

Who can work as DP?

Answer:

Banks, financial institutions, share broker, etc.

Question 40.

How does demat safeguard the investors?

Answer:

Through demat account the investors can keep their securities safely in electronic form.This has also solved problems related to the transfer of physical shares such as fake shares, wrong deliveries, etc.

Question 41.

How settlement of transaction has become very fast with the setting up of depositories?

Answer:

The transactions now take place online. Moreover, the investor can simply ask the DP to purchase or sell the securities on phone. Hence, …

Question 42.

State the types of order that an investor can place with his broker.

Answer:

(a) Limited order and

(b) Market order

Question 43.

What do you mean by limited order?

Answer:

The order system in which the investor sets the price at which he needs to purchase or sell the shares is called limited order. Thus, in this case, the price of purchase and sale is pre-determined.

Question 44.

What is market order?

Answer:

When an investor wants to trade at the prices existing in the market, he selects ‘market order’. Here, the buying/selling takes place at the latest quoted market price that appeared on the trading screen order was made.

Question 45.

Which details does the share trading , contract note contain?

Answer:

The contract note contains details such as name of the security traded, quantity, total amount of transaction, order number, brokerage, taxes applicable, etc.

Question 46.

What is pay-in-day and pay-out-day?

Answer:

Pay-in day is the day when the brokers shall make payment or delivery of securities to the exchange. Pay-out day is the day when the exchange makes payment or delivery of securities to the broker.

Question 47.

State two objectives of SEBI.

Answer:

- To protect the interest of investors in securities and

- To regulate the securities market.

Question 48.

Whose registration does SEBI cancel?

Answer:

Registration of share brokers who do not follow rules and guidelines determined by SEBI and who fail to provide necessary information to SEBI.

Long Answer Type Questions

Question 1.

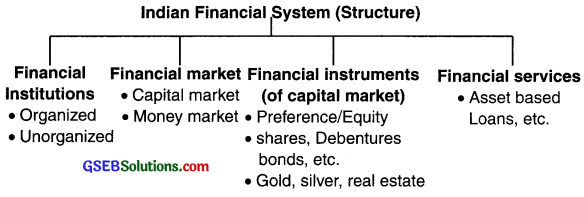

What is a financial system? State its key objective and components.

Answer:

- The economic development of a country depends upon the existence of a well-organized financial system.

- Financial system works as a platform for converting savers into investors and hence promotes faster economic development.

- The Indian financial system can be broadly classified as:

(I) Unorganized (informal) financial system and

(II) Organized (formal) financial system.

Unorganized (informal) financial system:

The informal financial system consists of individual money lenders, groups of persons operating as funds or associations, pawn brokers, etc.

Organized (formal) financial system:

The organized financial system is set of:

(a) Financial institutions

(b) Financial markets

(c) Financial instruments and

(d) Financial services

Together these four components help in the formation of capital and meet the short term and long term financial needs of households (investors and savers) and corporate houses.

Key objective of the financial system:

Money is the key asset traded in the financial system. So, the responsibility as well as the objective of the financial system is to mobilize the savings (money) of people and invest them in such a way that they get good returns and the country walks on the path of economic development.

![]()

Question 2.

What does the financial system of any country focuses on?

Answer:

- The economic development of a country depends upon the existence of a well-organized financial system.

- Financial system works as a platform for converting savers into investors and hence promotes faster economic development.

- The Indian financial system can be broadly classified as:

(I) Unorganized (informal) financial system and

(II) Organized (formal) financial system.

Unorganized (informal) financial system:

The informal financial system consists of individual money lenders, groups of persons operating as funds or associations, pawn brokers, etc.

Organized (formal) financial system:

The organized financial system is set of:

(a) Financial institutions

(b) Financial markets

(c) Financial instruments and

(d) Financial services

Together these four components help in the formation of capital and meet the short term and long term financial needs of households (investors and savers) and corporate houses.

A key objective of the financial system:

Money is the key asset traded in the financial system. So, the responsibility as well as the objective of the financial system is to mobilize the savings (money) of people and invest them in such a way that they get good returns and the country walks on the path of economic development.

Question 3.

Show the structure of financial system of India with the help of a chart.

Answer:

Indian Financial System (Structure):

Indian Financial System (Structure) can be classified as shown in the chart below:

Question 4.

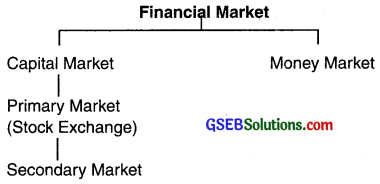

Explain briefly the concept and main components of financial market.

Answer:

Financial market:

- The market that deals with financial securities (or instruments) and financial services is called financial market.

- Financial transactions related to finance such as issue of equity shares by a company, purchase of shares and bonds in the secondary market, depositing money in bank account, etc. take place in the financial market.

On the basis of term of maturity, financial market can be classified into:

1. Money market:

Money market is a market of short term securities such as treasury bills, commercial papers, etc.

2. Capital market:

- Capital market is a market of long term securities such as shares, debentures, bonds, etc.

- Capital market is further divided into two parts:

- Primary market and

- Secondary market.

- When a company publicly sells new stocks or securities and bonds for the first time in the market, the market is called the primary capital market. So, primary capital market is the market of newly issued securities.

- The secondary market is the market in which securities such as shares (stock), bonds, etc. which were originally issued in the primary market can be purchased and sold (traded/exchanged). The secondary market is also called the stock exchange.

- Based on the condition of the financial market, investors can decide when and where they should invest their savings.

Participants:

Following participants participate for trading in the of capital market:

- Issuers of various type of securities, i.e. borrowers of money

- Purchasers of securities i. e. financiers

- Financial intermediaries, i. e. financial institutions

Question 5.

