Gujarat Board GSEB Textbook Solutions Class 11 Commerce Accounts Part 2 Chapter 10 Accounts from Incomplete Records Textbook Exercise Questions and Answers.

Gujarat Board Textbook Solutions Class 11 Accounts Part 2 Chapter 10 Accounts from Incomplete Records

GSEB Class 11 Accounts Accounts from Incomplete Records Text Book Questions and Answers

Question 1.

Write the correct option from those given below each question :

1. Normally who uses single entry accounting methods ?

(a) Businessmen

(b) Small retailers

(c) Public companies

(d) Government companies

Answer:

(b) Small retailers

2. Which statement is to be prepared to find out opening capital in single entry system ?

(a) Trading account

(b) Statement of affairs

(c) Statement of profit-loss

(d) Statement of stock

Answer:

(b) Statement of affairs

![]()

3. Under Single Entry System, …………………. .

(a) only one effect for all transactions.

(b) two effect (entry) for all transactions.

(c) no effect for any transaction.

(d) only one effect for some transactions and two effects of remaining transactions.

Answer:

(d) only one effect for some transactions and two effects of remaining transactions.

4. What should be prepared to find capital in capital comparision method ?

(a) Statement of profit-loss

(b) Statement of affairs

(c) Statement of goods for business

(d) Balance sheet

Answer:

(b) Statement of affairs

5. Single entery system is also called ………………… .

(a) Accounts from complete records

(b) Accounts from incomplete records

(c) Double entry accounting system

(d) Independent accounting system

Answer:

(b) Accounts from incomplete records

Question 2.

Answer the following questions in one or two sentences :

(1) What is Single Entry System ?

Answer:

As a rule, the system of recording transactions relating to cash and personal accounts only is called Single Entry System.

(2) How does single entry system differ from double entry system?

Answer:

Single entry system differs from double entry system in the following manner :

| Single entry system | Double entry system |

| 1. Every transaction does not have two effects. | Every transaction has two effects. |

| 2. Only personal accounts are maintained in the ledger. | All accounts are maintained in the ledger. |

| 3. Trial balance and Balance sheet cannot be prepared. | Trial balance and Balance sheet can be prepared. |

(3) What is Statement of Affairs ?

Answer:

This statement is like a Balance sheet, on left side liabilities and payables are shown and assets and receivables are shown on the right side.

![]()

(4) Which capitals are compared in capital comparision method?

Answer:

Closing capital is compared with opening capital in capital comparision method.

(5) Which items are added or which items are deducted from closing capital in statement showing profit or loss ?

Answer:

Cash withdrawn, goods withdrawn and personal expenses paid from the business are added in closing capital while opening capital and additional capital are deducted from closing capital in statement showing profit or loss.

Question 3.

Answer the following questions in detail :

(1) What is Single Entry System ? Give the characteristics of Single Entry System.

Answer:

Meaning: Small traders like hawkers, sole traders, small shopkeepers do not want to maintain all books of accounts. As per requirement, they keep only cashbook and ledger and record transactions relating to cash and personal accounts only. In this system double effect may not be given to each transaction of business. As per requirement, only one effect is given to some transactions, hence it is known as Single Entry System.

* Definitions: According to Eric Kohler, “single entry system is, a system of book-keeping in which as a rule only record of cash and of personal accounts are maintained, it is always incomplete double entry, varying with circumstance.”

According to R. N. Carter, “Single entry system is a method or a variety of methods, employed for the recording of transactions, which ignore the two-fold aspects and consequently fails to provide the businessman with the information necessary for him to be able to ascertain the financial position.”

Explanation: Single entry system is an incomplete method of accounting. Under this system, some transactions may have two effects, while some have one effect only, e.g., (l)Cash received from customer (debtor). In this transactions, two effects are given, one effect is in cashbook and second effect is in customer’s A/c. (2) Purchased furniture by cash. In this transaction, only payment of cash effect is given in cashbook, while second effect is not given in furniture A/c, because of this system Real accounts and Nominal accounts are not maintained.

* For Extra Knowledge.

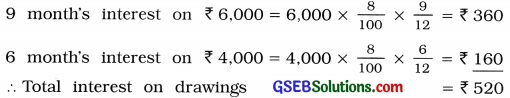

Characteristics of Single Entry System:

1. Incomplete records: As a rule, only cash transactions and personal accounts transactions are recorded. It is an incomplete method of accounting.

2. Mixture of Single Entry and Double Entry System: Most of the transactions are recorded with one effect whereas others are recorded with double effect and several transactions are not recorded.

3. Books as per requirement: Small traders keep a few books of accounts like cashbook and ledger as per their requirement.

4. Only personal accounts : Only personal accounts are maintained in the ledger.

5. Small retailers : Generally small traders like hawkers, small shopkeepers, street-venders, small retailers, etc. prepare accounts under this system.

6. Records : Complete accounting records are not maintained.

7. Uniformity : There is no uniformity in this systems for keeping books of accounts by traders.

8. Annual accounts : Trial balance and Balance sheet can’t be prepared under this system.

9. Entry for internal transactions: In this method, there is no effect (or entry) for internal transactions of business, e.g., Depreciation on assets, Interest on capital, etc.

