Gujarat Board GSEB Class 12 Commerce Accounts Important Questions Part 2 Chapter 4 Analysis of Financial Statements Important Questions and Answers.

GSEB Class 12 Accounts Important Questions Part 2 Chapter 4 Analysis of Financial Statements

Answer the following questions in one sentence only :

Question 1.

Which information is represent by financial statements?

Answer:

Financial statments represent historical informations.

Question 2.

Which are the components of financial statements?

Answer:

The components of financial statements are trading account, profit and loss account, balance sheet, cash flow statement and fund flow statement.

Question 3.

Which is known as income statement?

Answer:

Profit and loss account is known as income statement.

Question 4.

Gross profit is a result of which financial transaction?

Answer:

Gross profit is a result of purchase-sales financial transactions.

Question 5.

Give only name of objectives of financial statements.

Answer:

Objects befind the preparation of financial statement are as under :

- To know the information about profit and loss of the business entity.

- To know the financial position of the business entity.

- To know the cash position of the business entity.

- To give the financial information to the parties connected with the company.

![]()

Question 6.

What is external analysis?

Answer:

When published accounts like income statements, balance sheet, report of an auditor or directors are analysed by external parties like potential investors, financial institutions, government agencies, credit rating agencies, research etc. for their investment-related decision or for any other decision , it is known as external analysis.

Question 7.

What is internal analysis?

Answer:

When financial statements are analysed by the management for their decisions, it is known as internal analysis.

Question 8.

Which four different aspects are analysed from the analysis of financial statements?

Answer:

Generally following four aspects are analysed from the analysis of financial statements

- Profitability

- Liquidity

- Solvency

- Efficiency.

Question 9.

Give only name of stages of analysis of financial statements.

Answer:

Following are the stages of analysis of finanacial statements :

- New structural Arrangement of financial statement

- Comparison

- Analysis and Interpretation.

Question 10.

What does disclose by profitability analysis?

Answer:

Analysis of profitability discloses the earning capacity of business entity.

Question 11.

What does disclose by analysis of liquidity?

Answer:

Analysis of liquidity discloses the short-term solvency of business entity.

Question 12.

What does disclose by analysis of solvency?

Answer:

Analysis of solvency discloses the long-term solvency of business entity.

Question 13.

Which analysis does explain about use of assets?

Answer:

Analysis of efficiency explains about the degree of use of assets.

Question 14.

What is changes in the stock?

Answer:

Changes in the stock means difference of opening and closing stock.

Changes in stock = Opening stock – Closing stock

![]()

Question 15.

What is the other name of horizontal analysis?

Answer:

Other name of horizontal analysis is time series analysis.

Question 16.

Which information can be obtained through analysis of comparative statements?

Answer:

Through analysis of comparative statements we can get the information about development trend of a business entity.

Question 17.

In which form comparison can be done in comparative statements?

Answer:

In comparative statements, comparison can be done in horizontal form.

Question 18.

In which form comparison of common size statements can be done?

Answer:

In common size statements, comparison can be done in vertical form.

Question 19.

State two important pars of profit and loss statements.

Answer:

Total revenue and total expenses are two important parts of profit and loss statements.

Question 20.

State two important parts of balance sheet.

Answer:

Two important parts of balance sheet are

- Equity and Liabilities and

- Assets,

Question 21.

While preparing common size statements, what is taken as base for profit and loss statements and balance sheet?

Answer:

While preparing common size statements net sales is taken as base for profit and loss ‘ statements and total of balance sheet is taken as base for balance sheet.

![]()

Question 22.

In which type of statements 100% is taken as base?

Answer:

In common size statements, 100% is taken as base.

Select the right answer for each question :

Question 1.

In the context of final accounts of an unit by which name of statement, profit and loss account is known?

(A) Income statement

(B)Cash flow statement

(C) Expense statement

(D) Working capital statement

Answer:

(A) Income statement

Question 2.

What is the first object of financial statement?

(A) To know the financial position of the business entity

(B) To know the cash position of the business entity

(C) To know the profit and loss of the business entity

(D) None of the given

Answer:

(C) To know the profit and loss of the business entity

Question 3.

Which statement is prepared to know the profit and loss for a specific period of a business entity?

(A) Working capital statement

(B) Cash flow statement

(C) Income statement

(D) Fund flow statement

Answer:

(C) Income statement

Question 4.

From the following which analysis is show the classification as per parties?

(A) Horizontal Analysis

(B) Internal Analysis

(C) Vertical Analysis

(D) Long-term Analysis

Answer:

(B) Internal Analysis

![]()

Question 5.

The analysis of financial statements are done for decision making by managements known as ………………….. .

(A) Internal Analysis

(B) External Analysis

(C) Long-term Analysis

(D) Vertical Analysis

Answer:

(A) Internal Analysis

Question 6.

If the comparison of financial statements for different years is done then that analysis is known as …………………… .

(A) External Analysis

(B) Time-series Analysis

(C) Vertical Analysis

(D) Internal Analysis

Answer:

(B) Time-series Analysis

Question 7.

Which analysis is useful to compare the performance of different units of a year?

(A) Horizontal Analysis

(B) Internal Analysis

(C) Vertical Analysis

(D) External Analysis

Answer:

(C) Vertical Analysis

Question 8.

Generally, by which analysis, all types of parties obtained the decisions regarding own investments?

(A) Earning capacity

(B) Efficiency of management

(C) Efficiency

(D) Budget

Answer:

(A) Earning capacity

Question 9.