Differentiate between primary market and secondary market. Difference between primary market and secondary market:

Answer:

| Points of difference | Primary market | Secondary market |

| 1. Meaning | When a company publicly sells new stocks or securities and bonds for the first time in the market, the market is called the primary capital market. | The secondary market is the market in which securities such as shares (stock), bonds, etc. which were originally issued in the primary market can be purchased and sold (traded/exchanged). |

| 2. Objective | To raise fund for the corporates by motivating investors to invest their idle money in the market | To enable investors turn their savings into investments through trade of securities issued in the primary market |

| 3. Scope | The scope of this market is quite narrow because it deals with issuing only new securities. | The scope of this market is quite wide because itdeals with trading all those securities issued in the primary market. |

| 4. Type of purchasing | Direct | Indirect |

| 5. Participants of trade | Company and investors | Investors among themselves |

| 6. Entity that earns out of sale of shares | Companies who sells the shares | Investors who sell the shares in the market (to other investors). |

Question 6.

Which are the main components of financial market on the basis of term of maturity? Explain them very briefly.

Answer:

On the basis of term of maturity, financial market can be classified into:

1. Money market:

Money market is a market of short term securities such as treasury bills, commercial papers, etc.

2. Capital market:

- Capital market is a market of long term securities such as shares, debentures, bonds, etc.

- Capital market is further divided into two parts:

- Primary market and

- Secondary market.

Question 7.

Who participates in the financial market?

Answer:

| Points of difference | Primary market | Secondary market |

| 1. Meaning | When a company publicly sells new stocks or securities and bonds for the first time in the market, the market is called the primary capital market. | The secondary market is the market in which securities such as shares (stock), bonds, etc. which were originally issued in the primary market can be purchased and sold (traded/exchanged). |

| 2. Objective | To raise fund for the corporates by motivating investors to invest their idle money in the market | To enable investors turn their savings into investments through trade of securities issued in the primary market |

| 3. Scope | The scope of this market is quite narrow because it deals with issuing only new securities. | The scope of this market is quite wide because itdeals with trading all those securities issued in the primary market. |

| 4. Type of purchasing | Direct | Indirect |

| 5. Participants of trade | Company and investors | Investors among themselves |

| 6. Entity that earns out of sale of shares | Companies who sells the shares | Investors who sell the shares in the market (to other investors). |

Question 8.

Give an overview of the money market.

Answer:

Money market:

- Money market refers to a section of financial market where financial instruments (assets) with high liquidity and short-term maturities are traded. It is a market for assets or instruments which are close substitutes for money.

- Financial assets traded in money market include treasury bills, certificate of deposits, call money, money via. money lenders, pawn, indigenous bankers, shroffs, etc.

- Money is borrowed and lent for a short term. Securities or financial assets having a maturity period of one year or less are traded in this market.

- It is important to note that unlike stock exchange, money market is not a physical location, but group of various institutions trading or dealing in money.

- Transaction takes place between two parties. One is lender and the other is borrower.

- Reserve bank, commercial banks, co-operative banks, shroffs, etc. are mainly included in the group of money lenders, while individuals, business enterprises,

farmers, traders, state governments, central government are the borrowers of money.

![]()

Question 9.

Discuss the characteristics of money market.

Answer:

Characteristics of money market:

- Money market is divided into two parts. They are:

(a) Organized money market and

(b) Unorganized money market. - Money market is a market for short term assets or instruments, whose maturity period is one year or less.

- Credit worthiness of participants in money market is important so that both the borrower and lender can trade at ease.

- Money market is not a fixed physical location but a collective structure of various institutions like Reserve Bank of India, commercial banks, financial institutions, mutual funds, insurance companies, indigenous bankers, shroffs, etc.

- It is a market of financial instruments which can easily be converted into cash (i.e. are highly liquid). For example, treasury bills, call money, etc.

- Sub-branches of money market also develop with economic and technological development, such as call money market, bond market, treasury bills market, etc.

- Most of the financial instruments are debt instruments. Element of risk is less as compared to other financial instruments.

- The success and operation of money market depends on the banking system and financial institutions.

Question 10.

Classify money market into its major groups. Give description of each.

Answer:

Money market of India can be classified into two parts. They are:

(A) Organized money market and

(B) Unorganized money market

Organized money market:

- The organized money market is a formal money market. It consists of Reserve Bank of India, commercial banks, mutual fund houses, etc.

- The financial instruments (assets) traded in organized money market include treasury bills, certificate of deposits, call money, etc.

- In India, organized money market is systematically co-ordinated and regulated by Reserve Bank of India.

- The Reserve Bank of India keeps changing the rate of interest to maintain adequate liquidity in money market.

Unorganized money market:

- The unorganized money market is an informal form of money market.

- Since it is an informal market, there is neither any regulation to run it nor there is any centralized institution on it. Thus, activities in this market are carried out without any rules and regulations.

- Money market consists of money lenders, landlords, pawn, indigenous bankers, shroffs, etc. But, there is no co-ordination between these entities and all of them operate according to their free will. They charge interest rate as per their will.

- Although unorganized money market is more developed in rural areas of India, it is also found in most urban areas.

Question 11.

What is unorganized money market?

Answer:

Unorganized money market:

- The unorganized money market is an informal form of money market.

- Since it is an informal market, there is neither any regulation to run it nor there is any centralized institution on it. Thus, activities in this market are carried out without any rules and regulations.

- Money market consists of money lenders, landlords, pawn, indigenous bankers, shroffs, etc. But, there is no co-ordination between these entities and all of them operate according to their free will. They charge interest rate as per their will.

- Although unorganized money market is more developed in rural areas of India, it is also found in most urban areas.

Question 12.

Differentiate between organized market and unorganized market.

Answer:

Difference between organized market and unorganized market:

| Points of difference | Organized money market | Unorganized money market |

| 1. Type of market | The organized money market is a formal money market. | The unorganized money market is an informal form of money market. |

| 2. Participants | Reserve Bank of India, commercial banks, mutual fund houses, etc. | Money lenders, landlords, pawn, indigenous bankers, shroffs, etc. |

| 3. Regulation | It is systematically regulated by the Reserve Bank of India. | No one regulates it. It works on its own manner. |

| 4. Co ordination | The institutions are weaved in a fine thread of the financial system and all co ordinate with each other to run the financial system of the country smoothly. | There is no co ordination between the participants. All work on their free will and as per the market trend. |

| 5. Safety of investment | Investment is safe as it is watched by the Reserve Bank. | Money traded in this market is solely on the basis of trust and loyalty. |

| 6. Spread | This market is spread across the nation. | This market is more functional at rural level and some bigger towns and cities. |

Question 13.