![]()

(2) Describe the uses (advantages) of single entry system.

Answer:

The advantages of single entry system are as under :

- Limited object: This method is very useful for small traders like hawkers, small retailers or street-venders because their utility to prepare the accounts is limited.

- Time and Expense : In this method, books of account are prepared by small traders with less expense and less time, because all accounts are not prepared.

- Limited books : Small traders keep the books as per their business requirement. Normally they prepare only personal accounts. So, it requires limited books.

(3) Discuss the limitations of Single entry system in detail.

Answer:

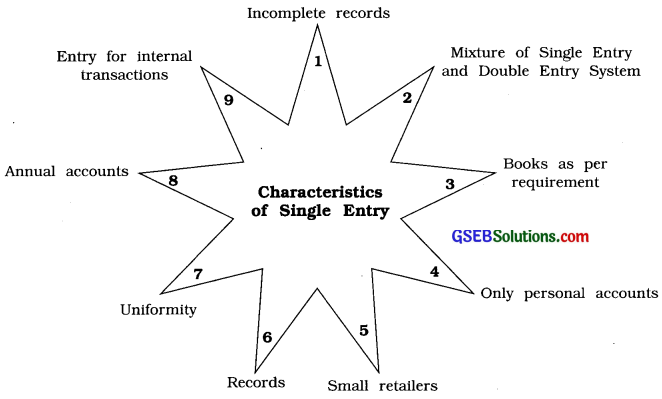

The limitations of single entry system are as under :

1. Importance only to personal accounts : In this system, importance are given only to personal accounts. Impersonal accounts are not opened in the ledger. So, it is not possible to get information of all accounts.

2. Trial balance can’t be prepared: As dual effect of all transactions are not recorded, trial balance can’t be prepared. Hence, it is not possible to check the arithmetical accuracy of the accounts.

3. Profit or Loss can’t be ascertained: As nominal accounts are not prepared, it is not possible to know the profit or loss at the end of the year.

4. Financial position can’t be obtained : In this method as assets accounts are not kept and trial balance is also not prepared. Hence, it is not possible to prepare final accounts, therefore it is also not possible to know the true and fair financial position of the business.

5. Statistical information can’t be obtained: As two fold effects of all transactions are not recorded, it is not possible to obtain statistical information.

6. Errors of rectifications are not easy: Errors can be detected and prevented easily in the double entry system, but it is not so far easy in this system.

7. Possibilities of frauds: In this system, it is not possible to check the arithmetical accuracy of the accounts, hence there are more possibilities of errors, manipulation in accounts, frauds, etc.

8. Comparison is not possible: Due to insufficient record of information, comparison of accounts with previous years are not possible in this system.

9. Difficulties : Due to inadequate information, difficulties arise in taking decisions in determining purchase price, taking a loan or insurance, etc.

![]()

(4) Explain the difference between Single Entry System and Double Entry System.

Answer:

| Difference | Single Entry System | Double Entry System |

| 1. Meaning | A system of accounting that records one aspect or effect of each transaction either a debit or a credit, is called Single Entry System of book-keeping. | A system of accounting that records dual aspects or effects of every business transaction is called Double Entry System of book-keeping. |

| 2. Effect of transaction | Every transaction does not have two effects. | Every transaction has twc effects. |

| 3. Ledger accounts | Only personal accounts and cash accounts are opened in the ledger. | All types of accounts are maintained/ opened in the ledger. |

| 4. Trial balance | Trial balance cannot be prepared. | At the end of the year, trial balance can be prepared. |

| 5. Profit or Loss | True profit or loss cannot be known. Only an estimate of profit or loss can be arrived at. | By preparing profit and loss account correct profit or loss can be ascertained. |

| 6. Financial position | Balance sheet cannot be prepared for knowing the financial position of the business. | Balnace sheet can be prepared for knowing the financial position of the business. |

| 7. Adjustments | In this system, adjustments are not considered. | In this system, adjustments are considered. |

| 8. Suitability | It is suitable and convenient to small traders. | It is more suitable and convenient for all types of business organisations /traders. |

| 9. Manipulation | It is difficult to detect fraud or manipulation in this system. | In this system, frauds or manipulation can be detected and prevented. |

| 10. Information | As this system is incomplete, necessary information is not available. | This system being complete, necessary information is available. |

| 11. Authenticity | This system is not considered as authentic by the court, government and tax authority. | This system is accepted as authentic by the court, government and tax authority. |

| 12. Reliability | This system is not reliable because it is incomplete. So it is not valid for taking loan, insurance and for tax purposes by government authorities. | This system is reliable because it is complete. So it is valid for taking loan, insurance and for tax purposes by government authorities. |

| 13. Errors | In this system errors cannot be detected easily. | Errors can be detected and prevented easily. |

| 14. Decision making | Due to insufficient record of information, important decisions cannot be made. | Due to sufficient record of information, important decisions can be made. |

| 15. Rules | Under this system, while recording the business transactions in the books of accounts no specific set of rules are followed. | Under this system, while recording the business transactions in the books of accounts, rules of double entry system are strictly followed. |

| 16. Cost | This system is less costly. | This system is comparatively more costly and expensive. |

| 17. Control | As system is incomplete, it is not possible to keep control over activities of business. | As system is complete, it is possible to keep control over various activities of the business. |

