GSEB Gujarat Board Textbook Solutions Class 11 Economics Chapter 9 National Income Textbook Exercise Important Questions and Answers, Notes Pdf.

Gujarat Board Textbook Solutions Class 11 Economics Chapter 9 National Income

GSEB Class 11 Economics National Income Text Book Questions and Answers

1. Choose correct option for the following from the options provided :

Question 1.

Who gave the definition of national income by production method? .

(A) Marshall

(B) Fisher

(C) Pigou

(D) Samuelson

Answer:

(A) Marshall

Question 2.

Which among the following can be considered in GNP?

(A) Operation in hospital

(B) Household work of housewife

(C) A teacher teaching his/her own child

(D) Sing a song in the bathroom

Answer:

(A) Operation in hospital

Question 3.

Which among the following is not included in closed economy?

(A) Families

(B) Firms

(C) Industries

(D) Foreign trade

Answer:

(D) Foreign trade

Question 4.

Which expenditure of government is not considered in national income?

(A) Production

(B) Transfer payment

(C) Wages of labourers

(D) Defence expenditure

Answer:

(A) Production

Question 5.

How many factors constitute monetary expenditure?

(A) 4

(B) 2

(C) 1

(D) 10

Answer:

(A) 4

Question 6.

Which one of the following is not a method to measure national income?

(A) Production method

(B) Income method

(C) Sales method

(D) Expenditure method

Answer:

(C) Sales method

![]()

Question 7.

What should be deducted from GDP to get NDP?

(A) Depreciation

(B) Net factor income from abroad

(C) Indirect tax

(D) Subsidy

Answer:

(A) Depreciation

2. Answer the following questions in one sentence :

Question 1.

What is national income?

Answer:

The monetary value of the total production done in agriculture, industries and service sector in a country during a year is called the national income of that country.

Question 2.

What is called closed economy?

Answer:

The economy in which there is no role of foreign trade and which does not conduct economic transactions with other countries is called closed economy.

Question 3.

Give formula of Per Capita Income.

Answer:

The division of gross national income with total population of that nation is called the per capita income.

Per Capita Incoime = \(\frac{\text { Gross National Income }}{\text { Total Population }}\)

Question 4.

Give the meaning of Net Domestic Product.

Answer:

During the process of production within a given year, when the depreciation of domestic or foreign factor of production is . deducted from gross domestic product, we get net domestic product i.e. NDP.

∴ NDP = GDP – Depreciation

Question 5.

What are transfer payments?

Answer:

Payments made or income received in which no goods or services are being paid for such as subsidy, taxes, etc. are called transfer payments.

Question 6.

Whether the purchase of old building can be considered in national income or not? Why?

Answer:

Selling old building means it is a resale. This means the good was produced in the past and hence it must have been included in the national income. Again considering it in national income will lead to double counting. Hence, it will not be considered.

Question 7.

Why the service of a house wife is not included in National Income?

Answer:

Household work done by housewives is not sold in the market. Hence, its monetary value cannot be measured and so is not considered while calculating national income.

Question 8.

What is imputed rent?

Answer:

Those who live in their own house do not need to pay rent. This benefit of rent that they get is a part of their income and is called imputed rent.

Question 9.

Name the institution which measures national income in India.

Answer:

Central statistical Organization (CSO)

![]()

Question 10.

At which price monetary national income is measured?

Answer:

At current prices

Question 11.

‘Per capita income is not the income of every citizen of the country.’ How?

Answer:

Per capita income is obtained by a simple division of gross national income with total population. These results in average income a person earns. Thus, some person must be earning high and low. Hence, ……….

3. Answer the following questions in short :

Question 1.

Give definition of national income as given by Marshall or Fisher.

Answer:

1. Alfred Marshall’s definition (Production based definition):

- The net production of physical (tangible) and non-physical (service) things by using natural wealth (land) with capital and labour in a country during the year is called the national income of the country.

- Prof. Marshall lays stress on net production of goods and services in the definition and so this definition is based on production.

2. Irving Fisher (Consumption based definition):

- The proportion of direct consumption of goods and services by the people of a country during a year is called the national income.

- Fisher lays stress on consumption of physical and non-physical goods and services in this definition. Hence, his definition is based on consumption.