Discuss briefly the instruments of money market.

Answer:

- Money market is a market for short term assets or instruments, whose maturity period is one year or less. Both, secured and unsecured instruments are traded in money market.

- The main instruments of money market are as follows:

- Treasury bills

- Commercial papers

- Certificate of deposits,

- Commercial bills and

- Call/Notice money

1. Treasury bills:

- When the central government is in need of funds for short term, it issues treasury bills into the financial market.

- A treasury bill is a short term financial instrument (government security). It is issued by Reserve Bank of India on behalf of Government of India.

- Treasury bill is an important component of money market all over the world.

- Treasury bill is also known as ‘T-Bills’.

2. Commercial paper:

- The way central government issues T-bills to fulfill its financial needs, commercial papers are issued by large private corporations having very high and strong reputation as well as financial credit in the market.

- Banks, large private institutions, etc. can issue commercial papers.

- Commercial paper is an unsecured and short term document just like a promissory note.

- Commercial papers can be issued for minimum seven days and maximum one year. It is regulated by Reserve Bank of India.

3. Certificate of deposits:

- A certificate of deposit (CD) is a money market instrument to procure short term finance from people.

- CD can be issued to individuals, firms, companies, etc. by scheduled commercial banks and financial institutions.

- Minimum amount of CD is ₹ 1 lakh. The banks pay a specific interest on these CDs.

4. Commercial bills:

- When a buyer purchases goods on credit, the seller draws a commercial bill on buyer. It is an unconditional order to pay specified amount of goods in full.

- Commercial bill is negotiable and arises out of business transactions.

- There are many types of commercial bills such as exchange bill, hundi, inland bill, demand bill, foreign bill, etc.

5. Call and notice money:

Call money:

- In day to day transactions it is quite likely that each bank faces a shortage of money even for as short as 24 hours or even lesser. In such cases the bank may borrow money from another bank at an interest rate which is determined by the shortage of money or say demand or supply pattern in the market.

- This money is known as ‘Call money’ or ‘Inter-bank-call money’.

- Notice money: When money is borrowed or lent for 2 to 14 days, it is called notice money.

![]()

Question 14.

How can one earn by investing in treasury bills?

Answer:

- Government does not pay any interest to people who buy T-bills, but sells these bills at a discounted rate.

- For example, government might sell treasury bill of ₹ 25,000 at ₹ 23,500 to the investor. The investor would then be paid the actual value i.e. ₹ 25,000 on maturity date.

- Thus, the difference between the purchase amount and redemption amount becomes the profit for the investor.

Question 15.

Explain commercial paper in detail.

Answer:

Commercial paper:

- The way central government issues T-bills to fulfill its financial needs, commercial papers are issued by large private corporations having very high and strong reputation as well as financial credit in the market.

- Banks, large private institutions, etc. can issue commercial papers.

- Commercial paper is an unsecured and short term document just like a promissory note. It is also known as finance paper, industrial paper and corporate paper.

- Commercial papers can be issued for minimum seven days and maximum one year. It is regulated by Reserve Bank of India.

- Just like T-Bills, commercial papers are also sold at a discount rather than paying interest.

- Commercial paper became more popular at the world level after 1980.

- Reserve Bank of India issued commercial papers first time in January, 1990.

- It is a negotiable instrument and therefore transferable. Corporates and financial institutions can issue commercial paper for minimum seven days and maximum one year.

- It is issued for minimum ₹ 5 lakh and then in multiples of ₹ 5 lakh.

Question 16.

What is the most significant difference between T-Bills and commercial papers? Also, state alternative names for both.

Answer:

- Treasury bills are issued by the central government to raise capital whereas commercial papers are issued by large private corporations having very high and strong reputation as well as financial credit in the market.

- Another name for T-Bills is ‘zero coupon bond’. Commercial paper is also called finance paper, industrial paper and corporate paper.

Question 17.

Write a detailed note on commercial bills.

Answer:

- When a buyer purchases goods on credit, the seller draws a commercial bill on buyer. It is an unconditional order to pay specified amount of goods in full.

- Commercial bill is negotiable and arises out of business transactions.

- There are many types of commercial bills such as exchange bill, hundi, inland bill, demand bill, foreign bill, etc.

- Generally, commercial bills have maturity period of 30, 60, 90 days. In other words, the buyer gets a credit of the said days. He needs to make the payment to the seller within the specified maturity date.

- At times, the buyers approach the commercial banks to accept the bill on the behalf of buyers. This means that in case the buyers are unable to make the payment to the sellers on maturity date, the banks will make the payment. For this service, the banks charge a commission from the buyers.

- The bank pays to the seller after discounting the bill i.e. after charging interest on the bill for the number of days the buyer wish to have the credit. This is called discounting of bill.

- In case, if the bank requires money, it can send the bill to other financial institution. That institution (or bank) will accept the bill, rediscount it and pay to the previous bank.

- When the seller draws the bill on buyer the bill is called Trade Bill’ and when this bill is accepted by the commercial banks, it becomes ‘Commercial Bill’.

Question 18.

Ideally it is the buyer who has to accept the bill, then why does he approach the bank for the same?

Answer:

- At times, the buyers approach to the commercial banks to accept the commercial bill on the behalf of buyers. This means that in case the buyers are unable to make the payment to the sellers on maturity date, the banks will , make the payment. For this service, the banks charge a commission from the buyers.

- Such a scenario takes place when the buyer is new or unknown for the seller or if the seller wants to be double sure that he will receive his payment.

Question 19.

What is the difference between discounting and rediscounting of bill?

Answer:

- When a buyer approaches the bank to accept a bill, the bank pays to the seller after discounting the bill i.e. after charging interest on the bill for the number of days the buyer wish to have the credit. This is called discounting of bill.

- In case, if the bank requires money, it can send the bill to other financial institution. That institution (or bank) will accept the bill, rediscount it and pay to the previous bank.

![]()

Question 20.

Give an idea about certificate of deposits.