![]()

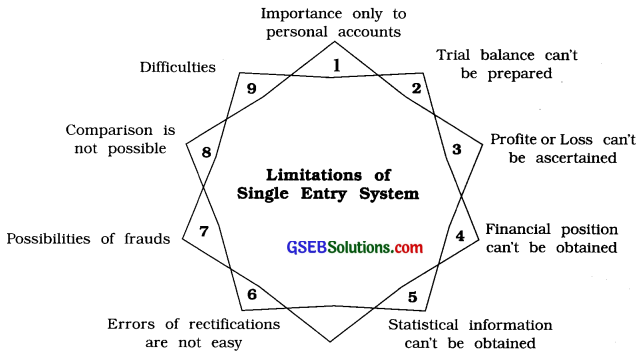

(5) What is Statement of Affairs ? Give specimen to explain.

Answer:

Meaning: A statement showing the estimated balances of various assets and liabilities of a business on a particular date is called ‘Statement of Affairs.’

Explanation : Under this system capital of the proprietor is ascertained by preparing statement of affairs. This statement is like a Balance sheet, on left side liabilities are shown and assets and receivables are shown on the right side.

The difference between total of assets side and the total of liabilities side is known as capital.

In other words, capital is calculated by using the following accounting equation :

Capital = Total amount of Assets – Total amount of Liabilities.

Objective : Under this system profit earned or loss sustained in the business in any accounting year can be ascertained by comparing capital at the end of the accounting year with the capital at the beginning of the same accounting year. In single entry system capital account is not maintained. Hence, to find out opening and closing capital of the business on a particular date, statement of affairs is prepared.

Specimen: The specimen of statement of affairs is as under :

Forming : Statement of Affairs is like a Balance sheet, on left side liabilities other than capital are shown and Assets and Receivables are shown on the right side. After having deduction of all liabilities (excluding capital) from the total of assets side, the arised difference is known as capital.

By showing opening balances of assets, receivables and liabilities in opening statement of affairs, the arised difference is known as opening capital. Similarly by showing closing balances of assets, receivables and liabilities in closing statement of affairs, the arised difference is known as closing capital.

Here amount of assets, receivables and liabilities can be ascertained from accounts maintained and if the accounts are not maintained, then their valuation can be considered.

Summary: Statement of affairs is prepared by balances and estimated values from incomplete records. From this statement, true and fair view of economical condition of a business cannot be found.

![]()

(6) Explain the difference between Statement of Affairs and Balance Sheet.

Answer:

| Difference | Statement of Affairs | Balance Sheet |

| 1. Meaning | A statement showing the estimated values of assets and liabilities as on a particular date is known as Statement of Affairs. | A statement showing the financial position of the business in the form of its assets and liabilities at their correct values as on a particular date is called Balance Sheet. |

| 2. Accounting system | Statement of Affairs is prepared under the single entry system of accounting. | Balance sheet is prepared under the double entry system of accounting. |

| 3. Trial balance | Trial balance is not prepared before preparing this statement. | Trial balance is prepared before preparing a Balance sheet. |

| 4. Objective | It is prepared to find out capital as well as profit or loss of the business on a particular date. | It is prepared to ascertain the financial position of the business on a particular date. |

| 5. Reliability | As it is prepared on the basis of incomplete records and informations, the amounts and informations shown in this statement are not fully reliable. | As it is prepared on the basis of actual balances, the amounts and informations shown in Balance sheet are fully reliable. |

| 6. Adjustments | For preparing this statement additional information or adjustments are not considered. | For preparing Balance sheet necessary adjustments are considered. |

| 7. Informations | In this statement, the information about the financial position of business may not be complete. | In this statement, the information about the financial position of business are complete. |

| 8. Comparison | By this statement comparison with previous year or with firms with similar business nature is not possible due to the absence of uniform base. | By this statement comparison can be made with previous year or firms with business of similar nature. |

| 9. Financial position | Financial position of the unit can’t be judged with the help of this statement. | With the help of Balance sheet, financial position of the unit can be judged. |

| 10. Omission | Omission of any asset or liability cannot be detected easily. | Omission of any asset or liability can be easily detected. |

| 11. Arithmetical accuracy | Arithmetical accuracy can’t be scrutinised/ verified as trial balance is not prepared. | As the trial balance is prepared, arithmetical accuracy can be scrutinised/ verified. |

![]()

