Gujarat Board GSEB Textbook Solutions Class 12 Commerce Accounts Part 2 Chapter 3 Company Final Accounts Textbook Exercise Questions and Answers.

Gujarat Board Textbook Solutions Class 12 Accounts Part 2 Chapter 3 Company Final Accounts

GSEB Class 12 Accounts Company Final Accounts Text Book Questions and Answers

1. Select the correct option for each question :

Question 1.

Financial statements of a company includes ……………………. .

(A) statement of profit and loss and balance sheet

(B) cash flow statement and statement showing changes in equity

(C) notes to the accounts

(D) all of above

Answer:

(D) all of above

Question 2.

It is compulsory to prepare statement of profit and loss and balance sheet in ………………… form as per schedule III of Companies Act, 2013.

(A) horizontal or T,

(B) vertical

(C) statement of profit and loss is horizontal and balance sheet vertical

(D) statement of profit and loss is vertical and balance sheet horizontal

Answer:

(B) vertical

Question 3.

…………………………… is/are compulsory to prepare in specified form as per schedule III of Companies Act, 2013.

(A) Balance sheet

(B) Statement of profit and loss

(C) Balance sheet and statement of profit and loss both

(D) Neither balance sheet nor statement of profit and loss

Answer:

(C) Balance sheet and statement of profit and loss both

Question 4.

For ……………………………… it is compulsory to prepare statement of profit and loss and balance sheet in specified vertical form.

(A) sole proprietorship

(B) partnership

(C) all companies

(D) companies except insurance company, electricity company and banking company

Answer:

(D) companies except insurance company, electricity company and banking company.

![]()

Question 5.

Balance sheet is prepared …………………….. while statement of profit and loss is prepared

(A) for a particular accounting period, as at particular date

(B) as at particular date, for a particular accounting period

(C) as at particular date, as at particular date

(D) for a particular accounting period, for a particular accounting period

Answer:

(B) as at particular date, for a particular accounting period

Question 6.

…………………. shows financial position of a company while ………………………. shows financial performance of a company.

(A) Statement of profit and loss, cash flow statement

(B) Balance sheet, cash flow statement

(C) Statement of profit and loss, balance sheet

(D) Balance sheet, statement of profit and loss

Answer:

(D) Balance sheet, statement of profit and loss

Question 7.

Assets and liabilities of a company are classified into …………….. and ………… as per Companies Act, 2013.

(A) current, fixed

(B) fixed, fixed

(C) for short-term, for long-term

(D) current, non-current

Answer:

(D) current, non-current

Question 8.

……………………. assets is considered as current asset.

(A) Convertible into cash during 12 months after the date of balance sheet

(B) Realisable during 12 months after the date of balance sheet

(C) Consumable within 12 months after the date of balance sheet

(D) All of above.

Answer:

(D) All of above.

Question 9.

A machine to be sold during 12 months after the date of balance sheet is considered as ……………………. as per Companies Act, 2013.

(A) fixed asset

(B) non-current asset

(C) current asset

(D) expense

Answer:

(C) current asset

![]()

2. Answer in two or three sentences :

Question 1.

What is financial statements?

Answer:

Financial statements are statements presenting accounting information in brief at the end of accounting process for an accounting period.

Question 2.

What is included in the financial statements?

Answer:

As per section-2(40) of the Companies Act 2013, ‘Financial statement’ in relation to company includes –

- A balance sheet as at the end of the financial year.

- A profit and loss account or in case of a entity carrying on any activity not for profit, an income and expenditure account for the financial year.

- Cash flow statement for the financial year.

- A statement of changes in equity, if applicable.

- Notes related to the accounts.

Question 3.

State characteristics of financial statements.

Answer:

Following are some of the characteristics of financial statements :

- Financial statements are called historical statements as they are related to past period.

- Figures stated in financial statements are expressed in terms of money.

- Financial statements are based on recorded facts.

- Profit and loss accounts shows profit or loss for a given period.

- Balance sheet gives an idea about the financial position of a company.

- Financial statements are prepared based on generally accepted accounting principles.