What is shown by efficiency analysis?

(A) Short-term solvency of business

(B) Long-term solvency of business

(C) Information regarding use usage of assets

(D) Earning capacity of business

Answer:

(C) Information regarding use usage of assets

Question 10.

Which type of analysis is important for taking decision of dividend?

(A) Profitability Analysis

(B) Solvency Analysis

(C) Liquid Analysis

(D) Efficiency Analysis

Answer:

(A) Profitability Analysis

![]()

Question 11.

What is taken as base in income statement?

(A) Net revenue

(B) Net sales

(C) Net purchase

(D) Total of income statement

Answer:

(B) Net sales

Question 12.

In a company current year expenses ar ₹ 8,00,000 and in the comparison of previous year it has been increased by 25%, then find out the last year expenses.

(A) ₹ 2,00,000

(B) ₹ 6,00,000

(C) ₹ 6,40,000

(D) ₹ 10,00,000

Answer:

(C) ₹ 6,40,000

Question 13.

Current year sales revenue is ₹ 6,00,000 of a company. In the comparison of previous year if has been decrease by 20% then find out the last year sales revenue.

(A) ₹ 1,20,000

(B) ₹ 4,80,000

(C) ₹ 7,20,000

(D) ₹ 7,50,000

Answer:

(A) ₹ 1,20,000

Question 14.

Amount of trade creditors of a company are ₹ 2,25,000. There is a increase of 25% in the comparison of last year. Find out the last year amount of trade creditors.

(A) ₹ 56,250

(B) ₹ 1,80,000

(C) ₹ 2,81,250

(D) ₹ 3,37,500

Answer:

(B) ₹ 1,80,000

Question 15.

Amount of last year long term investment was ₹ 5,00,000. In current year if there is increase/decrease of (4.50%) in it then find out the amount of current year.

(A) ₹ 22,500

(B) ₹ 4,77,500

(C) ₹ 5,22,500

(D) ₹ 4,57,500

Answer:

(B) ₹ 4,77,500

Give answer of the following questions :

Question 1.

Prepare comparative profit-loss statements from the following profit-loss statements of Nayan Ltd. for the year ending on 31-3-2018 and 31-3-2019.

| Particulars | Note No. | 31-3-’19 (₹) |

31-3-’18 (₹) |

| Sales revenue | 24,00,000 | 21,00,000 | |

| Other income | 4,50,000 | 3,75,000 | |

| Expenses | 14,40,000 | 10,80,000 |

Answer:

| Particulars | Increase/ Decrease (₹) | Increase/Decrease (%) |

| (I) Sales revenue | 3,00,000 | 14.29 |

| (II) Other income | 75,000 | 20.00 |

| (III) Total income | 3,75,000 | 15.15 |

| (IV) Expenses | 3,60,000 | 33.33 |

| (V) Profit before tax | 15,000 | 1.08 |

![]()

Question 2.

Prepare comparative profit-loss statements from the following profit-loss statements of Binali Ltd. for the year ending on 31-3-2018 and 31-3-2019.

Summarised Profit-Loss statements for the year ending on 31-3-’18 and 31-3-’19

| Particulars | Note No. | 31-3-2019 (₹) |

31-3-2018 (₹) |

| Sales revenue | 18,00,000 | 16,00,000 | |

| Other income | 4,00,000 | 3,50,000 | |

| Expenses | 9,60,000 | 8,00,000 |

Income tax rate is 30%

Answer:

| Particulars | Increase/Decrease(₹) | Increase/Decrease (%) |

| (I) Sides revenue | 2,00,000 | 12.50 |

| (II) Other income | 50,000 | 14.29 |

| (III) Total income | 2,50,000 | 12.82 |

| (IV) Expenses | 1,60,000 | 20.00 |

| (V) Profit before tax | 90,000 | 7.83 |

| (VII) Less: Income tax (30%) | 27,000 | 7.83 |

| (V) Profit after tax | 63,000 | 7.83 |

Question 3.

Profit and Loss statements of Janki Ltd. for the year ending on 31-3-18 and 31-3-19 are as follows. On the basis of them prepare comparative profit and loss statement.

| Particulars | Note No. | 31-3-2019 (₹) |

31-3-2018 (₹) |

| Sales revenue | 21,00,000 | 12,60,000 | |

| Net purchase for resale | 12,60,000 | 8,40,000 | |

| Changes in stock | 70,000 | 70,000 | |

| Other expenses (% of cost of sales) | 10 | 12 | |

| Income tax | 30% | 30% |

Answer:

| Particulars | Increase/Decrease (₹) | Increase/Decrease (%) |

| (I) Sales revenue | 8,40,000 | 66.67 |

| (II) Expenses : | ||

| (i) Net purchase for resale | 4,20,000 | 50.00 |

| (ii) Changes in stock | – | – |

| (iii) Other expenses | 23,800 | 21.79 |

| Total Expenses | 4,43,800 | 43.54 |

| (III) Profit before tax | 3,96,200 | 164.53 |

| (IV) Less: Income tax (30%) | 1,18,860 | 164.53 |

| (V) Profit after tax | 2,77,340 | 164.53 |

Question 4.