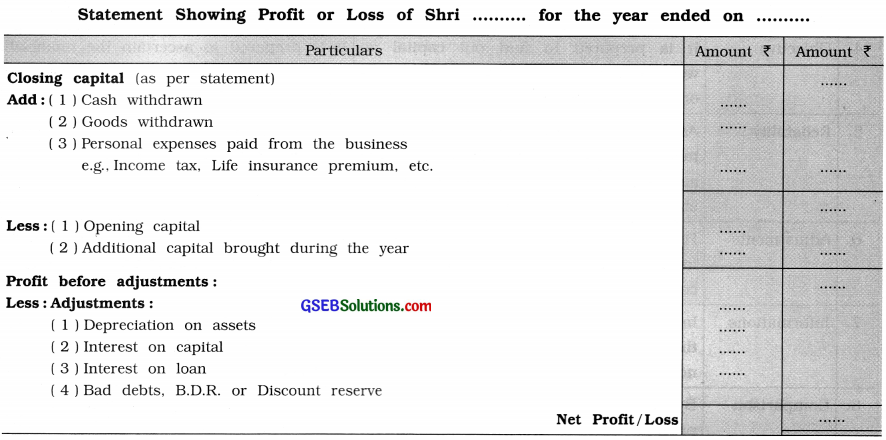

(7) Discuss in detail how to determine profit or loss in capital comparision method.

Answer:

Method of capital comparison is used to find out the profit or loss amount in the Single entry system. In this method, opening capital and closing capital are compared, therefore it is known as comparison of capital method.

Steps : Following steps are to be followed for ascertainment of profit or loss and also for the preparation of Balance Sheet by capita comparison method :

- First of all prepare opening statement of affairs to find out opening capital.

- Prepare closing statement of affairs to find out closing capital.

- Prepare statement showing profit or loss as per specimen given as under to find out net profit or loss with adjustments.

- At the end, prepare Balance sheet after considering the adjustments.

The specimen statement given as under can be used to find out profit or loss :

→ Single entry system is an incomplete method of accounting. Therefore, sufficient information cannot be obtained from this method. Nominal account are not maintained. Therefore Profit and Loss A/c cannot be prepared. So opening capital and closing capital are compared to find out the profit and loss.

→ If closing capital is more than opening capital, the difference is treated as profit.

∴ Profit = Closing capital – Opening capital

→ If closing capital is less than opening capital, the difference is treated as loss.

∴ Loss = Opening capital – Closing capital

→ In this method, total amount withdrawn during the year is to be added in the closing capital and amount of additional capital is to be subtracted from the closing capital. Afterwards both capital balances are compared to find out profit or loss.

Note: If result is positive, it is considered as profit and if result is negative, it is treated as loss.

![]()

Question 4.

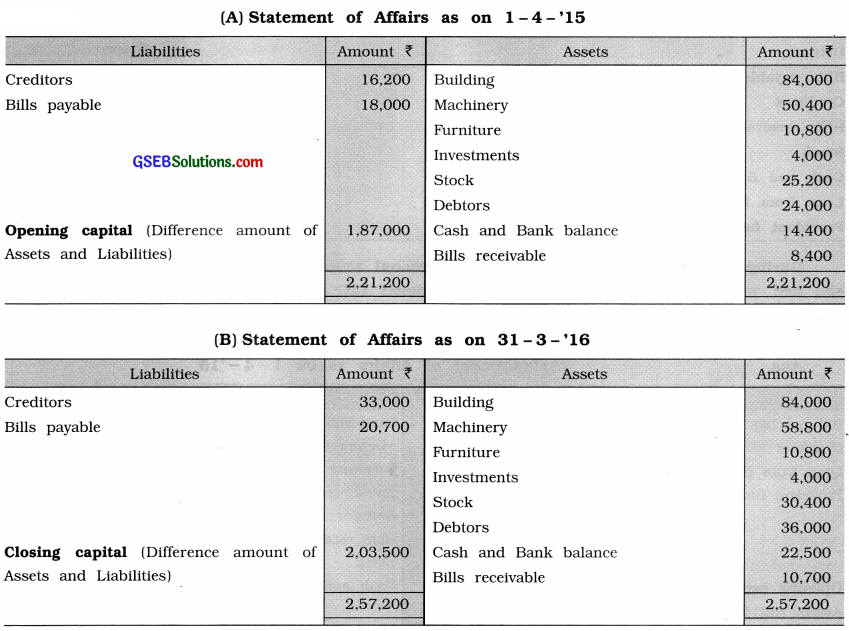

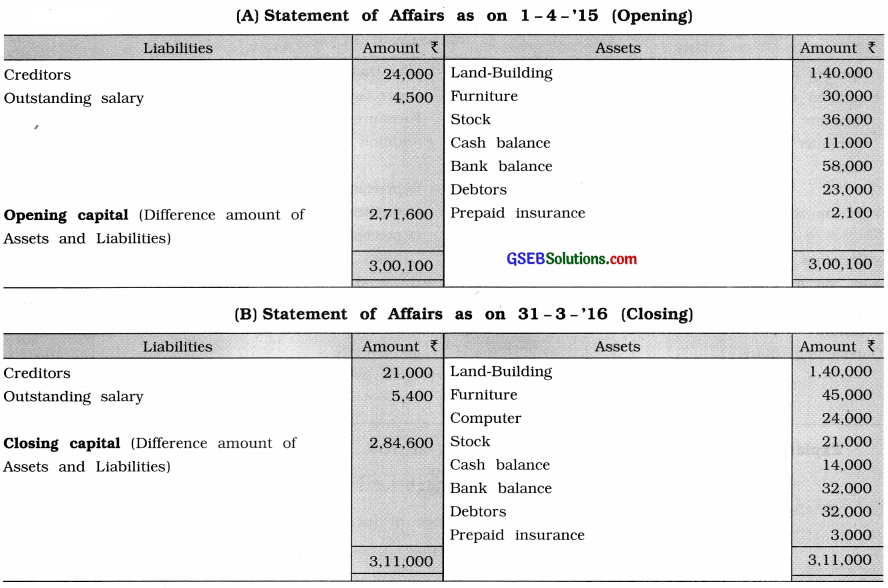

Smt. Maltiben keeps her books of account as per single entry system. Her assets and liabilities as on 1 – 4 – ’15 and 31 – 3 – ’16 are as under :

| Particulars | 1 – 4 – ’15 Amount ₹ | 31 – 3 -’16 Amount ₹ |

| Building | 84,000 | 84,000 |

| Machinery | 50,400 | 58,800 |

| Furniture | 10,800 | 10,800 |

| Investments | 4,000 | 4,000 |

| Stock | 25,200 | 30,400 |

| Debtors | 24,000 | 36,000 |

| Creditors | 16,200 | 33,000 |

| Cash and Bank balance | 14,400 | 22,500 |

| Bills payable | 18,000 | 20,700 |

| Bills receivable | 8,400 | 10,700 |

During the year her cash withdrawal was ₹ 13,200 and goods withdrawal was ₹ 4,200. She had brought ₹ 12,000 as additional capital in the business.

Prepare a statement showing profit or loss for the year ended 31 – 3 – ’16.

Answer:

![]()

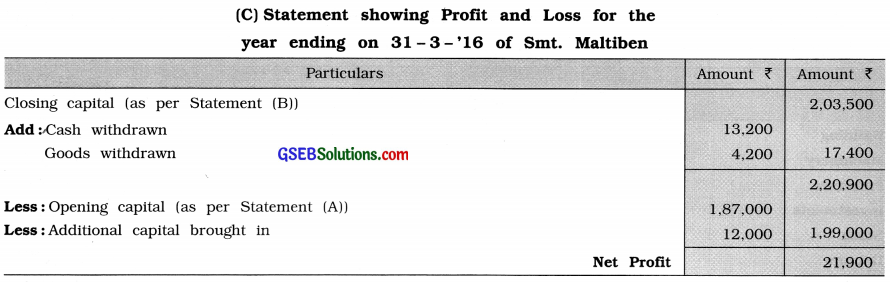

Question 5.

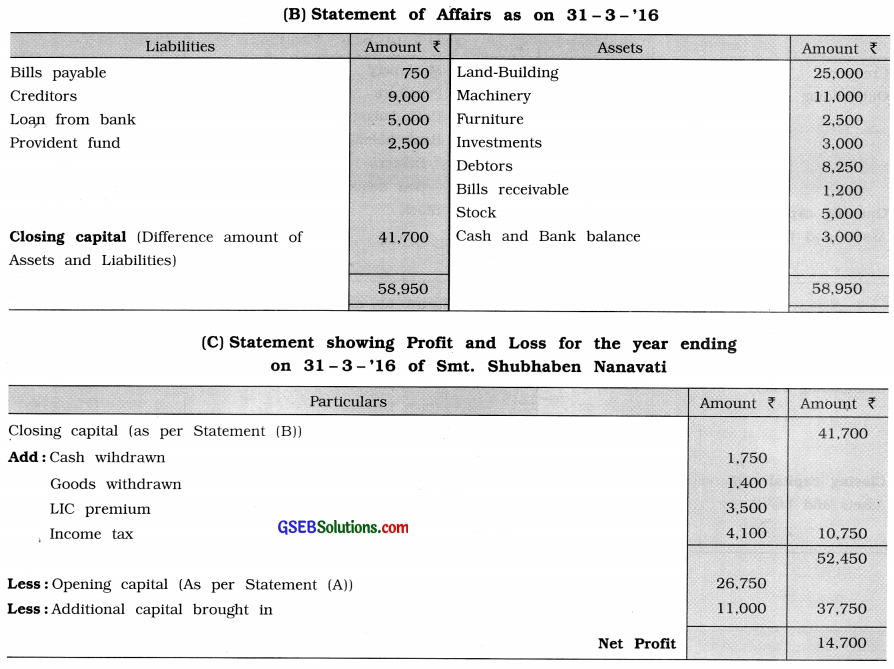

Smt. Shubhaben Nanavati keeps her accounts as per single entry system. From the following information find out the profit / loss by capital comparison method :

| Particulars | 1 – 4 – ’15 Amount ₹ | 31 – 3 -’16 Amount ₹ |

| Land-Building | 13,000 | 25,000 |

| Machinery | 9,000 | 11,000 |

| Furniture | 1,500 | 2,500 |

| Investments | 2,500 | 3,000 |

| Debtors | 6,250 | 8,250 |

| Bills payable | 600 | 750 |

| Creditors | 7,500 | 9,000 |

| Bills receivable | 1,600 | 1,200 |

| Stock | 4,000 | 5,000 |

| Cash and Bank balance | 4,000 | 3,000 |

| Loan from bank | 5,000 | 5,000 |

| Provident fund | 2,000 | 2,500 |

During the year, she had brought her personal scooter worth ₹ 11,000 in the business and she had withdrawn ₹ 1,750 by cash. Her personal LIC premium of ₹ 3,500 and income tax of ₹ 4,100 are paid from business, while goods of ₹ 1,400 were taken away from business for her personal use.