![]()

Question 4.

State objectives of preparing financial statements.

Answer:

Following are some of the objectives of preparation of financial statements :

- To know about true and fair view of financial performance of a company.

- To know the true and fair view of financial position of a company.

- To comply with legal requirements.

- To communicate financial information of the company to various interested parties.

Question 5.

State main headings of equity and liabilities side of balance sheet as per schedule-III of Companies Act, 2013.

Answer:

Following are the main headings :

- Shareholder’s funds,

- Non-current liabilities,

- Current liabilities.

Question 6.

Show the classification of non-current liabilities.

Answer:

Classification of non-current liabilities :

- Long-term borrowings,

- Other long-term liabilities,

- Long-term provisions.

Question 7.

Show the classification of current liabilities as per schedule III of Companies Act, 2013.

Answer:

Classification of current liabilities :

- Short-term borrowings,

- Trade payables,

- Other current liabilities,

- Short-term provisions.

Question 8.

What is current assets and non-current assets?

Answer:

1. Current Assets: An asset shall be classified as current asset if it satisfies any of the following criteria :

- When it is expected to be realised in or is intended for sale or consumption in the company’s normal operating cycle.

- If it is held primarily for the ‘ purpose of being traded

- If it is expected to be realised within 12 months after the reporting date.

2. Non-current Assets: Assets other than current assets are classified as non-current asset.

Question 9.

What is current liability and non-current liability?

Answer:

1. Current Liability: A liability shall be classified as current if it satisfies any of the following criteria :

- If it is expected to be settled in the company’s normal operating cycle.

- If it is held primarily for the purpose being traded

- If it is due to be settled withing twelve months after the reporting date.

2. Non-current Liability: All other liabilities except current liabilities are classified as non-current liabilities.

Question 10.

Show the classification of current assets as per schedule-III of Companies Act 2013.

Answer:

Classification of current assets :

- Current investments

- Inventories

- Trade receivables

- Cash and cash equivalents

- Short term loans and advances.

![]()

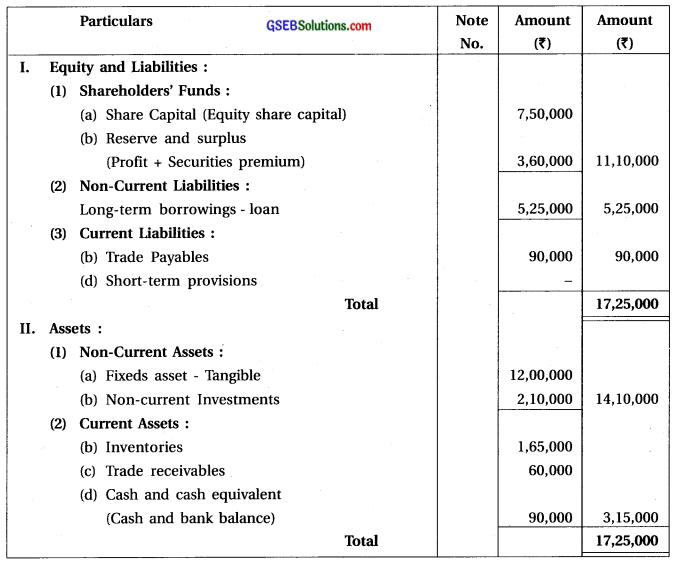

Question 3.

How will you show following balances in the balance sheet of a company as per schedule-III of Companies Act, 2013?