Answer:

Certificate of Deposits (CD):

- A certificate of deposit (CD) is a money market instrument to procure short term finance from people.

- CD can be issued to individuals, firms, companies, etc. by scheduled commercial banks and financial institutions.

- Minimum amount of CD is ₹ 1 lakh. The banks pay a specific interest on these CDs.

- Although, certificate of deposits look quite similar to fixed deposits (FD), they are not. Certificate of deposits is negotiable and can be sold whereas fixed term deposit receipt is neither negotiable nor it can be sold.

Question 21.

What is call money and notice money? Explain. Also explain the need of call money market.

Answer:

Call money:

- In day to day transactions it is quite likely that each bank faces a shortage of money even for as short as 24 hours or even lesser. In such cases the bank may borrow money from another bank at an interest rate which is determined by the shortage of money or say demand or supply pattern in the market.

- This money is known as ‘Call money’ or ‘Inter-bank-call money’.

Notice money:

When money is borrowed or lent for 2 to 14 days, it is called notice money.

The need of Call money and Notice money:

- Every commercial bank has to maintain minimum cash balance as per the

rules and regulations of Reserve Bank of India. This is called cash reserve or cash reserve ratio (CRR). - It is quite a routine that one bank borrows money from the other bank to maintain minimum cash balance. All the banks have to maintain ratio of cash reserve.

- This gives rise to the call money market. Call money market includes call money and notice money. No mortgage is to be given for call money and notice money.

Question 22.

Why does bank need call money and notice money?

OR

No bank can survive without the facility of call money. Explain.

Answer:

Call money:

- In day to day transactions it is quite likely that each bank faces a shortage of money even for as short as 24 hours or even lesser. In such cases the bank may borrow money from another bank at an interest rate which is determined by the shortage of money or say demand or supply pattern in the market.

- This money is known as ‘Call money’ or ‘Inter-bank-call money’.

Notice money:

When money is borrowed or lent for 2 to 14 days, it is called notice money.

The need of Call money and Notice money:

- Every commercial bank has to maintain minimum cash balance as per the rules and regulations of Reserve Bank of India. This is called cash reserve or cash reserve ratio (CRR).

- It is quite a routine that one bank borrows money from the other bank to maintain minimum cash balance. All the banks have to maintain ratio of cash reserve.

- This gives rise to the call money market. Call money market includes call money and notice money. No mortgage is to be given for call money and notice money.

Question 23.

Into which parts is financial market classified? Name them.

Answer:

Financial market is mainly classified into two parts. They are:

- Capital market and

- Money market.

On the basis of maturity period, capital market is further classified in two markets. They are:

- Primary market and

- Secondary market.

Question 24.

What is capital market? Explain.

Answer:

- A capital market (locally – share market) is an organized market in which capital is raised by the investment made by general public in the form of shares, debentures, bonds, etc.

- When companies issue equity shares in the market, investors buy them. The money invested becomes the capital for the company who issued the shares. So, the companies and industries get fund through the savings of general public.

Capital market is divided into two markets. They are:

- Primary market and

- Secondary Market

- Capital market is a source of long term capital fund for industrial enterprises.

- Long term securities like shares and debentures are traded in capital market.

- Capital market is a market for all types of securities including industrial securities and government securities.

- Since this market mobilizes savings of the community, it boosts economic growth.

Question 25.

State the characteristics of capital market.

Answer:

Characteristics of capital market:

- Capital market is a market for raising long term capital fund.

- Instruments of capital market include government securities, debt instruments, securities of industrial enterprises like shares and debentures.

- Investment of fund is in long term securities.

- In India, capital market is strictly regulated by Securities and Exchange Board of India (SEBI).

- Ownership of shares and debentures is easily transferrable.

- Provides liquidity to financial assets (securities).

- Capital market is divided into two parts:

- Primary market and

- Secondary Market

![]()

Question 26.

State and explain the meaning of secondary market and enlist its characteristics.

Answer:

Meaning and explanation:

- The secondary market is the market in which securities such as shares (stock), bonds, etc. which were originally issued in the primary market can be purchased and sold (traded/exchanged). The secondary market is also called the stock exchange.

- Thus, stock exchange is an organization which enables share brokers and investors to buy and sell shares, debentures and other securities. It is an organized market for trading of existing securities.

Characteristics of stock exchange (Secondary market):

- Registered corporate body: Stock exchange is a registered and established corporate body that prepares rules and regulations for the transactions of securities.

- Approval of government: Stock exchange has to obtain approval of the central government as per the provision of Securities Contracts (Regulation) Act, 1956.

- Organized market: It is an organized market for dealing in existing listed securities.

- Membership: Membership of stock exchange must be obtained for dealing transactions in stock exchange.

- Market of securities: Stock exchange is an approved organized market for buying and selling of securities.

- Listing of securities: The securities which are listed on stock exchange are transacted in stock exchange.

- Management: It is administered and managed by board of directors.

- Strict control over the members: The Board of Directors exercise strict control over the members through their disciplinary powers.

- Organizational structure: The organizational structure of stock exchange is in the form of public company.

- Regulation of stock exchange: All the stock’exchanges of India are regulated by Securities and Exchange Board of India (SEBI) and Securities Contracts (Regulation) Act.

Question 27.

Write a short note on secondary market or stock exchange.

Answer:

Secondary market (Stock exchange):

- The secondary market is the market in which securities such as shares (stock), bonds, etc. which were originally issued in the primary market can be purchased and sold (traded/exchanged). The secondary market is also called the stock exchange.

- Thus, stock exchange is an organization which enables share brokers and investors to buy and sell shares, debentures and other securities. It is an organized market for trading of existing securities.

- According to K. L. Garg, “Stock exchange means a place for buying and selling industrial and financial securities like shares and debentures of a company, government securities, municipal securities.”

- The oldest and first stock exchange of India was formed on 9th July, 1875 as a “The native share and stock brokers’ Association”. Today, it is known as Bombay Stock Exchange.

- Ahmedabad Stock Exchange started in 1894.

Question 28.

Explain valuation of securities as an important function of the stock exchange.

Answer:

Valuation of the securities:

- The demand and supply of the securities in the market decide their valuation or say price.