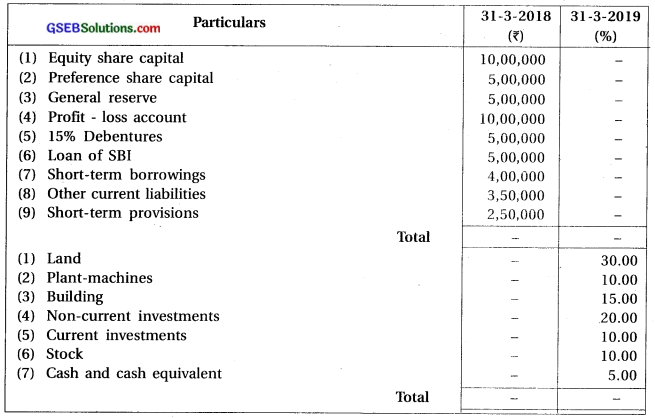

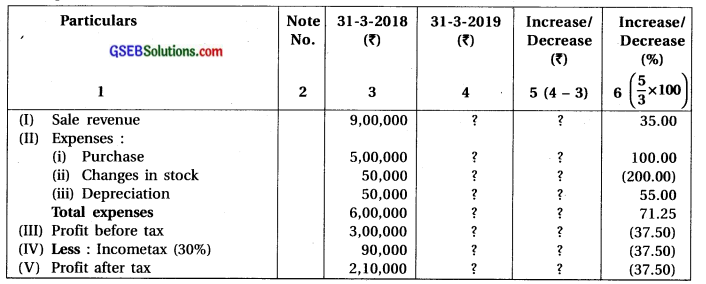

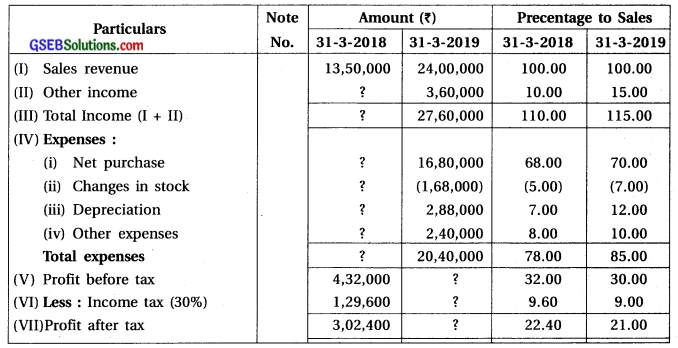

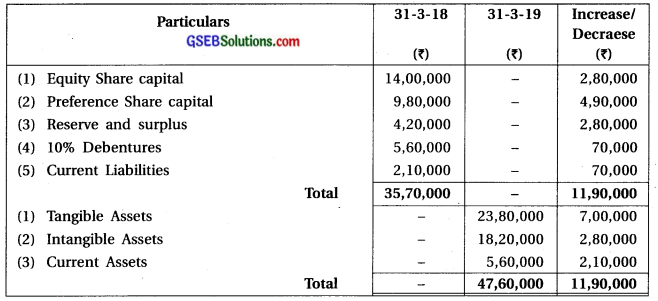

Find out balancing figures of comparative statement of Aanal Ltd. and prepare new comparative statement.

Answer:

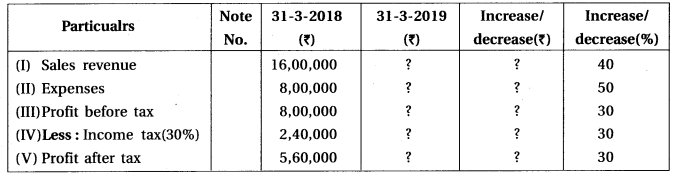

Question 5.

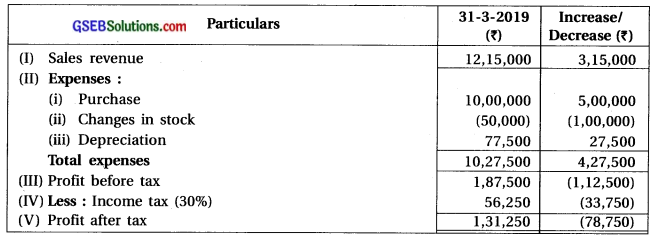

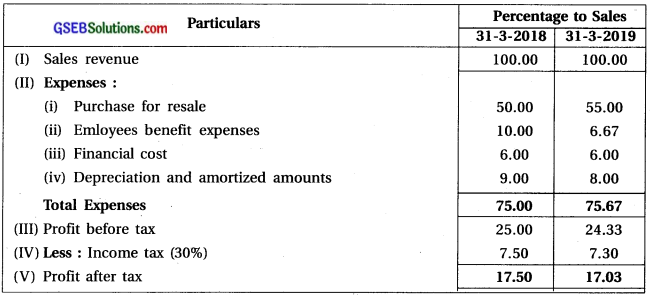

Find out the balancing figures of common size profit and loss statements of Satyam Ltd. Profit and Loss statements for the year ending on 31-3-2018 and 31-3-2019

Answer:

| Particulars | Dt 31-3-2018 (₹) | Dt.31-3-2019 (₹) |

| (I) Sales revenue | 25,00,000 | 30,00,000 |

| (II) Expenses | 20,00,00 | 27,00,000 |

| (III) Profit before tax | 5,00,000 | 3,00,000 |

| (IV) Less: Income tax (30%) | 1,15,000 | 90,000 |

| (V) Profit after tax | 3,50,000 | 2,10,000 |

![]()

Give answer of the following questions :

Question 1.