(1) Creditors

(2) Security premium

(3) Bond

(4) Goodwill

(5) Bank overdraft

(6) Bills receivables

(7) Equity share capital

(8) Copyrights

(9) Debenture discount (To be written off during next year)

(10) Calls in advance

(11) Cash

(12) Provident fund

(13) Debentures

(14) Trademark

(15) Loose Tools

(16) Loan (Payable during next year)

(17) Bills payable

(18) General reserve

(19) Public deposit

(20) Debtors

(21) Patents

(22) Calls in arrears

(23) Debenture redemption fund

(24) Stores and loose Tools

(25) Licences

(26) Closing stock

(27) Bank balance

(28) Surplus as per statement of profit and loss

(29) Deposit in electricity company

(30) Premium on redemption of preference share

Answer:

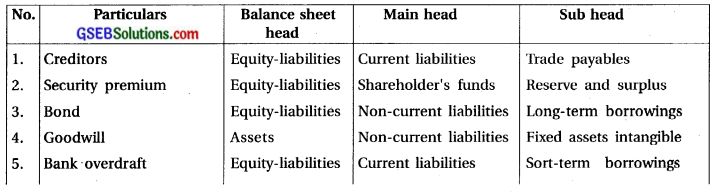

Question 4.

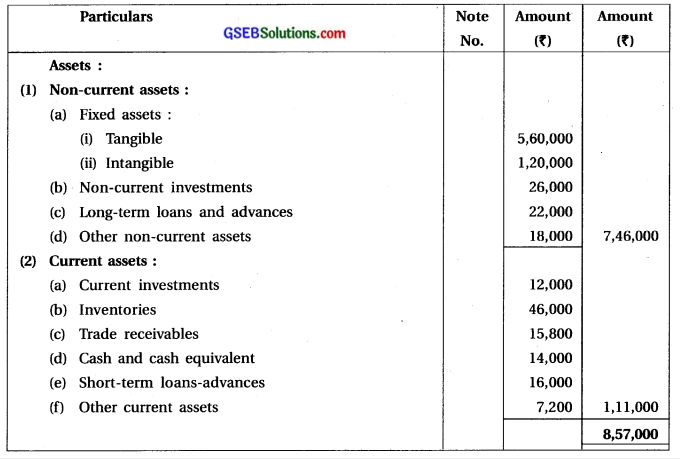

Following balances are taken from the books of Seema Ltd. on 31-3-2017. Prepare statement indicating assets of balance sheet as at 31-3-2017 as per schedule-III of Companies Act, 2013.

| Balance | (₹) |

| (1) Current investments | 12,000 |

| (2) Short-term loans and advances | 16,000 |

| (3) Other current assets | 7,200 |

| (4) Fixed assets – tangible | 5,60,000 |

| (5) Cash and cash equivalents | 14,000 |

| (6) Inventory | 46,000 |

| (7) Trade receivables | 15,800 |

| (8) Other non-current assets | 18,000 |

| (9) Non-current investments | 26,000 |

| (10) Fixed assets – intangible | 1,20,000 |

| (11) Long-term loans and advances | 22,000 |

Answer:

Balance sheet of Seema Limited as at 31-3-2017

Question 5.

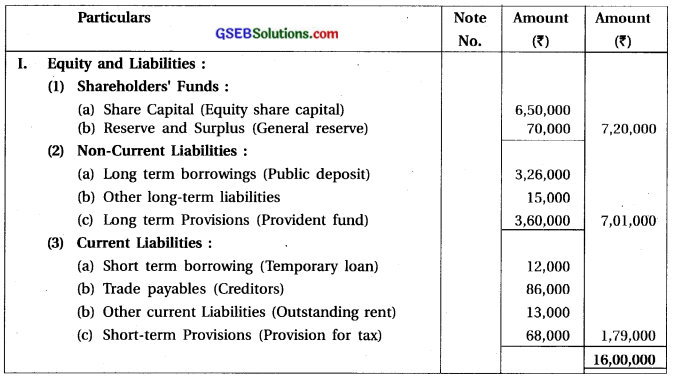

Following balances are taken from the books of Yuva Ltd. on 31-3-2017. Prepare statement indicating equity and liabilities of balance sheet as at 31-3-2017 as per schedule-III of Companies Act, 2013.

| Balance | (₹) |

| (1) 1,30,000 equity shares of ₹ 5 each | 6,50,000 |

| (2) General reserve | 70,000 |

| (3) Provident fund | 3,60,000 |

| (4) Creditors | 86,000 |

| (5) Public deposit | 3,26,000 |

| (6) Outstanding rent | 13,000 |

| (7) Provision for tax | 68,000 |

| (8) Other long-term liabilities | 15,000 |

| (9) Temporary loan (Credit balance) | 12,000 |

Answer:

Balance sheet of Yuva limited as at 31-3-2017

![]()

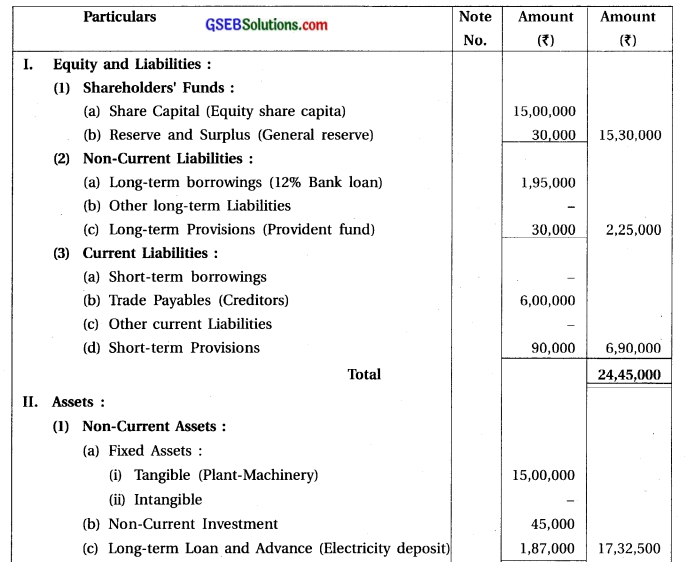

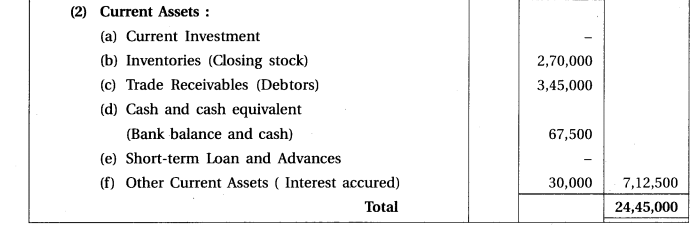

Question 6.

Following balance are taken from the books of Moon Ltd. Prepare balance sheet as on 31-3-2017 as per schedule-III of Companies Act, 2013.

| Balance | (₹) |

| (1) Interest accrued | 30,000 |

| (2) Plant-machinery | 15,00,000 |

| (3) Equity share capital | 15,00,000 |

| (4) Bank balance and cash | 67,500 |

| (5) General reserve | 30,000 |

| (6) Closing stock | 2,70,000 |

| (7) Creditors | 6,00,000 |

| (8) Debtors | 3,45,000 |

| (9) Provision for tax | 90,000 |

| (10) 12% bank loan | 1,95,000 |

| (11) Non-current investments | 45,000 |

| (12) Electricity deposit | 1,87,500 |

| (13) Provident fund | 30,000 |

Answer:

Balance sheet of Moon Limited as at 31-3-2017

Question 7.

Under which head, will you show the following balances of profit and loss as per schedule III of Companies Act, 2013?

(1) Sales

(2) Salary

(3) Depreciation

(4) Bad debt recovered

(5) Debenture interest paid

(6) Audit fee

(7) Income of scrap

(8) Profit on sale of asset

(9) Advertisement expenses

(10) Contribution to provident fund

(11) Interest on bank overdraft

(12) Bank charges

(13) Bonus to employees

(14) Debenture discount written off

Answer:

| Particulars | Head of Profit and Loss Statement |

| (1) Sales | Revenue from operation |

| (2) Salary | Employees benefit expenses |

| (3) Depreciation | Depreciation and amortized expenses |

| (4) Bad debt recevered | Other income |

| (5) Debenture interest paid | Financial cost (expense) |

| (6) Audit fee | Other expense |

| (7) Income of scrap | Other income |

| (8) Profit on sale of asset | Other income |

| (9) Advertisement expenses | Other income |

| (10) Contribution to provident fund | Employees benefit expense |

| (11) Interest on bank overdraft | Financial cost (expense) |

| (12) Bank charges | Other expense |

| (13) Bonus to employees | Employees benefit expense |

| (14) Debenture discount written off | Depreciations and amorized expense |

Question 8.

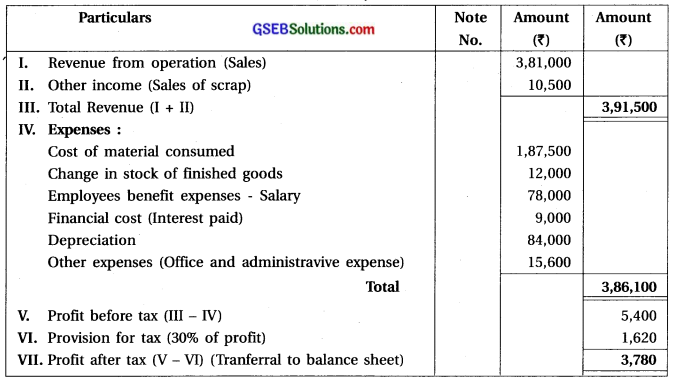

Following balance is taken from the books of Patel Ltd. Prepare statement of profit and loss for the year ending 31-3-2017 as per schedule-III of Companies Act, 2013.

| Balance | (₹) |

| (1) Sales of scrap | 10,500 |

| (2) Cost of material consumed | 1,87,500 |

| (3) Salary | 78,000 |

| (4) Interest paid | 9,000 |

| (5) Sales | 3,81,000 |

| (6) Change in stock of finished goods | 12,000 |

| (7) Office and administration expenses | 15,600 |

| (8) Depreciation | 84,000 |

| (9) Provision for tax on profit is | 30% |

Answer:

Statement of Profit and Loss for the year ended on 31-3-2017

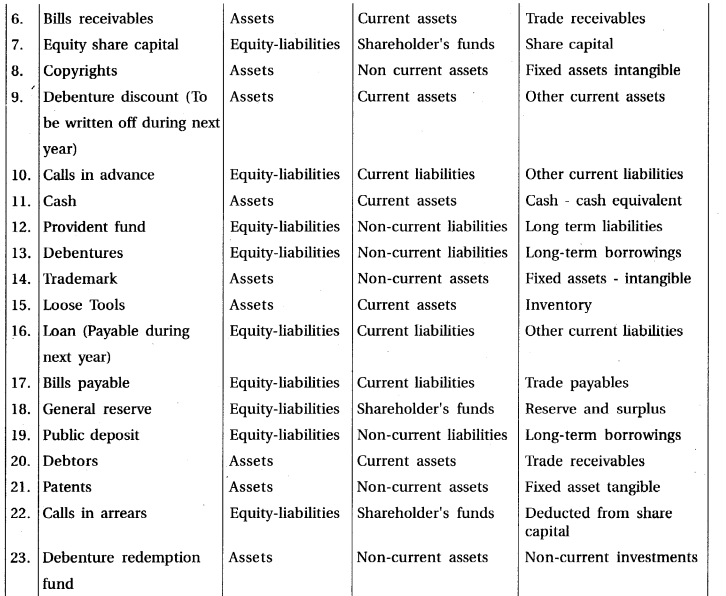

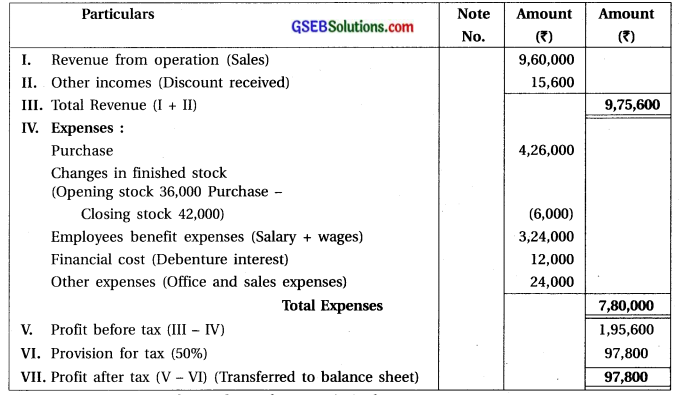

Question 9.

Following is the balance sheet of Keyur Ltd. as on 31-3-2017 :

| Particulars | Debit (₹) | Credit (₹) |

| Equity share capital | 2,40,000 | |

| Office and sales expenses | 24,000 | |

| Purchase | 4,26,000 | 1,20,000 |

| 10% Debenture | 9,60,000 | |

| Sales | ||

| Software | 1,20,000 | |

| Wages | 24,000 | |

| Debenture Interest | 12,000 | |

| Salary | 3,00,000 | |

| Bank overdraft | 14,400 | |

| land-building | 2,28,000 | |

| Opening stock | 36000 | |

| Discount received | 15,600 | |

| Debtors | 1,80,000 | |

| 13,50,000 | 13,50,000 |

Other information :

(1) Closing stock ₹ 42,000

(2) Make provision for tax at 50 % of net profit.

From the above information, prepare final accounts of the company for the year ending on 31st March, 2017 as per schedule-III and Companies Act, 2013. Notes to the accounts are not required.

Answer:

Statement of Profit and Loss of Keyur Limited for the year ending on 31-3-2017

![]()

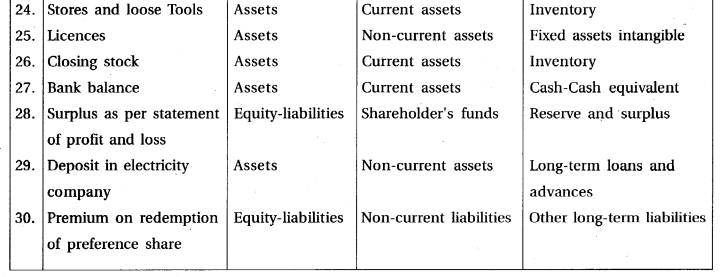

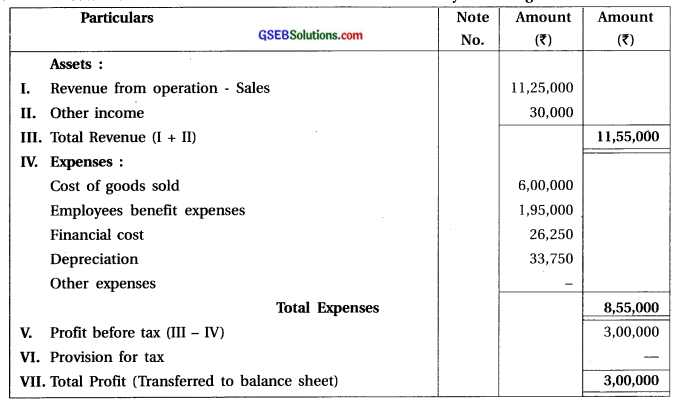

Question 10.

Following is the trial balance of Parth Ltd. as on 31-3-2017 :

| Particulars | Debit (₹) | Credit (₹) |

| Sales | 11,25,000 | |

| Employee benefit expenses | 1,95,000 | |

| Inventories | 1,65,000 | |

| Finance costs | 26250 | |

| Security premium | 60,000 | |

| Fixed assets – tangible | 12,00,000 | |

| Trade payables | 90,000 | |

| Equity share capital | 7,50,000 | |

| Trade receivables | 60,000 | |

| Other income | 30,000 | |

| Long-term borrowings | 5,25,000 | |

| Cash and bank balance | 90,000 | |

| Depreciation | 33,750 | |

| Cost of goods sold | 6,00,000 | |

| Non-current investments | 2,10,000 | |

| 25,80,000 | 25,80,000 |

From the above information, prepare final accounts of the company for the year ended on 31-3-2017 as per schedule-III of Companies Act, 2013. Notes to the accounts are not required.

Answer:

Statement of Profit and Loss for Parth Limited for the year ending on 31-3-2017

Balance sheet of Parth Limited as on 31-3-2017