- The valuation of securities is also determined by other factors such as dividend declared by the company, factors affecting money market, etc.

- Valuation of securities enables the investors to decide whether to purchase or sell the securities.

- The valuation of securities is also useful to the government and creditors.

Question 29.

SEBI is the savior of investors. Give reason.

Answer:

- In the market, the securities are traded as per the rules of the stock exchange.

- The stock exchange is governed by SEBI which is a government body.

- The brokers working in stock exchange perform their role under the regulation of SEBI.

- SEBI also black lists companies who do not follow the regulations and who might be threat to investors’ interests.

- Hence, SEBI is the savior of investors.

Question 30.

Capital market is one of the strongest pillars for national economy. Explain.

Answer:

- Investors invest in share market. This way public savings gets converted as capital for industries and companies.

- This way the industries form long term capital.

- When companies grow by using these funds the investors further invest in the market. This boosts the overall economy.

- Thus, capital market brings the money of individuals into the market and the money get invested in various industries which in turn boosts economic growth drastically.

- Thus, capital market is one of the strongest pillar for national economy.

Question 31.

The stock exchange is the barometer of the economic condition of the country. Give reason.

OR

The stock exchange serves as the barometer for investors.

Answer:

- Stock exchange provides important information useful to the various parties. For example, information about changes in the price of securities, flow of purchase and sale of securities, etc.

- Such information serves as an important guide for investors, companies, government, SEBI, etc.

- The information is useful for the government for formulating economic policy and financial policy.

- The information also describes the economic condition and growth of company and nation. ‘

- Studying the information, the investor can understand the equity in which he should invest so as to get best returns from his saving.

- Hence, the stock exchange is called the barometer of the economic condition of the country (or the investor).

Question 32.

What is a demat account? How did its need arise?

Answer:

- In the past, when an investor wanted to invest in the shares of a company, he was given a share in the physical (paper) form. This share was known as share certificate and the purchaser or the holder of the share certificate was known as share-holder.

- Along with the share form, the investors also used to fill up share transfer form. Whenever a share-holder wanted to sell a share, he had to send the original share certificates along with a filled share transfer form to the company.

- This entire procedure was lengthy and tedious. To eliminate all these difficulties, the government started the procedure of converting these physical shares and other securities in electronic form.

- The process of converting physical shares in electronic form is called dematerialization or demat in short.

- These physical securities are maintained in electronic form through computer by the depository institutions. If a person wish to covert his physical shares in electronic form then he need to open a demat account with one of the depository institution.

- Under Depository Act 1996, investors have an option to hold securities either in physical form or dematerialized form.

Question 33.

What is a depository? Explain.

Answer:

A depository institution is a financial institution that provides financial services to individuals and business firms.

Functions of the depositories:

- Convert physical shares (paper format) into electronic format (dematerialized format).

- Keep deposit of these securities in electronic form i.e. preserve them.

- Transfer the ownership of shares from one investor’s account into another when the two investors involve in buying and selling.

- In India, a company registered under Companies Act can perform work as Depository. Depository Act came in force from August 1996.

- In order to start a depository, the depository needs to obtain certificate of . registration from SEBI.

- The operations of depository are regulated by Depository Act and SEBI.

- Demat account and dematerialization are at center of the depository process.

Presently there are two depositories in India. They are:

- National Securities Depository Limited (NSDL)

- Central Depository Services (India) Limited (CDSL).

The centralized system of NSDL and CDSL keeps an eye on every financial transactions that registered investors make.

Depository participant:

Intermediaries or agents that provide depository services on behalf of depositories to the customers are called depository participant (DP).

Banks, financial institutions, share broker, etc. can work as a Depository Participant.

![]()

Question 34.

What is a depository participant?

Answer:

Depository participant:

Intermediaries or agents that provide depository services on behalf of depositories to the customers are called depository participant (DP).

Banks, financial institutions, share broker, etc. can work as a Depository Participant.

Question 35.

State the services provided by depositories very briefly.

Answer:

Functions (services) of the depositories:

- Convert physical shares (paper format) into electronic format (dematerialized format).

- Keep deposit of these securities in electronic form i.e. preserve them.

- Transfer the ownership of shares from one investor’s account into another when the two investors involve in buying and selling.

Question 43.

Which online services does NSDL provide to its investors?

Answer:

The full form of NSDL is National Securities Depository Limited. It was the first electronic securities depository of India. It was established and registered with SEBI in 1996.

- NSDL is a public depository company formed under the Companies Act. Since it is a public company, it is managed by Board of Directors.

- In order to form NSDL, the National Stock Exchange (NSE) and some financial institutions promoted it.

- NSDL appoints several depository participants which then executes the functions of NSDL. These participants work as agents between the investors and NSDL.

- NSDL does not charge any fee from the investors for their investments. NSDL takes this fee from the depository participants.

- Thus, investor has neither to pay any fee, nor any operating charges directly to NSDL. However, depository participant charges some fees from the customer/ investor.

Online Services of NSDL (via. participants):

- Dematerialization and Rematerialization

- Electronic settlement of transactions

- Crediting right and bonus shares in customer’s account

- Freezing customer’s account, etc.

Question 45.

State only the points of services that depository provides.

Answer:

The depository institutions provide the following services:

- Dematerialization and rematerialization

- Easy transfer of securities at less expenses

- Prompt settlement of transaction

- Record in customer’s account

- Facility to mortgage

- Facility to freeze or close account

- Record and storage of information

- Link between investor and clearing house

- Service through internet

Question 46.

Discuss in detail the various services provided by the depository institutions.

Answer:

The depository institutions provide the following services:

1. Dematerialization and rematerialization:

- Depository institutions enable conversion of physical securities (paper format) into electronic format i.e. dematerialization and electronic into physical i.e. rematerialization.

- Depository maintains physical securities of investors in electronic form under demat service. It preserves securities in demat account.

- When the securities are saved in electronic form in the demat account, there arises no risk of theft and destruction. The way a bank maintains money, depository maintains securities.

- If an investor wishes to convert his electronic shares into physical, then he can get this done under rematerialization.