Question 2.

According to Prof. Pigou, what is called national income?

Answer:

A.C. Pigou (Money based definition):

- The flow of those things (goods) and services whose payments have been done through money or which can be easily presented by money is called national income. In other words, the total income of society along with foreign income which can be easily measured with the help of money is called its national income.

- Pigou lays stress on money and so his definition is based on money.

Question 3.

Which expenditures are not included in the expenditure method of National Income?

Answer:

Expenditure not considered in national income:

- Expenditure done on purchasing second-hand goods, transfer expenditure (transfer payment), pension, unemployment allowances, financial assistance to widows, etc.

- The expenditure on purchase of old shares and expenditure on use of goods of interim use are not considered in national income.

- Some expenditure is incurred even when the production of goods and services is not done. This expenditure involves only transfer of monetary expenditure and so is not considered. For example, subsidies.

Question 4.

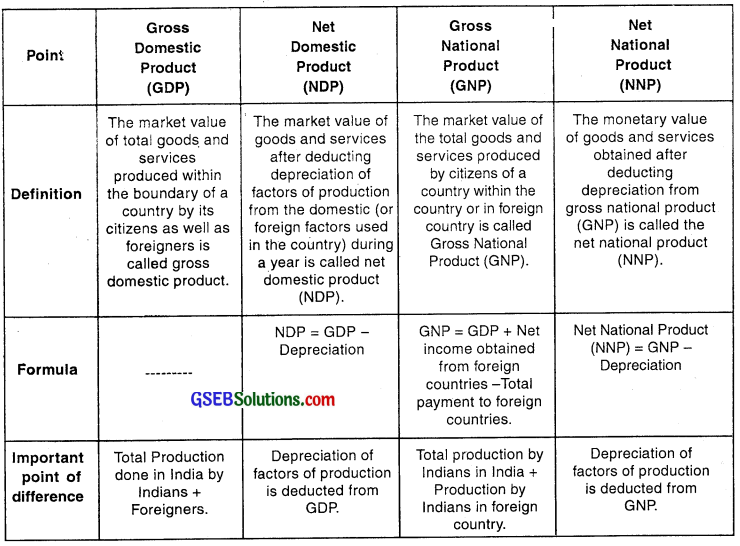

Show the Difference between :

(a) GDP and NDP

Answer:

table-1

(b) GNP and NNP

Answer:

table-2

(c) GDP and GNP

Answer:

table-3

(d) Closed economy and open economy

Answer:

table-4

4. Answer the following questions in brief points :

Question 1.

Explain in brief the problems arising in measuring National Income.

Answer:

- The Central Statistical Organization (CSO) calculates the national income of India since 1954.

- The CSO takes 1999-2000 as base year and then calculates national income .at constant prices.

Problems faced by CSO during measurement are:

- Problems of double accounting

- Problems of self-consumption

- Problems of depreciation

- Tax avoidance and tax evasions

- Illegal income

- Problems of net foreign income

- Problems in accounting

Following problems arise in accounting:

(A) Illiteracy

(B) Small scale production-sale

(C) Barter system

(D) People involved in more than one occupation

The CSO tackles all these problems well and tries to obtain national income by counting the income carefully.

Question 2.

Explain the concept of monetary income and real income.

Answer:

(A) Monetary national income:

Monetary national income is the money value of final goods and services produced by residents of a country in a year, measured at the prices of the current year.

Explanation:

When we multiply the production of all goods with the market price of respective goods what we get is called monetary national income. However, this monetary national income is not true income.

Reason:

- Suppose in the previous year, the production was ‘a’ and prices were ‘b’. National income of previous year = (production ‘a’) × (price ‘b’) = ab

- Now, suppose that the production in current year is equal to the production in the previous year but the prices have doubled in the current year. So, the prices in the current year become ‘2b’.

National income of current year = (production ‘a’) × (price ‘2b’) = 2ab - In this case the national income of current year will be double than that of the previous year which is actually not true because there is no change in production in the current year.

Drawback:

- Although the national income has increased, it has increased because the prices have increased and not because production has increased.