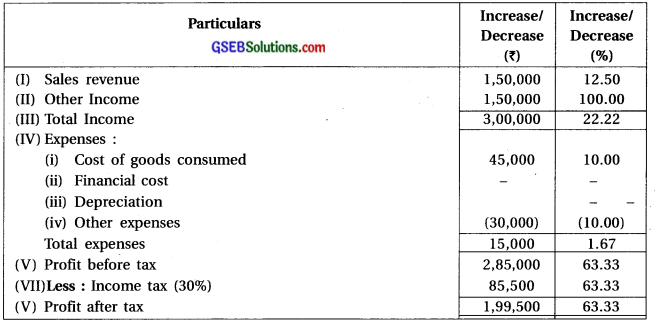

The abridge profit and loss statement ending on 31-3-2018 and 31-3-2019 of Parth Limited are given as follows. Prepare comparative statement of profit and loss.

Profit and Loss statements for the years ending on 31-3-’18 and 31-3-’19

| Particulars | Note No. | Dt.31-3-2019 (₹) |

Dt.31-3-2018 (₹) |

| Sales revenue | 13,50,000 | 12,00,000 | |

| Other income | 3,00,000 | 1,50,000 | |

| Cost of goods sold | 4,95,000 | 4,50,000 | |

| Financial cost | 90,000 | 90,000 | |

| Depreciation | 60,000 | 60,000 | |

| Other expenses | 2,70,000 | 3,00,000 |

Income tax rate is 30%.

Answer:

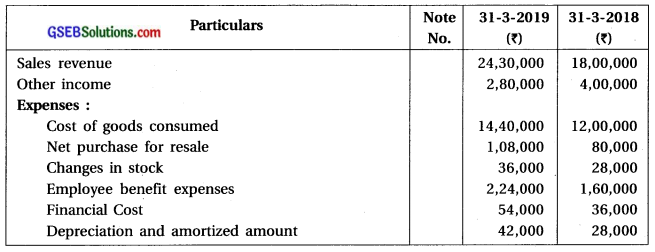

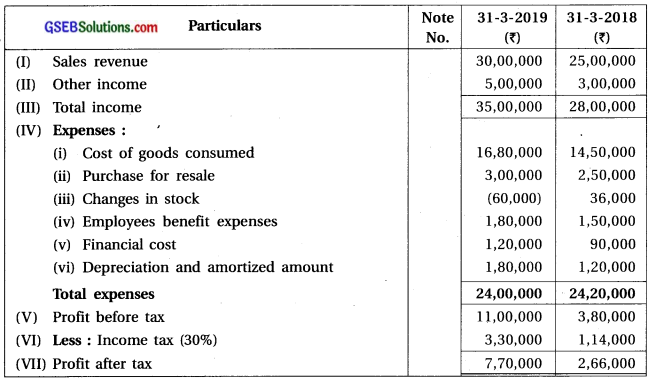

Question 2.

Profit and loss statements for the year ending on 31-3-2018 and 31-3-2019 of Bina Ltd. are given as under. Prepare comparative statement of profit and loss.

Profit and Loss statement for the year ending on 31-3-’18 and 31-3-’19

Income tax rate is 30%.

Answer:

![]()

Question 3.

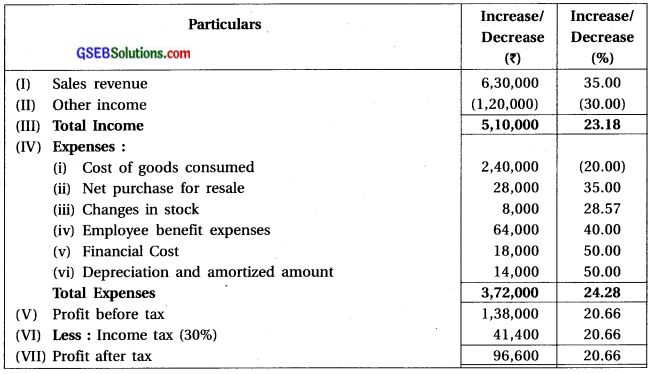

On the basis of following information of Dilpesh Limited, prepare comparative profit and loss statement.

| Particulars | Note No. | 31-3-2019 (₹) |

31-3-2018 (₹) |

| Sales revenue | 18,75,000 | 22,50,000 | |

| Net purchase for resale | 7,50,000 | 6,25,000 | |

| Changes in stock | 2,00,000 | 1,25,000 | |

| Other expenses (% of sale) | 45 | 40 | |

| Other income (% of sale) | 12 | 10 |

Income tax rate is 30%.

Answer:

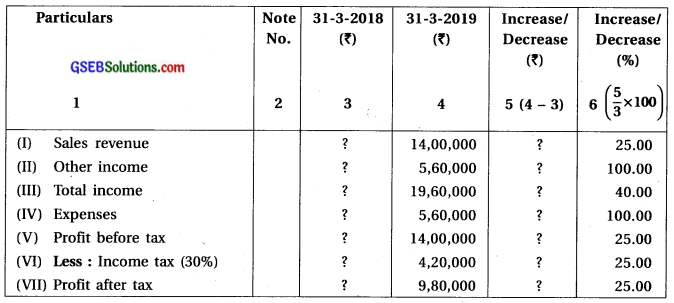

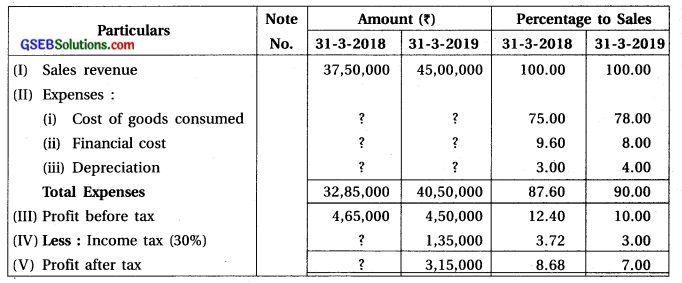

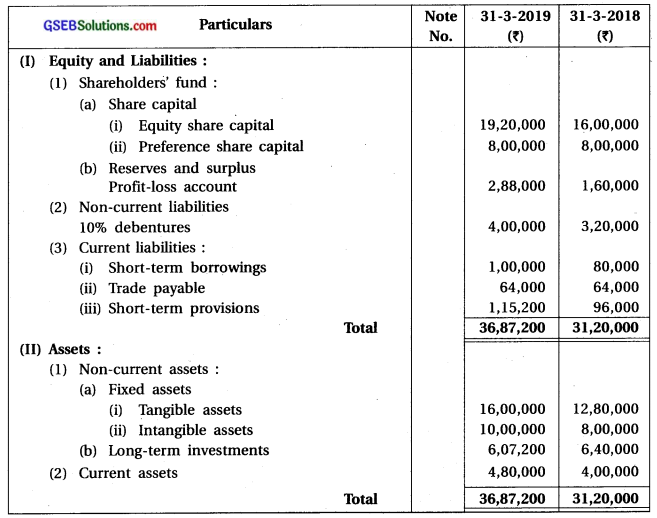

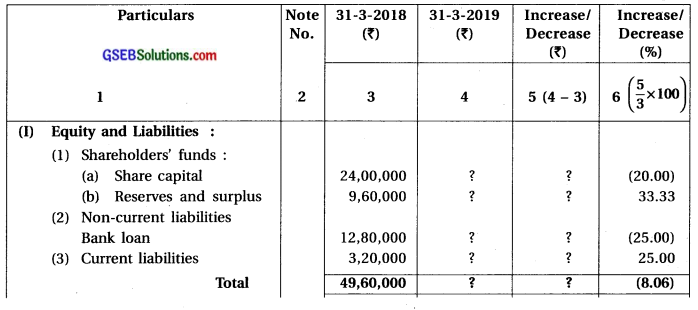

Question 4.

Find out the balancing figures of comparative statement of Bhargav Ltd. and prepare new comparative statement.

Answer:

Question 5.

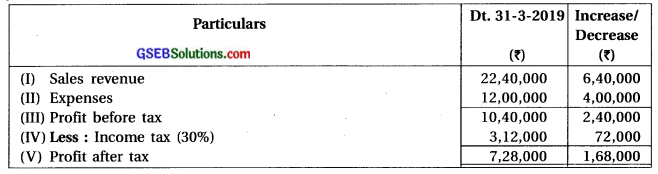

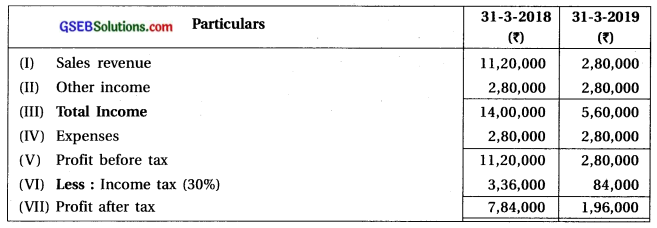

Fill the comparative profit and loss statement of Vaibhavi Ltd. for the year ending on 31-3-’18 and 31-3-’19.

Answer:

Question 6.

On the basis of the following profit and loss statement of Aradhana Ltd. prepare common size profit-loss statements.

| Particulars | Note No. | 31-3-2019 (₹) |

31-3-2018 (₹) |

| (I) Sales revenue | 60,00,000 | 48,00,000 | |

| (II) Expenses : | |||

| (i) Purchase for resale | 33,00,000 | 24,00,000 | |

| (ii) Employees benefit expenses | 4,00,000 | 4,80,000 | |

| (iii) Financial cost | 3,60,000 | 2,88,000 | |

| (iv) Depreciation and amortized amount | 4,80,000 | 4,32,000 | |

| Total expenses | 45,40,000 | 36,00,000 | |

| (III) Profit before tax | 14,60,000 | 12,00,000 | |

| (IV) Less: income (30%) | 4,38,000 | 3,60,000 | |

| (V) Profit after tax | 10,22,000 | 8,40,000 |

Answer:

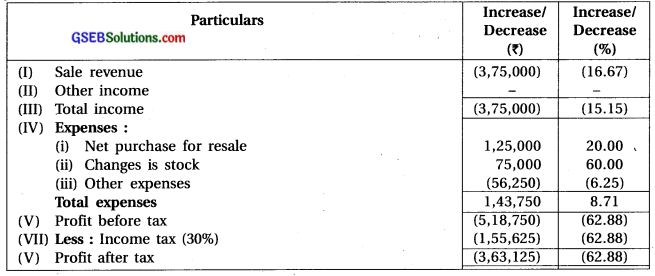

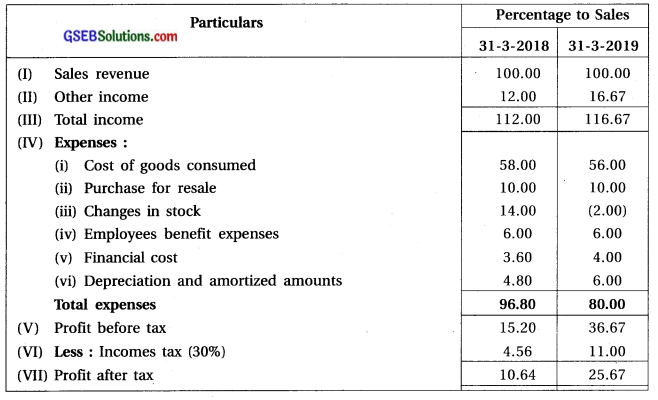

Question 7.