2. Easy transfer of securities at less expenses:

- Since the depository mainly focuses on online services, an investor can get his securities transferred very fast.

- This has also decreased paper work. Problems related to the transfer of physical shares such as fake shares, wrong deliveries, etc. no more exist.

- Investor also saves money on brokerage, postage, courier, stamp duty, etc.

3. Prompt settlement of transaction:

- Settlement of transaction becomes speedy due to electronic depository. The settlement of transactions among various parties takes place through electronic system.

- On investor’s request, the depository participant immediately transfers securities.

- Moreover, the investors also receive the transaction money quite fast.

- Investor does not need to contact the company whose share it wants to sell or purchase.

4. Record in customer’s account:

Receivable bonus shares, shares allotted through public issues, dividend received, etc. are credited in customer’s account by electronic system. The customer can see all these records himself by logging on to internet.

5. Facility to mortgage:

Depository provides facility to mortgage securities and to obtain loan against securities.

6. Facility to freeze or close account:

If a person is going abroad for a long period or if he wishes to close the demat account for a short period, then he can avail the facility of freezing the account for a particular period.

7. Record and storage of information:

- Depository maintains the record of each and every transaction connected with securities safely in demat account.

- The information can be accessed when in need.

8. Link between investor and clearing house:

Depository serves as a link between investor and clearing house during the transactions of securities and also during the the settlement of transactions.

9. Service through internet:

- Depository provides service to investor through its depository participant through internet at fair price.

- The investor can himself perform all the transactions such as obtaining information related to the securities traded by him, exchange prices of other securities, buying and selling of securities, etc.

- Moreover, the depository also provides latest information about the market to the investor.

Question 47.

Give an overview about the older and the current trading procedures.

Answer:

- Before the electronic system of trading came, share brokers used to gather in the stock exchange of India at a fixed time.

- They used to conduct transactions on the floor through outcry and with the different signs of hands.

- Now, online screen based electronic trading has come into existence in place of old traditional system.

- All the stock exchanges of India now allow only online trade.

- National Stock Exchange (NSE) and over-the-counter exchange have adopted screen based online trading system right from their inception.

- Bombay Stock Exchange (BSE) and National Stock Exchange have introduced fully self-automated screen based trading system all over the nation.

- The screen based trading system of National Stock Exchange is known as NEAT (National Exchange for Automated Trading). Screen based trading system of Bombay Stock Exchange is known as BOLT i.e. BSE Online Trading.

- Due to the internet based trading services of these exchanges, investors can buy and sell their securities online.

Question 48.

Explain limited order and market order methods of trading.

Answer:

(a) Limited order:

- When an investor selects the option of ‘limited order’, it means that he will set the price at which he needs to purchase or sell the shares. Thus, in this case, the price of purchase and sale is pre-determined.

- Retail investors and fund houses generally trade by placing order in this format.

(b) Market order:

When an investor wants to trade at the prices existing in the market, he selects ‘market order’. Here, the buying/selling iakes place at the latest quoted market price that appeared on the trading screen order was made.

![]()

Question 49.

What is contract note? Which details it contains?

Answer:

Contract note:

- Once the broker further places the order received from the investor, he prepares a contract note for the investor.

- Contract note is a confirmation of the day on which transaction took place.

- Generally, the broker sends contract note to the customer within 24 hours after transaction takes place.

- The contract note contains details such as name of the security traded, quantity, total amount of transaction, order number, brokerage, taxes applicable, etc. Thus, contract note is a summary as well as agreement about the traded securities.

Question 50.

What is SEBI? What are its objectives?

Answer:

- Securities and Exchange Board of India(SEBI) came into existence as a statutory body on January 30, 1992 under the Securities and Exchange Board of India Act 1992.

- its head office is in Mumbai. It has regional offices in Kolkata, Delhi and Chennai, SEBI is a statutory body regulating stock exchanges in India.

Objectives of SEBI:

- To protect the interest of investors in securities

- To encourage the development of securities market

- To regulate the securities market

Question 51.

Discuss the functions of SEBI.

Answer:

Functions of SEBI:

1. To regulate business in stock exchange:

- SEBI regulates the business in stock exchanges and the operations of the stock exchanges. It monitors whether the specified rules and guidelines are followed or not by share brokers, sub-brokers, merchant bankers.

- It keeps an effective control on the entire working of the stock exchanges.

2. Protection of the interest of the investors:

The fundamental function of the SEBI is to protect the interest of the investors. So, it enforces the intermediaries to obey the specified rules and regulations.

3. Registration and regulation of intermediaries:

- It registers the intermediaries such as merchant banker, share broker, sub-broker, registrar of securities, etc. working in stock exchange and monitors their functions.

- It plans for the training of intermediaries.

4. Registration and regulation of mutual funds:

It registers and monitors mutual funds and regulates their working. For this, SEBI has determined rules and regulations which are followed by mutual funds.

5. To prevent fraudulent trade:

It takes necessary steps to prohibit fraudulent trade in stock exchanges.

6. To cancel registration of brokers:

It cancels the registration of share brokers who do not follow rules and guidelines determined by SEBI and who fail to provide necessary information to SEBI.

7. To regulate the merger and take-over of the companies:

It regulates merger and take-over of the companies for preserving the interest of investors. SEBI has issued guidelines so that merger and take-over do not take place at the risk of small investors. .

8. Guidelines with reference to public issues:

SEBI has issued different guidelines for both, first time capital issue by new company and capital issue by existing company coming in market for capital.

9. Self-regulation:

SEBI is active for the self-regulation followed by intermediaries of stock exchange. It encourages the intermediaries to promote their professional unions.

10. Maintaining stock exchanges as an efficient market:

It maintains stability and efficiency of stock exchanges through regulations, restrictions and guidelines.

11. Inspection of books:

If necessary, it inspects the books of company that issues securities, depository participant and beneficiary owner.

12. Monitoring and inspection of stock exchange:

- SEBI can monitor and inspect whether regulations laid down for stock exchange are followed or not, whether stock exchange organization system and its working is followed as per SEBI Act or not.

- If necessary, it conducts inquiry, inspection and audit of the accounts of the intermediaries.