- This means that people have been consuming same amount of quantity current year as they used to in the previous year. So, we can say that consumption of product has not increased among people and so the overall standard of living has not improved.

- Hence, a country should focus not just focus on monetary national income.

(B) Real national income:

The calculation of national income at base-year price or fixed price is called real national income.

- Real national income is obtained by multiplying the production of all goods with the fixed price of respective goods during the year.

- Since, the real national income considers the price of the base-year, any rise in national income means that some rise has occurred due to the rise in production and some due to market price (current price). Hence, real national income shows the true situation of a country.

Advantage:

If national income increases due to increase in production it means that people consume more products or more people consume the products. In either case, since the production has increased the consumption and standard of living of people have become higher. Hence, real national income is a better measure of national income as compared to monetary income.

Question 3.

Give the meaning of Per Capita Income and show its importance.

Answer:

Per capita income (PCI):

The division of gross national income with total population of that nation is called the per capita income.

Gross National Income Per capita income = \(\frac{\text { Gross National Income }}{\text { Total Population }}\)

Importance:

- If population grows faster compared to national income the per capita income decreases.

- The per capita income is an average measurement.

- Per capita income docs not change with change in the distribution of national income.

- Per capita income is not a true criterion of individual income.

- The true criterion of country’s progress is not the national income but per capita income.

- UNO also uses figures of per capita income along with the figures of national income while comparing the progress of two countries.

- The comparison of two countries can be done by comparing their per capita incomes.

- Per capita income helps to assume the standard of living of citizens of that country.

![]()

Question 4.

Write short notes on :

(a) Gross Domestic Product

Answer:

Gross Domestic Product (GDP):

The market value of total goods and services produced within the boundary of a country by its citizens as well as foreigners is called gross domestic product (GDP).

Important points:

- In gross domestic product, the final products or goods produced within • the country’s limit/boundary by natives and foreign citizens or by nature such as (crude oil) are considered.

- The concept of gross domestic product is related to the boundary of a country. This means production done by citizens of a country residing in a foreign country or the incomes generated by citizens of a country from foreign countries is not considered.

- The figures of GDP are used to compare economies of different countries and hence study their progress.

(b) Net Domestic Product

Answer:

Net Domestic Product (NDP):

- When factors of production such as machines, building, equipment, etc. are used for producing goods and services, they undergo wear and tear and their value decreases. This is called capital depreciation.

- After sometimes, these factors of production become useless and they need to be replaced. Capital is needed to repair these factors of production or replace them in case they become obsolete with the arrival of new technology.

- Thus, during the process of production within a given year, when the depreciation of domestic or foreign factor of production is deducted from gross domestic product, we get net domestic product i.e. NDP.

- After deducting depreciation of factor of production from the domestic (or foreign factors used in the country) during a year is called net domestic product (NDP).

∴ NDP = GDP – Depreciation

(c) Gross National Product

Answer:

Gross National Product (GNP):

- The market value of the total goods and services produced, by citizens of a country, within the country or in foreign country is called Gross National Product (GNP).

- The major difference between GDP and GNP is that in GDP production done within the boundary of the country is considered irrespective whether it is done by Indians or foreigners in India. However, in GNP production done by citizens done in a country or in a foreign country is considered.

Important points:

- GNP considers the value of production done only in current year and not that of previous year.

- GNP = GDP + Net income obtained from foreign countries -Total payment to foreign countries.

- Since GNP gives a true picture of the national income over GDP, it is used widely in practice.

(d) Net National Product

Answer:

Net National Product (NNP):

- When factors of production such as machines, building, equipment, etc. are used for producing goods and services, they undergo wear and tear and their value decreases. This is called capital depreciation.

- The monetary value of goods and services obtained after deducting depreciation from gross national product (GNP) is called the net national product (NNP).

∴ Net National Product (NNP) = GNP – Depreciation - While calculating NNP, the value of production of current year is only considered.

A brief overview and comparison of GDP, NDP, GNP and NNP. (For memorizing easily)

5. Answer the following questions in detail :

Question 1.

