Gujarat Board GSEB Textbook Solutions Class 11 Commerce Accounts Part 2 Chapter 7 Accounting Standards: Concept and Objectives Textbook Exercise Questions and Answers.

Gujarat Board Textbook Solutions Class 11 Accounts Part 2 Chapter 7 Accounting Standards: Concept and Objectives

GSEB Class 11 Accounts Accounting Standards: Concept and Objectives

Text Book Questions and Answers

Question 1.

Write a short note on Accounting Standards.

Answer:

Accounting Standards are written statements of uniform accounting rules and guidelines, which is to be followed while preparing and presenting the financial statements. Various business entities prepare their accounts in their own way because of management policy or accountants have different opinions on various practices. If, in this way, different entities adopt different policies for the same accounting matter, accounts do not remain comparable and useful conclusions cannot be drawn from such accounts.

Therefore, to bring uniformity in preparation and presentation of financial statements, attempts are made at the international. and national level to formulate and issue accounting standards. For this purpose, in the year 1973 International Accounting Standards Committee (IASC) was set up.

On 1st April 2001, International Accounting Standards Board (IASB) took over the responsibility for setting International Accounting Standards. Now, preparation is on in India also for applying IFRS and ICAI has started issuing Indian Accounting Standards Compliant with IFRS.

In the initial years, sometimes, issued accounting standards are recommendatory for entities and are made mandatory gradually after some time. However, accounting standards are not rigid. When business environment or laws change, the accounting standards are revised. The objectives of setting accounting standards is to bring uniformity in accounting policies and practices and to ensure transparency, consistency and comparability.

Question 2.

State meaning of Accounting Standards and explain the concept thereof.

Answer:

Meaning: An accounting standards are guidelines for financial accounting, such as how a firm prepares and presents its statements and reports. In other words, accounting standards are written statements of uniform accounting rules and guidelines, which is to be followed while preparing and presenting the financial statements.

Explanation: Accounting standards are prepared keeping in view the business environment and laws of the country. Accounting Standards are not rigid. Therefore, when business environment or laws change, the accounting standards are revised.

Concept: The rules, policies or guidelines stated by accounting standards are usually for measurement, valuation and disclosure of accounting information in the financial statements. According to Kohlar, accounting standards are a Code of Conduct imposed on accountants by custom, law and professional body.

Professional accounting bodies identify areas of accounting where alternative and diverse practices are followed. In the initial years, such accounting standards are recommendatory for entities and are made mandatory gradually after some time. Accounting Standard recommends the practice out of diverse accounting practices that are available or evaluates them in details to ascertain acceptability thereof. In case of conflict between the accounting standard and law, the law shall prevail.

![]()

Question 3.

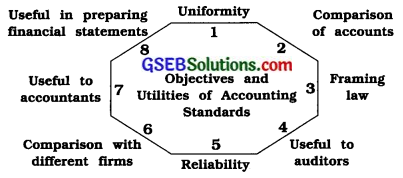

State the objectives and utilities (uses) of Accounting Standards.

Answer:

Objectives and utilities (uses) of Accounting Standards are as under:

- Uniformity: The main objective of setting accounting standards is to bring uniformity in accounting policies and in practices.

- Comparison of accounts: Accounting standards are useful for comparison of accounts.

- Framing law: Accounting standards provide useful information and data to Central Government in framing law relating to accounting matters.

- Useful to auditors: Accounting standards also become useful to auditors. If the accounts are not maintained following accounting standards, auditors can resort to detailed scrutiny and can unearth accounting frauds.

- Reliability: Accounts become objective and reliable by following accounting standards.

- Comparison with different firms: Because of accounting standards, comparison of different years as also of different firms becomes possible.

- Useful to accountants: Accounting Standards are also useful to the accountant in his accounting work. If he follows accounting standards, personal opinions or bias does not creep in accounts.

- Useful in preparing financial statements :

Accounting standards provide rules and guiding principles for preparation and presentation of financial statements.

Question 4.

Answer the following questions in one sentence:

1. In which year International Accounting Standards Committee (IASC) was established?

Answer:

International Accounting Standards Committee was established in the year 1973.

2. In which year ASB was set up by ICAI?

Answer:

Accounting Standards Board (ASB) was set up by Institute of Chartered Accountants of India (ICAI) in the year 1977.

![]()

3. For what purpose ASB was set up?

Answer:

ASB was set up for the purpose of formulating accounting standards.