13. Guidelines:

SEBI has issued guidelines time to time for share brokers, and sub-brokers, merchant bankers, trustees of debenture, buy back securities by company, etc.

14. To obtain annual and periodical reports:

It receives report in form of various statements for obtaining information about working and activities of stock exchanges.

15. Research work:

SEBI undertakes the research work so that all the above functions can be done effectively.

Multiple Choice Questions

Question 1.

Which of the following is not a component of the financial market?

(i) Financial institutions

(ii) Financial markets

(iii) Financial instruments

(iv) Financial services

(A) Only (i)

(B) Both (i) and (iv)

(C) Only (iii)

(D) None

Answer:

(D) None

Question 2.

__________ is the key asset traded in the financial system.

(A) Stocks

(B) Money

(C) Investor

(D) Financial instrument

Answer:

(B) Money

Question 3.

Division of financial market into capital market and money market is based on the __________

(A) Amount of investment

(B) Term of maturity

(C) Size of investment

(D) Type of market

Answer:

(B) Term of maturity

Question 4.

Which of the following does not participate in the capital market?

(A) Issuers of various type of securities

(B) Purchasers of securities

(C) Financial intermediaries

(D) None of these

Answer:

(D) None of these

Question 5.

Who co-ordinates organized money market in India?

(A) SEBI

(B) CSDL

(C) RBI

(D) Finance ministry

Answer:

(C) RBI

![]()

Question 6.

Which of the following is not a part of unorganized money market?

(A) Banker

(B) Shroff

(C) Pawn

(D) Landlord

Answer:

(A) Banker

Question 7.

__________ is not an instrument of money market.

(A) Commercial paper

(B) Certificate of deposit

(C) Notice money

(D) Debenture

Answer:

(D) Debenture

Question 8.

The central government releases in need of short term money.

(A) Certificate of Deposit

(B) Commercial bill

(C) Call money

(D) T-Bill

Answer:

(D) T-Bill

Question 9.

The lock-in period or maturity of T-Bills bills is __________ days.

(A) 91

(B) 182

(C) 364

(D) All of these

Answer:

(D) All of these

Question 10.

Commercial papers can be issued for minimum __________ days and maximum __________ year.

(A) 7;1

(B) 15;2

(C) 30;1

(D) 10; 1

Answer:

(A) 7;1

Question 11.

T-Bill: ₹ 25,000, Commercial paper: ₹

(A) 25,000

(B) 10,000

(C) 500,000

(D) 100,000

Answer:

(C) 500,000

Question 12.

The minimum amount for a certificate of deposit is ₹

(A) 10,000

(B) 25,000

(C) 100,000

(D) 500,000

Answer:

(C) 100,000

Question 13.

Every commercial bank has to maintain minimum cash balance as per the rules and regulations of Reserve Bank of India which is called

(A) SR

(B)CRR

(C)ACR

(D) RR

Answer:

(B)CRR

Question 14.

When a company publicly sells new stocks or securities and bonds for the first time in the market, the market is called the market.

(A) Secondary

(B) Primary capital

(C) Secondary money

(D) Secondary capital

Answer:

(B) Primary capital

Question 15.

What is the other name for secondary capital market?

(A) Depository

(B) Stock Exchange

(C) SEBI

(D) Trade capital market

Answer:

(B) Stock Exchange

Question 16.

Who manages the stock exchange?

(A) SEBI

(B) Government of India

(C) Board of Directors

(D) Corporate investors

Answer:

(C) Board of Directors

![]()

Question 17.

The organizational structure of the stock market is that of a

(A) Public company

(B) Co-operative society

(C) Government company

(D) Corporate

Answer:

(A) Public company

Question 18.

In India, the stock exchange is regulated by

(A) Securities and Exchange Board of India

(B) Securities Contracts (Regulation) Act

(C) NSDL and CSDL

(D) Both (A) and (B)

Answer:

(D) Both (A) and (B)

Question 19.

The oldest and first stock exchange of India was formed on

(A) 15th August, 1947

(B) 9th July, 1875

(C) 26th January,. 1950

(D) 4th November, 1894

Answer:

(B) 9th July, 1875

Question 20.

Ahmedabad Stock Exchange started in the year

(A)1897

(B)1984

(C)1894

(D)1972

Answer:

(C)1894

Question 21.

An important function of the stock exchange is to see that the securities

(A) Remain liquid

(B) Do not get obsolete

(C) Are sold to genuine investors

(D) All of these

Answer:

(A) Remain liquid

Question 22.

What/Who decides the value of a security?

(A) SEBI

(B) BSE

(C) Demand and Supply

(D) Financial position of the country

Answer:

(C) Demand and Supply

Question 23.

__________ governs the stock exchange.

(A) NSDL

(B) RBI

(C) SEBI

(D) Finance ministry

Answer:

(C) SEBI

Question 24.

When securities get listed in the stock exchange, the __________ of investors increase for such securities.

(A) Disinvestment

(B) Leverage

(C) Trust

(D) All of these

Answer:

(C) Trust

Question 25.

Under __________, investors have an option to hold securities either in physical form or dematerialized form.

(A) Depository Act, 1996

(B) SEBI Act, 1979

(C) NSDL Act, 1996

(D) RBI Act, 1952

Answer:

(A) Depository Act, 1996

Question 26.

To function as a depository, a company needs to register itself under

(A) RBI

(B) Co-operative society Act

(C) Companies Act

(D) SEBI Act

Answer:

(C) Companies Act

Question 27.

When did the Depository Act come in force?

(A) August 1996

(B) July 1875

(C) September 1991

(D) May 1989

Answer:

(A) August 1996

![]()

Question 28.

Who provides certificate of registration to depository?

(A) SEBI

(B) RBI

(C) Finance minister

(D) Stock Exchange

Answer:

(A) SEBI

Question 29.

Depository serves as a link between investor and __________ during the transactions of securities.

(A) Banks

(B) Stock exchange

(C) Clearing houses

(D) Investment

Answer:

(C) Clearing houses

Question 30.

Screen based trading system of Bombay Stock Exchange is known as __________

(A) BOLT

(B) BEAT

(C) BSEOT

(D) BOT

Answer:

(A) BOLT

Question 31.