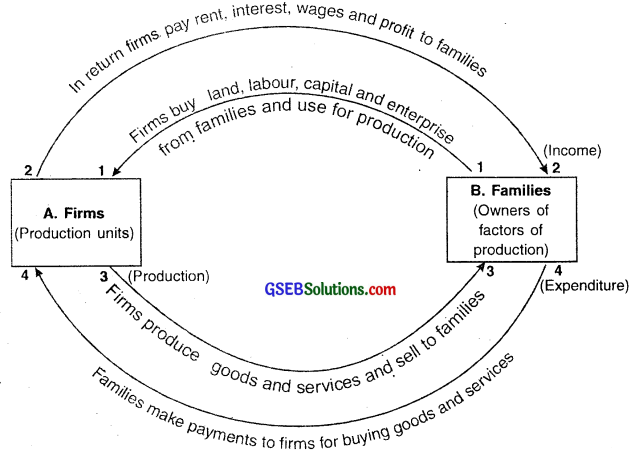

Explain with diagram the circular flow of national income in a closed economy.

Answer:

Circular flow of national income in closed economy:

Assumptions:

- The closed economy is the one in which there is no role of foreign trade.

- Such economy does not undergo economic transactions with other countries.

- Neither any goods, services and factors of production are exported from such country nor any goods, services and factor of production are imported in such.country. Thus, closed economy is self-dependent or self-reliant.

Circular flow:

- Production, income and expenditure are three important pillars of an economy. Hence, national income of an economy can be measured by these three components namely

- Production,

- Income and

- Expenditure.

- In a closed economy, these three components keep on circulating and form a circular flow of national income.

- To understand the circular flow of ‘Production-Income-Expenditure’, we divide economy into two major sectors (fields) namely,

(A) The business firms (Production units) and (B) Families.

(Note: As per accounting terms, firms and individuals are two separate entities and hence even though entrepreneur runs the production units they are considered separate from the firms. Hence, entrepreneur as a factor of production comes from families.)

Circular flow of production, income and expenditure in closed economy

1. First, the business firms purchase necessary factors of production namely land, labour, capital and enterprise (from entrepreneurs) from families or households and use them for production. This way the factors of production reach to firms through families.

2. Income component: For using these factors of production the firm pays rent, interest, wages and profit to the owner of factor of production or the families. Thus the flow of money first goes to the families from the firms.

3. Production component: The firm then produces goods and services with the help of these factors and puts them in market for sale. The families purchase these goods and services from market. Thus the flow of goods and services comes to families from firms.

4. Expenditure component: Families pay money to firms for purchasing goods and services and so the flow of money comes back to firms from families. Here, one cycle gets over.

The firm again purchases factors of production with the help of this money, does the production and again pays to families and the circular flow of production-income-expenditure goes on. The national income is then calculated based on the total circular flow of Rent, Wages, Interest and Profit in the economy in a given period of time.

Question 2.

Explain the output method for measuring national income.

Answer:

Production (output) method:

- The sum of monetary value of finished goods and services produced in agriculture, industries and service sector in a country is called the national income of that country.

- Thus, National income – (Production in agriculture + Production in industries + Production in service sector) × Market value

- This method of calculating national income has been developed from the definition given by Prof. Marshall.

Classification of economy in different sectors:

To obtain the national income the economy is classified into various sectors like agriculture, industries, services, mines, construction, manufacturing, trade-commerce, transportation, communication, banking, education, etc.

Types of incomes and their role while calculating national income:

(I) Incomes that are considered:

1. Selection of goods or services:

Value of only finished goods and services produced in the economy is considered i.e. value of goods and services still in the process of production are not calculated.

2. Imputed rent:

- Those who live in their own house do not need to pay rent. This benefit of rent that they get is a part of their income and is called imputed rent.

- Here we assume that if the house is given to someone on rent it can earn rental income and so that value is considered in national income.

3. Export:

Value of total export is added.

(II) Incomes that are not considered:

1. Service of housewives:

Household work done by housewives is not sold in the market. Hence, its monetary value cannot be measured and so is not considered while calculating national income.

2. Self-consumption:

- Goods produced for seif-consumption are not sold in market so their monetary value cannot be measured. Hence, such goods are not considered in national income.

- However, as an exception the food-grain produced by Indian farmers for self-consumption is considered in national income.

3. Defence (Police):

There are no markets for goods produced for defence and police services except using them in defence/police. Hence, these goods are not considered in calculation of national income.

4. Double counting:

Double counting means counting the value of the same product (or expenditure) twice i.e. more than once.

- According to production method while calculating national income, the value of only final products and not the interim products or products and services in process.

- This is incorrect and so double counting should be removed from national income accounting because it over-values national income.

There are two ways to avoid double counting. They are:

(a) To count the value of finished goods only.

(b) Value Added Method.

5. Resale:

- If a good was produced in the past its value was counted in the national product at that time. When it is resold its value is not counted. If it is counted, it will be double counting.

- For example, if a house purchased in year 2000 is resold today this resale is not considered in national product.

6. Smuggled/lllegal goods:

The value of smuggled or illegal goods is not considered in calculation.

(III) Incomes or items that are deducted:

1. Depreciation:

During the process of production the depreciation related to capital factor is deducted from the national product.

2. Indirect tax and subsidy:

- While deriving the market value of a good, the indirect taxes of the government levied on the goods are added.

- Hence, while finding out national product, the indirect taxes are deducted whereas the subsidy given by government is added.

![]()

Question 3.

Define double counting and discuss remedies to remove double counting.

Answer:

Double counting:

- Double counting means counting the value of the same product (or expenditure) twice i.e. more than once.

- According to production method while calculating national income, the value of only final products and services should be considered.

- For example, for an iron manufacturer, iron is a final product and for a machine manufacturer the machine which also consists of iron is a final product. In this sense, the value of iron gets double counted.

- This is incorrect and so double counting should be removed from national income accounting.

- When the value of a commodity is calculated for more than one time in national income it gives an over-valued national income.

There are two ways to avoid double counting. They are:

(A) To count the value of finished goods only:

- In this method, instead of counting the value of goods that are half-made or in interim use, the monetary value of the final good the value of raw material used in it is separately valued.

- For example, if the value of machine which is a finished good and the value of iron involved in it are considered separately, the problem of double counting can be solved.

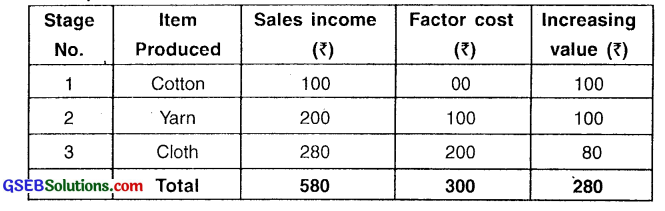

(B) Value Added Method:

- In production process, when a production of goods goes from one stage to another stage, its monetary value increases.

- If this increase in value can be measured out and added in national product, the problem of double counting can be resolved.

Example:

- As shown in the table, in the first stage the factory buys cotton of ₹ 100. It then converts it into yarn of ? 200 in the second stage. Finally, in the third stage from the yarn, it makes cloth of ₹ 280.

- Thus, when the .monetary value is counted as ₹ 100 + ₹ 200 + ₹ 280 = ₹ 580 in national product, then double counting takes place.

- In the monetary value of ₹ 580, the value of cotton is included in both yarn and cloth, and therefore the value of cotton is considered and counted for 3 times. This is double counting,

- However, if the value of cotton of ₹ 100 + yarn of ₹ 100 + cloth of ₹ 80 is counted or value addition of ₹ 280 is considered the double counting does not occur.

- The above stated example shows that factor cost for producing cotton is zero because it is assumed that the production of cotton is of the previous year which has been considered in the national product of-the previous year.

Question 4.

Explain the income method for measuring national income.

Answer:

Income method:

- The summation of the income earned by the citizens of a country and the state is called the national income of that country obtained as per the income method.

- To calculate the national income through this method, the rent, interest, wages and profits obtained from the four factors of production namely land, capital, labour, and entrepreneur are added together.

- Moreover, the income obtained from foreign countries is added and the payment done in the form of rent, interest, wages and profits for foreign factors used in the country is deducted.

- This method of measuring national income has been developed from the definition given by Prof. Pjgou.

Types of incomes and their role while calculating national income:

(I) Incomes that are considered:

1. Income earned from factors of production:

(A) Income of rent:

- The rent obtained on land/building.