From the following given profit-loss statements of Parijat Limited prepare common size profit-loss statement.

Answer:

![]()

Question 8.

Fill the following common size profit-loss statements of Aaradhana Limited.

Common size profit-loss statement for the year ending on 31-3-’18 and 31-3-’19

Answer:

| Particulars | 31-3-2018 (₹) |

31-3-2019 (₹) |

| (1) Cost of goods consumed | 28,12,500 | 35,10,000 |

| (2) Financial cost | 3,60,000 | 3,60,000 |

| (3) Depreciation | 1,12,500 | 1,80,000 |

| (4) Income tax | 1,39,500 | – |

| (5) Profit after tax | 3,25,500 | – |

Question 9.

Find out the balancing figures of following common size statements of profit and loss of Aishwarya limited for the year ending on 31-3-’18 and 31-3-’19 and prepare it incomplete form. Common size profit-loss statement for the year ending on 31-3-’18 and 31-3-’19

Answer:

| Particulars | 31-3-2018 (₹) |

31-3-2019 (₹) |

| (1) Other income | 1,35,000 | – |

| (2) Total income | 14,85,000 | – |

| (3) Net purchase | 9,18,000 | – |

| (4) Changes in stock | (67,500) | – |

| (5) Depreciation | 94,500 | – |

| (6) Other expenses | 1,08,000 | – |

| (7) Total expenses | 10,53,000 | – |

| (8) Profit before tax | – | 7,20,000 |

| (9) Less : Income tax | – | 2,16,000 |

| (10) Profit after tax | – | 5,04,000 |

Give answer of the following questions :

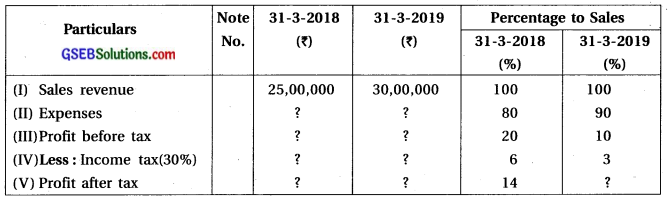

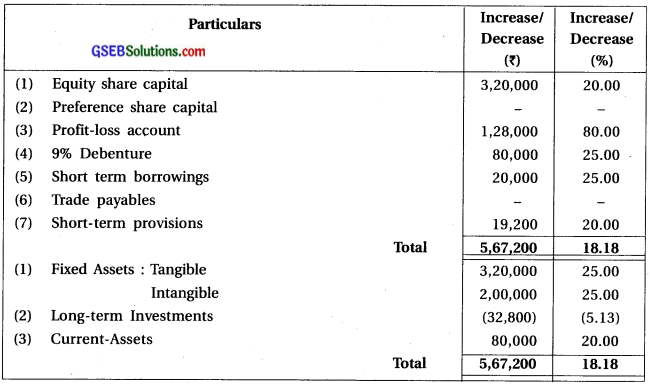

Question 1.

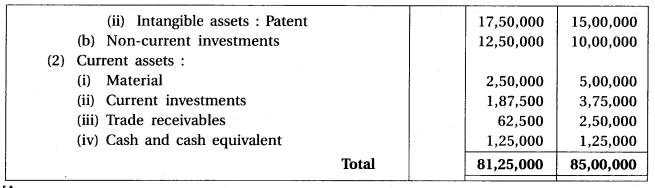

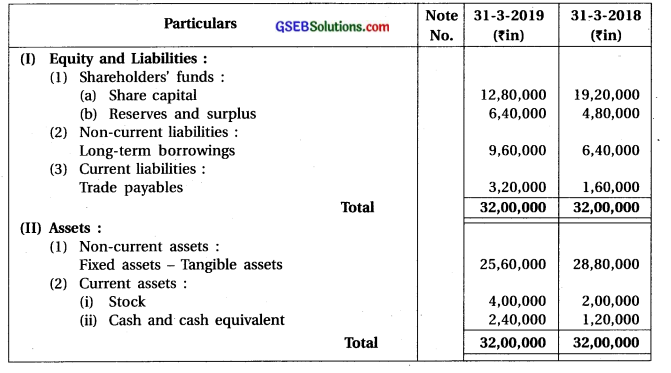

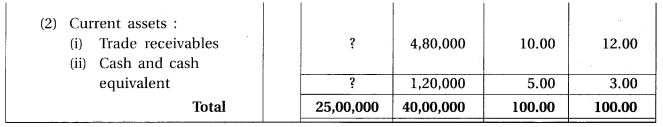

From the balance sheets of Kajal Ltd. of 31-3-2018 and 31-3-2019 prepare comparative balance sheet.