The DP can open a demat account under

(A) NSDL

(B) CDSL

(C) NSDL and SEBI

(D) Both (A) and (B)

Answer:

(D) Both (A) and (B)

Question 32.

Generally, the broker has to send the contract note to the trader within

(A) A week

(B) A day

(C) The weekend

(D) A fortnight

Answer:

(B) A day

Question 33.

SEBI came into existence on

(A) 12th August, 1996

(B) 3rd September, 1992

(C) 31 st October, 1991

(D) 30th January, 1992

Answer:

(D) 30th January, 1992

Financial Market – GSEB Std 12 Organization of Commerce and Management Notes

Financial system:

- The economic development of a country depends upon the existence of a / well-organized financial system.

- The Indian financial system can be broadly classified as:

- Unorganized (informal) financial system and

- Organized (formal) financial system.

- The organized financial system is a set of:

(a) Financial institutions

(b) Financial markets

(c) Financial instruments and

(d) Financial services.

Concept of financial market:

Financial market is an important component of the organized financial system of financial structure. Two important components of financial market are

I. Money market and

II. Capital market.

I. Money market:

(a) Meaning:

Money market isamarket of borrowing money and lending moneyforashortterm. It is a market for securities having a maturity period of one year or less.

(b) Characteristics of money market:

- Divided in two parts

- Maturity period 1 year or less

- Creditworthiness

- Not a fix physical location

- Convertible into cash

- Several sub-branches

- Mostly contains debt instruments

- Banking and financial institutions are the base of success of money market

(c) Money market can be classified into:

(A) Organized money market and

(B) Unorganized money market

(A) Organized money market:

The organized money market is a formal money market. It consists of Reserve Bank of India, commercial banks, mutual fund houses, etc. It is regulated by Reserve Bank of India.

(B) Unorganized money market:

- The unorganized money market is an informal form of money market.

- Since it is an informal market, there is neither any regulation to run it nor there is any centralized institution on it.

- It consists of money lenders, landlords, pawn, indigenous bankers, shroffs, etc.

(d) Instruments of money market:

The main instruments of money market are:

- Treasury bills

- Commercial papers

- Certificate of deposits

- Commercial bills

- Call/Notice money

1. Treasury bills:

It is short term government security. Government issues is at discount, possesses cash liquidity.

2. Commercial paper:

It is short term document like promissory note but issued by corporate companies at discount.

3. Certificate of deposits:

This is unsecured negotiable and short term financial instrument.

4. Commercial bills:

When a buyer purchases goods on credit, the seller draws a commercial bill on buyer. It is an unconditional order to pay specified amount of goods in full. Bank discounts the bills and provides credit to its customer (buyer of goods).

5. Call and notice money:

Call money is a transaction for one day. Call money means loan of one day within the banking/ financial institutions. When money is borrowed or lend for 2 to 14 days, it is called Notice money.

II. Capital market:

- A capital market (locally – share market) is an organized market in which capital is raised by the investment made by general public in the form of shares, debentures, bonds, etc.

- It includes two markets,

- Primary market and

- Secondary market

(a) Characteristics of capital market:

- Market for raising long term fund

- Instruments are shares, debenture, government securities, etc.

- Investment in securities

- Regulated by SEBI

- Transfer of ownership of securities is easy

- Provides liquidity

- Two parts

(A) Primary capital market:

When a company publicly sells new stocks or securities and bonds for the first time in the market, the market is called the primary capital market.

Characteristics:

- Market for newly issued securities

- Purchasing by investors and direct selling of securities

- Intermediaries

- Issues through prospectus.

(B) Secondary Market (Stock Exchange):

Oldest and first stock exchange of India is Bombay Stock Exchange. It is a market for trading of listed securities or say securities listed in the primary market.

Characteristics:

- Registered corporate body

- Approval of government

- Organized market

- Membership

- Market of securities

Functions:

- Liquidity

- Valuation of securities

- Conversion of savings into capital

- Intermediary in creation of capita!

- Safety in transactions

- Growth of capital market

![]()

Concept of Demat Account:

Dematerialization means conversion of physical securities into electronic data (or say electronic form) through computer. For this the investor needs to open a demat account.

Depository:

A depository institution is a financial institution that provides financial services to individuals and business firms.

- It is a company registered under Companies Act. It has to obtain certificate of registration from SEBI.

- Presently, there are two depositories in India. They are:

- NSDL and

- CDSL.

National Securities Depositry Limited (NSDL):

Public company formed under the Companies Act. It was registered with SEBI in 1996. NSDL performs its function through the depository participant appointed by it. All services provided by NSDL are as provided by depository.

Central Depository Services (India) Limited (CDSL):

Incorporated in 1999. It publishes time to time on its website the list of participants registered with it. The centralized system of CDSL and NSDL keeps an eye on every transaction. It provides all the services as provided by depository.

List of depository services:

- Dematerialization and rematerialization

- Easy transfer of securities at less expense

- Prompt settlement of transaction

- Record in customers account

- Facility to mortgage

- Facility to freeze or close account

- Record and storage of information

- Link between investor and clearing house

- Services through internet

Trading securities in the stock market (in the present time):

End of old traditional system of transaction on the floor by outcry. Online trading system in all the stock exchanges. Investors can buy and sell their securities online.

Procedure of trading the securities:

- To open demat account

- Order to buy and sell

- Execution of order

- Contract note

- Settlement of transaction

- Payment of amount and delivery of security

- Inform to customer about settlement of transaction

Objective of SEBI:

- To protect the interest of investor

- To encourage the development of securities market

- To regulate the securities market

Functions:

- To regulate the business in stock exchange

- Protection of the interests of the investors

- Registration and regulation of intermediaries

- Registration and regulation of mutual funds

- To prevent fraudulent trade

- To cancel registration of brokers

- To regulate the merger and take-over of the companies

- Guidelines with reference to public issues

- Self-regulation

- Maintaining stock exchanges as an efficient market

- Inspection of books

- Monitoring and inspection of stock exchange

- Guidelines

- To obtain annual and periodical reports

- Research work