- Those who live in their own house do not need to pay rent. This benefit of rent that they get is a part of their income and is called imputed rent. ‘ It is considered in national income.

- The income obtained through various rights such as copy right of a book, patent, etc.

(B) Income of interest:

- The interest obtained by people on their capital during a year.

- The interest obtained from the government is not considered as income. The reason for this is that a state generates income through taxes and pays it as interest which means that the money is simply transferred.

(C) Income of wages:

The wage or salary given to labourers for their work during a year.

(D) Income of profit:

The income obtained in the form of profit or dividend by investor/. It includes reserved profit and taxes paid on it.

2. Other incomes:

(A) Net foreign income i.e. income through export-import.

(B) Income generated as commission or brokerage on sale of consumable goods.

(C) Incomes which show flow of production of goods or services in the economy and which increase the monetary value of goods of the economy.

(II) Incomes that are not considered:

- Income generated from gifts, rewards, prizes, tips, thefts, unemployment allowances, government assistance to elders, lotteries, etc.

- The income of the second hand goods is not considered. For example, the income obtained by selling old mobile phones.

(III) Incomes that are deducted:

Subsidy given by the government is deducted from the national income.

Question 5.

Describe the expenditure method for measuring national income.

Answer:

Expenditure method:

- All domestically produced goods and services are produced for final use either by consumers for consumption or by producers for investment. Individuals incur expenditure (i.e. need to spend money) for using these gpods and services. The total expenditure in a given year is called the GDP i.e. Gross Domestic Product.

- The method of considering the total expenditure incurred in purchasing finished goods or services during a financial year is called the expenditure method of measuring national income.

- This method has been developed from the definition given by Prof. Fisher.

- In this method, the national inosiepe is measured by summing up the total monetary expenditure incurred on goods and services by individuals, families, firms and government during a year.

- Thus, National Income = Consumption expenditure + Investment expenditure + Government expenditure + Net export expenditure.

The following things are considered while counting national income in terms of Expenditure method:

1. Four factors of monetary expenditure:

The various components of final expenditure considered in national income can be divided into four parts. They are:

(A) Consumption expenditure:

- The expenditure incurred by citizens, families and firms on consumable goods is called consumption expenditure.

- It includes expenditure done on durable goods like TV, scooter, car, etc., perishable goods like food grains, fruits, vegetables, services like education, medical treatment, transportation and communication, etc.

(B) Investment expenditure:

It is the expenditure incurred on building a factory, plant, machinery and necessary goods, equipment for running a business or profession, etc.

(C) Government expenditure:

- It refers to the expenditure incurred by government on various administrative services like defence, law and order, education, etc.

- Consumption expenditure, investment expenditure, administrative expenditure, etc. are different types of expenditures done by central government, state government and local bodies.

(D) Net export expenditure i.e. Export minus Import:

- It refers to the difference between exports and.imports of a country during a period of one year.

- The expenditure done on importing foreign goods by citizens of country is the expenditure of the country. Similarly, our export is expenditure incurred by foreign citizens on domestic goods.

- Therefore, the difference between these two is the net export which is included in the national income.

2. Expenditure not considered in national income:

- Expenditure done on purchasing second-hand goods, transfer expenditure (transfer payment), pension, unemployment allowances, financial assistance to widows, etc.

- The expenditure on purchase of old shares and expenditure on use of goods of interim use are not considered in national income.

- Some expenditure is incurred even when the production of goods and services is not done. This expenditure involves only transfer of monetary expenditure and so is not considered. For example, subsidies.

3. Difficulty in calculating national income through expenditure:

The official data of people’s expenditure cannot be obtained correctly and therefore it becomes difficult to calculate national income by this method.

Example:

- Suppose a business person named Arav gives ₹ 30,000 as salary to Milap, who works as his accountant and considers ₹ 30,000 as the expenditure incurred.

- Now Milap gives ₹ 3000 to Khushbu who is his domestic helper. This becomes Milap’s expenditure. Now, the question that arises is ‘What is the actual expenditure? ₹ 30,000 or ₹ 30,000 + ₹ 3000 = ₹ 33,000?

- So, even in this method the problem of double counting arises in calculating national income.