Balance Sheet as on 31-3-2018 and 31-3-2019

Answer:

![]()

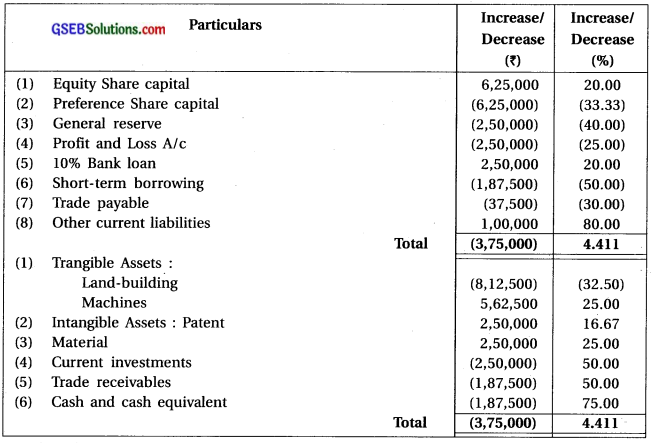

Question 2.

The balance sheet of Ajay Ltd. as at 31-3-2018 and 31-3-2019 are as follows. Prepare a comparative balance sheet.

Answer:

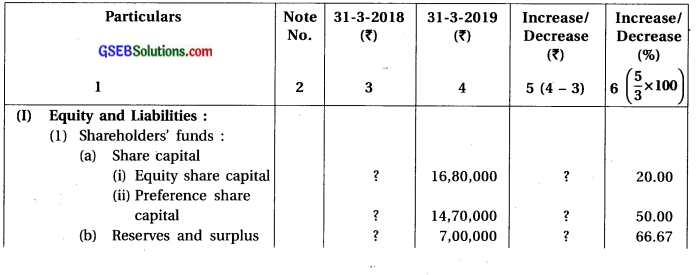

Question 3.

Complete the comparative statement of balance sheets of Sujata Limited for the year ending on 31-3-2018 and 31-3-2019.

Answer:

![]()

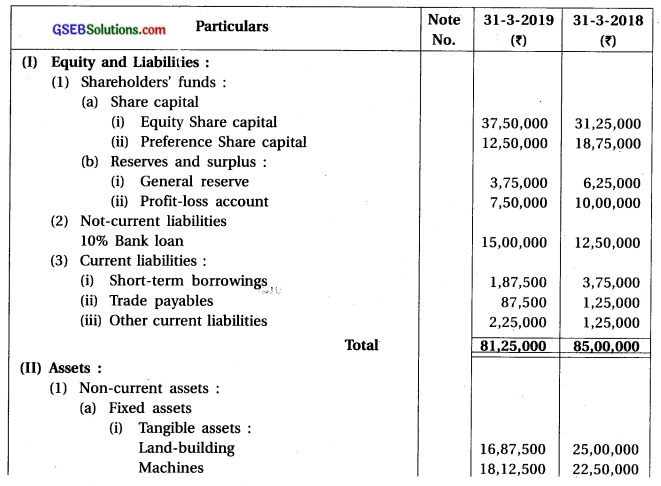

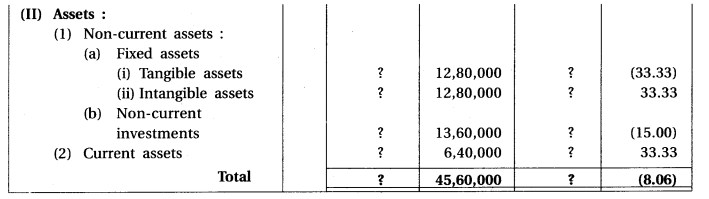

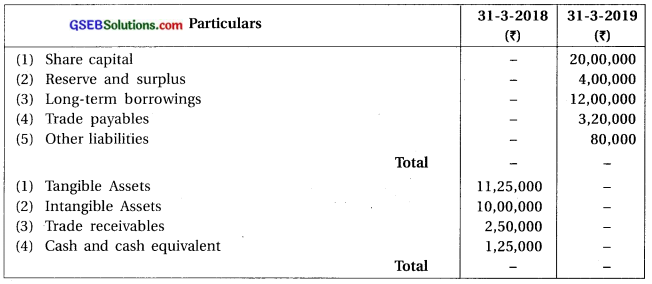

Question 4.

Complete comparative balance sheets of Bharat Company Limited for the year ending on 31-3-2018 and 31-3-2019.

Answer:

Question 5.

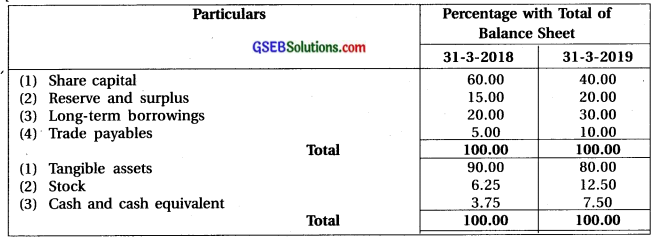

From the following given abridge balance sheet as on 31-3-2018 and 31-3-2019 of Radhika Ltd., prepare common size statement of balance sheet.

Balance Sheet as on 31-3-’18 and 31-3-’19

Answer:

Question 6.