Answer:

![]()

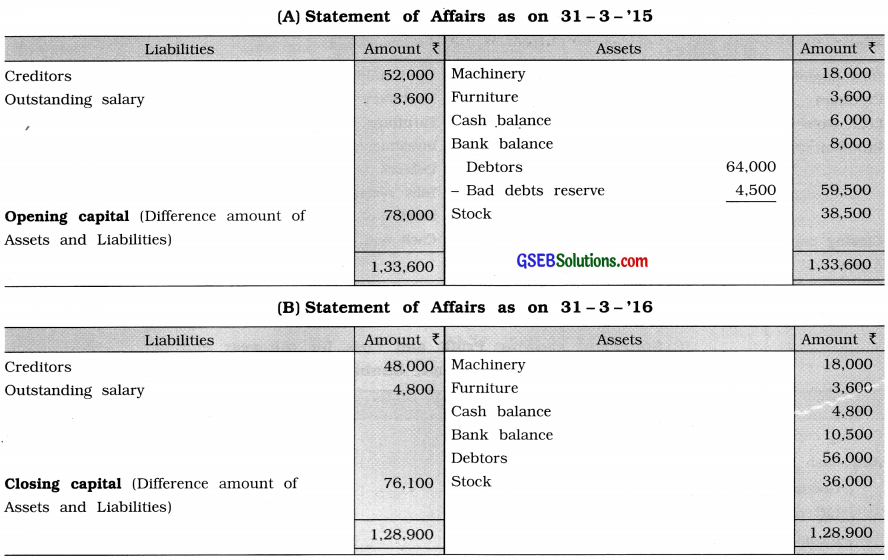

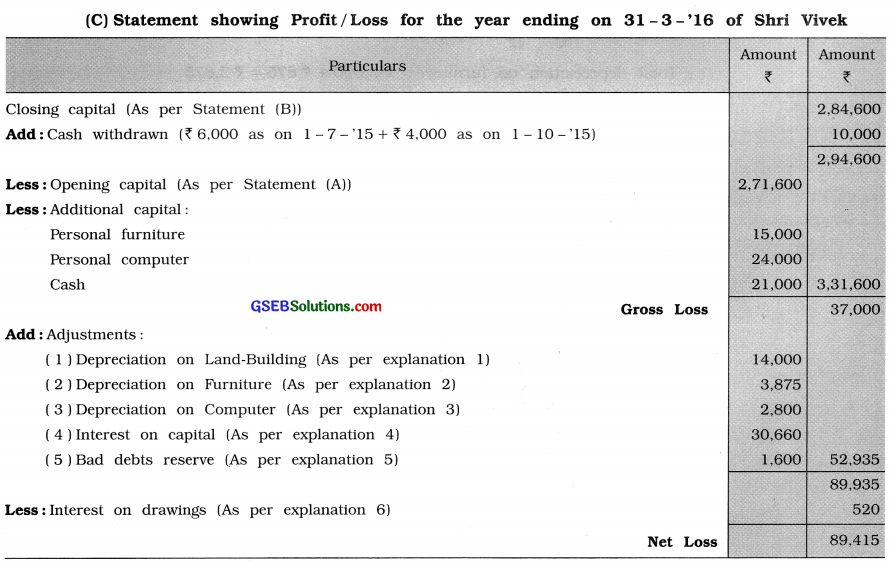

Question 6.

From the following information, prepare a statement showing profit / loss of Sureshbhai Patel for the year ending 31st March, 2016 :

| Particulars | Dt. 31- 3 – ’15 Amount ₹ | 31 – 3 -’16 Amount ₹ |

| Machinery | 18,000 | 18,000 |

| Furniture | 3,600 | 3,600 |

| Cash balance | 6,000 | 4,800 |

| Bank balance | 8,000 | 10,500 |

| Debtors | 64,000 | 56,000 |

| Stock | 38,500 | 36,000 |

| Bad debts reserve | 4,500 | – |

| Creditors | 52,000 | 48,000 |

| Outstanding salary | 3,600 | 4,800 |

Sureshbhai has withdrawn ₹ 300 every month. He brought ₹ 6,000 as additional capital during the year. Provide depreciation on machinery and furniture at 10 %. Provide bad debts reserve on debtors at 5 %.

Answer:

![]()

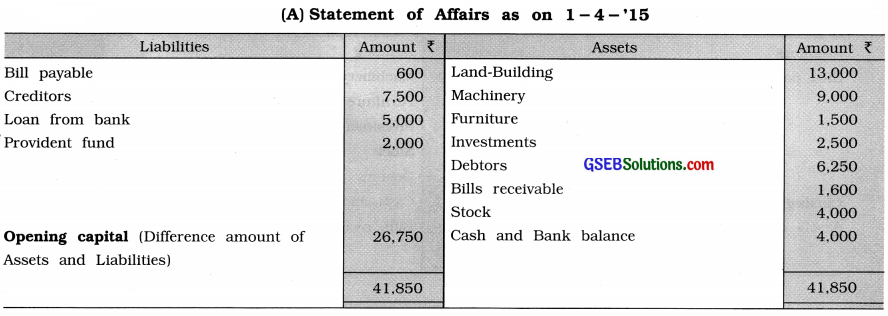

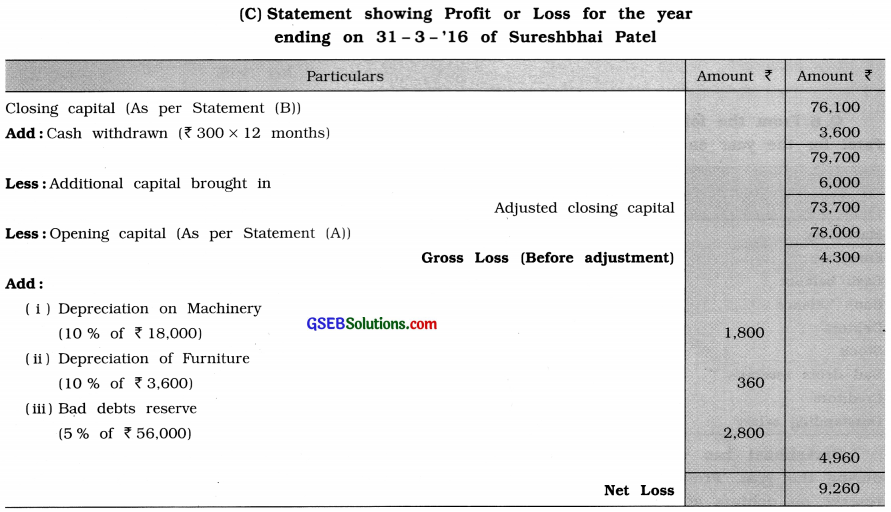

Question 7.

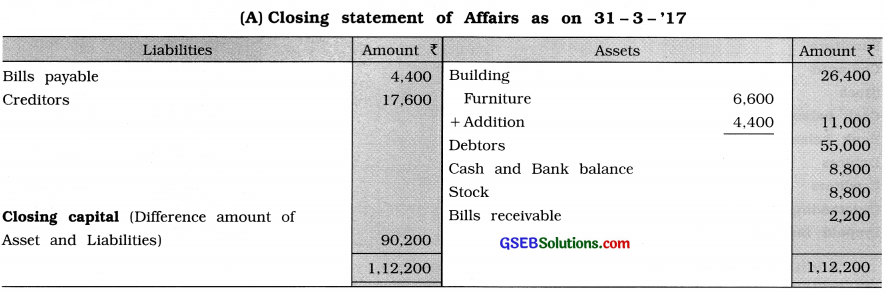

Ramesh Priyadarshani keeps his account as per single entry system. The statement of affairs of showing his business condition as on 1 – 4 -’16 is as under:

Additional information :

During the year he had brought his personal furniture worth ₹ 4,400 in business and he had withdrawn ₹ 1,100 per month. His LIC premium of ₹ 2,200 and income tax of ₹ 4,400 were paid from the business. Provide 5 % bad debts reserve on debtors. Calculate depreciation on building and furniture of ₹ 2,400 and ₹ 1,000 respectively.

From the above information, prepare a statement showing profit /loss for the period ending 31 – 3 – ’17.

Answer:

![]()

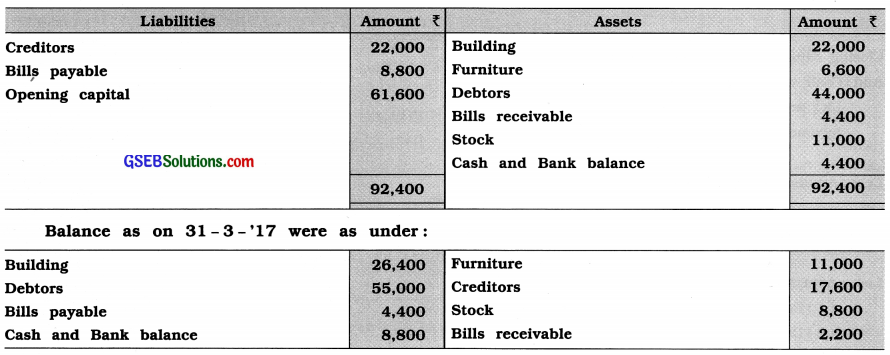

Question 8.

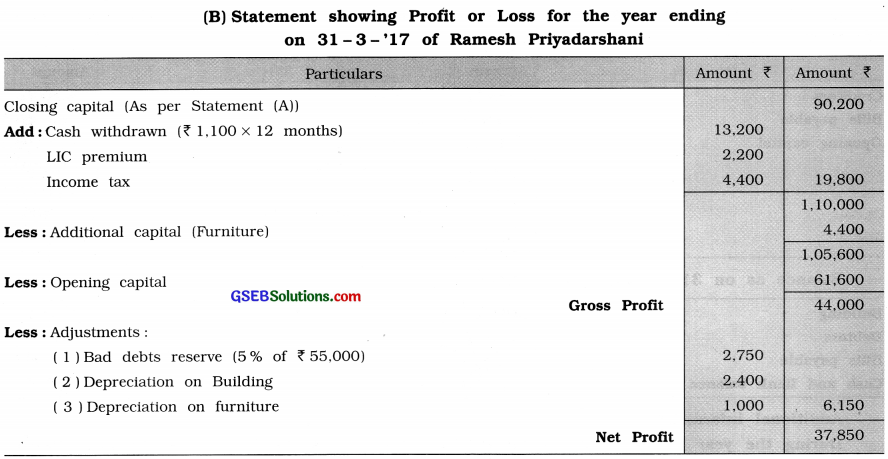

Shri Vivek keeps his accounts as per single entry system. His particulars of assets and liabilities are as under:

| Particulars | 1 – 4 – ’15 Amount ₹ | 31 – 3 -’16 Amount ₹ |

| Land-Building | 1,40,000 | 1,40,000 |

| Furniture | 30,000 | 45,000 |

| Computer | – | 24,000 |

| Stock | 36,000 | 21,000 |

| Cash balance | 11,000 | 14,000 |

| Bank balance | 58,000 | 32,000 |

| Debtors | 23,000 | 32,000 |

| Creditors | 24,000 | 21,000 |

| Outstanding salary | 4,500 | 5,400 |

| Prepaid insurance | 2,100 | 3,000 |

Additional Information:

His cash withdrawals were ₹ 6,000 as on 1 – 7 – ’15 and ₹ 4,000 on 1 – 10 – ’15. On 1 – 9 – ’15, he brought personal furniture worth ₹ 15,000, personal computer worth ₹ 24,000 and cash of ₹ 21,000 in the business.

Depreciation is to be provided at 10% p.a. on land-building and furniture and 20% p.a. on computer. Provide 5 % for doubtful debts on debtors. Interest is to be calculated at 10% p.a. on capital and at 8 % p.a. on drawings.

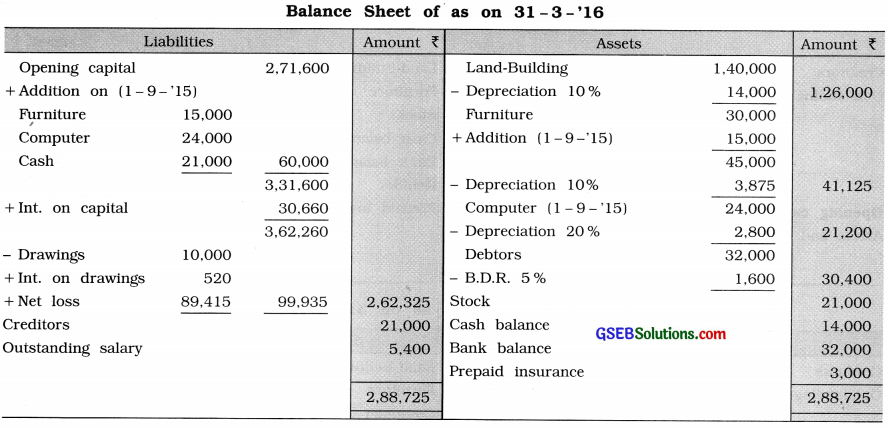

From the above information, prepare statement showing profit /loss and a balance sheet as on 31 – 3 – ’16 in the books of Vivek.

Answer:

Explanation :

(1) Depreciation on Land-Building at 10% on ₹ 1,40,000 for 1 year

= Depreciation ₹ 1,40,000 × \(\frac{10}{100}\) × 1 = ₹ 14,000

(2) Depreciation on opening balance of furniture at 10% on ₹ 30,000 for 1 year

= ₹ 30,000 × \(\frac{10}{100}\) × 1 = ₹ 3,000

7 month’s depreciation on personal furniture brought in as on 1 – 9 – ’15

= ₹ 15,000 × \(\frac{10}{100}\) × \(\frac{7}{12}\) = ₹ 875

∴ Total depreciation on furniture = ₹ 3,000 + ₹ 875 = ₹ 3,875

(3) 7 month’s depreciation on personal computer brought in as on 1 – 9 – ’15 at 20% on ₹ 24,000

= ₹ 24,000 × \(\frac{20}{100}\) × \(\frac{7}{12}\) = ₹ 2,800

(4) Interest on capital at 10% :

On opening balance of ₹ 2,71,600 for 1 year = ₹ 2,71,600 \(\frac{10}{100}\)× 1

= ₹ 27,160

+ 7 month’s interest on additional capital brought in as on 1 – 9 – ‘15 on ₹ 60,000

= ₹ 60,000 × \(\frac{10}{100}\) × \(\frac{7}{12}\) = ₹ 3,500

∴ Total interest on capital = ( ₹ 27,160 + ₹ 3,500) = ₹ 30,660

(5) 5% Bad debts reserve on debtors = ₹ 32,000 × \(\frac{5}{100}\) = ₹ 1,600

(6) Interest in drawings at 8 % :