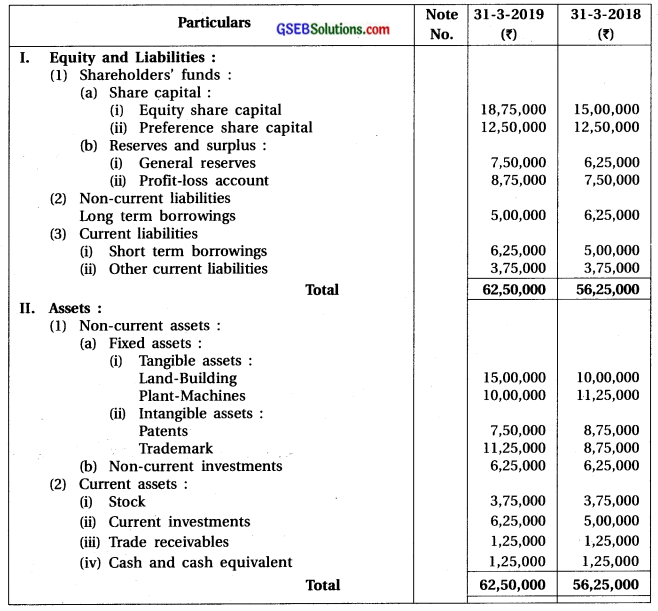

Balance sheets of Jay Limited as at 31-3-2018 and 31-3-2019 are as follows. Prepare common size statement of balance sheet.

Answer:

Balance Sheets as on 31-3-2018 and 31-3-2019

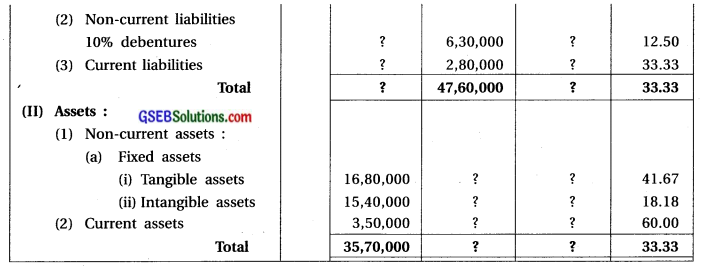

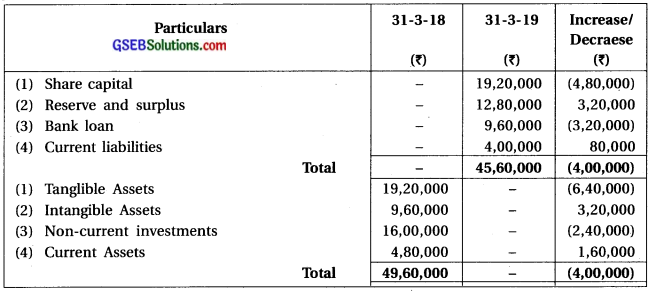

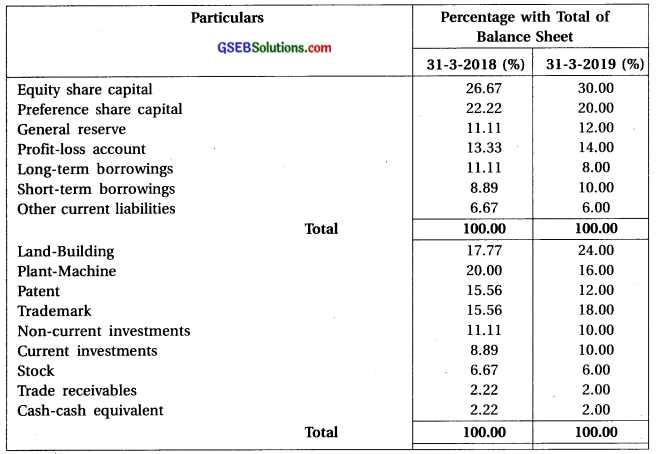

Question 7.

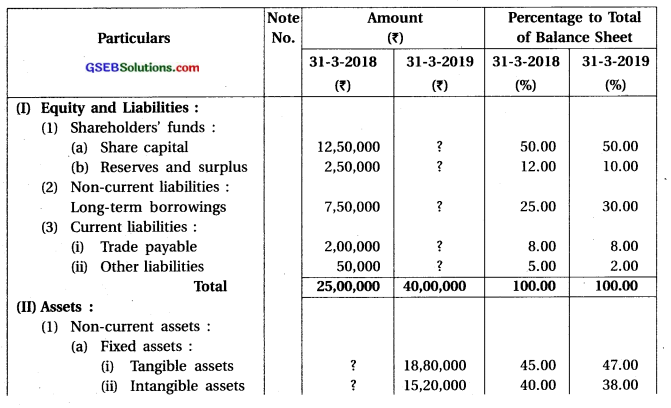

The common size balance sheets as at 31-3-2018 and 31-3-2019 with balancing figures of Ashka Limited are as follows. Ascertian balancing figures and complete common size balance sheet.

Answer:

![]()

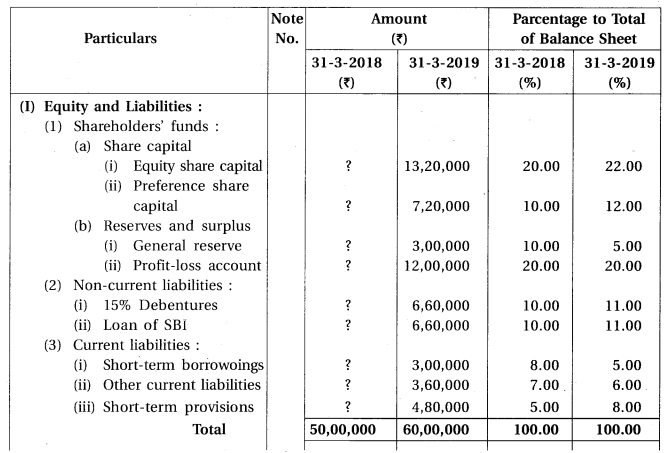

Question 8.

Find out balancing figures of common size balance sheet as at 31-3-2018 and 31-3-2019 of Dahod Limited.

Answer: